IC Markets Review: Complete Broker Overview

IC Markets is a top-notch broker that provides access to securities including foreign exchange, commodities, indices, shares, bonds, futures, and cryptocurrencies. The broker offers competitive pricing across all account types with low spreads, and it has been ranked as a top MetaTrader broker.

IC Markets is a global CFD broker that was established in 2007 and has been growing steadily since then.

They offer their clients the opportunity to trade an extensive range of assets with true ECN capability. This means that traders are able to get some of the lowest spreads on the market with near-instant execution.

However, is IC Markets safe and can you trust them?

In this IC Markets review, we will give you everything that we found out about this broker. We will also give you some essential hints and tips that help your trading experience.

Overview

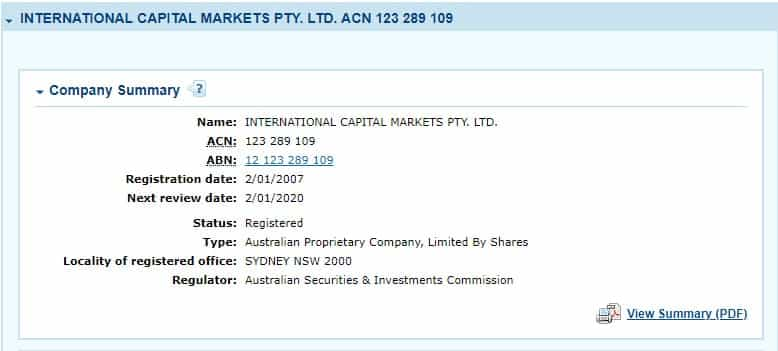

IC Markets is registered International Capital Markets Pty. Ltd and they are based in Australia. Their company registration number is ACN 123289109 and their offices are located at Level 6 309 Kent Street, Sydney. IC Markets is often credited for being the best forex broker in Australia and rank highly among its users.

They have expanded rapidly since their inception and have over 60,000 traders with them. They also process some of the highest volume in the industry and turn over $646bn in volume per month! You can see their trading stats right on their website.

IC Markets is an Electronic Crossing Network (ECN) broker. This means that they connect their traders directly to a pool of liquidity providers. This allows the traders to get tight raw market spreads on a number of assets.

They have a global presence and take traders from numerous regions. In order to cater to such a large array of clients, they have translated their website into over 14 different languages.

Despite this though, there are some regions that they do not provide their services to. These include the Unites States, Canada, Israel and Iran.

Is IC Markets Safe?

This is probably one of the biggest concerns for any Forex trader.

There are number of things that we look for when determining broker safety. The most important of these are the regulatory oversight and the internal protocols at the broker.

Regulation

You will be pleased to know that IC Markets is fully regulated by Australia's Securities and Investment Commission (ASIC). They have an AFSL number of 335692.

The Australian regulators are some of the most reputable in the world and there are a number of benefits that come with their oversight. These relate to the rules that they place on brokers and how they conduct their business. Here are some of the most important of them:

- Segregated Accounts: ASIC requires that brokers keep their client's funds in separate bank accounts from the main broker operations.

- Capital Reserves: The regulator stipulates that the broker must store A$1m in reserves in their bank accounts.

- Regular Reporting: Brokers are required to maintain these levels and regularly report back to ASIC.

- Extensive Due Diligence: Before a broker can get an ASIC licence, they will have to complete a series of background checks on a company and individual level.

Apart from these client protections, you also have the comfort of knowing that there is always some authority that you can turn to in the case of a dispute.

Pro Tip✔️: IC Markets is a member of the Australian Financial Complaints Authority (AFCA). They are an external dispute resolution scheme that can help mediate any issues you have with IC Markets.

Other Protections

There are a host of other protections that you have at IC Markets, which makes them a great Australian securities exchange.

For example, they bank with top tier banking institutions in Australia. They use National Australia Bank (NAB) and Westpac Banking Corporation (Westpac). This means that your segregated funds are in a safe place.

They also have liability insurance from Llyods of London. This means that the broker is protected from any legal liability that could be thrown its way.

IC Markets is also externally audited by an independent firm. This is great to know as it means that accurate liquidity and reporting numbers are being presented to the regulators.

Finally, as is standard with most financial websites, they have full SSL protection. You can feel comfortable sending them your documents and using your credit card as it is all encrypted.

Asset Coverage & Leverage

This was something that really impressed us about IC Markets. They have an extensive range of assets across numerous asset classes.

Exactly what assets you will be able to trade depends on the account that you open up and the platform that you use. We cover the platforms below but here is a sneak peak of the assets that they provide:

- Forex: 60 Pairs covering all Majors and most Minors

- Indices: You can trade over 7 indices from a number of global markets

- Commodities: You have 14 commodity CFDs including hard, soft and most metals

- Stocks: They offer 120 single stock CFDs from the ASX, NYSE and Nasdaq

- Crypto: You have 10 crypto assets including Bitcoin, Litecoin, Ethereum etc.

- Bonds: 6 different government bond indices.

- Futures: Futures on Oil, VIX, ICE.

This is one of the first CFD brokers that we have seen offering government bonds! Now you can trade the credit worthiness of the US and UK governments for example.

Top Trade 📈: Why not trade the VIX futures so that you can trade volatility or "fear" in the markets?

You also have quite an extensive range of cryptocurrency CFDs that you can trade. This is more than other brokers that we have seen.

Leverage

Given that IC Markets is a CFD broker, it means that you are trading on the margin with borrowed money. This means that your positions are leveraged by a certain factor and your gains / losses are maximized.

Leverage at IC Markets will vary depending on the asset that you are trading and the size of the position. However, here is a helpful breakdown of the max leverage you can achieve on each asset class:

- Forex: 500:1

- Commodities: 500:1

- Indices: 200:1

- Futures: 200:1

- Bonds: 200:1

- Stocks: 20:1

- Crypto: 20:1

These are reasonable leverage levels. The minimum leverage that you can trade with is 1:1 so there is no need for you to trade with the max when you first start.

While the crypto leverage factor is better than most other CFD brokers, you can trade with higher leverage in other locations. For example, you could trade CFDs at IQ Option or Futures at Prime XBT.

Caution⚠️: There is no negative balance protection at IC Markets so watch your margin closely

You can take a look at the margin call levels in all of their documents. You should also take note of the stop out positions where you will have your position closed.

IC Markets Spreads

The size of the broker spreads directly impacts on trading profitability and is hence a really important criterion for us.

Given that IC Markets operates an ECN model, the spreads that you are charged are really thin. For example, if you have a True ECN account, you are able to get close to 0 spreads on some of the major Forex pairs.

Of course, the exact spread that will be applied depends on the type of asset you are trading and the account you have. Below is an indication of some of the spreads on a small subset of assets on the Standard / True ECN (in pips).

- EURUSD: 0.1 / 1.1

- GBPUSD: 0.4 / 1.4

- USDJPY: 0.2 / 1.2

- Brent: 0.05 / 1.05

- Gold: 0.09 / 1.09

- Aus200: 5 / 5

- US500: 0.6 / 0.6

- US 10YR T-Bill: 0.06 / 0.06

- BTC: 20 / 20

These are pretty thin spreads and are lower than some of those that we have seen at other brokers such as Plus500.

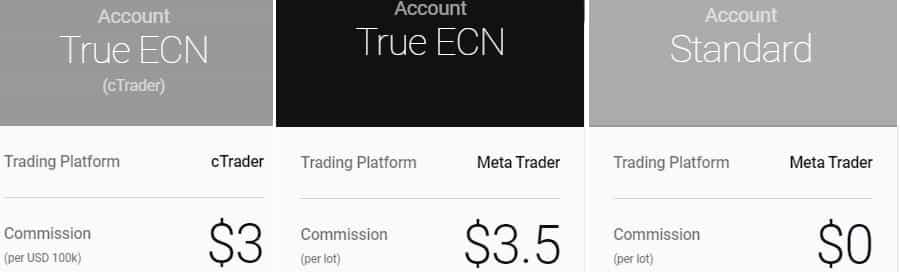

Take note though that although the True ECN has a lower spread, you will have to pay a commission on the lots that you trade. This is $3.5 per lot and $0.035 if you are trading the Micro Lots. If you are on cTrader, you are charged $3 per 100k lot.

As is standard with Forex brokers, you will also be charged a standard swap rate. This can be considered an "overnight" fee that is charged to finance your positions. You can see this swap rate in the platforms before you enter the trades.

Take Note ✍️: You will be charged a three day swap on Wednesday nights to account for the weekend days.

Deposit / Withdrawal Fees

Thankfully, there are no fees charged by IC Markets to deposit funds. There may be a third-party fee that is applied by your bank or intermediary banks if you are doing an international wire transfer.

Withdrawals are also free for nearly all of the same payment methods. However, if you are taking a wire withdrawal to an international bank then IC Markets will have to charge you A$25 in order to make up for the cost of them initiating the wire at their bank.

IC Markets Account Types

As mentioned above, their are quite a few account types that you can open at IC Markets. These will differ in the types of spreads you will be charged, the platform that you will use and the subsequent assets that you can trade.

All of the accounts below make use of ECNs which connect directly to the liquidity providers. This means that IC Markets operates a "no dealing desk" model and is not the market maker to any of the trades that you are putting on.

Below is a breakdown of the different account types:

| True ECN (cTrader) | True ECN | Standard | |

| Trading Platform | cTrader | MetaTrader | MetaTrader |

| Commission (per lot) | $3.0 | $3.5 | $0.0 |

| Spreads from (pips) | 0.0 | 0.0 | 1.0 |

| Server Location | London | New York | New York |

| CNS VPS Cross Connect | No | Yes | Yes |

| Programming Language | C# | MQL4 | MQL4 |

| Suitable For | Day Traders & Scalpers | MetaTrader | MetaTrader |

| Trading Platform | cTrader | EAs & Scalpers | Discretionary Traders |

All of the accounts above have Microlots which facilitate flexible lot sizing. These Micro-lots start at just 0.01 lots. The minimum deposit amount on all accounts it $200.

You are also allowed to trade on all accounts with any trading style that you fancy. This includes scalping, hedging, or running an Expert Advisor (EA) on the account.

Pro Tip✔️: Why not combine the EAs with a VPS that they offer. Run your trading account 24/5 automatically?

All of these accounts have a 50% stop out level, offer one click trading as well as Index CFDs as standard.

Islamic Accounts

For those of you who are of the Islamic faith, then you can request a fully Sharia compliant Islamic account. This is available on all of the accounts above and effectively makes the accounts "swap free".

Instead of the overnight swap rate, you are charged a flat commission on the lot size. You can see the exact commissions here. If you want to open an Islamic account then you first need to create a normal account and ask them to convert it for you.

IC Markets Demo Account

Why risk funds initially if you can test them out first?

IC Markets offers no obligation demo accounts on all of the above. These are a great way for you to test the platform and broker in a non-threatening way with demo funds. Demo accounts are supposed to replicate live trading conditions.

Take Note ✍️: Demo accounts cannot replicate the impact of "slippage" that one is likely to get on a live account.

All that you will need in order to open this account is an email address and phone number. Once you have signed up they will send you the login details for the accounts that you have requested.

Trading Platforms

There are three trading platforms that you can make use of with this broker. These are all third party trading platforms.

Firstly, they offer both of the MetaTrader platforms. These are trading platforms that are developed by the MetaQuotes software company. They also offer the cTrader software suite that is developed by Spotware.

Let's take a closer look into each of these now.

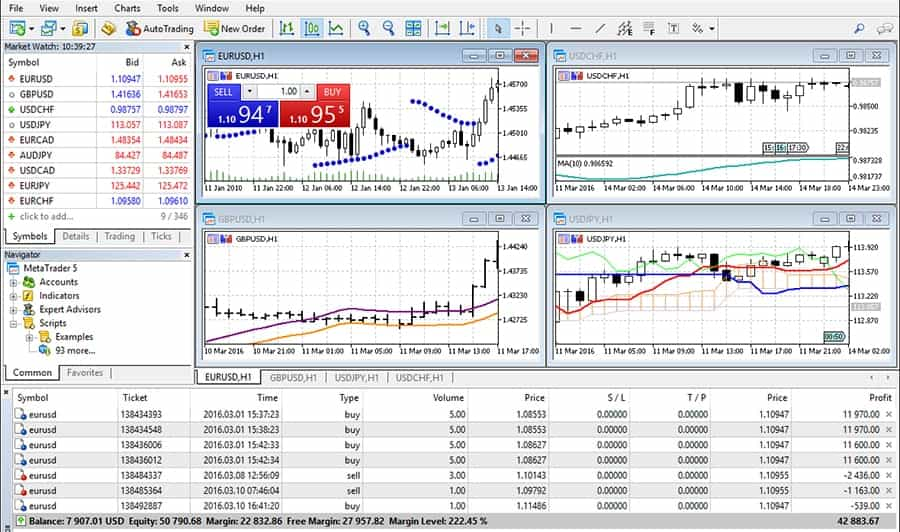

MT4

This is probably the most well-known trading platform in the world and has been around for a number of years. It has been downloaded by millions of traders and is used by most online Forex brokers.

The MT4 platform is relatively well laid-out and has a plethora of trading tools that you can use. These include advanced charting and technical analysis studies and access to historical data. You can also model numerous different Forex pairs at the same time.

The MT4 platform also has its own proprietary coding language. MQL4 can be used to develop your own Expert Advisors or "EAs". These are algorithms that will trade on the MT4 automatically 24/5.

The MT4 platform is available on PC, Mac and Linux. You can also trade it through your web-browser but we would rather suggest the Desktop based versions.

MT5

As you can probably tell, this is the upgraded version of the MT4 platform. IC Markets also gives their Standard and True ECN traders the choice of the MT5 platform. The MT5 allows you to trade the single stock equities as well as the crypto assets.

This has an updated user interface and has some new features. For example, you can view the order book depth charts. You also have an economic calendar right there on your trading platform.

The coding language has also been updated to MQL5. This has more customization options because it is an object orientated language. You can code your own indicators and save them for later use on the platform.

As is the case with the MT4, this is available on a Mac, PC, Linux and Web browser.

So, MT4 or MT5?

Well, the MT4 is a more "battle-tested" platform that is well-known by millions of traders. There are more integrations for it and more trading communities know how to develop on it. We would suggest the MT4 unless you have to trade assets that are not available on it.

cTrader

This platform is available on IC Market's ECN cTrader account. It gives you Straight Through Processing (STP) functionality using multi-bank liquidity. You can also trade 10 major equity indices here as well as 64 Forex pairs.

The cTrader interface is more functional than those of the MetaTrader platforms. You also have more charting capability as well as tools and indicators.

Pro Tip✔️: You can use cTrader's "smart stop out" tools that you can set just above the margin level. This can protect against margin calls

For the developers, cTrader is built on C# and has a handy extension called "cAlgo".

This allows you to build your own unique trading indicators in a universally known programming language. You can also leverage the cTrader developer network to help you code your own indicators and algorithms.

The cTrader is available in Mac, PC and online through your browser.

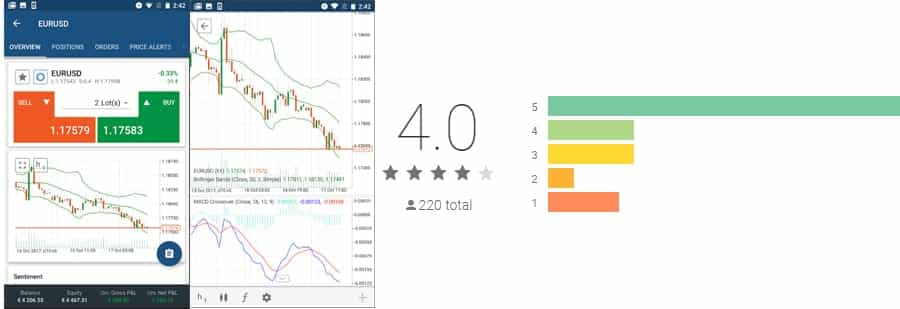

IC Markets Mobile App

While IC Markets does not develop their own proprietary mobile application, each of the trading platforms that were mentioned above have their own mobile apps.

The MT4 and MT5 mobile apps are perhaps some of the most popular trading application in existence today. For example, the former has been downloaded 10m+ times and the latter has been downloaded 1m+.

They are available in iOS and Android and have a range of features. You have one click trading, order management as well as relatively advanced charting. You can also easily toggle between the different markets.

You can also take a deeper look at the reviews for the MT4 and MT5 mobile apps in the iTunes store and the Google Play Store. They are all above 4.5 stars and most of the traders are quite complimentary.

cTrader also has a mobile app although it is way less popular than the MetaTrader versions. This is available in iOS and Android and has much of the same functionality as the MT4 / MT5 apps (Charting, order management, technical studies etc.)

There are no reviews for the cTrader app in the iStore but there are quite a few in the Google Play. They are quite positive and the developers are responsive.

So, should you use a mobile trading app?

We would always opt for a desktop version of the software. Mobile screens are not the most effective for conducting technical analysis. You also have order latency when using mobile networks.

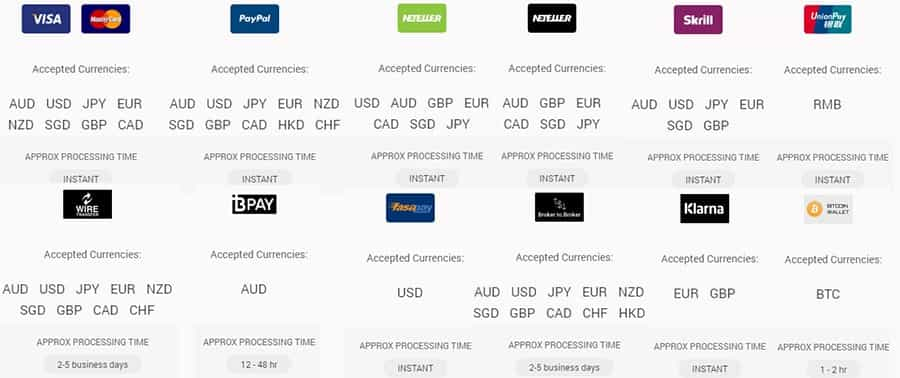

Funding / Withdrawals

Once you have tested the Demo and are ready to fund a live account, there are a number of ways in which you can do this.

You can fund your account in the following currencies: AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF. Funding can be done pretty easily directly from your IC Markets admin area.

Below are the funding methods that you have at IC Markets:

From the above, it looks like the quickest way for you to fund your account is through the use of a Credit Card or a Web Wallet of some sort. These should clear instantaneously.

The method with longest lead times is through a wire transfer. This could take 2-3 days depending on the where your bank is located.

Note ✍️: You can't fund your account with third party transfers. This means that you have to use an account that is in your name

Withdrawals

Withdrawals are just as simple as funding your account. You will have to complete the online withdraw form in your account administration panel.

You can use most of the same methods that you have used above in the funding. The fastest of these are probably through a web wallet if you used it. Wires could take 2-3 days assuming that you provided the correct information.

The cut-off times for your withdrawal to be completed is the 12:00 AEST. If you submit it before this time then it will be processed on the day.

Note ✍️: If you funded via credit card, then IC Markets will refund the initial amount via card. If you have profits, then these will be sent via another payment method

If you had not initially completed identification and submitted KYC documents when funding then you will have to do this before they will authorise your withdrawal request. As is the case with funding, they will only send to an account that is in your name.

IC Markets Execution

One of the biggest benefits of IC Markets is their trading infrastructure.

Firstly, they use some of the best-known liquidity providers in the world including the likes of Citi, UBS, JP Morgan and Goldman Sachs. They also use dark pools for hidden sources of liquidity.

IC Markets also uses the Equinix datacentres in New Jersey and London. These are the same datacentres that are used by High Frequency Trading (HFT) firms to execute their lightning fast strategies.

In the case of the New Jersey datacentre, this is used by numerous large institutions on Wall Street. Some of these are the same institutions that provide liquidity to IC Markets that I mentioned above.

This means rapidly reduced order latency...

When you place an order at IC Markets, it can be routed to the liquidity network with fibre optic cabling almost instantaneously. The faster that your order can be executed, the better your overall order fills.

Fun Fact ⏱️: Given this trading setup, IC Markets is able to execute orders in under 40 milliseconds!

IC Markets has also partnered with a number of hosting providers where you can rent a Forex VPS. This will allow you to connect directly with Equinix using VPS cross connect.

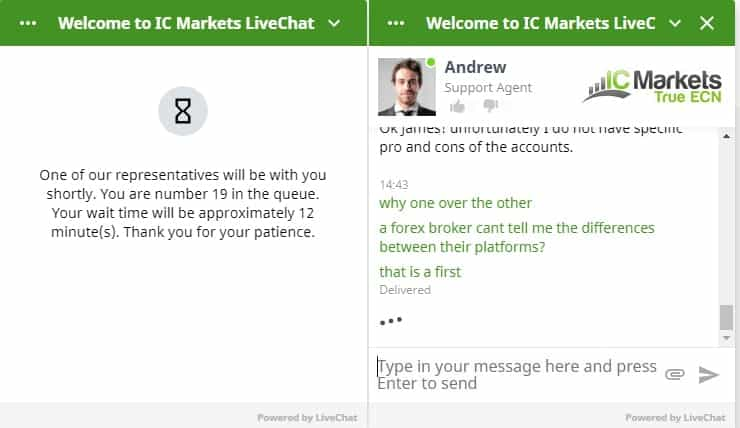

IC Markets Customer Support

Customer support is an important criterion for us at Coin Bureau. Nothing can kill a trading experience like terrible customer support!

So, how does IC Markets stack up?

They operate a number of support desks around the world and these are manned by English and Chinese native speakers. There are number of methods that you can get in touch with their agents.

For example, you could use their generic customer support email at [email protected]. They also have a Chinese specific customer support email at [email protected].

You could also reach out to them with their live chat function. If you prefer to speak to someone on the phone then they have this option as well. They have an Australian toll free number on +1300 600 644 and a Chinese contact number on +86 400 609 6783.

While this is good in theory, our experience in practice was quite disappointing...

When we reached out to them on their live chat, we had to wait for a total of 20 minutes to first be connected to their support agents. When we finally did get in contact with an agent, they were not that knowledgeable.

For us, it seemed as if IC Markets has outsourced their customer support to an offshore support centre. Of course, we could have reached them at a bad time but we have had much more pleasant customer support experiences at brokers such as FP Markets.

Pro Tip✔️: If your query is general in nature, then instead of waiting for a support agent you can take a look at their help-centre. There are numerous FAQs that could answer your question

Education

Brokers adding value through additional educational material always get extra points in our book.

IC Markets is no exception and they seem to have quite a range of educational guides and resources that could help traders of varying skill levels.

Guides & Videos

These are simple bullet pointed guides that give you a short overview of elementary disciplines. They cover topics such as the pros / cons of CFD trading and the basics of Forex markets. These are aimed at the beginner Forex traders.

They also have some video tutorials that take you through basics of the MT4 platform. This was slightly sparse and there are only 4 videos here. These are also over 6 years old so they definitely are in need of an update.

Of course, if you are just in need of a quick explanation of some term on the terminal then you can jump over to their pretty extensive Forex glossary.

Trading Central & Economic Calendar

IC Markets also streams in live video feeds straight from Trading Central. These are live trading news segments that cover the latest market movements and economic announcements.

Trading Central videos are professionally presented and the videos are relatively easy to understand. They are also streamed to a number of brokers around the world so you can be sure of their quality.

IC Markets also provides a handy economic calendar on their website. This is helpful to keep track of upcoming economic announcements and data releases. Traders use it to either hedge risk around important releases or to trade price action on the actual release volatility.

Information Hub

This is the main blog section at IC Markets and it is pretty extensive. It is updated daily and covers numerous different categories and sections.

For example, you have how-to guides, Fundamental Analysis, Technical Analysis, Education and other trading tips. There are also regular market updates with the key levels and potential trade set-ups.

We found these relatively easy to read and well presented. The market guides are written in simple bullet point form with the key daily levels. The longer guides and analysis posts include helpful charts and other graphical aids.

Other Tools

A trader is only as good as the tools that his has in his trading toolbox...

IC Markets offers a number of different tools that can either enhance your trading experience or that of your account manager (if used).

VPS

As mentioned above, IC Markets has a strong relationship with a number of VPS providers with direct connections to their servers at Equinix.

Many traders understand the benefits of using a VPS as it allows them to trade with EAs automatically and continuously. It can also be co-located at a liquidity provider data-centre to execute trades with near zero latency.

There are three partner VPS providers that IC Markets works with and the are the following:

- Forex VPS: This is one of the most well known in the industry and they can get your account set up in 5 minutes. It will come with an IC Markets VPS pre-installed

- Beeks FX VPS: This is another well known provider with connections directly to the Equinix data centre. They use fibre optic cross connect and have a 0.5 millisecond latency

- New York City Servers: They also come with the MT4 pre-installed and have some pretty reliable uptime statistics. The latency on the server connections is about 1 millisecond.

These servers start at about $20 per month which is about reasonable for a good quality VPS. However, if you trade more than 15 lots in that month then FC Markets will sponsor the cost of that VPS.

MT4 Advanced Trading Tools

If you have a live account at IC Markets, they will also throw in the MT4 advanced trading tools for free. These are similar tools than those that are used by institutional clients.

There are over 20 of these in total and this includes apps that assist in making trade decisions along with tools like sophisticated alarms, messaging broadcasting facilities etc. Below is the full list:

These will all help to augment your trading and are only available on MT4. This is another reason why it could make sense to opt for the MT4 platform over the MT5 / cTrader.

PAMM / MAM

Multi Account Managers (MAMs) and Percentage Allocation Management Module (PAMM) are account management methods whereby one manager can trade numerous accounts.

IC Markets provides a number of tools that could make it easier for these managers to administer the numerous trader accounts and appropriately apportion the returns across these. There are numerous benefits which we won't go into now but you can read more about it their website.

Note ✍️: If you want to use a PAMM / MAM account, you will have to sign Power of Attorney over to the manager

ZuluTrade & MyFXBook

IC Markets also lets you link your MT4 account up to third party trade copying services. This will allow you to follow the signals and trading strategies of other successful traders.

This is through the use of MyFXBook and Zulutrade integrations. If you have accounts at these services then you can link up your MT4 account and sync your trading strategy with those of the traders you are following.

You can either place trades that replicate these traders completely or you can control the trades that you would like to make on a case by case basis. ZuluTrade is particularly interesting as it ranks traders and you can follow only the most profitable.

What We Didn't Like

We could not do a complete IC Markets review without going into some of things that we think warrant improvement.

Firstly, we were not too impressed with the customer service. The time it took for us to get connected to an agent was not ideal. Moreover, the knowledge of said agent was really sub-par. We tried to connect several times and had similar wait times. If customer service is important to you, we recommend checking out eToro, as we were quite impressed with their support response times.

Secondly, given that this is an ECN account, you have significant market risk that you cannot mitigate. For example, IC Markets does not offer negative balance protection or any sort of guaranteed stops.

Lastly, while they do offer some educational material, they could have offered other more bespoke resources. For example, a number of Forex brokers provide free trader webinars which are a great way for traders to learn in an interactive and engaging way.

Regulated CFD Brokers ⚖️

Pepperstone vs IC Markets

IC Markets and Pepperstone are both well-established and popular Australian-based forex and CFD brokers. While both brokers offer a range of similar trading services and have a good reputation, there are some differences between the two that may affect your decision.

Regulations: Both IC Markets and Pepperstone are regulated by multiple financial authorities, including ASIC in Australia, while Pepperstone is also regulated by the FCA in the UK, IC Markets is not. IC Markets is also regulated by CySEC in Cyprus, while Pepperstone is regulated by DFSA in Dubai. Pepperstone is better suited to traders in the European Union as well.

Trading platforms: Both brokers offer a range of trading platforms, including the popular MetaTrader 4 and 5 platforms and cTrader, a popular alternative to MetaTrader. Both platforms also support the TradingView charting interface and the same market hours.

Trading instruments: Both brokers offer a range of trading instruments, including forex, commodities, and indices. However, IC Markets also offers more cryptocurrency CFDs and assets for trading.

Fees and spreads: Both brokers offer competitive fees and tight spreads. However, there may be some differences in fees depending on the trading instrument and account type. It is important to compare the spreads and fees between the two brokers to determine which one offers the best value for your trading needs.

Account types: Both brokers offer a range of account types, including standard and raw spread accounts. IC Markets also offers a Swap Free account for Islamic traders, while Pepperstone offers a Razor account that offers tight spreads with a commission per lot traded.

Overall, both IC Markets and Pepperstone are reputable brokers with competitive trading conditions. The best choice for you will depend on your specific trading needs and preferences. It is recommended that you compare the features, fees, and services of both brokers before making a decision.

Conclusion

Our IC Markets review found them to be a well regarded and regulated broker with low fees, instant execution and extensive asset coverage.

Moreover, they use some of the most advanced trading technology in the industry in the MetaTrader and cTrader platforms. They have also supplemented this with additional trading tools and resources.

Yes, there are things that we think they can improve, but these can easily be worked on. Hiring better customer service or starting a weekly webinar is not too hard to implement.

So, should you use IC Markets?

We would encourage you to do your own research, but based on this review we think that they can considered a highly recommended broker.

Warning ⚡️: Trading CFDs is very risky. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.