The Karura Project has a lot to live up to. Winning Kusama’s first Parachain Auction in style (somewhat predictably, some might say), brings high expectations. Rather than shy away from the inevitable scrutiny such a victory evokes, Karura boldly self-proclaim as “THE all-in-one DeFi hub of Kusama”, a claim we will be exploring in this Karura Review.

This article explores just how deserving this mantle is, details how to utilise Karura’s current functionality, and considers how much potential this fledgling app may have.

What is Karura?

While we’ve already let the cat out of the bag regarding the DeFi nature of Karura, a little context should help to place it within the wider cryptoverse. For those unfamiliar with Karura, think “Acala’s slightly more carefree younger sibling”. Karura is to Acala what Kusama is to Polkadot, Moonriver is to Moonbeam, and Altair is to Centrifuge - chiefly a lesser-known instantiation that the community has afforded a little rope in order to hasten the development of both ecosystems.

Being the first anything brings a bit of extra pressure. Being the first project to launch on an unaudited “Canary Network” which proudly dons a tagline warning users to “EXPECT CHAOS”, ratchets this up several levels.

One of the most telling aspects of Karura’s launch was the absence of any obvious mayhem, carnage, gremlins or glitches. I mean, come on Karura, was it really too much to ask for one or two hiccups through the process? Nothing catastrophic, obviously. Just enough to evoke a heightened state of tension heading into the third act.

It's almost as if the entire team knew exactly what they were doing months before the final implementation. You know, rather than just having a bunch of cobbled-together ideas that hopefully all come together in the end. (future project developers please take note) The fact that the launch went off without a hitch gave many early investors and crypto enthusiasts even greater confidence in the project, understandably as this is the world of crypto after all, where things seldom run so smooth. It is almost as if the crypto space is becoming more “mature,” and developed, hmmmm, imagine that.

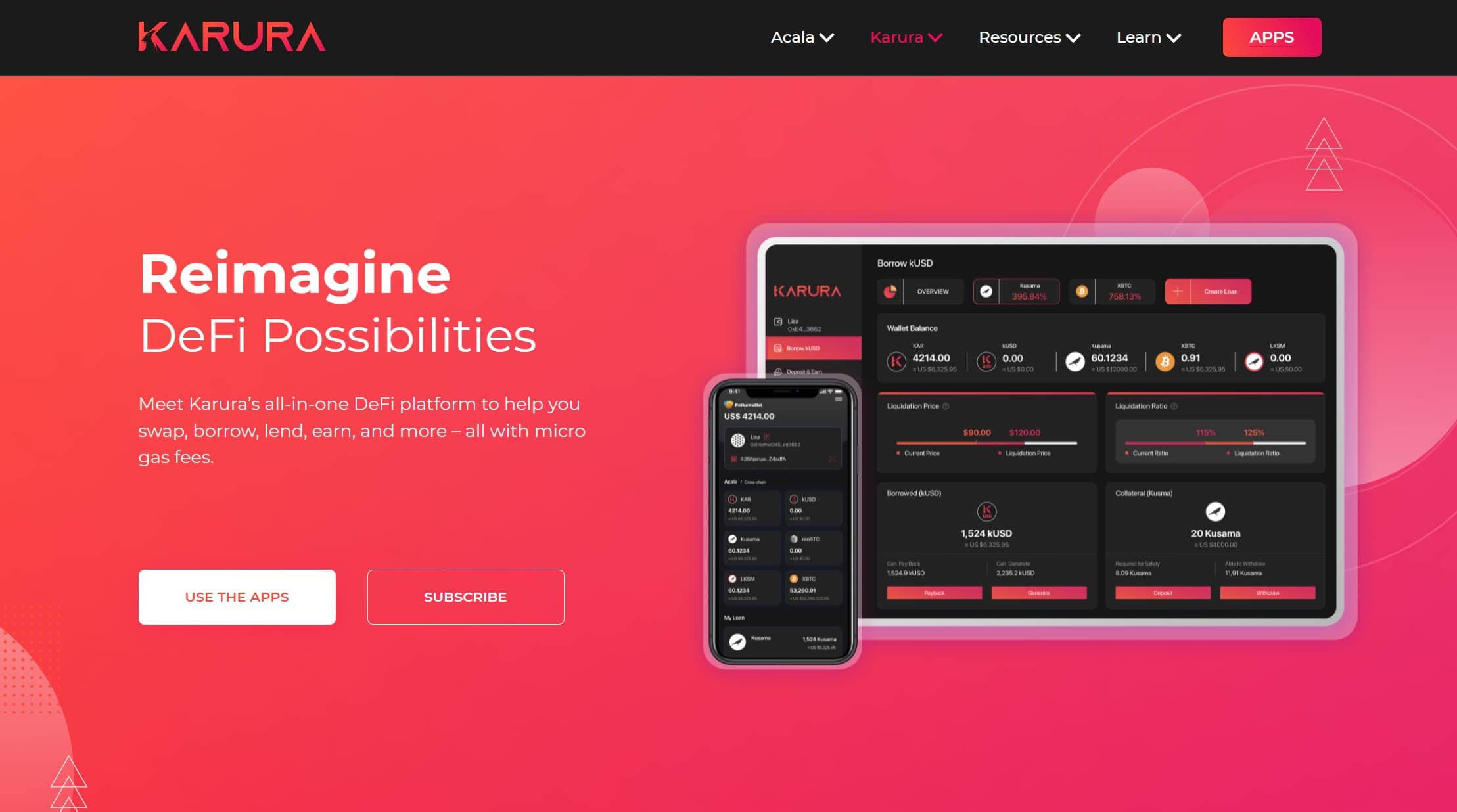

Karura is Reimagining DeFi Possibilities Image via acala.network/karura

Karura is Reimagining DeFi Possibilities Image via acala.network/karura “THE all-in-one DeFi hub of Kusama”

The Karura DEX went live approximately two weeks after winning the first Parachain Auction. Since then, steady progress through various launch phases has resulted in regular additions to functionality and increases in use cases. While Karura is still in its infancy, such a self-proclamation motivates scrutiny even at this early stage. Let’s begin by examining the DeFi applications currently supported and how to get started.

Getting Started

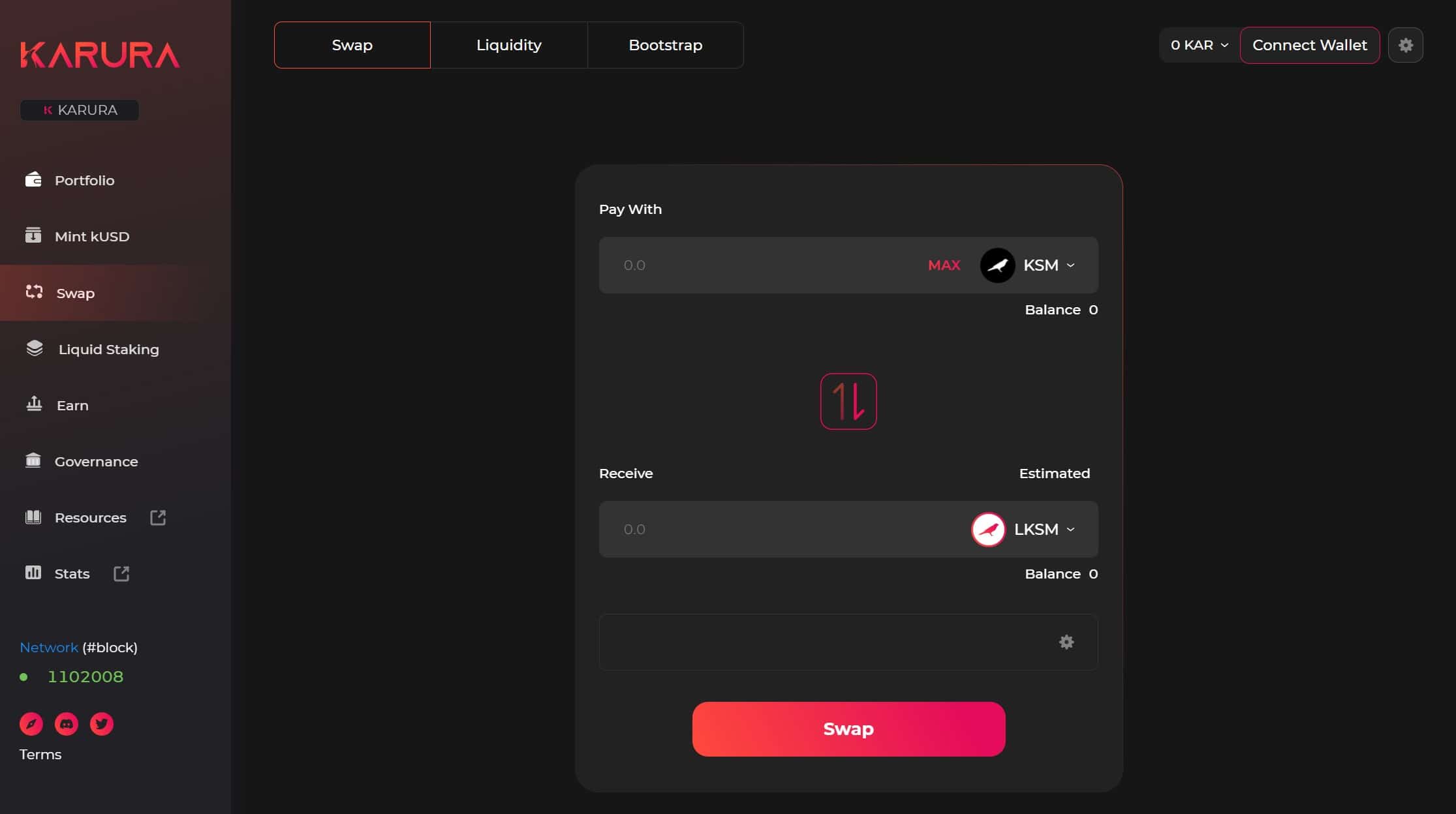

The “All-In-One” DeFi Hub Image via apps.karura.network

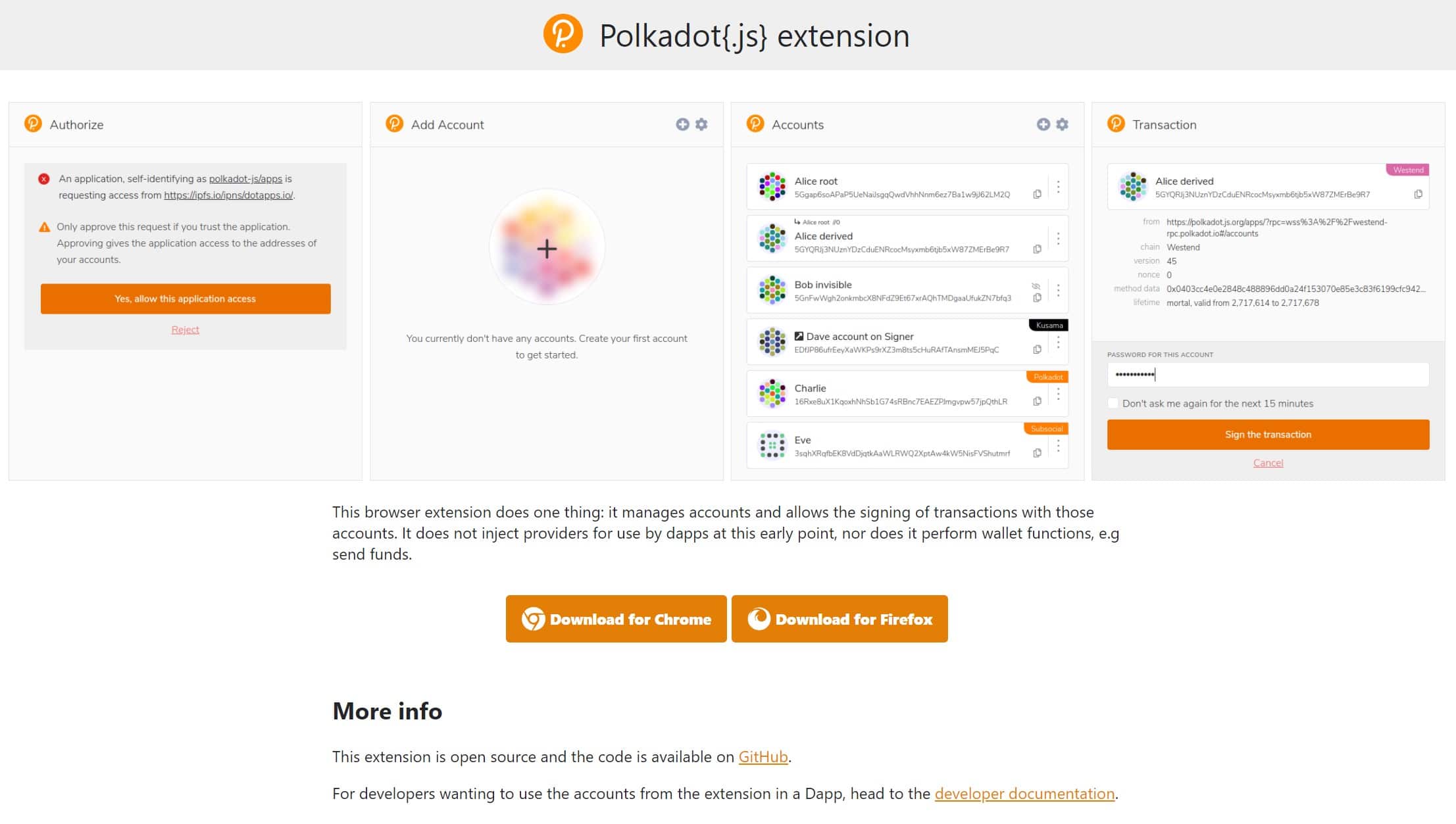

The “All-In-One” DeFi Hub Image via apps.karura.network For completeness, let's first go over how to use Karura. The image above depicts the app running on Google Chrome and offers a high-level insight into what is currently available. No login is required. Like Metamask, the Polkadot.JS browser extension stores your account details allowing you to interact with decentralised applications.

So while there is no specific Karura signup or login, it really is essential to have a Polkadot.JS account to unlock functionality similar to what Metamask does for other networks. Admittedly, much of the functionality is accessible via mobile wallets such as PolkaWallet and MathWallet, but it's a far nicer experience via a desktop/tablet-based web browser.

Currently, the Polkadot.JS extension interaction is limited to applications within the Polkadot and Kusama ecosystems. It works well within these domains, but before long, such network specificity shall, unfortunately, render it somewhat redundant.

Polkadot.js will likely be used much less in the near future as better, more user-friendly options like Talisman begin to launch. When the Acala EVM+ goes live, we’re likely to see support from well-known Ethereum wallets such as Metamask, which means users will be able to manage their assets and Web3 connections with their preferred toolset.

Polkadot.js Browser Extension. Not Quite as Catchy as the Name "Metamask" Image via polkadot.js.org

Polkadot.js Browser Extension. Not Quite as Catchy as the Name "Metamask" Image via polkadot.js.org

One important difference to be aware of is how addressing is handled within the Polkadot and Kusama ecosystems. While one address can be used for various Ethereum-compatible network tokens on Metamask, Polkadot, Kusama, and their various parachain children all have their own distinct address format.

This isn't as bothersome as it may sound, and may even be preferable as it will avoid users sending unsupported tokens around different applications on the Ethereum network and needing to go through the process of “recovering” them or risk losing them altogether which happens frequently.

Upon creating a Polkadot.JS account, addresses are generated for each chain within the greater ecosystem. All addresses are connected so are possibly best viewed as subaccounts contained within a primary account, each sharing the same account name, password, and all-important seed phrase. Let's begin drilling down a little to explore some of the use cases nestled beneath this high-level view.

Mint kUSD

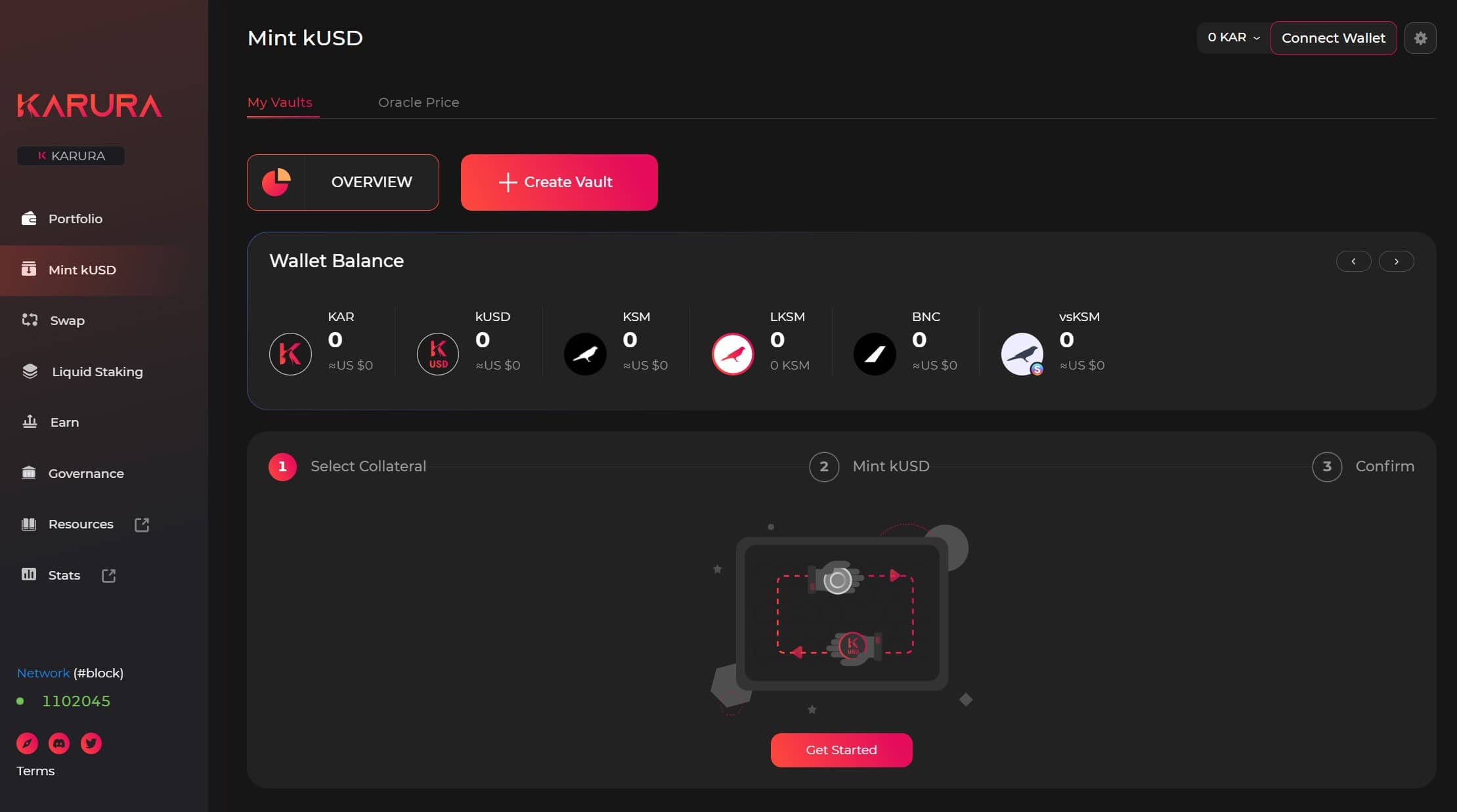

Karura Dollar (kUSD) was the first and remains the only stablecoin currently in existence on Kusama. Admittedly, these are early days, but with first-mover advantage, it is easy to imagine kUSD becoming the ubiquitous Kusama coin. Users are able to mint kUSD by using KSM or its liquid derivative, LKSM, as collateral. Mint kUSD is primarily a borrowing application.

Users can borrow this utility token at an APR of 3% (stability fee) to use for any number of desirable use cases, without having to sacrifice ownership of an underlying asset that may be equally desirable to hold on to. Currently, only KSM and LKSM may be used as collateral due to their decreased volatility compared to far newer coins such as KAR or Bifrost's BNC. In time, other candidates will emerge from the Kusama and Polkadot ecosystems, in addition to established cross-chain coins such as BTC and ETH upon the completion of certain bridging protocols.

Mint kUSD Directly Within the Karura DeFi app Image via apps.karura.network

Mint kUSD Directly Within the Karura DeFi app Image via apps.karura.network Karura Swap- The “Uniswap” of the Kusama Ecosystem

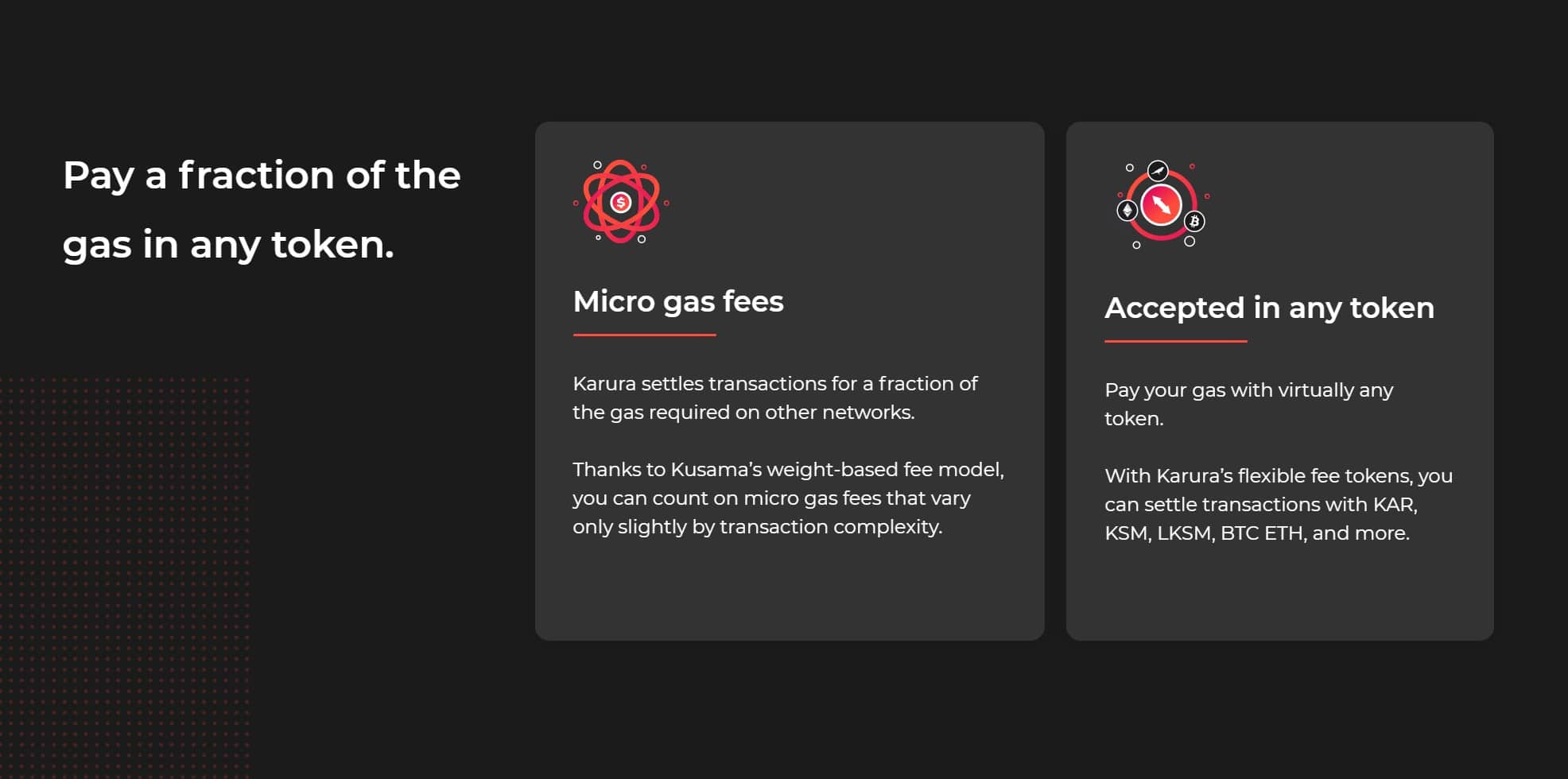

Karura's Swap function probably speaks for itself. It allows tokens to be traded in a permissionless and automatic way by employing liquidity pools that users of the DEX contribute to. As expected, tokens native to Kusama and Polkadot are supported, plus those compliant with the ERC-20 standard. Swap fees are negligible and may be paid for by any of the coins within your wallet.

Karura’s trustless, cross-chain exchange is powered by an automated liquidity provisioning protocol. Users can become liquidity providers and earn in two ways: Exchange fees from Karura Swap and stability fee profit-sharing from the kUSD stablecoin protocol.

Say Goodbye to High Gas Fees and Being Forced to Pay Fees in a Specific Token Image via acala.network/karura

Say Goodbye to High Gas Fees and Being Forced to Pay Fees in a Specific Token Image via acala.network/karura Liquid Staking

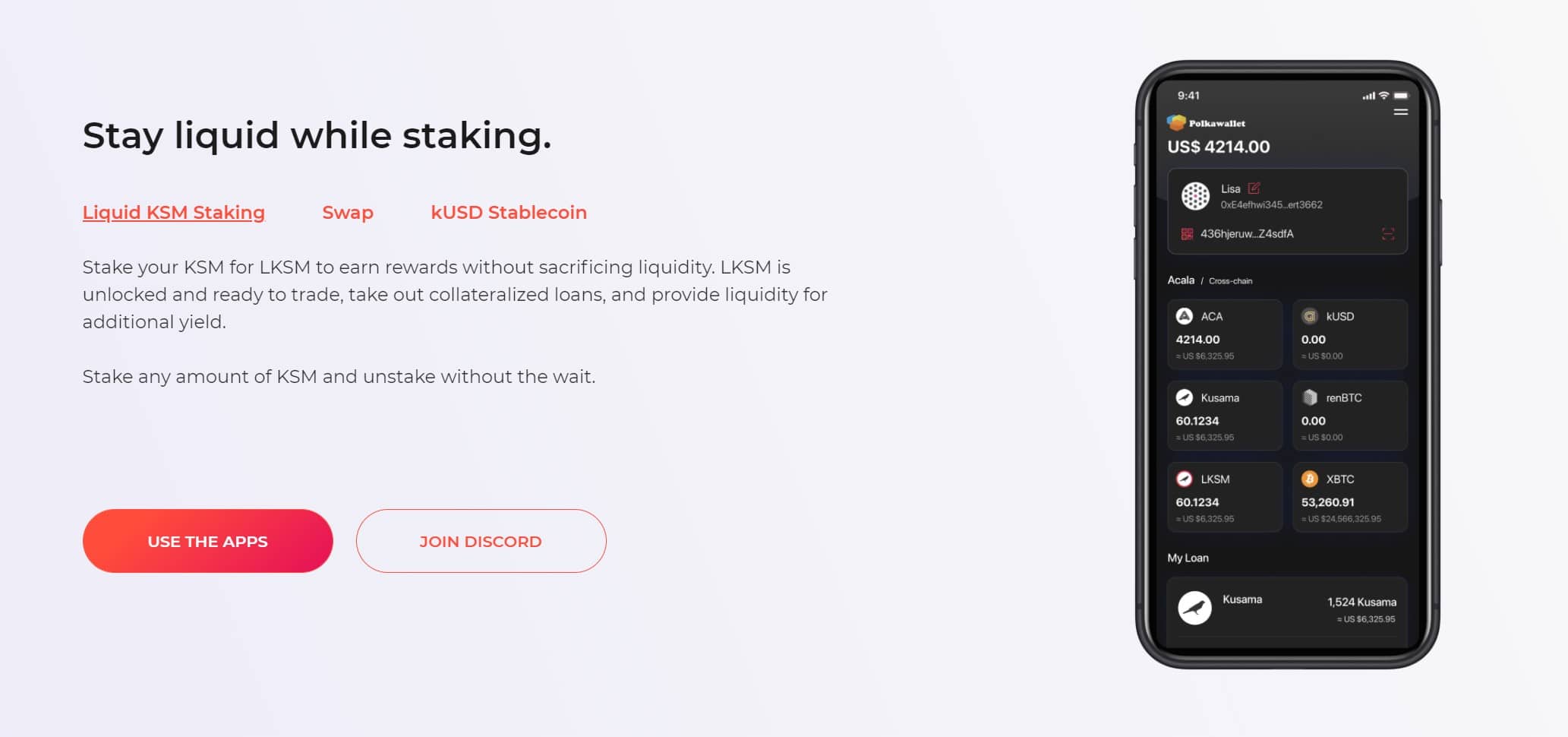

This one is big, staking without having to lose the liquidity of your tokens? I’ll take that any day!

The Liquid Staking protocol offers two important benefits for the greater Kusama ecosystem. By encouraging users to perform their usual KSM staking via Karura, network security is maintained due to less KSM flowing out to alternative DeFi applications. Karura achieves this by offering users the freedom sorely missing when staking via the usual method. We might refer to this as negating the cost of tying up KSM.

You spend long enough in crypto, it's almost inevitable you'll experience one of those awful "opportunity-of-a-lifetime-is-going-to-pass-me-by-due-to-the-unstaking-period-infinite-FOMO" moments. We could equally describe it as having your cake and eating it too.

Staking KSM on Karura offers the same 16% APR benefit, with little obvious downside. Each KSM staked generates approximately 9.65 LKSM for the user which is yield-bearing. As long as the user doesn't trade it away, they shall receive the usual staking rewards while various other opportunities are also afforded.

Liquid Staking-What DeFi Dreams are Made of Image via acala.network/karura

Liquid Staking-What DeFi Dreams are Made of Image via acala.network/karura Earn

Karura's Earn section offers users the ability to earn trading fees and other rewards for performing various activities on the platform. There are a number of liquidity pools for a user to contribute to, with each pool being proceeded by a bootstrapping event in order to establish an initial exchange rate between the two tokens which make up a given LP pair.

Liquidity Providing (LPing)

Karura App offer users the ability to earn trading fees and other rewards by providing liquidity to Karura Swap. Users who choose to provide liquidity earn a cut of the trading fees relevant to the amount of liquidity they provide. It is important to note that liquidity providing does come with the risk of impermanent loss.

This can happen when there are significant fluctuations in the underlying asset exchange rates which results in LP’s being worse off than they would have been if they simply chose to hold the tokens. If the exchange ratio of the underlying token diverges from the exchange ratio when the LP provides liquidity then there is a potential loss compared to if they just held the tokens, the bigger the deviation, the bigger the loss.

The loss is, of course, only realized at the time the LP withdraws their liquidity. If you want to go way more in-depth about the liquidity rewards and risks associated, you can find all that information in the Acala Wiki

Liquidity Mining

The Karura network from time to time may also choose to offer additional incentives to users who perform certain activities on the network. To mine liquidity, users need to first become a liquidity provider (LP) then stake their LP tokens where they can earn liquidity mining rewards, loyalty bonuses and a kUSD surplus bonus.

How to Mine Liquidiy on Karura Swap Image via Wiki.acala.network/karura

How to Mine Liquidiy on Karura Swap Image via Wiki.acala.network/karuraLiquidity Bootstrapping

Users can participate in bootstrapping during the bootstrap period. The bootstrap period is the process by which new token pairs launch on the Swap. Users will be able to submit a proposal to bootstrap a pool and if it is accepted users will be able to participate under the following parameters:

- Not Before: Pool cannot be started before a particular block number

- Target Provision for Token A: Minimum requirement of liquidity for Token A

- Target Provision for Token B: minimum requirement of liquidity for Token B

- Minimum Contribution for Token A: Each contribution requires a minimum amount of Token A

- Minimum Contribution for Token B: Each contribution requires a minimum amount of Token B

A liquidity pool can only be started once the following criteria are met:

- The “Not Before” block has passed AND

- Either “Target Provision for Token A” OR “Target Provision for Token B” has been met AND

- Both Token A and Token B has >0 liquidity

During the bootstrap period, no trading will be allowed, but approved users can contribute liquidity for token A, or Token B or both at the same time. Users should only participate in the bootstrapping process if they intend to be liquidity providers for the pair as well, users will not be able to withdraw their tokens during the bootstrapping period.

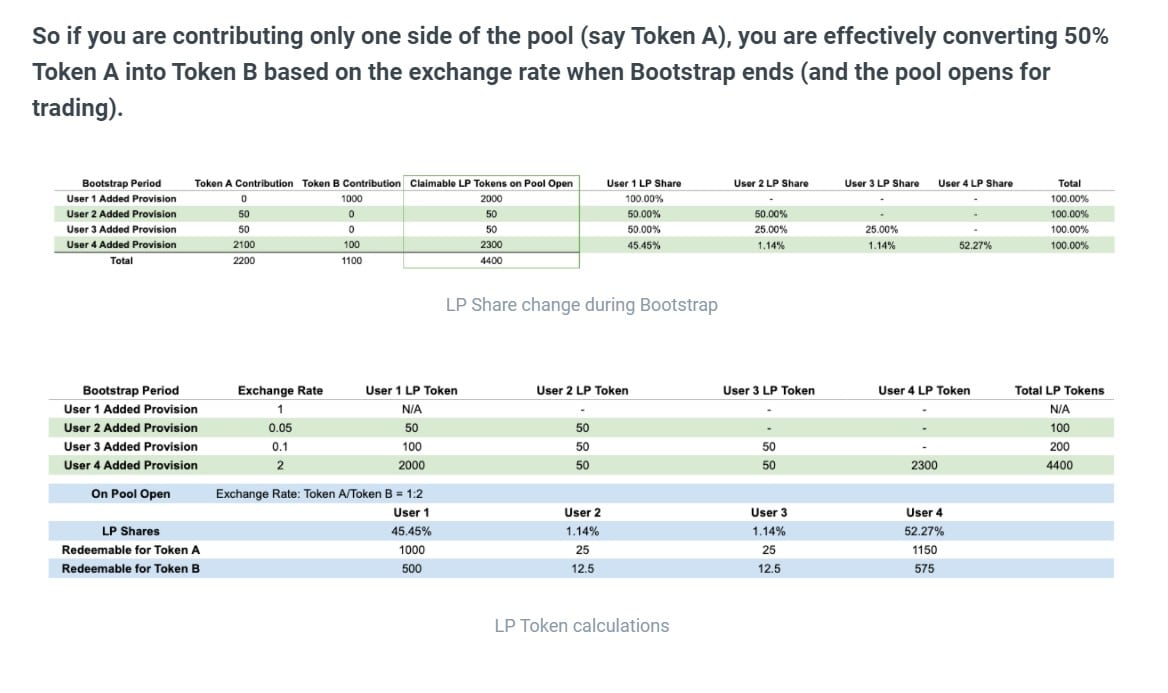

Here is a chart showing an example of what participating in a bootstrapping event would look like:

Example of bootstrapping share change and calculations image via wiki.acala.network/karura

Example of bootstrapping share change and calculations image via wiki.acala.network/karura After the bootstrap is completed and the tokens are available for users to swap, the LP tokens are allocated to each liquidity provider. LP shares are a pro-rata representation of an LP’s contribution to the overall liquidity of a given pool. LP Tokens can then be redeemed for the underlying asset at any time. Liquidity bootstrapping is more appropriate for advanced users and to learn more, you can consult the wiki on Karura bootstrapping.

Lending and Borrowing

Yes, that is right, this “all-in-one” DeFi Hub lives up to its name and users can also participate in lending and borrowing, one more way to say bye-bye to those pesky, fee hungry banks who take and take and give so little. It is refreshing that these advancements are being made in the crypto space where all this can be done directly on the Karura platform as having coins spread across 6 different platforms as I currently do for different purposes can be burdensome!

Users will be able to lend their tokens out directly on the Karura platform and earn interest and borrowers will be able to take out loans in the form of kUSD. The lending and borrowing mechanism will work via an over-collateralization method meaning that borrowers must put up more crypto as collateral than they are trying to borrow. This is the network’s way of ensuring that they aren’t losing any money in the event that the borrower is not able to pay the borrowed funds back.

This allows users to not have to liquidate their crypto holdings so they can hodl-on and keep their crypto assets without needing to sell them for access to cash. It is important to note that there are risks involved such as liquidation events should the value of the tokens drop too much in price, generally below 100% of the value of the token at the time it was borrowed.

This would result in a fraction of the collateral being sold at 20% intervals until price recovers or heaven forbid, your entire collateral is liquidated due to a severe price crash. Borrowers can further reduce this risk by offering even more funds up for collateral than they are borrowing to allow for more, “breathing room.”

The Features of Karura DeFi Image via pbs.twimg.com

The Features of Karura DeFi Image via pbs.twimg.com Governance

The least sexy section of the app allows users to participate in the governance of the platform protocols. While governance is rarely the first section we're likely to seek out on a DeFi application, it highlights the inherent ethos of Karura, and indeed the entire Kusama and Polkadot ecosystems. Each phase of launch and each new coin must be given the green light via the democratic process.

Of particular interest is an upcoming vote regarding the addition of USDT to be used as collateral and as part of a trading pair. Several concerned voices within the community have already questioned this step. This particular vote may not be as straightforward as those which have preceded it. It begs the question as to whether the Karura team have a backup plan should USDT prove unpalatable to the Karura community.

Karura will take a phased approach to employ various governance mechanisms that will allow for the decentralization of the platform. Karura’s governance framework is based on Polkadot’s technology that employs a referenda chamber, a general council and a technical committee to govern the network.

Referenda- Referenda is a straightforward, all-inclusive, stake-based voting scheme. A referendum can be started by public proposals or council proposals, and be brought forth to the governing community. There is an 8-day enactment delay associated with it, emergency proposals (e.g. fix urgent network issues) can be "fast-tracked" to have a shorter enactment period. Karura has adopted Polkadot's voting mechanisms including Tallying, Voluntary Locking and Adaptive Quorum Biasing.

General Council- Karura will initially be governed by a Referenda Chamber together with a General Council appointed by the Acala Foundation. It is their decisions that will determine important network considerations such as runtime upgrades, resolving network issues, improvements etc. In true blockchain fashion, all decisions are made transparent on-chain.

Meanwhile, any KAR holders can propose any changes to the network or protocol and the proposal will be voted for or against by the Referenda Chamber. The General Council then provides oversight with veto rights to stop proposals that they may deem of ill-intent or pose security risks or anything deemed to not be in the best interest of the Karura network.

Once the network is sufficiently stabilized and security measures are in place, a Referenda will be started to move governance to the Elected Council phase where the candidacy of councillors is open, and councillors will be elected via a public voting process.

Financial Council- Will oversee updates of stablecoin parameters, DEX parameters, Liquid Staking fees, and protocol tasks. The Financial Council will be elected by the General Council with a 2/3 approval rating needed.

Liquid Staking Council- Will oversee updates of Liquid Staking parameters for things like validator selections. Liquid Staking Council members will be elected by LKSM Token holders.

Oracle Collective- Membership of the Oracle Gateway will require approval from the General Council, which is essentially a Proof-of-Authority model that only allows authorized trusted operators to provide price feeds into the network. This model will evolve with the contemporary research and development of the Oracle problem. Membership will be elected by the General Council with a 2/3 approval rating.

Technical Committee- The Technical committee can fast-track emergency proposals that are critical to the network operation, delaying an enactment, or cancelling dangerous proposals. Technical Committee members will be elected by the General Council with a 2/3 approval rating.

This seems to be a well-rounded, all-encompassing fair and democratic decentralized approach to governance. Even with a few coins, holders vote in an impactful manner. The voting algorithm is more formally defined as quadratic voting and it's a mathematically optimized way to make a choice in a democratic community.

Zero knowledge voting provides collusion resistance (ie. after the voting takes place, what each person voted for is not revealed), and the on-chain snapshots before announcing voting provides some sybil resistance (eg. with one wallet one vote, whales could move to multiple wallets, therefore voting with all their coins but spreading it under multiple identities, increasing the net weight of their vote)

Karura (KAR) Tokenomics

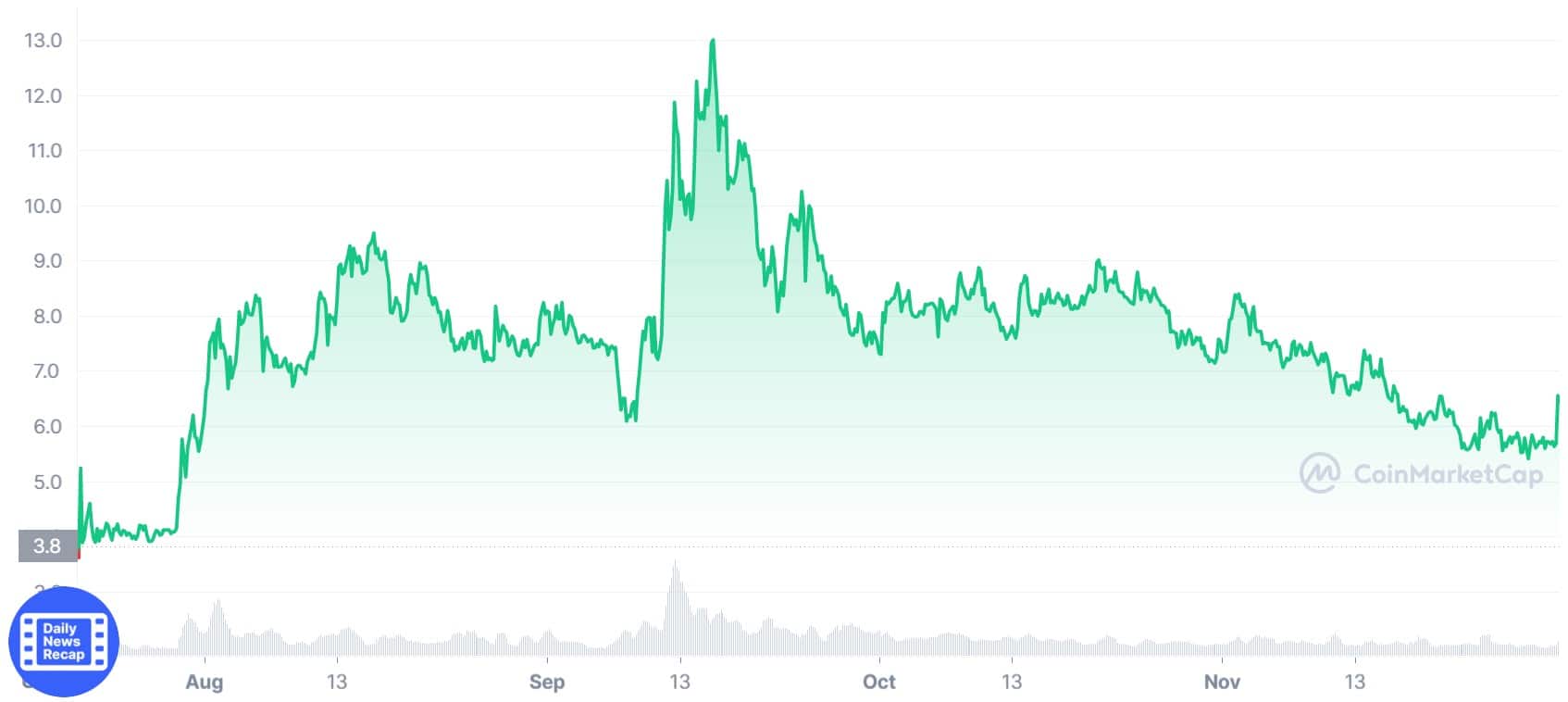

Karura is all about providing utility. However, it would be remiss to omit and direct examination of the native coin itself. The Karura ICO happened between the 8th to 22nd of June 2021 with an initial price of 3 dollars per token. What was really great to see is that the price did not instantly drop hours after the token launched to the public which is often the case following a public sale as early investors are eager to take profits, resulting in a stark drop in price.

Karura enjoyed fairly stable price action right from the launch of the token which is a good sign as it shows that many of the investors who participated in the private sales rounds believe in the long-term growth of the project, and not everyone was only involved just to make a quick buck.

The token has been enjoying a steady price increase since the launch, seeing an all-time high of $13.20 and is now back down to just above the ICO price at $3.36 following the overall drop we have seen across the entire crypto space.

Karura Experienced Truly Encouraging Price Action Following the ICO Before the Overall Crypto Trend Changed in the Fall of 2021 Image via Coinmarketcap

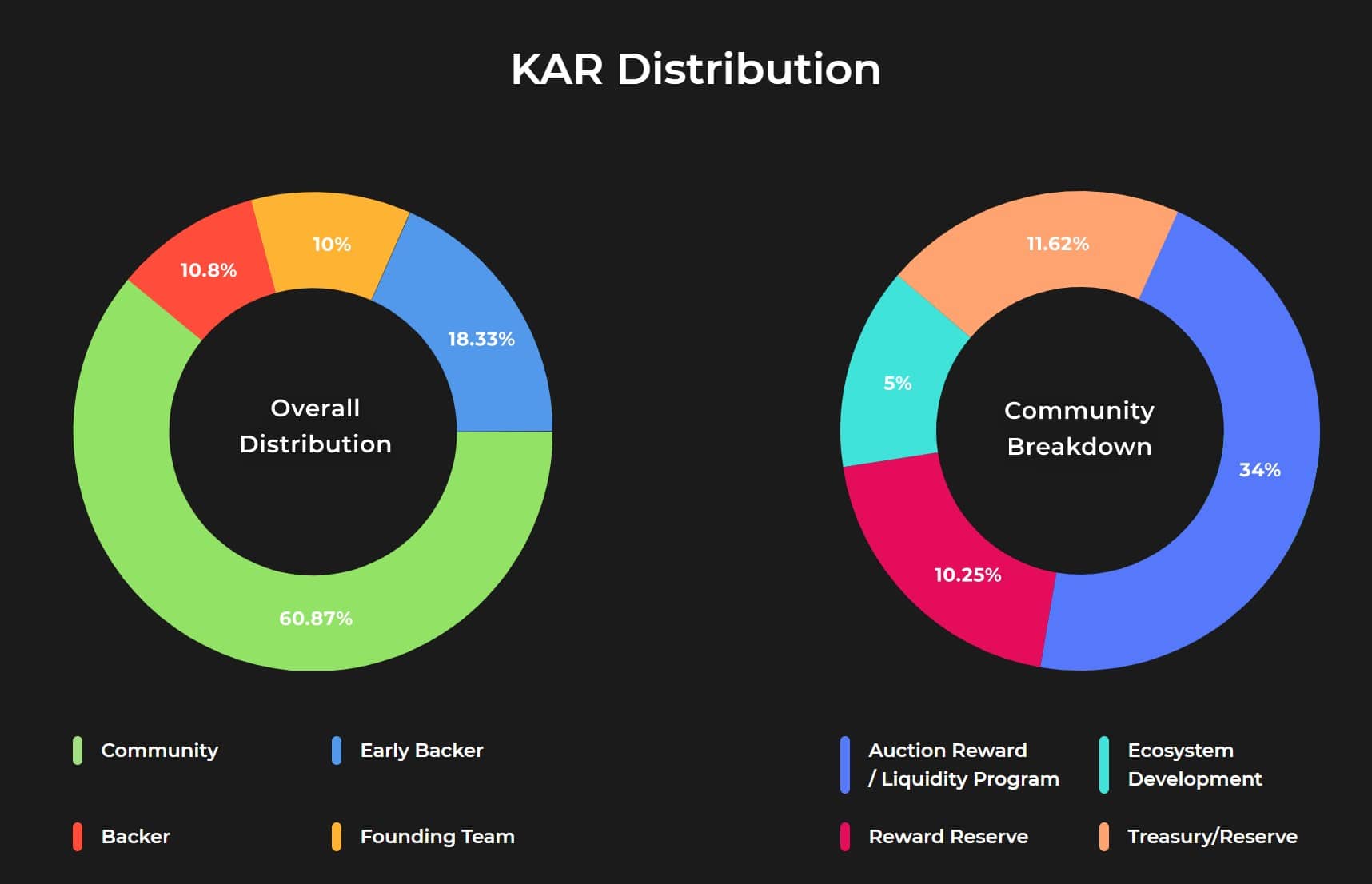

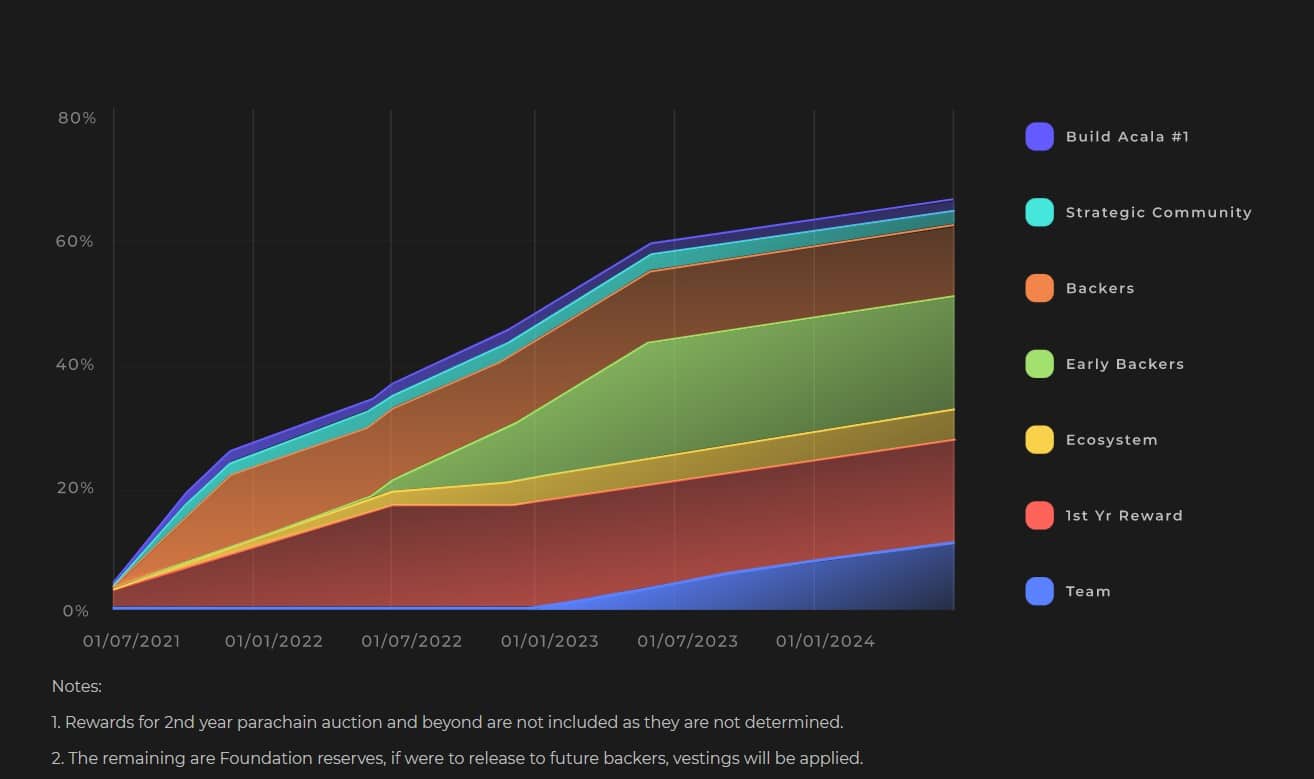

Karura Experienced Truly Encouraging Price Action Following the ICO Before the Overall Crypto Trend Changed in the Fall of 2021 Image via Coinmarketcap Market corrections aside, the other tokenomics behind KAR also look fantastic in terms of overall token distribution and the vesting schedule. The community has access to the vast majority of the tokens, 60.87%. Early backers and investors have access to 18.33%, general backers have 10.8%, and the founding team hold 10% of the tokens.

It is always important to know whether or not the community are the majority holders of the token as this means that no founders or insider investors are holding the majority of the tokens which means they can’t all decide to sell at once which can lead to massive drops in price or shady rug pulls where the community is left holding bags full of tokens that are falling in value.

The Fair Distribution of the KAR Token Image via acala.network/karura

The Fair Distribution of the KAR Token Image via acala.network/karura The Community breakdown shows that 34% of community tokens went to the parachain auction and reward liquidity program, 5% to the ecosystem development, 10.25% to the reward reserve which Karura will be using in the future to grant active network participation, and 11.62% to the treasury/reserve which will be used to encourage growth within the network.

The vesting schedule should also give token holders confidence. These schedules are important to understand because it gives us information about what pool has access to how many of their tokens and when. This allows retail investors to better prepare for events where early investors gain access to a large number of their tokens who may choose to sell and trigger a significant drop in the price of the token.

The founding team has an 18-month lock-up period followed by a consistent release for the next 18 months to avoid large sell-offs at once. The early backers will have a 12-month lock-up followed by a consistent release for the following 12 months, and the backers will have a one month lock-up followed by an even release for the following 5 months.

KAR Vesting Schedule Show’s a Fairly Stable Release of Tokens Which Should Result in Less Volatile Price Action as Whale Token Holders Won’t Be Able to Dump All at Once Image via acala.network/karura

KAR Vesting Schedule Show’s a Fairly Stable Release of Tokens Which Should Result in Less Volatile Price Action as Whale Token Holders Won’t Be Able to Dump All at Once Image via acala.network/karura The Karura token can be picked up at major exchanges such as KuCoin, Kraken, OKEx, BKEX, Hotbit and Gate.io.

The Team and Backers

As Acala and Karura are “sister networks” and Karura was founded by Acala, many of the Acala team members also work on the Karura DeFi protocol, which is a good sign as Acala has some serious talent and funding behind the project. Bryan Chen and Bette Chen, Co-founders of Acala are both also working on the Karura side, along with Fuyao Jiang, another Co-founder of Acala and the two also share multiple advisors and other team members. You can take a deeper look at the Acala team page and Karura team page to learn more about the teams behind these projects.

Acala was founded in 2019 and has received five Web3 foundation grants and has backing from Coinbase Ventures, Pantera Capital, Polychain Capital, Hypersphere and many other top firms. Those are some of the biggest names in the industry folks, those guys don’t toss around money around to projects who do not have some seriously high-flying potential, I would be keeping a close eye on Acala and Karura.

The Firms Backing Acala/Karura Image via acala.network/karura

The Firms Backing Acala/Karura Image via acala.network/karura Roadmap

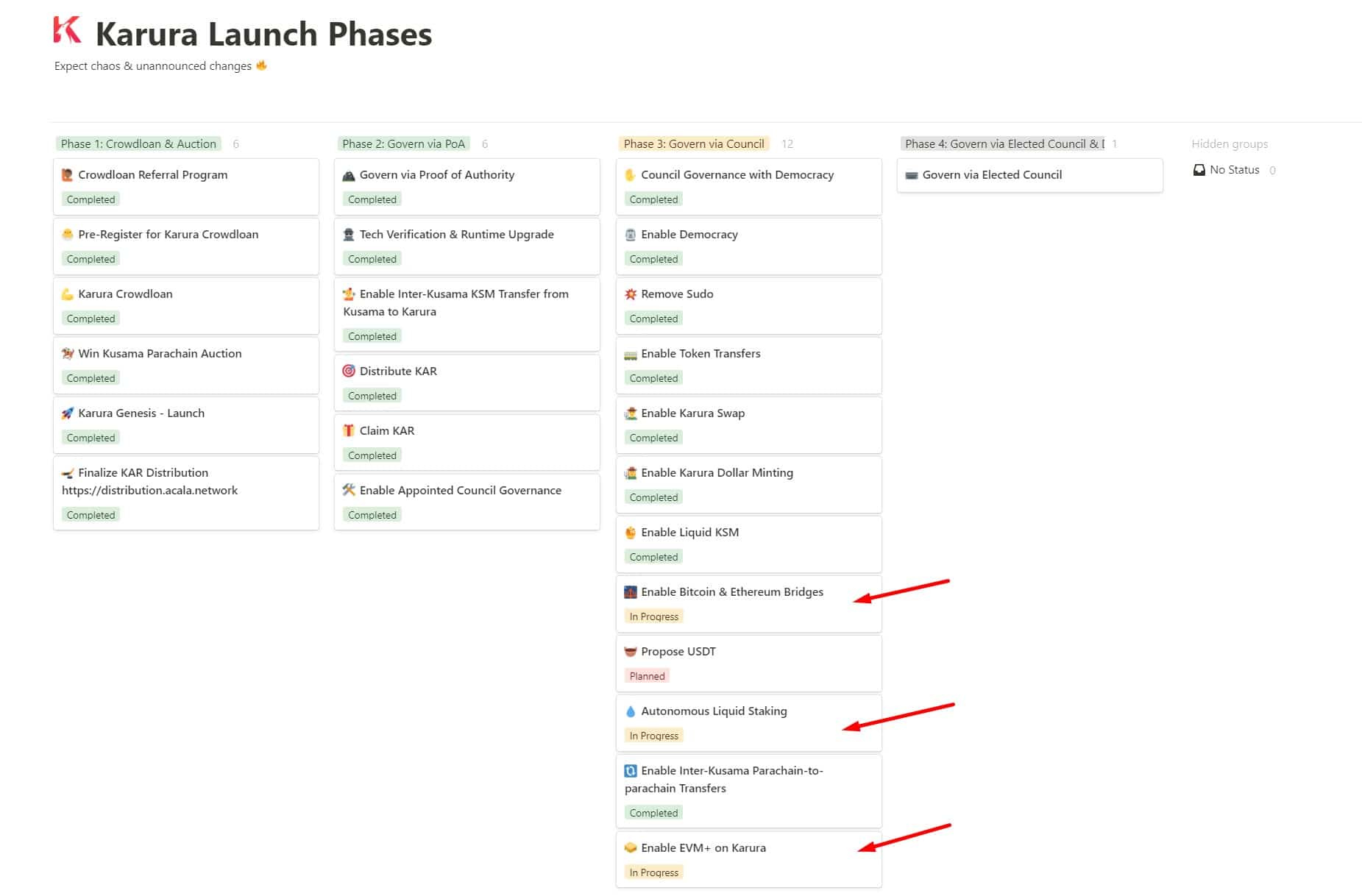

The Karura team have some exciting things in the pipeline including enabling Bitcoin and Ethereum bridges to be used in the Karura ecosystem which will be massive for increasing the adoption of the Karura app and Kusama network, and they will be implementing autonomous liquid staking and introducing the Ethereum Virtual Machine Plus (EVM+). A full list of their upcoming launches can be found on their launch phases roadmap.

Karura Has a Lot of Exciting Things in the Pipeline With EVM+, BTC and ETH Bridges and Autonomous Staking Having Massive Potential Image via the Team’s notion

Karura Has a Lot of Exciting Things in the Pipeline With EVM+, BTC and ETH Bridges and Autonomous Staking Having Massive Potential Image via the Team’s notion Conclusion

With only a handful of parachains fully launched on Kusama, it is extremely difficult to contend with Karura's claim as "THE all-in-one DeFi hub of Kusama". However, without any genuine competition, it seems best to appoint Karura as the Crown Prince, heir apparent, (highly likely) future Kusama King of DeFi. A number of factors heavily favour Karura's continued success.

- Favourable reputation

- First mover advantage

- Seamless launch

- Acala ("THE all-in-one DeFi hub of Polkadot")

While distinct, these four factors closely relate to each other and create a perfect positive feedback loop. Acala's favourable reputation preceded the first Kusama Parachain Auction and ensured a comfortable victory. The first-mover advantage could have quickly turned out to be a poisoned chalice due to the potential chaos of Kusama.

Instead, the ostensibly smooth launch only added to the reputation, laying the foundations for Acala's bid in the first Polkadot Parachain Auctions. Not every project launched on Kusama has made the most of this opportunity. The success of Karura and Moonriver have all but guaranteed success for Acala and Moonbeam in the first Polkadot Parachain Auctions.

Unfortunately, some other projects, (which shall remain unnamed), may have unintentionally reduced their chances of success by struggling to achieve milestones throughout their Kusama launch.

If our assumption is correct that Acala will achieve similar early success on Polkadot, the positive feedback loop will be complete. As more and more utility becomes available on both parachains, and a likely integration with Acala's third project Laminar, we will likely witness this combined monster of DeFi truly standing out.

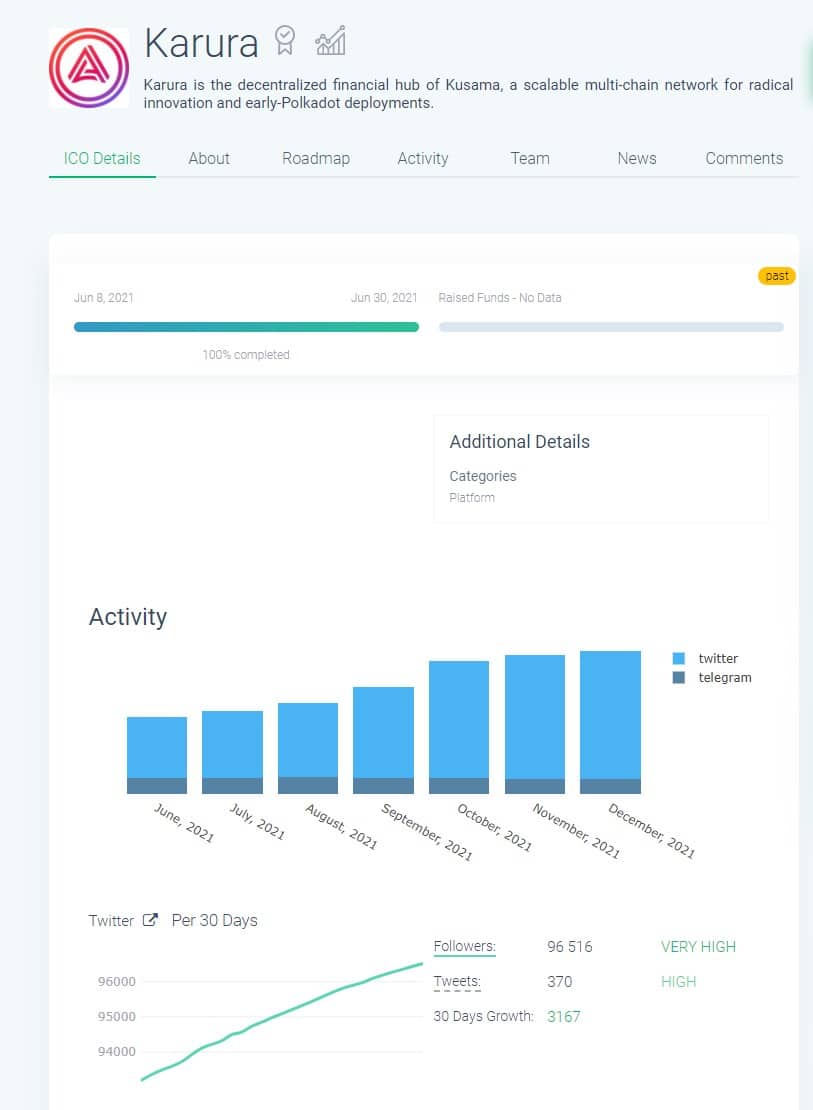

Right now, it is very difficult to doubt their original claim as being “The” all-in-one DeFi hub. Social media hype around Karura has also been on a steady increase, witnessing month over month growth as more and more users are becoming interested in the Kusama and Polkadot ecosystems and are naturally looking for the top DeFi solutions for these networks.

Karura has Enjoyed Growing Social Media Attention Each Month Since the Token Launch Image via icoholder.com

Karura has Enjoyed Growing Social Media Attention Each Month Since the Token Launch Image via icoholder.com With the number of backers behind the project, the skill and experience of the Acala team, the innovation and ease of use and utility of the platform, and the highly anticipated mass adoption of the Polkadot and Kusama ecosystems, Acala and Karura truly have a massive leg up on any competition, enjoying first-mover advantage in the race to be the most widely used DeFi protocol in the Kusama ecosystem. This of course means there are high expectations for the team and their projects have massive potential as we are still in the very early days of all things Polkadot and Kusama.