KuCoin Shares (KCS) are the native currency of the KuCoin exchange, a relatively new but rapidly growing crypto exchange.

There has been a great deal of interest in these tokens given their unique profit sharing structure which allows users to earn a passive income. The coins were also highly publicized back in 2017 when the KuCoin exchange conducted a much touted crowd sale ICO.

However, with the collapse in trading volume recently, are the coins still worth it?

In this KuCoin Share review we will take an in-depth look the coin ecosystem, development and roadmap. We will also analyse the long term use cases and mass adoption potential of the KCS tokens.

Note: Users located in the US and UK are not supported.

What is KuCoin Shares?

KuCoin Shares (ticker: KCS) were launched by the KuCoin exchange in October 2017 and are a profit sharing coin that allows traders to draw value from the KuCoin exchange.

A daily dividend is paid to those who hold KuCoin, with the dividend coming from the fees collected by the exchange. KCS has seen impressive growth as investors have been keen to invest in a cryptocurrency that pays them to hold it.

The KuCoin exchange is also relatively new, but the addition of KuCoin Shares has helped the exchange grow rapidly. The exchange itself aims to be one of the top cryptocurrency exchanges, and it is well on its way. KuCoin is based in Hong Kong, and the exchange currently handles roughly $10 million in daily volume.

Overview of KuCoin Shares in Exchange Ecosystem. Image Source: KuCoin

Overview of KuCoin Shares in Exchange Ecosystem. Image Source: KuCoinBesides being paid out as a dividend, the KCS coin can be used on the KuCoin platform for various functions. When used to pay trading fees it results in substantial discounts, but most users seem to enjoy the daily dividend they get when holding the coin in the exchange wallet.

The really exciting facet of this coin is that as trade volume on the exchange increases so will trading fees, and the biggest beneficiaries will be KCS holders. Those who invested early in KCS will be able to control large amounts of the coin as trade volume scales up.

If KuCoin were to make it into the top ten exchanges those holding KCS would see significant daily profits flowing their way, not to mention the inevitable increase in the price of the KCS token as its dividend becomes increasingly valuable and it sees demand grow.

The dividend paid is split evenly between the number of KCS in circulation, so just as if you were holding a dividend bearing stock, the greater the number you hold the larger your dividend.

How do Kucoin Shares Work?

The distribution on dividends and discounts earned by KCS holders is all dependent on how many of the coins are held. For example, the tiered maker/taker fees are discounted as the number of KCS held increases up to a maximum of 135,000 or more KCS which has a minimum fee of 0.0125% for makers and 0.03% for takers. This tiered discount recently replaced the initial discount program that gave a 1% discount for every 1,000 KCS held.

Another benefit to holding KCS comes from the KuCoin Shares buyback and burn program. In this program KuCoin uses up to 10% of their quarterly profits to buyback KCS tokens on the open market and then burn them, thus reducing the supply and theoretically making the remaining KCS more valuable.

This is meant to guarantee investors that not only will their passive income from dividends continue to grow, but that the value of the KCS they hold will also increase over time.

The dividend on KCS is paid every day and the proceeds are deposited directly to your KuCoin wallet address. KCS holders also get additional benefits at higher holding such as a fast track customer service lane and a personal investment consultation.

KCS Coin Supply and Distribution

The total supply of KCS is 180 million, but only about half of those are currently in circulation. The initial supply of KCS was set at 200 million, but the number has been declining as roughly 10% of all the exchange profits each quarter is used to buyback KCS and burn them in order to support higher prices. This buyback and burn will continue until just 100 million KCS remain. KuCoin has logically named this the “Buy-back” program.

The initial distribution of KCS occurred through a private sale, and subsequently through an initial coin offering. This was done with the intent to fund the growth and development of the KuCoin exchange and by extension the KCS coin.

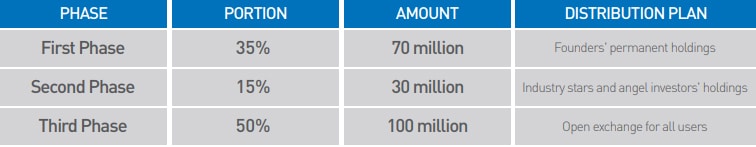

Distribution Plan for KCS. Image source: Whitepaper

Distribution Plan for KCS. Image source: WhitepaperThe initial distribution saw the founders of KuCoin receive 35% of the KCS coins, 15% went to angel investors in the exchange and the remaining 50% was sold to investors. According to the KCS whitepaper the 35%, or 70 million KCS, that was distributed to the founders is locked up until September 2, 2021.

In addition to that the 30 million coins given to angel investors are also locked up, but only until September 2, 2019.

KCS is not a mineable cryptocurrency, but shares can be purchased through any exchange that offers trading in KCS coins. The majority of trading volume is in BTC, with the second largest amount being exchanged for ETH and the third largest pairing with USDT.

KuCoin Team

Given that you are buying into the success of the exchange with the KCS token you will want to make sure that it is being run by a competent group of people. Taking a look at the KuCoin Exchange team in their whitepaper, we have a pretty diverse group.

CEO and founder is Michael Gam who used to have a position at Ant Financial which used to be known as Ali Pay. He also held previous roles at internet companies such as MikeCRM and KF5.com.

He is joined by Eric Don who is the COO. Eric is supposed to be an "internet industry star" and has been a CTO at a number of other internet companies including youlin.COM, kiteme and reinot. We could not find information on these companies online.

Sitting in the CTO seat we have Top Lan. Top is an "open source community technical expert" who contributes to a number of open source projects. He was the one who developed the KuCoin trading platform. We could not find information of his projects online.

The Extended KuCoin team

The Extended KuCoin teamDespite these questions around the initial ICO team, the exchange has grown considerably over the past two years. They have expanded to have over 6 offices around the world and they are still expanding with lots of open positions.

KCS Price Performance

The launch of KuCoin to private investors began in August 2017 with a total supply of 200 million KCS coins. After the private funding round a public initial coin offering was held in which 100 million KCS coins were sold at $0.197326 each, netting KuCoin nearly $20 million.

The KCS coin hit an all-time high of $21.14 on January 7, 2018. It hovered around that level for a week and then began a slide lower that continued throughout 2018 and finally reached a low of $0.354022 on February 7, 2019, exactly 13 months later. As of February 21, 2019 the price has rebounded to $0.466788

Because KCS is and ERC-20 token it can be stored in any ERC-20 compatible wallet such as MetaMask or Mist, however in this case it is actually recommended that you store the coin in the KuCoin exchange wallet. The reason for that is you can only receive your daily dividend for KCS stored in the exchange wallet.

KuCoin has not been victim of a hacking attempt, and its security is to traditional international banking standards. All user data and other sensitive data is encrypted and a multi-factor dynamic authentication gives additional security.

Development & Roadmap

Given that the KuCoin Shares themselves perform a really simple function, there is not that much development on the blockchain / protocol side. Hence, there is no public GitHub repository to glean information on.

Nevertheless, the most important development from the perspective of the token holder is the growth of the exchange. KuCoin has been adding numerous features over the past two years which have helped increase its volume and hence profits. Below are the most important updates on the exchange that coincide followed as a result of the release of v2.0.

- Release new OTC trading desk

- Release of KuCoin v2.0 platform

- Implement Platform 2.0 order matching engine

- Increase number of order types (order life options)

- Release the new websocket API and Rest API for platform 2.0

These updates have helped make the KuCoin trading platform more robust and functional. While these technological updates were being pushed, the exchange has been introducing a wider array of crypto coins to trade. All else held equal, the more coins that an exchange lists, the more interest they are likely to have from traders.

Taking a look towards the upcoming year, there are quite a few things to look forward to on the exchange. Below is a breakdown of the most important quarterly milestones for 2019 as laid out in their roadmap.

KuCoin Roadmap for 2019

KuCoin Roadmap for 2019The most interesting of these will be the KuCoin blockchain protocol testnet as well as the deployment of KuCoin social features. If you wanted to stay up to date with these releases then you should keep an eye on the project's official blog.

KuCoin and The Howey Test

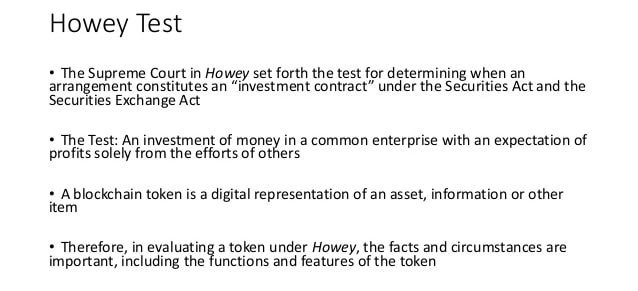

Something that many people may not realize about KuCoin shares is the fact that is may pass the "Howey test". This is an old rule of thumb that is used by the SEC to determine whether an asset is an investment contract.

Why is this important?

Well, if KCS shares pass the Howey test it means that they can be classified as "securities" by the SEC. There are a whole host of implications that come with an asset being classed as a security with the primary one among them being the fact that the ICO would have been a sale in unregistered securities.

Macalo ICO Presentation to SEC. Source: Slideshare

Macalo ICO Presentation to SEC. Source: SlideshareThis is a big no-no in the eyes of the SEC.

The key reason that KuCoin shares may pass the Howey test is that they confer the holder the rights to dividends. These are tied to the performance of the exchange which is by definition an investment contract.

The SEC has been taking unauthorized crowd sales seriously and they have been implementing enforcement actions on a number of other projects. Whether they could ever come after the KuCoin crowdsale is anybody's guess but stranger things have happened in crypto land.

Conclusion

A cryptocurrency offering a dividend is unique and as more users enter the markets this coin should give KuCoin exchange a strong edge over competitors. With an incentive to hold the coin and to use the exchange it’s a win-win for traders and for investors.

Adding the buyback and burn policy will ensure the coin remains in heavy demand as it becomes increasingly scarce. This also helps curb inflation.

Considering the current daily turnover at the exchange if it could grow to the size of Binance, which is the team’s aspirations, fees (and dividends) would increase nearly 100-fold, while the number of KCS would also be decreasing, giving early investors a huge windfall of dividends.

Even if KuCoin doesn’t grow to the size of Binance, as long as it continues to enjoy a good growth rate the dividend will continue to increase. And one would imaging the value of KCS will also increase alongside the rising dividend giving investors both passive income and capital appreciation.

Of course, there is the lingering question around the "Howey test" and the SEC but there have been no indications they are a target yet.