Linear Finance Review: Cross Chain Synthetic Asset Trading

Linear Finance is a fairly new blockchain project that’s looking to improve on decentralized finance by fixing the problems of front-running liquidity, and expensive gas fees that plague the ecosystem.

With Linear Finance’s derivative offerings users are able to avoid these problems on the cheap, fast, synthetic asset exchange platform. Users are able to mint their own derivative assets easily with Linear, using a portfolio of varied tokens to express the level of risk and exposure they are willing to take on.

This new synthetic assets platform offers up new yield making opportunities for everyone, and can be customized to match anyone’s personal financial goals.

What is Linear Finance?

Linear Finance is the first cross-chain compatible delta-one asset protocol for traders to create, manage, and trade synthetic assets. This allows for exposure to a wide range of financial assets without the need to actually purchase those assets directly.

The cross-chain decentralized protocol used by Linear Finance leads to a faster, more secure, and more affordable exchange for all types of synthetic financial assets.

The Linear ecosystem is powered by the native LINA token. The token was designed to cover several primary use cases including staking, governance, liquidity mining, transactional payments, and investing in the platform “Liquids”, which are the synthetic assets created in the Linear Exchange.

Linear Finance has three main use cases:

- Faster Prices – Users can refresh prices at a much higher frequency and much lower rates through oracles.

- Low Transaction Fees and Fast Transactions– This is enabled through their cross-chain compatibility approach by supporting both the Ethereum blockchain and EVM-compatible blockchains. Therefore, the user would only need to initialize both an Ethereum-based wallet and EMV-compatible wallet. Linear can achieve this action through smart contracts.

- Governance – The token holders of their governance token (LINA) will be able to vote on synthetic asset listings, distribution models, oracle selection, pledge ratio, etc.

How Does Linear.Finance Work?

Linear Finance allows its users the ability to mint and trade various synthetic assets that are based on actual financial assets. Each synthetic asset created by users is over-collateralized by the ℓUSD stablecoin.

The use of over-collateralization ensures that the system remains viable and doesn’t break, even in times of extreme volatility, including black swan events.

Users are incentivized to maintain the proper level over over-collateralization for their synthetic assets through the use of a system of rewards. Inflation rewards and exchange rewards can both be earned by keeping a prescribed level of ℓUSD to the synthetic assets.

This ratio is called the pledge ratio or simply the p-ratio. Through the use of incentives to maintain the p-ration the overall health of the system is also maintained.

The liquidity pools within the Linear system are the counter-parties to these transactions. This arrangement allows for unlimited liquidity on the exchange and zero slippage on orders. In addition ti that users can all earn LINA rewards by contributing to the liquidity pools.

After several months of testing the Linear.Exchange went live in February 2021 and has been performing as expected since. Users are able to use the exchange to stake, mint ℓUSD and to create and trade their own synthetic assets.

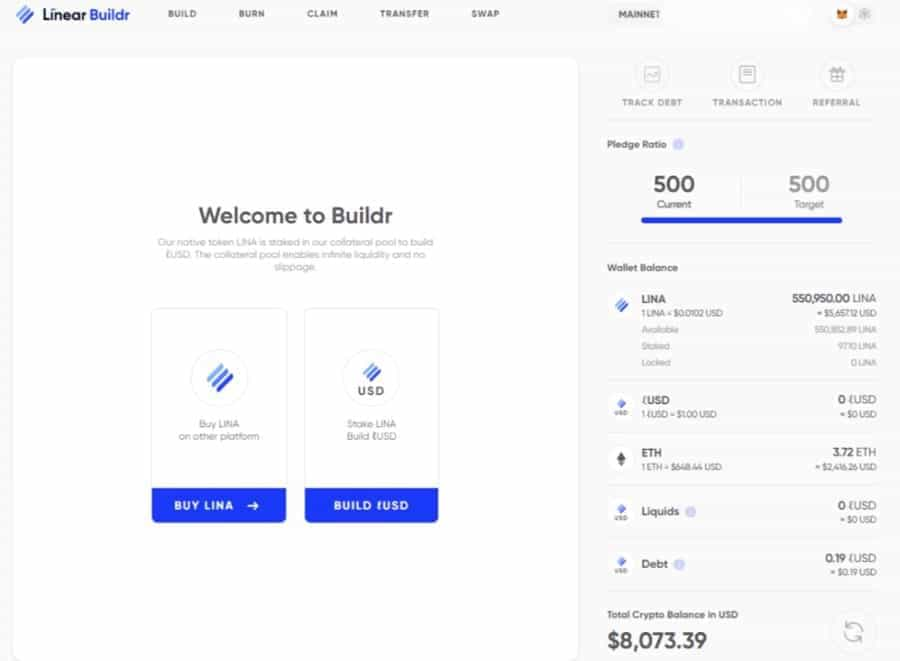

What is a Pledge Ratio?

The Pledge Ratio, or p-ratio, is the ratio between the synthetic asset holdings that were created and the users ℓUSD collateral backing those assets. By over-collateralizing, or over-pledging, it ensures that liquidity is maintained in the system even in times of extreme volatility.

In order to receive LINA rewards the user must maintain a ratio of greater than 500%. Initially the platform launched with a 600% requirement, but the DAO later reduced the amount to 500%.

The LinearDAO

The LinearDAO is the governance structure that controls the platform changes, additions, or deletions. They also control system parameters, such as the p-ratio required to receive LINA rewards as mentioned above.

They also control the implementation of proposals, the level of transaction fees, and LINA inflation rewards, among other things. Furthermore they regulate profits and losses regarding liquidation.

Perks and Special Features

The Linear platform promises users no slippage and infinite liquidity under any circumstances. Below are some of the features that users can expect when using the Linear Finance platform:

- Fast transactions with low transaction fees: This applies to all users whether they are a market maker, staker, or trader.

- No front running: Every transaction made within the exchange is made transparent to all users. This reduces front running and avoids systemic risks on the part of each network participant.

- Ethereum-based, but cross-chain compatible: Because it is built on the Ethereum network with cross-chain compatibility, it can work alongside other DeFi projects too. In fact, it has already been added to the Binance Smart Chain and other chains are planned for the future.

- User-tailored options: Users can tailor their own risk-reward ratios and systems using other tokens, commodities, or market indices.

- Dual-chain implementation: The whole Linear platform is built on two different blockchains but they complement each other thanks to cross-chain compatibility. For users, they only need to open an Ethereum-based wallet and an EVM-compatible wallet.

Linear uses smart contracts to automatically link the two blockchains. Such a design has several benefits as shown below:

- Maximized DeFi support: While LinearDAO and LINA tokens are based on Ethereum and Binance Smart Chain, its use of EVM and smart contracts make it easy for the platform to interact with other DeFi protocols.

- Affordability: Buildr and Exchange function through smart contracts on top of EVM-compatible blockchains. This enables Linear to support the building and trading of Liquids at very minimal gas fees.

- Fewer risks of front-running: The block time confirmation for other EVM-compatible blockchains are much faster than Ethereum. This allows users to create their own Liquids at near real-time prices through the help of oracles. This way, the risk of users front-running the exchange becomes much lower.

What is Buildr?

Buildr is part of Linear’s decentralised application suite. Users can stake LINA tokens to build ℓUSD, the base currency of Linear Exchange. Stakers are entitled to staking rewards and a split of the transaction fees generated by Linear Exchange.

Linear launched its mainnet Buildr platform on December 21, 2020 after months of extensive testing in the testnet environment.

Buildr is a dApp that sits at the center of Linear’s suite of decentralized applications. Buildr allows users to stake their LINA tokens to mint or burn ℓUSD and to earn rewards.

Users can use built ℓUSD to purchase synthetic assets on the Linear Exchange to gain different investment exposures. ℓUSD can also be moved to other protocols or dApps within the DeFi ecosystem. As such, Buildr will involve three separate functions: Build, Burn, and Claim.

This article from the Linear team explains how to use Buildr to Build, Burn, and Claim in complete detail.

Binance Smart Chain’s Buildr v2.0

Linear is determined to bring cross-chain functionality to its platforms, and as such soon after the launch of Buildr on the mainnet the team was also able to release the mainnet version of Buildr on the Binance Smart Chain.

The launch of Buildr v2.0 occurred less than a month after the launch of Buildr v1.0, on January 15, 2021. As the team itself has said regarding cross-chain compatibility:

“Linear was designed for all users (no matter how much LINA you hold) and transaction costs will not become a barrier to entry. Nobody will get left behind.”

Thanks to the launch of Buildr v2.0 users are now able to interact with the Linear platform and enjoy nearly gasless fees.

Be careful! There are now two versions of the LINA token. If you send the Etherum version to a BSC wallet or vice-versa (whether it is a custodial or non-custodial address) you will lose your tokens! If in doubt on what to do, contact the support team via one the official channels (Telegram, Discord, or Twitter).

Linear.Exchange

The Linear.Exchange was launched on January 28, 2021 and allows for trading “Liquids” which are synthetic assets created by using LINA as collateral. Assets can be purchased from the exchange using ℓUSD that’s also minted using collateralized LINA.

Current liquid asset offerings include digital assets, commodities, and our own curated thematic Digital Traded Indexes. In the future it will be possible to add any asset with a price feed as a Liquid.

Each trade has a 0.25% fee assessed and those fees are used as staking rewards for those who have created Liquids and have a p-ratio above 500%. Using the transaction fees to reward users for maintaining a minimum p-ration is a method to ensure the health of the overall ecosystem.

There are six main areas of the Linear.Exchange:

- Market — This section lists all of our Liquids (synthetic assets) pairs tradeable on our exchange with sections separated into spot cryptocurrencies, commodities, and indices.

- Market Pair — After selecting a market pair, this section will display the current price of the Liquid, 24hr Low/High Price, price chart, and the 24 hr trading volume.

- Order Form — In this section, users can purchase their selected Liquid with ℓUSD or sell their Liquid for ℓUSD. In the picture above, the user is attempting to purchase Liquid Cardano with ℓUSD. The user will input the desired ℓUSD to spend or desired Cardano to purchase and click on “Submit Order”. The user will then receive a confirmation transaction on their respective Metamask which they need to approve in order to complete the transaction.

- Trade Order — This section will show all of a user’s historical transactions on Linear.Exchange.

- Portfolio - When clicking the “Portfolio” tab, users will transition to a second page showing a list of the Liquids they have purchased along with their transaction history and a “Total Asset” tracker.

- Linear Swap – The bridge between the Ethereum and Binance Smart Chains. Explained in further detail below.

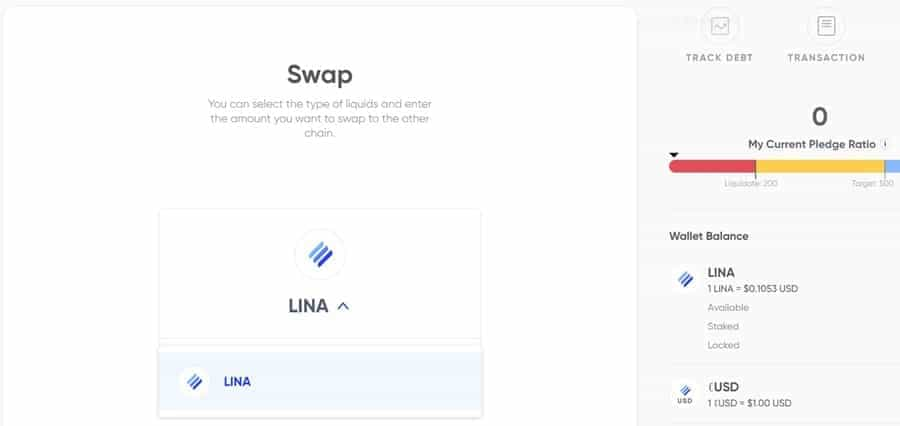

Linear.Swap

The move to the Binance Smart Chain also introduced a new Linear Swap functionality. Since the move made Linear a cross-chain compatible synthetic asset protocol (as planned), the Linear Swap serves as the bridge between the Ethereum Chain and Binance Smart Chain.

This enables users to access the DeFi ecosystems on both protocols.

Users are able to use Linear Swap to swap all of Linear’s assets (LINA, ℓUSD, and Liquids) between Ethererum (ERC-20) and BSC (BEP-20). The Linear Swap functionality can be found under the “Swap” tab within the Buildr dApp.

In addition, the Linear team built the swap functionality directly into the stake and build transaction feature in Buildr. The result is that the user can easily bring ERC-20 LINA into Buildr, press Build and the protocol will automatically swap the LINA into BEP-20 and stake and build ℓUSD on Binance Smart Chain. It’s that simple.

Partnerships

Over the past months Linear has announced a number of partnerships that improve the cross chain capabilities, add custodial services, automate trading, and address front-running on the exchange. These notable partnerships are as follows:

- Nervos is an open-source blockchain with a unique layered architecture that offers security and trustlessness without compromising on scalability and performance. The collaboration between the two entities is focused on improving Linear’s cross chain capabilities as well as penetrating the Chinese market.

- Moonbeam is an Ethereum compatible smart contract parachain, and is a strategic partner to help Linear connect with the Polkadot ecosystem which will help to increase Linear’s interoperability.

- Hex Trustwas added as a custody partner to give Linear the ability to offer secure, institutional grade custodial services to institutional investors.

- 3Commas is a cryptocurrency trading platform that helps users build automated trading bots. The partnership was entered into “to include future integration of the platforms and tools, streamlining operations and allowing for a greater range of features and offerings.”

- Finally is the Band Protocol, a cross-chain decentralised oracle. This is probably the most important partnership to date as the biggest problem this collaboration is trying to solve is front running.

As Drey Ng, Co-Founder at Linear Finance said: “Front running is a fundamental problem not just for current synthetic asset trading but all trading in general”.

Not solving this problem would jeopardize all “the benefits of cross-chain compatibility (such as speed and cost), and a superior creative selection of synthetic assets”.

How Band Protocol Oracle works with Linear

As mentioned above, the partnership with the Band Protocol could be the most important partnership for Linear so far.

In addition to addressing the issue of front running the Band Protocol also brings several other benefits such as minimizing network risk, providing customization options in real-time data, and of course the decentralized oracle mechanism that the protocol brings.

Linear Finance Team

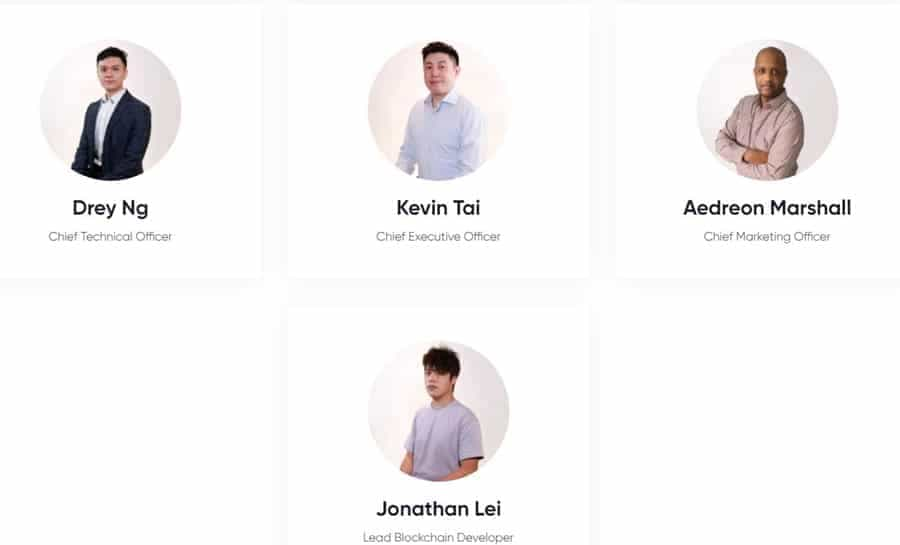

The vision that led to the creation of Linear was one of an inclusive and equal access to investment opportunities. Co-founders Kevin Tai and Drey Ng pooled their talents in finance and tokenization to realize this vision in just under two years.

According to the company LinkedIn page there are 11 employees currently working at Linear Finance, although the website shows just the four major executives and the Lead Blockchain Developer.

Kevin Tai – Kevin Tai is the CEO and co-founder of Linear Finance. He brings experience in M&A deals for enterprise/mobile software companies as well as doing collateralized debt and structured products for banks throughout Asia.

Drey Ng – Drey Ng is the second co-founder of Linear Finance and also serves as its CTO. He has experience in leading tokenization projects for real estate, hedge funds, and semi-government bodies.

Aedreon Marshall – Aedreon Marshall is very valuable to Linear Finace thanks to his experience in forming partnerships in the cryptocurrency industry between individuals and blockchain projects.

Jonathan Lei – Jonathan Lei is the Lead Blockchain Developer at Linear Finance. He has experience in blockchain engineering and creating dApps. He was also the co-founder, CTO, and lead architect for DueDex (a cryptocurrency exchange).

The LINA Token

LINA is the native token of the Linear ecosystem and can be used for governance, staking, and payments. However the primary use of LINA tokens is as collateral to mint Liquids through Buildr. It is also used to mint the ℓUSD used to purchase Liquids on the Linear.Exchange.

In both cases the LINA token is pledged as collateral to fully back the assets being created. This is how the system is secured and protected from volatility. Currently the pledge requirement is 500%, however that could be decreased in the future through a governance vote.

Staking

As you can see below there are a number of benefits to staking LINA tokens:

- Exchange Fee Reward: The transaction fees collected from users of the Linear.Exchange platform, currently set at 0.25%, is redistributed weekly to LINA stakers on a pro-rata basis. For non-LINA stakers, these rewards can also be provided too but it will depend on the decision of the community governance council.

- Inflationary Reward: LINA has a starting inflation rate of 75% which decreases on a weekly basis. The inflation reward is given to LINA stakers on a pro-rata basis as well.

- Yield Farming: Yield farmers help maintain Linear’s debt pool and the whole platform. For the first two years of the project, users who actively use the exchange can receive token bonuses. These token bonuses can then be deposited by yield farmers in other liquidity pools such as Balancer, Curve, and Uniswap.

LINA Token Public sale

LINA tokens were first offered in a public sale on September 14, 2020. There were two rounds to the sale, with the first round selling 25 million tokens for $0.004 each and the second round selling 22,222,222 tokens at $0.0045 each. The sale was meant to last 24 hours, but ended early due to being 40x oversubscribed.

The token sale required each person to purchase 500 USDT/USDC worth of LINA, and was on a first come, first served basis. This meant that only 400 participants were able to get their allocation of LINA tokens.

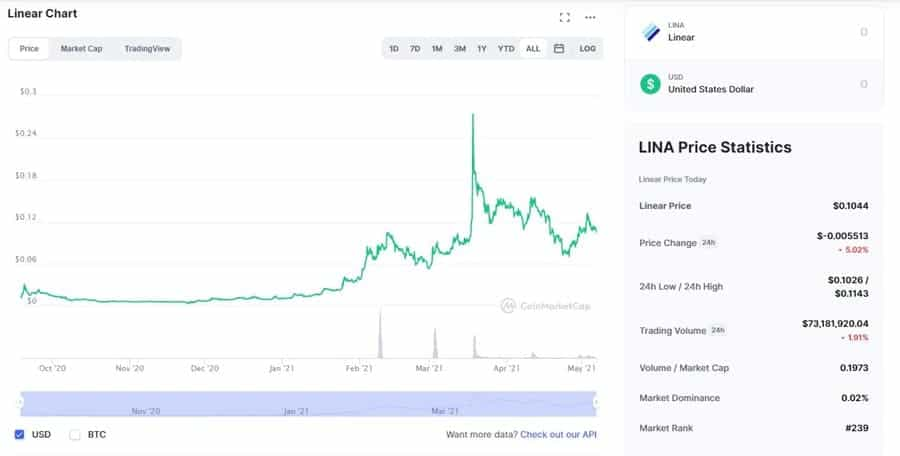

Those 400 participants were quite fortunate because as of May 6, 2021 the LINA token is trading for just over $0.10. That means the initial 500 USDT/USDC stake that purchased 125,000 LINA tokens is now worth roughly $12,500. And of course that’s still well off the all-time high of $0.3126 set on March 18, 2021.

LINA tokens can most easily be purchased from Binance, but there is also acceptable volume on Huobi Global.

Conclusion

Considering the skyrocketing gas fees on Ethereum and the increasing popularity of yield farming in the DeFi space, Linear Finance provides a unique new opportunity to get around the problems encountered with the first generation of DeFi platforms such as high costs, slow transactions, liquidity issues, and front-running of the exchanges.

The Linear.Exchange and Buildr platform allow users to enjoy profit-building financial trading that’s affordable and diverse. Plus it adds community governance and cross-chain functionality that expands the utility of the platform greatly.

Linear is certainly popular with investors, with the native LINA token increasing in price by some 2,500% from its public offering price.

Presuming the team can foster adoption of the platform, which is always a challenge with a new exchange, Linear could become a household name among traders in the coming years.

However if the platform fails to reach critical mass it could fade away as so many other platforms have done over the past several years.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.