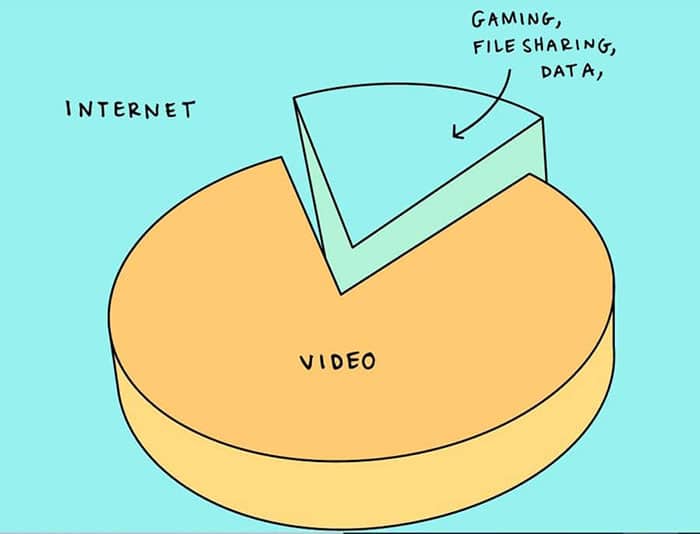

Video is now integral to how we share information and communicate globally. Data shows that nearly 80% of all internet users have a YouTube account, video streaming on the Twitch platform is growing by leaps and bounds, with more than 2 billion hours consumed in January 2021.

And that doesn’t even touch on the incredible importance of real-time video platforms like Zoom, Telegram, or Google Meet. While all of this seems fantastic, there’s still the issue of these centralized services having excessive control over their user bases, the data of those users, and the ability to censor whatever content they like.

In 2021 it remains very difficult to build an application that can compete with the existing centralized video streaming solutions. The costs of transcoding live streaming video remain a huge barrier as transcoding is very expensive from a computational standpoint.

Image via LivePeer Website

Image via LivePeer Website Any service which provides video to end users needs to perform this transcoding, which takes the video and changes it into a format that can be consumed by end-users.

The majority of video transcoding these days happens on the centralized cloud computing services like Amazon Web Services and Microsoft’s Azure, and this introduces the possibility of a single point of failure in delivering video.

In addition to this, despite the increasing popularity of decentralized video streaming services, none of them currently have the capability to stream video in an open fashion.

If it were feasible to launch a decentralized transcoding service it would make it possible to create applications that could deliver cheaper, more resilient and scalable video live streaming. And such a service with decentralized transcoding would also remain resistant to censorship and open for development.

Enter Livepeer

One of the blockchain projects tackling the issues related to decentralized video transcoding and live streaming is Livepeer. Livepeer is an Ethereum-based decentralized service that claims it can dramatically slash the costs associated with video streaming applications.

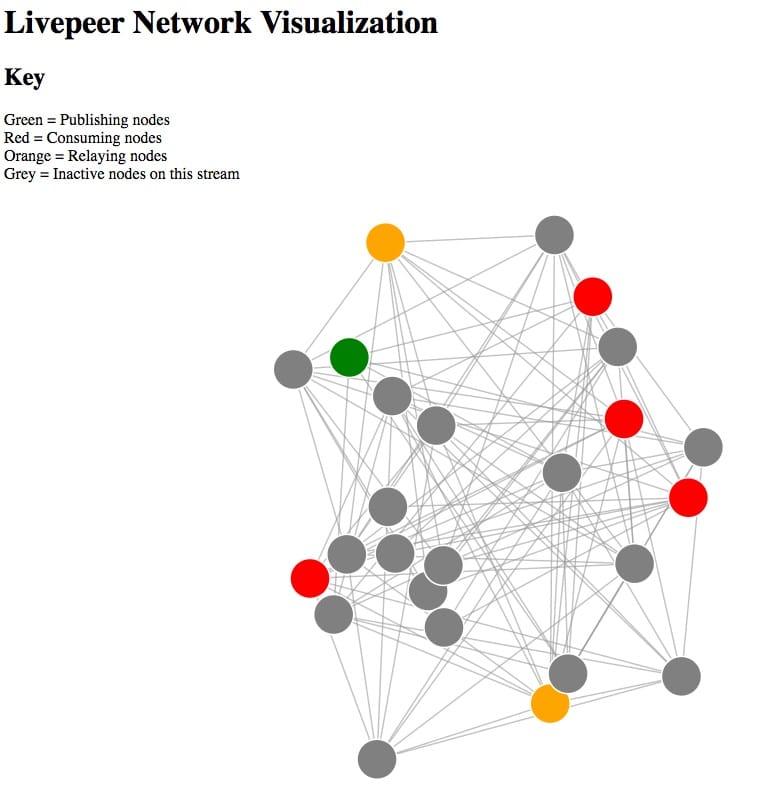

It accomplishes this feat by using a distributed network of nodes, where users lend their computer power to the network to handle the computationally intensive task of transcoding video. Participants in the system receive incentives for providing processing power, which increases the adoption of the network.

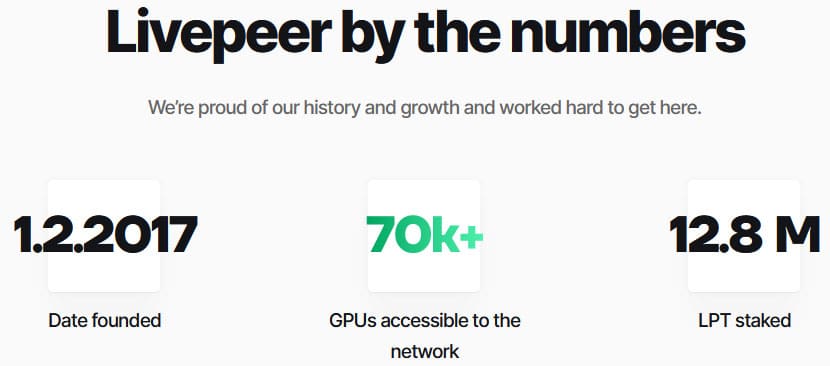

LivePeer Network statistics. Image via Livepeer website.

LivePeer Network statistics. Image via Livepeer website. It’s a great idea, and one that is definitely needed by the video streaming industry. In fact, the idea is so great that Grayscale, the firm behind the Bitcoin Investment Trust, added Livepeer as one of its five newly announced trusts in March 2021.

Grayscale obviously sees the value and potential in the project. And once you know what it’s all about you might see the value as well. Below we take a deeper look into what Livepeer is, how it works, the value of its LPT token, and where it might be headed in the future.

What is Livepeer?

Livepeer is a decentralized blockchain service that is designed to reduce the infrastructure costs associated with streaming video significantly.

Let’s be clear from the start however. This is not a consumer-facing application where people can go to watch video like YouTube, or to live stream like on Twitch.

It is a behind-the-scenes infrastructure solution that enables app developers to significantly lower the cost of transcoding video. This transcoding, which converts video from one format to another for playback, is handled by Livepeer on a network of distributed computers.

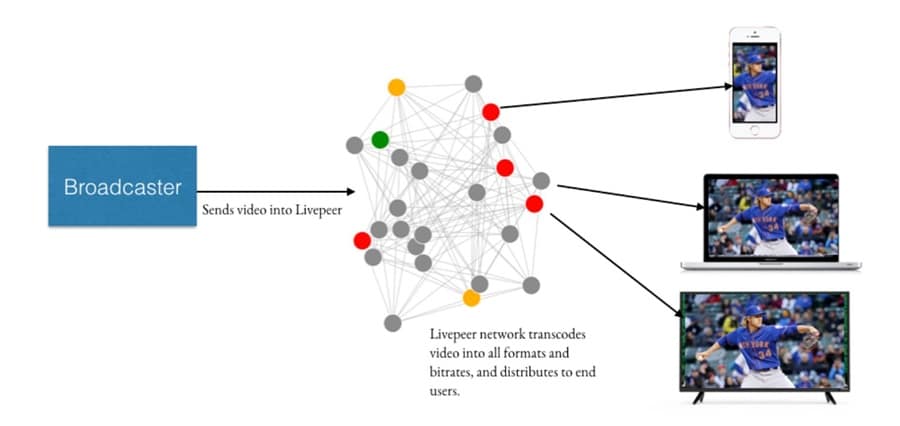

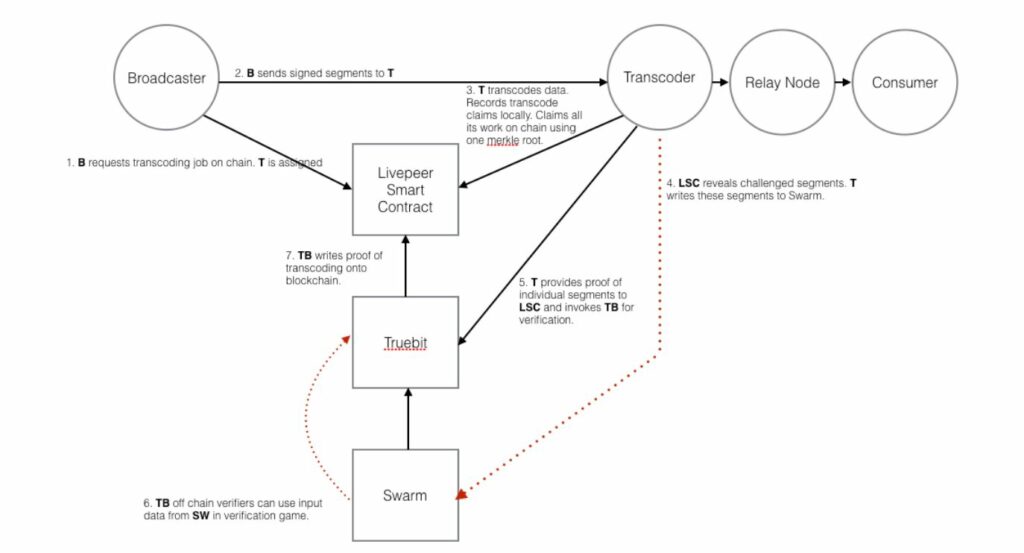

This is Livepeer at work. Image via Livepeer whitepaper.

This is Livepeer at work. Image via Livepeer whitepaper. Livepeer claims that its solution will reduce the resource costs associated with video transcoding by as much as 50 times when compared with the existing, centralized video transcoding solutions.

How does Livepeer work?

Livepeer relies on a group of users it calls “orchestrators” to handle the transcoding needs of app developers who are part of the network. These people have added their computers to the Livepeer network and they trade their computing resources such as bandwidth, CPU and GPU for the LPT cryptocurrency that powers the network. In keeping with the references to mining cryptocurrencies these users are alternatively referred to as “video miners”.

Any developer who wishes to use the Livepeer network to provide transcoding and distribution must pay for those services with the LPT tokens. It is also possible for an LPT holder to stake their tokens, or to become a delegator, thus earning a yield on the tokens they are holding while also helping to secure the network without being directly involved in providing computing resources to fuel the transcoding process.

By incentivizing those who participate in the network Livepeer believes it will be able to create a network that delivers decentralized, inexpensive, and censorship resistant transcoding and video delivery. The incentives are based on the native LPT cryptocurrency that powers the entire process.

The Livepeer protocol architecture. Image via Livepeer whitepaper.

The Livepeer protocol architecture. Image via Livepeer whitepaper. The economics of the Livepeer protocol revolve around the following key roles: orchestrators, transcoders, delegators, and broadcasters.

- Orchestrators – The orchestrators are the group that performs the actual work of transcoding video into the desired output format. They are paid by broadcaster in ETH, and are also rewarded with newly minted LPT tokens by the Livepeer network. An orchestrator node is required to run software on their computers that allow them to contribute computing resources to the network. Orchestrators are also required to stake LPT tokens as collateral to ensure that they provide good work and behave properly. If an orchestrator is found to be cheating or behaving badly they have their stake slashed as a penalty.

- Transcoders – The transcoder is run by orchestrators and they take the input video and transcode it into the desired format before outputting it. An orchestrator can run multiple transcoders.

- Broadcasters – The broadcaster is responsible for publishing a stream of video to the orchestrator and pays them in ETH for their services. For example, Twitch could be considered a broadcaster if they send along videos to Livepeer Orchestrators for transcoding before broadcasting them to end users.

- Delegators – This group stakes their LPT tokens through an orchestrator. Typically the delegator doesn’t have the ability or desire to participate in the network as an orchestrator. Instead they delegate their tokens to an existing orchestrator in order to earn a portion of the rewards.

Livepeer's distributed network of nodes. Image via Livepeer Wiki.

Livepeer's distributed network of nodes. Image via Livepeer Wiki. Besides transcoding video Livepeer also helps with the distribution of video to end users. This is a role that is typically handled by centralized content delivery networks such as Cloudflare, but Livepeer can do it just as effectively and at a lower cost.

Practical Applications of Livepeer

Any video steaming service that requires transcoding can benefit from the Livepeer service. By providing low cost transcoding Livepeer believes it can also offer a number of use cases such as pay-as-you-use consumption.

All of this can be possible by reducing costs for transcoding by up to 50 times. Already live streaming is a $50 billion market, and Livepeer believes it can be an integral part of the ecosystem.

Consider that Amazon purchased Twitch all the way back in 2014 for $970 million in cash and you can imagine how important live streaming is. Livepeer is small now, but it is growing rapidly as more streaming providers become interested and test its transcoding and delivery service.

Livepeer is currently supporting playdj.tv for live streaming as a way to broadcast live DJ shows to the site’s audience and file.video allows users to easily upload and share their video content. The Livepeer infrastructure is in place but applications are still in the process of gaining comfort with the protocol.

There are many potential applications for Livepeer in the future. Image via Livepeer 10-minute Primer.

There are many potential applications for Livepeer in the future. Image via Livepeer 10-minute Primer. One benefit to Livepeer is that it is able to use network incentives to scale rapidly as demand increases. Whenever a video is delivered to the network for transcoding the network incentives ensure that any free resources are used to complete the task.

This alone tackles the challenge faced by centralized services, where a major roadblock has always been having the necessary infrastructure available to support a growing number of video streams.

Why Livepeer is Special

App developers are constrained by the expense associated with video streaming. If you consume video streams you’ve likely never considered the costs associated with delivering the video to you, but you do pay for them.

Video streaming costs for centralized services are typically passed along to consumers through advertising, the sale of their personal data, or through subscription costs or service fees.

By using a distributed, decentralized network Livepeer is able to minimize those costs, which should enable new types of video driven apps to come into existence, and new video business models to be developed. And for the consumers, they are now able to earn for providing computing power, rather than paying the centralized services for providing video service.

What can you do with Livepeer?

Because Livepeer is more an infrastructure solution rather than a customer facing application it is quite possible that many consumers will watch videos that are transcoded or delivered by the Livepeer network and never know that Livepeer was involved.

You might use Livepeer and not even know it. Image via Livepeer 10-minute Primer.

You might use Livepeer and not even know it. Image via Livepeer 10-minute Primer. It’s the app developers who will become intimately familiar with Livepeer as they come to discover that the network provides them with a far less expensive alternative to centralized services. Livepeer can dramatically decrease their computing and transcoding costs, and allow for the implementation of video functionality where it may have been too expensive in the past.

And for the general user there’s always the potential for either staking or delegating LPT tokens to earn some yield, or to run your own orchestrator to collect even greater incentives.

The Livepeer Team

Because Livepeer is open source no one owns the technology behind Livepeer. As such no one can speak with authority for Livepeer. That said, the Livepeer.org website is maintained by members of Livepeer, Inc. and basement.studio.

Currently Livepeer is governed by Livepeer, Inc which is the organization that developed and released the protocol. Eventually the project is expected to be fully community governed.

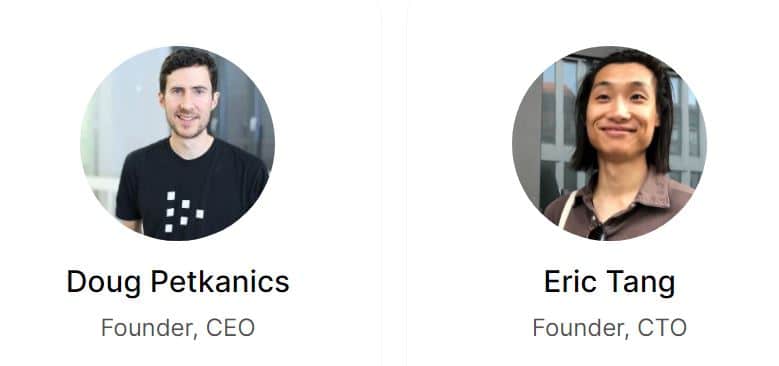

That said, the founders of Livepeer are Doug Petkanics and Eric Tang.

Doug Petkanics is the CEO of Livepeer Inc. Prior to founding Livepeer in 2016 he was the co-founder and VP of Engineering for Wildcard Inc, a native publishing platform and browser for the mobile web. As a serial entrepreneur he was also a co-founder of Hyperpublic, a data platform organizing the world's local information that was acquired by Groupon in February 2012.

The co-founders of Livepeer. Image via Livepeer.com

The co-founders of Livepeer. Image via Livepeer.com Eric Tang is the CTO of Livepeer Inc. He has been with Petkanics for most of his career, first as a lead developer at Hyperpublic, and then later as a co-founder of Wildcard Inc. He is a graduate of Carnegie Mellon University with a B.S / M.S in Electrical and Computer Engineering, Computer Science, and Business Administration.

The LPT Token

The LPT token is an ERC-20 token on the Ethereum blockchain and it serves as the native cryptocurrency of the Livepeer network, providing the incentive for users and providers. The LPT token thus serves as the fuel for the Livepeer ecosystem.

LPT tokens are used as collateral by orchestrator nodes to secure the network and provide the necessary work transcoding video. They are also used as the reward tokens for the orchestrator nodes, and fr delegators. The system is designed in such a way that the more LPT staked by an orchestrator node, the greater amount of work it can perform in the network and the greater fees it can earn.

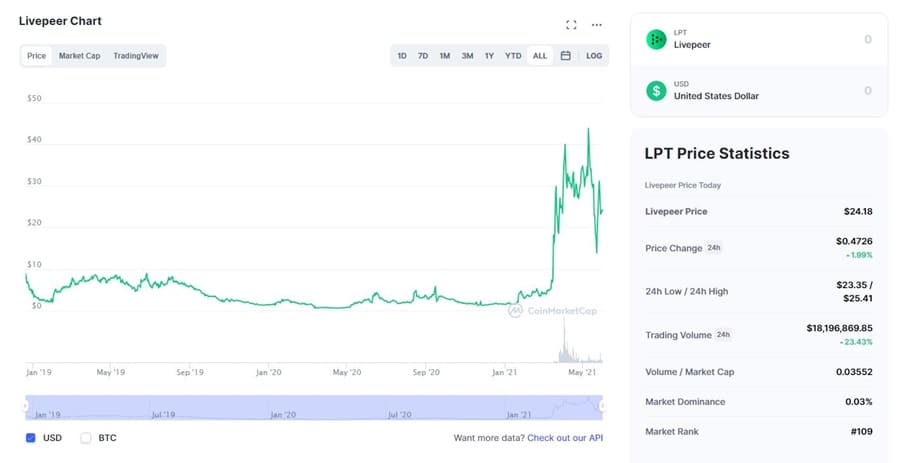

Livepeer had its ICO back in July 2018, selling LPT tokens for $25 each. That turned out to be not so great for early investors as the token started trading just under $9 in December 2018. It continued to trade between $5 and $7 over the next year and in 2020 the token fell below $1.

LPT has made its best gains in 2021. Image via Coinmarketcap.com

LPT has made its best gains in 2021. Image via Coinmarketcap.com That wasn’t the end however as the 2021 rally lifted the token back near the $5 level and then in March the token lifted off in response to the news of Grayscale adding a Livepeer Trust fund. Over the course of a month the token rocketed up to $39.99. From there it dipped to $28, but by May 11, 2021 it was at an all-time high of $45.22.

Since then the token has retreated along with the broader crypto markets and as of June 1, 2021 it is trading at $24.18.

How to buy LPT?

Thanks to the addition of the Grayscale LPT Trust Fund Livepeer tokens were picked up by many major exchanges. They can be purchased with USD from Gemini, but the biggest trading volumes for LPT are from Binance.

You can also acquire them through decentralized exchanges such as Uniswap and Balancer. To acquire LPT from one of these DEXs it’s first necessary to acquire some Ethereum (ETH), which can then be exchanged for LPT.

Co-Mining with Filecoin

In March 2021 Livepeer announced the launch of a co-mining program with Filecoin, a decentralized storage platform. This allows users to mine and earn rewards on both networks simultaneously.

Because Filecoin is a decentralized storage network allowing anyone to securely store, interact, and retrieve data it is a perfect match. Users are first able to “video mine” on Livepeer, and then store the transcoded videos on Filecoin, thus mining on that blockchain as well.

Image via Livepeer Twitter account.

Image via Livepeer Twitter account. In the future, the same miners could provide infrastructure for both networks not only unlocking additional economic opportunities for the miners, but also additional technical and product opportunities for web3 applications via the co-location of video transcoding with data storage.

The Grayscale Livepeer Trust

The hedge fund Grayscale was the first to create a Bitcoin trust and as of March 2021 they announced the creation of five new trusts, one of which will be based on the LPY token of Livepeer.

These cryptocurrency trusts are an exchange traded financial derivative that are designed to provide traditional investors with an easy way to participate in cryptocurrencies. The price of the trust is meant to roughly track the price of the underlying cryptocurrency, in the case of the Livepeer trust LPT.

Grayscale holds a significant amount of LPT within the trust, and while trust investors do not actually own any of the cryptocurrency they can still benefit from price gains in the underlying.

Grayscale's LPT Trust Fund kicked off the rally in LPT. Image via Investing.com

Grayscale's LPT Trust Fund kicked off the rally in LPT. Image via Investing.com By creating a Livepeer trust Grayscale is betting heavily on the LPT token increasing in value over time and that traditional investors will want exposure to it. As of the inception of the trust fund in March 2021 Grayscale owned $8.5 million worth of LPT, but if the fund is successful the firm could easily amass much greater quantities of LPT over time.

Potential Risks

Of course Livepeer isn’t without risks going forward, although the team is well aware of such and prepared to make adjustments where necessary to address any risk scenarios. Below are some of the current risks as we head into the second half of 2021.

Competition

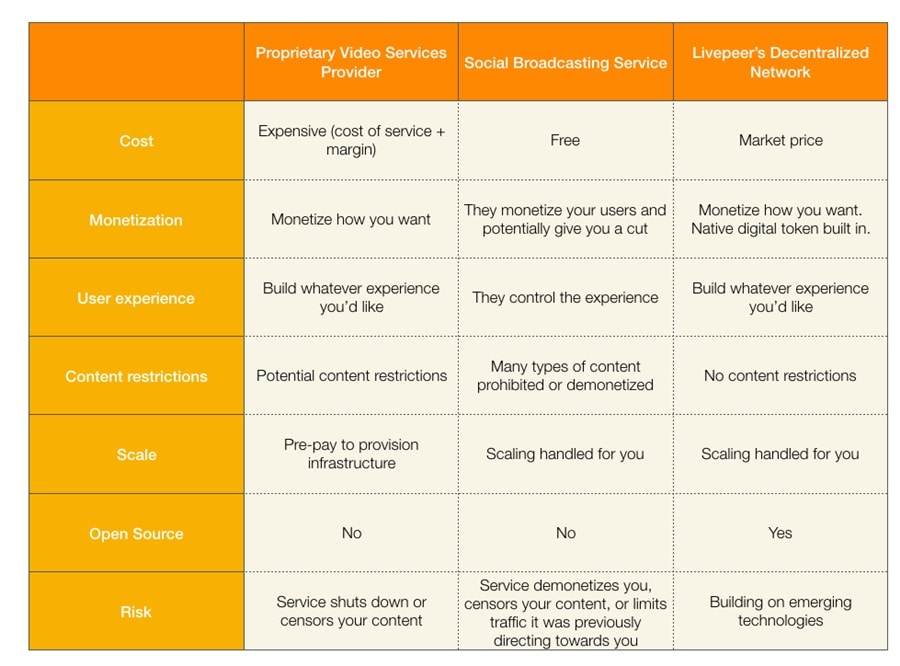

The biggest competitive threat for Livepeer comes from the established video transcoding service providers such as Amazon Web Services. The advantage Livepeer has is that it isn’t possible to develop decentralized applications on AWS since it represents a potential point of failure.

Livepeer versus competitors. Image via Medium.com

Livepeer versus competitors. Image via Medium.com As long as decentralized applications continue to gain in popularity and adoption Livepeer should be able to take market share away from the established video transcoding service providers.

Decentralization

Security in the Livepeer protocol is at least partially dependent on the decentralization of the orchestrator nodes. Currently Livepeer is still working on building a robust network and is vulnerable to any large scale event, such as a natural disaster, that could potentially impair a large number of its nodes. As the network grows and becomes more robust this should no longer be a risk.

Network Economics

Livepeer’s security is dependent on profitability for the nodes within the network. If the economics of the network become unsustainable, or are simply not attractive enough to pull in node operators, then Livepeer could potentially be vulnerable to attacks.

Token Volatility

As you’ve already seen above in the LPT Token section of this review, token volatility is very real, and it could potentially have a negative impact on interest in the network.

Regulations

While regulations on cryptocurrencies remain light as of June 2021, that isn’t likely to remain the case. The SEC in the U.S. has already ruled that certain cryptocurrencies can be considered as securities under existing U.S. securities laws.

Thus far only Bitcoin and Ethereum have been identified as digital assets which the SEC does not consider to be securities. That leaves LPT at risk of being deemed a security by the SEC, which would almost certainly have negative consequences.

Conclusion

Whether or not Livepeer is able to succeed will likely depend on its ability to first generate interest, and then to scale to meet demand. If the decentralized alternative is able to deliver service that’s similar to that provided by the current centralized solutions, and it can do so at a fraction of the cost, then the success of Livepeer is almost guaranteed.

While the network remains small, there are 98 active nodes as of June 1, 2021, it is also growing as the number of active nodes has more than doubled since March 2021. And the service has already transcoded 17.2 million minutes of video since its launch.

Of course Livepeer isn’t the only service trying to solve the high costs of video streaming through decentralization. Other potential solutions include those offered by Theta, which is using excess user bandwidth to serve streams to users in a per-to-peer like setup. Users there are rewarded with THETA tokens for providing the needed bandwidth.

There’s also VideoCoin, which is taking a similar approach to Livepeer, but isn’t as far along in adoption. And then there are the more general solutions to support video needs, such as the rendering solution proposed by Golem.

In time Livepeer plans on becoming completely decentralized, but as of June 2021 it is still run by the legal entity Livepeer Inc. that founded the network. There is also a 2017 official roadmap that has seen many aspects completed, while others are still in process.

And the team has added new goals as well, such as adding layer-2 scaling, bringing more efficient verification methods to production, and the possibility of using AI in a number of functions, such as scene classification, object recognition, song title detection, and video fingerprinting.

As the Web3 market grows and matures there’s no doubt that decentralized infrastructure services could be very useful and valuable. Livepeer could well be one of those services that will transform the video streaming market in the months and years to come.