Loopring (LRC) has been gaining quite a bit of traction recently. The token was depressed during the second half of 2019 and in the start of 2020, but since mid-May has been charging higher after the project finally launched its decentralized exchange (DEX) roughly two months earlier.

The enthusiasm for the project is because of the ever pressing need for Decentralised exchanges and the benefits that these are supposed to bring cryptocurrency users. Lower fees, safer exchanges and more transparency are just a few of the reasons that many projects are trying to develop DEX solutions.

However, is Loopring the solution and should you consider it?

In this review of Loopring we will take a deep dive on the project including the technology, the team members and competition. We will also take a look at the long term prospects for LRC tokens in an increasingly volatile and skeptical community.

What is Loopring?

Loopring is an Ethereum based decentralized exchange protocol that is being created to allow users to exchange assets across various exchanges. Loopring isn’t a decentralized exchange by itself, but instead will facilitate decentralized exchanging using order matching and ring-sharing technologies. In short, it allows anyone to build high-throughput, non-custodial, orderbook-based exchanges on Ethereum by leveraging Zero-Knowledge Proofs.

So, rather than simply standing as another decentralized exchange, Loopring seeks to pool orders from as many exchanges as possible, and then fill these orders by matching them with the order books of all the exchanges that participate in the Loopring network.

Loopring will allow both decentralized and centralized exchanges to take part in the Loopring network, giving all exchanges access to increased liquidity from across a number of blockchains. It will also give investors access to the best possible pricing without needing to cross check several different exchanges.

Best of all, Loopring is blockchain agnostic, and this means that any platform that has smart contracts implemented will be able to integrate with Loopring. So far Ethereum and NEO have been integrated, and while there were plans to integrate additional platforms those plans have been put on hold while the team works on developing the core of the Loopring DEX.

How Loopring Works

One benefit to using Loopring for traders is that they maintain control over their funds, which are locked into a smart contract when orders are placed. This is a change in version 3.0 of Loopring and it was implemented to increase the security of the platform.

This system gives users full control over their funds and orders, and allows an order to be increased, trimmed, or even cancelled at any time before it is executed. It is also comparable to the order flow seen from centralized exchanges, which makes it more familiar to traders.

Let’s have a closer look at how orders work with Loopring, and give you more details regarding the ring miners and off-chain relays.

Placing a Loopring Order

When users are ready to place a trade it’s done through the loopring.io wallet, and is signed with the users private key. The order is then relayed to the Loopring network smart contracts as well as the off-chain relay nodes.

The smart contracts ensure that the funds in your wallet are exchanged properly for the coins you’re trading, while the off-chain nodes maintain the order book and broadcast it to the ring miners.

Ring Miners Explained

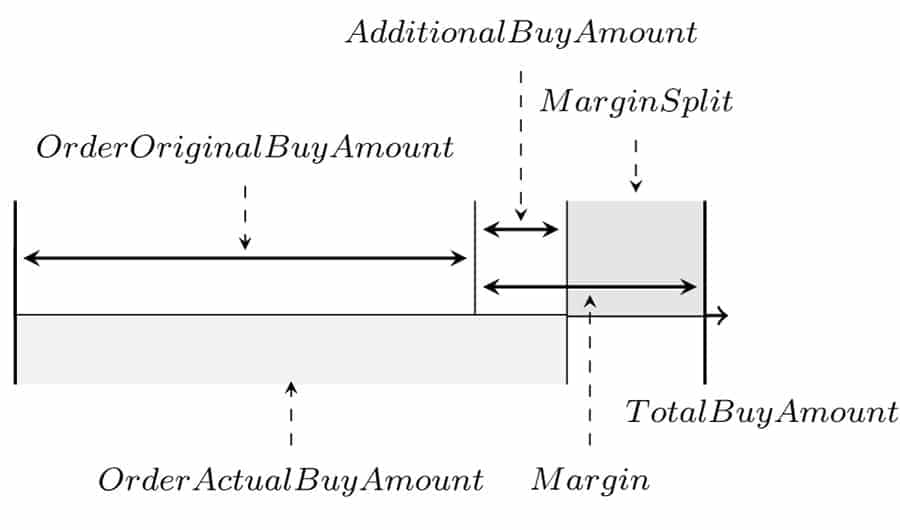

The ring miners have the responsibility to ensure that orders can be filled until the order actually are filled, or cancelled. Ring miners are compensated for performing this service either with a fee in LRC or a split margin on the amount of the order.

This system ensures that miners are paid fairly for their service, and gives them an incentive to find the best rate for traders, since they can increase their margin if they find a better exchange rate. It also theoretically reduces any arbitrage opportunities since the protocol should always have the best trade value.

Once the miner completes an order ring the Loopring smart contract checks to make sure the order can be filled. As long as everything checks out on both sides of the trade the smart contract transfers the appropriate coins to each side of the trade. This swap is an atomic swap and occurs directly from smart contract to wallet.

Order Rings and Order Sharing

These two functions differentiate Loopring from other decentralized exchange platforms such as OpenLedger, Waves, IDEX and Stellar. The order ring facilitates the process of ring-matching, which is the method used to fulfill orders by stringing them together.

It also allows for order sharing when an order cannot be completed with a single trade. This order sharing will split orders into partials if necessary until the full original order amount is finally filled.

To better illustrate how this works, consider a group of traders placing orders on the Loopring network. Bob, Sarah and Earl are all looking to place trades. Bob wants to trade 2 OMG for 10 ARK, Sarah wants to trade 21 EOS for 1.5 OMG, and Earl wants to trade 20 ARK for 40 EOS.

Ring-matching technology would form these three orders into a single order ring, and fill each of the orders. Once the smart contracts on Loopring approve the orders everyone would receive the coins they are looking to get.

Now, you might be thinking that everyone didn’t really receive the coins they’re looking for because Bob got his 10 ARK< but still has 0.5 OMG left and Earl hasn’t filled his order of 10 ARK for 19 EOS. Sarah is the only trader who had her order completely filled. Not to worry, the leftovers will all be processed by the order sharing system once more and added to another order ring until the partial orders are completely filled.

LOOPRING 3.0

Loopring 3.0 is the latest iteration of the protocol, bringing much better performance without a tradeoff in security. It was designed with two major objectives in mind – performance and security. It ensures that users are always able to withdraw their capital, no matter what happens.

Even in the worst-case scenarios users are able to withdraw their capital using Merkle Proofs generated from on-chain data, so long as On-Chain Data Availablity is enabled. This avoids the need to trust any central party or ask for help in recovering assets.

Loopring 3.0 has migrated most computations off-chain, significantly improving throughput and costs. User account balances and transaction history are all organized off-chain in a Quad-Merkle Tree. All user transactions and requests are batched and processed in large batches off-chain with the state root after each batch process then published to the blockchain. This allows for the re-construction and verification of state roots.

These changes do require some tradeoffs. One was that orders are no longer shared among multiple exchanges and now must be matched by a dedicated relayer. And users must now actually deposit their assets into a smart contract to make them available to the order book.

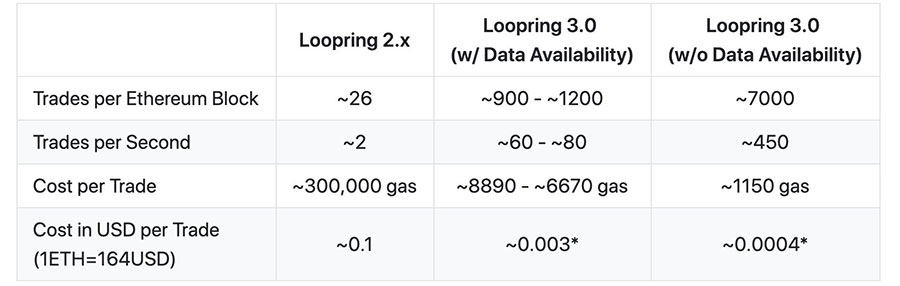

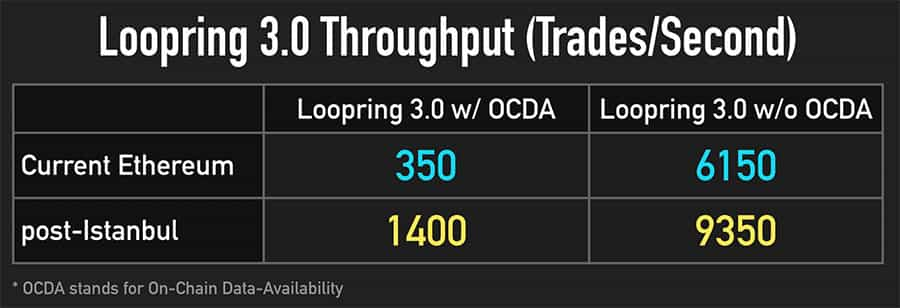

With Loopring 3.0 and OCDA enabled as many as 2,025 trades per second can be settled. If OCDA is disabled, which also results in security being relegated to the consortium which maintains the data, throughput is increased to 16,400 trades per second.

By comparison the prior versions of Loopring, and most current DEX protocols, can only settle up to 3 trades per second. Loopring 3.0 allows a DEX to match the performance of centralized exchanges.

You can learn more about the Loopring 3 protocol by reading the Loopring Design Document.

Loopring’s Superior DEX Performance

The idea of a decentralized exchange isn’t a new one. There have been quite a few created over the past few years, both on and off Ethereum. The main problems all of these DEXs face is a lack of throughput and high costs.

These scalability issues have prevented the DEX model from being widely adopted since professional traders and market makers aren’t able to use a DEX as a main trading venue. Loopring has been able to solve the scalability issues without making security compromises.

By finally bringing the zkRollup approach to a DEX Loopring is resolving the problems nearly every other DEX confronts. Using zkRollup moves computations off the blockchain and only broadcasts state roots and the corresponding proofs to the blockchain.

This makes the Ethereum blockchain a data layer for Loopring, and allows for throughput of as many as 2,025 trades per second with On-Chain Data Availablity (OCDA), or up to 16,400 trades per second without OCDA. This also gives Loopring trade costs as low as $0.00015, which the team believes can be further optimized to as low as $0.000075 in the near-term.

The team believes this makes Loopring suitable for professional traders and institutions who might want to employ trading bots and algorithmic trading methods. Loopring will be the first DEX to offer this functionality, and they believe this will finally make orderbook-based DEXs commercially viable. This should soon lead to the displacement of centralized exchanges.

The Loopring Team

Daniel Wang is the founder and CEO of Loopring. He previously ran Coin Port, a centralized exchange, in 2014. During that time he was attempting to solve the problems posed by centralized exchanges, but came to the conclusion that the problems couldn’t be solved as they were inherent in the centralized exchange model.

This led to the conceptualization and eventual creation of Loopring. He was also the co-founder and vice-president on Yunrang Technology in the past, and also held a position as a Google Tech Lead.

The CMO of Loopring is Jay Zhou, who previously worked in the Risk Operation Unit at Paypal, and was also previously employed by Ernst & Young. In addition, he was one of the principal founders of SJ Consulting.

The third member of the core team in Steve Gou, who holds the title of CTO at Loopring. He works closely with the projects Chief Architect Brecht Devos.

Loopring’s Roadmap

Loopring released a 2018 roadmap at the conclusion of 2017 and they made slow progress towards achieving the goals set out in that document. Items such as releasing the Loopr wallets and mobile wallets were completed on schedule.

Loopring also began implementing other blockchains, with NEO being added mid-year in 2018. However since then no other blockchains have been added and the push to add new blockchains has been put on hold. There was at one time plans to add QTUM support with an LRQ token, but those plans have been scrapped.

The launch of the Loopring DEX was greatly delayed from initial plans, but the beta version was finally launched in late February 2020. There remain some milestones that have yet to be met, for example support for ERC223 and trading between ERC2230 and ERC20 tokens. They also were able to implement decentralized governance through the dxDAO and still have plans to create their own native DAO, which will be funded through the trading fees collected.

One improvement going on behind the scenes is the improvement of the ring-mining algorithms. As the rings are refined to include more than three orders it allows for greater liquidity, smaller price spreads, and a better functioning market overall.

Loopring Competition

With Loopring entering the sphere of centralized and decentralized exchanges it may look as if the competition for them will be fierce. However, if you take a deeper consideration you’ll see that rather than being a competitor to the exchanges, Loopring looks to become a partner with all the exchanges by providing them with something they all need – liquidity.

On the surface it seems as if 0x is aiming for the same goal as Loopring, but there is a key difference between the two. Where 0x allows anyone to run a node as a decentralized exchange, and all orders are processed off-chain, but settled on-chain, 0x only gets its liquidity from exchanges established on the 0x platform. This is a huge difference from Loopring, where liquidity comes from any exchange that connects to the Loopring network.

There are some other competitors such as Kyber Network, Blocknet and Bancor. With Kyber Network and Bancor there are liquidity pools and order matching that ensures trades are met across smart contracts, and Blocknet works in a similar fashion solely with order matching. There is not a competitor that can offer the ring orders that are created by ring matching on the Loopring protocol.

LRC Price History

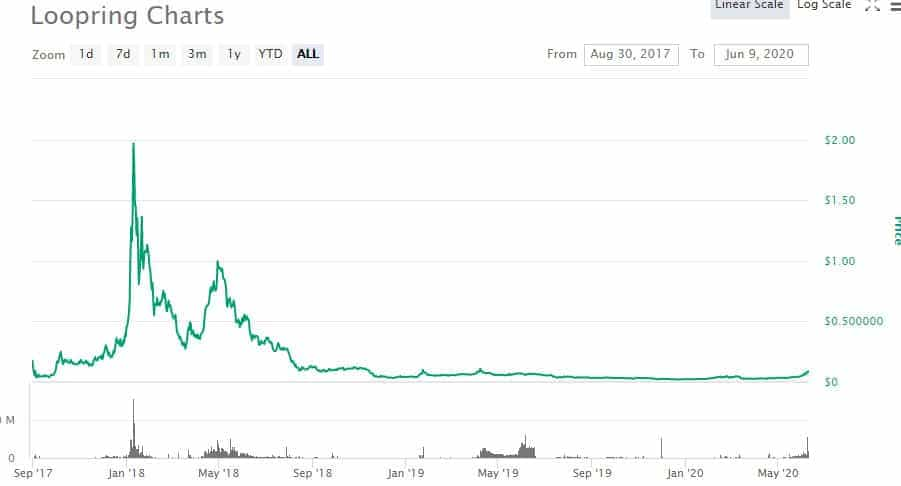

Like every other asset in the cryptocurrency ecosystem, Loopring’s LRC token took a huge hit in 2018. After reaching an all-time high of $2.19 on January 9 price fell, bounced in April, and fell steadily through 2018 and into 2019.

As of the beginning of 2020 the price of the token was all the way down to $0.0225, which was just off the all-time low of $0.019861 hit on December 18, 2019. Price has begun to rally substantially following the beta launch of the DEX however, and as of early June 2020 the LRC token is trading at $0.087895, for a gain of nearly 300% in the first half of 2020.

The LRN token that was created for the NEO blockchain is in even worse shape. After reaching a high of $3.32 just after its release in May 2018, the LRN token fell to $0.009917 as of the start of 2020. And it continued falling to the $0.007 area by May 2020. Unlike the native LRC token the recovery in the LRN token has been more muted, with LRN trading at $0.017040 as of June 2020.

One positive sign is the amount of ETH being locked up in Loopring smart contracts. Based on data from Defipulse.com that amount has jumped from $767,000 as of March 12, 2020 to $7.994 million as of June 9, 2020.

While some of this is due to increased trading volumes, much of it is also due to the staking feature that was added to Loopring 3.0. This staking feature allows users to stake their LRC (minimum 90 days), and also requires exchanges to stake anywhere from 250,000 to 1,000,000 LRC.

Where to Buy and Store LRC

Loopring LRC is listed on quite a few exchanges, but the greatest volume is on Bithumb, followed by DragonEX. You can also purchase LRC on the Binance Exchange. This will mean that you will have to first buy another cryptocurrency from a fiat gateway before you can purchase them.

The NEO Loopring LRN is only listed on Gate.io and DragonEX, with almost all of the volume on Gate.io. Both LRC and LRN can be purchased with ETH and USDT, and LRC can also be purchased with BTC.

Because LRC is an ERC20 token it can be stored in any ERC20 compliant wallet such as MyEtherWallet or MyCrypto. Alternatively you can head over to the Loopring website and download the official wallet.

Conclusion

The fact that Loopring is offering a decentralized exchange protocol that will allow any exchange to participate is a major difference and an advantage for Loopring. There’s no competition to beat out the established centralized exchanges or the rising decentralized exchanges.

Instead Loopring seeks to join with all exchanges and provide increased liquidity across the entire cryptocurrency market. In addition to increasing liquidity it also has the potential to do away with arbitrage in cryptocurrency markets thanks to the lowest order price matching that’s part of its protocol.

The downside has been the huge delay in getting the Loopring DEX launched. Even now it is only in beta, and that delay could have caused Loopring to lose precious momentum. Of course it is still very early days in the DeFi space, so perhaps the delay won’t be too damaging in the long run.

The use of ring-matching and ring orders distinguish Loopring from other decentralized exchanges, and as they continue to refine ring-matching we could see an even greater increase in market liquidity as three or more orders are paired. Additionally, Loopring’s order sharing model is an improvement over traditional order matching, allowing for more flexible buying and selling.

Perhaps one of the greatest strengths is the blockchain agnostic flexibility that Loopring can take advantage of. As long as a blockchain includes smart contracts it can use the Loopring network, allowing orders to be filled through several different avenues. Unfortunately Loopring has put this aspect of the project on hold.

With Loopring adding liquidity and leveling the playing field decentralized exchanges should be able to see increased adoption, and Loopring itself will benefit from additional exchanges joining its network.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.