Nexo is the world’s leading crypto lending and borrowing platform with a large global user base and a strong presence in Europe. Nexo was considered one of the “big 3” lending platforms alongside BlockFi and Celsius and pretty much has a monopoly on the space now after Celsius and BlockFi filed for bankruptcy in 2022. Nexo enjoys a positive reputation within the crypto and FinTech communities, which is why we are happy to be bringing you this Nexo review today.

⚠️Safety Notice⚠️- In light of the recent liquidity issues faced by the lending platform Celsius and 3AC, and the high risk of contagion that could result in further company failures during these difficult market conditions, we do not recommend users keep funds on any lending platforms or centralized exchanges until the markets recover. We suggest crypto holders self-custody during these uncertain times.

**Secondary Notice**⚠️ In January 2023, Bulgarian authorities announced a raid on Nexo, with allegations of legal misconduct. After investigation, Nexo was cleared.

However, in May 2023 Nexo shut down two UK subsidiaries and, once again, fell under Bulgarian inspection for allegedly being involved in an organised scheme.

Note: We do not recommend users sign up for Nexo at this time until the investigation is complete and Nexo is cleared of all wrongdoings. We advise that you do your own research.

Nexo has evolved into so much more than just a lending platform and is continuously innovating, becoming a leader in FinTech solutions and are also backed by some pretty influential names in the cryptocurrency space which we will cover later. The NEXO token has also been gathering quite a bit of momentum since its release and continues to perform positively over the long term, securing its position as a top 100 cryptocurrency.

If you are looking to learn more about crypto lending and borrowing platforms or are considering using Nexo and exploring other crypto solutions, then you have come to the right place.

What is Nexo?

Nexo is a project that provides lending services while using cryptocurrencies as collateral. Lending platforms have become highly popular in the crypto industry as they provide crypto hodlers with the ability to access cash, and make passive income, without needing to sell their digital assets. Crypto users can borrow fiat currencies or stablecoins against their crypto stash in order to meet daily expenses, avoid triggering a capital gains taxable event, buy themselves something nice, or heck, even buy more crypto!

Established in 2018 and headquartered in Zug, Switzerland, Nexo are one of the “OGs” in the crypto industry. With what seems like countless crypto projects popping up and disappearing all the time, it is nice to be able to trust a platform that has been around since 2018 which is essentially ancient in crypto years and boasts a sterling reputation and great track record among crypto enthusiasts.

Nexo is one of the most regulated and compliant-friendly crypto services around, the team has gone to impressive lengths to ensure that they remain on the right side of regulation. Nexo is registered with the U.S Financial Crimes Enforcement Network, FINTRAC, ASIC, and hold multiple specific U.S State licenses which can be found on Nexo's Licensing Page.

Achieving this level of regulatory compliance makes Nexo one of the best options available for European, Canadian, and Australian-based users, though they also have customers from Asia and across the globe. For our UK-based readers, many customers in the UK also use Nexo, though they are not registered with the FCA, so be aware of that.

Nexo Review: Lending

Lending platforms have become one of the most popular places for customers who want to earn a nice little APY on their funds. If you are someone sitting on some crypto and don’t want it to collect dust sitting in a wallet doing nothing, you can consider depositing them on a lending platform like Nexo for some nice returns.

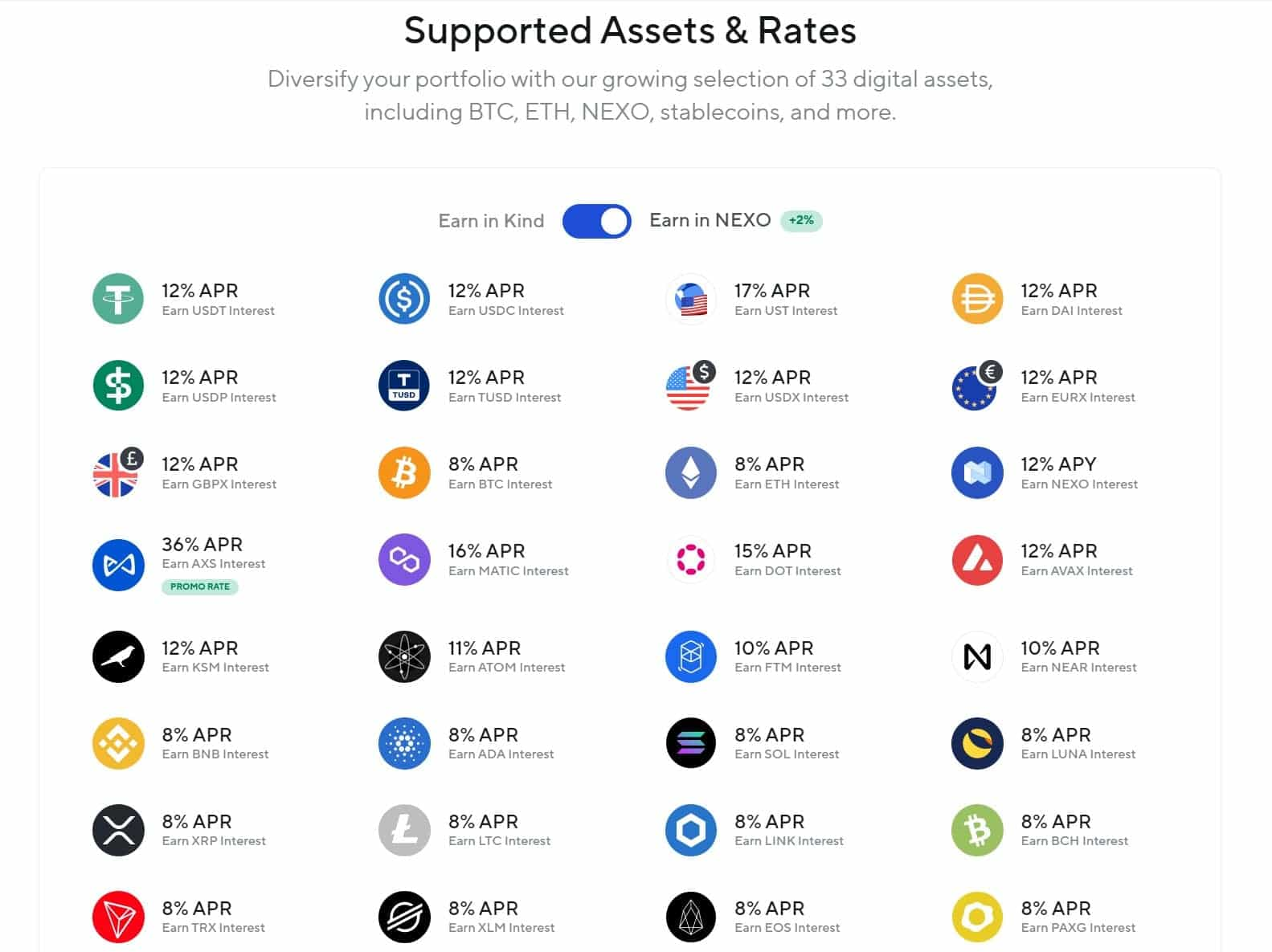

Nexo users have two options when it comes to how they want to earn passive Nexo interest on their crypto. They can either earn in-kind, meaning that if you deposit Ethereum, you earn interest in Ethereum, deposit Bitcoin, earn Bitcoin etc. The other option is that you can choose to earn Nexo interest in the platform’s NEXO token which gives users a nice little 2% bonus. Here is a look at some of the APYs available:

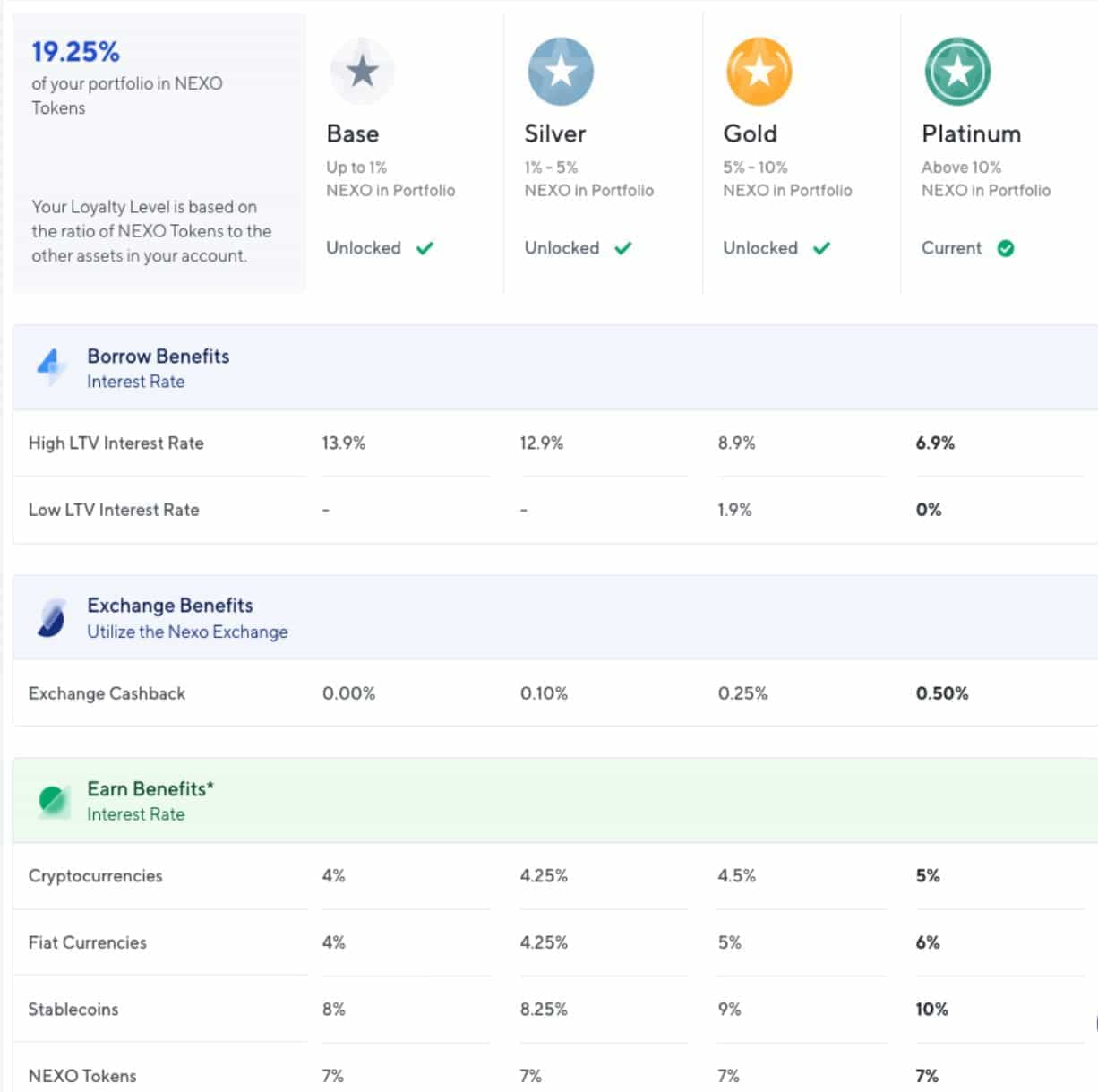

The APY that users can expect to earn is dependent on their loyalty level and the asset chosen. One thing I really like about Nexo is that they treat those with a couple of hundred dollars the same as someone with a million dollars with regards to the loyalty levels. Users’ loyalty level is based on what percentage of their portfolio is in NEXO, not how much money they have on the platform which is nice. The higher the loyalty level, the higher the APY rates that customers can enjoy in the Earn section, and the lower the borrowing repayment rates are. Here is a look at the loyalty tiers:

Earning on Nexo is easy. In order to earn on your crypto holdings, simply buy or transfer any of the 32 assets supported on the platform, and leave it. That’s it! Couldn’t be easier.

Nexo Review: Borrowing

Lending works by allowing borrowers to lock up cryptocurrencies as collateral in exchange for fiat currency or stablecoins. The cash is sent directly to a bank account, or it can be added to a debit card. In case of market volatility (which is almost a given with cryptocurrencies) the limit on the debit card will adjust in response to changes in the market value of the underlying cryptocurrency.

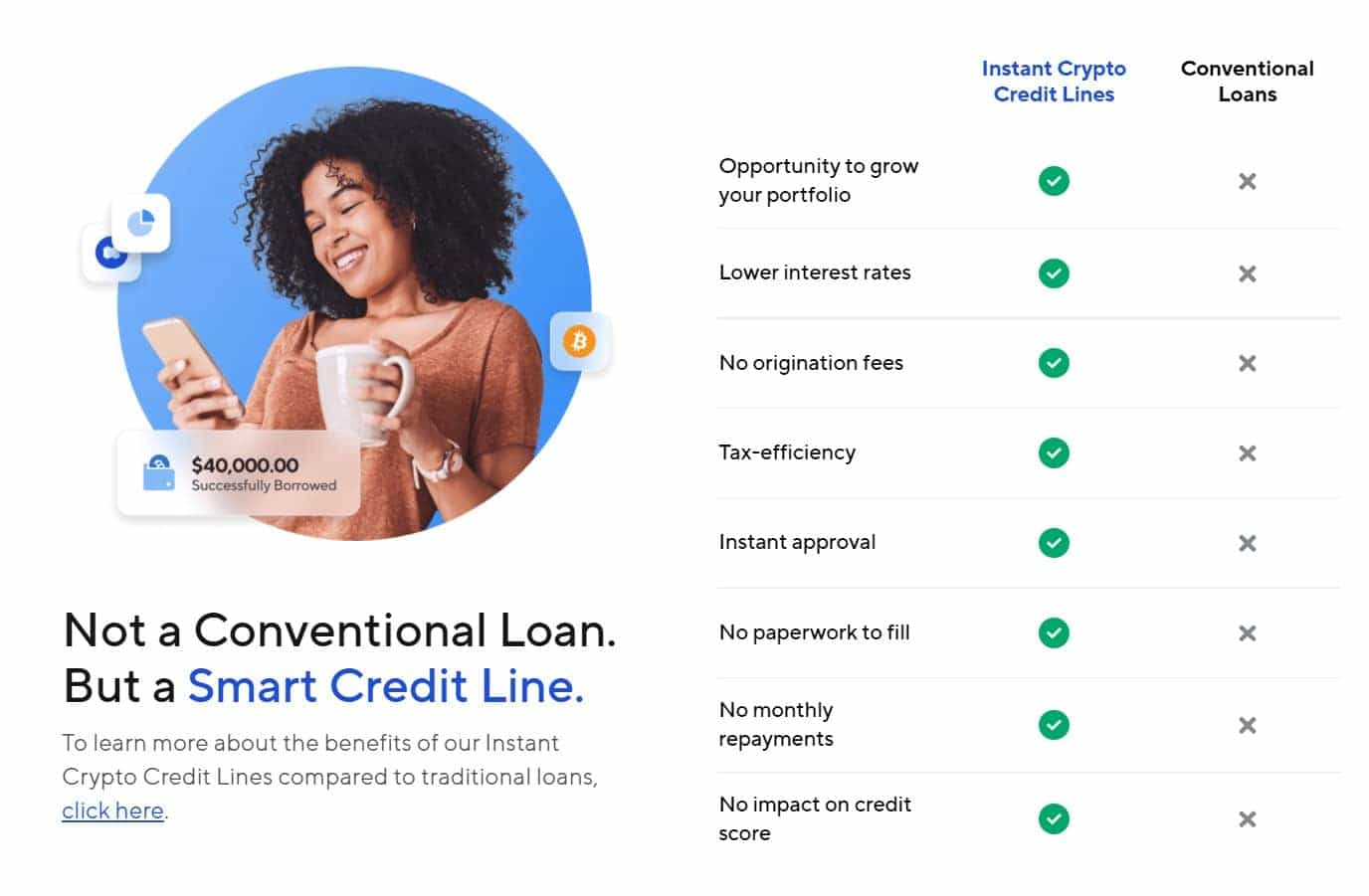

With Nexo, if users become a Gold or Platinum member and keep their loan-to-value ratio under 20% they can borrow for as little as 0% which is amazing. Users can also borrow funds with no credit checks, no origination fees, and have instant access once funds have been deposited in most cases, but can take up to 24 hours to be approved in some cases.

One important distinction that sets Nexo apart from other lending platforms is that Nexo does not offer traditional crypto loans, but rather a crypto line of credit which allows for more flexibility.

Here are some of the best reasons to borrow with Nexo:

- No credit checks

- Rates from 0%- 13.9%

- Instant Approval in most cases

- Ability to convert multiple assets

- 40+ currencies to borrow including fiat or stablecoins

- Easy repayment options via fiat, crypto, or a combination

- Choose from 38 collateral options and 40+ fiat currencies and stablecoins to borrow in.

- No Instalments- Users can pay their balance off partially or fully whenever they choose with no fixed payment schedule

Not only does Nexo support borrowing for more assets than any other platform, but they are also one of the first platforms that allow users to borrow against their NFTs! That’s right, all those holders of Bored Apes and CryptoPunks can borrow up to 20% of the value of their precious NFTs.

Nexo Review: Swaps/Exchange

Users on Nexo can swap between 300+ of their favourite crypto assets and stablecoins and even earn 0.5% cashback depending on loyalty level.

Nexo offers competitive rates on swaps through the Nexo Smart Routing System which connects users to the top 10 exchanges at once to ensure users get the most cost-effective rates. The swaps are done nearly instantaneously, and balances are updated immediately so crypto users aren’t left waiting around for their exchanges. All new swaps are also placed directly in the customer’s savings wallet, meaning they are always earning a nice yield for great all-around convenience.

Nexo Booster

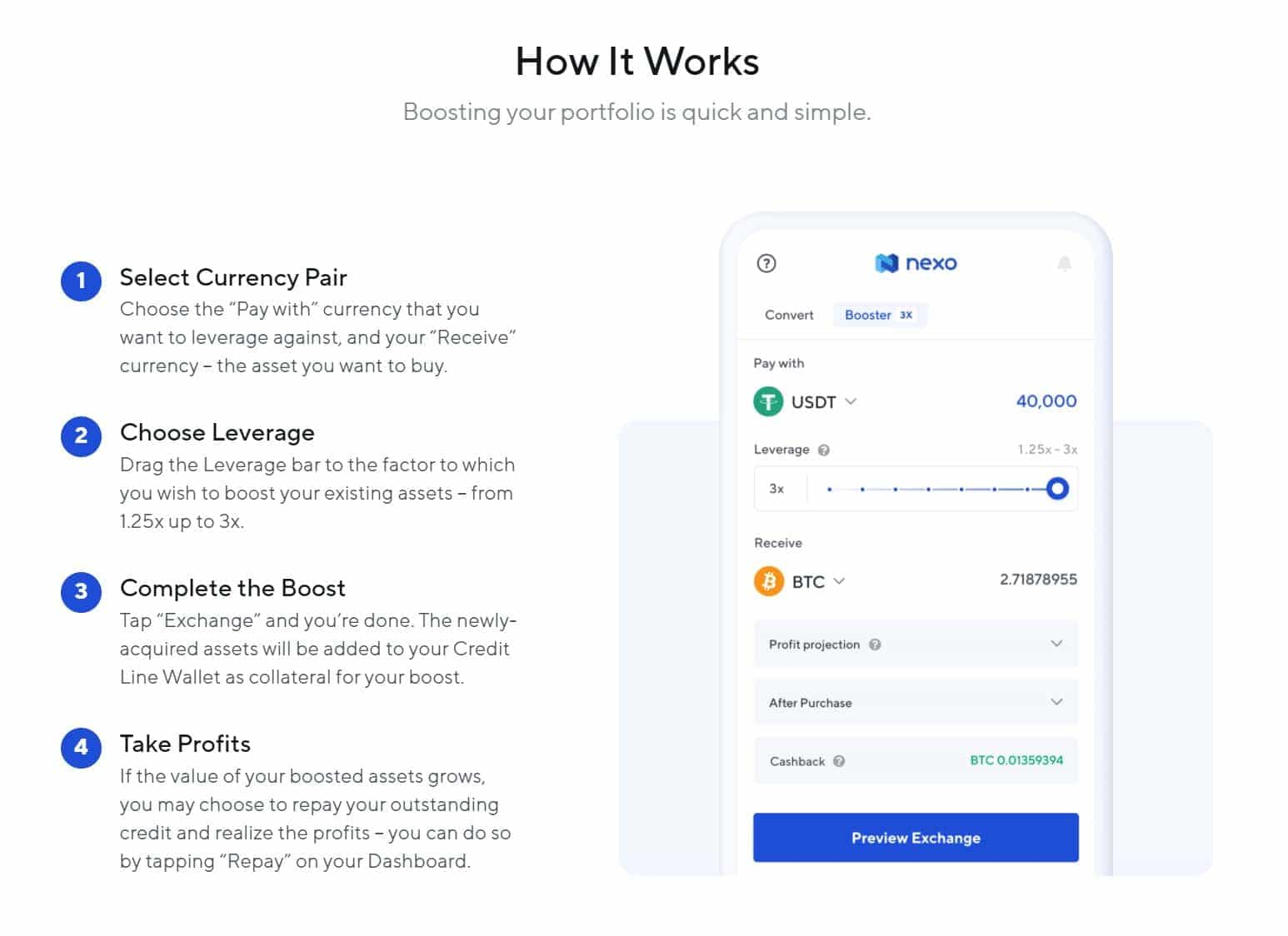

Nexo customers can boost their portfolio 3x using leverage on their crypto holdings.

By leveraging crypto holdings, users can borrow more funds and grow their positions in supported assets. Essentially, what this allows customers to do is use their current holdings to buy up to 3 times more of their favourite digital asset by financing the acquisition through a crypto-backed line of credit. Here is a look at how it works:

If used properly, leverage can help users further capitalize on uptrends, buy more during market dips, and grow their portfolios without having to put up extra capital.

Buying Crypto on Nexo

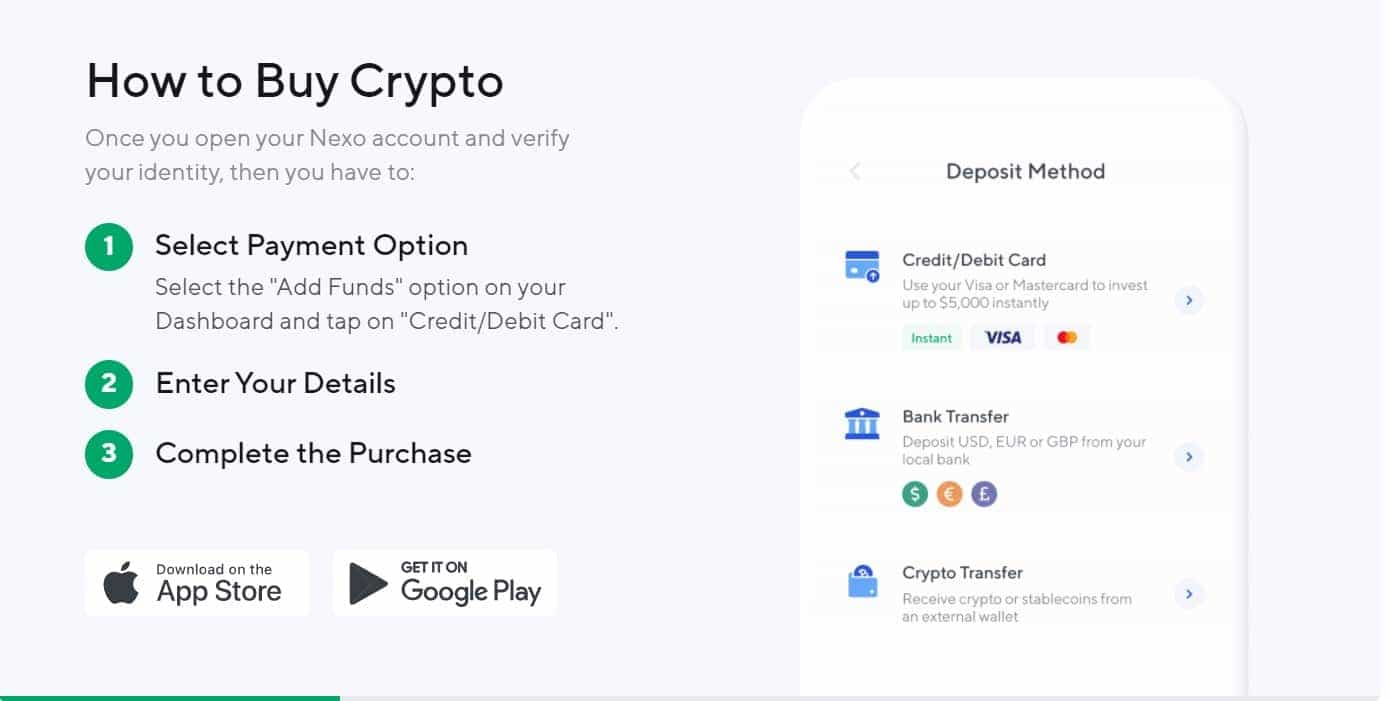

Nexo has over 38 digital assets that users can purchase simply using a debit/credit card or via bank transfer.

Nexo offers direct on-ramps for USD, EUR and GBP, and both MasterCard and Visa-issued cards are accepted. Once purchased, crypto funds are directly credited to the Earn section which is really convenient. The folks at Nexo want to ensure that no customer funds are sat idle, they want everyone to earn healthy interest from the minute their funds are deposited on the platform.

Depending on the loyalty tier, customers can earn an extra 0.5% cashback on crypto purchases through the platform as well. In order to purchase crypto, customers will need to undergo KYC and identity verification which can be completed in a couple of minutes. Card purchases are instant and the minimum card transaction limit is $50 while the maximum is $5,000 with a monthly cap of $10,000.

Wire transfers can typically take 1-3 business days depending on your country. Here is a look at the simple 3 step buying crypto process:

If you already hold crypto, funds can be transferred to the platform the same as you would send crypto from wallet to wallet, or exchange to wallet. Just make sure to double-check to see if the crypto asset you are sending to Nexo requires a memo or ID/destination tag. The most common assets that require memos/destination/ID tags when sending to an exchange are: Cosmos (ATOM), EOS, Stacks (STX), Stellar (XLM), Ripple (XRP), Hedera Hashgraph (HBAR) and some others, so always be sure to check before sending.

Nexo Card

I am a huge fan of crypto cards as using one feels like you get a double benefit on cashback earnings. With Nexo Lending (Earn) and the Nexo card, you can earn a nice APY simply for saving, while also being rewarded with 2% cash back for spending. Double dipping on the rewards… Nice one.

Using a crypto card is a great step in unbanking yourself and getting away from those greedy banking Fat Cats. Crypto users have a tough choice to make: Save money in a bank and earn 0.02% and receive 0% cashback when spending, or use a platform like Nexo where you can earn over 10% on savings and 2% cash back for spending.

Hmm, maybe that wasn’t such a tough choice after all.

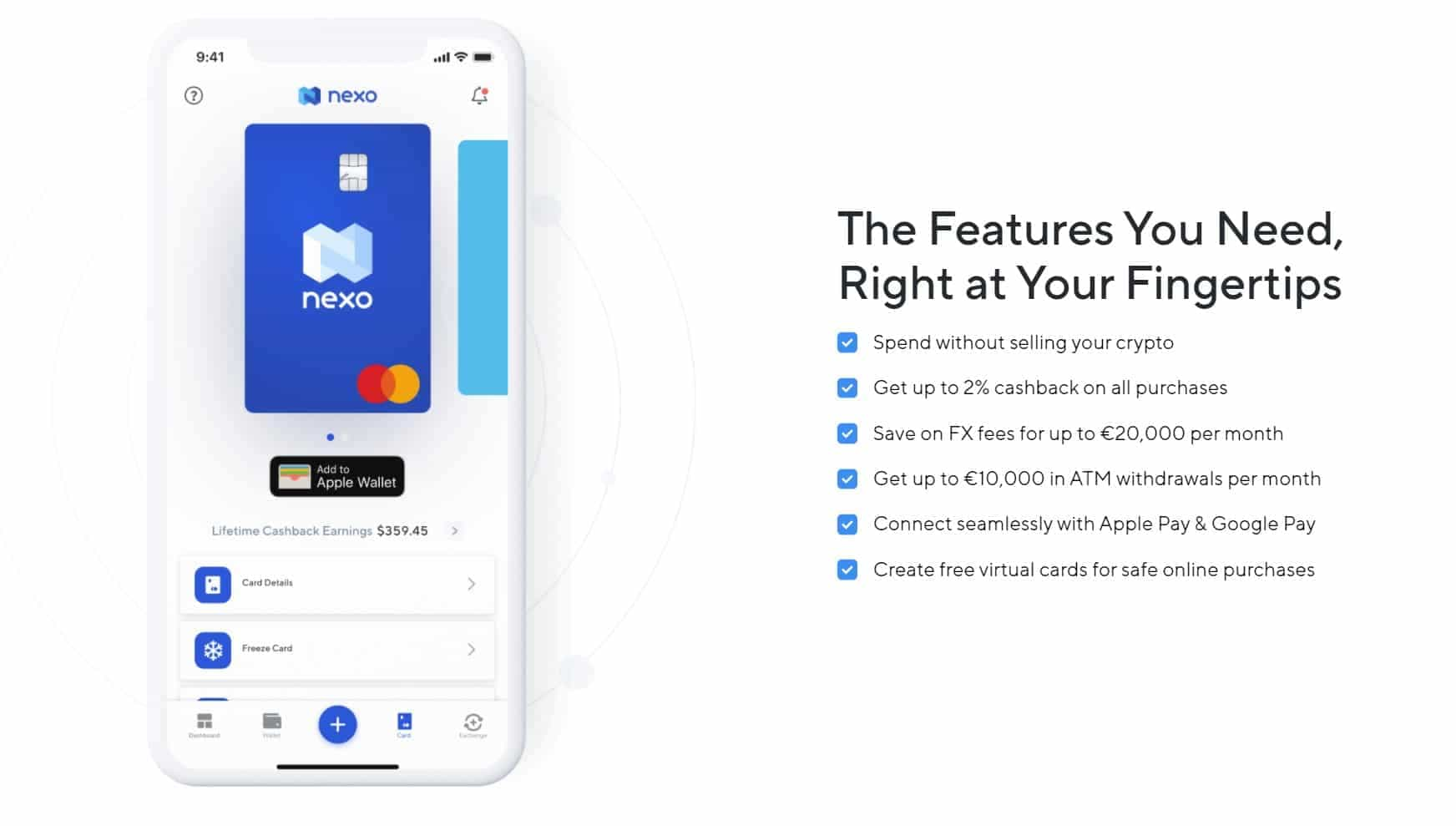

Using crypto debit cards are also a great way to help ensure you are taking profits during a bull run. The Nexo card is accepted anywhere that MasterCard is accepted. Here is a breakdown of some of the benefits:

- Payments in local currencies

- Up to 2% cashback on all purchases

- No monthly, annual, or inactivity fees

- Free additional virtual cards for secure online payment

- Accepted anywhere worldwide that MasterCard is accepted

Being able to pay in local currencies is a huge one that makes life so convenient for those who travel, especially around Europe where you can be spending in 3 different currencies in a single day as you cross borders. If you anticipate an upcoming trip, break out the water wings, sunscreen, sunglasses, and get your hands on a Nexo card as being able to spend in a local currency is a great feature and saves an incredible amount of money compared to trying to use a traditional bank or credit cards overseas. Here is a look at some additional benefits of the Nexo card:

If you are in the market for a crypto card, be sure to check out our article on the Top Crypto Cards.

Nexo Ambassador Program

If you have ever wanted to make an impact in the crypto community, contribute to the fight for crypto adoption and promote all the benefits that blockchain has to offer, the Nexo Ambassador program may be for you.

Ambassadors can earn a steady income stream for promoting the Nexo platform and bringing aboard new users. Users who sign up for the Ambassador program can enjoy the following benefits:

- Generous compensation and competitive salaries.

- Exclusive Access- Ambassadors get first-hand insider info about Nexo’s upcoming features, releases and news.

- Result-Based Bonuses- Ambassadors who meet monthly targets on a regular basis have no limit on how much income they can earn.

- Mentoring & Guidance- You won’t go it alone, Nexo offers training and mentoring opportunities with leaders in the blockchain space.

- Networking Opportunities- Open doors to new markets and customers by networking with Nexo team members and other Ambassadors.

- Recognition & Influence- Imagine becoming the official Nexo representative for your home country. The more you onboard, the more you earn.

This is more than your average affiliate program and may not be suitable for everyone. In order to become a Nexo Ambassador, users should be passionate about crypto and not just in it for the money. Here is what Nexo is looking for in terms of Ambassadors:

As an Ambassador, your mission, should you choose to accept it, will be to promote Nexo in your country and be a key player in building the local Nexo community. To learn more about the Ambassador program, you can find all the information on the Nexo Ambassador Program Page.

Nexo Security

Anyone who has been kicking around the crypto space long enough knows the importance of security, especially with how many exchange hacks frequent the news and all the horror stories we hear about customers losing their funds. There aren’t many platforms that can boast that they have never been hacked, and I am happy to announce that Nexo’s security reputation and history is flawless. No hacks here.

Nexo follows industry best practices and has partnered with BitGo, Ledger Vault, Bakkt, and others in order to secure funds and provide $375 million worth of insurance. Nexo also utilizes fully audited smart contracts, and they perform regular third-party penetration testing to ensure that there are no flaws in security.

BitGo provides Nexo with cold storage solutions and bank-grade class III vaults through their SOC 2 Type 2-certified custodianship program. Ledger Vault ensures digital assets for up to $150 million and provides cloud-based digital asset custody infrastructure. Bakkt provides Nexo with Bitcoin and Ethereum custody which utilises air-gapped cold storage solutions. Here is a look at the additional security solutions, certifications, and partners utilized by Nexo:

Customer information is contained behind secured networks with limited personnel access. Nexo uses an accredited information security management system that is ISO/IEC 27001 certified.

It is safe to say that Nexo has the back-end security on lockdown, but we know that many “hacks” are a result of carelessness and mistakes done by the user. Here is a look at the security features on the Nexo platform that customers can implement to help turn their accounts into Fort Knox:

- Withdrawal Confirmations & Log-in Alerts

- Biometric Identification: Using fingerprint or face recognition

- 2FA Authentication: SMS verifications, email verifications, authenticator app support

- Whitelisting: Manage your crypto addresses or improve the security of your account even further by enabling Address Whitelisting.

Nexo’s security goes much deeper than I am able to cover in full detail in this article. If you want to dive deep into all the steps Nexo has taken to ensure the safety of funds and the specific specs and certifications, you can find all that information on Nexo's Security Page

NEXO and Regulation

As mentioned above, Nexo is one of the most regulatory-friendly crypto platforms in existence. Nexo has been very clear in stating that the NEXO token is a security token and that it is compliant with the Securities and Exchange Commission Regulation D Rule 506(c). Interestingly, the NEXO token was the world’s first US SEC-compliant dividend-paying asset-backed security.

Nexo has done a fantastic job of being upfront about the status of their crypto asset, and they had the foresight to understand the crypto regulation that would be coming down the line and prepared for it well beforehand. Nexo has undergone a lot of effort to remain compliant with U.S. regulations and stay one step ahead of the ongoing crackdowns experienced by platforms like Celsius and BlockFi.

It is good to note that NEXO has decided to withdraw from the US market in 2022 due to a lack of regulatory clarity in the United States, and is focusing on the international market. Nexo recently received initial approval to operate as a licensed entity in Dubai:

- Nexo has received initial approval from the Virtual Assets Regulatory Authority (VARA) in Dubai to operate as a licensed entity in the region.

- Nexo's regional entity, Nexo DTC, is seeking full approval for Lending & Borrowing, Management & Investment, and Broker-Dealer activities in Dubai, which aims to become a global crypto hub.

- Nexo's co-founder and managing partner, Kalin Metodiev, expressed enthusiasm about aligning with Dubai's transformative guidance for new market strategies.

- Previously, Nexo agreed to pay $45 million to the SEC for failing to register its Earn Interest Product (EIP) but is seeking $3 billion in damages from Bulgaria for bringing it disrepute despite the nation's investigation finding no evidence against the company.

The NEXO Token

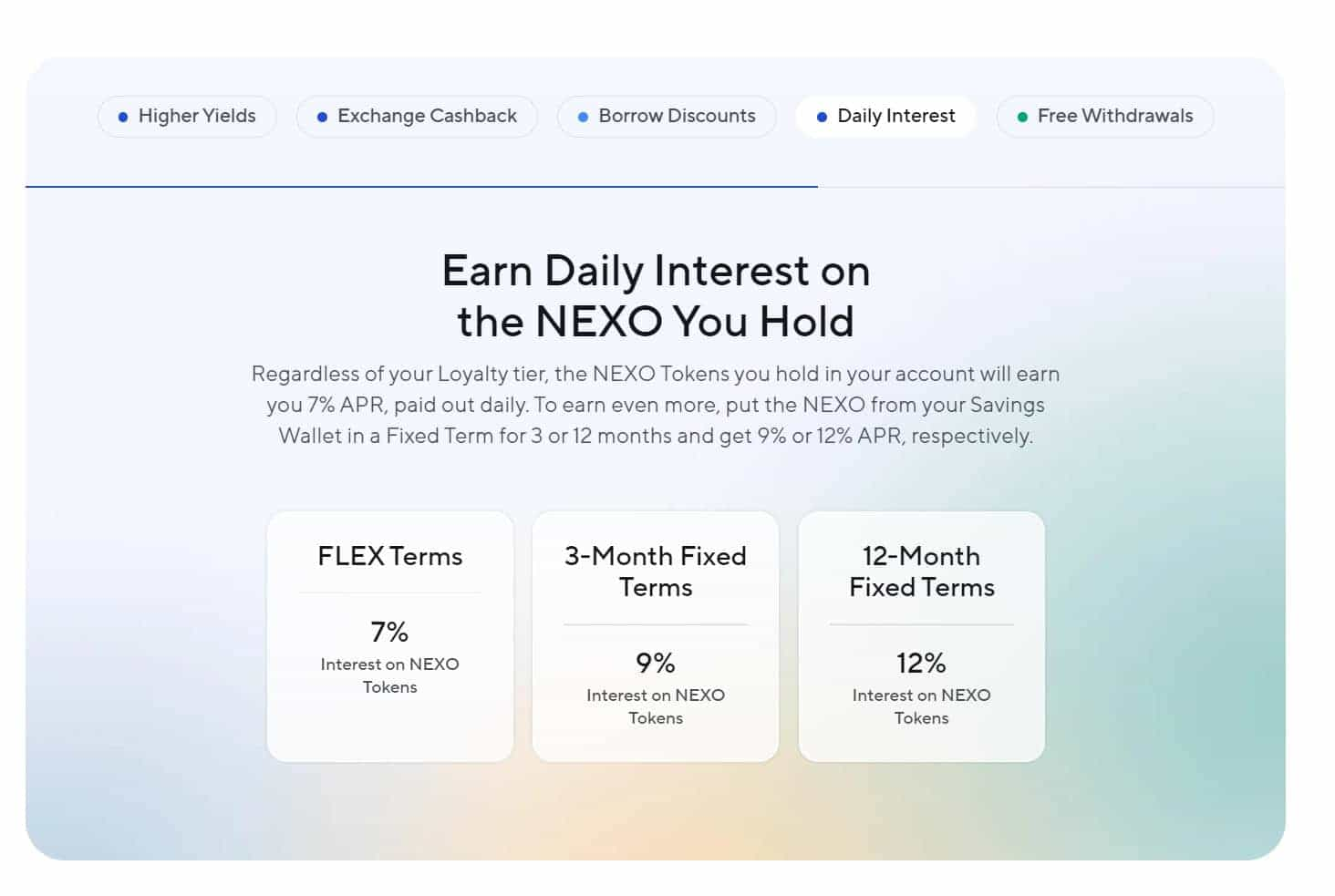

The Nexo team had come up with an interesting incentive to get investors interested in holding the NEXO token. Up until June 2021, investors who held onto NEXO tokens were paid a dividend. Thirty percent of the profits generated from Nexo loans were divided into a pool that was then distributed to NEXO holders. Dividends were paid out in Ethereum (ETH) at first but the team later decided to do one final payout to investors in the NEXO token before ending the dividend program to switch to just a simple daily interest payout method for crypto holders on the Nexo platform which is in place now.

Users are incentivized to hold and use the NEXO token to earn higher APYs, enjoy lower interest rates when borrowing, and receive discounts when paying borrowed funds back using the token. Holding the Nexo token is also necessary for users who want to increase their loyalty tier for better benefits and perks such as free withdrawals and cashback on swaps and crypto purchases.

NEXO conducted its ICO on April 1, 2018, raising $52.5 million and selling tokens for $0.10 each. Subsequently, the NEXO token began trading on May 1, 2018, at $0.190647. It rose quickly right out of the gate and hit $0.539466 just a week later. Nexo token exploded with the broader crypto markets in the first half of 2021 and hit its all-time high of just under $4 in May.

The Nexo token struggled with the rest of the crypto market, dropping in value in the second half of 2021 and as we venture further into 2023 amidst growing macroeconomic concerns that are affecting the entire investment space. The token has enjoyed consistent price appreciation overall during its lifespan. The long-term performance of NEXO remains strong, and the series of higher lows looks like this token may have some room to run in my opinion once interest returns to the industry.

The price appreciation of the token has been fuelled by the strong growth in the popularity and adoption of the Nexo platform, which has driven demand for the NEXO token. Nexo has remained a top 100 crypto asset for years, currently sitting at the 79th spot by market cap.

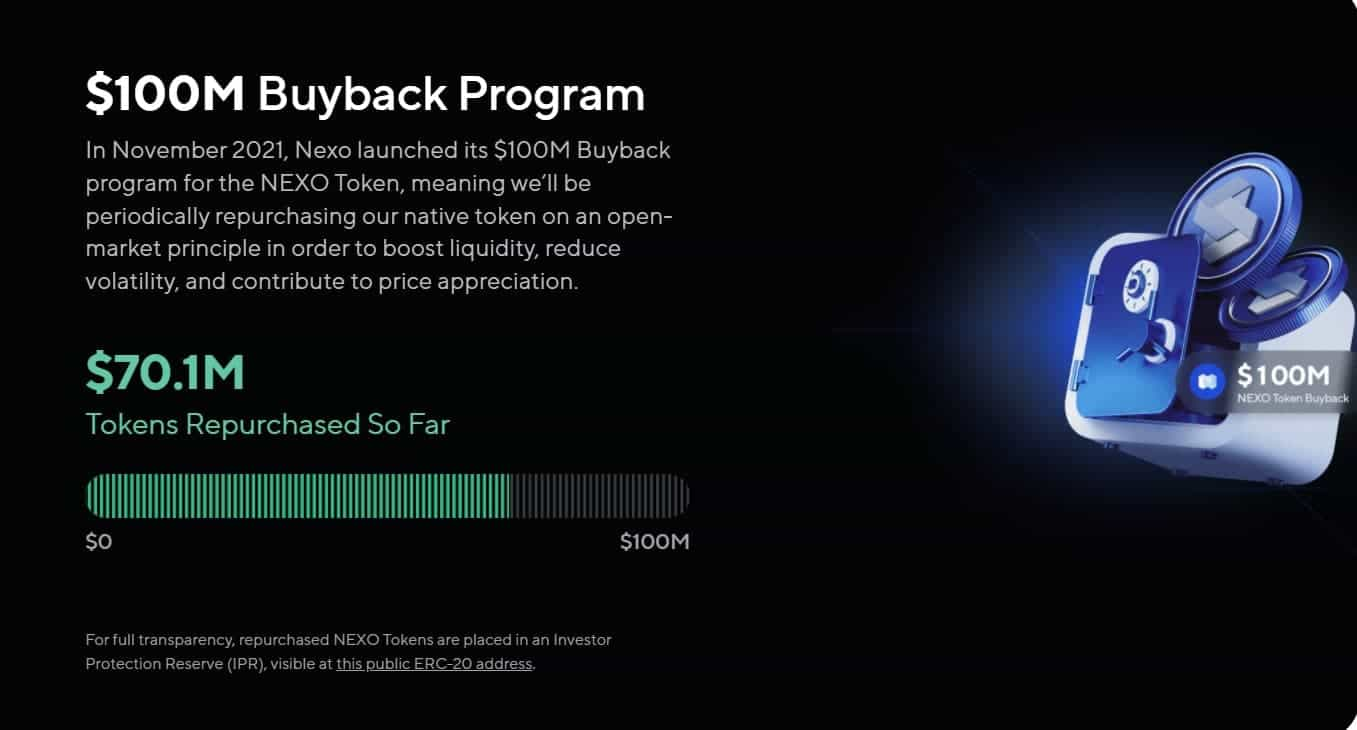

Nexo Buyback Program

In November 2021, Nexo launched its $100m buyback program for the NEXO token.

This is an initiative launched by the Nexo team, where they will be repurchasing the NEXO token periodically on an open-market principle which will help to boost liquidity, reduce volatility, and help promote capital appreciation of the NEXO token.

How Nexo Handles Crypto Volatility

Cryptocurrencies are some of the most volatile assets on the planet, with daily price swings of 10% commonplace, and monthly price swings of 50% or more not unusual. Stablecoins like TrueUSD and Tether (USDT) have learned to deal with upside price moves but still struggle with falling prices.

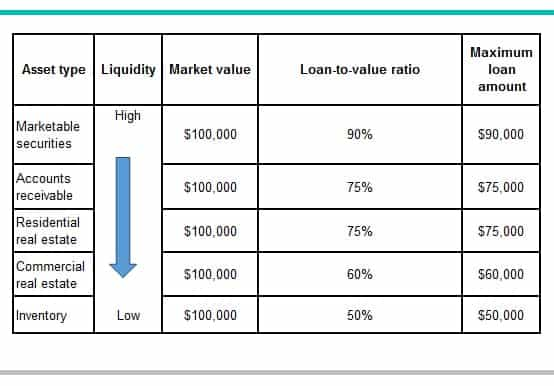

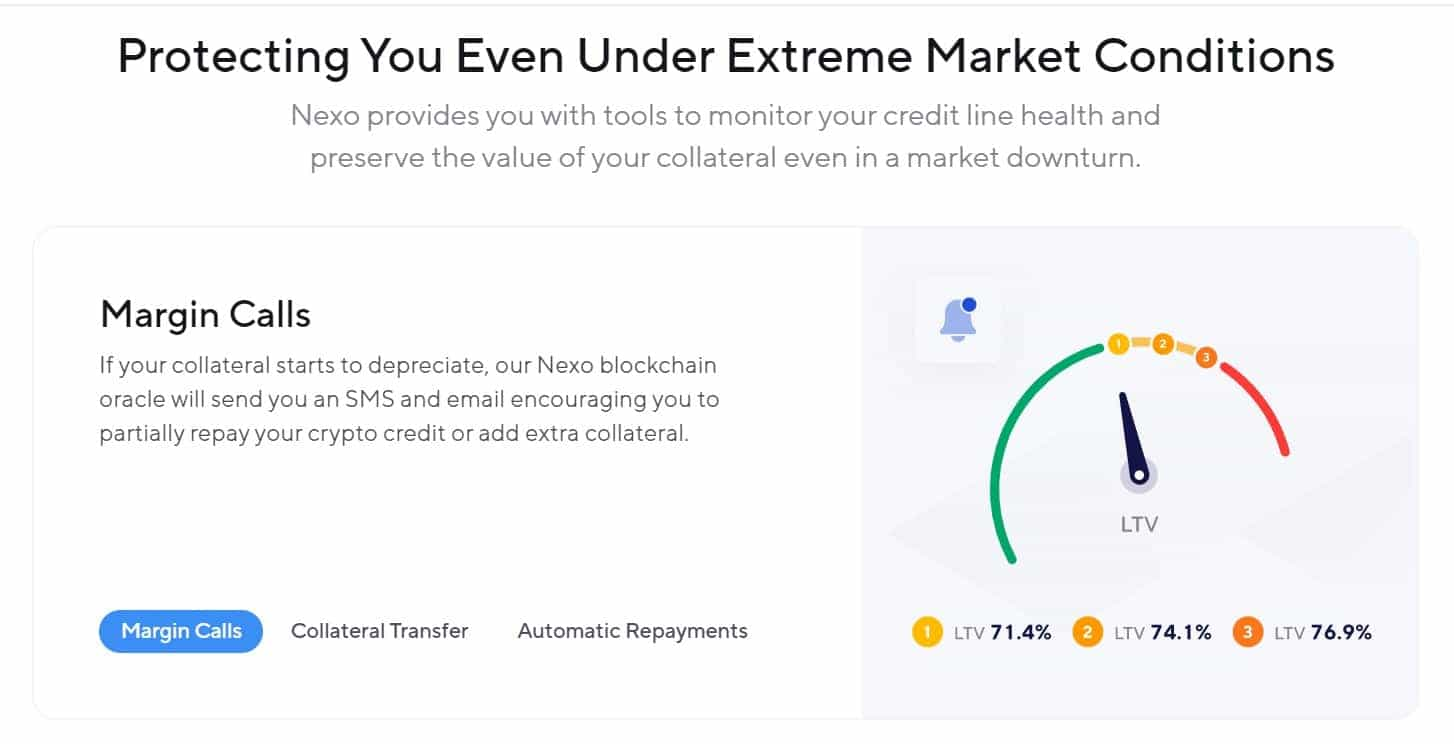

Nexo uses a concept from traditional lending known as Loan-to-Value to assess risk. In traditional lending, a borrower who is considered a default risk is given a higher LTV.

Nexo uses an algorithm called the Nexo Oracle to determine the LTV ratio for borrowers. Given the volatility that comes with cryptocurrencies, it’s likely that LTV ratios will often be greater than 50% unless cryptocurrencies become far less volatile (which has been occurring for Bitcoin). In practice, this means if you have $10,000 in Bitcoin in your wallet and the LTV is 50% you will be able to borrow 50% of your wallet Bitcoin balance, or $5,000.

The Nexo Oracle will work to avoid a situation similar to the U.S. housing crisis when many home values dropped below the value of the loans on those properties. Because there is always a risk of declining asset values in the cryptocurrency markets, the Nexo Oracle will be used to issue margin calls. Users will be able to monitor their LTV health and will be notified if they are approaching a margin call so they can take the appropriate steps and either repay or re-collateralize their borrowed funds.

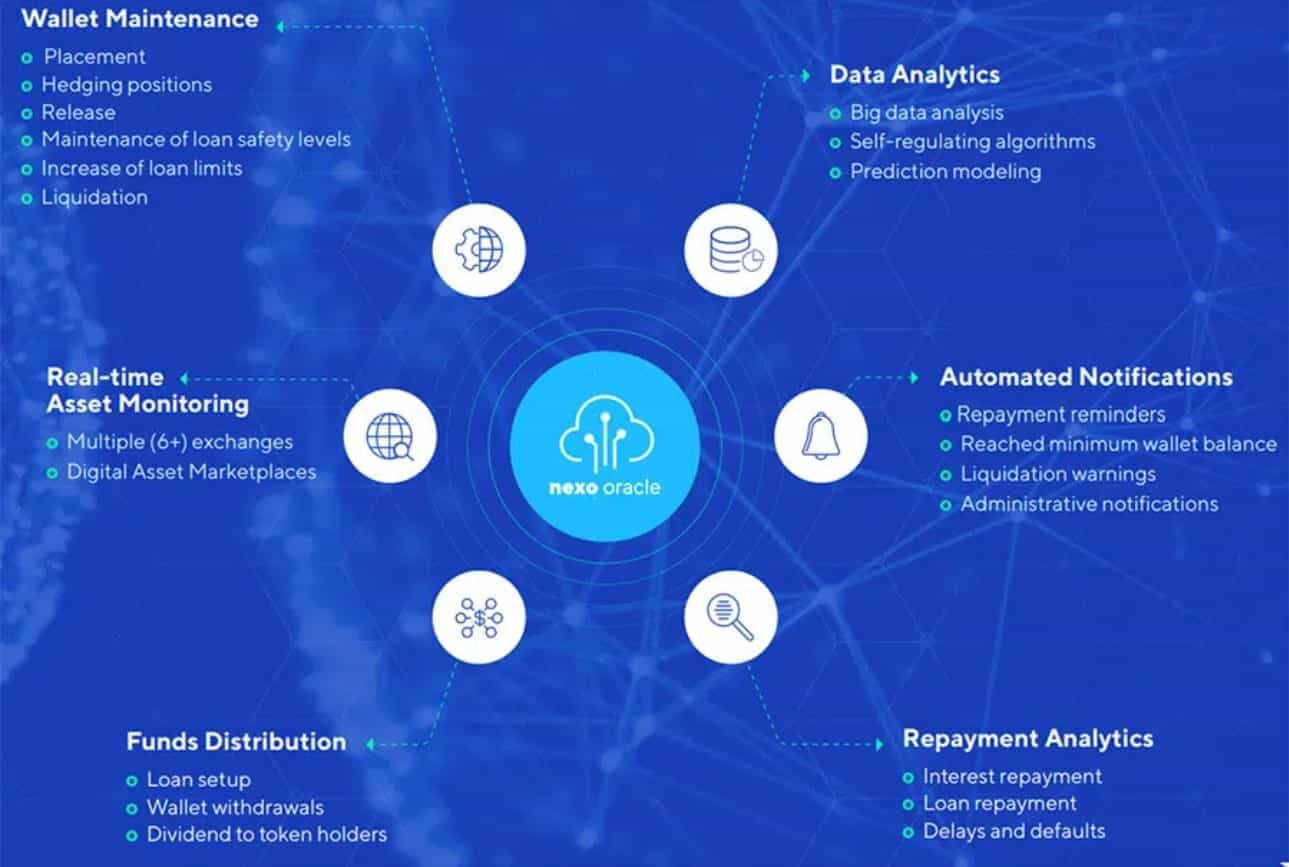

The Nexo Oracle monitors and regulates all aspects of the platform including analytics, loan distribution, asset monitoring, wallet maintenance, and others. Here is a diagram of how the Oracle works:

The Nexo Team

Nexo has a core founding team of 14 members, most of whom also hold high-level positions at the European consumer FinTech company Credissimo. Kosta Kantchev is the chief managing partner and co-founder of Nexo, and he was also a co-founder of Credissimo.

A second managing partner and co-founder of Nexo is Antoni Trenchev, who was previously a Member of Parliament at the National Assembly of the Republic of Bulgaria. He also has more than 7 years of experience in e-commerce development and strategy as well as automation of e-commerce processes.

The third managing partner and also co-founder of Nexo is Georgi Shulev. He has more than 6 years of experience in the investment banking industry and was a co-founder of Consestimate, an open financial estimates platform.

On the IT side, the fourth co-founder and CTO of Nexo is Vasil Petrov, who brought over 16 years of experience in system administration, back-end development and architecture to the Nexo project.

Advisors of Nexo include Michael Arrington, the founder of TechCrunch and Arrington XRP Capital. Trevor Koverko, the founder of Polymath, is a second advisor. The advisory team is rounded out by Ugo Bechis, who brings 40+ years of experience in SEPA compliance and finance to the project.

Nexo also has a heavy-hitting team of strategic partners, some of which include: bakkt, BitGo, Ledger, Paxos, Circle, Fireblocks, Terra, Securitize, Brave and more. Nexo holds memberships with the Bitcoin Foundation, Crypto Valley, Swiss Finance + Technology Association, Crypto UK, European FinTech Association, etc. A full breakdown of partnerships and advisors can be found on the NEXO About Us Page.

The NEXO Community

In the early days, Nexo had some growing pains and issues with community members defecting after it seemingly put its monthly dividend payments on hold as they re-evaluated how the dividend feature was going to be structured. In addition to complaints about the project failing to honour its commitment, there were additional complaints and negative reviews about the company not meeting other commitments and deadlines. Though it seems that much of those troubles have been overcome and recent Nexo reviews are overall positive, the platform is seeing massive growth from millions of happy users.

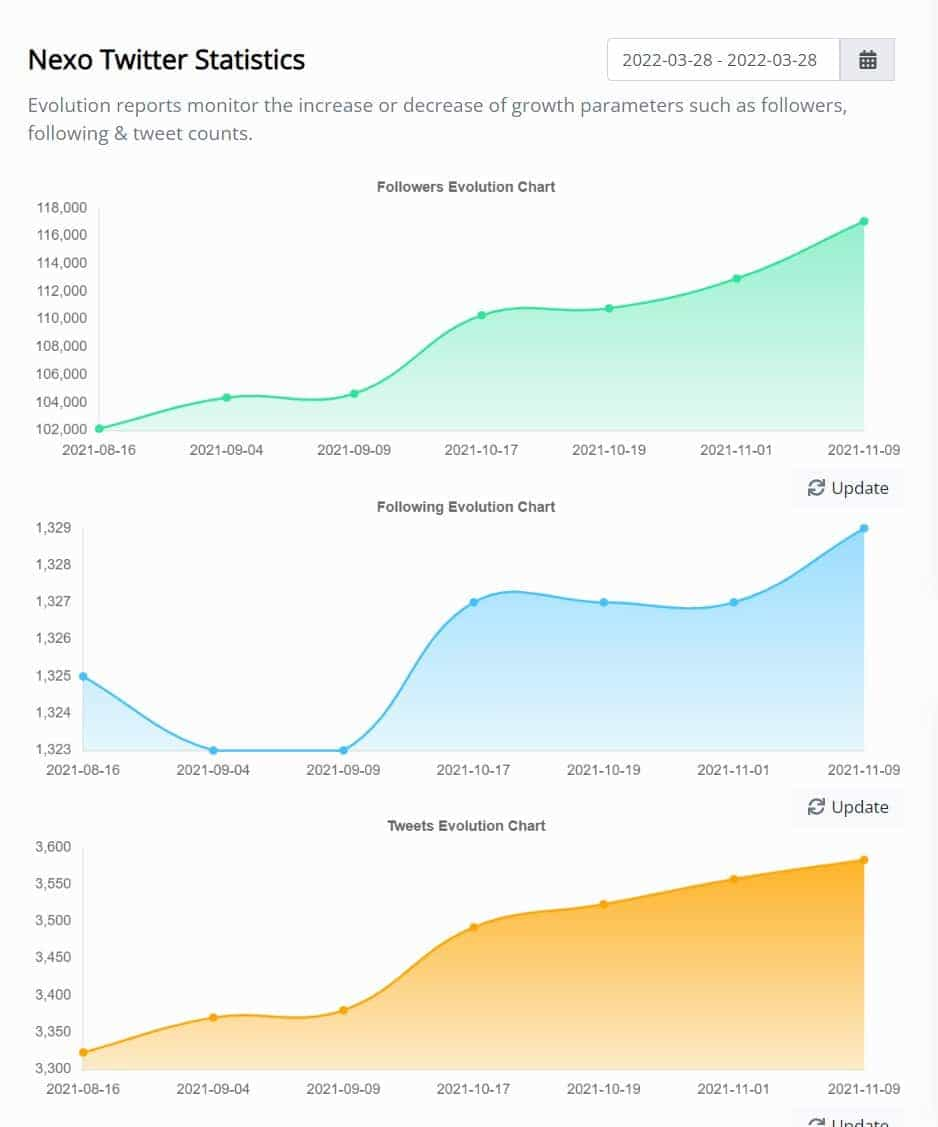

Nexo enjoys a large social media following and has more positive than negative criticisms by a large margin from what I was able to gather from their social platforms and the multitude of positive reviews from sites like Trustpilot.

The Nexo subreddit is also a bustling hub with over 35k members and daily posts and discussions on all things Nexo related. The NEXO Telegram chat is also a great place to check out as that is where the team and community with over 37,000 members are the most active.

Pro Tip: Most crypto projects have engaging communities on sites like Reddit and Telegram. If you are ever unable to find an answer you are looking for in the knowledge base, it is often worth posting your question on Reddit or Telegram, as the community is often quicker at answering questions than the support staff can be.

Just be aware that Reddit and Telegram are full of scammers pretending to work for customer support, so don’t ever share personal information like private keys, passwords, recovery phrases etc., as anyone asking for that information is likely trying to gain access to your account/funds.

Nexo Review: Support

I am instantly impressed by any crypto platform that offers live chat and fast response times. I’ve personally reached out to Nexo via live chat, and the process was a breeze. The team got back to me in under five minutes and quickly answered my questions, so hats off to them for that. Of course, many old crusty crypto veterans will tell you horror stories of deplorable customer service experiences that they have encountered with many crypto platforms, but Nexo is pretty top-notch in terms of support.

Nexo users can get 24/7 support by submitting a ticket/email support or clicking the little chat icon when they are logged in. For the do-it-yourself types, Nexo also has a well built out, very comprehensive self-help/knowledge section capable of answering most of the issues or queries you may have with the platform.

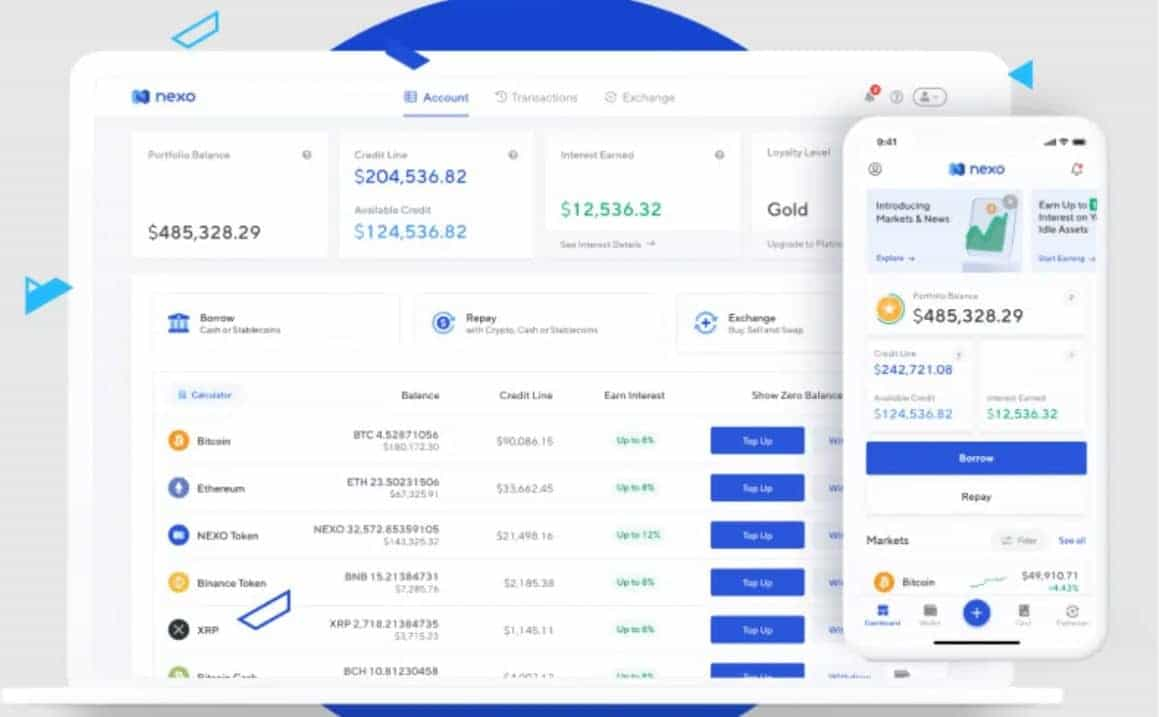

Nexo Interface & Mobile

Nexo is available via web browser and mobile on IOS and Android. Both platforms are very clean, intuitive and easy to use. When I say easy to use, I mean really easy! I would say that navigating Nexo on both web and mobile is more straightforward than any banking apps I’ve used.

The menu layout is straightforward, and the platform's simplicity is quite refreshing. It feels like so many crypto platforms are trying to be the Swiss Army Knife of everything, and it can be easy to get lost clicking around for what seems like forever.

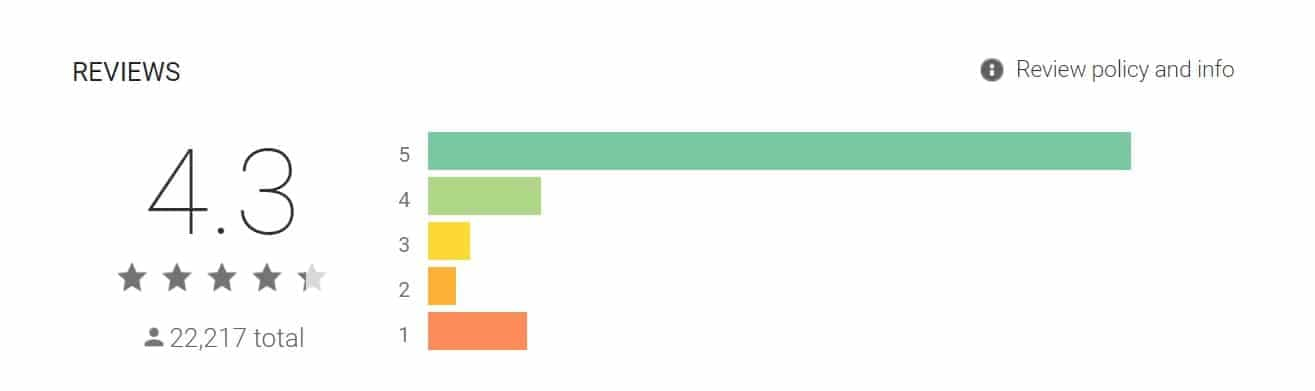

It looks like it isn't just me that is impressed by the mobile app either; the reviews on the Google Play Store and iTunes store appear to be quite positive.

Nexo Review: Conclusion

Nexo has quickly grown to become the largest crypto lending platform in the world. A platform doesn’t reach that status without having an excellent product, platform, and team behind the show. Lending platforms are popular as they allow holders to unlock the value of their assets without having to sell them. Another prominent attraction is obviously the fantastic APYs which are higher than you will ever get at a traditional banking institution, and of course, the sweet cashback crypto card.

The fact that the team has more than 15 years of experience running an established financial services firm is another positive for Nexo. You can be sure that they analyzed the need for cryptocurrency lending services and know what it takes to run a successful FinTech business. They also have solid backing from some of the biggest names in the space as advisors and partners.

Crypto lending has quickly grown to become a billion-dollar industry, and crypto lending companies are enjoying some of the fastest growth and adoption in the entire crypto space. Crypto lending may even potentially see itself as a trillion-dollar industry if cryptocurrencies escalate in value, as many financial advisors have suggested they will. So if you are looking for a fantastic place to borrow, lend, spend and unlock the power of crypto, then Nexo may be worth considering.

Note: Always do your own research for crypto lending platforms. Nexo has been in the negative spotlight a few times in 2023, so it's best to evaluate current updates.

If you want to look further into Nexo, you can also find Guy's take on the lending platform below:

Frequently Asked Questions

Nexo has proven itself to be the safest crypto lending platform after Celsius and BlockFi both experienced liquidity issues in 2022, freezing customer funds and filing for bankruptcy.

Nexo is a regulated, compliant friendly, and the most reputable lending platform in the industry. The company carries insurance and users can see real-time, third-party conducted audit results on their website to show the platform's financial health. Nexo follows AML and KYC standards and has extensive firewall server architecture, biometric-based ID verification, and segregated multi-signature cold wallets to secure funds.

Though, every crypto holder needs to determine for themselves if the risk of keeping funds on a non-custodial platform is worth the reward. Both BlockFi and Celsius were also considered "safe" at one time.

Yes, Nexo is a regulated and licensed digital currency provider that complies with regulations in over 200+ jurisdictions around the world.

Nexo and banks serve different functions. Nexo offers a higher APY than banks but also carries higher risk due to the inherent risks of crypto, and the fact banks can often expect bailouts from the government if they get into trouble.

Nexo is better than a bank for those who are interested in crypto loans, crypto lending, and crypto cards, as they offer these services that most banks do not.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.