Nexus Mutual Review (NXM): Defi Smart Contract Insurance

Nexus Mutual is an interesting concept built on the Ethereum network and bringing decentralized insurance to decentralized finance.

The project launched back in May 2019 and it gives users the ability to insure their smart contract positions using the native NXM token. By creating risk-sharing pools Nexus Mutual gives everyone the ability to cover smart contract positions, or to stake their capital in the pool for a stream of passive income.

Do we need DeFi Insurance?

Over the years there have been a pretty large number of cases where users have seen accounts hacked and coins stolen. There have even been some high profile cases where users simply lost their private keys and access to their coins. Wouldn’t it have been great if those coins were insured?

Unfortunately until Nexus Mutual was launched there was no good way to insure crypto assets. There was no company like State Farm that you could call and take out a policy to protect your Bitcoin or other cryptocurrency addresses. Stolen assets were simply gone.

The problems were compounded by the introduction of smart contracts in 2014. Many of the smart contracts being used in 2020 are value storing contracts that hold Ether or some other asset. All of these smart contracts are at risk of being hacked, or of losing coins to some other loophole. You probably remember the hack of the Ethereum DAO in 2016 that resulted in the loss of 3.6 million ETH.

If we want cryptocurrencies to move into mainstream acceptance they need to be secure enough that users aren’t worried about losing their funds. There needs to be a way to protect against theft or loss of cryptocurrencies before they become widely accepted. That brings about the need for a decentralized insurance protocol, especially as the amount of ETH and other crypto-assets being locked in various DeFi applications continues to grow.

It’s interesting that everyone acknowledges how risky the new DeFi applications are, but no one talks about insuring the funds being poured into these smart contract-controlled portals. Insurance seems to be a niche that opens up enormous potential in adding a layer of security that will increase the confidence of those who work with smart contract applications.

What Is Nexus Mutual?

Nexus Mutual is that insurance provider, offering users a way to protect or “cover” some of their activities in the DeFi ecosystem. You would call it insurance, but the team doesn’t call it that, primarily for legal reasons. And it also has some key differences from what we typically think of as insurance.

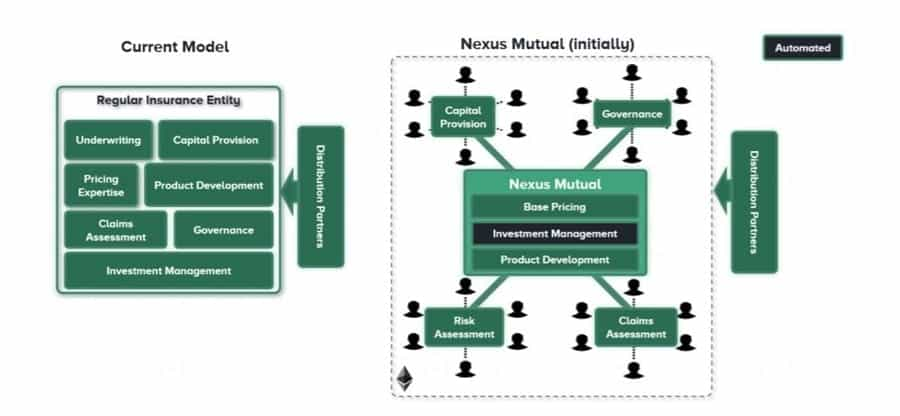

In traditional insurance the providers have an incentive to make a profit above all else. Without profits the insurance company would go out of business. So the need to make a profit often supersedes the needs of the policy holders. Nexus Mutual hopes to use blockchain technology to change that for-profit focus and make insurance better for everyone.

Insurance has become a critical part of modern life, but it could stand for some improvement to make it more useful to its users rather than the huge corporations profiting from insurance products. Naturally as a very new project and product Nexus Mutual has some way to go before it can disrupt the insurance industry, but its blockchain-based offering is working to do just that.

The name of the project comes from the insurance industry, where a “mutual” company is one that is owned by the policyholders. That is also true for Nexus Mutual. The policyholders, or in this case those who hold the native NXM token, are the owners of the blockchain and the ones who make decisions regarding payouts and governance of the blockchain.

The Use Cases of Nexus Mutual

It’s probably worth noting that unlike traditional mutual firms, Nexus Mutual is limited in the insurance it offers. So, you can’t use Nexus Mutual to insure yourself or your property against natural disasters, car accidents, health issues, or death. The team has hinted that these could become possible in the future, but right now Nexus Mutual is used only to insure against smart contract failures.

This is a good use case, because we’ve seen over the years how vulnerable blockchain assets and smart contracts can be. Whether from active attacks stealing coins, malfunctioning code in a wallet or other dApp, or simple personal errors it is too easy to lose coins permanently. And with DeFi growing in popularity smart contract vulnerabilities have become increasingly concerning.

Nexus Mutual is taking on the issue of smart contract vulnerability. Its Smart Contract Cover provides users with a level of protection that would help to avoid the types of losses such as the DAO hack in 2016. Not only is the project quite clear about what they can cover, they are also quite clear in defining when a payout would be made.

This makes it very important for users of Nexus Mutual to closely review the terms and conditions of any coverage they purchase. Nexus Mutual coverage does not payout in the event of network congestion causing a problem. The insurance does not cover entities that are external to the contract such as miners and oracles. And it will not payout if funds are lost as the result of a phishing attack.

And even though the conditions for payouts are clearly defined, ultimately the final word on issuing a payout in response to a claim comes from the members of the mutual.

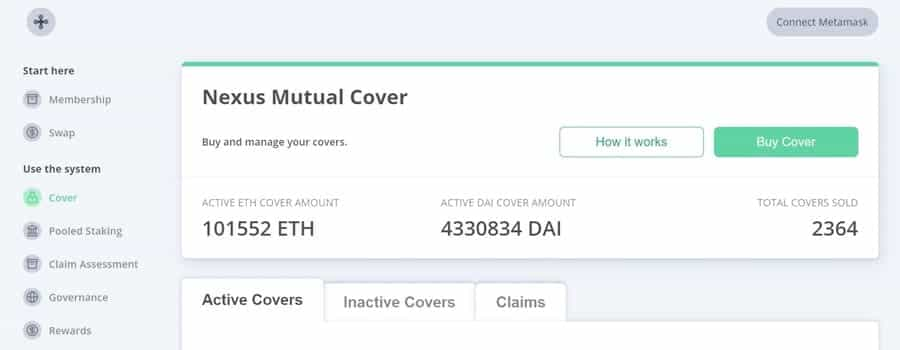

Buying Smart Contract Cover

Nexus Mutual currently offers one product called Smart Contract Cover. According to the protocol’s FAQ document “Smart Contract Cover is intended to provide protection against material loss of value resulting from "unintended uses" of smart contact code.” This covers instances where any security vulnerability in code has been exploited and funds have become irretrievable. Unfortunately at this time that does not include exchange hacks, and it also doesn’t yet include the loss of personal keys through a users’ own negligence.

In the Nexus Mutual scheme each Smart Contract Cover purchased has a fixed amount that’s called the cover amount. In essence this is the payout amount should a claim be filed and approved through the claims assessment process. This means that the payout is not necessarily equal to the loss. Instead it is equal to the cover amount, which is determined at the time the coverage is purchased, and is based on the size of the stake.

- Select “Get a Quote” from the website.

- Select “Buy Cover” from the dashboard.

- Input the smart contract address you want to purchase a cover for.

- Enter the amount in Dai (USD) or Ether you would like as the fixed cover amount.

- Input the length of time you wish the coverage to last.

After going through these steps, which only takes a few minutes, the system will generate a quote for you and you can choose to purchase coverage. If you do choose to purchase coverage you will also need to become a member of Nexus Mutual at this point, and the system will prompt you to do just that.

Benefits of Purchasing Smart Contract Cover

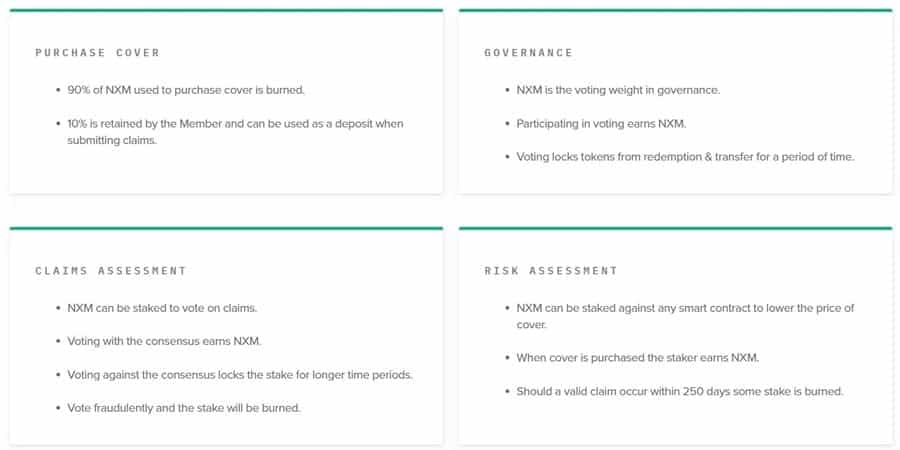

Right now buying coverage is the primary activity of Nexus Mutual members. Cover is often purchased to protect against common smart contract risks. After the coverage is purchased the cover amount goes to the Capital Pool, and that improves the financial position of the entire mutual group. The cover amounts are priced in a way that will generate a surplus in the Capital Pool over time, and that surplus is then shared among the member base of the mutual.

The Role of Nexus Mutual Members

Members fulfill several roles within the Nexus Mutual ecosystem. One of the primary roles filled is that of assessing the risk level of each smart contract covered. And whenever a claim is filed they are also responsible for voting on the legitimacy of the claims and deciding if a payout is made or not.

It is possible for members to stake their tokens with various smart contracts based on how secure they believe that contract is. So, the more NXM that is staked on a smart contract, the cheaper it becomes to purchase cover for that contract since the large amount being staked indicates that the smart contract is considered to be quite safe by the mutual members. Conversely a smart contract with little staked indicates that the community thinks there’s a large risk in that contract, and purchasing cover in more expensive as a result.

In NXM staking the user is at risk of losing part of their stake if the smart contract is hacked and there is a claim made. This means users who stake in NXM need to have a good deal of knowledge about the smart contracts they are staking, because they are putting their funds at risk when staking. In this way NXM staking is very much active staking rather than passive staking because there is always a risk of the users losing a portion of their stake if a claim is made on the smart contract staked.

In addition, when a user is one of the first to stake a smart contract they also earn rewards for signaling to other members that the smart contract is safe.

Any time a claim is made on a smart contract all the NXM holders are asked to vote on whether the claim is valid and a payout should be made. When voting with the consensus users earn greater rewards, but when voting against the consensus the user has their tokens locked for a period of time. This is to discourage users from voting simply for their own benefit.

It is even possible to have tokens destroyed when attempting to fulfill a claim that is clearly outside the definition of coverage.

Those who attempt to fulfill claims that clearly fall outside of the definition of coverage may even have their tokens destroyed.

Things members (NXM holders) can do:

- Buy smart contract cover.

- Stake on smart contracts to show they think that contract is secure, and to earn rewards.

- Stake to assess claims submitted by other members.

- Put forward governance proposals.

- Vote on proposals put forward by the team or other members.

- Contribute funds to the mutual and hold NXM tokens.

- All members of the mutual are sharing risk with each other.

Making a Claim

Any user can make a claim on their cover at any time during the coverage period, and for up to 35 days after the coverage period has ended. Because there are fixed cover amounts the assessment voting is a simple “yes” or “no” and no determination needs to be made based on the damage done to the cover holder. In order to submit a claim the cover holder must stake a minimum of 5% of the NXM tokens that were locked at the time the coverage was purchased.

Users can also stake an amount equal to 10% of the amount locked at purchase, and this gives them the right to submit the claim twice to be assessed. This staking cost has been implemented to avoid users making fraudulent claims. If a claim is successful the 5% or 10% stake is returned to the user, but if the claim is denied the stake is forfeited.

While members do not benefit from the payment of claims, it is in their long-term interest to pay all legitimate claims. This ensures trust in the system and allows for new users to more easily enter the system, feeling that their claims will be paid out if legitimate.

Claims Assessment

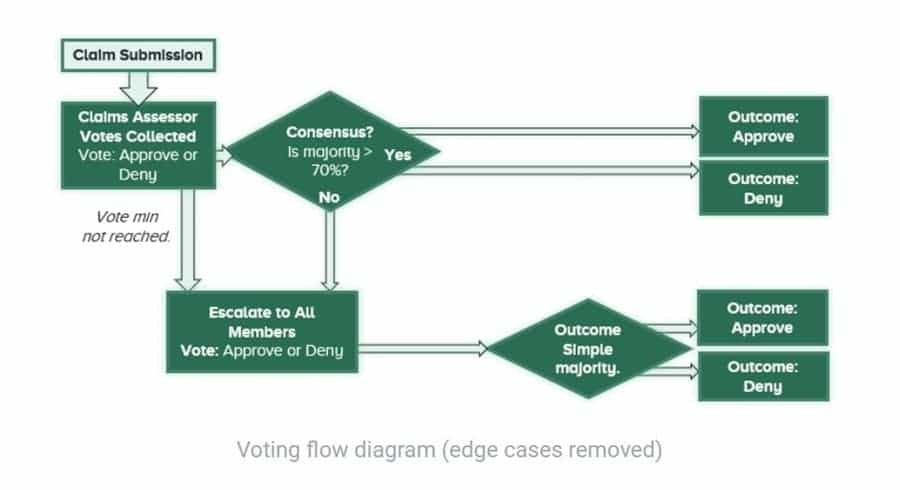

In a traditional insurance company claims are approved or denied by a centralized group, but in Nexus Mutual claims are approved or rejected through decentralized member voting. All of the mutual members act as claims assessors and cast their vote on the legitimacy of any claim submitted on the platform.

This voting either approves or rejects the payment of a claim, and the decision is final. There is no way to escalate a claim to higher authority. This system also allows for flexibility and the discretion of the mutual members. There may be some cases where a claim should be denied based on the terms and conditions of the cover, but the members determine there was a genuine loss and pay the claim anyway.

To make this system work there must be some incentive for voting on claims, as well as a strong disincentive that prevents fraudulent claims from being approved. Nexus Mutual has achieved this by distributing a reward to those who vote on a claim and are in the majority, and penalizing those who vote in the minority.

Who Is the Nexus Mutual Team?

Nexus Mutual was founded by Hugh Karp, a veteran of the insurance industry with nearly two decades of experience. He is joined by a handful of other team members and advisors. The project also has the backing of a number of venture firms, such as Kenetic, Blockchain Capital, and Version One. In addition, notable partners include Solidified and London Crypto Services.

The advisory board has become a controversial part of Nexus Mutual because it is a centralized group. According to Nexus Mutual the advisory board exists to “provide qualified technical guidance to the members of the mutual as well as enact emergency functions should they be required.”

The advisory board can help provide mitigation for fraudulent claims, or for malicious activities against the mutual. They have the power to burn member tokens and to kick members out of the mutual if there’s reason to do so.

How Does the NXM Token Work?

The NXM token is unique among cryptocurrencies because it can only be purchased through the Nexus Mutual platform. It is not available through any other exchange, broker, or trading platform. Those who wish to speculate on the price of NXM can do so on exchanges by purchasing and selling wrapped NXM (WNXM).

The reason for keeping NXM off of exchanges and trading platforms is that it was designed in such a way that all of the value creation of the token is also a function of the health of the Nexus Mutual platform. So, even though the price of the token is largely market-driven, it is actually more complicated than a basic supply and demand dynamic.

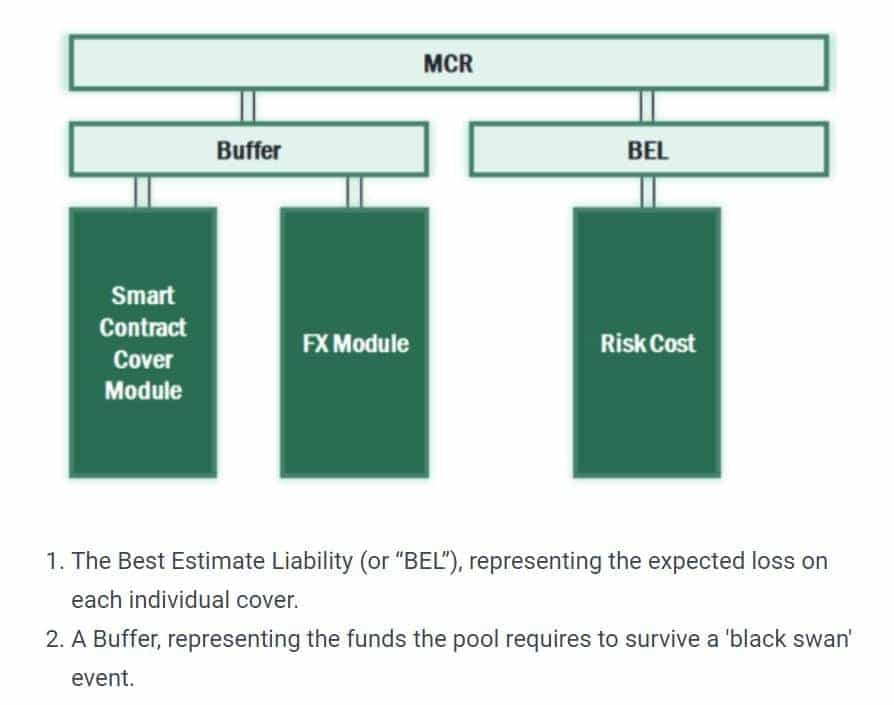

The price is driven in part by the Minimum Capital Requirement (MCR). This is the level that defines whether or not the system has enough capital to pay all claims. A higher MCR indicates a higher probability that all claims will be paid. It also provides an increase to the value of the NXM token.

This makes sense since a higher MCR means more funds are being held in the Capital pool. Since all the token holders are also members of the mutual each person benefits from the success of the platform. Thus the more capital held in the platform, the more value in each token held by members.

This Continuous Token Model has gained the attention of many advocates for decentralized finance. As of mid-November 2020 the NXM token is trading at $23.29, which is down more than 70% from the August 2020 high of $82.35. Of course it is also a nearly 300% gain from the July 2020 low of $6.84.

In Conclusion

As we said at the start of this piece, Nexus Mutual is a unique project in what is a potentially huge market. For the time being it is tightly focused on cover for smart contracts, and the team seems to have found the traction needed to keep growing. The future is looking quite bright.

The first challenge to the project came and went without a hitch as they paid out roughly $31,000 in claims following the February 2020 hack on bZx. That was enough to create a feeling of legitimacy around the project, leading to significant growth in 2020, and a massive rise in the price of the NXM token.

And yet many obstacles remain for Nexus Mutual and its team. Naturally the first issue that needs to be addressed is how to expand coverage and in what direction. Covering smart contract vulnerabilities is an excellent niche, but it’s only the tip of the iceberg in the nascent cryptocurrency world.

And project founder Karp has already mentioned the possibility of including coverage for all the typical things like natural disasters and injuries. That’s obviously a large step in the future, but it is also encouraging for the long-term and highlights just how huge Nexus Mutual could grow to become.

The only potential change we might suggest now is doing away with the advisory board, or finding a way to decentralize it.

Otherwise Nexus Mutual seems to be a strong project in an uncrowded blockchain niche. The team has made good progress already, and there is a great deal of future potential as well, presuming that Nexus Mutual remains ahead of any potential competitors.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.