Numerai Review: Hedge Fund Data Science Network

Numeraire is one of the most unique cryptocurrencies to have emerged so far. It also has serious potential as an asset. To understand why, we must first understand its utility within the Numerai ecosystem.

Numerai is a hedge fund that describes itself as “the hardest data science tournament on the planet,” with rewards paid out in NMR. The goal of the tournament is to create powerful data models Numerai can use to increase its investment yields.

So, why should we care about Numeraire?

Numerai believes it is on track to becoming the world’s most powerful hedge fund, and NMR is the incentive being used to make that happen.

The Numerai Hedge Fund

For those unfamiliar, hedge funds are the investment vehicle of the 1%. In the United States, only “accredited” investors can give their money to hedge funds. As such, it should come as no surprise that the minimum entry is normally in the hundreds of millions of dollars.

Hedge funds trade everything from stocks to fine art. Unlike legacy investment firms, hedge funds are essentially unregulated. This means that they are incredibly risky to invest in but also yield some of the highest returns in the world of finance (hey, that sounds like crypto!).

Richard Craib, the founder of Numerai, worked as a quant (a fancy word for market analyst) in a hedge fund shortly after graduating from UC Berkley and Cornell in mathematics and economics. He noticed there was a significant inefficiency in how hedge funds were operating. Specifically, they used primitive data models to predict asset prices and were very protective of the financial data they were modeling.

Craib created Numerai in 2015 as a way of introducing “network effects” to hedge fund operations and solving the two setbacks he was seeing. In short, he realized that if you could somehow get hundreds or even thousands of people to work together to create these data models without revealing the underlying data, you could generate more accurate price projections and become the most profitable hedge fund in the world.

How Does Numerai Work?

This is how Numerai works. First, users are given existing datasets that have been modified so that there is no way of knowing what assets they refer to. Then, these users participate in weekly tournaments by submitting predictions their data models generated. These predictions are applied to new sets of market data by Numerai. Users who submit accurate predictions of this new data receive payouts, normally a month after the weekly tournament has concluded.

Behind the scenes, Numerai takes note of which users’ predictions are generating the most profitable investments and/or trades and puts them together to create a “meta-model”. This meta-model is then used by the Numerai hedge fund to trade assets more effectively. According to their Medium article, back-testing suggests this meta-model is not only more effective than linear or machine learning models, it is also less correlated to them.

Put simply, this means it is a data model unlike any other in the financial market. Perhaps the coolest thing about Numarai’s infrastructure is that it is trustless – Numerai keeps their financial data masked, and users keep their data models private since only the predictions they generate are being shared with Numerai.

The Numeraire Token

You might be wondering where NMR fits into this picture. Well, Numerai initially used PayPal to reward winners of their weekly data tournaments. After a falling out with PayPal, they switched to Bitcoin.

However, they noticed two things: 1) that it was quite cumbersome for them to use Bitcoin as a method of payment and 2) that users needed some sort of incentive to create high-quality data models with high-quality predictions and not just spam the submission box with low-quality data models in hopes of winning some cash.

What is Numeraire?

Numeraire (NMR) was created on the Ethereum blockchain in 2017 as an ERC-20 token with two purposes in mind: for contestants to stake their funds on the effectiveness of their data models and to provide a more convenient payout method.

Ever since it was introduced, competitors in weekly data science tournaments must stake NMR when submitting their predictions. The payout is determined partially by the amount of NMR they staked as well as the accuracy of their predictions. Stakes from unsuccessful predictions are burned, making Numeraire a deflationary asset.

Recently, Numeraire’s use-case expanded to include staking and payment inside the Erasure ecosystem. Launched in 2019 by Craib, Erasure is a marketplace where users can do things like buy and sell data and even request specific information.

As noted on Erasure’s website, Numerai is a part of this broader project to decentralize and share data. Erasure seeks to expand this notion of “skin in the game” into social interactions and even offers a browser plug-in that only shows information from individuals who have staked cryptocurrency on their opinions.

Numeraire has undergone a number of changes since it was introduced. It initially had a maximum supply of 21 million, the same as Bitcoin. No ICO was launched. Instead, 1 million NMR tokens were airdropped to Numerai’s active users, which was around 12,000 at the time.

This might leave you wondering how it is that Numerai got the financial firepower required to start a hedge fund project of this kind. Thankfully, the answer is simple: they received funding to the tune of 7.5 million in 2016 from private investors, including other hedge funds, and have continued to receive investments ever since.

How Much NMR is There?

In June of last year, Numerai cut the total supply of NMR from 21 million to 11 million and minted the outstanding supply of NMR. Until then, Numerai had only been minting the amounts necessary to reward successful participants in their weekly data science tournaments. In fact, this was built into the Numeraire token – it contains a smart contract that burns stakes from unsuccessful participants and pays out the appropriate reward to winners.

According to Richard Craib, the 2019 update to the Numeraire token was done primarily to move towards decentralization. They wanted to put the token’s entire supply into play and give total control to Numeraire’s smart contract to handle the issuance and burning of NMR.

However, about a year before making the change, Numerai allocated 3 million NMR to a data science tournament set to conclude in May of 2028 and set aside a further 1 million NMR for future airdrops and partnerships.

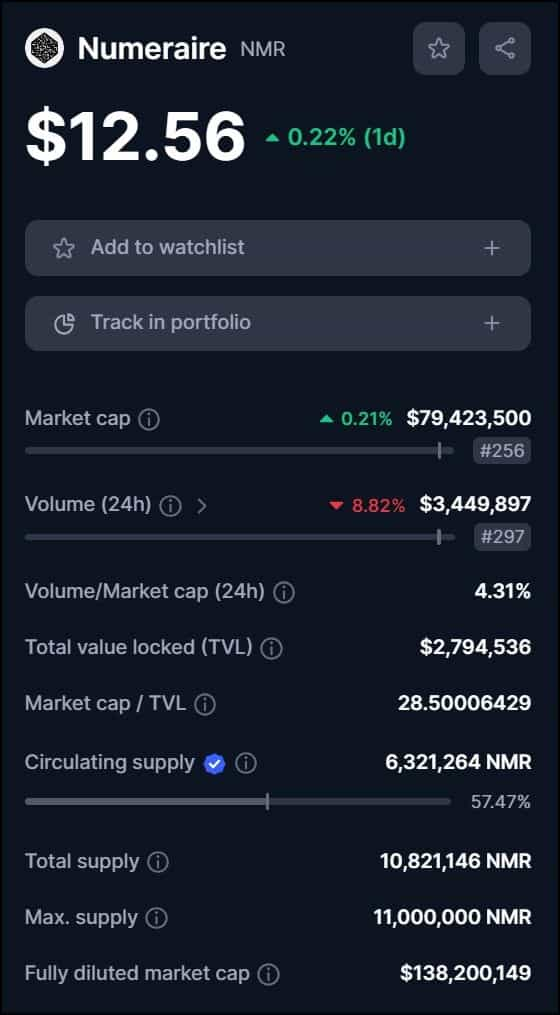

If you do the math (11 million minus 3+1 million), you are left with a total supply of 7 million tokens, 6.3 million of which are currently in circulation in September 2023, according to CoinMarketCap. The transparency around the supply of NMR tokens has been murky. When the supply of NMR was as low as 2.5 million earlier in the project's life, about 4.5 million of the tokens were unaccounted for, raising questions about who held them and what they used them for.

Numeraire Price Analysis

Compared to many other cryptocurrencies, Numeraire has an interesting price history. Introduced to the crypto market in June of 2017 at a price of around $25. A few days later it skyrocketed to over USD$150 and then gradually bounced between USD$10 and USD$20 for the remainder of 2017.

What’s fascinating is that the price of Numeraire was hardly affected by the famous bull run in December 2017/January 2018. By that, we mean it fell just short of hitting USD$60 during the bull run, which is only slightly more than double its original issuance price of USD$25, one which it had revisited multiple times during 2017.

By December of 2018, the price of Numeraire had crashed to a mere USD$2. After hovering between USD$5-10, the token began to pick up steam in February of this year and has since reclaimed the USD$25-30 price range.

One thing that is important to note is that it had an incredibly fast recovery from the 65% flash crash in March of this year and has since been gradually increasing in price. This may be due to the increase in participants in the Numerai tournament due to the coronavirus pandemic.

Where Can I Get Numeraire?

In terms of trading, Numeraire is traded most on Bilaxy and Bittrex, which account for roughly USD$1.4 million of its $2 million daily trading volume (at the time of writing). Almost 50% of Numeraire trading is taking place on Bilaxy alone. Although it does not have the same clout as Bittrex, Bilaxy is safe to use (tested by yours truly).

Thankfully, upon close examination, we can see very clearly from the order books that there is real volume being traded, and liquidity is looking pretty darn good! This means you should have no issues trading on either of these platforms.

Besides winning the Numerai data science tournaments, the only way to get Numerai is to buy it from an exchange (and remember you need some NMR to stake to enter the tournament).

How to Store Numeraire (NMR)

If you are looking to store your Numeraire, it is quite simple to do since it is an ERC-20 token. This means you can store it on any wallet that supports Ethereum, including desktop cryptocurrency wallets like My Ether Wallet (MEW), mobile cryptocurrency wallets like Atomic Wallet and Trust Wallet, and hardware wallets like Ledger and Trezor.

Don’t leave your NMR on exchanges! Always remember to keep your crypto in your own wallet whenever possible (trust me, I lost a few hundred USD on QuadrigaCX).

Numeraire and Numerai Roadmap

What’s next for Numerai and NMR? Well, this isn’t too clear. In lieu of a defined long-term roadmap, Numerai has outlined its “master plan” in a Medium article written by Numerai’s founder, Richard Craib. Numerai’s long-term goals include monopolizing intelligence, monopolizing data, monopolizing money, and then decentralizing the monopoly.

Craib himself has stated that he wants Numerai to become the world’s “final” hedge fund. His reasoning is that the Numerai hedge fund, containing hundreds of thousands and eventually millions of data scientists, will eventually outperform every other financial investment firm in the world.

As you know by now, NMR is used as both the stake and reward for data scientists in Numerai’s weekly data science tournaments. This means that as Numerai’s ecosystem continues to grow, so too will the demand for Numeraire by new data scientists entering the weekly competitions. The recent introduction of Erasure will also drive more demand for Numeraire since it is the token used to both purchase and stake information on the platform.

Numerai appears to be on track to achieve its goal of becoming the world’s most powerful hedge fund. It should be noted, however, that the focus of the team behind Numerai, including Richard Craib, has shifted their focus to Erasure.

As previously noted, Numerai is now a component of this new ecosystem, which fundamentally seeks to bring the principle of “skin in the game” to every online interaction and transaction. It seems that Numeraire will continue to be the primary asset used for these purposes in Erasure’s future projects.

Our Opinion on Numerai

Numerai is a truly unique project in the world of cryptocurrency. In fact, there is probably only one other that is similar, and that is HedgeTrade. On the HedgeTrade platform, users also make predictions about assets.

However, in contrast to Numerai, these predictions are purchased by other traders. In short, instead of pooling together your predictions into a meta-model for a hedge fund, you are submitting individual predictions to a marketplace where predictions are bought and sold using the HedgeTrade token.

There are also similar projects existing outside of the crypto sphere. These include QuantConnect, Quantopian, and WorldQuant. They also pool together the brain power of thousands of data scientists to create models to trade and invest from. However, there are a few significant differences between these hedge funds and Numerai.

First, their ecosystems are not built using smart contracts, meaning you must trust that these hedge funds will pay their dues and actively uphold the process in a consistent manner indefinitely. Second, none of them seem to have additional incentives beyond rewards for accurate data models from their data scientists. Specifically, there is no real stake involved. Finally, there is a vetting process for data scientists who participate – it isn’t open for the world to join.

Although we can’t speak for Richard Craib, we know he would point out these flaws in detail, as he has done many times before in interviews. Simply put, Numerai’s is much less fallible since it uses a smart contract to burn stakes and issue rewards, provides much more incentive to participants to submit accurate models via staking, and can be joined by just about anyone on the planet with a computer.

While it is skeptical whether Numerai will achieve its goals of total monopoly over finance, the project certainly has lots of potential and stands out as a promising venture both inside and outside of crypto.

Conclusion

Our opinion on the Numeraire token is slightly less positive. Here’s why:

NMR’s Suspicious Supply

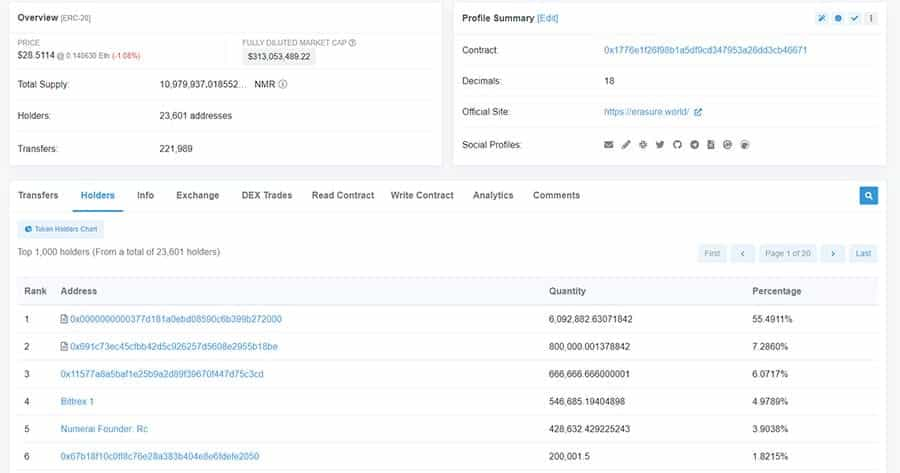

Being an ERC-20 token, it is quite easy to pull up more detailed information about NMR using Etherscan.io. In an email correspondence between Coindesk and Richard Craib, it was noted that 1.7 million NMR were unaccounted for when Craib had outlined what would happen with the token after the supply cut.

As we can clearly see in the screenshot above, Craib (obviously Numerai Founder: Rc) has kept over 400 000 NMR for himself. A few other addresses seem to contain substantial amounts of NMR as well, and it is questionable whether they belong to super-successful data scientists from Numerai.

This fact may put some people off since it can be a red flag when the creator of a token is keeping a substantial amount for himself.

NMR’s Price Potential

Numeraire’s price performance has been quite impressive compared to most other cryptocurrencies. However, the fact that it didn’t rise substantially in accordance with the 2017/2018 bull run suggests that it may not be an asset that will10x any time soon.

Since NMR is burned every time a data scientist loses a tournament on Numerai or when someone submits faulty information on Erasure’s marketplace, this means that NMR’s total supply will gradually decrease.

While this gradual reduction in supply suggests a gradual increase in price over time (assuming demand for NMR stays the same or increases), it presents a second issue, which could be the downfall of both Numerai and the Erasure ecosystem. This is because the moment the last NMR token is burned, there will no longer be a way for data scientists or information hunters to stake their submissions or receive payouts on either platform.

It seems that the likelihood this will happen anytime soon is quite slim, and given that the amount of NMR received or offered is expressed in USD, this means that both Numerai and Erasure have quite a lifetime ahead of them.

They will at least exist until May of 2028, which is when the mega data science tournament is set to conclude on Numerai. The 3 million tokens that are won will likely be sold, introducing a fresh supply of NMR to markets via exchanges for others to purchase and use to be staked in both Numerai and Erasure.

All being said, it’s up to you where you place your bets. None of the above is financial or investment advice, and we recommend you do your own research for any topics we covered here that you’d like to learn more about.

Be sure to stay tuned for more in-depth cryptocurrency reviews. Until then, check out our YouTube channel for the latest and greatest developments in crypto. See you in the next article!

Frequently Asked Questions

Numerai is a cryptocurrency-driven hedge fund that hosts the world's hardest data science tournament. It rewards participants with its native token, NMR, for creating data models that enhance the fund's investment returns. The platform's vision is to become the world's most powerful hedge fund using NMR as an incentive.

Traditional hedge funds often use basic data models and guard their financial data. Numerai, founded by Richard Craib, introduces network effects by crowdsourcing data models without revealing the underlying data. This approach aims to generate more accurate price projections and higher profitability while maintaining privacy.

NMR is essential for the Numerai platform. Initially a payout method, its use has expanded to the Erasure ecosystem. Participants in Numerai's tournaments stake NMR when submitting predictions. Accurate predictions earn rewards, while incorrect ones result in the staked NMR being burned, making it a deflationary asset.

Yes, there's skepticism about NMR's supply, especially with a significant amount held by the founder, Richard Craib. The token's unique burn mechanism, which reduces its supply, also as a deflationary asset, it raises questions about its long-term viability and the sustainability of the staking and reward system.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.