PIVX Review: Proof-of-Stake Based Privacy Coin

PIVX made the news in May of this year when it was revealed that John McAffee’s privacy-oriented cryptocurrency, Ghost, had copy-pasted parts of PIVX’s original whitepaper.

The question is why?

PIVX is short for “Private Instant Verified Transaction”. It a cryptocurrency focused around privacy and community with an ambitious goal of becoming the most advanced cryptocurrency in existence.

Given these facts, it should come as no surprise that Ghost developers capitalized on the information in the PIVX whitepaper and have further stated that the Ghost cryptocurrency is a fork of PIVX. Although these actions are distasteful, they reveal that there is some serious legitimacy to the PIVX project. As you will see, PIVX uses some of the most novel technology in crypto and is a pioneer among privacy coins.

The Beginnings of Pivx

The story of PIVX begins with another cryptocurrency called Dash. Those familiar with Dash will know that it is a fork of Bitcoin which seeks to be faster and more privacy oriented.

Rumor has it that in 2015, a small group of Dash developers were unsatisfied with the direction the cryptocurrency was headed and decided to create their own crypto which was initially named Darknet and later rebranded to PIVX.

Around this time, James Burden (AKA s3v3nh4cks) became the founder and one of the developers for the project. Burden has over 20 years of experience working as a hardware technician with a passion for software and has been an active cryptocurrency developer since 2012. In April 2019, he stepped away from PIVX after giving an ultimatum to the development team a year prior.

Like the original group of developers which left Dash, Burden was dissatisfied with the lack of privacy PIVX had come to have as well as various flaws within its governance architecture. He created a new cryptocurrency called Veil which seeks to become what PIVX was intended to be – a scalable cryptocurrency which ensures user privacy at all costs.

PIVX has seen a significant slow-down in public activity since Burden’s departure in 2019. Furthermore, the other two notable developers including Jeremy Anderson (who is also a Ravencoin developer) (who is also a Ravencoin developer) seem to have shifted focus to other projects including Veil.

For the past year or so the only visibly active member of PIVX has been Bryan Doreian, its community manager and marketing lead. As you will see, the PIVX team still seems to be hard at work behind the scenes despite these concerning circumstances.

The PIVX ICO

PIVX as launched in January 2016 as Darknet and did not have an initial coin offering (ICO). Instead, 60 000 PIVX were premined to allow for 6 masternodes to operate the initial network.

These 60 000 coins were then burned in the months that followed once the PIVX community grew to a sufficient size to become self-sustaining.

How Does PIVX Work?

PIVX is in fact a decentralized autonomous organization (DAO) which is self-funded and community driven. PIVX is intended to be a “third generation” privacy coin and uses a modified version of Dash’s masternode architecture and Zcoin’s Zerocoin privacy protocol (which was originally designed for Bitcoin).

According to the PIVX website, its network fees are 40x lower than Bitcoin. While the website notes a transaction speed of 70 transactions per second (TPS), Doreain has stated that TPS can go as high as 1000 using the SwiftxX payment protocol. Let us take a closer look at these elements.

PIVX Mining & Staking

PIVX uses a proof of stake consensus mechanism which consists of two parties: masternodes and validators.

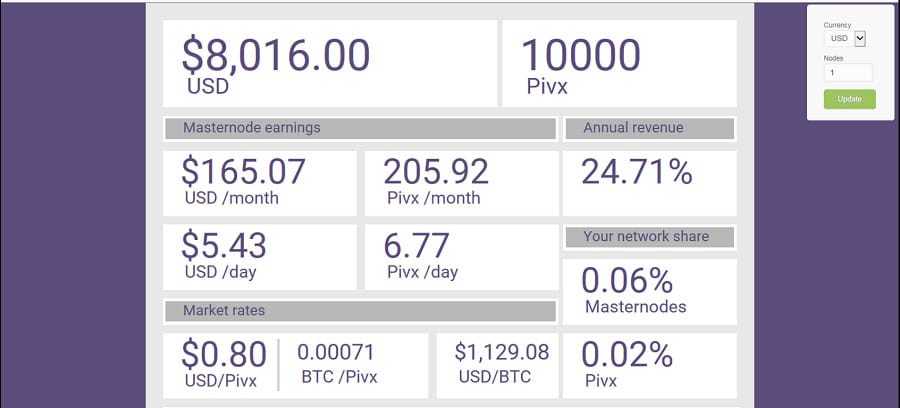

Masternodes have two tasks: to vote on development proposals tabled by the PIVX community and validate transactions on the blockchain with as little as a single confirmation that can take place off-chain via the SwiftX payment protocol. A stake of 10 000 PIVX is required to run a masternode. Each masternode gets 1 vote and is not at all involved in the mining of new PIVX tokens.

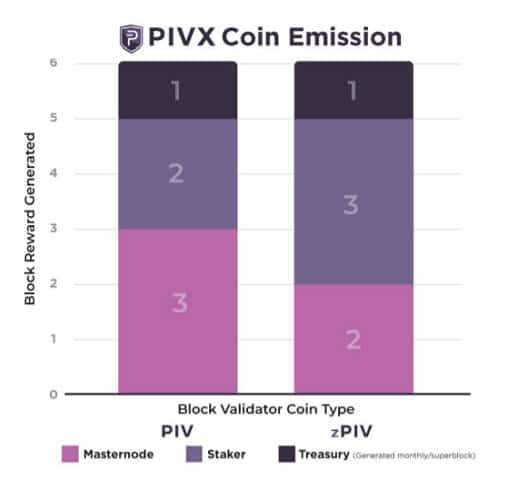

Mining PIVX is the job of validators which have a chance of generating a block proportional to the amount of PIVX they have staked, requiring roughly 500 PIVX to generate a single block in a 1-month time period. A new block is generated roughly every minute and yields a reward of 6 PIVX coins with 2 coins going to the validator, 3 to the masternode, and 1 to the PIVX treasury which funds successful development proposals and community initiatives.

To ensure a balance between masternodes and validators, PIVX uses a “seesaw” mechanism which sees rewards increased for validators when there were too many masternodes and vice versa in the event of too many validators.

This small detail sets PIVX apart from other governance focused cryptocurrencies such as Decred which uses a pre-programmed division of mining rewards which cannot be changed. You can also estimate your PIVX staking rewards using their very own calculator.

PIVX Privacy

Oddly enough, PIVX currently does not offer private transactions. Up until last year, PIVX used the Zerocoin privacy protocol. While the fundamental technology behind the Zerocoin protocol is quite complex, how it worked within PIVX is straightforward.

If a user wanted to send a private transaction, they would use PIVX to “mint” zPIV. The corresponding amount of zPIV would be sent on the PIVX blockchain and then “burned” to create the corresponding amount of PIVX for the recipient.

What is quite remarkable is that it was possible to stake zPiv in the same way PIVX was staked. This was enabled to enhance the security and liquidity of the PIVX network. The only difference between zPiv staking and PIVX staking was that the block reward distribution; masternodes would receive 2 coins with the validator receiving 3.

PIVX Cryptocurrency Supply

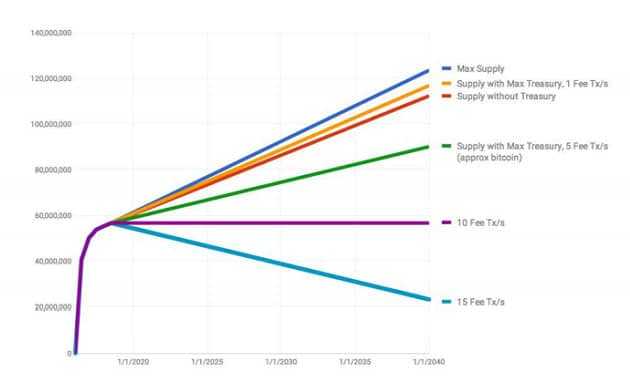

The ‘tokenomics’ of PIVX are quite interesting. PIVX does not have a hard supply cap and has an inflation rate of anywhere between 3-4% per year. However, PIVX has a theoretical “soft-cap” because of one small feature: transaction fees.

Every transaction on the PIVX network costs 0.01 PIVX (this was also the cost for minting zPIV). Since transaction fees are burned, there is a point at which the number of transactions taking place outnumbers the number of new PIVX being generated.

If this were to happen, PIVX would actually become deflationary like other proof of stake cryptocurrencies. This would lead to a complete crash of the network were it not for the fact that the PIVX community can simply vote to lower the transaction fees to prevent excessive deflation. The community can also vote to increase transaction fees to reduce inflation if it gets out of hand.

The PIVX Roadmap

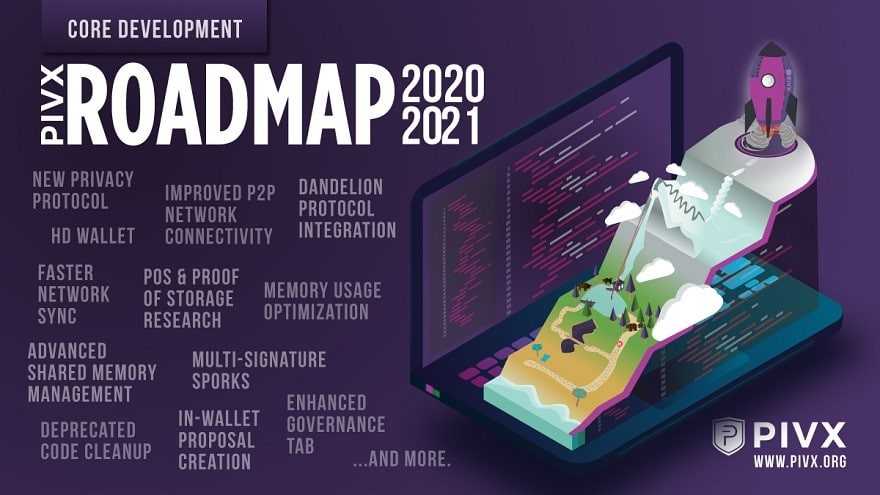

In the world of cryptocurrency roadmaps, PIVX takes the cake when it comes to comprehensibility and transparency. This is impressive considering that the direction of development is fundamentally determined by PIVX masternodes. It is worth noting that certain projects which were greatly anticipated earlier on such as zDex, PIVX’s decentralized exchange, have yet to come to public fruition.

Despite a few missing elements, the PIVX development team has achieved quite a bit since 2016. The most notable milestones include the implementation of the Zerocoin protocol which brought private transactions to the network via zPiv along with the ability to stake zPiv in 2017 and 2018, respectively. Unfortunately, the use of zPiv was limited to desktop wallets and never made it to mobile PIVX wallets.

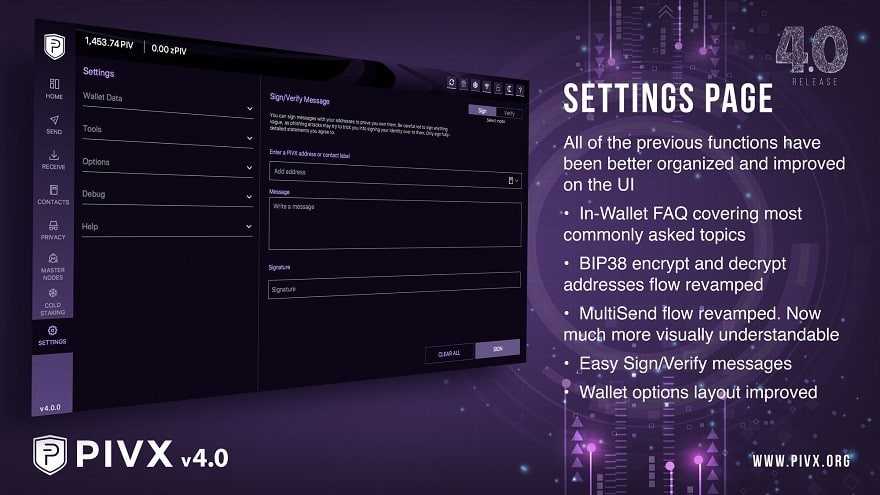

In a recent interview with a PIVX team member, Doreian noted that the development team was hard at work developing a new privacy protocol for PIVX. In February, the PIVX development team detailed the architecture of the new protocol which has yet to be implemented.

In March of this year, PIVX released a detailed roadmap for 2020-2021. The roadmap is divided into 4 sections: core wallet, lightnode wallets, community, and alliances. There are roughly 2 dozen projects in total and the progress bar next to each one lets you know how far along they are in completing them. Notable goals include implementing the new privacy protocol, cold wallet staking functionality, sponsoring athletes, and even starting a charity called the PIVX Foundation.

PIVX Price Analysis

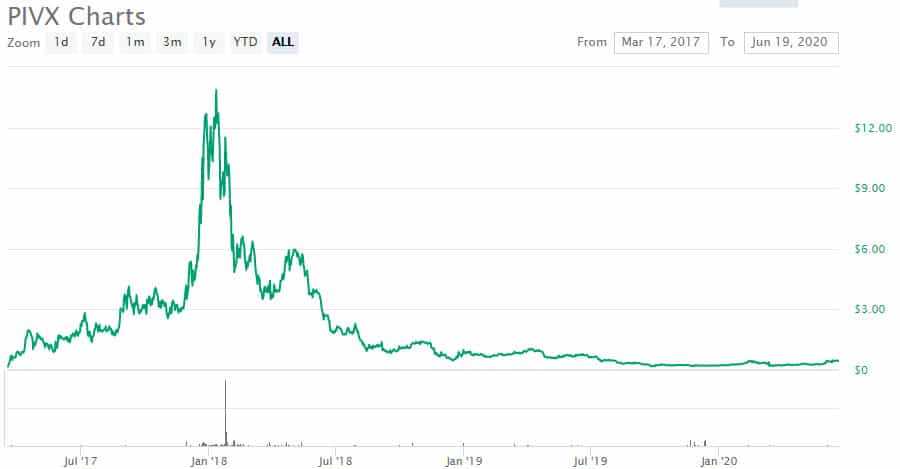

PIVX’s price history is quite predicable. When it first entered the market in February of 2016 it was worth a fraction of a cent and began to rally in 2017, eventually reaching an all time high of nearly 13$USD in January of 2018. The price dropped in the months that followed, effectively flatlining by mid-2019 at a price of just over 22 cents USD.

Despite this dismal drop in price, the ROI of PIVX remains incredibly high. It has also experienced a slight increase in price in recent months, doubling from 22 cents to around 44 cents USD. A closer look at the last year of price data seems to indicate that PIVX is slowly but surely on the rise.

Exchange Listings

PIVX is available for trading on about a dozen cryptocurrency exchanges including Binance and Bittrex.

Unfortunately, trading pairs are quite limited and the trading volume for PIVX is exceptionally low, possibly because a substantial amount of PIVX is being used for staking. This means that markets can become quite volatile with even a few BTC worth of buying power, so trade with caution!

PIVX Cryptocurrency Wallets

PIVX has quite limited support when it comes to cryptocurrency wallets. If you are looking to store your PIVX cryptocurrency, you effectively have 3 options: the Ledger hardware wallet (which has PIVX staking functionality), the PIVX desktop and mobile wallets, and the Coinomi desktop/mobile wallet.

If you prefer an offline wallet, you can create a PIVX paper wallet using walletgenerator.net. You can learn more about PIVX cryptocurrency wallets by reading our in-depth article on the topic.

Our Opinion of PIVX

Although PIVX had a lot of promise coming out the gates, it seems that the bottom has fell out of the project. In addition to being sidelined by its most notable developers, the ‘decentralized’ structure of its development funding has put PIVX in a self-imposed trap.

Specifically, the approximately 20-22 000 PIVX which is allocated to operations on a monthly basis cannot possibly be enough given its currently low price which cannot increase without serious advances in development and marketing.

This is evidenced by the sudden disappearance of its previously hyperactive community outreach. The PIVX YouTube channel was uploading videos every single week and even hosted cryptocurrency tutorials focused around PIVX technology on the PIVX Class YouTube channel. Unfortunately, PIVX’s intense focus on community seems to have taken away from the blockchain’s actual development.

PIVX & Privacy

PIVX seems to have strayed away from its original goal of total user privacy. This was in fact why Burden left the project to start his own. PIVX was supposed to move towards greater and greater privacy but started moving in the opposite direction. In PIVX’s defense, this is probably due to the increased scrutiny privacy coins have received in recent months from governmental regulators.

This seems to be an issue common across all privacy coins. As regulatory bodies around try to bring “transparency” to cryptocurrency, privacy coins are being pushed off exchanges and out of reach for unseasoned traders and investors. Last year, South Korean cryptocurrency exchange delisted a handful of privacy coins including PIVX and Monero, even though PIVX’s privacy function was optional.

PIVX design flaws

Both Burden and Doreian had noted that PIVX’s zPIV Zerocoin protocol had privacy flaws in metadata, specifically in how zPIV “change” was returned to users in transactions. Since zPIV cannot be sent in decimals, the resulting “change” in any transaction would be returned to the original sender.

If they chose to receive that change in PIVX, it would make it possible for third parties to determine who had sent the private transaction based on the publicly available PIVX transaction history.

Burden has also noted that the role of masternodes in PIVX has resulted in a “rich boy’s club” where decisions have become increasingly centralized. Masternodes are the only players in the system which can vote on new development proposals and Burden claims that their voting quickly became like-minded, causing many development proposals desired by the community at large to be voted down.

Conclusion

While PIVX sounds good on paper (at least good enough to be plagiarized) in practice its design flaws seem to have undermined the project, which appears to be on its last leg. There is still hope for PIVX though – they continue to post regular development updates on their website and appear to be on their way to achieving their future development milestones.

With some luck, they may just find their footing and get back on track to becoming the most advanced privacy-oriented cryptocurrency on the market.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.