Polymath Review: The Blockchain For Financial Securities

Security tokens seem to be all the rage now. From exchanges to regulations and issuance platforms. One such project looking to capitalise on this is Polymath.

This is a project that is looking to power the issuance of digital securities. They are also looking to do so in a way that is completely within global regulatory frameworks - providing issuers with an entire suite compliant tools.

However, can it really be the security token platform?

In this Polymath review I will attempt to answer that and give you what you need to know. I will also analyse the the long term use cases and adoption potential of POLY Tokens.

Why Polymath?

ICOs have become both incredibly attractive and incredibly risky.

While early investors in new blockchain projects have the opportunity to see their investments increase by 100% or even 10,000%, they have an equal opportunity to see their investments go to $0 when the project dies, or even worse the developers simply disappear with the ICO funds.

Let’s be honest, with roughly half of all the 2017 ICOs already failures, this is a pretty risky space.

There are also the legal ramifications to consider. Many of the current ICOs are in violation of U.S. securities laws in one way or another, and while they might not be regulated now, if they do become regulated this could pose a definite long-term risk.

Possibly worst of all, they threaten to bring more scrutiny to cryptocurrencies from government agencies and regulators.

Polymath is looking to be the cure to the ICO sickness. It was developed to help issue securities tokens in a safe and blockchain regulated manner. And they’ll do so while also providing incentives to bring new financial products to market on the blockchain, while also keeping regulators happy and at bay.

As an additional security measure, only verified buyers will be able to purchase or trade POLY coins.

It seems like an ideal scenario. Companies get easy access to capital, there’s increased transparency, no need for onerous regulations and paperwork, increased liquidity, greater visibility, and an incentive to create financial products.

Let’s take a deeper look and see if Polymath really will be good for cryptocurrencies, or if there’s a fatal flaw in the plan to created a securities blockchain.

What is Polymath?

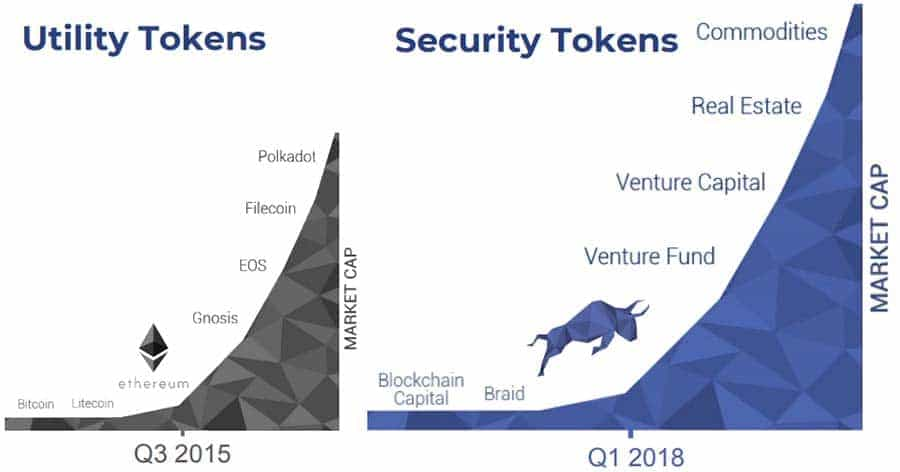

Bitcoin, Ethereum and most cryptocurrencies are application or utility tokens on unregulated, decentralized networks. Security tokens, which make up a miniscule portion of cryptocurrency market cap, are similar to traditional assets like stocks or bonds, which are typically regulated.

While the securities token market is currently very small, Polymath aims to flip that statistic on its head, making securities tokens more than 10x the size of the app token market. There are several reasons they believe that this can happen, including:

- Security tokens are more secure

- Security tokens will increase liquidity

- Their ST20 standard provides nearly instantaneous transactions

- And there will be a 24/7 low fee trading environment.

The Polymath team seeks to garner acceptance for security tokens through the use of smart contracts to apply restrictions from the ground up, rather than having them imposed after the fact with a top-down regulatory enforcement model.

Polymath Seeks a New Model

Traditionally, financial markets are overseen by a central agency who provides regulations and enforcement of non-compliance. This is how stock, bond and commodities markets work today.

The regulatory agencies create laws and regulations that get pushed down to all the investors and companies involved in listing or trading, and they all have to follow these regulations or get banned from the markets, or worse, face legal actions.

That’s exactly the type of regulation that cryptocurrency markets will get if an alternative isn’t found.

Polymath seeks to turn that process upside down by involving government officials and attorneys at the beginning of the token creation process.

If this is set-up properly it could do away with the need for a regulatory body to get involved later in the process. It could even create a more legitimate blockchain based market that will reach mainstream faster than following the traditional route.

Under this set-up any new security tokens issued would be regulatory compliant right from their issuance.

Checks and Balances

This process also assumes some checks and balances would be rolled up into process. One such would be the use of a “template” for token creation, and all new security tokens would have to adhere to this template.

This would allow each token to have its own transparency and history, allowing investors to get full information about the token before investing. And since it all occurs on the blockchain it will be transparent and do away with the need for multiple unreliable channels to disseminate information.

There would be two very positive outcomes from this.

- It would help police any bad actors.

- It would allow investment rules to be added for individual security tokens.

Currently there is something known as an Accredited Investor classification that the SEC uses to restrict the purchase of certain assets and asset classes. The idea behind this is that those who receive Accredited Investor classification are more sophisticated investors and less likely to fall for scams. They are also more able to assess risk and take on a high-risk high-return investment.

By using this model in the security token market the same outcome can be achieved, but without the need for the SEC and regulations.

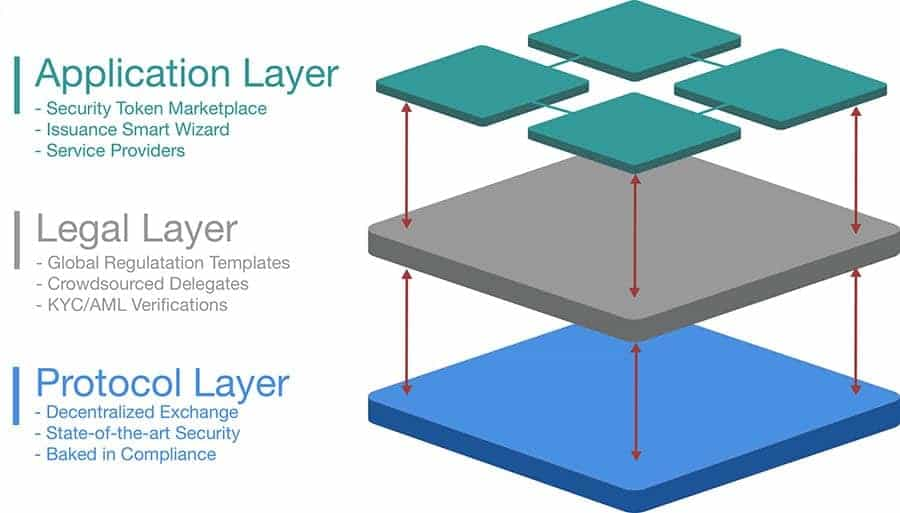

How Does Polymath Work?

Polymath will use the POLY token to run the entire network, and will incentivize developers and lawyers to participate by awarding them POLY. Those issuing assets on the blockchain, and those investing in the assets will pay fees in POLY to keep the network running smoothly.

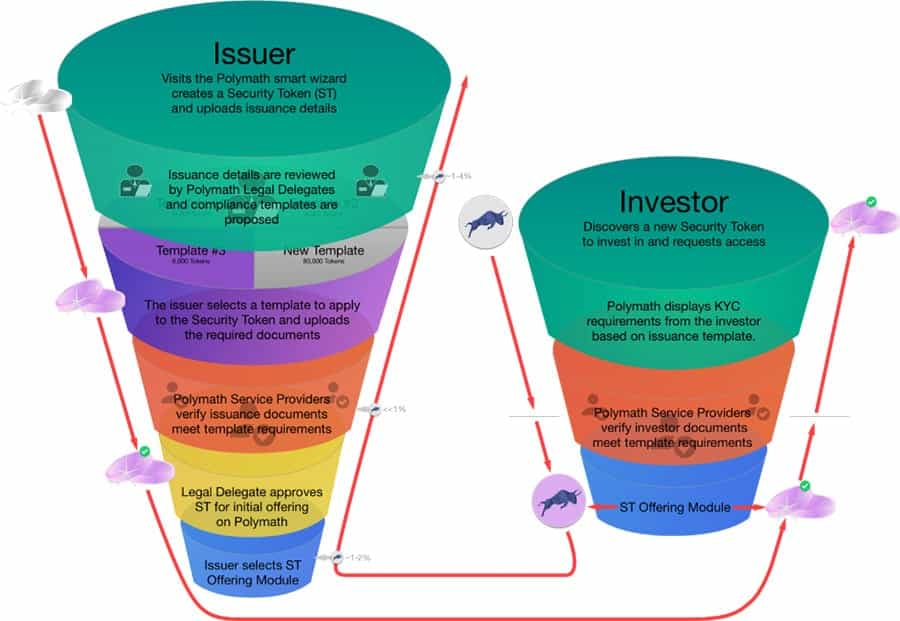

With templates in place, an issuer can create their own security token quickly and easily through the use of smart contracts and a Create a Security Token wizard. This is already being tested and you can try it out for yourself at the Polymath website.

There are 29 fields that ask for basic company information, the type of investors you’re looking for, the location of investors, and whether investors must be accredited among other things.

Once the form is filled in completely you can submit it and it is reviewed by Polymath Legal Delegates. The Legal Delegates will look for regulatory compliance, and can make suggestions for which security token template would be a best fit.

The system brings together Protocol, Legal, Application, and Exchange layers, thus increasing compliance, transparency, and ultimately liquidity.

Polymath Seeing the Future

All of this becomes important now because it’s only a matter of time before our traditional securities end up on the blockchain. And while there are some downsides, the security, efficiency and transparency far outweigh these.

There are other blockchains looking at a solution for this, but none is taking the big picture approach that Polymath has taken. They are looking to involve not just the public, but also venture capital funds, private equity, and even derivatives in one platform that solves legal compliance, security, decentralization and liquidity issues.

And surprisingly, liquidity might just be the key.

Current exchanges remain terrified of giving away too much information about new tokens that could cause increased regulatory investigations. This keeps ICOs in the potentially illegitimate category, and limits liquidity as investors remain hesitant to invest.

The Polymath solution makes for a regulatory friendly market, and removes the primary roadblock to liquidity. This should serve to help an active community of investors from all areas of finance grow in an organic fashion. If this proves true, Polymath will quickly grow to be not only the first security token exchange, but also the biggest and most developed by far. They would have an immense first mover advantage.

While this all sounds wonderful, some issues remain, although Polymath does seem to be working their way through them.

Polymath’s Potential

The SEC is correct in at least one huge risk with ICOs. Many issues are complicated by international trading, and a borderless, anonymous and opaque market only amplifies these issues.

Consider the comments you see on Facebook posts. They can be funny, and even inflammatory, but there are no ramifications to them. And if your money were tied to them they might not be so funny anymore.

The SEC doesn’t want to get too caught up in cryptocurrencies yet, and this is why they’ve largely taken a “you’re on your own, so be careful” approach to the markets. This can’t last forever and already its changing in some corners of the world.

For example, Gibraltar recently announced the world’s first ICO regulations aimed at protecting their citizens from fraudulent ICOs. They are looking to require ICO projects to provide “adequate, accurate and balanced information to anyone buying tokens.” And the catalyst was the explosion of ICO funding in 2017.

The Polymath version of security tokens would already provide much of the information Gibraltar is seeking with its regulations, meaning with security tokens the regulations wouldn’t be necessary in the first place.

POLY Token

The POLY token is an ERC20 utility token on the Polymath platform. I know what you are thinking - isn't Polymath a security token platform?

Well, yes it is but the native POLY tokens are not the securities. They are the fuel that will power the platform. They will be used by those issuers on the platform that would like to create their own digital securities.

POLY tokens were released as an airdrop in 2018. There is a total supply of 1 billion POLY tokens with a circulating supply of just over 400m POLY. You can view the Polymath ERC20 smart contract here.

Poly Price Performance

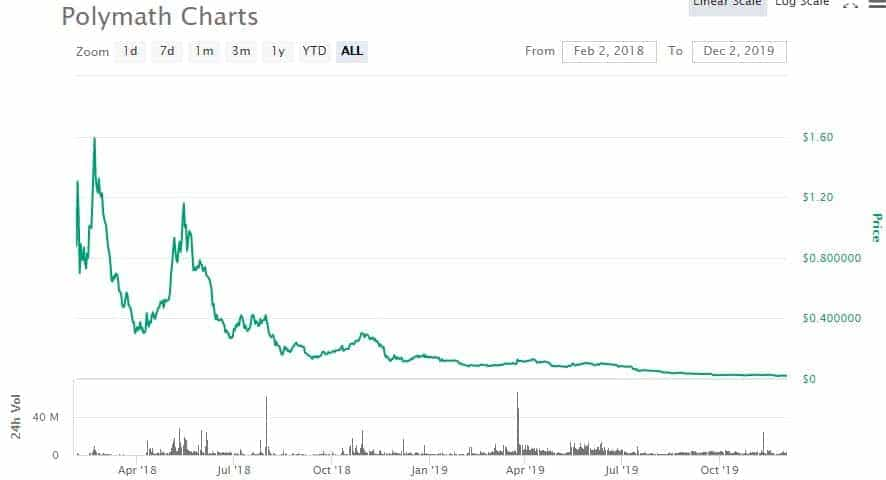

When released early in 2018 as an airdrop of 240 million coins, Polymath was priced at $0.79 a token, but quickly shot as high as $1.64 a token.

Unfortunately, time has not been kind to POLY, and the token has lost more than 95% of its value, trading down to around $0.02 as December 2019 gets off to a start.

This is of course not something that is isolated to Polymath. The entire Altcoin space has faced a collapse in price as pessimism has gripped the sector. However, POLY hodlers should feel less hard done by as the POLY tokens were after all not part of an ICO.

POLY was distributed through a cryptocurrency airdrop. This means that it was given out for free and was not sold in any crowdsale. It also means that Polymath is unlikely to face any questions from the SEC on whether their tokens constitute a security.

Buying & Storing POLY

POLY is listed on a fair amount of exchanges. These include the likes of Binance, Upbit and HTX. However, the bulk of the volume appears to be taking place on the Bittrue exchange with over 50% of the daily volume.

This is not the best from a token liquidity perspective as it means that this one exchange can have an outsized impact on the market for POLY tokens. It also means that token price discovery is a bit distorted. Indeed, you can see that there is quite a disparity in value across these exchanges.

Taking a bit of a closer look into the Binance order books we can see that they are relatively thin and there is not that much daily turnover. This means that your orders are likely to face quite a bit of slippage if you were to place large block orders.

When it comes to storage, these are ERC-20 tokens which means that you have quite a selection. You can use wallets such as MyEtherWallet or MyCrypto or you can you use Metamask. Of course, the most prudent would be to store it in a hardware wallet like a Ledger or Trezor.

Polymath in 2020

Since its inception a little over 2 years ago, there have certainly been a number of changes that have taken place at Polymath.

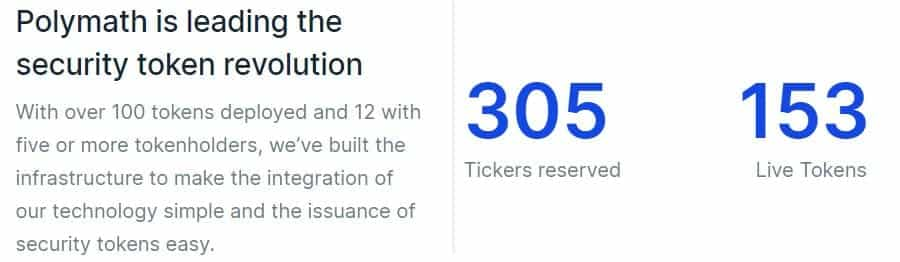

One of the most visible changes is the number of tokens that have been issued. In December 2019 there have been 153 tokens deployed, and twelve of those have five or more token holders. There have also been 305 ticker symbols that have been reserved.

Obviously, there is still quite a way to go, but the growth in the past 18 months has been outstanding, especially when you combine it with all the background changes that have occurred, such as the release of V.3 of Polymath, which makes it ERC-1400 compatible, or the impending release of a native Polymath blockchain.

Socially we’ve seen Polymath grow its following on Twitter by 10,000 and its following on Reddit by 1,500. More disappointing is the loss of nearly 30,000 Telegram subscribers.

Also disappointing is the performance of the POLY token, which has fallen to just above $0.02 and is now the 297th largest cryptocurrency by market capitalization. That’s a huge drop from its release price and is just a bit above the all-time low of $0.018557 which was hit on November 25, 2019.

Obviously, there’s a lot of room to the upside for the token, but it needs a catalyst. That catalyst could come with the release of a native blockchain for Polymath, but we will have to wait since the testnet won’t be released for at least 6 months, and the mainnet could be more than a year distant.

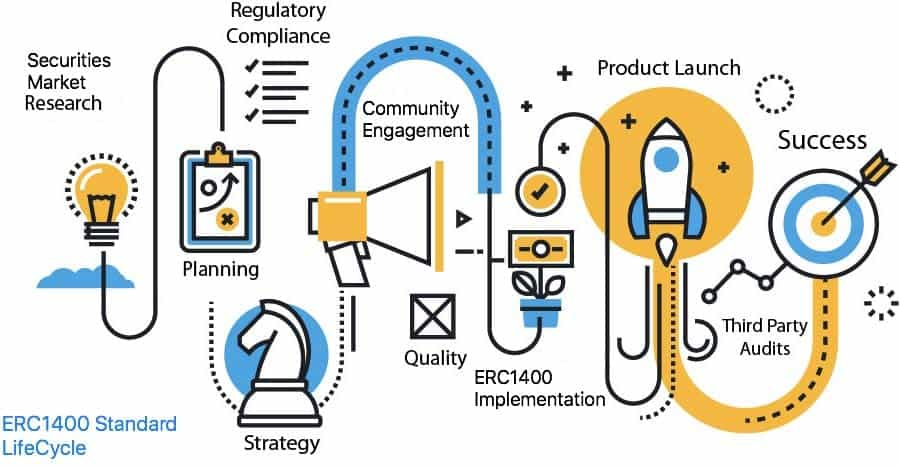

ERC-1400 Security Token Standard

The ERC-1400 Security Token Standard is a library of standards that have evolved over time, and have seen increasing adoption among Ethereum protocol developers and service providers.

Polymath upgraded to make their ST-20 tokens fully compliant with the ERC-1400 standard with their v3.0 “Poho” release in July 2019. The upgrade was necessary as service providers and projects across the security token space have been increasingly adopting the standard.

ERC-1400 evolved from a single monolithic standard into a library of interoperable standards with the intention of facilitating its adaptability and growth in a rapidly changing legal and regulatory landscape, allowing new functionality to be added without compromising existing compatible services and infrastructure.

The Polymesh Blockchain

In May 2019 during Consensus New York, Polymath announced its intent to develop and release a new base layer public blockchain underlying Polymath. They named this new public blockchain Polymesh. Since then a team of 6 developers has been working on the open-source project, and in October 2019 they were able to deliver a proof-of-concept.

The Polymesh blockchain will be built on top of the Parity Substrate, a blockchain foundation which builds upon the achievements from the major blockchain protocols, and uses the lessons learned to give developers the latest technology to build flexible blockchains.

The Polymath team considered a number of approaches to building their base blockchain and settled on Parity Substrate for several reasons involving technology, roadmaps, product fit, and community aspects. Ultimately the decision to use Parity Substrate came down to its modularity which is something Polymath feels is critical to its architecture.

Polymath plans on extending the core Substrate capabilities by building a suite of modules that provide financial primitives at the base blockchain layer. These cover critical functionality such as identity, the regulated assets themselves, settlement and other key categories of capital market functionality.

Polymath plans on releasing the testnet for its base blockchain sometime in the second quarter of 2020, and the mainnet is scheduled for release in the fourth quarter of 2020. With no other major upgrades on the project’s roadmap, we will have to wait roughly 6 months for the testnet to show us the new direction for Polymath.

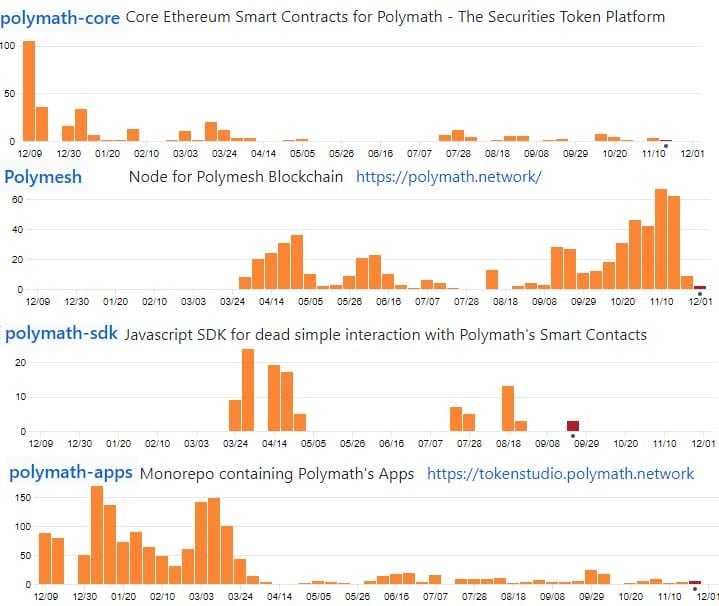

Polymath Development

All this looks great but has all the work that Polymath claims to have been doing over the past year translated into development output?

One of the best ways to determine this is to look into their open source code repositories. By observing the total code commits one can get a rough sense of how much work is taking place.

Hence, I decided to dive into the Polymath GitHub and take a look at their public repositories. Below are the total commits to their pinned repos over the past 12 months.

As you can see there has been quite a lot of code commits to these repositories. It is also worth noting that there are a further 45 other repos with varying degrees of commits.

This is more than I have seen on other projects that are at a similar stage in their lifecycle and shows that things are quite busy at the Polymath HQ. You also may want to take a look into their Polymesh repo to see exactly why they are so excited about it.

If you wanted to keep up to date with the project then you can follow their official blog. The team is quite active when it comes to updating their community.

Conclusion

The blockchain is here, and here to stay, and given the characteristics it has, it’s nearly impossible to imagine that our securities and assets won’t soon be on a blockchain. It’s just the most efficient and transparent method. As we’ve already seen with Polymath issuing securities on a blockchain is both possible and efficient.

Add to that the massive shift to STOs versus ICOs as a preferred method for raising capital in the blockchain space and Polymath could be looking at substantial growth.

Unfortunately, governments are also certain to step in to regulate these markets, in fact, some have already begun. With so much capital at risk, and security laws being broken already by some ICOs, it’s almost surprising we haven’t already seen regulations popping up like mushrooms after a spring rain.

So far regulators have been slow to act. If a solution like Polymath can standardize the release of security tokens we might find regulators mostly standing aside to allow the nascent space to grow organically.

The solution is in front of us in the form of the Polymask Network Security Token. Obviously, Polymath is still very new and it seems to have had a spotty start, but there’s also a solid team behind it, and it has a working product. Once a native blockchain goes live things could get very interesting indeed.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.