QuickSwap Review: Polygon's Layer 2 DEX

QuickSwap is a new addition to the decentralized exchange (DEX) landscape, but with a difference that’s allowing it to stand out among its competitors. While it is based on Ethereum, it is built on the layer-2 infrastructure of the Polygon (formerly Matic Network), which provides a number of benefits not seen in DEXs such as Uniswap.

Because it uses layer-2 infrastructure for its transactions the users of QuickSwap can trade any of the thousands of ERC-20 assets with almost zero gas costs and at lightening fast speeds.

QuickSwap also uses a community-based governance structure, and a fair token distribution that was not based on any pre-mine or private offering. The DEX empowers its users and traders and removes the excessive costs that have become associated with the DEX in 2021.

QuickSwap features a strong ecosystem of liquidity providers as well, which is the result of yield farming and liquidity mining opportunities that have incentivized the growth of the platform.

Furthermore, unlike many of the food-named exchanges QuickSwap was developed, created, and backed by some of the Ethereum ecosystem’s best and brightest thought leaders. They bring extensive knowledge and experience of layer-2 scalability and Ethereum contract and token standards to the DEX.

The team at Quick Swap believes this layer-2 protocol is the next-generation of decentralized exchanges and trading, and it will usher in the next wave of traders to enter the DeFi landscape.

Why We Need a Layer-2 DEX

Decentralized finance grew so rapidly in 2020 that by 2021 the DeFi ecosystem had reached a critical juncture due to the exponential growth of yield farming, liquidity mining, and DeFi trading.

This growth put enormous stresses on the Ethereum mainchain, as was clearly seen by all DeFi users. The increased DeFi protocol usage has caused transaction times and gas fees to skyrocket, with no end in sight.

The most popular decentralized exchanges like Uniswap and SushiSwap are completely dependent on the Ethereum mainchain for their transactions. While not solely responsible for the network congestion seen on the Ethereum mainchain, they are huge contributors to that congestion. This is actually detrimental and has made them victims of their own success.

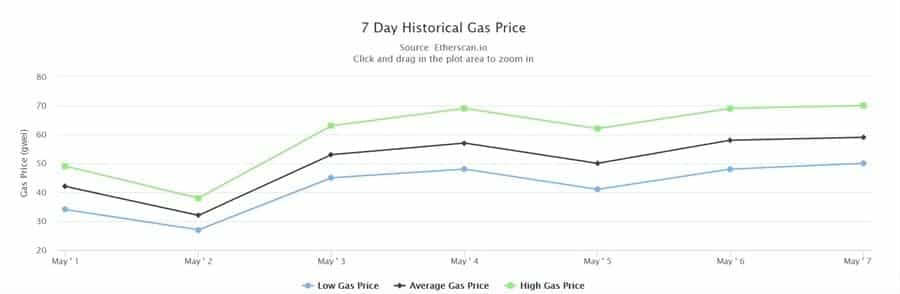

When Uniswap issued its UNI token n September 16, 2020 the transaction fees on Ethereum soared to a high of 800 GWEI ($6.31) for a fast transaction of less than 30 seconds. Those willing to wait for 11 minutes or longer could take advantage of the slow transaction costs of $3.98.

Fast forward to May 2021 and as you can see from the image above the situation is little improved. In fact, gas costs continue slowly moving higher, and DeFi proponents continue looking for alternatives to the Ethereum network.

Also note that when using Uniswap or other DEX protocols the gas costs are much higher. In fact, they increase by a factor of 10x! That means users are paying as much as $40 or more in gas fees for a single transaction to be confirmed in under 30 seconds.

It’s obvious to everyone that these exorbitant and continually rising gas prices and long transaction times are not conducive to bringing new traders into the DeFi ecosystem. And without a growing and thriving DeFi community mainstream adoption of DeFi will be impossible.

There’s a huge dichotomy in the DeFi ecosystem in as much as the more people that come onboard, the greater network congestion becomes, and yet the greater network congestion becomes the harder it is to bring new users into the DeFi ecosystem. This catch-22 is preventing DeFi from reaching its true potential and until it is resolved it will continue to do so.

What DeFi needs is a scalable, high-performance, low-cost infrastructure that allows for the growth of the ecosystem without creating huge transaction fees, and excessively long transaction times.

The good news is we already have a solution in layer-2 protocols. And QuickSwap is the DEX that’s leading the way on the layer-2 front. QuickSwap believes it has the solution to the problems currently affecting the current crop of DEXs.

What is QuickSwap?

QuickSwap is a newly developed permissionless decentralized exchange that is based on Ethereum and is powered by Polygon’s layer-2 scalability infrastructure.

Similar to the way other DEXs work, anyone is able to come to QuickSwap and trade any ERC-20 token at all. If the asset is an ERC-20 token that isn’t currently supported by the exchange users are able to list the token by simply providing liquidity to enable instant swaps.

The user providing liquidity in this way then earns the fees generated each time another user makes a trade using that trading pair, which incentivizes users to provide liquidity as much as possible.

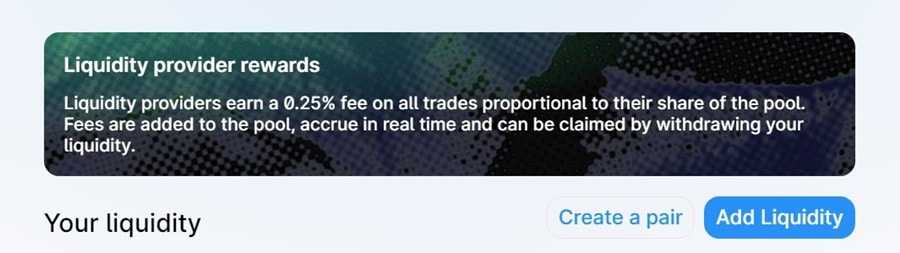

Liquidity providers are incentivized by both liquidity mining opportunities, and by yield farming opportunities. In addition to being entitled to a portion of the 0.3% transaction fee levied by the platform on each trade, liquidity providers also collect some of the native QUICK governance token for participating in liquidity provisioning.

This gives the liquidity providers a stake in the platform because the protocol is governed by the community of QUICK holders. That community is able to make proposals and vote on those proposals in order to modify or add to the parameters being used.

These include the transaction fee, or the amount of fees shared with the liquidity providers. QuickSwap was built with a focus on community governance, and its developers intend for it to be run entirely by the community.

While all of that might make QuickSwap sound like another clone of Uniswap, the fact that QuickSwap uses a layer-2 integration makes it worlds different from Uniswap and other automated market maker (AMM) platforms.

Because QuickSwap utilizes a layer-2 solution for its transactions it means traders are able to enjoy nearly zero gas fees and lightening fast transaction speeds.

As a comparison, currently a fast transaction (under 30 seconds) on the Ethereum network costs $4.23. However a Uniswap swap with a fast transaction speed is $40.28. The same transaction on QuickSwap using the Polygon network costs roughly $0.00001 and transaction confirmations are completed in as little as 1 second.

By utilizing its layer-2 solution QuickSwap is removing the massive transaction costs and slow transactions of the Ethereum network, making DeFi more accessible for everyone.

This is expected to allow the next, and larger, wave of traders to enter the DeFi ecosystem. QuickSwap brings lightening fast transactions and nearly zero transaction fees to decentralized trading, yield farming, and liquidity mining.

Polygon (formerly MATIC Network)

Polygon is the platform that QuickSwap is built upon. Rebranded from MATIC Network in the first quarter of 2021 Polygon is a highly developer friendly protocol based on Ethereum.

It uses a hybrid Proof-of-Stake and Plasma to create an environment where developers are able to easily and quickly deploy Ethereum compatible dApps that can also scale easily as they grow.

Through the use of PoS checkpoints Polygon is able to use the Ethereum mainnet to finalize transactions, providing dApps with Ethereum’s security. At the same time Polygon transactions are far cheaper than the Ethereum gas fees, and are also far faster, with transactions being processed in under 2 seconds.

Polygon chains are also capable of using the Ethereum mainnet to execute elements of their logic. They do this through the use of a series of smart contracts.

Polygon also allows developers to deploy customized blockchain networks. This gives them the security and robustness of Ethereum, with the scalability and flexibility provided by Polygon.

The combination makes it extremely easy for developers to code, test, and release dApps to market safely and quickly. Plus, these apps are compatible with all the existing Ethereum developer tools.

Polygon has seen a number of successful projects launch on its network rather than Ethereum as developers have become frustrated with the high gas fees and long transaction times of Ethereum.

This includes some popular NFT platforms such as SuperFarm. The adoption of Polygon in lieu of Ethereum proves that layer-2 solutions are in demand, and that their use is essential to the continued growth of the DeFi ecosystem.

QuickSwap Platform Features

Even though QuickSwap is built using layer-2 infrastructure, it is still able to offer traders all the popular features of the leading decentralized exchanges.

In addition it also provides the missing ingredient of those popular DEXs – namely fast transactions with nearly no transaction fees. Below are the features you’ll find when using QuickSwap:

Permissionless Listings

Users are able to list any of the thousands of ERC-20 tokens on QuickSwap, just as they can on any of the other leading DEX platforms.

All that’s required to list a token is to provide liquidity for a trading pair. Unlike traditional exchanges there is no need to apply for permission from any person or entity in order to list an asset.

Layer-2 Transactions

The transactions on QuickSwap are powered by Polygon (formerly the Matic Network, which is a plasma-based layer-2 Ethereum based scalability solution. This means the asset swaps on QuickSwap are performed in under two seconds at a small fraction of the gas costs that traders experience on the Ethereum mainchain.

Transactions on Polygon maintain their security however, because they receive finality on the Ethereum mainchain. This means traders get the benefits of the performance improvements delivered by the layer-2 solution, while still enjoying the security benefits of the Ethereum blockchain.

Non-custodial Trading

Unlike the early centralized exchanges like Binance, users at QuickSwap are able to trade directly from their own personal wallet. This includes MetaMask, Coinbase Wallet, and various other wallets that support ERC-20 assets.

This means traders maintain full control over the private keys of their tokens since there’s no need to deposit the tokens in an exchange wallet. This is certainly preferable from a custody standpoint.

Liquidity Mining

QuickSwap users are able to provide liquidity to the trading pools at the exchange, and to incentivize them to do so users who provide liquidity receive QUICK tokens as a reward. This type of incentive encourages the growth of a strong liquidity provider community.

In addition, it adds to the distributed governance nature of the platform since the users of the platform are now the governance entities as well. So the community makes the important decisions that can affect their use of the platform.

Yield Farming

QuickSwap charges a 0.3% fee on every transaction. Those fees are used in a number of ways, but one way is that a portion of all the collected fees are paid out to the liquidity providers in proportion to their stake in the liquidity pool.

Yield farming on QuickSwap works in much the same way as it does in other AMMs. Of course this does present the possibility of impermanent loss, but yield farmers who keep a close eye on their positions should be able to avoid this.

Community Governance

It’s been mentioned before, but at the risk of repeating myself QuickSwap is a community-governed project. QUICK token holders will provide governance for the platform, following the necessary processes to make modifications to the protocol when needed.

QUICK holders are able to submit proposals for changes to the protocol and vote on factors such as which pools are eligible for QUICK mining, and much more.

QuickSwap Team

Unlike some of the other Uniswap clones, QuickSwap is fully transparent regarding its development team. And that team is composed of some of the most prominent leaders from the Ethereum ecosystem.

The founders and developers have extensive experience and knowledge when it comes to layer-2 scaling and the Ethereum contract and token standards.

Nick Mudge: Nick is an Ethereum contract programmer, code reviewer, security auditor, standards author and web developer with over 6 years of active blockchain programming experience.

Nick participated in the discussions that developed the ERC721 standard and is the author of EIP-2535 Diamond Standard, in addition to ERC1538 and ERC998 Ethereum contract standards. Needless to say he is intimately familiar with the Ethereum ecosystem, network, and blockchain.

Sameep Singhania: Sameep is the Co-Founder and Director of the blockchain development and consulting company Ginete Technologies. He is an experienced blockchain developer who has devoted the past two years of his life to assisting businesses explore synergies with, and integrate, blockchain. Sameep is focused on facilitating widespread adoption of decentralized technologies.

Advisors

Lunar Digital Assets: Lunar Digital Assets is a premier blockchain marketing and consultancy firm. Already huge proponents of Polygon before their work with QuickSwap, Lunar Digital Assets understands the revolutionary nature of Layer-2 for blockchain infrastructure and are putting their full weight behind QuickSwap to ensure the wider community understands the hugely impactful value proposition that the protocol brings to the DEX ecosystem.

QuickSwap Grants

Polygon (Formerly Matic Network): Polygon is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks, and is built by a decentralized team of contributors from all over the world.

Polygon is providing close support for the QuickSwap team on the technical level, and has provided a grant to enable QuickSwap to have a community orientation rather than a VC orientation. Polygon also participates in the governance of the platform.

The QUICK Token

The QUICK token was released without any pre-mine, private or public sale. The founders thought this was important to the long-term growth and health of the protocol, since it is a community governed protocol.

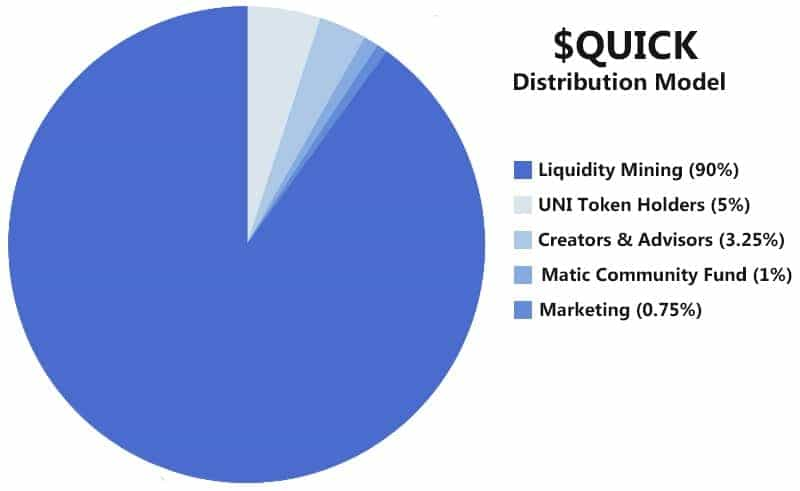

A total of 90% of the 1,000,000 QUICK tokens were set aside for the community governance treasury and will be distributed through liquidity mining. These are planned to be distributed during the first four years of the protocol, with diminishing numbers in later years.

During the first year there will be 986 QUICK tokens distributed each day, split evenly among the applicable pools. However, the community can vote through governance to determine the distribution of tokens held in the treasury.

In addition, 3.25% of the total token supply was reserved for the founders and advisors. 5% was distributed to UNI token holders as a tribute to Uniswap, and to provide the Uniswap community with a significant governance position in QuickSwap.

UNI pools are also receiving greater rewards during the first year. Then 1% is being distributed to MATIC stakers, and the remaining 0.75% are earmarked for marketing campaigns to promote the launch of QuickSwap.

This tokenomics distribution model was carefully crafted in order to foster the rapid growth of the platform, and to create an active and engaged user community.

The early days of 2021 saw the QUICK token begin trading on exchanges, and the price during the first weeks ranged from $350 to $580 roughly. By early March the price settled to a range of $150 to $200 and remained closer to $150 over the following 6 weeks.

Late in April the price shot higher, reaching an all-time high of $1,669.32 by April 30, 2021. The price fell of almost as quickly from that point and as of May 8, 2021 QUICK tokens are trading at $795.54.

QUICK tokens are primarily available through the provisioning of liquidity on QuickSwap, but can also be purchased at Uniswap, Bilaxy, and 1inch Exchange.

dQUICK

There’s another token in use in the platform and that’s the dQUICK, or Dragon’s Quick, token. It is distributed to those who stake their QUICK into the “Dragon’s Lair” pool at Quickswap.

It is used to incentivize borrowing and lending on the platform, and the longer that QUICK is staked in the Dragon’s Lair pool, the more QUICK users get back when they unstake and withdraw. At the time of writing the APY for dQUICK was 1.034%.

Conclusion

QuickSwap is taking decentralized trading to new heights as it removes the performance constraints encountered on the Ethereum mainchain. It allows anyone at all to trade ERC-20 tokens with negligible fees and lightening fast transactions speeds of under 2 seconds. And it does so while providing the security and reliability of the Ethereum mainchain. All thanks to the layer-2 infrastructure provided by Polygon.

Unsurprisingly, QuickSwap has attracted massive amounts of liquidity since its launch in February 2021. Users are migrating to QuickSwap to take advantage of the nearly free transactions and the fast transaction speeds. In under three months QuickSwap has become one of the most popular AMMs available to DeFi enthusiasts.

As the number of token pairs and liquidity pools expands QuickSqap should attract even more users, allowing it to compete with some of the largest DeFi platforms (like Uniswap) and layer-2 scaling solutions. And of course the QUICK token has seen massive gains since its launch, which helps attract even more liquidity to the platform.

Those looking for a new and better way to profit from DeFi might want to have a look at QuickSwap to see if it meets their needs.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.