Review of RChain (RHOC): Building Scalable Blockchain Applications

The current group of blockchain platforms have brought about a new decentralized world, but they also come with some problems that need to be addressed.

Problems with speed, scalability and safety will ultimately keep blockchain technology from reaching widespread adoption and its true potential if not addressed and corrected.

One team looking to do just that is the RChain Cooperative, which has been working since 2016 to build a better blockchain architecture. In this RChain review, we will take an in depth look at the project including the team members, technology and token potential.

RChain’s Blockchain Improvements

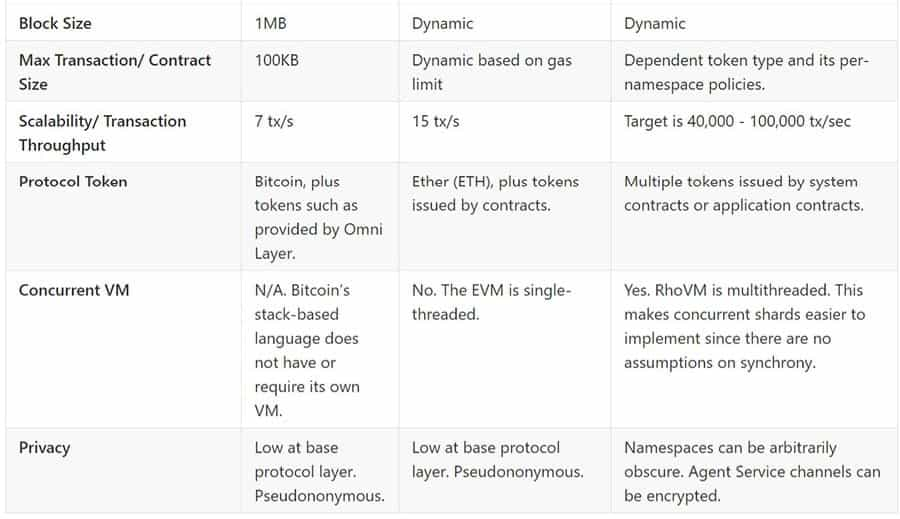

RChain is working on improvements in speed, developers tools, community and trust. The team feels that these improvements will give them a significant advantage over their blockchain competitors. The most noticeable change will be in speed, with the network being planned to launch with the capacity to handle 40,000 transactions per second, and the ability to scale up to 100,000 transactions per second.

In terms of developer tools, the planned toolset is intended to be superior to anything currently offered. They will allow developers from different backgrounds, coding languages and blockchains to easily connect whatever app they’ve built to the RChain blockchain.

The team was built with the notion that community and trust would bring about the strongest and best blockchain possible. RChain’s co-operative design allows for the development of its open-source software and gives every member the chance to influence the future of RChain.

This co-opertive structure also fosters the development of a tamper proof decentralized solution that will be safe, scalable, and fast.

The RChain Cooperative

The cooperative formed for RChain is a one-of-a-kind development and governance group. The members of the cooperative own, develop and control the open-source RChain platform. It is based in Seattle, Washington and gives the community an organized and rul-based structure that many blockchain platforms lack.

The Cooperative is open to anyone, but there is a $20 one-time membership fee. The fee was set at such a low price so that people of any financial background would be able to help shape the future of RChain.

By joining the RChain Cooperative members receive the following benefits:

- Access to all of RChain’s Discord channels

- Ability to elect Board Members

- Lets members participate in governance committees

- Allows members to vote on project approval and budget allocations.

How Does RChain Work?

The RChain architecture was designed with maximum scalability in mind, and is based on a branch of mathematics known as mobile process calculi. The platform is capable of supporting multiple blockchains, both public and private, and even on the same node. The blockchains will be secured with the Proof of Stake (PoS) consensus mechanism.

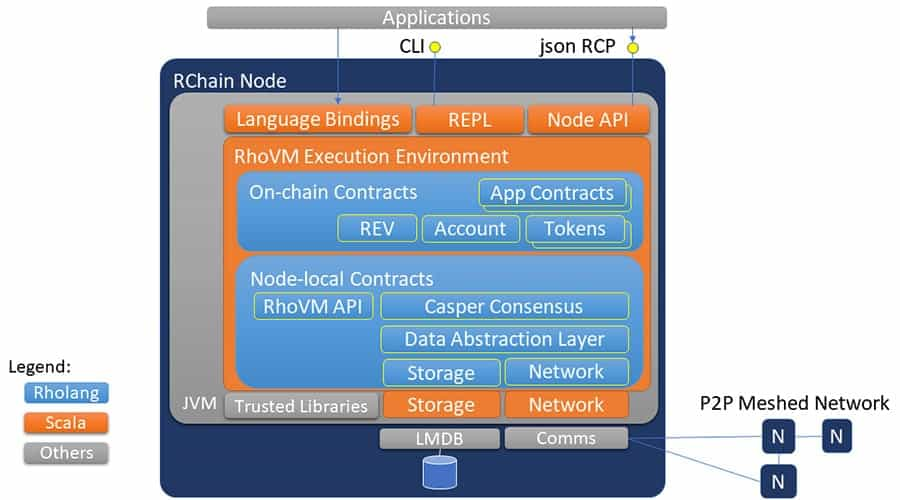

The Rho Virtual Machine

One of the key components of the RChain platform is the Rho Virtual Machine, which enables concurrency and allows applications on RChain achieve incredible scalability and speed.

The Rho Virtual Machine Execution Environment also runs multiple instances of the Rho Virtual Machine, and can create new instances at any time to handle additional loads.

The RChain blockchain is unique in that it has a multi-chain structure that allows blockchains to run parallel and coordinated. Each Rho Virtual Machine can execute independently on separate blockchains and networks with an independent set of smart contracts. Additionally, nodes are multithreaded and lightweight, making them capable of handling many instances simultaneously, allowing RChain application to achieve blockbuster results.

RChain Smart Contracts

As many of you may know, Ethereum smart contracts are coded in a proprietary language called solidity. RChain makes use a of a more sophisticated language.

RChain smart contracts are written in a programming language known as Rholang, which stands for Reflective Higher Order language. It provides support for internal concurrent programming and makes the smart contracts extremely versatile and fast by design.

The smart contracts are highly scalable thanks to a formal verification method. Once verified the Rho VM will compile and execute the contracts.

RChain Namespaces

Most blockchains were designed to use public keys to differentiate between virtual address spaces, but RChain divides the virtual address spaces in namespaces. These namespaces are a set of named channels that can communicate the location of network resources. The use of namespaces allows for smart contracts on one blockchain to be visible to contracts elsewhere on the network. This allows developers to improve system encryption and protocols.

RChain Token Sale

RChain held a private token sale in August 2017 that sold out in just 2 weeks and generated $15 million. The RHOC tokens were sold for $0.20 per token with a minimum purchase requirement of $50,000. Once the main net launches all the RHOC tokens will be converted to REV tokens at a 1:1 rate.

It’s also possible that RChain will hold a public ICO for REV tokens once the main net launches, but there is nothing concrete at this time. As with any governance issues the Board and Cooperative will need to vote to determine if an ICO will be held. The earliest possible ICO date would be the end of 2018.

Trading RHOC Tokens

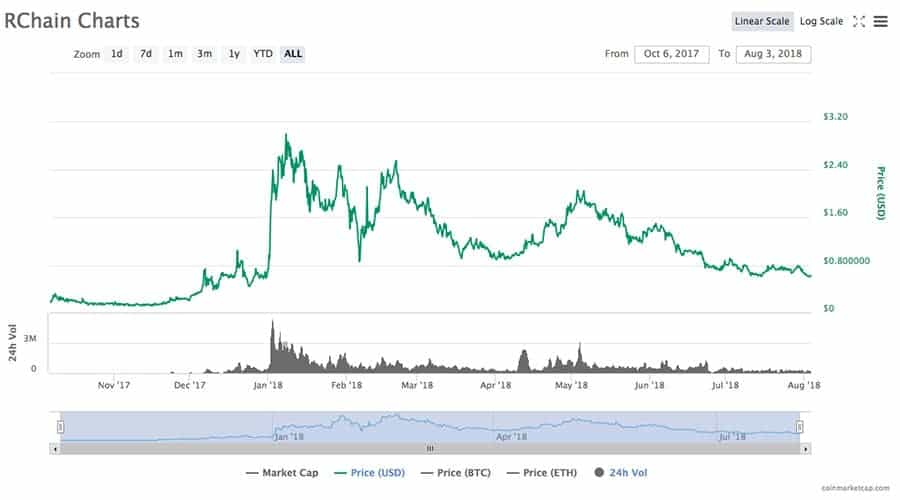

The RHOC tokens were sold at $0.20 each during the private sale and have moved substantially higher since. On January 9, 2018 they hit a high of $2.99, but have been trending lower since as the broader cryptocurrency markets have been depressed throughout 2018.

The token did see good support at the $0.80 level for months, but as of August 2018 it has dropped through that support and is trading at $0.638822.

Where to Buy RHOC

If you’re interested in buying RHOC on the secondary markets your options are somewhat limited. KuCoin is the largest exchange offering RHOC and you can purchase it there with BTC or ETH.

ChaoEX sees almost as much trading volume, but you can only use BTC there to purchase RHOC. One other option that accepts both BTC and ETH is BitMart.

Where to Store RHOC

The RHOC token is an ERC-20 token and can be stored in any compatible wallet. MyEtherWallet is a popular choice as is MetaMask. I think the best choice for safety reasons is the Ledger Nano S. Once the main net launches and RChain switches to the REV token they will be launching their own native wallet.

The RChain Team

The team behind RChain is well-rounded and with a good deal of experience. This gives confidence that they will deliver on the technical promises being made.

There are two main strengths that the team members have. Firstly, they have several strong core members that are experienced with blockchain projects. They also have a strong advisory team. Notably, they have Vlad Zamfir who is a researcher that is also working on Ethereum’s POS protocol

On the downside though, some members of their core team have questionable reputation within the crypto community. However, the technical team looks very strong, and we can only hope that any controversies remain in the past and don’t weigh on the project as a whole.

RChain Future

The RChain team is looking to replace Bitcoin and Ethereum, which means they’re tackling a huge market. The method for getting to the top will rely on faster and more scalable blockchains that can be used for large-scale applications.

RChain Opportunities

- Hit 100,000 transactions per second;

- No one discussing concurrency, which could be RChain’s secret weapon;

- Building the network effect into their chain via DApps and having their equivalent to the ERC20 standard.

RChain Challenges

- There’s no proof they can hit 100,000 transactions per second;

- There are other scaling factors outside transactions per second;

- The non-technical team is quite controversial among the cryptocurrency community;

- Lack of clarity in their token supply and fundraising model;

- Uncertainty over the benefits of concurrency.

Conclusion

RChain is trying to build a better and faster version of Ethereum as well as improving on the community around the blockchain. With the launch date of RChain so far in the future it will likely need to be disruptive to some degree if it wants to take share away from Ethereum and gain a solid foothold.

However, its scaling strategies don’t really seem disruptive, and there are several projects working on scalability solutions. By the time the project launches we could already be seeing similar solutions in scalability and speed from other projects.

RChain’s documentation may show it as far ahead of its competition, but that’s in the current state of blockchains. With some theorizing that the main net for RChain could be significantly delayed, it’s possible that Ethereum will be delivering its Serenity update at roughly the same time as RChain delivers a main net.

It seems almost certain that Ethereum will beat Rchain to sharding, Proof of Stake, side-chains and state channels. In the face of all that RChain won’t be delivering a blockchain that’s much of an improvement over Ethereum.

That leaves the one unique feature of RChain, concurrency, to deliver a better blockchain. But they haven’t made it clear how concurrency will benefit applications that have been tailored for Ethereum’s non-concurrent implementation. It isn’t likely many dApps would jump from Ethereum to RChain immediately, but would more likely take a wait and see attitude.

Technically the team does look solid, and the updates given from the developer meetings seem to highlight the competence of the engineers working on the project. However there is still the controversy surrounding the non-technical team, and it’s also not clear that the team is working on solving the right problems to make it successful, or if it can do so quickly enough to ensure success.

One final red flag is the financial history of the project and the uncertain economic model the token is working from. The lack of information regarding how much the team has raised from the Synereo AMP swap, and the lack of details about how many REVs will be created, how much the dev team will keep for themselves, and if there will be an ICO for REVs are all troublesome from an investing standpoint.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.