Red Pulse has been in the news quite a bit over the past few weeks. This past July the Red Pulse team unveiled its new Phoenix upgrade at a meeting in Seoul, South Korea.

The Hong Kong based team created an open research platform with Red Pulse Phoenix, including an upgrade to the token smart contract that took the NEP-5 RPX token out of circulation and introduced a new native PHX token. The new token has already garnered a lot of interest recently and the price is a reflection of that.

However, can the upgrade really move the needle for Red Pulse?

In this piece we will give you everything you need to know about the new platform and what it means for the red pulse ecosystem. We will also analyse take a look at the long term prospect of the PHX token and whether it has what it needs to succeed.

What is Red Pulse?

Red Pulse views themselves as a blockchain research gathering and analysis service that is squarely focused on Chinese cryptocurrency investors. Red Pulse aggregates information from thousands of sources in order to provide a more holistic view of the Chinese crypto markets. The hope is that the collective efforts of participants can help sift through all the misinformation and shoddy data.

Overview of the Red Pulse Platform

Overview of the Red Pulse PlatformYou can think of them as a decentralised version of market research.

Red pulse is also noticeable for another reason and that is because they were the first project to hold their ICO on the NEO blockchain. They completed the ICO in October of 2017 in the peak of the bull run. They were able to raise $15m in exchange for 40% of the total supply of RPX tokens.

These RPX tokens were issued to be the utility tokens in the Red Pulse ecosystem. It would be used in order to reward those curators and researchers who provided their insight and analysis. On the supply side, RPX was also meant as a sort of access token for those users who wanted purchase access to the research.

However, since the launch of Red Pulse and the release of the RPX tokens, the crypto market has gone through a great deal of change. China has banned and unbanned cryptocurrencies, markets have retraced significantly and the landscape has slightly shifted.

The Red Pulse team thought that this was the ideal time to develop a new and exciting platform and token.

The Phoenix Platform

Red Pulse Phoenix is a cloud based collaborative knowledge network connecting content producers with research consumers. It does this utilizing blockchain technology in combination with natural language processing and machine learning. This has created a platform that allows for automated matching of industry experts and insightful research with the clients seeking these.

Let's take a look at some of the main reasons for the launch of Red Pulse Phoenix as well as some of the most important features that it will include.

MiFID II Compliance

The team at Red Pulse have added an emphasis on regulatory compliance with their upgrade to Phoenix. They are aiming to conformity to the European Union consumer protection regulations contained in the Markets in Financial Instruments Directive (MiFID) II. This is likely in response to the growing trend from governments to push aside cryptocurrencies that aren’t willing to accept regulatory pressures.

In regard to market research, the MiFID II requires that institutions are transparent and explicit in revealing the costs of investing and trading to their clients. The regulation came about because of the tendency for financial institutions to pass along research costs to the clients in hidden fees and through methods that haven’t been subject to audit, such as via the commission structure.

Because of the pressures created by MiFID II the financial services industry has seen a shift from the use of the large, expensive research firms to inexpensive boutique firms, where industry experts work to provide detailed and tailored investment research reports.

How Phoenix Works

Red Pulse has noted that the traditional method of delivery for research findings has been a manual process, which often occurs during meetings or phone conversations between the industry experts and clients. This is extremely inefficient and creates situations where there exists no record of how information was shared, which has been an issue in cases where insider trading allegations have emerged.

Red Pulse Phoenix plans to address these issues with an inexpensive information exchange platform designed to

demonstrate that a specified entity identified by a NEO wallet address, has produced unique content at a specified date and time, and that they are the initial owner of the produced content.

It will be possible for consumers of research to access Phoenix and specifically request research on any market sector or topic they desire. Through the use of machine learning algorithms and natural language processing the request will be matched with a subject expert, who will conduct the research, write the paper, and deliver it to the content requestor.

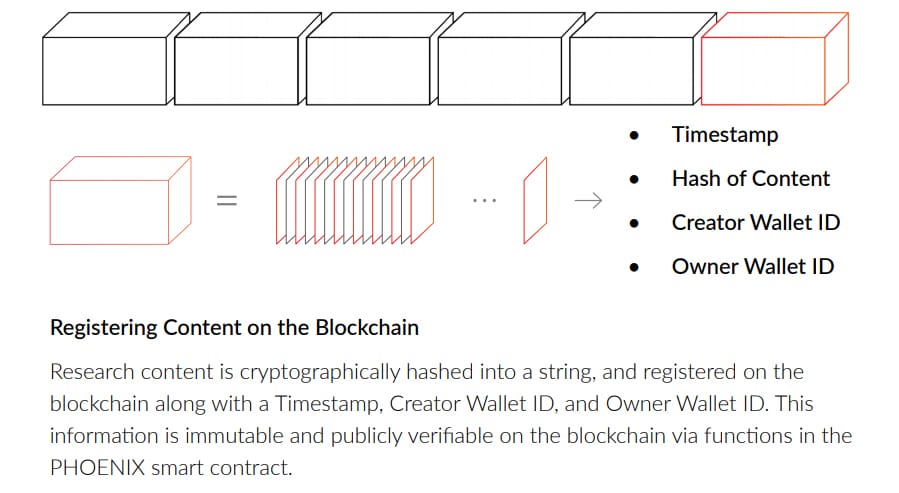

Content Placed on Blockchain with Red Pulse Ecosystem. Source: Phoenix Development Plan

Content Placed on Blockchain with Red Pulse Ecosystem. Source: Phoenix Development PlanEvery piece of content that is created on the Phoenix platform will be recorded on the blockchain, including a timestamp, the wallet ID of the creator of the content, and the wallet ID of the owner of the content. Once recorded to the blockchain all of this information is made immutable, which means it can always be proven when the information was requested, what specifically was requested, who delivered on the information request, and what exactly was delivered.

It will also prove who the owner of the content is. All of this protects all of the parties involved in the creation and exchange of information. The originality and ownership of the information can always be proven, and it is impossible to change any of this information.

The Red Pulse Phoenix team believes their platform will be relatively inexpensive to scale once implemented, thanks to its fixed cost structure based on automation of requests and deliveries. With the reduced cost structure savings can be passed along to the content requestors, and increased compensation can be paid to the content creators.

Upgraded Smart Contract Functionality

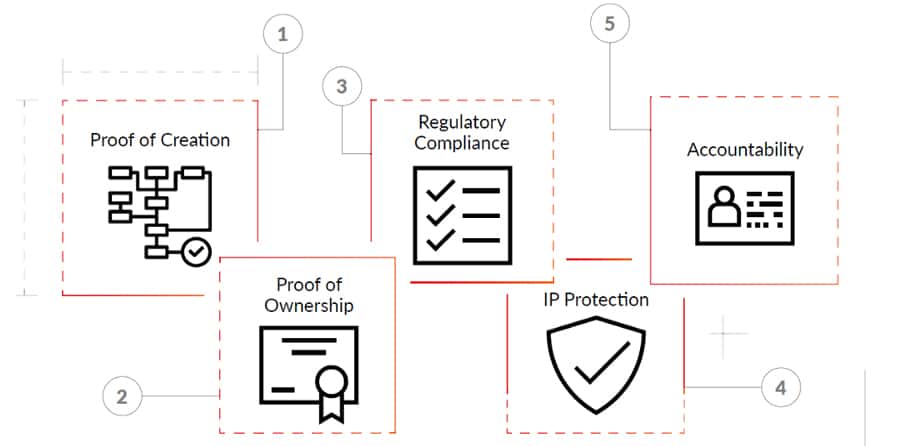

Along with the upgrade to Phoenix, the Red Pulse platform is getting five new core elements that have been enabled by the smart contract functionality of the platform’s research and knowledge ecosystem. These five core elements are proof of creation, proof of ownership, regulatory compliance, intellectual property protection and accountability.

Red Pulse Phoenix Platform Features. Source: Red Pulse Blog

I think you’ll agree that these five core elements are the most critical parts of any content creation platform, and will be far better at protecting works than the current third-party copyright system. Let’s see what each of these core elements brings to the platform:

Proof of Creation – This is how the platform will irrefutably establish the relationship between the content on the platform and the creator of that content. In Proof of Creation a hash is created and assigned to the created content, which is then permanently stored on the blockchain. In addition, this hash is timestamped and has the creators wallet address assigned to it.

Proof of Ownership – This occurs anytime ownership of content is transferred from one entity to another. Just as occurs in a transfer of digital currency, the original owner signs the transaction with their private key, and specifies which wallet address the content is being transferred to. The ownership of the content is then verified, and remains indelibly on the blockchain to be audited whenever necessary.

Regulatory Compliance – This third core element is very important to the Red Pulse team moving forward as it seeks to provide regulatory bodies with immutable information request and response records that are stored on the blockchain. The goal is to ensure a publicly verifiable system of record by incentivizing users to comply with all international and local regulations pertaining to confidential or material non-public information.

Intellectual Property Protection – The Intellectual Property Protection implemented on the Phoenix platform is meant to offer protection to user generated original content. Any content uploaded to the Phoenix platform is assigned a unique hash, which is compared with all the other hashes already stored on the blockchain. If it is found that the content uploaded is a duplicate to content already stored on the blockchain it is rejected. In this way the platform avoids duplicate content issues.

Accountability – The final core element addressed by Phoenix is accountability, and this is tackled by associating each piece of content stored on the blockchain to a distinct wallet address. In addition, there will be an off-chain profile for each wallet address maintained on the platform. This is put in place so that credibility can be earned by users, which is an incentive to maintain a strong user reputation.

RPX to PHX Token Swap

On August 12, 2018 a snapshot of the NEO blockchain was taken at block height 2608500, and all RPX holders when the snapshot was taken received PHX tokens at a 1:1 ration in their NEO wallets on August 14.

The Token Swap from RPX to PHX. Source: Red Pulse Blog

The Token Swap from RPX to PHX. Source: Red Pulse BlogThe PHX tokens were airdropped to the wallets, and users then had both the new PHX tokens and the older RPX tokens, although the RPX tokens no longer have any value and there are no exchanges offering trading in the RPX tokens.

In addition to the airdrops to NEO wallets, the following exchanges had support for the PHX airdrop:

- Binance

- HTX

- Kucoin

- Bitbns

- TDAX

- HitBTC

- Switcheo

- Coinrail

While the tokens were airdropped on August 14, all trading, withdrawals and deposits did not begin until August 19.

PHX Price History

When trading in the PHX token commenced on August 19, 2018 the price was $0.016109, and the price continued to decline throughout August and September. Price began to climb on October 26 and by October 28 it reached $0.041946, however on the following day it dropped to $0.029413. There was no discernible news affecting the coin, although it is possible there was something released in the Chinese language since the Phoenix platform is focused on China’s financial markets.

Register at Binance and Buy PHX Tokens

Register at Binance and Buy PHX TokensBinance remains by far the largest exchange for buying and selling PHX, although there is a modest volume being traded on HTX and Kucoin.

Conclusion

The upgraded Red Pulse Phoenix promises to track the ownership of content in such a way that plagiarism is combated and so that the original creator of content not only gets credit for that, but also receives fair compensation. In addition, it will support international regulations, and incentivize creators and clients to follow these rules.

The platform is quite new, and is offering incentives now for content creators to post their research on Chinese companies and financial matters. The platform went live to outside contributors on October 16, and is giving away up to $5,000 per day of PHX tokens as an incentive for creators to join and contribute.

Considering that there have been many such platforms over the years, and that most died due to trust issues and plagiarism issues, the Red Pulse Phoenix platform could be just the answer to these previous problems. If we get a trustless platform that is inexpensive for clients, profitable for content creators, and avoids the issues of plagiarism and spam we could see a platform for research and creators that will last long term.

Currently the platform is focused on China and Chinese companies. The platform is to be used by “investors, analysts, researchers, and professionals for keeping up to date with the latest happenings in the Chinese economy.” To be eligible for the daily rewards, contributors can submit opinion articles, commentary, analysis, or news about China’s companies, industry sectors, or macroeconomy.

If the platform is successful in China we could see it opening up globally in the coming months, and that should give the token itself a boost as adoption rates skyrocket.