Solrise Finance: Decentralised Fund Management On Solana

The DeFi ecosystem has come such a long way since the beginning of 2020, bringing life to some very attractive alternatives to the products and services offered by traditional financial infrastructures. From lending and borrowing protocols to high APY staking and yield farming, DeFi poses itself as a true powerhouse in the realm of FinTech innovation and has firmly established itself as the go-to solution for individual crypto enthusiasts as well as leading-edge financial institutions.

At present, in the 21st century, one could indeed argue that we are living in somewhat of a golden age of finance and that we are currently at the very tail end of a decades-long process of expanding, opening up and democratising access to financial instruments.

Over the last several decades, investors, big banks, institutions, high-end hedge funds and some private investors have taken advantage of the multiple financial booms spearheaded by innovation and technological advancement, generating unprecedented amounts of wealth along the way.

Stock markets in most countries are currently at all-time-highs, companies are experiencing aggressively fast growth, record profits are being registered, and the world is becoming more and more interconnected by the day. Furthermore, development and automation of production have made the world’s goods cheap and plentiful, and services more accessible than ever before in human history. While this scenario does in fact paint a utopian and incredibly flourishing financial ecosystem, the reality is that this quite simply just isn’t the case.

In parallel with markets soaring, unprecedented wealth being generated and financial institutions registering all-time-high profits, a rather pressing economic disparity started emerging, that is the growing gap between the wealthy and those in need, the rich and the poor.

In fact, the majority of wealth propositions that have characterised the new century have remained trapped by the bottlenecks of legacy and traditional finance, dictated by big banks and institutions. Moreover, today’s financial empires are built on restricted access and inefficiency, supported by king-making regulation.

With crypto, on the other hand, a new infrastructural paradigm can develop in order to inherently disrupt the limitations imposed by legacy entities and essentially liberate wealth creation from hierarchical models. Starting with Bitcoin, we have gained the first truly free, trustless, disintermediated form of money and DeFi, subsequently, appeared as the most logical step forward from there. DeFi’s philosophy indeed relies on giving everyone access to economic and investment opportunities that were previously only open to accredited investors.

One protocol built on the Solana blockchain that is looking to democratise access to DeFi infrastructures, synthetics assets and investment funds is Solrise Finance.

Solrise Value Proposition

In essence, Solrise aspires to be the protocol to completely free money for the benefit of everyone. As technological innovation continues to progress, a new more democratised financial model has come to life, but only in part however. This is due to the fact that big legacy players are not really that keen on innovation in the space, and neither access nor fairness seem to be among their top priorities.

In fact, these prerogatives were recently made clear when investing App Robinhood decided to freeze trading of the GameStop stock (GME) because of the high trading volumes coming in from retail investor accounts. This scandal additionally showcases the apparent market manipulation on-going in traditional financial infrastructures and sheds light on their ever-present hierarchical system.

Ultimately, Solrise seeks to emphasise the role of individual investors in the digital asset ecosystem by providing them with investment opportunities that are completely tailored and custom-made to fit their requirements and risk appetite. Solrise wants to enable everyone to invest and manage their money in a way they completely understand, while limiting the complications inherent in most DeFi protocols and opening up opportunities even for non-savvy investors.

About Solrise Finance

Solrise is a Solana-based protocol for decentralised, non-custodial asset management. Solrise allows anyone to create, manage and invest in a managed portfolio of native and synthetic assets with as little as $20. The project decided to built on the Solana blockchain due its speed, security, reliability, DeFi friendliness and exceptional scalability features.

The initial concept for Solrise can be viewed as a direct response to the frustrations caused by Robinhood’s centralised decision to halt all trading of GME stock. This consequently led the Solrise team to the realisation that there was no effective way for retail investors to deploy small amounts of capital on Ethereum-based asset management protocols due to high gas fees. Therefore, Solrise is building a protocol for creating and running decentralised, trust-minimised investment funds on the more efficient Solana blockchain.

The world of DeFi has no doubt opened up an incredibly diverse ecosystem of opportunities and Solrise, at heart, seeks to mitigate the series of complexities that this new financial model poses to newcomers. Solrise, in fact, wants to improve the DeFi experience for those looking to allocate capital and strives to offer users a permissionless, open and transparent investment platform catering to both experienced crypto enthusiasts and non-savvy investors.

This Solana-based project will allow third party managers to create and provide actively managed funds or passive automated investment pools, allowing investors to participate in a variety of different assets and crypto-native protocols, on both the Solana blockchain and off-chain. The aim is to enable users to gain access to the same perks offered by a centralised investing App while preserving the core elements of DeFi’s philosophy, i.e. non-custody of assets, security of funds and openness.

Solrise Use Cases

Users will be able to compare different investment funds offered by third party managers on Solrise based on understandable, transparent and objective metrics and find the ones that best suit their risk tolerance and appetite. They can then choose the fund that focuses on their preferred asset class and market environment, be it NFTs, aggregated token portfolios or synthetic assets, for instance.

Solrise is easy to use, practical, and almost trustless. Choose a fund to invest in, or create your own - with just a few clicks. Get exposure to assets from across Solana without sacrificing security or your time - Solrise.Finance

Additionally, Solrise is looking to increase the market and investment knowledge of newly arrived crypto users by allowing them to benefit from the expertise of fund managers and market leaders. This could potentially prove to be truly advantageous for new participants, as it would enable them to browse through a wide array of attractive investment funds, allocate capital to them and be certain of the security of their funds overall.

Every Solrise fund will have specific characteristics and will present users with a variety of investment strategies. These funds will furthermore encapsulate a diverse selection of assets including:

- A risk-minimised index tracking blue chip crypto assets and stablecoins.

- A liquidity pool fund to provide liquidity across different protocols.

- An NFT fund focusing on shares of one or more fractionalised NFTs.

- A growth fund focusing on early, medium and long term investments into undervalued crypto assets.

- A macroeconomic fund looking to invest in commodities and foreign exchange (FX) through synthetic assets.

- A fund investing in highly speculative assets, for those looking for higher risk and higher reward.

How Solrise Works

The Solrise protocol allows anyone to create an investment fund and act as Manager of said fund. Solrise funds hold a pool of different assets and support any SPL token existing on the Solana blockchain. The protocol moreover supports native and wrapped assets, but will be soon expanding in order to include more generalised asset classes.

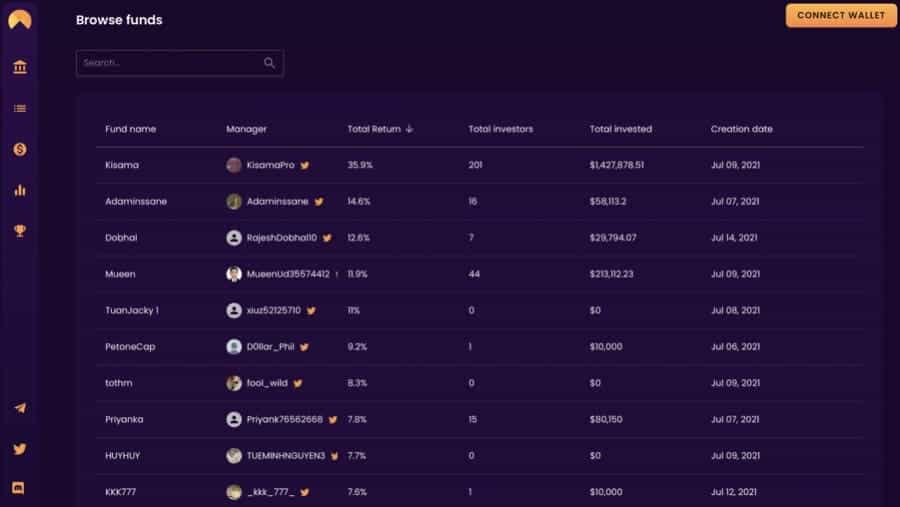

The Solrise team will on-board price oracles to determine the efficiency and reliability of a particular asset class, and verify that it is suitable enough to be added to the Solrise fund platform. Users can browse through the selection of existing funds on the Solrise platform by clicking on ‘Browse Funds’.

Once having done that, users can scroll through the wide array of investment funds and select the ones that are most appealing to them. As displayed in the image above, Solrise shows the fund’s name, manager, total return, the number of active investors, total capital invested, and creation date.

Taking the visual of the fund displayed above as an example, one can see that since its creation the fund has returned a respectable 35.9% ROI, with a total $1,427,878 invested. This fund tracks the performance of 4 digital assets in particular, with these being Ripple, Solana, Step Finance and 3x Long Ethereum Token (shown in first visual).

The advantages that come with implementing this system and investing in an active crypto fund managed by an experienced third party on Solrise are indeed clear. However, while this system is appealing, users should exercise due diligence and token research regardless of the fund’s performance.

The Solrise protocol currently permits a single Manager key to perform trades with integrated platforms on behalf of fund investors without the need to exit the fund itself. In the future, Solrise also plans to add pluggable governance models which will involve fund investors in the selection of whitelisted assets for their preferred funds.

Built On Solana

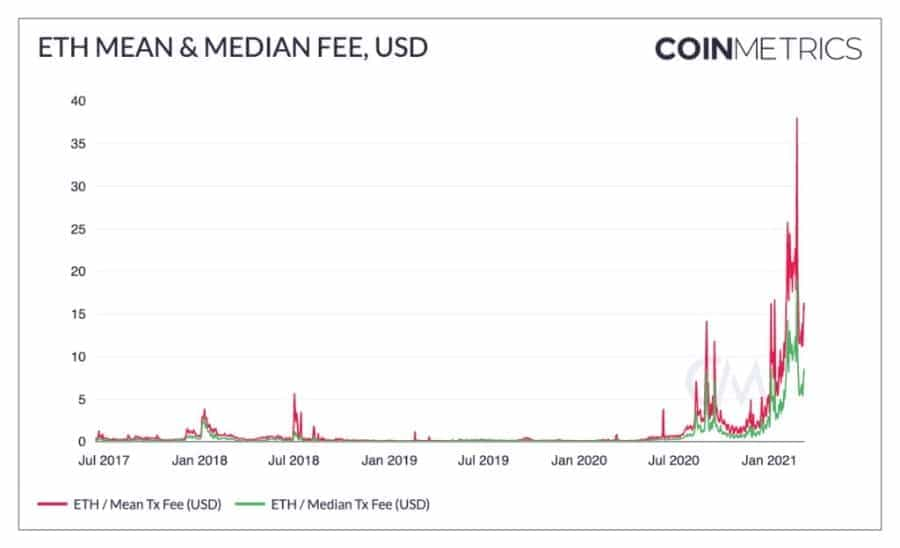

Compared to existing decentralised fund models operating on the Ethereum blockchain, Solrise reduces the cost of basic operations from hundreds of dollars to cents at most, alongside exceptionally faster trading speeds. In fact, the Solana blockchain offers unparalleled low latency and transaction fees, which helps protocols building on top of it to achieve more substantial levels of decentralisation.

In essence, creating a democratic DeFi fund platform entails keeping transaction fees as low as possible which, as most crypto users will know, is no easy feat. While Ethereum and its massive ecosystem are clearly here to stay, its blockchain infrastructure in the current state is in no way suitable for a fund platform like Solrise.

This is because creating a Solrise-style fund on the Ethereum network entails an initial fee of approximately $500 in gas due to storage costs, alongside a $250 fee for investor entry and even higher fees for investor exit. In this scenario, fund managers would basically find themselves paying at $150 every time they wished to rearrange their portfolio of assets, which is of course unsustainable. Thus, Solrise decided to build on the more efficient Solana blockchain.

Solana provides a true high-performance blockchain architecture that currently offers some of the best, unparalleled transaction speeds and costs. This is because Solana can scale up to 50 thousand transactions per second, a major step up from ETH’s 15, and offers costs that are multiple orders of magnitude lower than the competition. This means that Solrise users and managers can enter and exit funds for an overall price of $0.001, and trades are confirmed within seconds.

Solana provides a platform for high-frequency activity at low cost, with cross-chain integrations that allow access to key assets across the crypto sphere. Solana’s bidirectional token bridge, called Wormhole, is now in the process of active rollout and allows tokenised assets to be transferred directly from Ethereum to Solana, giving it access to every notable ERC-20.

The Solana ecosystem is growing at an exponential rate and is developing some very strong integrations, such as Serum DEX. Indeed, Serum and its cross-chain functionality will allow Solrise to offer multiple top-tier tokens including BTC, ETH and USDC, and will enable the platform to supply traders with a series of hedge fund-like tool sets.

The key to all of this is that, through Solrise, anyone can create and launch their own, personal fund with near-zero initial costs and anyone with a laptop and $500, for instance, can deploy capital to this Solana-based asset management protocol and reap the same benefits and returns previously only available to high-end individuals and private-investors.

Launching Solrise Funds

Solrise funds operate in a manner similar to hedge funds in traditional markets, with each fund representing a pool of tokenised assets managed by third party fund managers and their respective teams.

Fund mangers can perform asset swaps via AMM pools, execute trades, stake and unstake tokens in protocols, do yield farming, and perform similar investment actions on the underlying integrated DeFi protocols. In addition, its non-custody protocol features mean that fund managers never gain direct access to assets in the fund.

This increases the overall security of the platform and reassures investors of the safety of their capital. Furthermore, fund managers cannot actively transfer assets out of the fund to a third party entity, reducing the chances of protocol attacks as a whole.

In order to buy into a Solrise fund users will be required to hold a base asset which, in this case, is USDC. In Solrise, anyone can become a participant of a fund as long as the fund remains open and if they have a balance of the appropriate base asset. When depositing the base asset, users will in turn receive the proportional amount of fund tokens (FT) representing their share in the fund.

Fund managers will have the ability to set a combination of different fee structures on Solrise funds, including but not limited to:

- Performance Fees, based on high-water-mark performance against a benchmark.

- Management Fees, based on the averaged value of assets over a specific period.

- Exit Fees, based on the percentage of the exit value by the user.

- Entrance Fees, based on the percentage of entry value by the user.

Solrise DAWN Contest

On May 27th 2021, Solrise released the details of its first official Solrise Incentivised Testnet, called Solrise Decentralised Asset Winners Network (DAWN). Solrise DAWN is a competition run on the Solana Devnet through which fund managers and fund investors enter a race to achieve the highest ROI with their funds.

The competition ran from June 8th to June 21st 2021, with over 5 million SLRS, Solrise’s native asset, up for grabs worth approximately $250k with rewards split into two tracks, one for investors and one for managers.

Each user could create a single fund for the competition with starting capital of $50k USDC. The ultimate objective was to maximise return on the fund during the two weeks of the competition through a combination of clever asset selection and well-timed swaps.

Each platform user also received $10k to simulate investing in Solrise funds during the competition, and users could invest into up to 3 funds at a time. The winners of the competition were naturally those investors who achieved the highest ROI throughout the competition.

SLRS Token

The native token of Solrise Finance, SLRS, is a transferable representation of attributed governance and utility functions specified in the Solrise protocol, and is essentially designed to be an interoperable utility token on the platform. The SLRS token is a non-refundable, functional utility token that will be used as the decentralised medium of exchange between participants on Solrise Finance.

The goal of introducing SLRS is to provide a secure payment and settlement mode between participants who interact on the Solrise Finance platform and does not in any way represent any shareholding, participation, title, right or interest in the Solrise Company.

The primary utility of SLRS is to function as the base asset of the platform, meaning that it is spent by users to pay for Entry and Exit gas fees to Solrise funds, or locked by Fund Managers to reduce the share of management fees taken by the Solrise Protocol. In the future, SLRS holders will also be able to vote on on-chain proposals and changes to the protocol, and become involved in its governance mechanism.

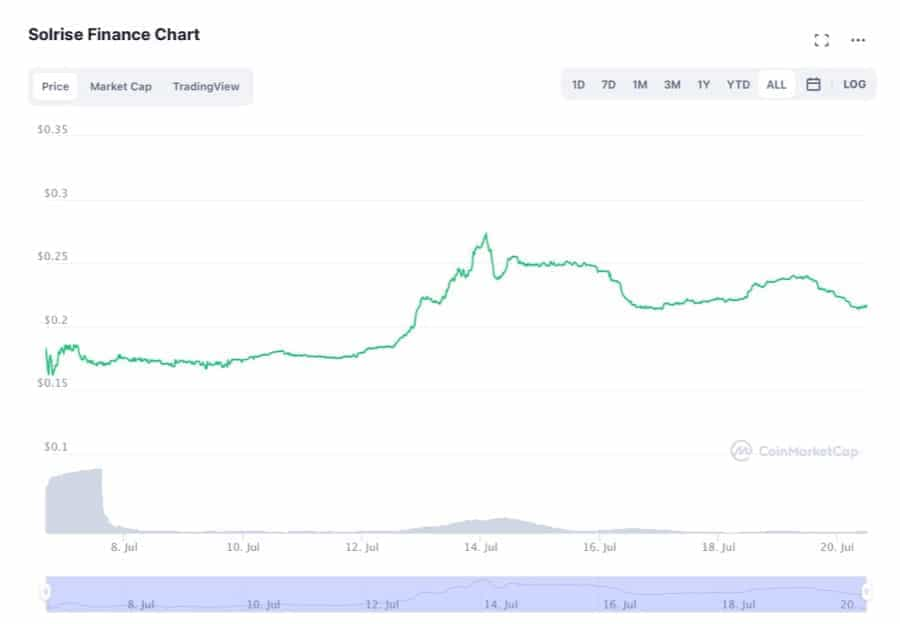

In terms of price, the SLRS token is currently trading at $0.22 and peaked at an all-time-high of $0.2736 on July 14th 2021. The Solrise token currently holds a market capitalisation of approximately $8.5 million and there are 37,174,010 SLRS in circulation out of the total 1 billion tokens in existence.

This is still an incredibly young project and as it develops, expands its use cases and establishes valuable partnerships with notable projects in the digital asset space, one can expect the SLRS token to gain more traction and upward momentum in the medium to long-term outlook.

Solrise IEO & IDO

On June 29th 2021, the leading digital asset exchange FTX held an Initial Exchange Offering (IEO) for SLRS and distributed 5 million tokens to the highest bidders. The SLRS IEO price on FTX was $0.04 per token, with a minimum investable amount of $200 and a hard cap of $250.

In addition to its IEO on FTX, Solrise also held its Initial DEX Offering on Raydium’s AcceleRaytor on July 5th, distributing 2 million SLRS tokens at a fixed price of 0.05 USDC per token.

Solrise gained the long-term support of heavyweight firms and VCs in the crypto space, securing a $3.4 million investment round from Alameda Research, CMS Holdings, Delphi Digital, Parafi Capital, DeFi Alliance, Reciprocal Ventures and Skyvision Capital.

It is indeed not at all surprising that these firms decided to invest into SLRS infrastructure and believe in the long-term success of this Solana-based project. In fact, the value proposition of building a cheap, reliable, user-friendly, democratic and efficient fund management protocol stems from the innate desire to expand the benefits of Decentralised Finance into the enclosed realm of legacy financial structures.

Solrise furthermore presents itself as a rather enticing project tapping into the somewhat undervalued and yet unexplored DeFi area of on-chain asset management, and seeks to open up a variety of unprecedented opportunities for investors by leveraging the speed and functionality of the Solana blockchain.

While this project is still pretty young, the future of the SLRS token and of its ecosystem appears to be very bright indeed.

Solrise Team

Besides being backed by top-notch crypto VCs, Solrise can count on some well-experienced co-founders, lead developers, architects and product designers to help it achieve the long-term success that it aspires to. Solrise was founded by Vidor Gencel, a Computer Science Ph.D. candidate actively doing research and development in the blockchain space with a focus on Ethereum, Tendermint and Hyperledger.

Vidor has been involved in software development since a young age and has participated in the development of different software solutions for microprocessors, core banking, the web, chatbots, and real money-handling equipment. As CEO of Solrise, Vidor strives to leverage his experience and skill set to continue developing Solrise’s infrastructure and will work towards making the Solana-based platform the go-to solution for on-chain asset management.

The Team at Solrise is composed of:

- Vidor Gencel - CEO & Co-Founder

- Matt Martin - Co-Founder

- Filip Dragoslavic - Co-Founder https://www.linkedin.com/in/filip-dragoslavic

- Boris Vujicic - Lead Developer

- Andrej Budincevic - Blockchain Developer

- Alex Kovacevic - Lead Designer

- Pavle Batuta - Blockchain Developer

- Zlatko Poljovka - Frontend Developer

- Natalija Lovrincevic - Frontend Developer

- Petar Markov - Frontend Developer

Conclusion

Solrise proposes an alternative investment paradigm that seeks to disrupt the bottlenecks typical of traditional financial systems and empower individuals through blockchain and, more specifically, the Solana blockchain.

The world of DeFi has no doubt opened up an incredibly diverse ecosystem of opportunities and Solrise, at heart, seeks to mitigate the series of complexities that this new financial model poses to newcomers. In fact, it wants to improve the DeFi experience for those looking to allocate capital and strives to offer users a permissionless, open and transparent investment platform catering to both experienced crypto enthusiasts and non-savvy investors.

Solrise strategically taps into a specific segment of the DeFi space that is yet to reach its full potential and, in doing so, it ignites a new exciting frontier in the digital asset ecosystem. Ultimately, the project looks to embody the fundamental principles of decentralised financial philosophy and aspires to completely detach monetary power from the hierarchies of centralised systems, with the single objective of making money unequivocally free.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.