Telcoin Review: Blockchain For The Telco Industry

Telcoin is a project that’s been in the works since 2017, but has only recently captured the attention of traders, with its TEL token now up more than 80,000% off is March 2020 lows!

It’s based on the Ethereum blockchain and is meant to be a payments protocol, using mobile payments to provide borderless transfers similar to Western Union, but at far lower costs.

It bills itself as the first cryptocurrency to tap into the synergies provided by the reach of mobile telecom operators and the fast, borderless nature of the blockchain.

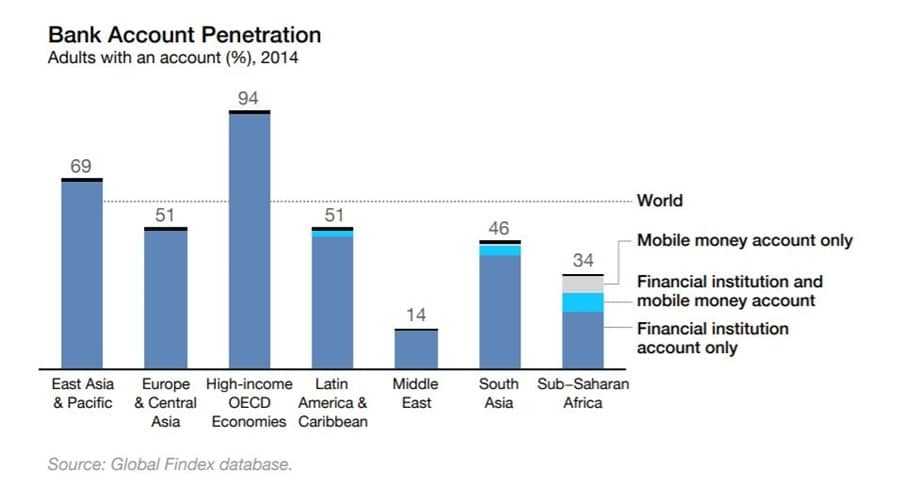

According to the World Bank there are nearly 5 billion mobile phones operating globally, but just 1.2 billion bank accounts. That’s because in many parts of the world it is far easier to access mobile services than it is to access banking services.

Telcoin is looking to capitalize on that by providing Telcoin to mobile service partners in exchange for providing their customers with seamless access to the growing digital economy. In short, they are looking to provide access to cross-border remittances, payments, and ecommerce.

The objective of Telcoin is not to compete with the massive mobile telecom industry, but rather to provide a cooperative solution that can deliver mobile money to users through cryptocurrency backed solutions and its unique and easy to use mobile wallet.

The developers of Telcoin believe they can become part of the global financial system through the delivery of mobile money solutions in partnership with mobile telecom operators.

Given the massive rise in the value of the TEL token recently there are many people out there who believe in this mission, but is Telcoin able to deliver on their promises? Let’s take a closer look at the project and see where it’s been and where it’s headed.

Why Partner with Telecoms?

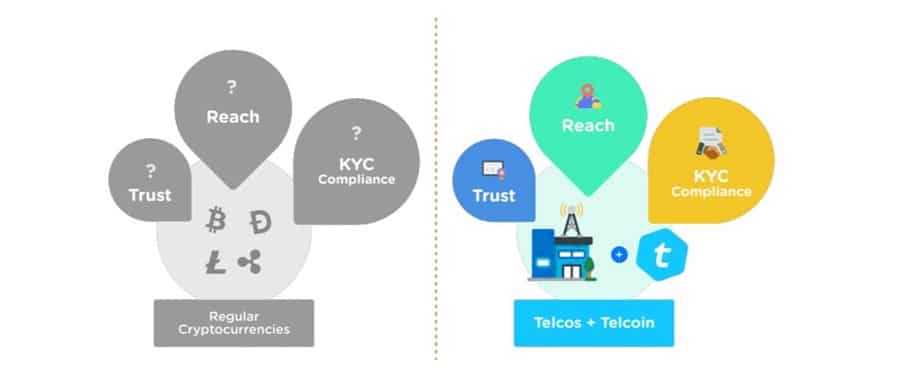

Telcoin believes that its partnerships with mobile telecom operators can help the project succeed where similar projects have failed. Namely by avoid the three major friction points of:

- Trust

- Reach

- KYC Compliance

Let’s look at these friction points more closely, and how Telcoin will be able to surmount them through its partnerships.

Gaining Trust

While it has been improving, cryptocurrencies still suffer major trust issues among the mainstream population. While the instantaneous nature of blockchain transactions provides definite advantages, it also opens up the potential for hackers to gain control of funds.

Telcoin is looking not only to increase the usage of its own services, but it also believes it can help increase the overall adoption of cryptocurrencies. It believes once users of the Telcoin ecosystem see how safe and useful it is, they will also become more interested in other cryptocurrencies.

By partnering with existing telecom operators Telcoin hopes to leverage the existing trust levels with their customers as the bridge between cryptocurrency and mobile money.

As a default security level the Telcoin wallet includes a multi-sig component, where the telcom and Telcoin each hold a key, and the user holds the third key. This prevents the movement of large amounts of TEL without two of the three wallet keys, thus protecting user funds.

Telcoin also plans on working with the telecom companies to implement all the existing security measures available in order to protect users.

And since Telcoin is focused on the inclusion of compliance measures with telecoms the digital asset shouldn’t attract criminal types in the first place. By maintaining a clean image Telcoin believes it can build a trustworthy brand over time.

Improving Reach

As mentioned above there are more than 5 billion mobile devices in the world. One of the hurdles for any new business is reaching and acquiring new users. This aspect of the business process can be both time consuming and costly.

By partnering with existing telecom operators Telcoin will be able to leverage their existing customer base and reach. And by incentivizing the telecom companies through the issuance of TEL tokens they feel they can gain immediate access to the customer base.

So far they’ve had limited success. A partnership has already been formed with GCash in the Philippines, which has provided the very first remittance channel from Canada to the Philippines.

Telcoin is using that first successful channel as a springboard for the creation of other channels, and recently announced partnerships with Unipagos in Mexico, which gives them access to more than 1.6 million Mexican households and roughly $36 billion in annual remittances from the U.S. They have also announced partnerships with major mobile money platforms in Nepal and Tanzania.

While that improves the in-bound reach of Telcoin there’s still plenty of work to do on the outbound side. While Canada is open, the team is still working on adding outbound corridors from the U.S., Singapore, and Australia. These will be critical for remittances as they are the origin of the majority of global remittances.

Telcoin is also planning on increasing their reach through the addition of practical use cases. Already in the works is a payments card and a decentralized finance platform. These can help drive further adoption of mobile money platforms and the reach of Telcoin.

Telecom partners are very interested in expanding mobile money adoption as it has an excellent ROI. Currently financial services are largely untapped for telecoms’ due to regulatory barriers, but once those are removed mobile users are very willing to adopt mobile money solutions, as shown by the rapid adoption of such services in several African nations and in the Philippines.

Of course this also means that regulations need to loosen for both cryptocurrencies and financial services before Telcoin can see significant progress and growth in many areas of the world.

At present Telcoin is getting around this barrier in some nations by firewalling the cryptocurrency function from fiat payments and remittances. They have also added KYC to their wallet to comply with regulations in the major outbound target countries, most specifically the U.S.

Handling KYC Compliance

Despite the desire for privacy among many early cryptocurrency adopters, most of the centralized exchanges now require onerous Know Your Customer (KYC) processes and authorizations before they allow the purchase of cryptocurrencies with fiat.

Telcoin planned on getting around this by using the KYC compliance already in place through the telecoms’ agreements with their customers. They believed they would be able to leverage the existing KYC compliance of the telecom operators with regulators, thus easing this major friction point of using cryptocurrencies.

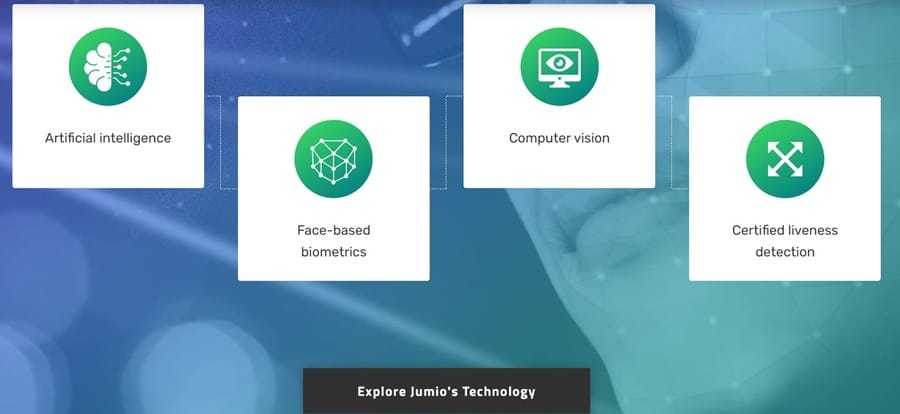

In practice this has turned out to be a long and laborious process, and in the meantime Telcoin has added a KYC feature to their wallet. They have been able to do this thanks to a partnership with leading identity authentication platform Jumio.

Jumio’s AI-powered technology, which has been integrated into the Telcoin app, allows users around the world to simply upload a photo of their government-issued ID card and take a selfie to confirm their identity.

KYC enables Telcoin to fulfill emerging regulatory requirements and is a major step in bringing compliant money transfers to users worldwide. This compliance-first strategy will allow them to quickly add smooth fiat payment rails globally, while also expanding digital asset capabilities in parallel. This is also critical the plans to embrace the US market.

In the meantime Telcoin will continue to work towards leveraging existing telecom KYC in place for mobile money access by working with the telecoms to meet standards required for cryptocurrency. By partnering with telecoms, Telcoin strives to solve basic trust, marketing, and compliance challenges that have inhibited cryptocurrency adoption to date.

The Role of Mobile Money Accounts

One of the primary motivations in creating Telcoin was the disparity the founders saw in access to financial services versus access to telecom services.

Globally there are over 2 billion people who are unbanked according to the World Bank, which means roughly one-third of the Earth’s population doesn’t have access to the basic financial services many of us take for granted.

However, nearly all of the world’s population does have access to telecom services. In fact, nearly the entire adult population of the Earth has a mobile phone.

One of the most successful stories when it comes to mobile money is that of Safaricom in Kenya. According to the World Bank roughly 90% of the adult population of Kenya has a “bank account.” That’s the same level as high-income OECD economies.

How did they do it?

Regulations in Kenya have allowed telecom mobile money to flourish, and while only a small minority of Kenyans have traditional bank accounts, they almost all have mobile money accounts. The majority of Kenyans would be considered underbanked, as the usability of mobile money is still somewhat restricted.

But as the Kenya example has illustrated, regulators have played a major role in holding back financial inclusion. Here is where Telcoin enters the picture.

The Case for Telcoin

Now that cryptocurrencies are part of the financial system regulators are facing increasing pressure to include them in monetary policy.

That’s because national security is tied with monetary policy, and despite the powerful lobbying nature of the banking system cryptocurrencies are increasingly gaining mainstream acceptance and usage.

This has led to the acceptance of cryptocurrencies in a number of jurisdiction around the globe, with more coming onboard all the time.

Governments around the world are increasingly accepting cryptocurrencies, but at the same time they see the need to regulate them more heavily to capture the taxes that have far outweighed the initial worries over the potential threat of cryptocurrencies.

This being the case, Telcoin believes that once a telecom has regulatory approval to provide mobile money, and once the government has provided a regulatory approval or legal framework for cryptocurrency as a regulated taxable asset, there will be minimal regulatory barriers to a telecom establishing exchange capability with Telcoin.

In the meantime the two – cryptocurrencies and fiat currencies – have been separated in the Telcoin wallet to avoid potential regulatory hurdles to the creation of remittance corridors by Telcoin and its telecom partners.

Creating Partnerships & Remittance Corridors

If Telcoin is to become successful it needs to gain access to all or at least most of the global telecom firms. However, gaining access to all the world’s telecoms is simply not practical.

So, Telcoin works with local, regional, and global aggregators in order to connect with as many telecom operators and mobile money platforms as possible. So far that number is small, but as the technology matures and cryptocurrencies become more mainstream the resistance to joining the Telcoin platform is eroding.

This is allowing Telcoin to finally grow, and is expected to give them the ability to deliver an end-to-end product, such as the established remittance corridor between Canada and the Philippines, relatively quickly.

And once basic access is attained Telcoin should be able to rapidly add-on new products, including card access and DeFi products, once partners can help clear regulatory hurdles in their respective jurisdictions.

One of the key aspects of current remittance corridors is that cash out today occurs just as much with airtime as it does with fiat currency in mobile money accounts. If Telcoin can make sending TEL to any mobile device in the world as simple as sending a text message then they have become successful.

To this end, they are establishing connections to airtime platforms via aggregators, while going through the process of securing mobile money connection capability in each market.

Regulatory and banking complications of mobile money connectivity are not the only reason to first connect to airtime platforms. In very important financial inclusion markets like Nigeria, for example, where mobile money adoption is extremely low, converting Telcoin to airtime can actually be much more effective than connecting to mobile money.

Commercial Model

The mobile operators are expected to benefit from Telcoin as it differentiates them and makes them more attractive to those who appreciate cryptocurrency usage and the other use cases promised by Telcoin such as remittances and roaming payments.

It is also presumed that the mobile operators will benefit from the increased adoption of mobile money since it provides them with a very good ROI.

Telcoin is working to position itself as a partner to the telecoms in the mobile money ecosystem, and hopes to help drive increased adoption of both mobile money and cryptocurrency.

On the commercial side Telcoin benefits by collecting a transaction fee whenever TEL is purchased from or sold to a mobile operator. At the point of conversion a 0.5% fee will be applied. Telcoin also has plans to capture the exchange spreads whenever a mobile operator buys or sells TEL from Telcoin in exchange for fiat currency.

Telecom operators may not need to buy or sell TEL however. If their subscribers are buying and selling equal amounts of TEL then they will provide their own liquidity. However in the case where there’s an imbalance in inbound versus outbound remittances Telcoin can apply a spread to help manage forex and TEL secondary market risks.

These spreads will depend on currency markets, the degree of forex imbalance, and the liquidity and volatility of TEL on secondary markets, but will be designed in a conservative manner and is expected to generate a modest profit margin from this activity.

Remittances and Fees

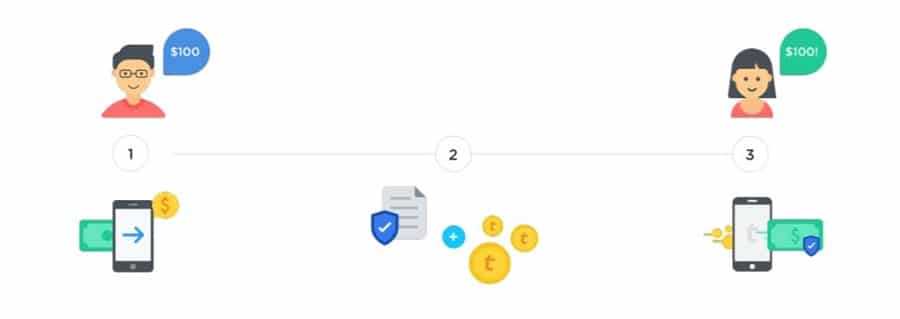

According to the white paper there is no remittance fee charged by Telcoin. Instead there is a 0.5% transaction fee for conversions between TEL and mobile money.

That would make the total fee for a remittance as 1% since there would be a 0.5% fee for the sender when they convert to TEL, and another 0.5% fee for the receiver when they convert from TEL to mobile money.

Overall Telcoin expects to keep transaction fees under 2%, and that did seem possible when the white paper was published in 2017, however now it certainly is not.

That’s because TEL is an ERC-20 token, which means users are required to pay the Ethereum network gas fee for any TEL transfer. Back when the whitepaper was published this gas fee was equal to roughly $0.25, which kept the cost of transfers quite low at 1% + $0.25.

However with the rise of DeFi in 2020 the gas fees for a transfer on the Ethereum network can go as high as $40 or more in some cases. When you consider that a remittance service like Telcoin would likely be used to send smaller amounts of less than $1,000 you can soon see that the Ethereum gas fees are going to be a significant cost.

Of course Telcoin is instantaneous and far more convenient when compared with traditional remittance channels, so possibly this added cost in the form of Ethereum gas fees won’t discourage users. And once Ethereum fully transitions to Ethereum 2.0 the gas costs should come back down to manageable levels.

The Telcoin Team

Telecoin is a global team, with members spread all across the globe, and physical offices in Los Angeles, Manila, and Singapore. The project was founded by Paul Neuner and Claude Eguienta, however only Paul remains with the project as of May 2021. So, Paul is the founder and CEO of Telcoin.

Paul has more than two decades of experience as a tech entrepreneur in the telecom space, including a successful exit. In 2006 Paul founded Mobius, a leading provider of telecom fraud management solutions that is now installed at more than 30 mobile operators globally.

The project has been hiring consistently over the past year, and the majority of the team members can be seen at the Telcoin LinkedIn page. There is no information regarding the team on the website, and the team information in the whitepaper is outdated.

The Telcoin Wallet

The Telcoin wallet was developed to be as simple to use as possible, which makes perfect sense since it is expected to gain usage by a group of individuals who are unfamiliar with cryptocurrencies, private keys, and wallet addresses.

Setting up the wallet is dead simple as all it requires is a mobile phone number and a six digit PIN. After that the user is required to take a photo of their government ID and a selfie, and then the wallet handles the whole KYC process without the need to fill out endless forms. It’s a process that really can’t be messed up.

However there are also some questions regarding the setup process, such as how would one go about restoring an existing wallet. There’s no option to do so when installing the wallet for the first time. I’m sure there must be an answer, but it isn’t clear from the app, and there’s no detailed documentation for the wallet app that I was able to find.

Once the wallet is created the dashboard is also dead simple. The only button to be concerned with is at the bottom of the screen and it is to “Send Money.” Even the settings page only contains a few settings for receiving notifications. There’s really not much to fiddle with and nothing to clutter the interface or confuse new users.

Sending TEL tokens does allow you to send by ERC-20 address if you are familiar and comfortable with that method, but it also has a far easier method which is to send to a phone number.

Again this is perfect for the new user who isn’t familiar with cryptocurrency. Of course with the huge increase in Ethereum network fees it would be nice if there was an advanced options screen that let you set the gas amount, but as it is the interface remains clean and easy to use.

One question that came to mind is what if the recipient hasn’t set up a Telcoin wallet on their phone? I presume that the transaction would remain and once a wallet is added to the device with the phone number the coins would immediately show up in that wallet, but it isn’t clear from the information provided.

Note that as of May 2021 approval for new wallets is slow due to huge volumes, and the team is only approving accounts for those in target corridors (Canada, Philippines, Australia, and Singapore).

The TEL Token

The TEL token was offered in an ICO during December 2017. There were 20 billion of the 100 billion total supply offered for sale at a price of $0.0013 each with a soft cap of $10 million and a hard cap of $25 million.

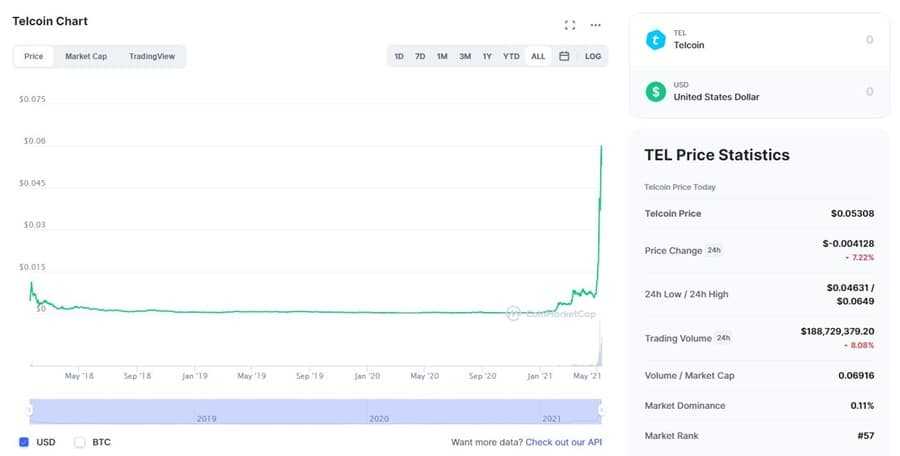

With TEL tokens currently selling for $0.05308 the initial ICO investors have a return of almost 4,000%. However they needed to hold through some rough times since the token began trading in January 2018 and heading steadily lower until reaching a bottom in March 2020 of $0.00006516.

From there is began creeping higher, but it wasn’t until February 2021 that the TEL coin really took off. The catalyst for the rally was the release of the Telcoin V2 mobile app, which included the first remittance corridor for the project and proved that there really was a potential for success.

Since then the token has skyrocketed and is up over 80,000% above the March 2020 low, which is pretty incredible even in the volatile cryptocurrency space.

TEL is not listed on many exchanges, but does trade on KuCoin. It is also available from several DEXs, including 1inch, Balancer, and most recently QuickSwap.

Conclusion

This is a project with very high aspirations and a long time horizon to get fully involved with all the remittance corridors necessary. The addition of the very first remittance corridor between Canada and the Philippines was a very big deal and the catalyst that sent the value of the token soaring higher.

It makes sense that additional and larger corridors, such as the U.S. to Mexico, would increase the value of the project and its token several times over.

That said, the regulatory hurdles involved are steep, which could delay the growth of the project. Also, until Ethereum 2.0 launches fully the network fees involved currently are making the cheap remittance case for the project moot.

While we can certainly see the use case for Telcoin, the extreme gains seen in the token seem unsustainable. Of course only time will tell, and the team is also planning on releasing a V3 of the platform that is rumored to contain a DeFi component, which would presumably create further upside for the token.

One thing we would definitely like to see is an updated whitepaper or a Docs that explains the current situation for the project more fully. While the project does appear to be transparent it also lacks current information that can be found easily for other projects.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.