UNUS SED LEO Review: The Bitfinex Exchange Token

The UNUS SED LEO token is a utility token created for the iFinex platform, however unlike other similar tokens like the Binance Coin or the KuCoin Shares token it was created in response to a financial crisis for the Bitfinex exchange.

That financial crisis was loss of $850 million when various governments seized funds from Crypto Capital Corp., a financial services company that iFinex was using for banking services in 2018 after finding difficulty in using the traditional banking system.

The UNUS SED LEO token gets its name from the iFinex company motto, which is the same. It derives from one of Aesop’s fables, ”The Sow and the Lioness”, and is Latin, meaning “One, but a lion.” The fable (in short) details how a sow brags about how many children she has and then asks the lioness if she only had one child. The lioness replies “One, but a lion.” The fable encapsulates the ethos of quality over quantity and individual strength.

UNUS SED LEO tokens were released in May 2019, and there were 1 billion created, with 66% on the Ethereum blockchain and 34% on the EOS blockchain. Bitfinex uses 27% of the transaction fees it collects to purchase and burn the tokens, and eventually will burn all of them. That’s quite different from nearly every other cryptocurrency in that UNUS SED LEO was created with specific plans to eventually cease to exist.

With that in mind let’s look in more detail at the token. How is it used, where can you buy and store it, and is it even worth buying?

UNUS SED LEO ($LEO) Origins

Bitfinex is one of the oldest cryptocurrency exchanges in existence, having been formed in 2012. While it remains one of the world’s largest crypto exchanges, its path hasn’t always been smooth. In fact, 2018 was an extremely difficult year, and not only due to the popping of the crypto bubble and beginning of the crypto winter.

No, the biggest problem Bitfinex faced was a loss of $850 million suffered when the shadow banking firm Crypto Capital Corp had its funds seized by a number of global governments, including Poland, the U.K., Portugal, and the U.S. In addition, at the same time U.S. prosecutors accused the parent company iFinex of illegally transferring funds to Crypto Capital Corp. and of trying to conceal the $850 million loss by covering it with reserves from Tether Ltd., a company also owned by iFinex.

The subsequent controversy and negative press obviously put iFinex, and Bitfinex, in a very bad light in the eyes of investors. In response iFinex announced the creation and release of the UNUS SED LEO token, which would also cover the $850 deficit in Tether funds. And in May 2019 the UNUS SED LEO token appeared.

There were a total of 1 billion UNUS SED LEO tokens minted, with 660 million minted on the Ethereum blockchain and 340 million minted on the EOS blockchain. All of the tokens were sold in a May 2019 private sale and a June 2019 IEO at the rate of 1 USDT each, thus raising $1 billion and covering the loss.

One difference in this utility token is that it was created with plans to eventually burn all of the tokens. With that in mind, Bitfinex uses 27% of its profits to purchase and burn tokens.

In order to provide complete transparency Bitfinex maintains a dashboard that shows information regarding token purchases, burned tokens, information about transactions, and more. It is very interesting and informative, and you can see it in action here.

UNUS SED LEO Utility

The UNUS SED LEO token was created with three primary functions in mind:

- replenishing the Bitfinex budget;

- expanding opportunities for service customers;

- iFinex ecosystem development.

It accomplishes the first goal simply through its sale. The other two functions are ongoing, and like other exchange tokens the LEO acts as the internal utility token for the Bitfinex exchange, providing holders with several advantages when trading on Bitfinex. These benefits include the following:

- Commission fees on Bitfinex and Ethfinex for coin holders are reduced by 15%. The discount applies to all cryptocurrency pairs, including pairs with stablecoins. To use the option, it is enough to have at least one coin on the account.

- The commission for takers who store more than 5000 USDT in cryptocurrency is reduced by another 10% (total savings – 25%).

- A discount of up to 5% in peer-to-peer lending fees. Holders receive a 0.05% discount which is accrued monthly for every 10,000 USDT held in LEO. The maximum discount of 5% is reached when 1 million USDt in LEO is held across the previous month.

- Bitfinex affiliates also receive multipliers when one of their referrals holds more than 500 USDt worth of $LEO tokens across a month. This multiplier amount is as follows: 500+ USDt LEO equivalent - a 1.1x multiplier, 5,000+ USDt LEO equivalent - a 1.2x multiplier, and 50,000+ USDt LEO equivalent - a 1.5x multiplier.

As tokens are burned the value of the remaining tokens is expected to increase. That allows traders to benefit not only from the reduction in trading commissions, but also from the increase in the market value of the token itself.

The UNUS SED LEO Initial Exchange Offering

The $LEO token was launched on Bitfinex on May 20, 2019 after a 10-day long IEO that raised $1 billion by selling the 1 billion newly minted $LEO tokens for 1 USDt each. The launch was unique in that iFinex made the decision to release the token as a dual chain token. Of the 1 billion total supply, 660 million was released on the Ethereum blockchain and 340 million was released on the EOS blockchain.

The benefits of a dual protocol token launch are to:

- Provide enhanced flexibility and ease of use for Unus Sed Leo token holders.

- Contribute support and resources to protocols which we have identified as highly valuable.

- Contribute to developments focused around blockchain interoperability.

- Allow for Unus Sed Leo to become an integral part of the decentralised exchange space, including through integrations with both Ethfinex and eosfinex.

The Unus Sed Leo token contracts on both Ethereum and EOS can be found here: Ethereum or EOS.

It is possible to seamlessly convert between the two protocol tokens, with Bitfinex acting as the bridge. To do so, simply deposit 1 LEO-ERC20 and withdraw 1 LEO-EOS. When done, Bitfinex adjust cold wallets/issuances on the different chains depending on the demand to effectively bridge the chains.

The dual protocol launch was unique, and there are plans for the issuance of Unus Sed Leo on the Blockstream Liquid Network. Initially Bitfinex was planning on that occurring in the summer of 2019, however there has been a delay. With USDt launching on the Blockstream Liquid Network in March 2021 we could soon see $LEO tokens released there as well, although there’s been no announcement of such from Bitfinex.

The $LEO Token

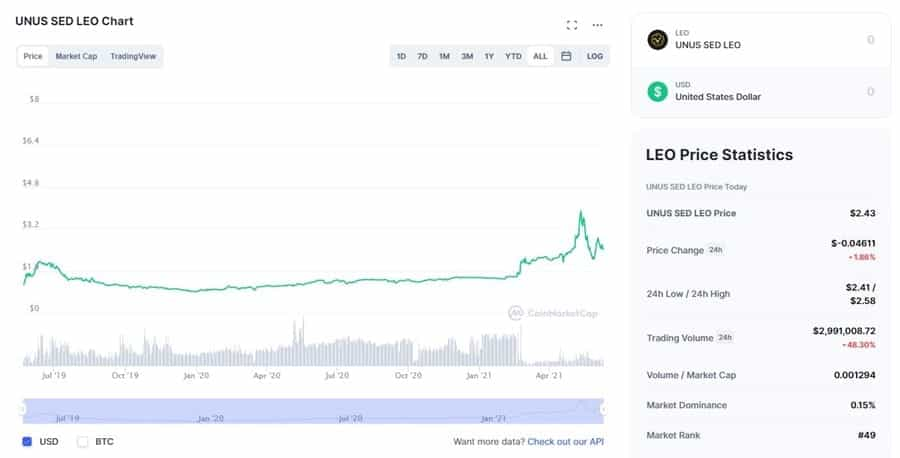

Immediately after listing the LEO token increased in value, trading up to $1.98 by June 11, 2019. That increase was partially supported by the listing of LEO on OKEx as traders were optimistic over the additional exchange listing of the new token.

From there the token dipped and was below $1 by October 2019. It remained depressed through April 2020, but then recovered to trade back above $1 and hasn’t dipped below $1 since. Instead it steadily moved higher throughout 2020 and into 2021.

By February 2021 the token was part of the cryptocurrency rally taking place at the time, which allowed it to surge to an all-time high of $3.92 on May 14, 2021. Since then the price has deflated by roughly 35% as the entire market has entered a bearish phase. On June 10, 2021 the LEO token trades at $2.43 and is the 49th largest cryptocurrency with a market capitalization of almost $2.4 billion.

The token has remained remarkably stable for a cryptocurrency, and it seems like there are several things that have allowed that stability and a steady increase in the value of the LEO token. These include:

Bitfinex’s popularity – Despite the Tether scandal, a large hack in 2016, and frequent other negative press Bitfinex remains one of the largest and most respected cryptocurrency exchanges in the world. That is helping contribute to the stability of the token as the large trading community has embraced the token as a means to lower trading costs. That dynamic can be expected to support the LEO token throughout its existence.

Generous loyalty program – The reduction in commissions, lowered borrowing costs, and benefits to Bitfinex affiliates have all increased the utility of the LEO token, making it more attractive to traders. As time moves on Bitfinex has promised additional bonuses for LEO holders, which can only serve to keep interest in the project high.

Generous burn program – By consistently burning tokens Bitfinex is reducing the supply even as demand is increasing concurrently. This dynamic is sure to continue lifting the price of LEO tokens as they become increasingly scarce through the mechanism of the burn program.

Where to trade $LEO

There is no additional emission mechanism for the LEO token, so no mining and no staking. All of the tokens have already been emitted and the total supply is capped at 1 billion tokens. In addition, the circulating supply is steadily declining as tokens are regularly burned. That means the only way to acquire LEO tokens is by buying them on exchanges.

The Bitfinex exchange is the logical place to purchase LEO, and not surprisingly this is where the majority of trading volume in the token occurs. Another high volume alternative is the Omgfin exchange, a smaller centralized exchange located in Estonia.

Not surprisingly since it is the Bitfinex utility token, LEO has not been listed on other major exchanges such as Binance and KuCoin.

UNUS SED LEO Wallets

Because the LEO token was issued on both the Ethereum and EOS blockchains you’ll have no problem finding a wide variety of wallets where you can store the token easily. However, in order to receive all the discounts and benefits offered by holding LEO tokens they need to be held in the Bitfinex online wallet.

While that might not be a problem for you, it does create a problem for those who don’t fully trust the centralized exchanges. There are always hacking concerns, and when it comes to Bitfinex some users remain very skeptical due to the questions surrounding whether or not iFinex has all the reserves they claim to back Tether.

Conclusion

The LEO token is quite unique in terms of why it was created, putting it out as a dual chain coin, and the fact that it is planned to eventually cease to exist. That said, it has seen a good price history, and considering the small number of coins burned so far it is logical to assume that the upward price momentum of the token will continue.

Thus far less than 5% of the total supply has been burned, which isn’t a huge hit to supply. If we presume that Bitfinex remains a popular exchange, and that its users remain interested in discounts to their trading fees, then the steady reduction in supply should combine with continuing or increased demand to put upward pressure on the token price.

Of course nothing is guaranteed. There’s always the possibility of Bitfinex falling out of favor as an exchange. That would negate everything said in the paragraph above. However, as of June 2021 there are no signs of that happening.

Adding some LEO to your portfolio could be a good move for experienced crypto investors who are willing to do their own due diligence on the coin. The best strategy would be to follow the price trend of the coin and look to buy in when you feel price is near a bottom. Alternatively a dollar-cost averaging strategy could also work quite well if you believe the token will continue making steady gains in response to falling supply.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.