Vertcoin: Is the Buzz Around the Cryptocoin Legitimate?

Vertcoin (VTC) isn't trying to reinvent the wheel by messing around with oracles or smart contracts; instead, the project is aiming for the contextually tried and true model of a peer-to-peer (P2P) digital currency.

So if you think of the crypto ecosystem as being divided up into categories of use cases, then you can slot Vertcoin with the OG payment cryptocurrencies like Bitcoin and Litecoin. It's digital cash, not a smart contracts platform like Ethereum, for example.

So what's Vertcoin's claim to fame? What sets it apart?

Simply put, it's ASIC resistant. Allow us to explain.

Decentralized mining is the name of the game

When Bitcoin first came out, the mining difficulty was still so minimal that regular old computers would be enough to successfully mine coins. But it didn't take long for that to change.

Soon, users of the Bitcoin network starting use graphics cards to mine Bitcoin, which proved themselves to be exponentially more effective at the task than CPUs.

And then came ASIC chips: extremely specialized hardware designed specifically to be Bitcoin mining beasts.

So, while these ASICs are insanely efficient miners, they've also helped to consolidate hash power in the hands of a few large mining conglomerates that can afford to buy and run thousands of ASICs at once.

Needless to say, that's not exactly the "decentralized" dynamic that Bitcoin creator Satoshi Nakamoto had originally envisioned for the project. And many believe this ever-centralizing mining dynamic is only going to uglier in the future.

Alas, that's where Vertcoin comes in.

Vertcoin ASIC resistant

Unlike Bitcoin, Vertcoin's Proof-of-Work (PoW) consensus system has been built from the ground up with the idea of ASIC resistance in mind.

Accordingly, ASIC chips don't provide any competitive advantage for miners of Vertcoins. And since graphics cards are a lot more accessible and affordable for everyday users, this ASIC resistance means Vertcoin mining is set to be decentralized, open to anyone and not just large mining factories.

To this end, if you're looking to get into cryptocurrency mining, Vertcoin could be a great starter coin.

Other unique elements

But being ASIC resistant isn't Vertcoin's only perk. The project has some other interesting benefits, including:

- Stealth Address transactions

- SegWit activated

- Merge mining capabilities (mining multiple coins at once)

- Lyra2REv2 PoW algorithm

Vertcoin's 2017 performance

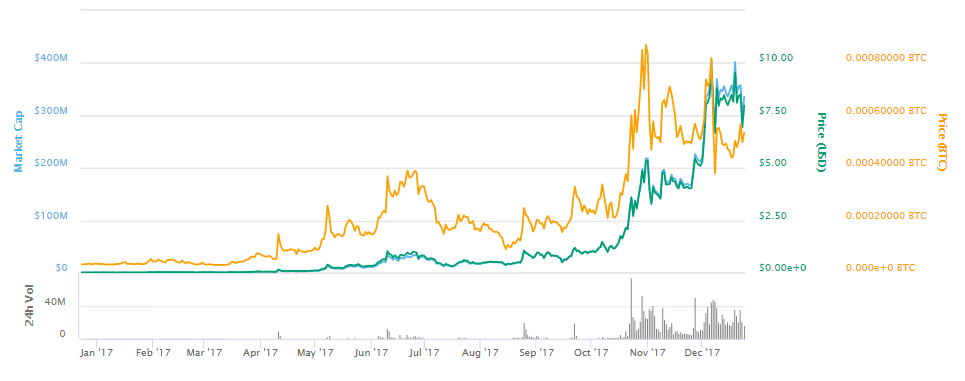

Market-wise, Vertcoin has surged over the course of the year. That's not saying much, though, since virtually every other cryptocurrency project has done the same.

VTC has surged from below one dollar to just below $10 USD at press time. Not bad.

A pretty good year for VTC - Image via CoinMarketCap

A pretty good year for VTC - Image via CoinMarketCap

Where we go from here is anyone's guess.

But if you're personally interested in VTC, you'll need to put your speculator's cap on.

Do you think GPU mining is going to stay big for the foreseeable future? Do you think demand will increase for mining going forward? Is Vertcoin's merge mining capabilities a strong first-mover advantage?

These are the kinds of questions you'll need to ask yourself in the weeks and months ahead.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.