Vertcoin (VTC) is one of the more established cryptocurrencies that was launched "way back" in 2014 without too much fanfare.

It was released without an ICO, without an airdrop, and without a pre-mine as a simple blockchain project on Github. It was and is open-source and was built on the Bitcoin codebase with one simple change – Vertcoin is committed to remaining ASIC-free.

However, with so many newer projects, can Vertcoin still stand out?

In this Viacoin review, I will give you everything that you need to know about this project. I will also take a look at the long term adoption potential of VTC tokens.

What is Vertcoin?

Vertcoin is a fork of Bitcoin that took place in January of 2014. It was created as a GPU mined version of Bitcoin in order to ensure decentralization and therefore, network security.

It’s this strong commitment to mining fairness that distinguishes Vertcoin from other cryptocurrencies that are Proof-of-Work but have fallen to the power of ASIC mining and the decreasing decentralization that follows.

Vertcoin remains the coin that can be mined by anyone with a GPU, and the community of volunteers that support the project have ensured it remains this way, even though the project has already faced three hard forks to keep it free from ASIC miners and botnets.

In the past Vertcoin has referred to itself as “The People’s Coin” because it remained committed to the ideals from the Bitcoin whitepaper that kept voting power of the network with the individual. That ideal was that one CPU is equal to one vote, but the rise of ASIC miners and large mining pools has sadly meant that most Proof-of-Work cryptocurrencies no longer adhere to that ideal.

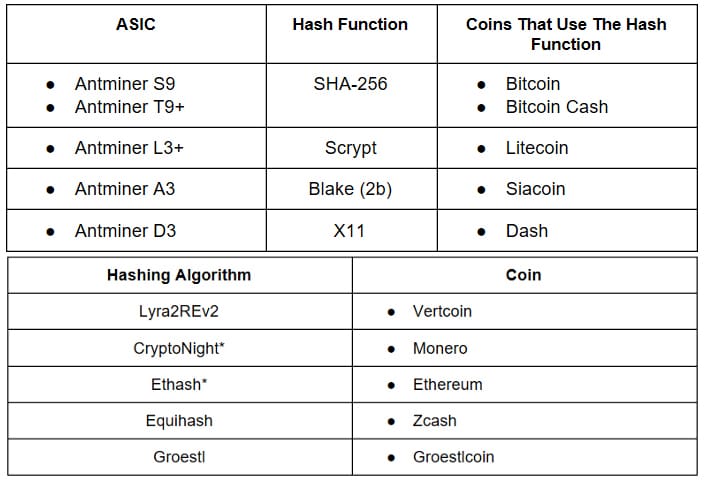

The Vertcoin Algorithm

Being based off of Bitcoin, Vertcoin was created to use Proof-of-Work as its consensus method. Unlike Bitcoin’s use of SHA-256, Vertcoin used Scrypt Adaptive N as its algorithm when it launched in order to remain ASIC resistant. It was less than a year later that the coin had to undergo a hard fork to remain ASIC resistant, and it switched to the Lyra2RE algorithm.

Less than a year after that the Vertcoin development team found that a botnet had taken control of more than 50% of the network, and this prompted a move to the Lyra2Ev2 algorithm.

Algorithms ASICs hash & resistant Algorithms. Via Vertcoin Blog

Algorithms ASICs hash & resistant Algorithms. Via Vertcoin BlogThat lasted until late 2018, when it was discovered that an ASIC capable of mining the Lyra2REv2 algorithm had been created in China. On February 1, 2019, Vertcoin forked for a third time to the Lyra2REv3 algorithm.

Vertcoin has also taken the trouble to make itself Lightning Network compatible, as well as implementing Segregated Witness, and providing compatibility with Stealth Addresses. The development team is now working on upgrading the blockchain to allow for instantaneous atomic swaps.

Vertcoin Fair Mining

As mentioned above Vertcoin has already been through three hard forks, and another is on the way due to new developments in the hardware used to mine cryptocurrencies.

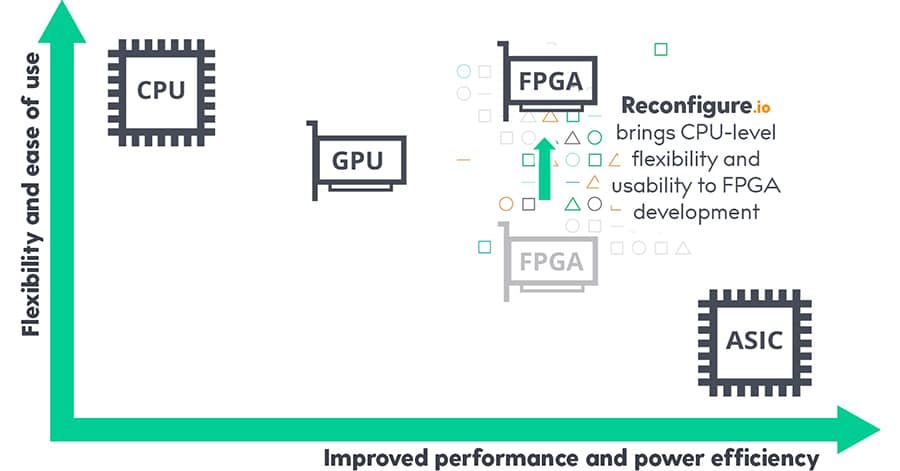

This new development is the rise of Field Programmable Gate Array (FPGA) hardware.

The FPGA device is the GPU equivalent of ASIC mining, which is a CPU based device. The previous Lyra2REv2 algorithm was totally exploitable by FPGA devices, and the newer Lyra2REv3 algorithm will soon be affected as well. This would do away with fair mining and could push all the individual GPU miners away from Vertcoin.

FPGA Compared to other computing chips. Via Reconfigure.io

FPGA Compared to other computing chips. Via Reconfigure.ioThe Vertcoin developers are now working on a new algorithm which they are calling Verthash. It’s been in development for quite some time, and while there is still no release date set for the new algorithm the team has been diligently working to release it as rapidly as possible.

The team has said the algorithm will be similar to the Ethash algorithm used by Ethereum and will not only secure the blockchain for fair mining, but will also maintain the security of the network.

One other consideration the team has to deal with is the mining platforms that sell hashing power. These platforms could make it possible for a single entity to purchase enough hashing power to successfully launch a 51% attack on the network. As long as Vertcoin is able to keep its fair mining standard this type of activity will be blocked.

Even though remaining ASIC free and maintaining a fair mining environment is one of the goals of Vertcoin, it doesn’t mean the project will be successful. However, it does almost guarantee that the project will continue to live on with at least a small, but dedicated community of miners and users.

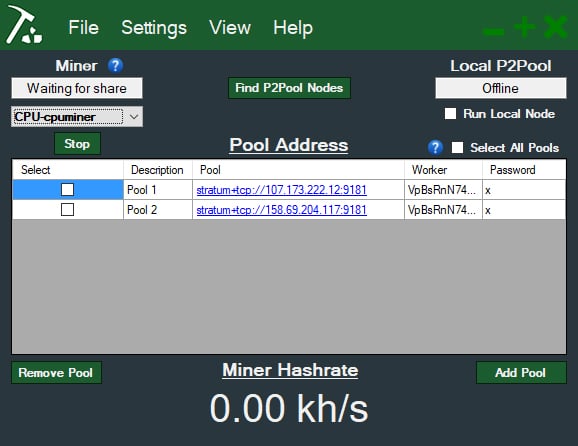

Vertcoin’s 1-Click Miner

In order to make mining as simple for users as possible Vertcoin has developed and released their own 1-click mining software. It has to be the easiest mining software for any cryptocurrency.

You can download the 1-Click miner from the Vertcoin website, but unfortunately, it is only available for Windows. In addition to the 1-Click miner, you’ll also need a wallet capable of storing Vertcoin and a Vertcoin mining pool.

UI of one-click miner. Via vertcoin.org

UI of one-click miner. Via vertcoin.orgAside from letting the software know which mining pool to use and what wallet address to send rewards to you also specify either CPU or GPU mining. Once you have those three things in place you can simply run the miner and collect your VTC.

Merged Mining with Vertcoin

Vertcoin has enabled merged mining, allowing users to mine more than one coin at a time, but currently, there aren’t many other coins that can be merge mined with Vertcoin. Unitus (UIS) has been available to be merge mined since the beginning, and according to the information at Give Me Coins you can also merge mine Monocle and Parallaxcoin through them.

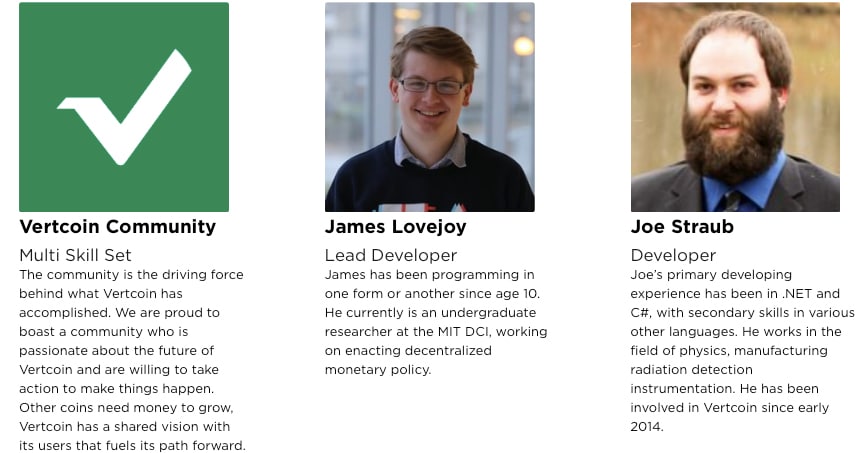

The Vertcoin Team

Vertcoin has historically been little more than a loose group of volunteer developers, and that’s still true in 2019. That will likely change in the near future as there has been an application filed with the IRS in March 2019 to create the Vertcoin Foundation.

This will help the project take advantage of tax-exempt status, and will give the project the legal framework necessary to file for trademarks and copyrights.

Some of the Vertcoin Developers & Team members. Image source

Many of the developers working on Vertcoin over the years have come from MIT since the coin and the project has close ties with the school. In fact, some of the work done with Vertcoin comes from other MIT projects, which allows for some free development for Vertcoin.

The downside to working solely with volunteer developers has been a negative impact on Vertcoin when developers have inevitably left for better-paying work over the years.

Once the Vertcoin Foundation has been created it will be able to offer salaries to the lead developers, giving the project a more consistent development atmosphere and maintaining top talent.

Vertcoin Community

One of the most effective ways in order to increase adoption for a cryptocurrency is through an active and engaged community. To that end, Vertcoin prides itself on its community.

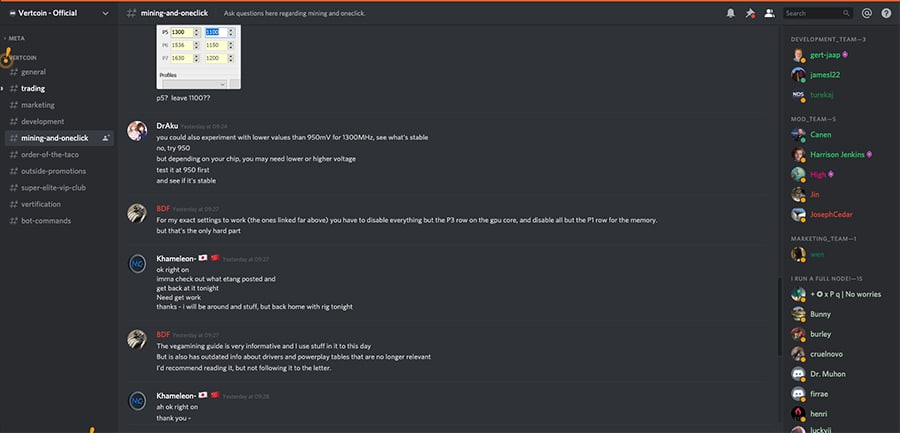

Firstly, they have their official Discord channel. They have over 9,400 members in the channel. I jumped into it to get a sense of the discussion and it was encouraging to see that many of the members.

Vertcoin Discord Channels with Community Chat

On the social media front, the Vertcoin Twitter has over 62k followers. They regularly keep their community up to date over here and they get a great deal of engagement from their followers.

There are also two subreddits on Reddit for the Vertcoin community. The official one has over 33k users. Then you have the vertcoin mining subreddit and this has 3.8k members. Both of these are pretty active with regular discussion.

Finally, Vertcoin has an official Medium blog that is relatively active. Every month they will share the latest updates on every aspect of the project - well worth following.

The VTC Token

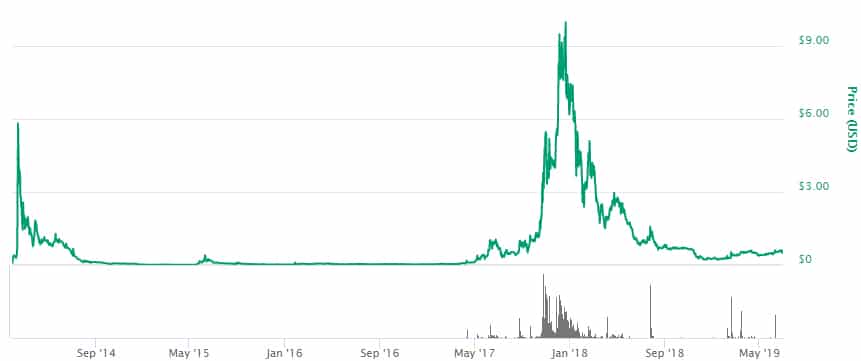

When Vertcoin launched in 2014 the token was trading at $0.07, but by the second day, it had nearly tripled to $0.20. It continued climbing and in just two weeks the price skyrocketed as investor demand for the coin reached a fever pitch. It hit $10.12 on February 5, 2014.

That spike was short-lived and just a week later price had gone back to $3.47. It continued declining and by September 2014 it was back at $0.07 for a loss of 99.25% from its high.

From there VTC declined even further, and by May 2015 it was at its all-time low of $0.005343. That was on May 6, 2015. By May 28 the price of VTC was nearly back to $0.20 and after a couple of weeks, it had nearly tripled again to almost $0.60 each. Price declined from there and was around $0.02 as 2016 began.

It remained in the range of $0.02 to $0.06 throughout 2016 and into 2017.

VTC's rocky price history. Image via CMC

A new rally began in April 2017, with levels reaching above $1 by June. Price pulled back and shot higher at the end of 2017 along with the broader cryptocurrency markets, reaching an all-time high of $10.53 on December 6, 2017.

2018 was a bad year for Vertcoin as it declined steadily alongside the rest of the cryptocurrency market during the bear market that lasted until 2019. As of mid-June 2019 price was above $0.60, but by late June 2019, the price pulled back to $0.52, showing that volatility remains high in this coin.

Buying & Storing VTC

Those who believe now is a good time to load up on some VTC can head over to CoinEgg, Bittrex, Upbit or Poloniex to buy. It is also listed on a few other exchanges but there is almost no trading volume on these exchanges.

When it comes to VTC trading volumes in general, they are quite thin on each of the individual exchanges. This could present an issue from a liquidity perspective. If you were looking to buy / sell large block orders of VTC then you may run into some slippage on the orders - so trade carefully.

Once you have your VTC, best practices would have you taking it off the exchange and storing it in an offline wallet. We are all too aware of the risks that come from the some of the largest exchange hacks.

Perhaps the safest place to store your VTC would be on a hardware device such as a Ledger Nano. This will keep your keys in a secure offline environment and interact with the Ledger PC client through a USB cable.

If you don't have a ledger then you can always use Vertcoin's Electrum Wallet. This is forked from the original Electrum wallet and is quite intuitive and easy to use. It is also a light wallet so it means that you can connect to remote nodes and don't have to download the entire blockchain.

Finally, if you are looking for a third-party wallet with mobile support then the Coinomi wallet could be ideal. This is also a multi-currency wallet that supports numerous other cryptocurrencies - over 500 to be exact!

Vertcoin Development

Something that I always like to do in order to determine how much work is been done on a project is to take a look at their public code commits.

For an open source project like Vertcoin, it really is "the proof is in the pudding".

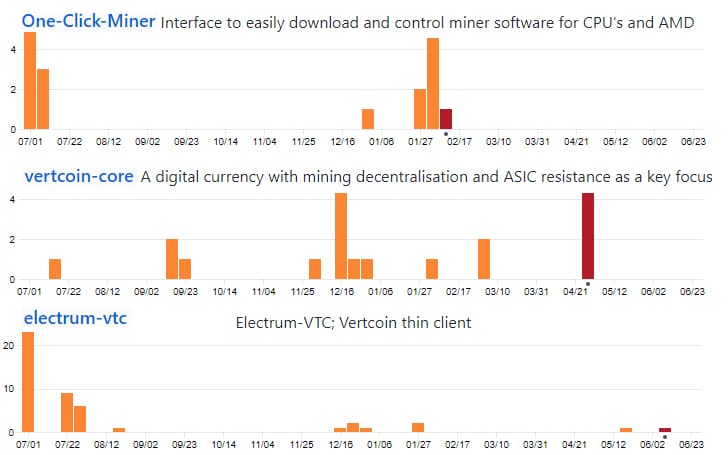

Hence, I decided to dive into the Vertcoin GitHub and take a look at their three most active pinned repositories. Below is the commit activity in these repos.

Number of commits in select repos over past 12 months

As you can see in the above, the developers are still busy pushing code to their repositories. Of course, this is much less than we see on some of the newer projects.

For example, if we were to take a look at the ranking of Vertcoin as based on the number of code commits, they come in at number 383 on Cryptomiso.

Having said that, Vertcoin is a more established protocol and was built off the Bitcoin core. This means that they did not have to build a protocol from scratch. This is also the reason why some of the newer projects like Insolar have so many commits.

Finally, Vertcoin is mostly community driven and the developers are not paid for their contributions. This is unlike many of the other projects that may have held an ICO or a pre-mine where the developers pocketed it.

Conclusion

In 2014 the International Business Times wrote an article praising Vertcoin and calling it a superior alternative to Bitcoin because of its fair mining policy. It also claimed that Vertcoin could be one of the altcoins to make its way to mainstream adoption.

That hasn’t happened yet, and as of June 2019, Vertcoin is ranked in the 188th spot based on its market cap. That certainly isn’t mainstream, but no other cryptocurrency has made it to mainstream adoption levels yet either, so there’s still hope.

Continued development and a dedicated community will keep it in the running, and if fair mining becomes one of the most important factors of a useful cryptocurrency Vertcoin will quickly jump into the top positions.

Considering its early start we can say that it’s impressive to see Vertcoin hanging on for six-and-a-half years already. It kept chugging along during the ICO and airdrop mania of late 2017, survived the bear market of 2018 and has come out stronger than ever.

And even though it had to fork three times over the years, it remains one of the few ASIC resistance coins, thanks to the commitment of the development team. That alone should ensure the survival of Vertcoin, and ensure it maintains a strong mining community.

While the mainstream prospects for Vertcoin may not look great right now, its consistent and steady growth could eventually leave it as one of the remaining cryptocurrency after most other disappear into the mists of history.

Featured Image via Fotolia

Disclaimer: These are the writer's opinions and should not be considered investment advice. Readers should do their own research.