Wanchain (WAN) Review: A Cross Chain Smart Contract Ecosystem

Wanchain is no doubt one of the most interesting smart contract blockchains to come out of Asia recently.

The main objective of the project is to create a financial market of digital assets by facilitating cross-chain transfers from one blockchain to another. However, this seems to be the main objective of numerous projects today.

How does Wanchain seperate themselves and how could we eventually see the project progressing?

In this Wanchain review, we will take a deep dive on the project by analysing the technology, use cases, team as well as the prospects for the WAN token. We will also take a look at some of the competition Wanchain is up against.

Let's jump in!

Overview

Today there are hundreds of Blockchains operating in the crypto space, each possessing their own coins that grant users access to utilize the services provided within their respective ecosystems.

As the industry continues to grow, the next logical step in its evolution is to provide ways for users to exchange value between Blockchains. This is the problem that Wanchain aims to solve.

Wanchain is creating a platform for transferring digital assets between different Blockchains. Users will be able to spend their cryptocurrencies in non-native Blockchains without having to trade them on exchange.

Wanchain’s own platform is an independent blockchain, which enables it to design a unique framework for transferring value between cryptocurrencies under one shared ledger.

With its cross chain transfer framework, Wanchain also provides a variety of financial applications:

- Borrowing and Lending

- Payment and Settlement

- Transaction and Exchange

- Investment and Financing

How WanChain Works

Wanchain uses a cross chain communication protocol combined with smart contracts in order to transfer data between Wanchain and other Blockchains.

This protocol has 3 functional modules:

Registration module:

In the registration module, Wanchain first registers the original chain participating in cross-chain transaction. Once registered, a unique ID is produced through specific algorithm rules from that particular chain. An ID registry is also maintained of that original chain to avoid fraud or security breaches.

The digital asset is then registered as transferring. Another unique ID is produced that outlines specific algorithmic rules for the transfer of the asset.

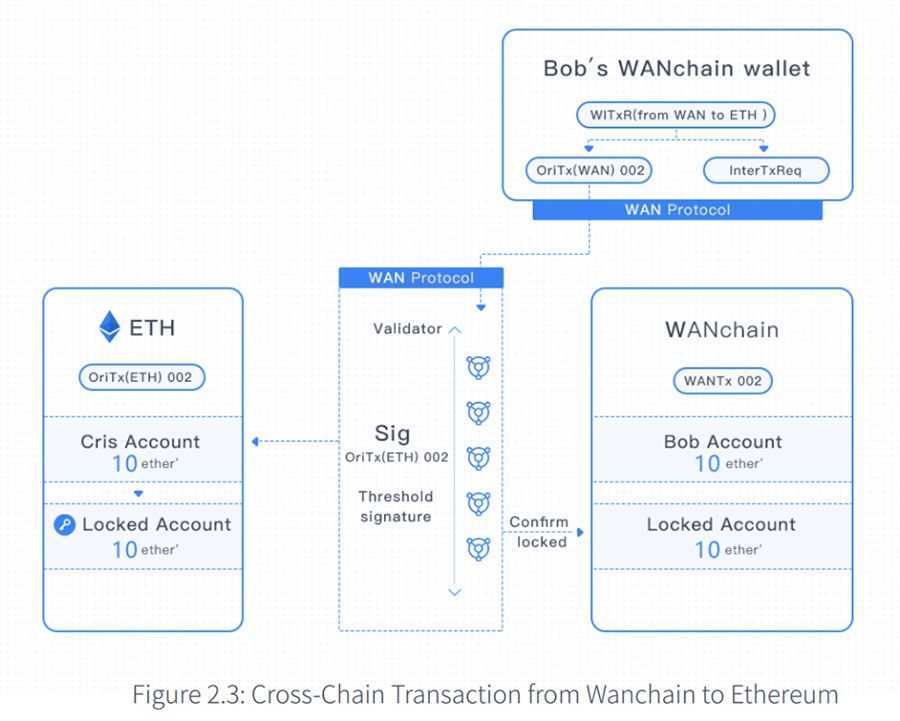

Cross-chain Transaction Data Transmission Module:

With this module, the user of the original chain delivers a cross chain transaction request to Wanchain. Wanchain’s validator node acknowledges the request as a success or not.

Lastly, Wanchain’s validator node sends the legal transaction to the original chain to complete the transfer-back process.

Transaction Status Query Module:

This module monitors the status of the transaction.

Wanchain uses the delegated proof of stake (or DPoS) consensus protocol. Within their protocol, there are 3 types of nodes that validate transactions.

- Vouchers are used to provide proof of transactions between the original account and the locked account.

- Validators: General verification nodes: Validator informs the Storeman of actions connected to the locked account and provides a complete record of operations on the Wanchain whenever a transaction reaches consensus.

- Storemen: in charge of maintenance and management of the keys of locked accounts to ensure they are secure and trustworthy.

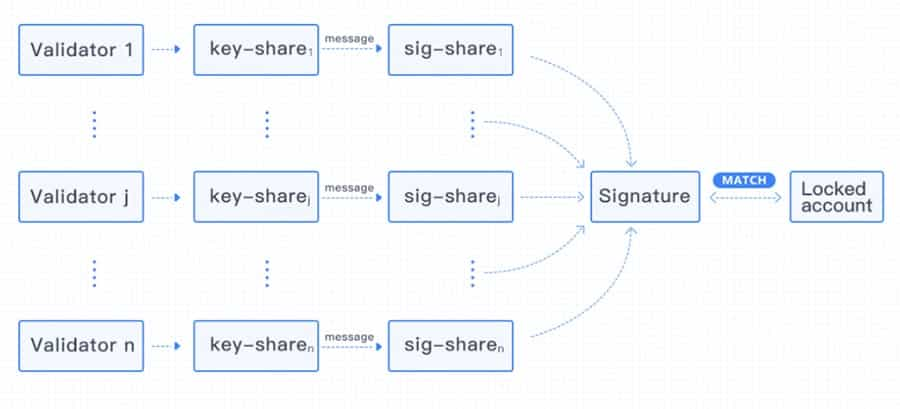

Locked Account Generation Scheme

In order to secure funds and keys when multiple parties are involved in a transaction, Wanchain uses a Locked Account Generation Scheme. In this scheme, keys are broken up into shares and distributed to different participants.

The Storeman node takes charge of maintaining the security of the keys.

The locked account generation scheme is important because it provides a system for locking the assets of the original chain during the transaction process. Only when certain conditions are met will the locked assets be unlocked and returned to the original account or some other account.

Today other cross chain systems use the Hashed TimeLock Contract scheme, the Trusted Third-Party Escrow Account scheme and the Multi Signature Account scheme. The Locked Account scheme is superior because it is fully decentralized, secure and provides efficient data storage.

Other technical features of WAN include their use of ring signatures and one time address generation to allow privacy when participating in a smart contract.

WanChain Team

Jack Lu – Founder

Jack is a Blockchain entrepreneur and technical expert who graduated from Peking University and Ohio State University. Prior to working at Wanchain he was the co-founder of Factom, a decentralized data storage company.

He also cofounded Wanglu-Tech, a blockchain enterprise company. Jack has also been a senior software architect at Hewlett Packard and Xerox.

Li Ni – Vice president

Li also Graduated from Peking University with a BA degree and acquired a Master Degree of Science (MSc) in Computer Science from University of Durham, UK. He has over 15 years experience in IT industry, and international experience in marketing, business development and sales.

Before joining Wanchain, Li worked for ZTE Telecommunication, Delta Electronics and SuperMap Software as directors and principals in business teams.

He’s currently vice president of Wanchain and Wanglu Tech for business development, marketing, PR and sales. Li also served as the IT consultant for FECC, the Ministry of Agriculture (MOA) in China, and the Food and Agriculture Organization (FAO).

Oliver Birch – VP of Global Communications

Oliver graduated from Lancaster University with a BA in Philosophy, Politics and Economics. Prior to Wanchain, he managed several clinical research sites and was a project manager for several start-up companies with years of experience working in the Altcoin crypto space community: advising, blogging and performing admin work.

Advisors

Wanchain’s advisors include:

- Feng Han Secretary-General of DACA

- David A. Johnston Chairman of the Board at Factom, Inc.

- Albert Ching Founder of i-Sprint

- Ramble Lan Chairman of North America Blockchain Association (NABA)

WAN Token

WAN tokens are used to pay cross chain verification nodes when making transactions. Wanchain launched their ICO in October 2017, raising $36million.

Their tokens were initially ERC20, but they have since moved away from the Ethereum blockchain unto their own, and are now allowing users to convert their ERC20 tokens to WANs.

WAN is currently priced at $0.97, but has been priced as high at $9.68 this year. This is mostly because of the major market rout that we have seen across cryptocurrencies since January.

Competitors

Wanchain is not the only blockchain working on creating a cross chain transferring solution. Aion and ICON are 2 major players in the space working on blockchain interoperability (the ability for Blockchains to communicate with each other).

Wanchain has teamed up with both Aion and ICON to form the ‘Blockchain Interoperability Alliance’. Together they have the shared goal of promoting interconnectivity between the isolated blockchain networks.

There are however some key differences between how each platform approaches the problem.

Aion

Based in Canada, Aion provides a Flexible and powerful API to link between Blockchains. They’re well connected with major Fortune 500 companies. They’re also capable of transferring value between private and public Blockchains, and provide interoperable Dapps.

ICON

ICON is a Korean based Blockchain that already has a number of ICO built on their platform, and has established more major partnerships than any of its competitors. They aim to connect across private and public Blockchains, multiple industries, governments and public services.

Ark

Ark is based on France. They use a delegated proof of stake consensus protocol. Their primary focus is on connecting public Blockchains, as well as off chain tools, IPDB, Card networks, IPFS, and more.

Roadmap

Wanchain has been a long time in development and hence are quite far down the line when it comes to their road-map. In January of this year they launched their first version on on the live network.

In may, they released their Wanchain Name Service (WNS). This is similar to the Ethereum Name Service (ENS) in that it allows developers to use the Wanchain blockchain for conventional .wan domain name addresses.

The main benefits of moving to a more conventional naming standard is that people on the Wanchain network can easily send WAN to people without having to remember hex address identifiers.

Further down the Roadmap, there are plans to launch Version 2.0 of the Wanchain blockchain. This will include integration with Ethereum and the Multicoin-wallet. They are about to launch the Alpha test net in the next month or so as stated in this medium post.

Moving on from there, the team hopes to have Wanchain 3.0 up and running by December 2018. This will allow for integration with Bitcoin and the multi-Coin wallet. Of course, this will depend on how quickly they can get their version 2.0 of the blockchain up and running.

Lastly, there are also plans to launch version 4.0 of the Wanchain blockchain in December of 2019. This will integrate Private chains with the Multi-Coin wallet.

Pros

- Market leader for blockchain interoperability

- Enables users to exchange value between Blockchains, which opens to doors for more transaction to occur, and for the crypto space as a whole to grow significantly

- Maximizes security through the use of Locked Account Generation Scheme

- Supports all ERC20 and protocol tokens

Cons

Despite the really advanced technology and strong roadmap, Wanchain is facing serious competition from ICON and AION.

ICON ranked first based on market cap (#23 overall on the crypto market). Wanchain is second (#43 overall), and AION is third (#46 overall). These other Blockchains have established a network of partnerships globally, while Wanchain is still primarily dominant in China. Wanchain will need to expand beyond China in order to establish the top position amongst cross-chain focused Blockchains.

Despite this, it looks like Wanchain should benefit from being part of the Blockchain Interoperability Alliance. We also expect that the target market is large enough for all of these blockchains to co-exist and flourish.

Conclusion

Cross-chain transfers are quickly becoming more important as Blockchains look to collaborate with another in order to scale faster.

Wanchain offers a gateway for Blockchains to communicate and coin holders to make transactions across multiple chains without the need to trade coins on exchanges.

Much like API’s connected different social media platforms, enabling users to sign on to any website with their Facebook credentials, the real value for the blockchain space will be allowing users to seamlessly transfer value from one blockchain to the next without any significant effort.

Based on this trajectory, I believe Wanchain is already ahead of the curve, and by partnering with other Blockchains focused on interoperability; they are creating the building blocks for the technology to reach mainstream adoption.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.