Gaming constitutes a new, up-and-coming and exciting venture in the world of blockchain technology and decentralised applications, and it is furthermore proving to be a highly sought-after and increasingly fascinating ecosystem within the digital asset space.

In a recent report, Accenture estimated that the full value of the gaming industry now exceeds $300 billion which is undoubtedly a staggering number, however, this metric should come as no major surprise. In fact, the consulting firm additionally noted that the gaming demographic has increased by half a billion players over the course of the past three years, with approximately 2.7 billion active players in the world, and is expected to grow at a rate of roughly 10% between 2021 and 2025.

Since 2018, players have spent more than $100 billion on virtual in-game assets, such as unique character skins, items and exclusive unlockable content. Thus, sooner or later, it was only natural to witness the development of a symbiotic relationship and an ultimate convergence between the majorly profitable, booming gaming industry and the disruptive, cutting-edge infrastructure offered by blockchain technology.

For Years, Gamers Have Spent Billions On Virtual In-Game Assets

For Years, Gamers Have Spent Billions On Virtual In-Game Assets This is primarily because gaming applications being developed on the decentralised frameworks powered by blockchain allow players to leverage some of the most avant-garde utilities when it comes to DeFi and NFT implementation, or ‘NFT-Fi’ in short, and forge a completely alternative set of economic principles and financial paradigms.

Thus, throughout 2020 and 2021, the blockchain-based gaming ecosystem has turned into a real powerhouse in the space, not solely for its gamification of DeFi elements, but because it began merging with the artistic, economic and immutable nature of non-fungible tokens, bringing life to perhaps one of the most exciting environments in cryptocurrency at the moment, Play-To-Earn (P2E).

Play-To-Earn: An Innovative Gaming Model

NFTs have been on an absolute moon mission as of late and, with their entrance into the gaming sphere, non-fungible assets have progressively structured new mediums to deliver value and embody innovative use cases. But, this highly anticipated gaming and NFT ensemble is indeed not that new a concept.

CryptoKitties Embody One Of The Earliest Expressions Of DeFi, NFTs And Gaming Symbiosis

CryptoKitties Embody One Of The Earliest Expressions Of DeFi, NFTs And Gaming Symbiosis One of the earliest expressions of blockchain gaming and NFT symbiosis dates back to 2017 when the cat-centric collectibles game CryptoKitties infamously almost brought the Ethereum blockchain to a total halt due to unprecedented demand and trading volume. Since then, a plethora of other arguably more sophisticated blockchain games have launched, with perhaps the two most iconic ones being Axie Infinity and The Sandbox.

Since its inception back in 2018, Axie Infinity has helped architect a new genre in the gaming vertical and has ever since focused on building the infrastructure necessary for players to enjoy the benefits of advanced, blockchain-powered gameplay while also profiting handsomely along the way. The underlying pioneering force of Axie Infinity relies on its entirely unique, value-rich and thriving micro-economic structure revolving around its platform and its platform alone. This is because, in parallel with players battling, breeding, buying and selling Axie NFTs, the game’s proprietary and in-house Play-To-Earn ecosystem has fuelled the development of an Axie-native, autochthonous economic model based on arbitrage opportunities.

Now, the ability to earn whilst playing the game also led to the formation of what is commonly referred to as an Axie Scholarship, a system that essentially sees well-established players and in-game NFT holders, called Managers, lend out their assets to other smaller players or gaming communities around the globe to generate yield on their behalf in exchange for a cut of the profits based on a revenue-sharing model.

This, in turn, led to the development of other more broad, community-based and gaming-central economies known as game guilds.

Game Guilds: Community, Yield And NFTs

While gamers have traded virtual assets for years, from Second Life’s real estate and World of Warcraft’s gold, to Dota and Fortnite’s cosmetic character skins, these virtual economies have thus far operated almost exclusively within ‘walled gardens’, or enclosed and centrally-controlled marketplaces that prohibit players from exchanging their in-game assets for real-world economic value, such as fiat currencies or crypto.

Players have tried to circumvent these centralised structures time and time again, usually resulting in untrustworthy markets subject to fraud and failure. However, blockchain-powered gaming can break these marketplaces wide open so that players can exchange value and earn yield for their work, dedication and time spent in-game.

Players Can Leverage Blockchain-Powered Applications To Earn Yield Whilst Playing Their Favourite Crypto Games Image via GeekCulture Medium

Players Can Leverage Blockchain-Powered Applications To Earn Yield Whilst Playing Their Favourite Crypto Games Image via GeekCulture Medium Thus, blockchain gamers can earn yield either by playing a game individually or by teaming up with a community of like-minded players which, in terms of purely generating revenue from gameplay, has thus far proven to be an exponentially more lucrative solution. With the emergence of online gaming back in the 1990s, particularly MMO-RPGs, gamers quickly built social and democratic structures within these virtual worlds forming ‘guilds’ or ‘clans’, and other gaming communities to coordinate around shared goals, or ‘quests’, and share in the spoils of victory, or ‘loot’.

The same underlying social principles can also be applied to blockchain gaming and its Play-To-Earn framework, where gaming communities around the globe coordinate and come together to perform a ‘quest’ and earn some of that mighty NFT loot.

But, as opposed to traditional gaming guilds designed as groups of players who routinely play together in a game on a ‘Free-To-Play’ basis, blockchain gaming guilds democratise the entire process of generating revenue through gameplay and take the concept of online entertainment to an entirely new level.

So, without further ado, let’s dive deep into one of the top crypto gaming guilds in the space right now, Yield Guild Games.

Introduction To Yield Guild Games (YGG)

YGG deems itself as a 'Play-To-Earn gaming guild bringing players together to earn via blockchain-based economies’ and as the ultimate settler of new worlds in the Metaverse.

YGG Is One Of The Most Prominent Blockchain Gaming Guilds Enabling Users To Leverage In-Game NFTs To Generate Yield Image via YieldGuild.Games

YGG Is One Of The Most Prominent Blockchain Gaming Guilds Enabling Users To Leverage In-Game NFTs To Generate Yield Image via YieldGuild.Games Like the majority of existing P2E guilds, the Manila-based YGG is structured as a Decentralised Autonomous Organisation (DAO) for investing in NFTs used in virtual worlds, blockchain-based games and emerging Metaverse ecosystems.

YGG was built on the belief that digital economies will someday be worth way more than physical and tangible ones and, as one if not the most successful guild in the space at the moment, it combines DeFi, NFTs and gaming to forge an exciting new paradigm of employment, one that is fully guided by its participants.

The Origins

The story of YGG and its initial proof of concept date back to 2018, when gaming industry veteran Gabby Dizon started lending out his Axie NFTs to other Axie Infinity players who couldn’t afford to buy them outright. And by October 2020, it was clear that Axie had created an innovative employment model that could help players in the Philippines generate additional revenue sources while also enjoying the gameplay.

Scholarships Enable Axie Infinity Players To Borrow Axie NFTs In Order To Generate Yield In-Game Image via TechShali.com

Scholarships Enable Axie Infinity Players To Borrow Axie NFTs In Order To Generate Yield In-Game Image via TechShali.com As a result, YGG was co-founded by Gabby Dizon, Beryl Li and Owl of Moistness in October of 2020 and its primary objective was to introduce as many people as possible to the play-to-earn revolution spearheaded by Axie Infinity, particularly in the South East Asian region.

According to the YGGSPL Litepaper and as part of its initial project roadmap, YGG set some rather straightforward and realistic goals, with these being:

- Researching and investing in the most profitable and yield-bearing NFTs in the Metaverse ecosystem.

- Building a global, decentralised economy of P2E Gamers.

- Producing income by leveraging and renting out valuable in-game NFTs.

- Encouraging the development of a global gaming community through active participation in the guild.

Currently, after just over one year into its existence, the YGG guild is already one of the largest and most prominent of its kind, having registered almost 250,000 members across its social media platforms and expanded operations into a variety of P2E games.

NFTs Under Management

As part of the guild’s investment portfolio, YGG manages a trove of game-related NFTs, digital assets and virtual land parcels which can be leveraged and implemented in-game by members to produce greater earnings for both themselves and YGG through a revenue-sharing model.

YGG Has Invested Extensively Into A Variety Of P2E Games And It Will Actively Look To Expand Its In-Game NFT Allocations Image via YieldGuild.Games

YGG Has Invested Extensively Into A Variety Of P2E Games And It Will Actively Look To Expand Its In-Game NFT Allocations Image via YieldGuild.Games In addition to Axies, YGG’s Assets Under Management (AUM) include gaming NFTs from a plethora of P2E protocols including:

Given the expected growth trajectory for the gaming industry in the near and mid-term outlook, in tandem with the ongoing development of the GameFi sphere, YGG will actively look to expand and acquire more NFTs from a set of up-and-coming, promising games in the future.

How Does YGG Work?

The business model implemented by Yield Guild Games is indeed rather unique, and it is based on producing real-world, monetary value by creating new virtual worlds and supporting the emerging digital economy through the buying and renting out of top-tier NFTs to players.

The primary source of income for the DAO ecosystem in YGG is directly correlated to the ownership of YGG-owned NFT assets. Now, in-game NFT ownership inherently presents a series of advantages for both the guild and players, as they will equally benefit from the rise of the game’s unique economic value being reflected in the value of its NFTs on the open market, producing a sophisticated, dynamic and cyclical market structure revolving around the guild’s primary economy. Guild members will then be able to use these NFTs, either their own or rented, as the proprietary medium and trading currency to extract in-game rewards, bringing the Play-To-Earn framework to life and fundamentally expanding its use cases.

Now, it is important to note that, while it is currently feasible to allow players to farm or rent NFT assets, the present ERC-721 token standard does not technically enable such functionalities. Consequently, the process for farming and renting NFTs still remains within a centralised and somewhat siloed environment. Thus, to remedy this, YGG has designed an in-house smart contract architecture to issue ownership tokens to create a database to monitor and track ownership and rental assets, which is actually a rather cost-effective solution as it does not require any gas fees to be implemented. In this way, users will receive native YGG tokens by renting YGG-owned NFTs and participating in active gaming guilds.

Axie NFTs taken from the YGG guild, for instance, may be used to cultivate Smooth Love Potion (SLP) tokens within the game and the SLP earned during gameplay will be returned to the DAO, with the player receiving a predetermined share of YGG tokens for playing and participating in the DAO structure.

Furthermore, in order to engage and vote in governance proposals, as well as benefit from the DAO’s various features, guild members will require native YGG tokens which will act as their entry ticket into the ecosystem’s governance structure.

YGG’s Main Architecture

In its entirety, the main architecture of the YGG DAO can be subdivided into a few major components and defining elements all working in conjunction with one another:

- Treasury

- YGG Vaults

- SubDAOs

Subsequently, in order to gain a better understanding of how this works, a comprehensive analysis of each one seems only constructive.

YGG Treasury

First of all, the Treasury.

The YGG Treasury Is In Charge Of Overseeing In-Game NFT Asset Management Image via Yield Guild Games Medium

The YGG Treasury Is In Charge Of Overseeing In-Game NFT Asset Management Image via Yield Guild Games Medium The primary finality of the YGG Treasury is to oversee the management of YGG’s assets to maximise value returned to the DAO over time. The Treasury performs a series of economic activities such as the purchase of assets in the form of cryptocurrency, virtual assets in the metaverse such as land plots, Simple Agreements For Future Tokens (SAFTs), in-game tokens, as well as innovative NFTs that can benefit the development of the GameFi sphere overall. The Treasury is also in charge of managing locked, unvested and undistributed tokens to all guild members and to any affiliated third parties.

Following in the footsteps of the Axie Infinity Scholarship model, the Treasury also provides guidance in events that involve debt, interest payments and acquisition of assets, including any buybacks and future fundraising rounds. The Treasury also performs all major financial operations such as accounting, audits, reporting and tax.

It is important to note here that the Treasury’s assets are currently managed by the three co-founders via a multi-signature Gnosis wallet, with two out of three Trezor wallet signatures required to validate transactions.

Second in line, the YGG Vaults.

YGG Vaults

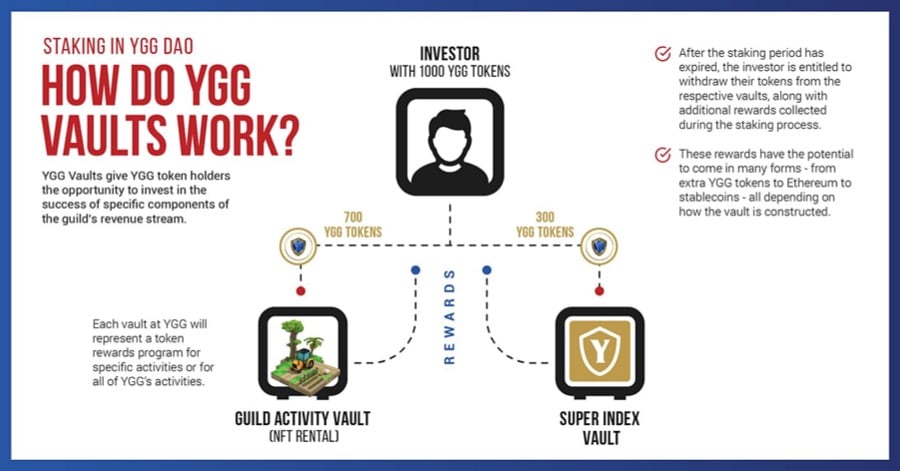

Unlike traditional DeFi platforms that involve staking tokens to accrue yield at a fixed interest rate or allocating tokens to a liquidity pool to earn a share of the collected revenue, the YGG DAO incorporates a slightly different methodology in that its tokens can be staked into a number of different YGG Vaults.

With YGG Vaults, Investors Can Allocate Capital And Bet On The Upside Potential Of A Specific Guild Activity Image via Yield Guild Medium

With YGG Vaults, Investors Can Allocate Capital And Bet On The Upside Potential Of A Specific Guild Activity Image via Yield Guild Medium Each Vault represents a compartmentalisation of the token rewards derived from either one or all of the guild’s revenue sources. For instance, one of the Vaults could be dedicated to the revenue from the breeding and sales of Axie NFTs, whereas another could be dedicated to the distribution of revenue acquired from NFT rentals.

These aforementioned token rewards generated from gameplay or NFT lending are distributed to guild members according to:

- The portion of tokens staked by each guild member.

- Amount of revenue generated by the source assigned to the Vault.

This essentially means that, as opposed to offering a traditional fixed interest rate on staked assets, YGG Vaults give YGG holders the opportunity to invest in the success of specific components of the guild’s revenue stream.

This could indeed prove to be an appealing proposition for investors, as it allows those YGG holders who want exposure to revenue from the DAO’s Axie breeding program or the soon to be announced Monkey Ball NFT rental program, for instance, to stake their YGG tokens in a Vault built specifically for that purpose.

YGG Vaults Allow Token Holders To Gain Exposure To Particular Programs Within The YGG Ecosystem Image via Yield Guild Games Medium

YGG Vaults Allow Token Holders To Gain Exposure To Particular Programs Within The YGG Ecosystem Image via Yield Guild Games MediumInterestingly, there are also plans to develop a YGG Vault representing a collection of all yield-generating activities, known as the YGG ‘Super Index Vault’, which will include returns in the form of rewards derived from subscriptions, merchandise, NFT rentals, Treasury performances and an Index of all SubDAOs.

Which leads us on to the third major component of YGG’s DAO structure, SubDAOs.

YGG’s SubDAO Ecosystem

SubDAOs embody perhaps one of the most cutting-edge elements within YGG’s DAO structure.

SubDAOs Are An Integral Component Of YGG's Main DAO Ecosystem And They Act As Subsidiaries Of The Underlying Organisation's Structure Image via Yield Guild Games Medium

SubDAOs Are An Integral Component Of YGG's Main DAO Ecosystem And They Act As Subsidiaries Of The Underlying Organisation's Structure Image via Yield Guild Games Medium In essence, a SubDAO is a specialised portion of the YGG DAO ecosystem that is centred around a specific game’s activities and assets. For instance, there will be one SubDAO dedicated exclusively to Axie Infinity players, another to League of Kingdoms, another to Zed Run, one to Monkey Ball, Illuvium, The Sandbox, Star Atlas, and so on and so forth.

What’s more, token holders within a SubDAO become ‘citizens’ of the particular game that the SubDAO is associated with, playing and working together to increase their collective yield generated from gameplay. In addition to this, players within a SubDAO can use assets owned by the main DAO Treasury to better equip and strengthen their in-game characters, thus furthering their potential for greater income while also increasing the quality of their gameplay.

Now, as the primary objective of a DAO structure is to automate the functions of an organisation, SubDAOs can inherently streamline this automation process by compartmentalising it into highly-specialised fractions, boosting the effectiveness of the DAO’s native architecture as a whole. Furthermore, SubDAO participation will be motivated by a series of incentives provided by the guild, such as greater DAO contributions destined to highly-performant players from a specific SubDAO. This means that the better the SubDAO members perform, the more they can contribute to the overall DAO and, thus, the greater they are rewarded for their contributions.

In parallel with these game-specific SubDAOs, YGG is broadening its horizons, quite literally, through the development of regional, DAO-affiliated, geographical partner entities such as the YGG South East Asian SubDAO, or YGG SEA.

Regional SubDAOs: YGG SEA

YGG SEA lines up with Yield Guild's roadmap to help expand and bring Play-To-Earn experiences to the vast global gaming community, starting with South East Asia. And for good reason too!

YGG SEA Is Yield Guild's South East Asian SubDAO Ecosystem Looking To Expand Play-To-Earn Experiences In The Region Image via YGGSEA

YGG SEA Is Yield Guild's South East Asian SubDAO Ecosystem Looking To Expand Play-To-Earn Experiences In The Region Image via YGGSEA Technically speaking, YGG SEA is a SubDAO designed specifically to capture South East Asia’s emerging P2E market and gaming activities and, according to YGG SEA’s documentation, the South East Asian region currently offers greater return opportunities compared to other areas primarily because of its large community of gamers and play-to-earn aficionados, making it the perfect environment for a localised SubDAO structure.

This is because countries such as Indonesia, Thailand, Vietnam and Malaysia, among others, are characterised by an unprecedented young working population that has traditionally lacked spending power due to regional politico-economic instabilities and now, in 2021, due to the pandemic. However, because of the huge financial upside offered by P2E, the recorded penetration of play-to-earn ecosystems in the area is currently among the highest and most significant. Therefore, according to its Roadmap, YGG SEA will initially focus on Indonesia, Vietnam, Singapore and Thailand in Phase 1 before eventually implementing its subsequent Phases of expansion throughout the entirely of South East Asia.

The YGG SEA SubDAO will boast a team of Local Operations Experts with deep networks in the South East Asian gaming sphere, with members associated with gaming production behemoths such as Electronic Arts, Unity, Axie Infinity and Yield Guild Games. In tandem with this, the SubDAO aims to establish multi-country local operations and translation houses, hire regional community managers, set up localised strategic and marketing partnerships as well as tech integrations to ensure efficient fiat on and off ramps, and ultimately create a geographical ancillary entity to Yield Guild’s Main DAO ecosystem.

The SubDAO is spearheaded by:

Evan Spytma - Co-Founder

Brain Lu - Co-Fouder

Richie Jiaravanon - Co-Founder

Josh Ho - Co-Founder

Irene Umar - Co-Founder

The ancillary will focus, firstly, on identifying and investing in locally-significant P2E games at early-stage and, secondly, on working in conjunction with the Main DAO and YGG's Treasury to deliver in-game NFT assets to local gamer communities in order to maximise and extract regional value whilst benefitting the development of P2E in the area as a whole.

YGGSEA SubDAO Token

In a similar fashion to YGG, YGG SEA will implement its own SubDAO native token, called YGGSEA, to allow members to vote in governance proposals, ecosystem reward allocations, local strategic partnerships, LP staking and more.

Capped at a maximum supply of 1 billion tokens, the YGGSEA token will derive its value from a combination of economic principles and will abide by the formula displayed below.

YGGSEA Will Derive Its Value From A Series Of Economic Elements Working In Conjunction With One Another Image via YGGSEA

YGGSEA Will Derive Its Value From A Series Of Economic Elements Working In Conjunction With One Another Image via YGGSEAThus, the YGGSEA token will gain its market valuation from an addition of:

- A regional economic index tracking the cumulative yield generated by the SubDAO Treasury’s in-game NFTs allocated to local gaming communities.

- The fair value of the NFTs within the YGG SEA SubDAO portfolio.

- A multiple of the SubDAO’s social growth and user base.

To date, YGGSEA has raised $15 million to help fund its growth from top-tier VCs in the blockchain space, including Crypto.com Capital, YGG, Infinity Ventures Crypto, Animoca Brands, MindWork Ventures and DCG, among others.

In terms of upside potential, as per the majority of tokens in the crypto space, the future value of YGGSEA will be entirely dependent on the growth of its ecosystem, in both economic and social terms, and on the percentage of regional value captured by the SubDAO. YGGSEA, like YGG, is a bet on the future success of play-to-earn environments and on the increasingly apparent integration of non-fungible tokens within our daily lives and online economies. Thus, while the native token of the YGGSEA SubDAO is yet to be launched, its use cases and utility might very well prove to be an interesting proposition in the long-run.

Disclaimer: YGG SEA has concluded its Seed, Private and Strategic Funding Rounds. Coin Bureau will be investing in the YGG SEA strategic round.

YGG Token

With a circulating supply of 69 million, YGG is the native ERC-20 governance and utility token of the Yield Guild Games ecosystem.

YGG will be utilised for staking in YGG Vaults, voting in governance proposals, funding the DAO Treasury, rewarding P2E gamers as well as Yield Guild’s advisory team.

YGG has a maximum circulating supply of 1 billion tokens being minted in aggregate with its distribution occurring in multiple phases scheduled at different dates and for different purposes. YGG’s monthly distribution breakdown can be consulted here.

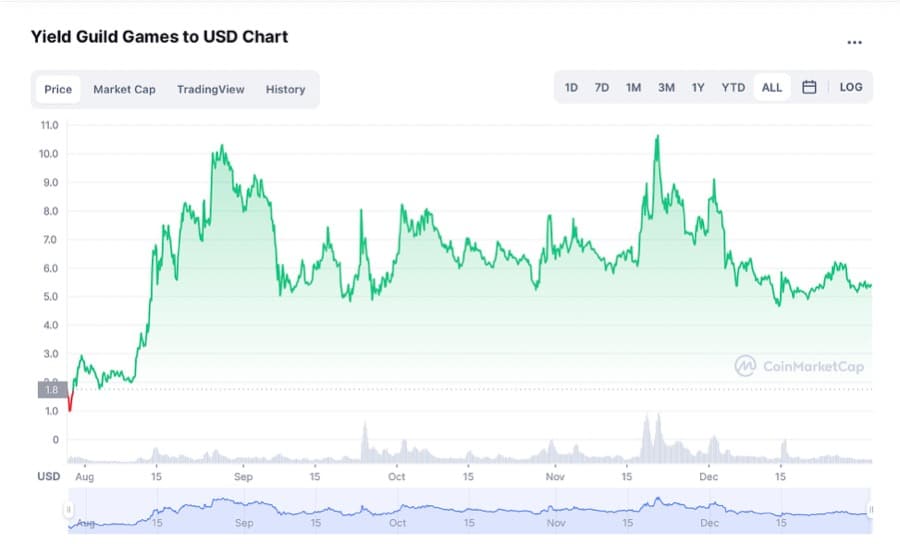

YGG Has Retraced Rather Drastically From Its November Highs Of Over $11 Image via CoinMarketCap

YGG Has Retraced Rather Drastically From Its November Highs Of Over $11 Image via CoinMarketCap At present, YGG has a market capitalisation of $370 million and a fully diluted market cap of $5.3 billion. YGG is currently trading above the $5 mark and is down more than 50% from its all-time-high of $11.50 which it hit in November of 2021. YGG is currently listed on some of the most liquidity-rich exchanges in crypto and it can be purchased on Binance, KuCoin, Huobi and Uniswap, among others.

In terms of price potential, the upside that the YGG token may experience is contingent on a variety of factors. Firstly, if YGG continues to onboard top-tier games that turn out to be a success in the long-run, then the future does indeed look promising for YGG token holders. Secondly, the rental offerings that YGG offers are unique and one-of-a-kind in the sense that not many NFT or gaming NFT platforms provide this type of feature. Pair this with the ongoing development of the YGG Vaults, holders may very well be attracted to deposit their assets into these Vaults to earn additional staking rewards from the YGG ecosystem as a whole, which is actually a win-win scenario for both holders and YGG.

In addition, it is important to emphasise here that given the eruption of the GameFi market in 2021, the revenue from P2E games is only expected to grow in the long-term. Thus, if we assume that YGG is poised to become the ultimate, go-to gaming guild in the space for players and investors to earn rewards, consequently it is reasonable to assume that YGG’s market and ecosystem value will appreciate over time.

Always Remember To Do Your Own Research! Image via Tenor.com

Always Remember To Do Your Own Research! Image via Tenor.com However, as per usual, there’s nothing more relevant here than doing your own research!

YGG IDO

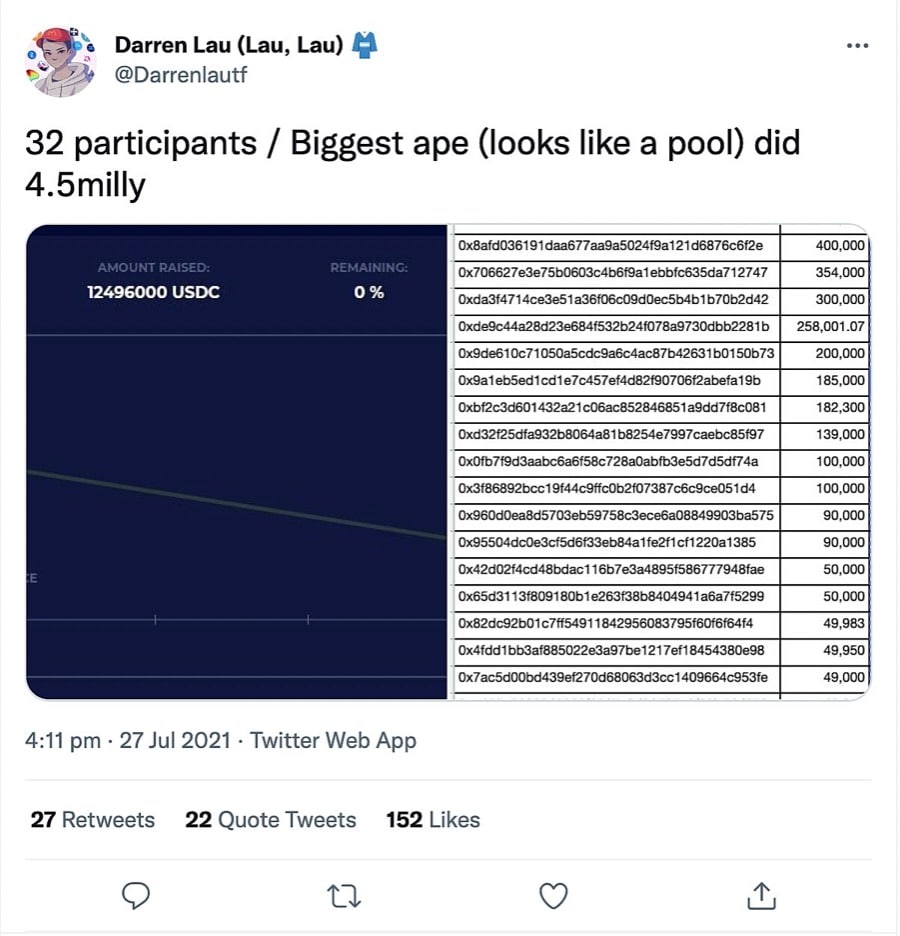

YGG held its Initial DEX Offering (IDO) on July 27th 2021 at MISO by SushiSwap.

The offering saw YGG raise roughly $12.5 million, with the token sale distributing 25 million tokens or 2.5% of the project’s 1 billion token supply via a Dutch auction at a price of roughly $0.50 per token.

Disappointed investors criticised the sale after 32 wallets exhausted the allocation in just 31 seconds, even though YGG’s Discord exceeded 47k members at the time.

One Wallet Managed To Secure A 4.5 Million Allocation Of YGG Tokens At IDO Price Image via Twitter

One Wallet Managed To Secure A 4.5 Million Allocation Of YGG Tokens At IDO Price Image via TwitterWhat’s more, a single address appears to have been able to snatch up a whopping 4.5 million YGG tokens, or 18% of the tokens available in the offering, however, onlookers have speculated that this address could very well have been a liquidity pool. As a result of this and in order to quench any suspicions about possible whale activity, YGG co-founder Gabby Dizon publicly announced that the 32 wallets did not belong to a group of individual whales, but to a different group of investors personally dedicated to the project’s long-term vision.

Investors

YGG raised $1.3 million during its Seed funding round in March of 2021 spearheaded by heavyweight VCs such as Animoca Brands, Sparq, Delphi Digital and Scalar Capital. Then, in June, Yield Guild raised an additional $4 million during its Series A round led by BITKRAFT Ventures, ParaFi Capital and Animoca.

Finally, in August of 2021, Yield Guild Games raised $4.6 million in a funding round led by digital asset behemoth a16z, with participation from Kingsway Capital, Infinity Ventures Crypto, Atelier Ventures and the gaming entrepreneur Gabriel Leydon. The funding was designed to allow YGG to increase its digital asset portfolio and help expand and grow its community of play-to-earn gamers and guild members.

Team

YGG has an incredibly strong and well-experienced founding team, with its members being long-term gaming and blockchain gaming veterans as well as deep connoisseurs of the crypto space. As previously discussed, the Team at YGG is dedicated to the ongoing development of the GameFi ecosystem and to facilitating user-onboarding into the play-to-earn experience on a global spectrum.

YGG's Founding Team Image via YieldGuild.Games

YGG's Founding Team Image via YieldGuild.Games The primary Team at YGG is made up of:

- Gabby Dizon - Co-Founder

- Beryl Chavez Li - Co-Founder

- Owl of Moistness - Co-Founder

Conclusion

GameFi currently represents one of the most roaring and promising ventures in the digital asset realm and, given its expected growth trajectory over the course of the next few years, its future potential, quite frankly, remains untapped.

With the newly-rediscovered match and symbiotic relationship between DeFi, NFTs and gaming, the proposition of blockchain-powered gaming projects seems to have taken the markets by storm in the last year, ushering in an entirely new set of financial paradigms and investment theses revolving around Metaverse worlds and interactive gameplay.

However, in-game NFTs have been a hot commodity for quite some time now and, due to this, the barrier to entry into some blockchain games is high and it simply just isn’t cost-effective nor a feasible option for many gamers around the globe.

Gaming guilds such as YGG, for instance, via its sophisticated DAO and attractive revenue-sharing model, allow players to gain access to some of the hottest, top-tier in-game NFTs in the space at the moment, giving them the opportunity to generate yield whilst enjoying the innovative gameplay offered by GameFi and blockchain technology.

While the future of the GameFi sphere still undoubtedly remains unclear, guilds such as YGG could prove to be the ultimate, go-to solution for social gaming communities around the globe looking to generate additional revenue streams that can improve, enhance and ultimately change lives, especially in areas hit by political and economic instability.

Therefore, while still uncertain as a whole, the future of Yield Guild Games, of its YGG token and of its growing regional SubDAO ecosystem appears to be very promising indeed.