Tradenostix: Our Review of The Latest Crypto Analytics Tool

Tradenostix is an up and coming company that is targeting the B2B and institutional sectors.

They track and calculate cryptocurrency portfolios. Unlike the large selection of free mobile application to track crypto trades, the Tradenostix platform is much more robust.

While they will release a final retail product, which is currently in beta, their company has a large focus towards enterprise functionality, which caught our attention. One simple example is that an accounting firm will be able log in to one portal, view all of their clients, and service them much faster.

They are trying to solve headaches around tracking cost basis, hard forks, mining income and other pain-points, which ultimately allows for users to easily generate more formal and sophisticated financial reports.

Overview

Their main goal is to create a bridge between the cryptocurrency industry and traditional financial services industry, so that businesses and institutional investors feel comfortable entering the crypto market.

It also provides them with a great deal of confidence when servicing their cryptocurrency clients knowing that they have a reliable, automated backend solution to free up their bandwidth.

We spoke with their CEO and co-founder Michael Rosenblat to discuss their goals and understand where they stand as a company.

Let's dig into some of the main benefits of the Tradenostix platform.

Experienced team

From our discussions with them, they seem to have an experienced team that has an understanding of traditional finance, cryptocurrencies and technology. It seems that many existing solutions in the cryptocurrency market are created by developers who do not have an understanding of finance.

Michael brings the financial knowledge. He has a background in the fintech space working with hedge funds, fund administrators, prime brokerages and other institutional clients. As a result, he understands how a sophisticated reporting portal should work, and different types of reports these clients need to view.

Co-founder and CTO, Aaron Pardes is an experienced developer who has been writing software for 15 years. He has worked with a range of companies from healthcare to fintech and has broad expertise in technology.

Accurate and reliable data

We gained some insight in to their process regarding exchange integrations. Michael mentioned that their number one priority is data accuracy. With each exchange integration, they create their own account, and perform each possible trade (deposits, withdrawals, buys and sells in different base markets).

They then pull data, normalize it and reconcile what their system calculates to what the true balance is on the exchange. Until this reconciliation process is complete and thoroughly tested, is when they push this integration to production for their users.

It is also worth mentioning that they are the only platform which ‘scans for hardforks’. Michael told us:

When you import data from these exchanges, they do not have an explicit transaction type for hard fork deliveries. For example, if you hold Bitcoin Cash on Bittrex from the hardfork delivery, no system would show you holding Bitcoin Cash after importing your data

He went on to say that they actually have a growing database that tracks at which blocks different coins hardforked, and when different exchanges delivered those forked coins to their users. Then, upon calculating a user’s portfolio, they create a transaction showing the hardfork delivery.

So, for example, you do indeed have a Bitcoin Cash balance on the proper date on each exchange if necessary.

Users also have complete control of their portfolio. They can edit, delete, or create manual transactions if needed.

Sophisticated reporting functionality

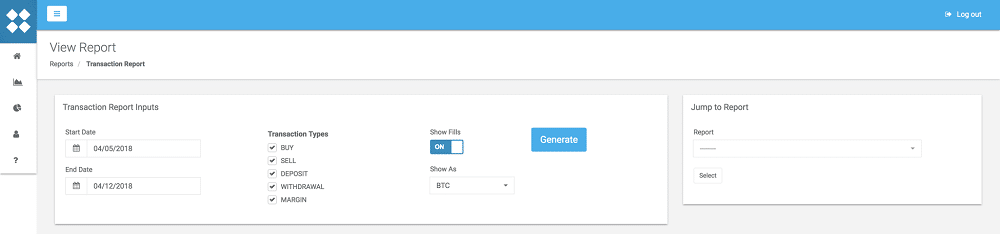

A unique aspect to their reporting portal, is that it allows their reports to be ran by date range, and adjust specific parameters before generating a report. This is similar to how the traditional financial market works. Here is an example of their transactions report parameter options:

Sleek design and UX

Their design and user experience is very intuitive and easy to follow. Their system has clean reports, with grand totals, so the data is expressed in a very comprehensible format.

Potential Concerns

We were quite impressed with our discussion with Michael on the Tradenostix platform. The technology is no doubt going to provide many businesses with better tools for data analytics.

Having said this, there were one or two concerns that we initially worried about with Tradenostix. These include the following.

Young Company

Keep in mind that they are still a young company. They are currently working with different firms to understand their ideal solution. While they are in beta for the retail market, time will tell if the B2B side of the industry will be referenceable.

This means there is still some major development required to service enterprise clients, one small example being formal US tax reports to be exported, rather than generic holdings and realized/gain loss reports.

More order types

As of now, they are very trading oriented, so you cannot enter mining income or gifts as an order type yet.

Limited exchange and wallet integrations

Currently they are integrated with Bittrex, Poloniex, GDAX, and Kraken Exchange. We understand that exchange integrations is an ongoing process, but we would like to see more connections to exchanges. They also are not currently integrated with any offline wallets.

We asked Michael about this and he told us that they are in active development for more exchange integrations. They hope to release these integrations over the coming months. He also explained that you can manually enter your offline holdings in their system should you have a wallet that is not supported.

Conclusion

We are optimistic about their B2B ventures from our discussions with them. They are very serious about this effort, and we think it will create a bridge for the traditional financial sector to feel comfortable entering the cryptocurrency industry.

Keep in mind they have work to do, but the product they have completed so far works well, and we will be following them as they progress. Learn more at their website.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.