If you’re reading this, chances are you understand the incredible future that cryptocurrency, and blockchain technology in general, is likely to experience. Equally, it may have come to your attention the incredible sums of money that some cryptocurrency investors have made to date. Either way, an understanding of the risk involved in various cryptocurrency investments is essential when it comes to building a crypto portfolio of your own.

Ultimately, the make-up of your portfolio, with regards to any asset, will hinge on your personal risk appetite. Are you looking to park some of your hard-earned cash into a long-term position in a relatively stable asset that might produce steady rewards over time? Or are you looking for as quick a return as possible and don’t mind risking the potential loss of some of your funds?

Chances are, if you’re looking at cryptocurrencies at all, your risk tolerance is reasonably high, given the high volatility involved in nearly blockchain investments. However, within the crypto-space, assets vary massively in volatility and, thereby, in risk-level.

To make life easier, we’ve broken down the cryptocurrency market into five categories, beginning with the safest and moving downwards towards the riskiest assets. These five categories are:

- Stablecoins

- Bitcoin (BTC)

- Altcoins

- Initial Coin Offerings

- Meme coins

The first thing to say, before we delve into the realms of different cryptocurrencies, is that the following rankings are based on prevailing opinion and past performance. In the grand scheme of things, cryptocurrencies are in their infancy, and any predictions of future price movements are fundamentally extremely speculative in nature. That said, using a few criteria, we are able to effectively rank various assets according to their respective risks.

To build on this concept, Guy also put together a video on how to build a crypto portfolio with tips for maximum gains.

Stablecoins

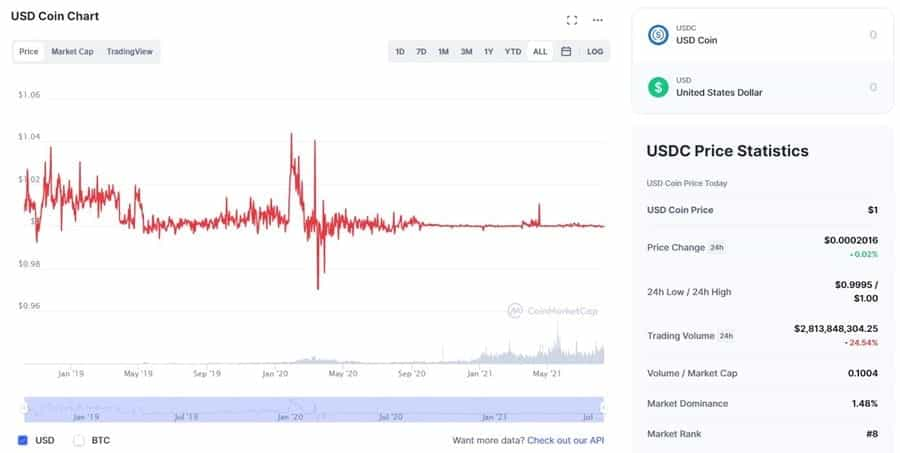

At the least risky end of the cryptocurrency spectrum are stablecoins. These are cryptocurrencies that have their value tied to some other asset such as gold or fiat currency. Examples include USD Coin (USDC), USD Token (USDT) and PAX Gold (PAXG).

As you might have guessed from the names, USDC and USDT are pegged against the US dollar. One USDC, for example, is fully backed by one dollar, held in a bank account. Each time someone purchases a USD Coin, Circle, the developer of USDC, are obliged to purchase one US dollar. What’s more, every USDC is fully redeemable for one US dollar. The result is that the value of one USDC, at any point in time, is almost exactly one USD.

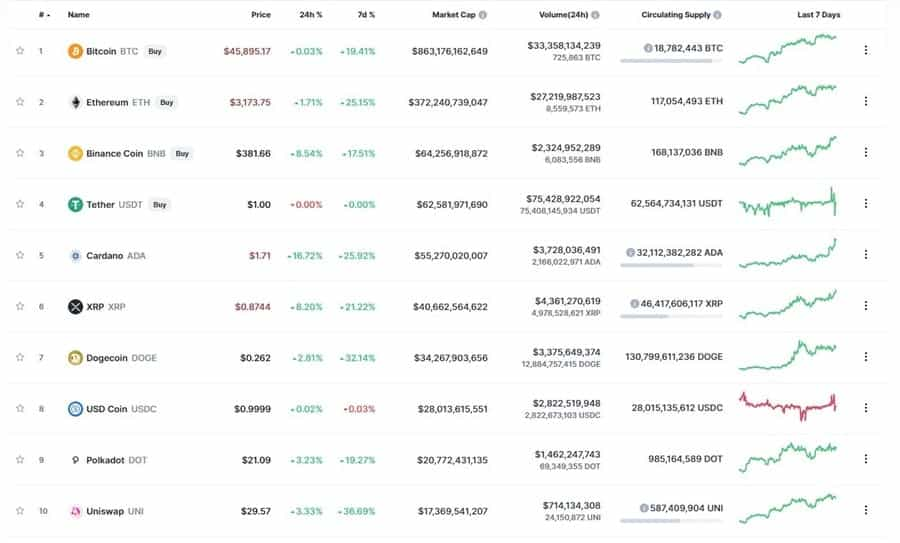

Below image from CoinMarketCap.

Similarly, PAXG is pegged to gold, with one PAXG token fully backed by one fine troy ounce of gold. If you own a PAXG token, you also own the underlying asset of one fine troy ounce of gold. PAX Gold is the only gold token that you can redeem for LBMA-accredited Good Delivery gold bullion bars. This gold is held in a vault by Paxos Trust Company.

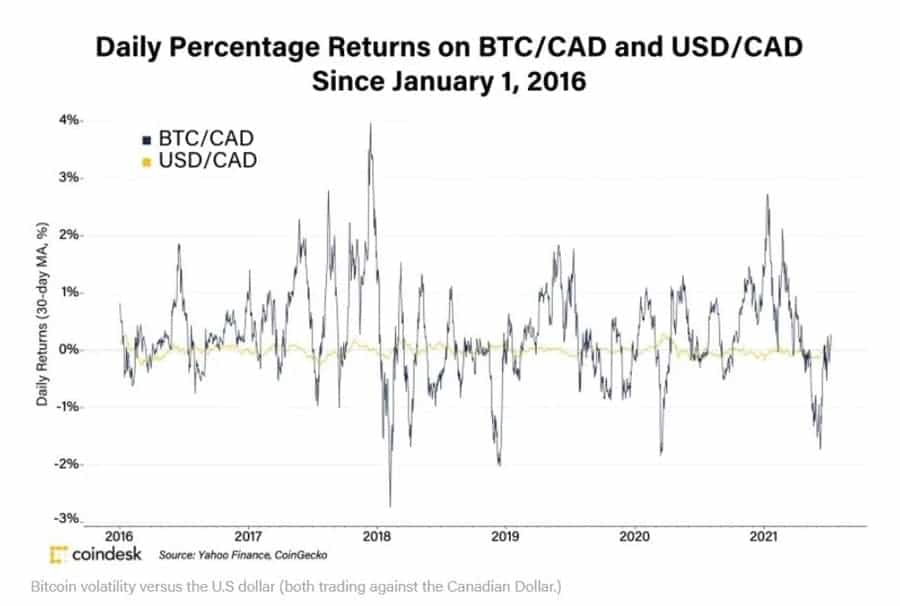

The benefit of tying the value of a cryptocurrency to another underlying asset is that you can circumvent the general volatility of cryptocurrency markets whilst still holding a digital asset. As the US dollar and gold are generally less volatile than even the most stable of other cryptocurrencies (like Bitcoin), the result is a more stable, less volatile blockchain asset. Hence, the name, Stablecoins.

The below image, from CoinDesk, helps to illustrate the relative stability of a currency like USD in comparison to BTC by showing the respective daily returns for both assets trading against the Canadian Dollar, since 2016.

However, the tradeoff for this stability is you are very unlikely to see any significant returns on your stablecoin positions, over and above the returns you would receive from simply holding the underlying asset. Here, lower risk is accompanied by low reward.

That said, many investors will hold some form of stablecoin in their crypto portfolio to provide liquidity for swiftly executing future purchases without the hassle of depositing using standard fiat currencies like USD, EUR or GBP. Furthermore, taking profits in the form of a stablecoin may well allow you to avoid some of the fees involved in converting your cryptocurrency profits into fiat, provided you are looking to reinvest your profits.

One further reason to hold a stablecoin is that it can be staked to receive greater year on year rewards than if you were to hold USD in a traditional bank account.

Bitcoin

While it might seem unconventional to dedicate an entire category to Bitcoin (BTC), there's a compelling rationale behind it.

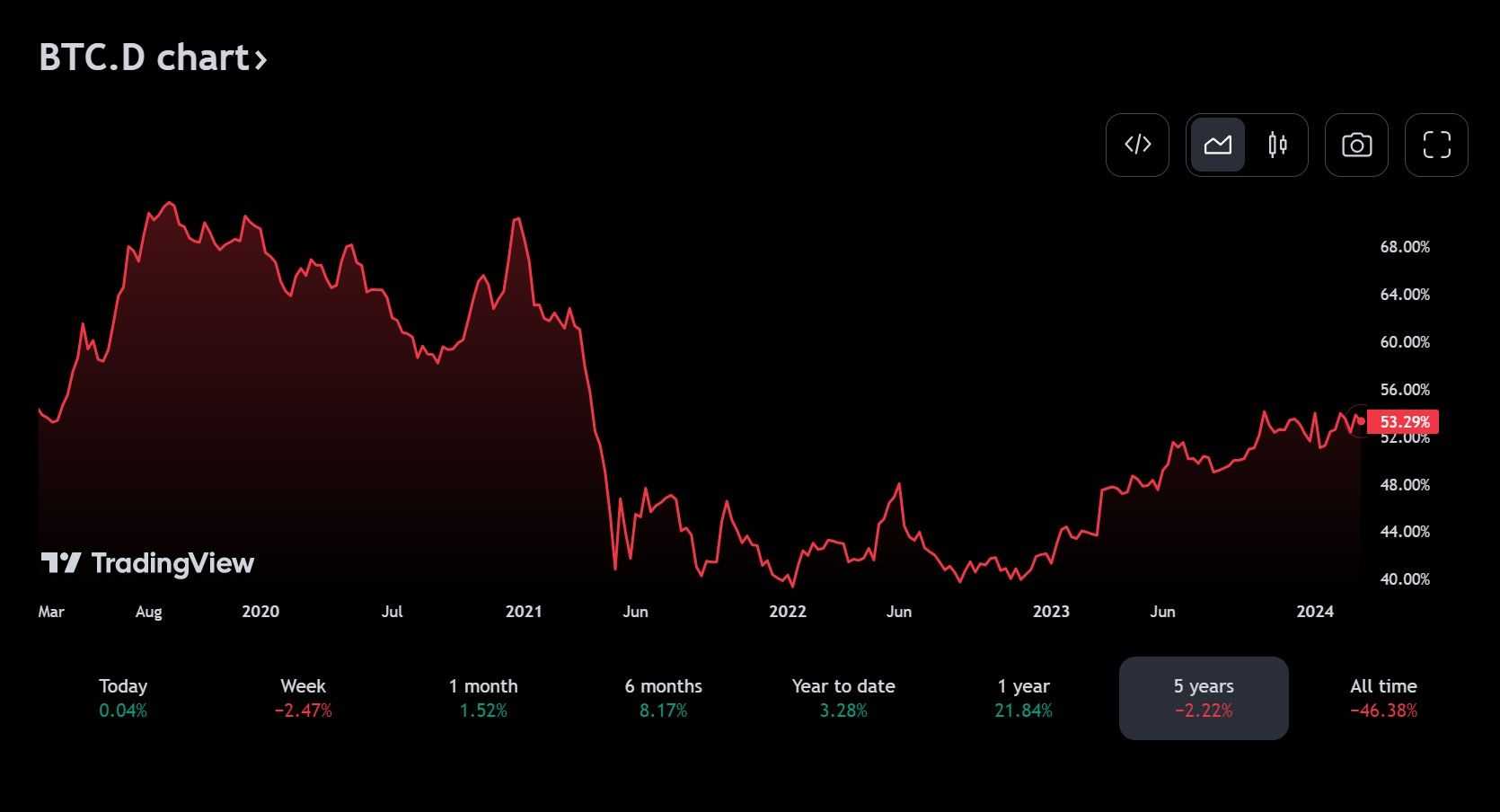

Bitcoin stands as the pioneer cryptocurrency, capturing widespread recognition. If people are familiar with any cryptocurrency, it's likely BTC. Dominating the crypto market, Bitcoin consistently holds a significant portion of the total crypto market capitalization, often more than half.

The distinctive nature and dominance of Bitcoin in the cryptocurrency sector lead some to speculate about its potential to evolve into a world reserve currency!

The below graph from Trading View tracks Bitcoin dominance over the past five years.

Bitcoin is perceived as a relatively safer asset within the crypto ecosystem, primarily due to its substantial market capitalization compared to other cryptocurrencies. For instance, Bitcoin's market cap surpassed one trillion USD again in Q1 2024, highlighting its significant presence. A larger market cap implies that a more considerable volume of transactions is necessary to influence the price, thereby stabilizing its volatility.

Bitcoin’s primary use is as a store of value and some ‘Bitcoin Maximalist’ investors center their investment strategies around stock-piling the world’s most popular crypto-asset, believing that its utility as a store-of-value make it the best coin to HODL for the long term.

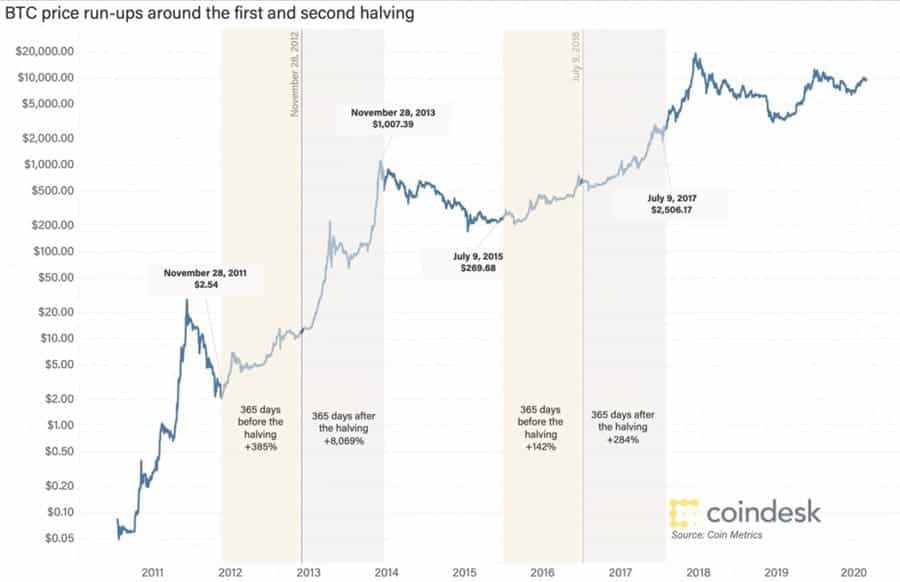

Indeed, prevailing opinion suggests the entire cryptocurrency market cycle is triggered by the Bitcoin halving that takes place roughly every four years, with the most recent halving taking place in May 2020, and the next one scheduled for April 2024. A Bitcoin halving occurs when the total year-on-year rewards available for mining is reduced by 50%, reducing the available supply.

This helpful chart from CoinDesk helps to illustrate the correlation between BTC price and the timings of Bitcoin halvings.

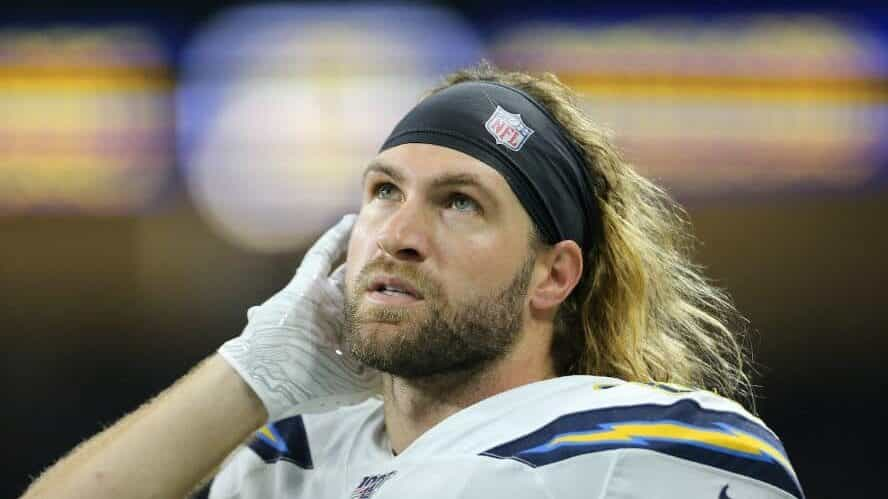

Regardless of its huge market capitalisation, dollar cost averaging into a Bitcoin portfolio is still considered a sound investment strategy by many. Indeed, several prominent NFL players have started to convert their entire salary into Bitcoin!

Sean Culkin, of the Kansas City Chiefs, was the first player to take this monumental step.

Altcoins

By ‘Altcoin’, what we really mean is any cryptocurrency other than Bitcoin. These altcoins range from a coin as big as Ethereum, with a market cap of $247 billion, to new and upcoming projects, many of which have their foundations on the Ethereum blockchain.

Naturally, these assets are more volatile than both stablecoins and Bitcoin. However, this increased volatility means there is greater potential for profits and, unfortunately, losses as well. Trading in altcoins is a quite popular activity for a subset of crypto investors!

For instance, BTC is up 388% from is December 2022 low in March 2024. Solana (SOL), another prominent altcoin is up nearly 1000% in the same time-frame.

These increased gains are caused by the lower market cap of altcoins when compared to Bitcoin and by the fact that adoption of these altcoins is of a higher rate than that of Bitcoin. To put it simply, they are newer and, therefore, have greater potential for upward price movement.

Of course, this earning potential should be tempered by the fact that, being less established, altcoins are an altogether riskier asset to hold because they also have a greater potential for downward movement.

That said, the levels of risk attached to these altcoins vary wildly from coin to coin. Ethereum has reached so high a level of adoption and market cap that it is now considered to be relatively un-risky. Indeed, we might consider any coins in the top-10 by market cap to be reasonably safe compared with the universe of other cryptocurrencies.

The reality is that the lower down the ‘market cap list’ we go, the smaller and, therefore, riskier the asset becomes. At the time of writing, the 100th coin by market cap (OMG Network’s OMG token) had a market cap of $629 million; this is only 0.21% of ETH’s market cap at the same point in time.

Whilst you have a chance to achieve multiple X gains on a smaller coin, there is a greater chance that said coin will meet with a collapse in value, wiping out that portion of your portfolio.

Many investors in cryptocurrency will look to make increased profits on the altcoins. However, as previously mentioned, the altcoin of choice and what proportion of your portfolio you invest into it, will boil down to your own risk appetite and research.

‘Others’ (Meme Coins & ICOs)

In spite of the highly impressive gains that some of the top altcoins have experienced, for some investors, this simply isn’t enough. Indeed, some of the most profitable strategies have involved investment into what are now known as ‘meme coins’, or even the buying of coins before they make it to market, through processes known as initial coin offerings (ICOs).

Meme Coins

Whilst meme coins technically constitute altcoins, we’ve given them their own category owing to their increased risk level.

In reality, meme coins are a breed of altcoin. However, they differ in that, unlike coins like Ethereum, they have no real use case. They are valuable only due to promotion by influencers and the popularisation of meme-culture. They are typically highly volatile in terms of price, market cap and trading volume.

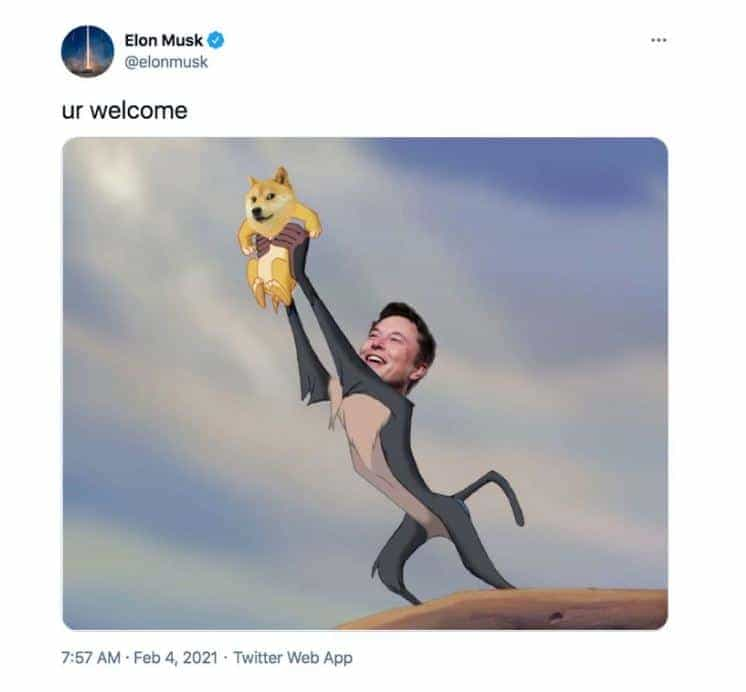

The second most well-known cryptocurrency after Bitcoin, is Dogecoin (DOGE). Originally a joke, born from the popular ‘Doge’ meme, the astronomical gains that DOGE has seen in 2021 cannot be dismissed. Dogecoin was made famous by Elon Musk’s comments on Twitter in early 2021, and by the incredible price action it has undergone, shooting up an incredible 1,250% in the period between April 1, 2021, and May 8, 2021.

Much wow. So crypto.

Much wow. So crypto.

On January 1, 2021, DOGE’s price was $0.005405 but by mid-May, its price had skyrocketed to upwards of $0.7. In other words, its price increased by a factor of more than 129 in less than 6 months. This inflated price was the result of Musk effectively popularising the token through various social media outlets.

Whilst many of the cryptocurrencies we see today, such as Ethereum and others, have real world use cases, Dogecoin has none. Its rise in value was the result of hype and hype alone.

While Dogecoin was the first, it is no longer the only meme coin to have seen extreme gains in 2021. Shiba Inu’s SHIB token has proved hugely profitable for early investors too and the number of meme coins available to speculate on grows by the day.

This reliance on social sentiment with no fundamental use cases or strong tokenomics makes meme coins a risky gamble at best and, at worst, a sexy way to throw away your money. However, as investors, we find ourselves unable to ignore the unrivalled upward potential of such unpredictable cryptocurrencies.

ICOs

ICO stands for Initial Coin Offering and is the cryptocurrency equivalent of an IPO (Initial Public Offering) in the stock markets.

In short, by offering a portion of the total supply of a token up for purchase before that token goes to market, developers can raise capital to assist in future development and advancement of their crypto project. Indeed, the sums of money they are able to raise can be herculean in some cases. Ethereum held an ICO in 2014 that managed to raise $2.3 million in its first 12 hours.

From an investment standpoint, initial coin offerings provide a way of buying into the next big cryptocurrency as early as possible and, oftentimes, at a hugely discounted price. The price of one ETH during its 2014 ICO was a mere $0.30. Let’s not forget that Ethereum’s price in mid-May of this year was as high as $4,133. That’s right: if you had managed to get hold of $75 of ETH in its ICO, and liquidated in mid-May of 2021, you would be a millionaire in USD terms.

The risk of buying into ICOs is that, if a cryptocurrency is holding an ICO, they are unlikely to be established. In other words, they are in their infancy. It can be difficult to discern whether or not the project in question is the next Ethereum, or whether it will tank to negligible value, shortly after going to market, resulting in massive financial losses for investors.

What’s more, it is not uncommon for individuals to set up an ICO, allow people to buy in and inflate the price of a token, only to quickly liquidate their substantial holdings of the token to make vast amounts of money for themselves and tank the price for everyone else. This is known as a ‘rug pull’, a phenomenon that should be in the back of your mind whenever you buy into a cryptocurrency as early as the ICO phase.

The only way to be sure you are not about to get played by nefarious actors is to carry out in depth research into the project before investing. With enough information, you may well be able to spot the next big thing. This is true of any cryptocurrency investment but is especially true when it comes to ICOs.

Crypto Portfolio Allocation

It follows from the above rankings that, if your risk appetite is low, you are likely to want to adopt an investment strategy such as dollar-cost-averaging into high-cap cryptocurrencies like BTC and ETH. Indeed, this is the strategy that I use for my personal portfolio.

Dollar-cost-averaging is an investment strategy that aims to mitigate the volatility of an asset by buying at regular intervals regardless of price.

By contrast, if you are willing to gamble with your funds, you may want to spend time trying to predict the next Dogecoin or successful ICO; a risky strategy but one that has the potential to pay off in a very big way indeed.

Naturally, you may wish to adopt a strategy that involves investment into all five of the above categories. However, your risk appetite will influence the proportions you allocate to each category.

An example of a crypto portfolio:

One possible portfolio crypto allocation layout may look like this. Let’s call this investor, John:

- 25% Bitcoin

- 25% Ethereum

- 15% USDC

- 35% Altcoins

This is just an example portfolio that I have made up. However, we can see why someone might want to construct a portfolio just like it.

15% of John’s portfolio crypto allocation is allocated to USD Coin. As previously mentioned, John is unlikely to see big gains from his USDC. It is likely, however, that John holds this USDC to make sure he has the liquidity to rapidly execute a trade if he spies an opportunity that he wants to enter quickly. Making a trade directly from USDC is quicker than buying a coin using his bank card every time. What’s more, John may have taken profit on a trade that he is, for now, holding in this particular stablecoin.

John also allocates 25% of his portfolio to BTC. Given the high adoption level of Bitcoin, John sees this as a relatively safe investment. Indeed, if the cryptocurrency markets are performing well, it is highly likely that BTC is experiencing this too.

John’s reason for holding another 25% in Ethereum is not dissimilar to the aforementioned reason for holding Bitcoin. The second largest currency by market cap, Ethereum is relatively safe too but, being younger than Bitcoin and with a plethora of Ethereum developments (Dapps, improved NFTs, increased DeFi use cases, and staking) in the works, he expects to see greater gains on his ETH than on his BTC.

The remaining 35% of John’s portfolio is held in other, lower cap altcoins. These altcoins might include, Cardano (ADA), Polkadot (DOT) and Polygon (MATIC) or countless others. A number of investors are highly bullish on these coins and John is hoping to see profits even greater than those obtained from his Ethereum position. Perhaps John has also sought to diversify his portfolio into the NFT space too. He may well hold Origin Protocol (OGN) or even AXS, the native currency to the growing NFT game, Axie Infinity.

These altcoins constitute John’s riskiest assets due to their relatively low market capitalisation, and it is for this reason that he is holding only 35% of his position in said coins.

We notice also that John does not hold any meme coins. He has decided that, despite the possibility of multiple X gains, such coins are risky enough to fall outside of his own personal risk tolerance.

The above portfolio is just a fictional example of how someone, like John, might allocate their cryptocurrency position. However, we can see the thought process that a potential cryptocurrency investor will look to engage in. John’s portfolio can be considered reasonably well diversified and in line with his own risk appetite. Most importantly, John has done his own research before investing into any of the above-mentioned coins.

If you’d like the see the specific breakdown of Guy the crypto king’s portfolio, then I suggest subscribing to the Coin Bureau weekly newsletter. In it, he gives his current portfolio, any changes and why they’ve been made, as well as a wealth of cryptocurrency news and wisdom.

Crypto Investing Portfolio: Conclusion

There is much more to investing in cryptocurrency than portfolio allocation. Methods like staking, for example, are something long term holders may well want to investigate. Indeed, where you actually store your cryptocurrency position is a topic in its own right!

You might want to keep some crypto in an exchange for swift trading (despite the security risks), whilst leaving most of your position in an ultra-safe hardware wallet.

If you want to learn about these topics, then you can’t go wrong by checking out other articles on our website or taking a look at our YouTube channel.

That said, hopefully this article has given you the basic information you need to start thinking about how you want your crypto portfolio to look, with respect to your own risk appetite. By understanding the respective risk levels of differing cryptocurrencies, investors can best equip themselves to deal with high levels of volatility that is part and parcel of the cryptocurrency markets.

At the end of the day, there is no replacement for doing your own research. Whilst it is healthy to learn from those more experienced in the crypto-space, the only advice worth taking is your own!

Frequently Asked Questions

As Bitcoin is considered the least risky cryptocurrency, is the most widely held and experiences the least volatility to the downside, this comes down to the risk appetite of each individual investor. A general consensus among traditional investment firms states that 1-10% of a total investment portfolio should be in Bitcoin.

If we are looking at crypto allocation, ignoring outside of crypto investments, someone who is risk-averse may want to go 50% or more into Bitcoin, many crypto enthusiasts are 100% in Bitcoin. For people who can handle more risk and enjoy altcoins, many investors go 25% Bitcoin, 25% Ethereum, then the remainder can be allocated to riskier small-cap altcoin plays. A popular strategy is 25% Bitcoin, 25% Ethereum, then the remaining 50% spread across the various layer one Ethereum competitors.

It is important to always have exposure to the main coins Bitcoin and Ethereum for the bulk of a portfolio. Many investors also like to include some layer one alternatives like Solana, Cardano, Avalanche, Near, Algorand etc. Many also feel that it is important to include one interoperability play such as Cosmos or Polkadot, An oracle such as Chainlink, and one or two metaverse/blockchain gaming plays with no more than 5% of a portfolio going towards speculative plays like memecoins or ICO/IDOs.

We also have a great article on How to Build a Crypto Portfolio to Prepare for a Bear Market.

There are many great crypto tracking tools that are available such as CoinStats. These apps and websites can link directly to all your exchanges and wallets to track your portfolio performance as well as things like trades and profit and loss, making crypto taxes easier.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.