Decentralised Finance (DeFi) has come to embody one of the most intriguing, versatile and exciting segments of the digital asset space. With its ecosystem growing at such an exponential rate, DeFi has firmly established itself as a natively disruptive technology that seeks to utterly refashion the financial status quo and revolutionise the way individuals conceptualise value.

Throughout its historical development, blockchain technology has given birth to a variety of different financial applications, value propositions, crypto assets and alternative infrastructures. While blockchain has most definitely spearheaded some of the most fascinating technological innovations of the last decade, to this day its design remains rather isolated and enclosed.

Despite Blockchain's Disruptive Technology, Its Ecosystem Remains Rather Siloed And Enclosed

Despite Blockchain's Disruptive Technology, Its Ecosystem Remains Rather Siloed And Enclosed Public blockchains, such as Bitcoin and Ethereum for instance, are built as digital ledgers that are open-source, transparent and visible to all. However, despite on-chain data being fully transparent, a blockchain’s infrastructure is essentially designed to be a self-contained, siloed ecosystem.

There is, of course, good reason for this as one of the most vital elements of blockchain technology resides in its ability to preserve network security. In fact, to maintain the consensus that underpins the security and accuracy of a shared ledger, only miners who meticulously follow the rules of each network are allowed to verify and write transactions to the blockchain.

This system is indeed effective, however, the siloed nature of blockchain is somewhat stunting the growth and progress of the DeFi ecosystem, locking DeFi participants into a single, enclosed network when actually, given its permissionless and disintermediated functionalities, it should allow users to gain access to a wider array of opportunities.

At a time when the DeFi Lego-like composability of decentralised Applications (dApps) is changing the face of financial infrastructures as we have always known them, it’s more important than ever for independent blockchains to communicate and share data with one another.

Most Blockchains Operate Within Their Own Siloed Ecosystems, But DeFi Requires Them To Intercommunicate

Most Blockchains Operate Within Their Own Siloed Ecosystems, But DeFi Requires Them To Intercommunicate While projects such as Polkadot, Kusama, Avalanche and Cosmos are experimenting with the concept of cross-chain interoperability and network composability, DeFi users quite simply would like to be able to move assets from one chain to another, use dApps interchangeably and leverage other DeFi services more efficiently. Thus, there seems to be a widespread desire for blockchain intercommunication and while blockchain infrastructures have remained rather isolated until very recently, one of the most optimal solutions can be found in cross-chain bridges.

About Cross-Chain Bridges

Cross-Chain Bridges enable interoperability and intercommunication between vastly different networks, such Bitcoin and Ethereum for instance, and between one parent blockchain and its child chain, known as a sidechain, which either operates under different consensus rules or inherits its security from the parent blockchain, as is the case for Polkadot and Kusama parachains.

Cross-Chain Bridges Connect Two Separate Blockchain Infrastructures

Cross-Chain Bridges Connect Two Separate Blockchain Infrastructures Cross-chain bridges allow for the transfer of assets, tokens, data or ever smart contract instructions from one chain to another and between completely independent platforms, enabling users to:

- Deploy digital assets on one blockchain to dApps on another.

- Conduct fast, low-cost transactions of tokens hosted on non-scalable blockchains.

- Implement and execute dApps across more than one platform.

Need For Cross-Chain Interoperability

Crypto enthusiasts, investors and institutional entities are all growing increasingly aware of the issues posed by chain maximalism, the risks of Balkanisation, and of the overall closure inherent in most blockchain networks.

This sentiment is primarily driven by the fact that blockchain, at heart, was always designed to solve some of the complexities, bottlenecks and limitations that have historically characterised traditional financial structures. Still, for the majority of blockchain participants, it is near to impossible to seamlessly execute trades and efficiently move assets across the digital asset space without encountering some kind of technical hurdle.

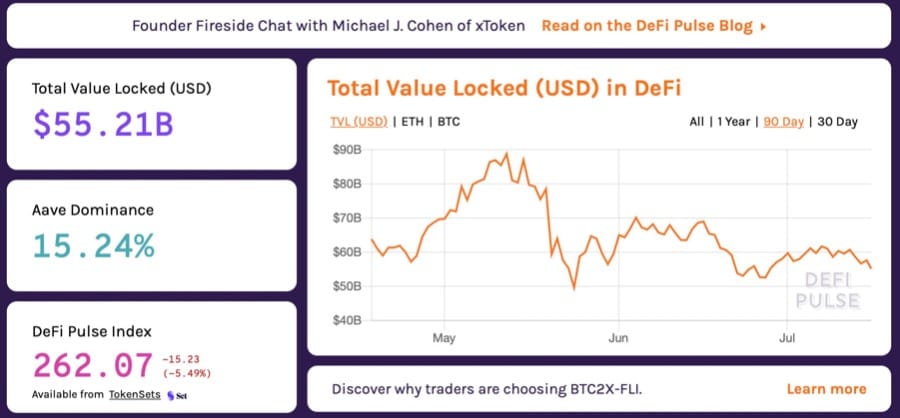

The Exponential Growth In DeFi's Total Value Locked (TVL) Is A Clear Indication Of The Need For Interoperability In The Space - Image via DeFiPulse

The Exponential Growth In DeFi's Total Value Locked (TVL) Is A Clear Indication Of The Need For Interoperability In The Space - Image via DeFiPulse With Decentralised Finance skyrocketing since the beginning of 2020, the demand for cross-chain composable systems in the DeFi space is currently at an all-time-high. In essence, this is due to the fact that today’s DeFi networks remain siloed and isolated within their own ecosystems and cannot trustlessly communicate with each other to exchange meaningful amounts of value.

We build too many walls and not enough bridges - Isaac Newton (1643-1727)

The solution to this essentially resides in cross-chain interoperability as it allows projects to effectively cooperate with one another and break the boundaries separating their respective infrastructures.

However, most of the existing solutions that provide cross-blockchain communication are either too complicated, risky, overloaded or will most likely include a third party medium. Having a third party act as escrow during a cross-chain transfer thoroughly deprives blockchain of its innate decentralised philosophy and inherently defeats the purpose of its technology altogether.

To remedy this, cross-chain bridges provide the necessary underlying architecture for blockchain projects to safely develop their interoperability features and reliably interact with other chains, while obviating the need for a third party medium.

How Cross-Chain Bridges Work

As previously mentioned, a cross-chain bridge is a connection that allows the transfer of tokens, assets and data from one chain to another. Both chains can have different protocols, rules and governance models, but the bridge provides an intercommunicative and compatible way to interoperate securely on both sides.

Cross-Chain Bridges Allow The Transfer Of Assets And Data Between Two Different Blockchain Platforms - Image via CoinClarified

Cross-Chain Bridges Allow The Transfer Of Assets And Data Between Two Different Blockchain Platforms - Image via CoinClarified Not all cross-chain bridges are the same as, in fact, there are quite a few designs in existence, but they can generally be divided into two main segments:

- Centralised Cross-Chain Bridges, based on third party trust.

- Decentralised and Trustless Cross-Chain Bridges, based on cryptographic-mathematical trust.

More centralised bridges rely on some kind of central authority or system to function, meaning that users are required to place their trust in a third party mediator to use a specific application or service. Using a centralised bridge can appeal to those users who have perhaps just entered the crypto space and haven’t yet developed the skillset or the confidence required to move their capital across different chains on their own.

While there are definitely some benefits to using centralised bridges, such as ease of use and relative automation, most crypto aficionados prefer to engage in cross-chain operations on their own accord and generally look to more decentralised and trustless options.

Wrapped Bitcoin Is Obtained Via A Centralised Cross-Chain Bridge And Minted On The ETH Blockchain

Wrapped Bitcoin Is Obtained Via A Centralised Cross-Chain Bridge And Minted On The ETH Blockchain Among the most popular trust-based, centralised bridge solutions is the initiative that enables Bitcoin holders to leverage the benefits of the Ethereum blockchain via Wrapped Bitcoin (WBTC). In this centralised bridge system, users deposit X amount of BTC through partners called ‘merchants’ into a wallet controlled by a trusted, centralised custodian which stores Bitcoin safely and then mints Wrapped BTC (WBTC) tokens of equal value on Ethereum.

This can potentially turn out to be rather beneficial for Bitcoin holders as Wrapped BTC, unlike native BTC, is an ERC-20 token that can be utilised as collateral in a variety of DeFi protocols, such as Aave, Compound, MakerDAO and Uniswap.

Trustless Cross-Chain Bridges Rely On The Mathematical Truth Of The Blockchain's Nodes

Trustless Cross-Chain Bridges Rely On The Mathematical Truth Of The Blockchain's Nodes On the other hand, decentralised cross-chain bridges are those in which users aren’t required to place their trust in a single entity or centralised authority, but rather their trust is placed in the mathematical truth of the underlying blockchain’s codebase. In blockchain systems, mathematical truth is achieved by many computer nodes reaching a common agreement, or consensus, in accordance with the rules written into the code. This allows for the creation of an open, decentralised and transparent system that almost entirely relies on the blockchain’s foundational infrastructure and removes many of the issues ingrained in centralised ecosystems, which are subject to potential corruption and malicious behaviour.

Cross-chain bridges can be built to serve a variety of purposes, and not just asset transfers. Indeed, they are not only capable of enabling tokens on one network to be utilised on another, but they can also be implemented to exchange any type of data, including smart contract calls, decentralised identifiers and off-chain information such as stock market price feeds via oracles.

Cross-Chain Bridge Architecture

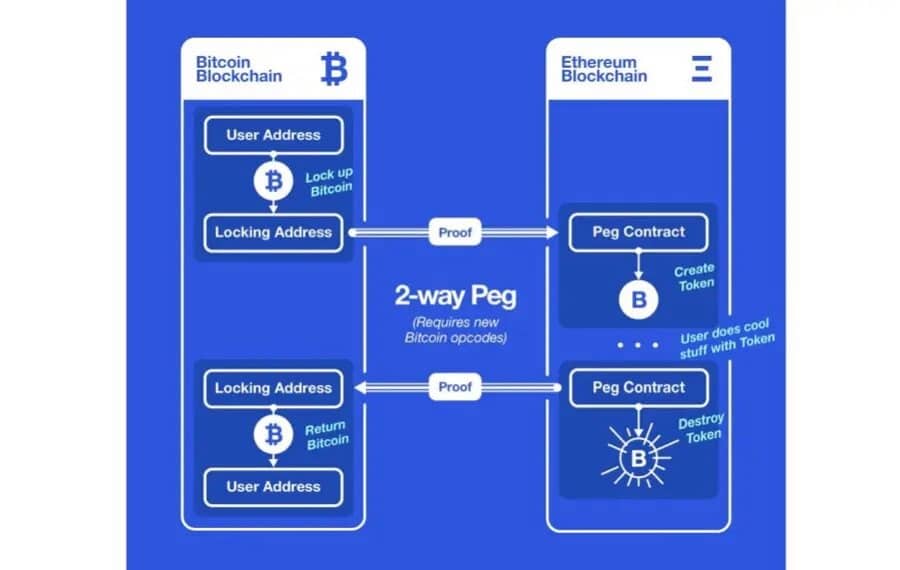

When a user transfers assets from blockchain A to blockchain B through a decentralised cross-chain bridge, these assets aren’t technically ‘sent’ or relocated elsewhere. In fact, this transfer is quite the illusion as assets on blockchain A are not transferred, but rather temporarily locked on blockchain A while the same amount of equivalent tokens is unlocked on blockchain B. Assets on blockchain A can then unlock when the equivalent amount of tokens on blockchain B becomes locked again.

Assets Are Locked On The Base Layer And Unlocked On The Secondary Blockchain And Vice Versa - Image via Consensys Medium

Assets Are Locked On The Base Layer And Unlocked On The Secondary Blockchain And Vice Versa - Image via Consensys Medium Many blockchain projects in the space have started implementing and developing their own interoperability features through this aforementioned system due to its effectiveness and decentralised nature. The concept for this cross-chain interoperable architecture, called a two-way peg (2-WP) system, dates back to the very early days of Nakamoto, and while this system does theoretically work it actually comes with some inherent risks.

Any decentralised cross-chain bridge system relies heavily on assumptions of trust and honesty between the two actors involved in the cross-chain bridge. If these assumptions fail to hold, then it is possible that assets on both blockchain A and blockchain B unlock at the same time, causing a malicious double spend. To counter this, projects such as Clover Finance, a Substrate-based parachain looking to forward its own in-house 2-WP mechanism, allow for a seamless and secure cross-chain communication system to be put in place via trustless 2-WPs.

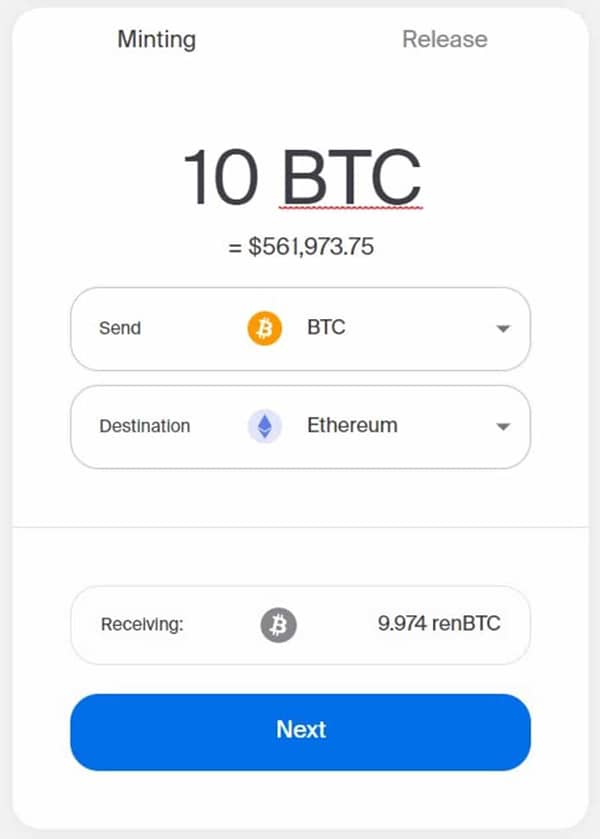

In DeFi Cross-Chain Bridges, Assets Are Locked On Blockchain One And Subsequently Minted On Blockchain Two - Image via MakerDAO Blog

In DeFi Cross-Chain Bridges, Assets Are Locked On Blockchain One And Subsequently Minted On Blockchain Two - Image via MakerDAO Blog Another pertinent example of a decentralised blockchain bridge is the Ren Protocol. The Ren Virtual Machine (RenVM) is supported by a large, decentralised network of computer nodes that establish consensus in a manner similar to the Ethereum network.

The RenVM spreads information and data across many devices, and leverages multi-party computation (MPC) to create shared cryptographic signatures that enable its network to lock digital assets on one blockchain and allow users to mint equivalent assets on another blockchain.

With Its Decentralised Network Of Devices, The RenVM Enables Users To Lock And Mint Assets On Two Separate Blockchain Infrastructures - Image via MakerDAO Blog

With Its Decentralised Network Of Devices, The RenVM Enables Users To Lock And Mint Assets On Two Separate Blockchain Infrastructures - Image via MakerDAO Blog Thus, the RenVM mechanism allows users to basically ‘transfer’ assets and data from blockchain A to blockchain B without assistance from any third party entity.

Sidechain Bridges

Before diving into sidechain bridges, it is constructive to briefly analyse what sidechains are, as it will help to better contextualise the functionality and importance of a sidechain bridge as a whole.

Sidechains are independent blockchains with their own consensus mechanisms, individual nodes and infrastructures. Sidechains benefit from the decentralisation and security of the underlying main blockchain and maintain the flexibility to perform highly specialised use cases. Primarily, sidechains are synonymous with scalability as they allow the underlying blockchain to dilute and spread out some of its workload across a parallel ecosystem of sidechains, thus making its entire system more efficient.

Sidechains Benefit From The Underlying Blockchain Architecture And Can Perform Highly Specialised Functions

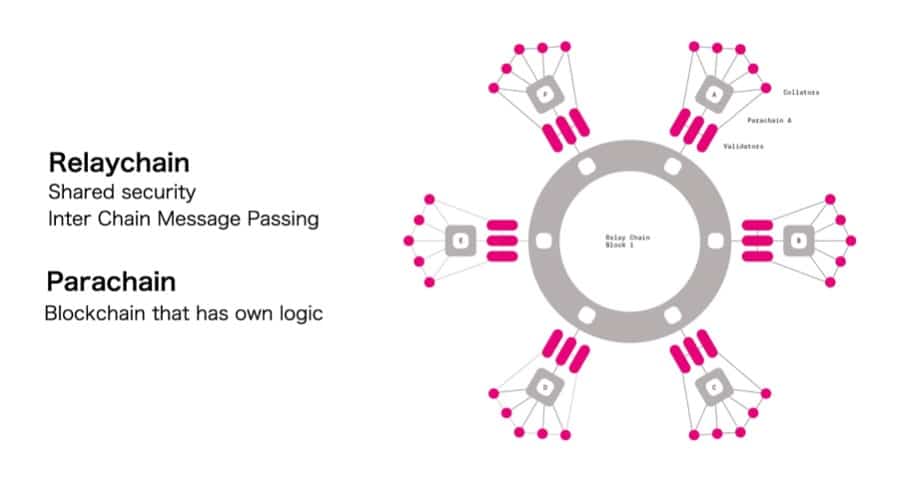

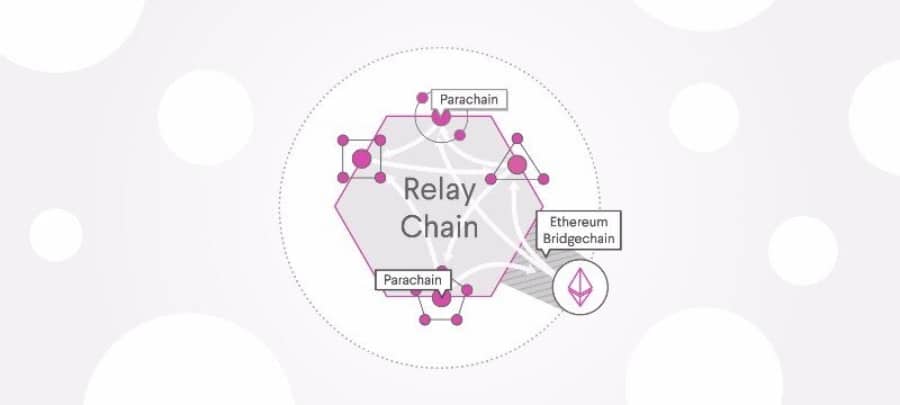

Sidechains Benefit From The Underlying Blockchain Architecture And Can Perform Highly Specialised Functions Polkadot and Kusama parachains constitute perhaps the most relevant example of a sidechain, as they too benefit from the security, reliability and Layer-0 scalability of the Polkadot Relay Chain, and possess independent, highly-specialised functions. Especially in the Polkadot ecosystem, sidechains need to be constantly tied-in with the central Relay Chain but can also establish cross-chain communication with other parachains as well. Of course, in order to do so, a sidechain-specific bridge is required.

The Relay Chain Is The Foundation Layer Of The Polkadot Blockchain And Provides Security To All Parachains - Image via PlasmNet

The Relay Chain Is The Foundation Layer Of The Polkadot Blockchain And Provides Security To All Parachains - Image via PlasmNet Unlike a bridge that links two completely different blockchains, a sidechain bridge connects a parent blockchain to its child. Because the parent and child operate under different consensus rules, communication between them requires a bridge.

For instance, the developers of the popular blockchain-based game Axie Infinity created a dedicated Ethereum-like sidechain, called Ronin, to allow the game to scale beyond what was possible on the Ethereum mainnet. Ronin’s Ethereum bridge enables users to deposit ETH, ERC-20 tokens and NFTs into smart contracts, which Ronin’s validators pick up and relay to the sidechain.

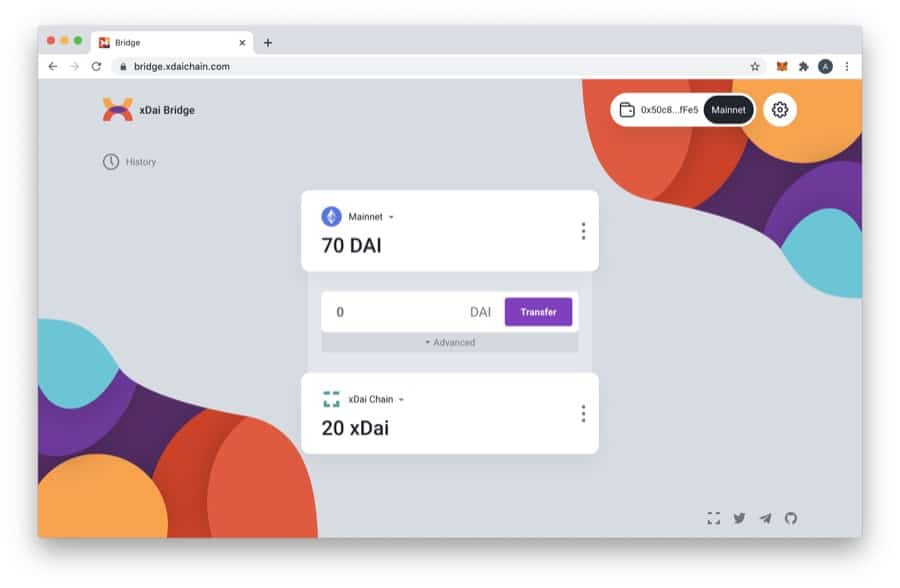

Another well-known example of an Ethereum-based sidechain bridge is xDai. Similarly to Ronin, xDai is secured by a set of validators distinct from the miners who maintain the main Ethereum blockchain. Two bridges, the xDAI Bridge and the OmniBridge, connect the xDai chain to the Ethereum mainnet, allowing easy transfer of tokens.

The xDai OmniBridge Enables Users To Lock Any ERC20 Token On Ethereum And Mint An Equivalent Token On The xDai Sidechain - Image via xdaichain.com

The xDai OmniBridge Enables Users To Lock Any ERC20 Token On Ethereum And Mint An Equivalent Token On The xDai Sidechain - Image via xdaichain.com Moreover, sidechains are set to play a vital role in the development process of the Ethereum network with the roll-out of its sharding capabilities with ETH 2.0. In fact, Ethereum 2.0 will introduce increased scalability to the ETH network by bundling many sidechain transactions into a single transaction secured on the main Beacon Chain.

Imagine that Ethereum has been split into thousands of islands. Each island can do its own thing. Each of the island has its own unique features and everyone belonging on that island i.e. the accounts, can interact with each other AND they can freely indulge in all its features. If they want to contact other islands, they will have to use some sort of protocol. – Vitalik Buterin at Devcon 2018 – LinkedIn

Building Bridges On Polkadot

Polkadot was designed to be a ‘blockchain of blockchains’ with the belief that all future blockchain infrastructures will require interoperability to function efficiently. Polkadot allows sovereign Layer-1 blockchains, called parachains, to be fully intercommunicative and cross-chain composable, while benefitting from the security, scalability and Layer-0 functionality of the Polkadot central Relay Chain.

Parachains Are Independent Layer-1 Blockchains Running In Parallel Within The Polkadot Ecosystem - Image via Polkadot Medium

Parachains Are Independent Layer-1 Blockchains Running In Parallel Within The Polkadot Ecosystem - Image via Polkadot Medium In addition, Polkadot allows its parachain structures to connect with external networks such as Bitcoin and Ethereum through cross-chain bridges. These Polkadot bridges can be implemented in a number of ways, with some being built as common good utility bridges for the entire Polkadot community, and others as a for-profit bridge design run by specialised teams.

One of the most intriguing and value-rich functionalities that come with Polkadot’s cross-chain bridge architecture is the ability to bridge and seamlessly interconnect two external and separate chains such as Bitcoin and Ethereum. For instance, through its parachain bridge system, Polkadot could allow the transfer of assets from Bitcoin to Ethereum in a completely decentralised manner. In order to achieve this, Polkadot leverages its in-house cross-chain bridge design called Cross-Chain Message Passing (XCMP).

XCMP Bridge

As mentioned earlier, parachains take their name from the concept of parallelised chains that run parallel to the central Relay Chain within the Polkadot ecosystem, on both the Polkadot and Kusama Networks. Due to their parallel nature, parachains are also able to parallelise transaction processing and deliver new levels of scalability to both Polkadot and Polkadot-based projects.

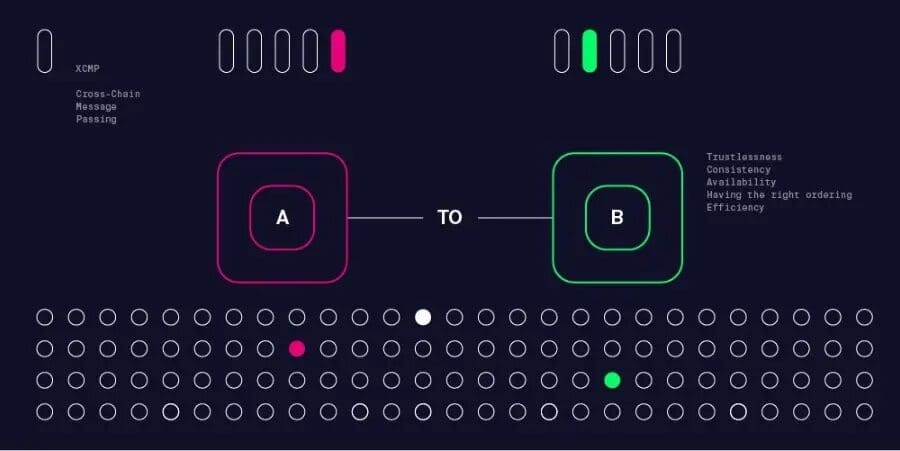

They are fully connected to the Relay Chain and enjoy the security provided by the Polkadot framework. However, in order to communicate and share data with other systems, parachains leverage a mechanism called Cross-Chain Message Passing (XCMP).

Parachains Use The XCMP Bridge To Communicate With Each Other And Exchange Data – Image via Web3Foundation

Parachains Use The XCMP Bridge To Communicate With Each Other And Exchange Data – Image via Web3Foundation Polkadot’s XCMP bridge is a protocol that lets its otherwise isolated parachain-sidechain networks send messages and data between each other in a secure and completely trustless manner. This Cross-Chain Message Passing system is firstly initiated by opening up a channel between the two parachains.

This channel must be recognised by both the sender and the recipient parachain, and it is a one-way channel. Furthermore, a pair of parachains can have at most two channels between them, one for sending messages and another for receiving them.

In order for the bridge to be established, a deposit in DOT is required which will then be returned once the bridge closes again. Thus, through the XCMP channel, two separate parachains can create an intercommunicative structure for them to transfer valuable data and assets between each other and attain unprecedented levels of cross-chain bridge interoperability.

Cross-Chain Bridges: The Future Of DeFi

Cross-chain bridges can essentially be conceptualised as the foundational infrastructure that will fuel all future blockchain systems, as they allow for the creation of dynamic, interoperable and interchangeable blockchain layers.

Interoperability and cross-chain composability between separate blockchains, including parent chains and sidechains, open up a vast ocean of opportunities for users and allow network participants to access the benefits of each chain without jeopardising the security and advantages of the main chain.

Consequently, this produces some exciting use cases for cross-chain bridges in the ever-changing realm of Decentralised Finance, giving crypto enthusiasts the option to move assets across the space in a permissionless, disintermediated fashion while leveraging the functionalities of both the main and secondary chains.

Cross-Chain Interoperability Encapsulates The Future Of DeFi and Of Blockchain Networks

Cross-Chain Interoperability Encapsulates The Future Of DeFi and Of Blockchain Networks

Bridges are proving increasingly valuable in DeFi protocols, as they enable DeFi users to transfer digital assets from a blockchain that holds considerable token value but that cannot maximise dApps of its own, like Bitcoin, to one that has developed a well-established DeFi ecosystem, like Ethereum.

Thus, in this scenario, it is only thanks to cross-chain bridges that Bitcoin can benefit from the functionalities of DeFi by becoming Wrapped Bitcoin (WBTC), an ERC-20 token, on the Ethereum blockchain. This is certainly beneficial for native BTC holders as they are now able to trade and move their Wrapped BTC around the DeFi space and reap the rewards of the best chains in the ecosystem.

Blockchain Bridges Allow Networks To Achieve Greater Scalability Through Higher Performance And Transactional Throughput

Blockchain Bridges Allow Networks To Achieve Greater Scalability Through Higher Performance And Transactional Throughput Furthermore, as previously mentioned, DeFi bridges enhance network scalability by allowing main chains to connect with their secondary chains and distribute some of their transaction load across their ecosystem.

The most optimal example of this is perhaps the Polkadot parachain network, through which the Polkadot main chain can dilute its work load via its sidechain system increasing its transactional throughput and performance overall. Given the obvious benefits inherent in cross-chain bridge solutions, Ethereum is currently developing the infrastructure necessary to support its own DeFi sidechain bridges, which are set to roll-out with Ethereum 2.0.

Conclusion

Scalability, efficiency and innovation are the name of the game and, with cross-chain bridges, DeFi just got way easier. In fact, it is only a matter of time before more and more dApps, blockchain-based projects and crypto investors come to the realisation that, without cross-chain bridges, the DeFi applications that we, the users, love and utilise the most wouldn’t actually be that feasible an option.

As the inherent connection linking one blockchain to another, cross-chain bridges provide projects with the infrastructure required to attain interoperability in a decentralised manner and allow for the seamless implementation of cross-blockchain composability.

The concept of a cross-chain bridge in the digital asset space dates back to the very early days of Bitcoin, when the value proposition of an innovative, permissionless peer-to-peer network first emerged. Since then, blockchain bridges have flourished to such an extent that they are proving to be crucial for the overall development of the DeFi ecosystem and its Lego-like liquidity structures.

Ultimately, the demand for cross-chain bridges in the space remains incredibly high, as they firstly enhance the network performance of many DeFi protocols out there and, secondly, because they could very well turn out to be the definitive, universal catalyst for blockchain adoption.