The Battle Against ASICs: Antminer Z9 Angers the Zcash Community

On May 3rd, Bitmain, the Bitcoin mining company behind ASIC (application-specific integrated circuit) chips, announced the release of a new Antminer Z9 mini, an ASIC miner capable of mining any crypto currency running the Equihash proof-of-work algorithm, particularly Zcash.

This announcement set off a firestorm of complaints from the Zcash crypto community, reigniting a debate that has long been going on between ASICs and crypto currencies.

Let's take a quick look at the current state of play and what the ZCash developers plan to do about it.

ASIC PoW Centralisation

The core of the problem has to do with the proof of work verification process inadvertently creating centralization amongst minors, especially those who use ASIC chips. This gives them the advantage of being able to mine coins more efficiently than regular GPU miners.

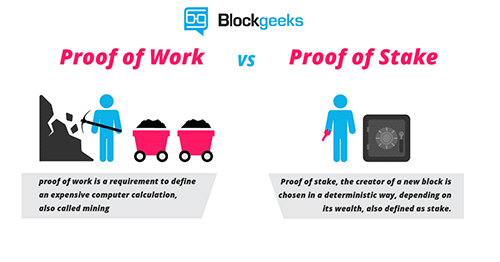

Proof of work is a method of consensus whereby complex computer calculations are performed in order to create a new group of trustless transactions on a Blockchain.

The problem with Proof of work is that it is resource-intensive and creates a centralizing tendency among miners based on computer resource capability. For Bitcoin, mining equipment (and therefore mining power) is mostly concentrated in the hands of a few mining companies.

With the creation of a new ASIC miner specifically developed for one crypto currency (Zcash), the concern is that Bitmain has the potential to manipulate the currencies price whenever something good or bad happens to the company.

Another problem created by centralization is the fact that miners with too much concentrated power could effectively manipulate transactions by overpowering 51% of the network. This is often termed the infamous "51% attack" that is the bane of every crypto chain.

Zcash, a privacy focused crypto currency, still has a low market cap and much fewer transactions than Bitcoin, and so many believe that a single company manufacturing its mining equipment goes against the decentralization ethos the crypto community abides by.

Bitmain is one of the largest miners of crypto currency, as well as the largest producers of ASIC chips. This shows a very clear objective to monopolize and occupy both the supply and demand side of the mining space, which forces all crypto currencies that use Bitmain to become centralized simply by association.

Other Coins Affected

Zcash is not the only crypto currency that has its community split on the ASIC issue. Just this April, Monero hard forked to avoid the impending centralization of ASIC miners.

Moreover, the move by Bitmain to target Equihash coins has got the Bitcoin Gold (BTG) developers in a bind. This Bitcoin fork was created specifically to avoid the impact of ASICs on the Bitcoin chain. The developers are now also wondering whether they will have to fork again.

Siacoin has made similar threats to do the same over the release of Bitmain Antminer A3, which is developed specifically to mine Siacoins.

Siacoin is developing a storage platform for large amounts of data, which makes it especially averse to centralization. The community has also been weary of Bitmains tactics to undercut Siacoin's developer's own mining operation – Obelisk.

Zcash Adoption

The Zcash community is the most recent victim of this controversy, and the implications of a Zcash custom made miner developed by Bitmain are significant.

For one, we could see a mass exodus of miners from Zcash. Miners who don’t feel like they can compete with big players in the space and seeing their profit margins continue to decrease will simply move on to mining other crypto currencies.

Investors, sensing the effects of centralization beginning to take hold, may jump ship as well. They, just like all other stakeholders, don’t want to risk investing their time and capital in a project that can be open to price manipulation.

Both of these factors will eat into Zcash’s value at a crucial time when they are competing with other players in the same privacy market, like Monero (XMR).

Perhaps Zcash may go the way of Monero in forking their protocol to keep away from ASICs entirely and avoid becoming more centralized.

For the Zcash community, it seems the choice is between a more efficient mining tool that could lead to long-term growth, or a slightly less efficient GPU mining process that allows them to stay true to their decentralization ethos.

It should be noted that the Zcash foundation is currently involved in research and development of a more ASIC resistant strategy an immediate technical priority.

Proof of Stake The Answer?

The conflict around mining companies creating centralization has only helped create more buzz for an alternative method of consensus called proof of stake (PoS). In this method of consensus, a user can mine or validate block transactions according to how many coins he or she holds.

Mining power is attributed to the proportion of coins held by the miner, and the miner essentially risks (or ‘stakes’) their coins in order to guarantee that they are incentivized to not manipulate any transactions and to maintain a secure network (otherwise they lose their stake).

This removes the arms race to accumulate hashing power, which creates centralization, while also reducing the massive amounts of energy consumed by mining rigs when using the proof of work consensus method.

Companies like Bitmain would have fewer opportunities to monopolize the mining process when Proof of stake is being used.

Ethereum is the most high profile Blockchain making the switch to proof of stake with its new consensus protocol - Casper. Currently, there is an expectation that a hybrid version of Casper will be implemented before the end of the year.

PoS Has Its Flaws

There are still risks that a POS method of consensus can become centralized.

Those who hold the largest stake in a Blockchain will also receive the largest reward. So even though these large players are not incentivized to validate fraudulent transactions, there is still a concentration of decision-making left to a small group of people with the largest tokens to stake.

Other flaws include the ‘nothing to stake’ problem, where people with no tokens to stake can still vote on a particular version of a proof of stake Blockchain, with nothing to lose, and something to gain if the particular version of the Blockchain they vote on is accepted.

Ethereum Co-founder Vitalik has proposed a ‘wrong voting penalty’ for those who vote on multiple versions of a block, or the incorrect block.

Another flaw is something called the ‘long range attack’ problem, where an attacker who (for example) holds 1% of all coins at or shortly after the genesis block can start mining from their own new chain.

Although the attacker will be selected to produce a block only 1% of the time, they could easily produce 100 times as many blocks, and simply create a longer Blockchain in that way.

One possible workaround to this issue is to give every block a timestamp, and have users reject chains with timestamps that are far ahead of their own, forcing the long-range attacker to conform to the same time constraints (more on this here).

Conclusion

The battle against ASICs is part of a wider discussion around what the ideal method of consensus is to validate transactions on a Blockchain. Just because the crypto community aspires to create a decentralized world, doesn’t mean that corporations like Bitmain, primarily driven by profit, are interested in playing by the same rules.

At this time, it seems like Zcash founder Zokoo Wilcox is not interested in forking Zcash, saying he doesn’t "believe that any proof-of-work change can achieve what we really want, which is decentralization and attack-resistance". He went on to say

miners who want the "we will continuously change the PoW to deter ASIC manufacturers" feature should mine Monero

Quite a few members of the community seem to be in disagreement, as evidenced by a recent Twitter poll that had more than 200 votes, of which 80% of them felt ASICs were bad for Zcash.

It remains to be seen how Zcash will resolve this issue, as they are expected to hold a more formal community vote in June.

However, what remains clear is that the crypto community will have to reckon with Bitmain's growing influence. As the founding team behind a cryptocurrency, you should ask yourself whether relying on a centralized mining company to boost the growth of your project is worth the risk of no longer being decentralized.

You will be exposing yourself to all the risks that come with a traditional centralized organization, primarily, exposure to a single point of attack on the network and price manipulation.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.