Arkham Intelligence Review 2024: Revolutionizing Crypto Analytics

Arkham Intelligence is a blockchain analytics platform that aims to transform complex blockchain data into refined and actionable insights. The platform leverages advanced data science and artificial intelligence techniques to filter, interpret, and present data in a user-friendly manner. By focusing on entity-based intelligence, Arkham Intelligence provides a deeper analysis of user behavior, transaction patterns, and decentralized application (DApp) utilization.

One of the key challenges in crypto analytics is the sheer volume and complexity of data. The transparency of blockchains generates vast amounts of information that can be overwhelming to parse without sophisticated tools. Arkham Intelligence addresses this challenge by aggregating and analyzing data from multiple blockchain networks in an intuitive interface.

The platform offers various features, including the Arkham Platform, where users can track transactions and assets across different networks, and the Arkham Intel Exchange, a marketplace for blockchain intelligence. The Intel Exchange allows users to share and trade on-chain intelligence, incentivizing the sharing of valuable information and democratizing access to crypto analytics.

Arkham Intelligence also provides customizable dashboards, a visualizer tool to analyze transaction data, an Oracle feature for text-based analysis, and a Tracer tool to trace fund flows across wallets and blockchains. The platform supports multiple blockchain networks, including Bitcoin, Ethereum, Avalanche, Tron, and more.

The ARKM token is the native cryptocurrency of the Arkham ecosystem and has utility as a settlement currency for the Intel Exchange, for rewarding contributors, and as a governance token for decision-making within the platform. The platform also has a decentralized governance mechanism that allows token holders to propose and vote on improvements and adjustments.

Arkham Intelligence can be leveraged for various purposes, including business analysis and decision-making, personal portfolio tracking, market research, and analyzing the activities of influencers. By utilizing the platform, users can gain insights, identify potential risks, and make informed decisions in the crypto market.

Overall, Arkham Intelligence is revolutionizing crypto analytics by providing a comprehensive and user-friendly platform for analyzing complex blockchain data. It aims to democratize access to information and shape the future of finance by integrating blockchain technologies into the global financial system.

Arkham Intelligence is a blockchain analytics platform that aims to transform complex blockchain data into refined and actionable insights. The platform leverages advanced data science and artificial intelligence techniques to filter, interpret, and present data in a user-friendly manner. By focusing on entity-based intelligence, Arkham Intelligence provides a deeper analysis of user behavior, transaction patterns, and decentralized application (DApp) utilization.

One of the key challenges in crypto analytics is the sheer volume and complexity of data. The transparency of blockchains generates vast amounts of information that can be overwhelming to parse without sophisticated tools. Arkham Intelligence addresses this challenge by aggregating and analyzing data from multiple blockchain networks in an intuitive interface.

The platform offers various features, including the Arkham Platform, where users can track transactions and assets across different networks, and the Arkham Intel Exchange, a marketplace for blockchain intelligence. The Intel Exchange allows users to share and trade on-chain intelligence, incentivizing the sharing of valuable information and democratizing access to crypto analytics.

Arkham Intelligence also provides customizable dashboards, a visualizer tool to analyze transaction data, an Oracle feature for text-based analysis, and a Tracer tool to trace fund flows across wallets and blockchains. The platform supports multiple blockchain networks, including Bitcoin, Ethereum, Avalanche, Tron, and more.

The ARKM token is the native cryptocurrency of the Arkham ecosystem and has utility as a settlement currency for the Intel Exchange, for rewarding contributors, and as a governance token for decision-making within the platform. The platform also has a decentralized governance mechanism that allows token holders to propose and vote on improvements and adjustments.

Arkham Intelligence can be leveraged for various purposes, including business analysis and decision-making, personal portfolio tracking, market research, and analyzing the activities of influencers. By utilizing the platform, users can gain insights, identify potential risks, and make informed decisions in the crypto market.

Overall, Arkham Intelligence is revolutionizing crypto analytics by providing a comprehensive and user-friendly platform for analyzing complex blockchain data. It aims to democratize access to information and shape the future of finance by integrating blockchain technologies into the global financial system.

In the realm of traditional finance, platforms like Bloomberg Terminal have revolutionized how professionals access, analyze and act upon financial data. These comprehensive systems aggregate real-time data from worldwide markets, offering investors, traders, and analysts a powerful tool for making informed decisions. The significance of such platforms cannot be overstated; they have become the backbone of modern financial analysis, enabling a depth and speed of insight previously unimaginable. Users can track stock movements, monitor economic indicators, and receive news updates all in one place, making it an indispensable part of the financial industry's infrastructure.

However, despite the advancements in data analytics technology, the financial world often grapples with data's elusiveness. Information asymmetry, where one party possesses more or better information than the other, can skew market dynamics and create inefficiencies. Regulatory frameworks and private interests can restrict access to critical data, leaving investors to navigate a fog of uncertainty.

This opacity can lead to missed opportunities and heightened risk, underscoring the perennial challenge of uncovering actionable intelligence from available data. For instance, Investopedia says a Bloomberg Terminal subscription costs a whopping $24,000 annually, well above many investors’ total investing budget.

Enter blockchain technology…

Contrast this with the decentralized finance (DeFi) ecosystem, where transparency is a foundational principle. No matter how insignificant, every transaction is recorded on the blockchain for anyone to see. This transparency could theoretically democratize access to information, levelling the playing field for all market participants. Yet, the rawness of this data presents its challenges.

Blockchain transactions, while openly accessible, are often inscrutable and recorded in formats that require technical expertise to decode and analyze. The potential for transformative insights is immense, but realizing this potential requires tools that can filter, interpret, and present data with the efficiency and clarity seen in traditional finance platforms.

Welcome to the domain of blockchain analytics, where platforms like Arkham Intelligence emerge as the Bloomberg Terminal of the crypto world. By harnessing advanced data science and artificial intelligence techniques, Arkham Intelligence transforms the raw, unwieldy data of the blockchain domain into refined, actionable insights. It aims to equip investors, regulators, and analysts with the tools needed to navigate the complexities of the DeFi landscape, providing a level of analysis and accessibility previously reserved for traditional markets.

This Arkham Intelligence review will delve into its offerings, exploring how it stands as a beacon for those navigating the often opaque (or, more precisely, translucent) waters of the Web3. We will examine its features and usability and explore how it stands out in blockchain analytics. Through this exploration, readers can expect to gain a comprehensive understanding of what Arkham Intelligence brings to the table and get a deeper look into the evolving landscape of blockchain analytics and its pivotal role in shaping the future of finance.

Arkham Intelligence Overview

Arkham Intelligence is a cutting-edge platform in blockchain analytics designed to transform complex blockchain data into actionable insights. Its primary aim is to illuminate the often opaque world of cryptocurrency transactions, providing clarity and understanding to users ranging from individual investors to large institutions.

The Key Features of Arkham Intelligence Are:

- Ultra AI: Aggregates raw on and off-chain data into entity-based actionable data.

- Entity-Based Intelligence: Tracking on-chain activity from the user’s rather than the network’s perspective.

- The Intel Exchange Marketplace: An exchange to trade on-chain intelligence.

Importance of Crypto Analytics in Today’s Market

In the fast-evolving landscape of cryptocurrency, crypto analytics has become indispensable. With the market's notorious volatility and complexity, investors, traders, and financial analysts rely on crypto analytics to make informed decisions, manage risks, and identify opportunities. Platforms like Arkham Intelligence are at the forefront of this field, offering deep insights into blockchain activities beyond surface-level transaction data.

One of the critical challenges in crypto analytics is the sheer volume and complexity of data. The blockchain's transparency generates vast amounts of information that can be overwhelming to parse without sophisticated tools. Additionally, the pseudonymous aspect of blockchain transactions adds a layer of complexity in accurately identifying and tracking the entities involved.

Arkham Understands the Challenges of Crypto Analytics

Arkham Intelligence addresses these challenges by aligning with its core values by providing entity-based intelligence and a comprehensive Intel Exchange. By focusing on the entities behind transactions and offering a platform for sharing and acquiring intelligence, Arkham empowers users with nuanced insights crucial for making strategic decisions in the crypto market.

However, the field of crypto analytics is not without its challenges. Ensuring data accuracy, protecting user privacy, and maintaining the integrity of the analysis are ongoing concerns. As the market continues to mature, the demand for advanced analytical tools will only grow, highlighting the importance of platforms like Arkham Intelligence in shaping the future of crypto analytics and providing clarity in a complex domain.

What is Arkham Intelligence?

Arkham Intelligence is a blockchain analytics platform. Blockchain networks generate staggering heaps of data at every block, which is transparent and globally accessible but often dense and unwieldy. Arkham organizes on-chain data from several commonly used blockchain networks and off-chain data from the real world in an intuitive interface so that users can draw meaningful inferences from it with minimal effort.

Arkham uses artificial intelligence to filter, classify, and organize data to make it actionable for its users. Cryptoeconomics democratizes data availability by making it transparent and accessible. Despite the transparency, extracting meaningful insights from the data requires considerable technical knowledge and understanding of blockchain architecture. Users must manually sift through transactions, decode smart contracts, and understand wallet interactions, which can be daunting for the uninitiated.

Blockchain Analytics vs. Blockchain Explorers

Blockchain explorers provide a window into blockchain transactions and blocks. Explorers like Etherscan or Blockchain.com are invaluable for anyone looking to verify transactions or track the movement of assets across the network. However, using these tools still requires skill and comprehensive technical knowledge we can’t expect every user to acquire if Web3 aims for global adoption.

Blockchain analytics services, on the other hand, such as platforms like Arkham Intelligence, take a step further by aggregating data and analyzing and interpreting it. They employ sophisticated algorithms, AI, and data science techniques to filter through the vast amounts of on-chain information. These platforms present their findings in user-friendly formats, highlighting connections, patterns, and trends that might be invisible or difficult to decipher using standard explorers. By doing so, they democratize access to blockchain intelligence, enabling a broader range of stakeholders, from casual investors to regulatory bodies, to confidently understand and act upon blockchain data.

Arkham Intelligence Vision

Arkham Intelligence posits a bold vision for the future of cryptocurrency, asserting that crypto-based technologies will become integral to the global financial system. This vision is underpinned by the belief in a seamless integration of real-life and on-chain identities catalyzed by the increasing adoption of digital IDs in the post-COVID era. The proliferation of Bitcoin ETFs, crypto credit cards, and other financial applications during the recent bear market has significantly aligned crypto assets like Bitcoin and Ethereum with the global economy, lending credence to Arkham's perspective.

Arkham's Thesis

Deanonymization is Destiny

The transition from pseudonymous internet activities to real-identity usage mirrors what Arkham foresees for blockchain identities. However, while digital IDs gain prominence, the complete linkage of blockchain identity to real-world identity in finance seems ambitious, given the enduring reliance on government-issued IDs for financial transactions.

Access to Crypto Data Will be Decentralized

Arkham predicts a future where raw transaction data processing, aggregation, and analysis are democratized, a vision that aligns with the ethos of crypto's inherent transparency and accessibility. This decentralization of data access is plausible and necessary for the broader adoption of crypto technologies.

Crypto is Becoming a Core Part of the Global Financial System

The integration of cryptocurrencies into mainstream finance is undeniable, with examples like Bitcoin ETFs and stablecoins being used for cross-border payments. These developments exemplify the ongoing merger of crypto with global financial infrastructures.

Crypto Intelligence Will Be Widely Adopted

The ubiquity of crypto use cases — from remittances to complex derivatives trading — suggests a future where crypto intelligence tools become as commonplace as smartphones. The trajectory of crypto's integration into daily financial activities supports this thesis.

The Crypto Intelligence Economy Will Be $30B+ Annually

While the potential for a multi-billion dollar crypto intelligence market exists, especially given the utility of on-chain data over traditional financial data, realizing this vision requires overcoming current challenges in adoption and the broader acceptance of crypto as a foundational technology of future financial systems.

The Future of Crypto Data is Entity-Based

Arkham's push for entity-based intelligence is insightful, offering a nuanced approach to understanding blockchain activities. This focus on the "who" behind transactions could redefine the landscape of crypto data analysis, offering clarity amidst the pseudonymity of blockchain transactions.

Crypto Intelligence Will Power Self-Regulation

The idea that the crypto industry will develop self-regulating standards and practices, much like historical guilds, is promising. DAOs, governance, and consensus protocols are successful examples of this narrative. These innovations demonstrate a shift towards self-regulation and transparency, where identifying the entities behind transactions is crucial.

Arkham Intelligence Team

Arkham Intelligence is spearheaded by a team deeply entrenched in the cryptocurrency and technology sectors. The team is driven by the vision of demystifying the blockchain for a broader audience.

- Miguel Morel, co-founder and CEO, brings a wealth of experience from his time at Reserve Protocol, a novel stablecoin network, showcasing his deep understanding of the crypto market's intelligence needs. His background positions him uniquely to lead Arkham's mission of providing crucial insights to decision-makers across various sectors.

- Henry Fisher, Arkham's CTO, and co-founder, previously contributed his engineering talents to Reserve as its first engineer and played a significant role at Tesla, enhancing his expertise in developing and deploying innovative technologies. His leadership at Arkham ensures the platform's intelligence and usability meet the highest standards.

- Zachary Lerangis, as the head of operations and chief of staff, leverages his experience from Bismarck Analysis, where he delved into the societal impacts of groundbreaking technologies. His role at Arkham is instrumental in shaping the company's organization and culture.

- Alexander Lerangis, heading business development, brings a strategic edge from his tenure at Deloitte's Risk and Financial Advisory consultancy. His experience with financial institutions enriches Arkham's business development and partnerships, driving the company forward in the competitive blockchain intelligence landscape.

The Arkham team's diverse background and expertise underscore their capability to revolutionize blockchain analytics, making complex data accessible and actionable for users across the spectrum.

Arkham Intelligence Backers

Arkham’s investors include an undisclosed OpenAI co-founder, Palantir Co-Founder Joe Lonsdale (8VC), Tim Draper (Draper Associates), Wintermute, GSR, and Geoff Lewis (Bedrock). The company raised over $10 million in two rounds of equity financing and was valued at $150 million in its last round.

Key Features of Arkham Intelligence

In today’s financial landscape, the ubiquity of stock trading can largely be attributed to the highly efficient filtration and real-time availability of trading data. This principle of making complex information accessible and actionable underpins the success of any analytical platform.

In the crypto economy, where data is notoriously dense, a platform's ability to abstract away the intricacies of on-chain data collection, filtering, and sorting is critical. This abstraction demystifies the blockchain for users and fosters greater adoption by making the technology approachable to a wider audience.

As we explore the key features of Arkham Intelligence, we will see how effectively the platform achieves this goal:

The Intelligence Platform

The Arkham Intelligence whitepaper describes three critical challenges of crypto intelligence that their platform is built to overcome. These challenges underpin the ethos of blockchain intelligence we inferred in our analysis today – cheap and real-time access to high-quality blockchain data. The challenges are:

- Collection: Reliable sources of on-chain and off-chain data.

- Aggregation: Combining data and making it accessible by simple queries.

- Attribution: Linking on-chain identities to real-life identities.

Arkham solves the ‘Intelligence Problem’ with a proprietary AI system dubbed Ultra. Not much is detailed about Ultra in Arkham whitepapers, except that it aggregates publicly available on-chain and off-chain data from several sources, transforming raw blockchain transaction data into a record of real-life entities conducting on-chain operations like crypto investing and DeFi. Ultra has enabled Arkham to index over 450,000 entity pages with over 800 million labels.

Ultra is definitely one of the standout features of Arkham. However, it is not one users actively engage with. Rather, Ultra works in the background and efficiently addresses the intelligence problem to enrich users with easily comprehensible data.

Let's discuss some Arkham features that the users do actively engage with:

The Arkham Platform

Arkham renders its services via a public web-based application. The Arkham Platform is intuitive to use and, in design, reminiscent of stock analysis platforms like Bloomberg markets. If you open Bloomberg markets, the homepage includes links to relevant headlines, displays prices of the most traded stocks and commodities, and provides access to additional features like price charts within a few clicks. Quite similarly, the Arkham platform homepage summarizes the latest transactions across different networks, displays trending assets, and lets users search for anything or anyone with a few clicks.

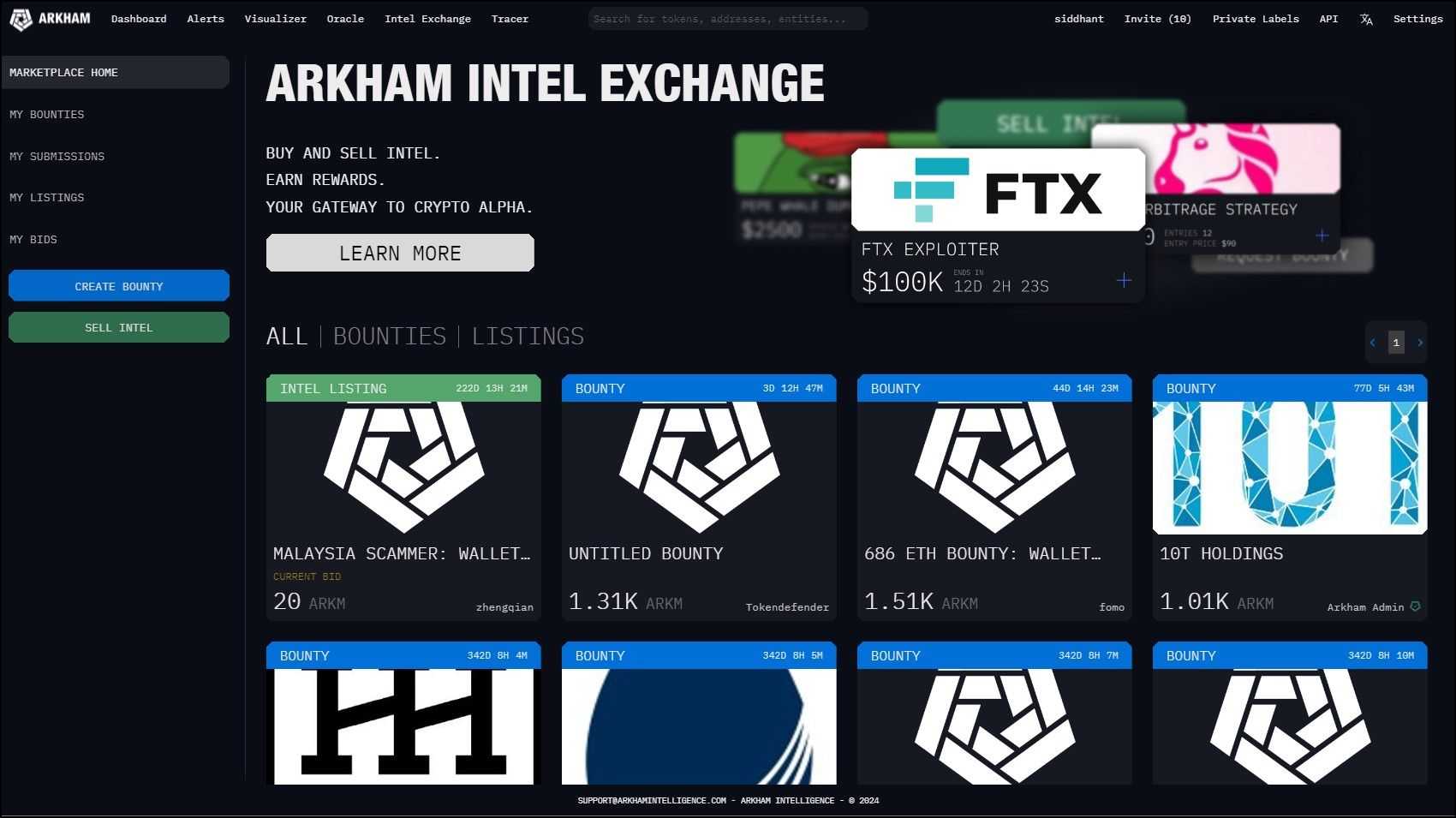

The Arkham Intel Exchange

Put simply, the Intel Exchange commodifies information. Users with information can sell it to buyers for ARKM, Arkham’s native cryptocurrency. The Intel Exchange incentivizes intel capture and sharing, creating an economy for information.

Governance

Arkham Intelligence's governance structure empowers ARKM token holders with significant influence over the platform's operational and strategic decisions. This decentralized governance mechanism allows stakeholders to actively participate in shaping the future of the intel exchange, addressing emerging challenges and opportunities.

Token holders can propose and vote on Arkham Improvement Proposals (AIPs), which may encompass a range of critical aspects such as refining the on-chain intel verification process, adjusting exchange fees, and deciding on utilizing funds within the Arkham Foundation Treasury.

At the core of this governance model is the ability of ARKM holders to influence the exchange's smart contract updates, potentially introducing more sophisticated features or adjustments based on collective experiences and insights. The fee structure can also be modified through AIPs, providing flexibility to adapt to the evolving marketplace dynamics.

Moreover, the Arkham Foundation Treasury, set to unlock over seven years, represents a strategic reservoir to fund initiatives that align with Arkham's mission, incentivize community contributions, and ensure the network's sustainability. Arkham Intelligence fosters a collaborative environment through this governance framework where the community's voice is pivotal in steering the platform's evolution.

Multi-chain Support

Arkham Intelligence supports the following chains:

We are familiar with blockchain explorers. Think of Arkham as an all-encompassing blockchain explorer with advanced analytics tools. As an entity-based crypto research platform, Arkham lets users treat all supported chains cohesively to combine attributes from different chains, aggregate assets from all chains, and analyze the movement of money. Aggregation is key to meaningful crypto analytics because individuals often hold assets across several networks but manage their portfolios as a combined unit.

ARKM Tokenomics

The ARKM token has the following utility in the Arkham Ecosystem:

- Settlement currency for the intel exchange.

- Used to propagate rewards and discounts to promote the Arkham ecosystem.

- Governance token for the Arkham Intel Exchange.

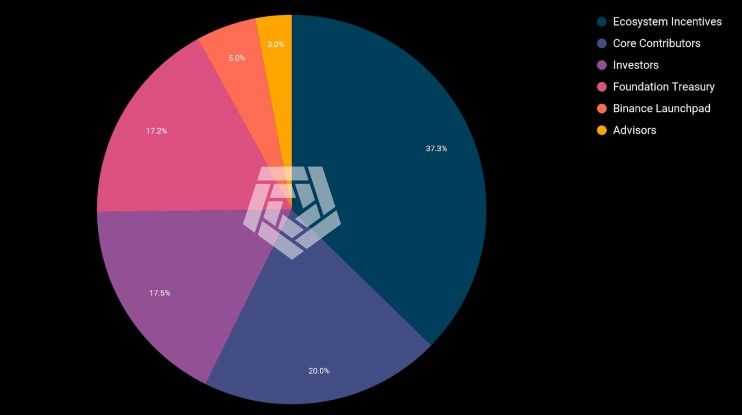

ARKM has a total initial supply of 1,000,000,000 tokens, distributed as follows:

- Ecosystem Incentives and Grants: 37.3%

- Core Contributors: 20%

- Investors: 17.5%

- Foundation Treasury: 17.2%

- Binance Launchpad: 5.0%

- Advisors: 3.0%

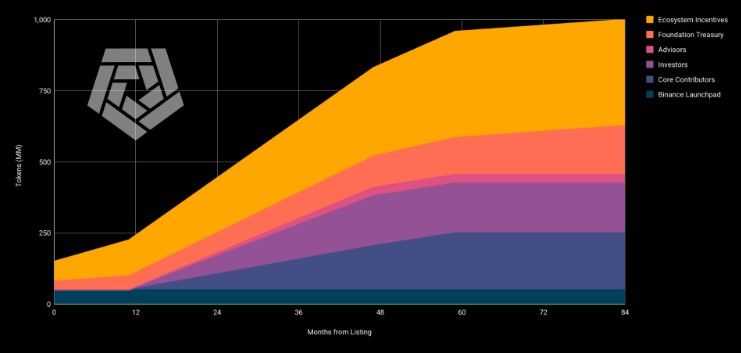

The total ARKM supply unlocks over 7 years. Investors and contributor tokens will begin unlocking one year after token listing and will become fully unlocked over the next three years.

Utilizing Arkham Intelligence for Crypto Analytics and Investment

One of the most fascinating revelations I encountered while using Arkham Intelligence was the profound shift in my approach to analytics. This platform offers a unique vantage point into blockchain analytics that I had never explored before. The key lies in Arkham's innovative use of entity-based intelligence.

Traditionally, tools like Dune Analytics and blockchain explorers present data from the blockchain's perspective, organizing it based on addresses. However, Arkham Intelligence introduces a paradigm shift by categorizing data according to users. Instead of focusing solely on the transactions and addresses, Arkham sheds light on the behaviours of individual users — revealing the specific transactions they conduct and the decentralized applications (DApps) they interact with.

A New Perspective with Arkham Intelligence

This shift from an address-centric to an entity-based approach unlocks new dimensions of understanding within the blockchain space. It allows for a deeper analysis of user behaviour, transaction patterns, and DApp utilization, providing invaluable insights for strategic decision-making in cryptocurrency investments. With Arkham Intelligence, I discovered a whole new perspective on blockchain analytics, revolutionizing my approach and opening doors to previously unexplored opportunities.

Arkham Intelligence comes with many interesting bells and whistles. Before exploring them, I recommend users sign up on the platform to ensure unhindered access to the entire Arkham ecosystem.

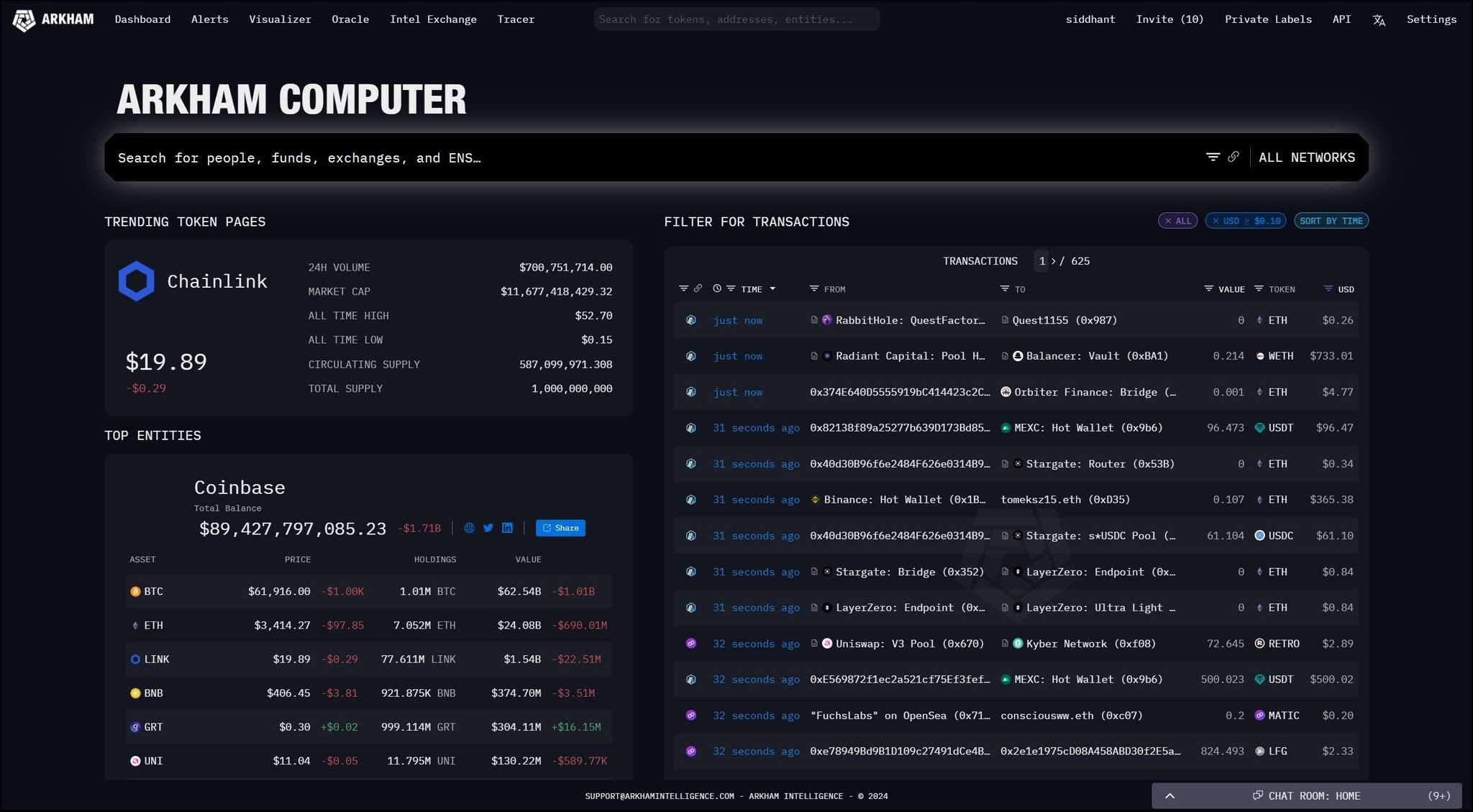

Arkham Platform Homepage

The Arkham Platform Homepage is the first page you land on. The homepage shows a snapshot of what’s happening across the supported networks. The right half of the homepage is dedicated to a live feed of transactions, where you will notice that activity from several networks is aggregated in a single timeline.

There are two search bars, a big one in the centre and a small one at the top. They serve different functions:

- Use the small search bar to look for anything on any network.

- Use the big search bar for a nuanced search by selecting a particular network.

With Arkham, you can look for any entity across these chains. Its AI data aggregation layer Ultra enables searching by a variety of fields. In addition to your standard address search, you can look for any individual or entity by their real-world name or their X (Twitter) handle. If your query involves an on-chain identity, Arkham indexes and can be searched by Ethereum Name Service (ENS) and OpenSea names. You can also look for a protocol by searching their contract name or token by searching for the ticker.

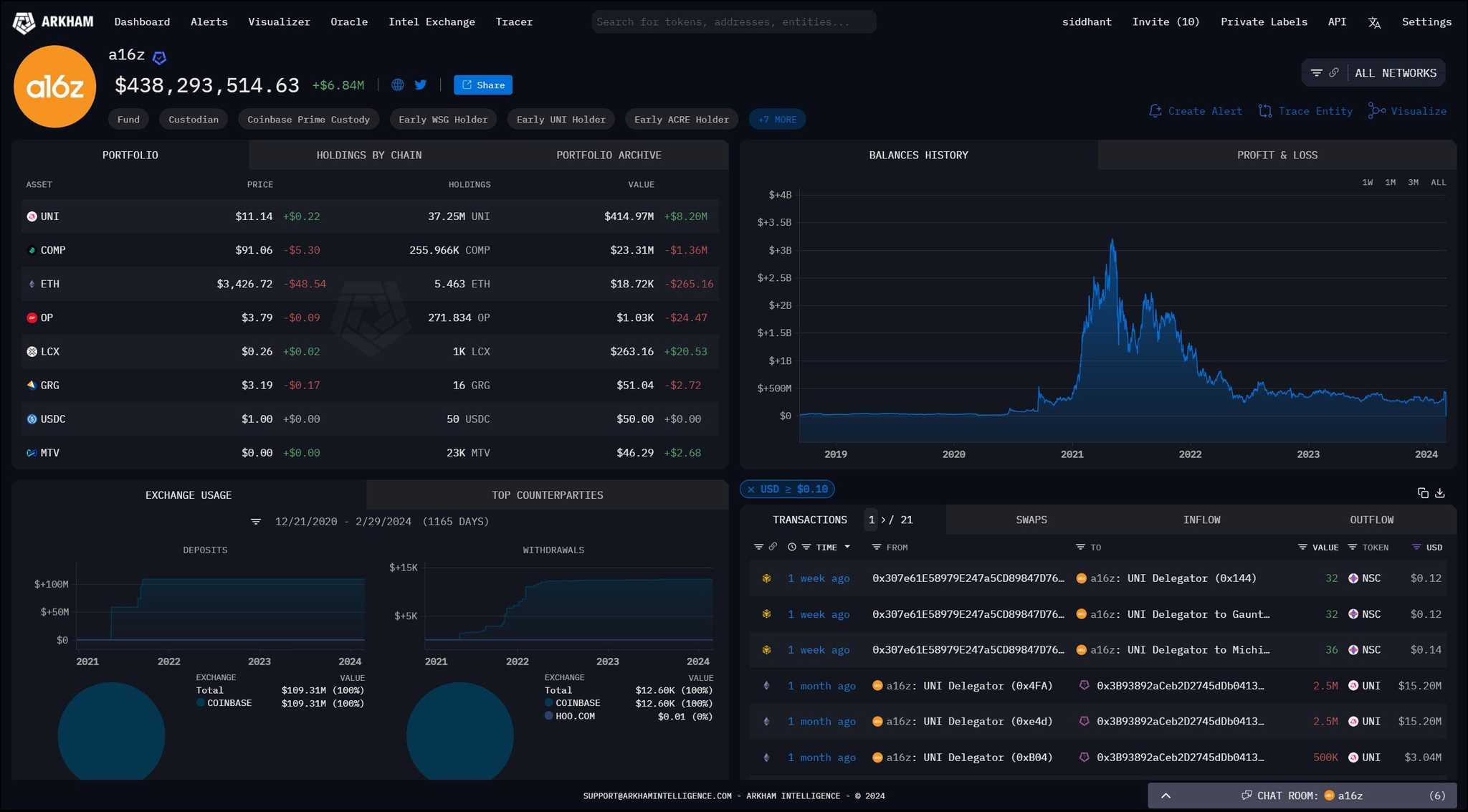

Arkham Profiles

When looking for any entity on Arkham, you land on their profile page, where you will find insights about their cryptocurrency holdings and on-chain activity. Having multiple addresses on a network or multiple addresses across several blockchain networks with assets scattered across all is a common practice in DeFi. However, when you’re on a profile page, details about different wallets are abstracted away from the user, and aggregated holdings are presented in a simple interface.

The Profiles are arranged in five tiles:

- Holdings / Holdings by Chain / Portfolio Archive: This is a summary of crypto holdings across different networks, which can be further broken down by chain and compared between any two dates.

- Balance History / Profit & Loss: The holdings graph charts the aggregate value of the entity’s holdings over time in USD. View the entity’s on-chain P&L over time.

- Exchange Usage / Top Counterparties: Following the entity’s exchange crypto deposits and withdrawals to gauge their sentiment. View their top counterparties and filter by chain, token, and time/duration.

- Transactions / Swaps / Inflow / Outflow: This tile shows transactions involving the entity, which can be sorted and filtered by chain, time, counterparty, value, token, and USD. You can filter transactions by inflow/outflow and see any DEX swaps.

- Barrows & Loans: See any open DeFi borrows & loans for the entity in protocols like Aave, Compound, and MakerDAO.

Arkham carefully designs profile pages by deciding what information to show and what to abstract away so that users can intuitively analyze the characteristics they care about without friction. Arkham simplifies following the trail of money.

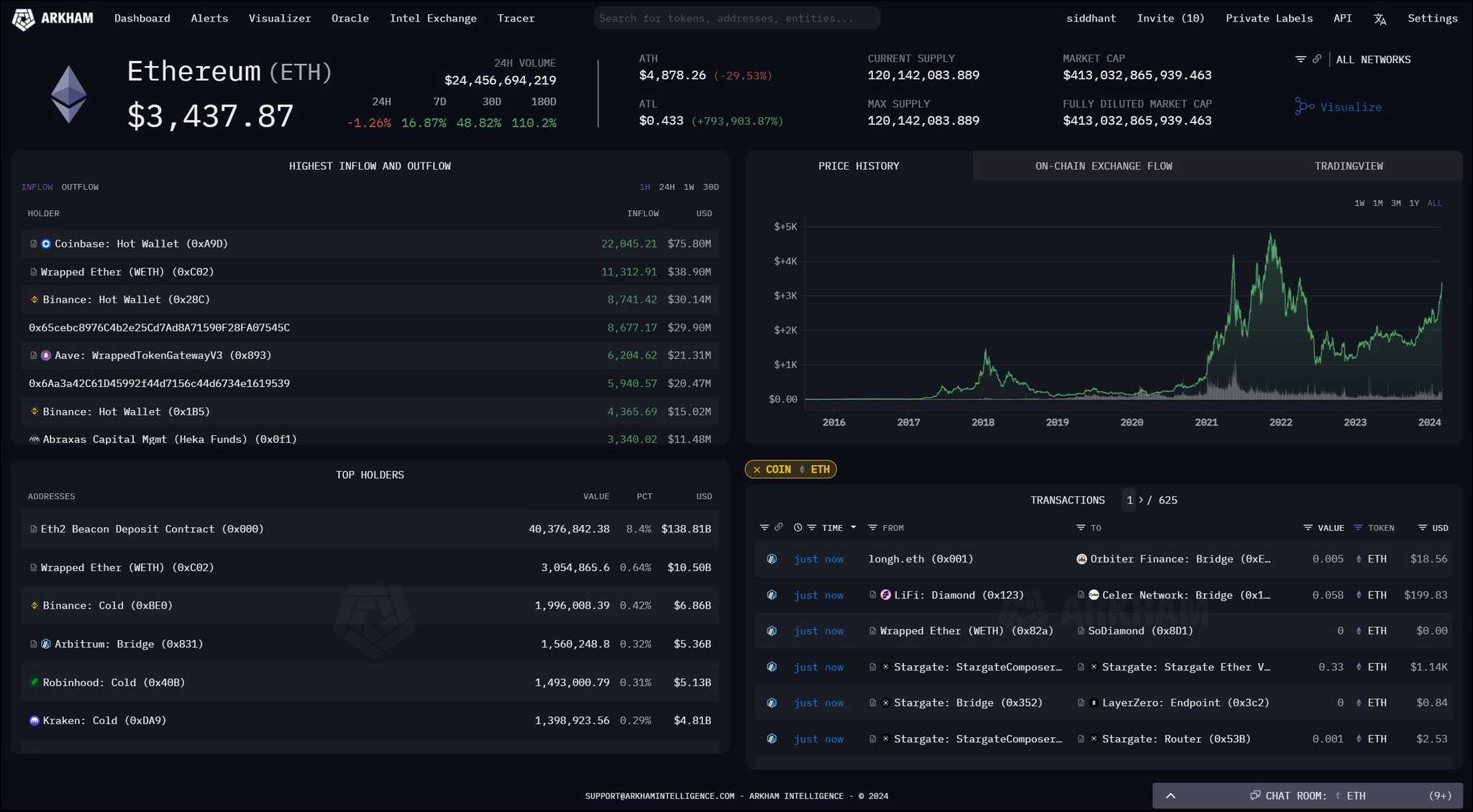

Token Pages

To open any token page, search for the desired token on any search panel. The top row of any token page summarizes essential technical metrics like its value, trading volume, supply, average returns, ATH/ATL, etc.

A Token Page comprises four sections:

- One section tracks the highest inflow/outflow across crypto entities and individuals, an essential metric to gauge market sentiment.

- Next, you can analyze the asset’s price history and on-chain exchange flow, including a TradingView integration.

- Arkham also tracks top token holders in real-time, making that data readily available.

- Finally, users can also shift through the latest transactions involving that token to see who trades it and what protocols are accessing it.

Token Pages on Arkham are significantly easier to interpret than extracting similar data from blockchain explorers. The token page interface is designed to track crypto assets as investments, so they don’t offer much insight into a token’s intrinsic properties, like inflation, gas levels (in the case of L1 tokens), and blockchain data. Users should refer to Arkham and Blockchain Explorers for a more granular outlook on any cryptocurrency.

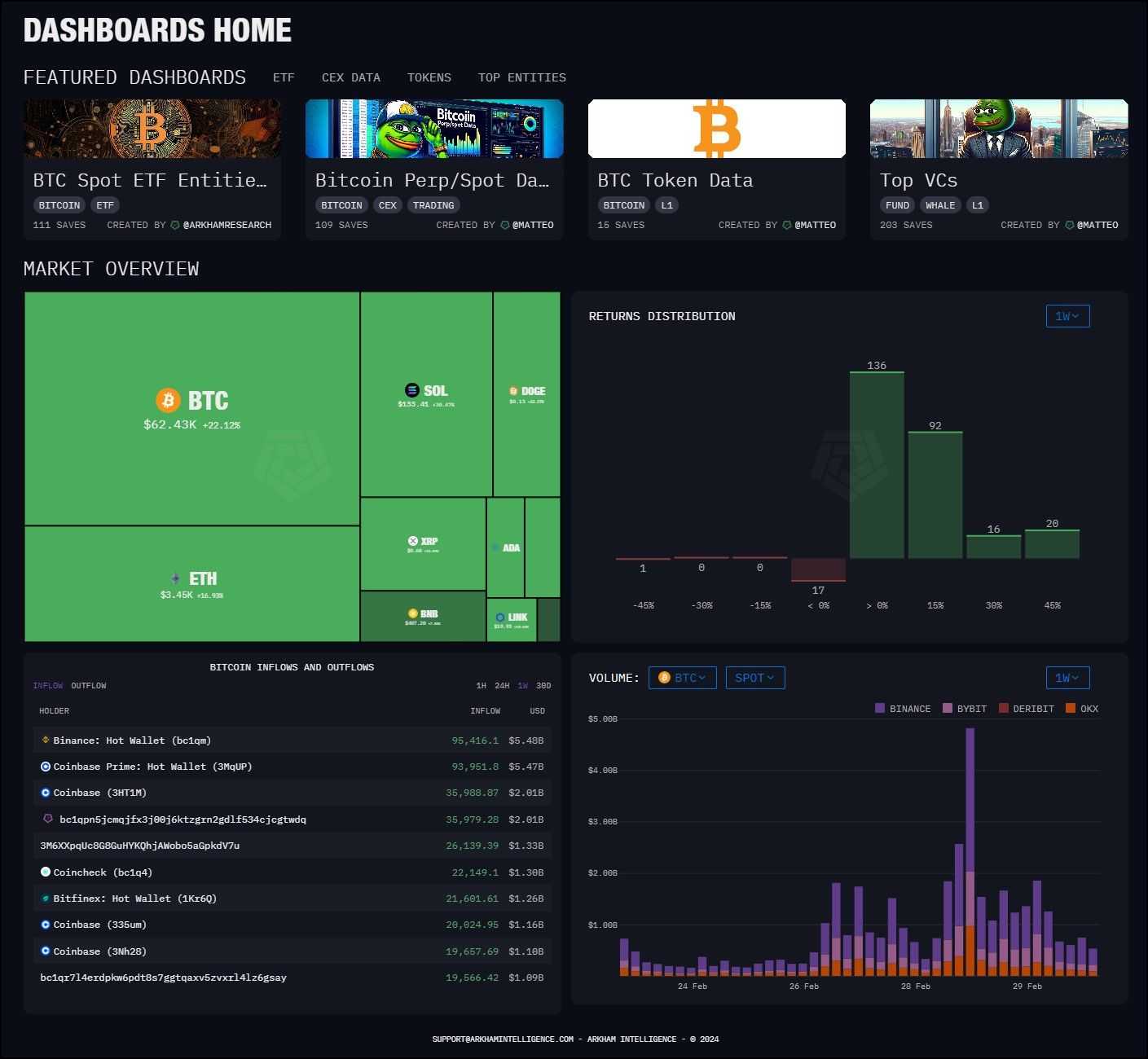

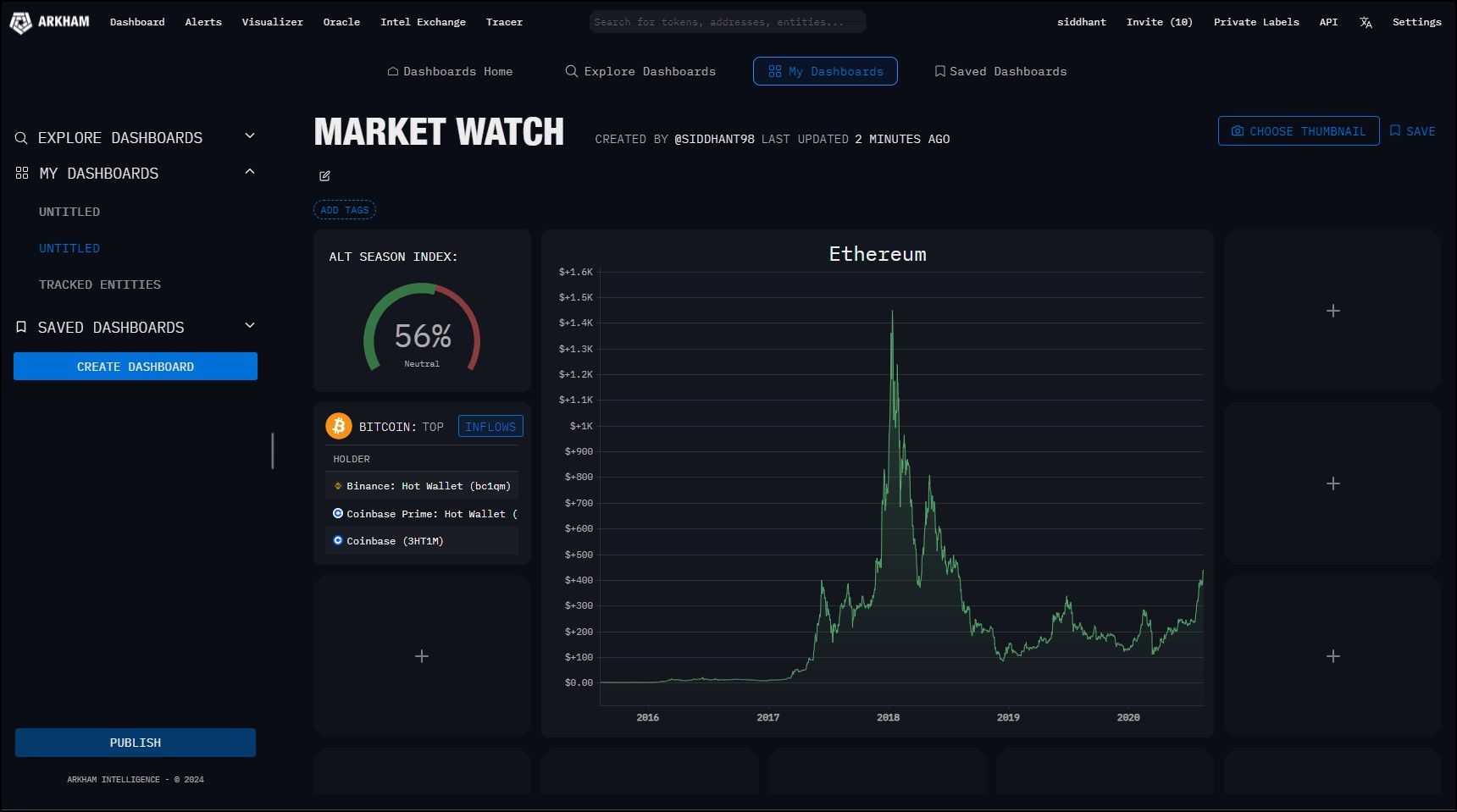

Dashboards

Financial markets are where investors employ a myriad of strategies involving different narratives, metrics, data, and investment goals. So, customizability is the key to designing an effective analysis platform that appeals to as many people as possible. Dashboards are one such customizable tool in Arkham.

A dashboard on Arkham, as the name suggests, is a blank space where users can create a customized view of various on-chain and off-chain metrics, including spot, futures, and options exchange data. They let users instantly glance at the state of address and entities based on metrics they value most.

Arkham offers this granular customizability with widgets. There are two ways to leverage the dashboard feature:

Create Custom Dashboards

Seasoned traders will love this feature because, through these dashboards, Arkham has solved the problem of having to reference many metrics from various sources by bringing them together in one place.

Creating custom dashboards is as easy as adding widgets to your phone's home screen. Head over to saved dashboards and find the ‘Create Dashboard’ tab to start a new dashboard. Users can find widgets for any metric they like, add them to their dashboard, and size them to their liking. I whipped up a quick test dashboard in the picture, which took less than two minutes to get up and running.

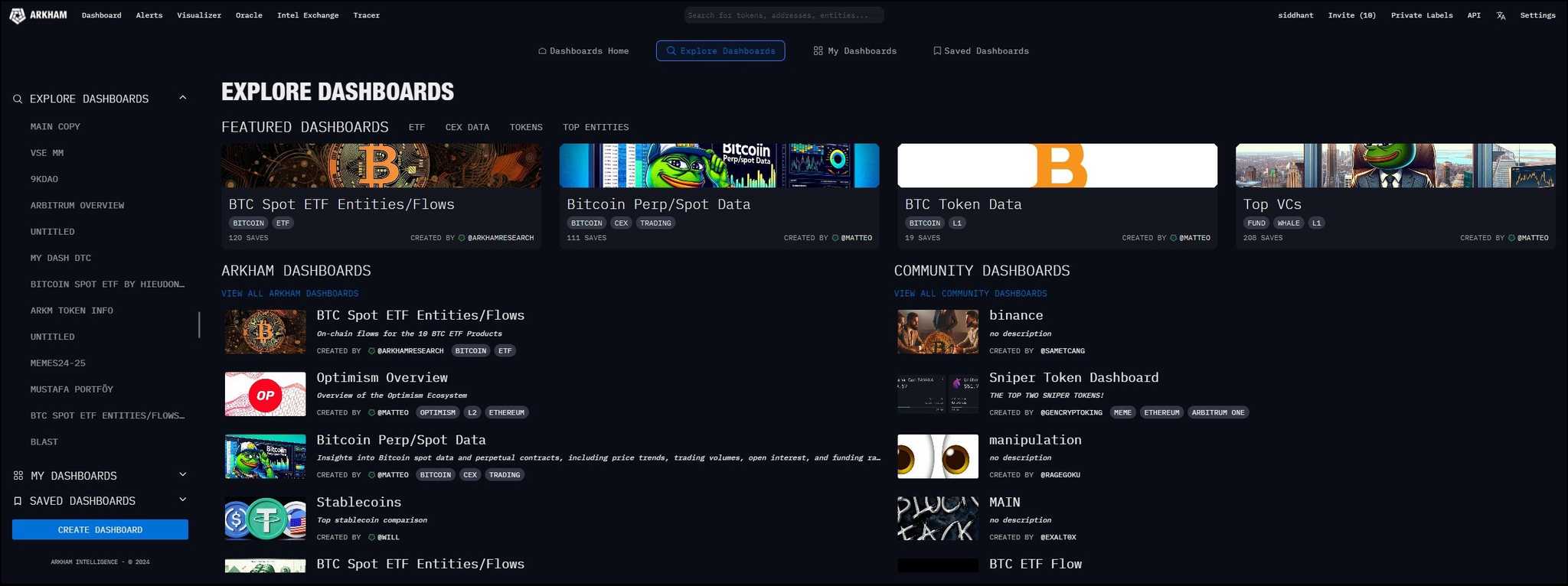

Explore User-Submitted Dashboards:

If you hit the ‘Explore Dashboards’ option on the Dashboards page, you'll find countless dashboards spanning several data areas. Investors with any trading style will find useful dashboards here, curated by the Arkham team and the community.

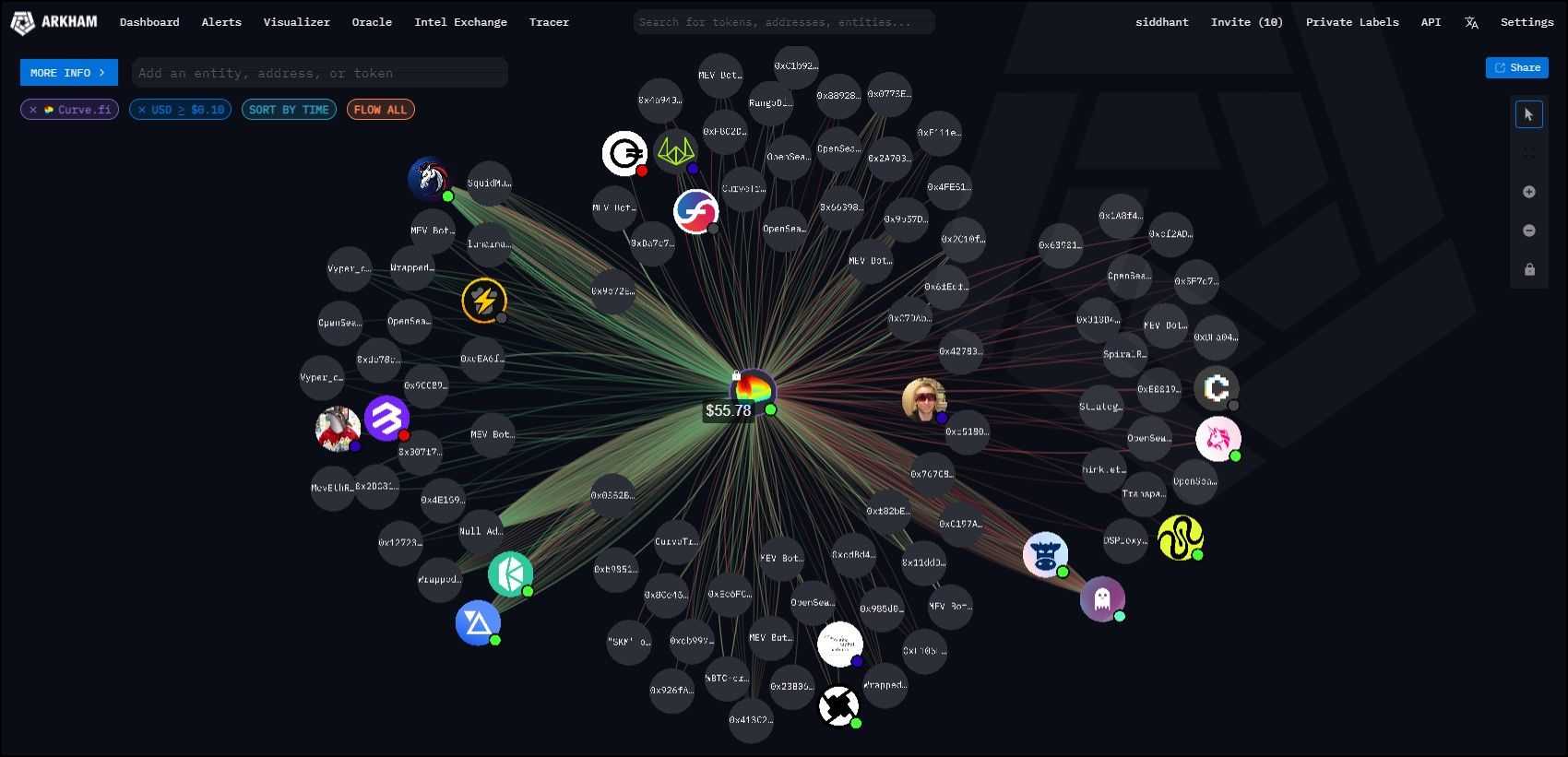

Visualizer

The visualizer is a fascinating approach to analyzing crypto transactions for particular or multiple entities. The tool creates an interactive mind map of transactions involving any entity. The infographic representation of transaction data from a counterparty point of view improves data absorption and helps draw inferences efficiently.

Tip: If you click on more info, you can further filter visualizer results by their characteristics (chain, token, time, counterparty, etc.).

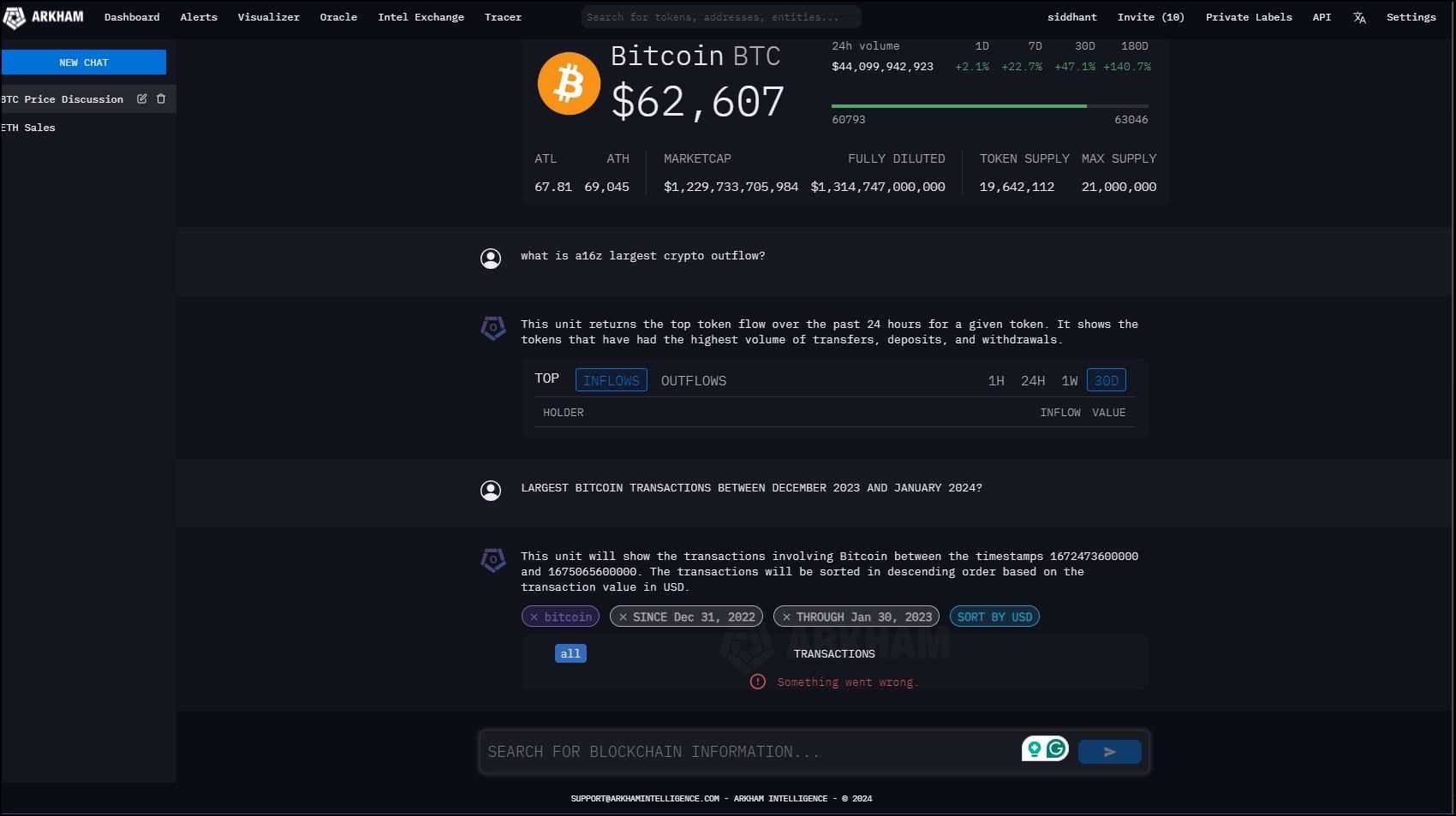

Arkham Oracle

Large Language Models have become proficient at understanding human text input and converting them into actionable queries. Making use of them, the Arkham Oracle is another AI-driven tool that lets you analyze blockchain data with text prompts similar to ChatGPT but focused on Arkham’s underlying dataset.

While the pace of innovation in AI has been faster than ever, Arkham’s Oracle is a miss at this point. The Oracle is an insanely cool idea on every account, but it did not work as expected despite multiple attempts (see above image). However, prompt-driven AI tools have been all the rage in this market cycle, so I anticipate Arkham to improve its Oracle response in due time.

Quick Rundown of Additional Features

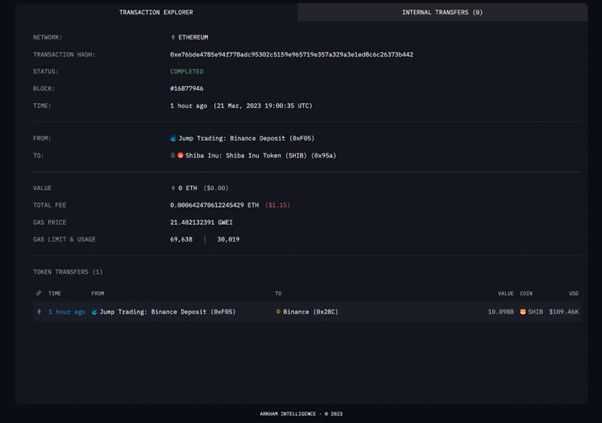

Tracer: Trace fund-flows across wallets & blockchains chronologically.

Block Explorer: Research on-chain data more thoroughly by transaction hash.

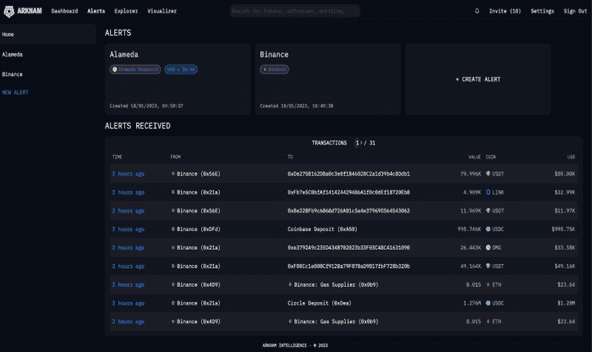

Alerter: Set instant alerts for anyone’s activity.

Arkham API: Get direct query access to Ultra for sophisticated users to customize data flows and integrate them into their existing systems. Write custom SQL queries to access a list of Arkham labels, as well as transaction logs & historical balance data for addresses and entities.

Arkham Intelligence Features Conclusion

Arkham Intelligence redefines the landscape of blockchain analytics by transforming complex transaction data into a comprehensive, user-friendly view of the crypto universe. Its proprietary technology, Ultra, stands out as a pivotal tool in the industry, synthesizing vast amounts of data to provide unparalleled insights into the activities of key players, from major exchanges to influential individuals.

With over 800 million labels and extensive entity pages, Arkham offers a granular look at transaction histories, portfolio holdings, and much more, enhancing transparency and decision-making in crypto. The platform's suite of features, including the Visualizer, token pages, and customizable alerts, equips users with the tools to navigate the blockchain confidently and clearly. By partnering with leading blockchain networks, Arkham ensures it stays at the cutting edge, offering its users a detailed and dynamic view of the crypto ecosystem.

The Revolutionary Intel-to-Earn Model by Arkham

In traditional finance, the flow of information is often tightly controlled, creating a significant imbalance between regular investors and influential market participants. For instance, institutional investors and large corporations have privileged access to advanced market analytics, insider information, and sophisticated tools that are out of reach for the average individual. This disparity is exemplified by the use of Bloomberg Terminals, which offer comprehensive financial data and analytics but at a prohibitive price point for most retail investors.

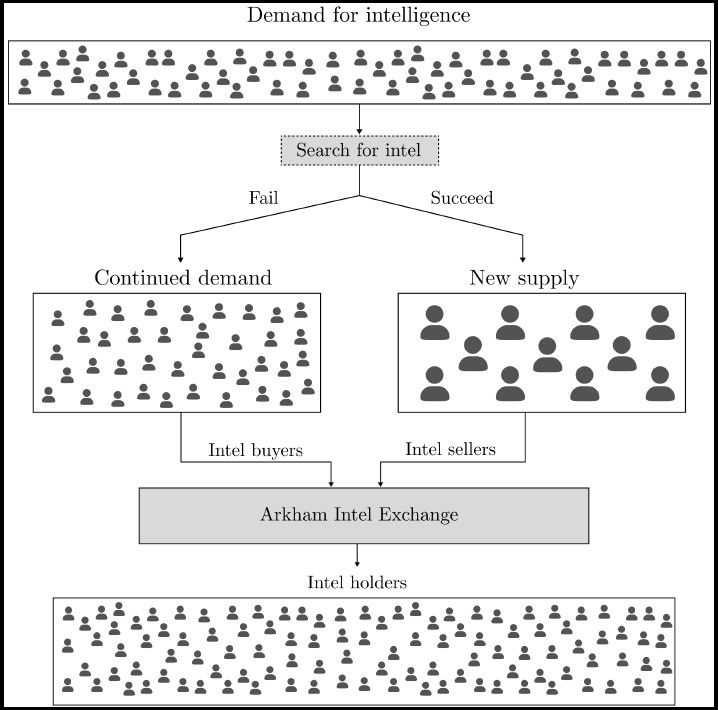

Contrast this situation with the DeFi sector, where, despite the abundance of data due to its free nature, significant gaps remain in the ability of information seekers to connect with providers.

Deciphering blockchain data into actionable intelligence is not straightforward. Where traditional markets suffer from data availability, the challenge with DeFi lies in processing, analyzing, and contextualizing this data to make it useful for diverse stakeholders. This is where Arkham Intelligence's Intel-to-Earn model steps in, bridging the gap by incentivizing the sharing and utilization of crypto intelligence to democratize access for all market participants, potentially transforming how information is exchanged and valued in the crypto ecosystem.

How the Arkham Intel Exchange Works

The Arkham Intel Exchange comprises three main participants – Intel seekers, Bounty hunters, and the Arkham Foundation.

The interplay between these participants results in a democratic marketplace for on-chain intelligence operating using smart contracts and in complete transparency. Importantly, Arkham has established clear guardrails around the kind of information that can be transacted on the Intel Exchange, and the Arkham Foundation reviews all proposed submissions prior to going live to ensure they meet these requirements:

Requests Allowed:

- Publicly verifiable data

- Uncovering scams, hacks and exploits

- Identifying key entities

- Market analysis

- Alpha sources

Requests Prohibited:

- Private data (physical addresses, contact numbers, etc.)

- Revenge posting and harassment

- Data irrelevant to on-chain activity

- Data outside the purview of public information

Here's how the exchange works:

Intel Seekers

Intel seekers in the Arkham Intel Exchange are buyers looking for specific blockchain-related intelligence. They post their requests on the exchange and stake ARKM tokens as a reward for servicing their request. The intel seekers retain exclusive rights to the information for 90 days. After this period, the exchange releases the intel in the market via the Intelligence Platform for anyone, ensuring a democratic environment that does not gatekeep information. The Arkham Foundation reviews all submissions to a given bounty on a first come, first served basis and validates whether a given submission has satisfied the bounty request accurately and fully using only publicly available information that can be independently verified.

Intel Providers

Intel providers are the sellers or contributors of valuable information on the Arkham platform. They can participate in two ways: by responding to bounties with their submissions or by setting up auctions with their intel.

Any information they publish on the exchange is initially verified by the Arkham Foundation, who ensure its efficacy and accuracy. In the auction system, once their information is verified, it is put up for auction, allowing multiple buyers to bid, thereby discovering the price of the intel in a competitive market. This mechanism rewards providers and establishes a market-driven valuation of blockchain intelligence.

Essential Attributes of the Intel Exchange Backend:

- The entire exchange runs on-chain with smart contracts. Therefore, Arkham never retains custody of ARKM stakes and only facilitates the collaboration of market participants.

- Arkham takes a 2.5% maker fee on submitted bounties and a 5% taker fee on bounty payouts and successful auction bids.

- Intel submitted in bounties and auctions is reviewed by the Arkham Foundation, which can reject it if it does not match their standards.

Arkham Intel Exchange Closing Thoughts - The Intelligence Oracle Problem

The Arkham Intel Exchange represents a significant leap forward in democratizing access to knowledge within the Web3 space. Arkham fosters an inclusive environment where emerging talents can showcase and monetize their analytical skills by offering a platform that values contributions from both established and budding researchers. This approach not only diversifies the sources of intelligence but also injects fresh perspectives into the blockchain analysis field.

However, the system faces a challenge — the 'Intelligence Oracle Problem' — which highlights the difficulty of verifying the quality of intel without breaching its confidentiality. This dilemma underscores the need for a robust mechanism that can ascertain the reliability of submissions without direct exposure, ensuring that only high-quality intel is transacted on the platform.

Currently, the Arkham Foundation plays a central role in this verification process, which, while effective, introduces a degree of centralization. The pursuit of a decentralized solution, potentially through zero-knowledge proofs, signifies Arkham's commitment to enhancing the integrity and trustworthiness of its platform. These proofs could allow validators to confirm the validity of intel without accessing its contents directly, maintaining confidentiality while ensuring quality.

As research continues to find a viable decentralized verification method, the Arkham Intel Exchange remains a pioneering initiative committed to evolving its systems to uphold the highest data integrity standards and maintain its users' trust.

Leveraging Arkham Intelligence for Business and Personal Use

Arkham Intelligence provides a robust platform for businesses and individuals to leverage blockchain data for myriad strategic and financial purposes, enhancing their decision-making processes and uncovering new opportunities in the crypto landscape.

Business Analysis and Decision-Making with Arkham Intelligence

- Competitive Intelligence: Businesses can use Arkham to monitor the blockchain activities of competitors, understanding their transaction patterns, partnerships, and investment strategies to make informed strategic decisions.

- Due Diligence: Before entering partnerships or investments, companies can analyze the blockchain activities of potential partners or investment targets to assess their financial health and integrity.

- Market Analysis: By tracking the flow of assets and identifying emerging trends in the crypto market, businesses can adapt their strategies to capitalize on market movements.

- Risk Management: Companies can monitor transactions related to their business to identify potential risks, such as fraudulent activities or association with dubious entities.

Personal Use

- Portfolio Tracking: Individuals can use Arkham to monitor the performance of their crypto investments, tracking profit and loss, portfolio balance history, and asset distribution.

- Market Research: Personal investors can analyze market trends, token movements, and the activities of major players in the crypto space to make informed investment decisions.

- Rewards through Intel-to-Earn: By participating in the Intel-to-Earn model, individuals can contribute their insights or analysis and earn rewards for their contributions.

- Analyzing Influencers: By examining the impact of high-profile individuals or entities on crypto markets, users can make more informed decisions about when to buy or sell based on the activities of these influencers.

These are some basic ideas I could think of off the top of my head. I can imagine Arkham unlocking innumerable applications of users who leverage this platform in different financial, business, and professional settings.

The Future of Arkham Intelligence and Crypto Analytics

Arkham Intelligence is positioning itself as a pivotal player in crypto analytics with many developments and a unique approach to democratizing knowledge in the Web3 space. The platform has integrated with multiple blockchain networks such as BNB Chain, Polygon, and Optimism, expanding its coverage and allowing users to track and monitor a wide array of on-chain activities across these networks. Over time, they plan to continue adding networks based on user demand. This expansion allows for a comprehensive analysis of entity transactions and asset flows, enhancing the platform's utility for a diverse user base.

A significant aspect of Arkham's innovation is its Intel Exchange, which revolutionizes how crypto intelligence is shared and monetized. This marketplace enables crypto sleuths to earn by providing on-chain analysis, creating a vibrant ecosystem where information is not only accessible but also rewards contributors. The use of the ARKM token within this exchange underlines a commitment to creating a self-sustaining ecosystem where users are incentivized to share accurate and valuable intel.

Arkham's approach addresses a critical gap in traditional financial intelligence by offering a platform where emerging researchers can monetize their skills alongside established analysts. This inclusivity fosters a broader base of intelligence sources, enhancing the diversity and richness of insights available on the platform. However, the platform faces challenges, particularly around the balance of transparency and privacy, reflecting broader debates within the crypto community.

In conclusion, Arkham Intelligence is not just evolving as a tool for crypto analytics but is also shaping the discourse around the use of blockchain data for insightful, actionable intelligence. Its future developments and growing adoption could significantly influence how market participants, from individual investors to large institutions, engage with and derive value from blockchain data.

Arkham Intelligence Review: Closing Thoughts

In this exploration of Arkham Intelligence, we've delved into its innovative approach to crypto analytics, which democratizes access to blockchain data and intelligence via a public platform. Through its integration with multiple blockchain networks and the introduction of the Intel Exchange, Arkham provides comprehensive tools for both business and personal use, enabling users to gain actionable insights from the vast landscape of blockchain data.

The platform's commitment to expanding its features, alongside its unique Intel-to-Earn model, positions it at the forefront of the crypto analytics evolution. However, challenges around privacy and transparency remain pivotal in the ongoing development of Arkham Intelligence.

Arkham Intelligence's vision for the future of crypto and its role within the global financial system is both ambitious and forward-thinking. The company's theses touch upon key facets of the evolving relationship between blockchain technologies and financial infrastructures. While some of these theses, like the inevitability of deanonymization and the industry's capacity for self-regulation, may seem more aspirational than immediate realities, they collectively offer a blueprint for a more transparent, accessible, and integrated financial future.

The journey towards this future, as Arkham suggests, will be shaped by advancements in crypto intelligence, the democratization of data access, and the ongoing merger of crypto with traditional financial systems. As these trends unfold, Arkham Intelligence's role in mapping the crypto frontier becomes increasingly vital, promising a path where every participant can navigate the blockchain landscape with confidence and clarity.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.

Frequently Asked Questions

Arkham Intelligence is a blockchain analytics platform that provides insights into cryptocurrency transactions and blockchain activities. It transforms complex blockchain data into actionable intelligence, enabling users to understand and analyze the movements and behaviors within the crypto market. This platform is designed for various users, from individual investors to large institutions, offering them tools to make informed decisions based on blockchain data.

Arkham Intelligence stands out with features like its Ultra AI, which aggregates publicly available on and off-chain data to offer comprehensive insights, and entity-based intelligence that reveals the actors behind blockchain transactions. The Intel Exchange is a unique marketplace for buying and selling crypto intelligence, and the platform also offers detailed dashboards and supports multiple blockchain networks, enhancing its utility and scope.

Crypto analytics is crucial in today's market as it provides the tools to decode the vast and complex data generated by blockchain transactions. This field helps investors, traders, and analysts make sense of market trends, identify investment opportunities, manage risks, and detect fraudulent activities. By converting raw data into understandable insights, crypto analytics empowers stakeholders to make data-driven decisions in a volatile and rapidly evolving market.

Entity-based intelligence in the context of blockchain refers to analyzing and identifying the real-world entities behind blockchain transactions. Instead of just analyzing transaction patterns, entity-based intelligence aims to reveal who is conducting these transactions, offering deeper insights into the behaviors and strategies of different actors in the crypto space. This approach enhances transparency and can provide more nuanced insights into market dynamics.

To track the flow of money in crypto using Arkham Intelligence, users can leverage the platform's detailed dashboards to analyze transaction histories, portfolio holdings, balance history, and other financial activities of various entities. By utilizing Arkham's entity-based intelligence and multi-chain support, users can trace how assets move across different networks and wallets, identify significant transactions, and understand the relationships between different market players, offering a clear picture of money movement in the cryptocurrency ecosystem.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.