Blockchain gaming is becoming one of the most exciting parts of the broader blockchain and decentralized app world, growing fast and gaining popularity in the digital asset space.

According to Fortune Business Insights, the global blockchain gaming market size should grow to $614.91 billion in 2030 from $154.46 billion in 2023 at a compound annualized growth rate of 21.8%.

In 2020 and 2021, blockchain gaming became a powerhouse — not only because of how it incorporated DeFi into gameplay but also because of its growing connection with NFTs, which were quite the hot topic in those years.

The first big combination of blockchain, gaming, and NFTs came in late 2017 with CryptoKitties, a game about collecting virtual cats on the blockchain. CryptoKitties was one of the first examples of using NFTs in games, and since then, many other projects have built on the idea. From luxury fashion and AR to virtual worlds and supply chains, almost every industry seems to be experimenting with digital assets and NFTs.

Today, we're going to explore one such game. This Axie Infinity review will delve into what makes this game a significant player in the blockchain gaming world.

We'll explore Axie Infinity's gameplay, economic model and aspects like its "Play-and-Earn" model, breeding mechanics, and use of in-game tokens like Smooth Love Potion (SLP) and Axie Infinity Shards (AXS).

Axie Infinity Review Summary

Axie Infinity is a blockchain-based game developed by Sky Mavis that centers around collectible creatures called Axies. It features a unique "Play-and-Earn" model, where players can earn real-world value by battling, breeding, and trading Axies. The game operates on a player-owned economy and uses the Ronin Network to facilitate in-game transactions.

The Key Features of Axie Infinity Are:

- Play-and-Earn Model: Players earn real monetary rewards through various in-game activities, including battling and breeding Axies.

- Breeding Mechanics: Players can breed Axies with different genetic traits to create unique offspring, enhancing the game's economy and strategy.

- Ronin Network Integration: A Layer-2 blockchain designed to scale Axie Infinity and support third-party game development, using a Delegated Proof-of-Stake (DPoS) consensus mechanism.

- Player-Owned Economy: Focuses on player-to-player transactions, where all game items are created by players, and marketplace fees contribute to a community-governed treasury.

- Raylights Minigame: A land-focused minigame that allows players to cultivate land and unlock recipes, expanding the gameplay within the Axie Infinity universe.

- In-Game Tokens: Uses Smooth Love Potion (SLP) for breeding and Axie Infinity Shards (AXS) for governance, rewards, and staking purposes.

Axie Infinity Overview

| Developer | Sky Mavis |

|---|---|

| Launch Year | 2020 |

| Main Gameplay | Collecting, Breeding and Battling Axies |

| Play-and-Earn Model | Players earn real monetary rewards by battling, breeding, and completing in-game tasks. |

| Blockchain | Ronin Network (Layer-2 EVM-compatible blockchain) |

| In-Game Tokens | Smooth Love Potion (SLP), Axie Infinity Shards (AXS) |

NFTs and Gaming: A Match Made in Blockchain Heaven

The marriage of NFTs and gaming leverages the strengths of both technologies to create new opportunities for players, developers and the gaming industry as a whole.

True Ownership of Digital Assets

One of the most transformative elements that NFTs bring to gaming is the concept of true ownership. In traditional gaming, players may spend countless hours or dollars acquiring in-game items, but these assets ultimately remain the property of the game developers. With NFTs, players can have actual ownership of their in-game assets — whether it’s a rare sword or a unique character skin. These digital assets exist independently of any specific game, allowing players to trade, sell, or even transfer them across compatible platforms.

Play-to-Earn Opportunities

NFTs have also given rise to a new gaming model: play-to-earn (P2E). Players can earn valuable NFTs or cryptocurrencies by playing games, turning their hobby into a potential source of income. Games like Axie Infinity have demonstrated the potential of P2E, allowing players, especially in developing countries, to earn real money through gameplay.

Unique and Customizable Experiences

NFTs offer endless opportunities for personalization and creativity in gaming. Players can own and customize unique avatars, items, and experiences, all recorded on the blockchain. This means each item has verifiable rarity and authenticity, which adds to its value. Game developers can also create limited-edition items or exclusive content.

Interoperability Across Games

Another major benefit of NFTs in gaming is the potential for interoperability. Imagine being able to take your favorite character or weapon from one game to another, seamlessly. NFTs can make this a reality, as items and characters are stored on the blockchain and can be used across different games that support the same standards.

Community and Player-Driven Economies

NFTs empower player-driven economies where users can buy, sell, and trade items without the need for intermediaries. Marketplaces allow players to exchange assets directly, creating a economy that is often more lucrative and engaging than traditional in-game stores. Moreover, NFTs enable community-driven development, where players can contribute content, vote on game updates, or even share in the game’s revenue.

What is Axie Infinity?

Developed by Sky Mavis, Axie Infinity is a blockchain game centered around collectible creatures known as Axies. Players can own, trade, and battle these creatures, each possessing distinct traits and genetic codes. The game's foundation is built on a blockchain-based economic model, allowing for true ownership of digital assets.

In Axie Infinity, the gameplay is multifaceted, combining strategy, competition and social interaction. The breeding mechanic allows players to create new Axies with specific body part combinations, further enriching the diversity of the creatures within the game. Collecting rare Axies, such as Mystics and Origins, adds an element of speculation and excitement for players and collectors alike.

Axie Infinity is Centered Around Collectible Creatures Known as Axies. Image via Axie Infinity

Axie Infinity is Centered Around Collectible Creatures Known as Axies. Image via Axie InfinityA defining feature of Axie Infinity is its “Play-and-Earn” model. Unlike traditional games where players may invest time and money without tangible returns, Axie Infinity rewards players for their skills and contributions. Players can earn resources with real monetary value through various activities, including competing in battles, breeding Axies, creating art and content, and onboarding new players into the ecosystem.

According to DappRadar, Axie Infinity boasts 30-day unique active wallets of 157,370, transactions of 3.23 million and a volume of over $25 million.

Transactions are conducted via the Ronin Network, a Layer-2 EVM-compatible blockchain designed to scale Axie Infinity. It hosts most digital assets within the Axie ecosystem and is expanding to allow third-party game development. Ronin utilizes a Delegated Proof-of-Stake (DPoS) consensus mechanism, with RON as its native token. In March 2022, the Ronin Network was hacked to the tune of $620 million in an attack that was later attributed to North Korean state-sponsored hacker groups.

Axie Infinity Gameplay

Axie Infinity is structured as an open-ended digital pet universe where players can collect, breed, and battle unique creatures called Axies. These Axie NFTs act as tickets, granting access to current and future experiences within the Axie intellectual property.

Breeding Mechanics and Economy

Axies can be bred to create new offspring, similar to real-world pets. To maintain a balanced population and prevent hyperinflation, there is a cap on the number of times each Axie can breed before becoming sterile. Breeding costs a combination of AXS tokens and Smooth Love Potions (SLP), with the SLP cost increasing based on how many times the parent Axies have already bred. Players can earn SLP by participating in battles in the PvP Arena, with no direct sales of SLP to players by Axie Infinity.

Each Axie possesses genetic traits across six body parts, with three types of genes: dominant, recessive, and minor recessive. The dominant gene determines the visible characteristics, while recessive genes can be passed down during breeding with varying probabilities. Players can use a breeding calculator to estimate these probabilities, enhancing strategic breeding decisions.

Axie Infinity Has Players Battle Their Axie Monsters Against One Another To Earn Rewards. Image via Axie Infinity

Axie Infinity Has Players Battle Their Axie Monsters Against One Another To Earn Rewards. Image via Axie InfinityEconomic Structure and Long-Term Sustainability

Axie Infinity operates a 100% player-owned economy, focusing on player-to-player transactions rather than direct sales of game items. Marketplace fees contribute to a Community Treasury, which is governed by AXS token holders. The developers, Sky Mavis, monetize through their ownership of AXS tokens, which represent a form of governance over the economy. Axies, created by players using in-game resources, can be traded, resembling a nation with its own economy.

Population growth within the Axie ecosystem is crucial. The game aims for an ideal inflation rate to ensure accessibility for new players while preventing unhealthy price increases. Long-term economic sustainability will involve adding utility to Axies through new experiences like land ownership, mini-games, and continuous updates to gameplay mechanics. This ongoing development fosters a sense of progression and intrinsic value for players.

Axie Infinity: Raylights

Looking to capitalize on the popularity of virtual land metaverses like The Sandbox and Decentraland, Axie Infinity unveiled Raylights at AxieCon in 2022.

Raylights is the first land mini-game accessible to landowners in the Axie Infinity universe. It was developed in collaboration with Quicksave Interactive, and the game can be played directly from a browser without any downloads required.

Raylights is a Land-Focused Minigame Accessible in the Axie Infinity Universe. Image via Axie Infinity

Raylights is a Land-Focused Minigame Accessible in the Axie Infinity Universe. Image via Axie InfinityGameplay

Players start by exploring the early civilization of Axies and learn to cultivate land. The core gameplay focuses on sowing various minerals to grow plants and unlock recipes. Progressing through the game involves completing missions to access more minerals and experimenting with combinations to achieve aesthetic goals.

Key Features

- Seedling Nursery: Players can drag and drop minerals into a designated area to grow plants, which are then added to their plots.

- Minerals: There are ten types of minerals, including Edenite, Aqua, and Beastium. Players begin with three and can unlock more by completing missions. Different combinations of minerals yield different plants, with some plants having multiple recipes.

Axie Infinity Tokens

The Axie Infinity universe has two in-game tokens:

- Smooth Love Potion (SLP)

- Axie Infinity Shards (AXS)

Smooth Love Potion

Axie Infinity does not sell SLP to players directly. Instead, players can earn Smooth Love potions by playing the game in the PvP Arena. Once you earn them, you can sync them to your wallet.

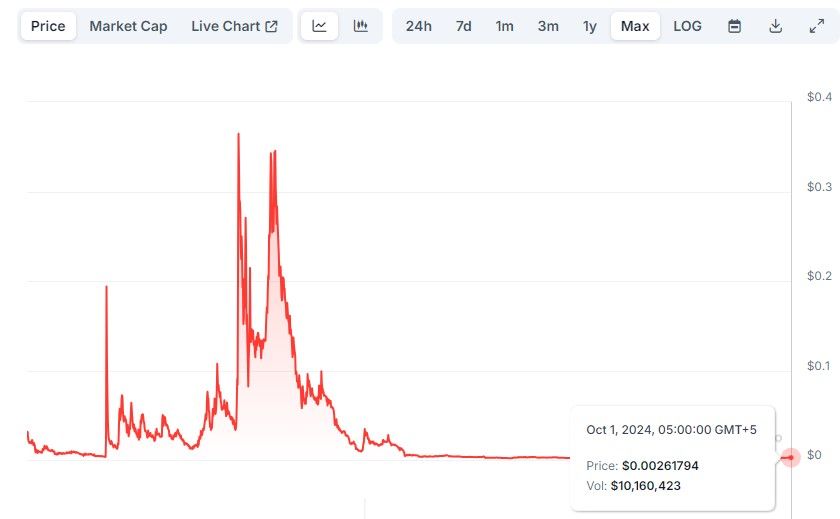

SLP crashed in February 2022 amid a wider NFT and cryptocurrency rout, losing over 99% of its peak value. And while Sky Mavis pulled levers to try and stabilize the price, those efforts weren't very effective. As a result of the low exchange value of SLP, many players stopped playing the game.

SLP Lost 99% of its Value in 2022 Amid a Wider Market Rout. Image via CoinGecko

SLP Lost 99% of its Value in 2022 Amid a Wider Market Rout. Image via CoinGeckoAxie Infinity Shards

AXS is the native token of Axie Infinity and is released according to a predetermined schedule over 65 months following the public sale in October 2020. The initial circulating supply is set at 59,985,000 AXS, accounting for 22.22% of the total supply, which is capped at 270 million AXS.

Tokenomics

- Play and Earn: 54 million AXS (20%) - Locked, issuance started in Q1-Q2 2021.

- Staking Rewards: 78.3 million AXS (29%) - Locked, issuance started in Q1-Q2 2021.

- Ecosystem Fund: 21.6 million AXS (8%) - Some tokens unlocked, some locked.

- Sky Mavis (Developers): 56.7 million AXS (21%) - Some tokens unlocked, some locked.

- Advisors: 18.9 million AXS (7%) - Some tokens unlocked, some locked.

- Public Sale: 29.7 million AXS (11%) - Unlocked.

- Private Sale: 10.8 million (4%) - Some tokens unlocked, some locked.

Where to Buy AXS?

You can buy AXS on the following exchanges:

Also, read our top picks for the best crypto exchanges.

Will Crypto Gaming Onboard the Masses?

Web3 gaming is a fast-growing sector of decentralized applications, but it still faces quite a few challenges:

- Player Onboarding and Accessibility: Over half of respondents in a Blockchain Gaming Alliance (BGA) survey cited onboarding and accessibility as major barriers to adoption. Players need to manage wallets, deal with seed phrases, and navigate complex processes—significantly raising the entry barrier compared to traditional games.

- Game Design Issues: Play-to-earn (P2E) games are often designed around tokens and NFTs, focusing on financial rewards rather than the player experience. This model can alienate traditional gamers who prefer games designed for entertainment, rather than monetary gains.

- Poor Gameplay Experience: Many crypto games fail to deliver engaging gameplay. A BGA survey found that 37.2% of respondents considered poor gameplay a reason for low adoption. Blockchain games often prioritize monetization over fun, strategy, and challenge, reducing player satisfaction.

- Security Concerns: Crypto games face vulnerabilities such as smart contract exploits, phishing attacks, data privacy concerns, and risks associated with trading assets on centralized exchanges. Notable security incidents include the $140 million breach of Vulcan Forged in 2021.

If this piques your interest, you should check out our article where we unravel the intricate layers of play-to-earn games, dissect the core mechanics that underpin these virtual ecosystems, examine the challenges that have hindered their progress, and explore solutions that could pave the way for their integration into the daily lives of traditional gamers.

Axie Infinity Review: Closing Thoughts

Axie Infinity integrates NFTs and the "play-and-earn" model to offer players true ownership of digital assets and potential real-world earnings.

The game's multifaceted mechanics, including breeding Axies, battling, and community-driven economies, have established it as a major player in the blockchain gaming space. However, it also faces challenges such as security vulnerabilities, token price volatility, and barriers to onboarding new players due to the complexities of blockchain technology.

As blockchain gaming continues to evolve, addressing these challenges will be crucial for Axie Infinity and similar projects to achieve broader adoption and sustained success in the gaming industry.