Decentralized finance (DeFi) has grown with amazing speed in 2020 and is heading into 2021 with incredible momentum and a huge array of interesting and useful projects.

One of the metrics that clearly shows just how popular DeFi is and how much it’s grown is the Total Value Locked (TVL) in DeFi projects. You can see from the graph below just how much TVL has increased in 2020, and how it is holding strong above $40 billion in 2021.

One of the more interesting projects in Badger DAO and its BADGER token. The reason this project stands out is its use of Bitcoin in DeFi, which is something we haven’t seen in many projects, unless they are using wrapped Bitcoin.

Badger DAO has also taken its lead from Yearn.finance in some ways by following the “fair token launch” model when releasing the BADGER token. This model gives the community ownership of the project right from the start rather than selling tokens off to investors who really have no interest in the project other than its profit potential.

Also helping in this DeFi space is the increased demand that’s been occurring for Bitcoin on the Ethereum blockchain (the wrapped Bitcoin previously mentioned).

Just a few months after launch and Badger DAO has over $40 billion in TVL. Image via DeFiPulse.com

Just a few months after launch and Badger DAO has over $40 billion in TVL. Image via DeFiPulse.com There are many blockchain proponents who claim that Bitcoin is the soundest form of money ever created. They believe it is both the soundest method of collateral and the best method of exchange. However Bitcoin usage in DeFi has always been confined to the small Bitcoin ecosystem, at least until it became possible to “wrap” Bitcoin in an ERC-20 token that can be used on the Ethereum network.

Since the invention of wrapped Bitcoin we’ve seen the amount of Bitcoin on the Ethereum network increase dramatically.

While this has been helpful in some respects it certainly isn’t ideal, and not least of all because the infrastructure currently in place for using Bitcoin on Ethereum remains new and quite undeveloped. That means minting wrapped Bitcoin remains dependant on centralized platforms and all the custody, trust, and KYC requirements that come with those platforms.

The good news is that you can use Bitcoin in DeFi as there are many borrowing and lending protocols that use synthetic Bitcoin as collateral, however the bad news is that there are very few large liquidity pools available to trade this synthetic Bitcoin.

So, with the increasing growth in DeFi and all the current challenges faced by Bitcoin holders who wish to participate in DeFi, the team behind Badger DAO was motivated to find a better way to include Bitcoin in the DeFi revolution. We’ll take a deeper look into how that works just below.

What Is Badger DAO?

You might already be familiar with the term DAO, which is an acronym for decentralized autonomous organization. So, the Badger DAO has been created with a decentralized governance structure that puts the community in control of the project right from the start.

And, Badger DAO is attempting to build out the infrastructure needed to accelerate the use of Bitcoin in decentralized finance, and across Ethereum and other blockchains.

Badger DAO wants to bring Bitcoin to DeFi. Image via YouTube.

Badger DAO wants to bring Bitcoin to DeFi. Image via YouTube. The original Badger DAO development team designed it as a complete ecosystem that will allow projects from any DeFi protocol to collaborate and build joint products. Because Badger DAO was created with a DAO governance structure it’s possible for developers to align their incentives with the decentralized governance, no matter what project they are working on. The thought is to create a spirit of collaboration in the DeFi ecosystem rather than one of competition.

Also, one of the primary goals since the inception of the project has been to make sure that Badger DAO will be community led and governed right from the beginning. Community governance will make the decisions regarding new products, and the community governance will be responsible for ensuring fair distribution of BADGER tokens to all participants. All of this shows how committed the founders are to a community-first approach that is transparent and fair for everyone.

The key to success for the project will lie in how successful they are in attracting all the liquidity needed, not to mention the content creators and coders that will need to join the community to keep Badger DAO moving forward.

The greater numbers and broader diversity of skillsets will be of great benefit to the project and to everyone involved with it. Plus, the community members have the greatest stake in the success of the project as the revenues generated will create profits that will be distributed to those who contribute most to the growth of the DAO.

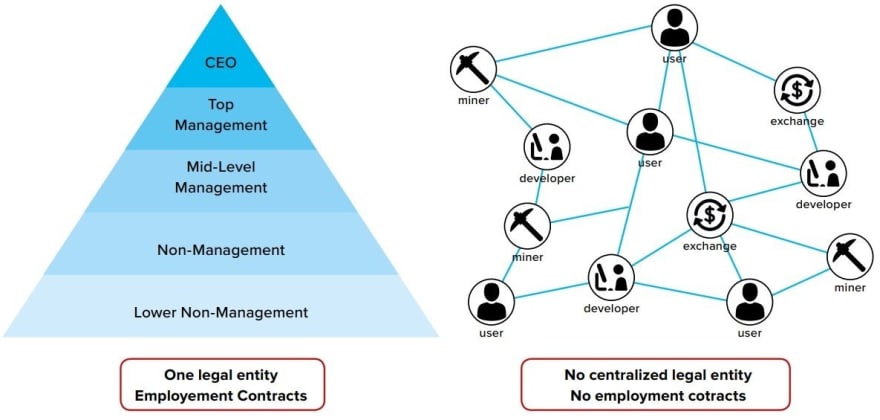

How DAOs are Meant to Work

A few years ago DAOs were quite rare, but their formation has increased as projects see that community led governance is preferable to centralized control. In a way this has led to the transformation of governance tokens to a type of new utility token.

How a DAO is Structured. Image via Dev.to

How a DAO is Structured. Image via Dev.to There’s an ideal when designing a community led DAO, however in the real world DAOs don’t typically attract much participation from their communities. There are lists of reasons why this is true, including the gas fees associated with voting on-chain.

In many cases the lack of participation is simply due to a perceived lack of ownership or responsibility to the DAO. Voting and community participation are a nice ideal, but become useless when most ignore them, or worse when proposed changes are dismissed and disapproved out of hand. If the vote doesn’t matter, and there’s little chance of change, people quickly lose interest.

Venture DAOs

The Badger DAO founding team believes that the most activity in DAOs can be seen in Venture DAOs. It seems clear why this might be the case since not only are such DAOs responsible for every aspect of the business and platform, but they also have an incentive to see that the protocol and products perform well. DAOs that are more product focused could learn how to maintain an engaged community and share the value created by their products by taking some lessons from Venture DAOs.

While creating a DAO is the “in” thing to do, Badger DAO didn’t decide to create a DAO just to be trendy. They have a real desire to build a community that will foster an environment of collaboration, and will be able to share their goal of bringing Bitcoin fully into the DeFi ecosystem. They want to be more than just a legally formed organization, and more than the usual DAO that claims to foster community, but never seems to be capable of building one.

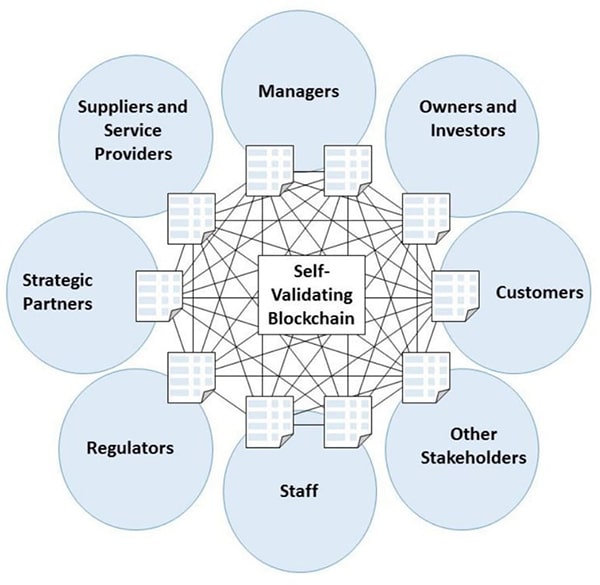

Partial architecture of the DAO. Image via LinkedIn.

Partial architecture of the DAO. Image via LinkedIn.That’s why the team will be keeping shared ownership of the platform as one of the cornerstone’s, and why all of the products will be launched by community members. In addition, any value that is created through fees and revenue will also flow back to the product creators and to the holders of the BADGER token.

One issue here is that at times the split of rewards might not be entirely clear cut. For example, some questions might arise regarding which community members first proposed which ideas. Or suppose a product is fully funded by a DeFi protocol, including the provisioning of developer talent to the project. In this case there would need to be some accounting of the resources being allocated to the project, and a determination needs to be made as to the appropriate rewards.

It may not be clear cut now, but it is very early in the development of Badger DAO and it is likely that many of these issues will be resolved in a manner that is suitable and acceptable to the majority of the community.

Badger Builders

The Badger Builders are the lifeblood of Badger DAO. This is the group of community members who are collaborating with other developers and creating new products within the Badger DAO ecosystem. Badger builders don’t have to be individuals either, they can be a group of developers or even an entire company.

Anyone can be a Badger Builder. Image via Badger blog.

Anyone can be a Badger Builder. Image via Badger blog. The great thing for the Badger Builders is the lack of participation requirements to benefit from being part of the DAO. Anyone who wants to can become a Badger Builder and help to create something great using their skills with open-source code and a handful of governance tokens

Pitching New Products

It isn’t just the building of products that’s open to anyone either. Any community member is free to pitch new product ideas in the Badger DAO Discord channel. They will get feedback on the idea, and can also find partners to collaborate with.

If a proposal is made and the community shows interest the proposal can be developed further, followed by an off-chain vote to determine if the idea should be put forward to the entire community. If it’s decided to move forward the final step in an on-chain vote to get approval for the project.

Whenever a project is approved the development team will get involved to help fund the project, build it, and then market it. Off-chain voting on the Telegram and Discord channels are used to determine solutions for any product or operations related issues. The governance was designed in this way to keep from isolating individuals when they make proposals. Instead it is hoped that contributors will join together and contribute some of the most amazing DeFi products ever.

Collaboration

The developers at Badger DAO are really waiting just to collaborate with anyone who has an idea for something that’s going to be cool and potentially profitable. As the project gains momentum they hope that not only individual developers will join in, but also entire DeFi protocols.

This type of collaboration is just what the DeFi ecosystem needs to discover the best products. And that’s why Badger DAO is kept open for any individual, developer, team, or company to participate. And every product released will be transparent and fair, and hopefully profitable for everyone involved in its creation.

Collaboration is expected to help Badger Builders make something great. Image via IvanonTech.com

Collaboration is expected to help Badger Builders make something great. Image via IvanonTech.com The Badger DAO team has a sincere belief that a community can come together and build products that improve on anything a centrally controlled organization might make. Plus the Badger DAO treasury provides the funding for the new projects, and the BADGER token can be used to incentivize new users in the post-launch phase of any project.

BADGER Token Launch

Badger has taken the same direction as Yearn.finance when launching their token, making it clear that the BADGER token has no monetary value and that it is meant strictly for DAO governance purposes. And also like Yearn the BADGER token got started with a fair liquidity mining launch.

What that means is that at no time was there centralized control over the protocol. There were no early investors, no VC funds, and no anonymous backers who could cause the token to crash at a later date if they choose to dump all their holdings.

The BADGER token launch was truly fair. Image via Badger DAO blog.

The BADGER token launch was truly fair. Image via Badger DAO blog. All of this means that Badger DAO is avoiding the bad examples and mistakes of many blockchain projects that launched under sketchy circumstances, or gave control over 90% of the project token to the founders, advisors, and early investors. Plus all of the smart contract code and systems have been fully audited by the third-party auditing firm Zokyo to ensure that they are secure and with no hidden flaws.

There’s no anonymity to hide the team. They are fully transparent and publicly known. They are holding 10% of the token supply to maintain connection with the project. There is also 35% of the token supply that was held for the community to decide on distribution. These funds can be used for things such as partnership incentives, operations, more liquidity mining, or many other things, but only after the community votes and approves the use for the tokens.

Because control of the project and the tokens is being given to the community right from the beginning one thing you won’t find on the Badger DAO website are charts and tables showing the percentage being allocated to VC funds, angel investors, early advisors and such. Instead the community will determine how to use the Badger tokens right from the start of the project. Given that the token is up roughly 600% since launch that could have been the right decision.

Time-Locked Founder Rewards

As mentioned above there are 10% of the total BADGER supply that’s been allocated as founder rewards. These tokens are meant to incentivize success from the founding members, and they will be incrementally distributed to public wallets.

In addition, the founder rewards have a 1-year time lock that releases tokens on a weekly basis over the course of 52 weeks. This is to prevent the founders from dumping a huge amount of BADGER tokens on the market all at once, thus driving the price down significantly.

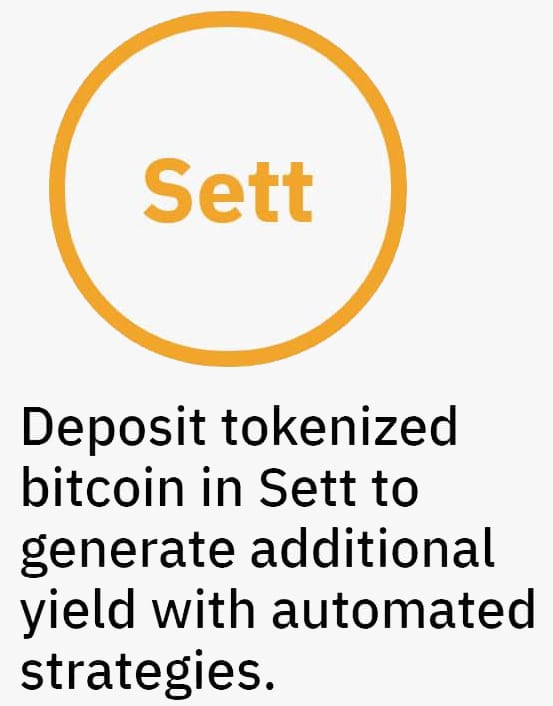

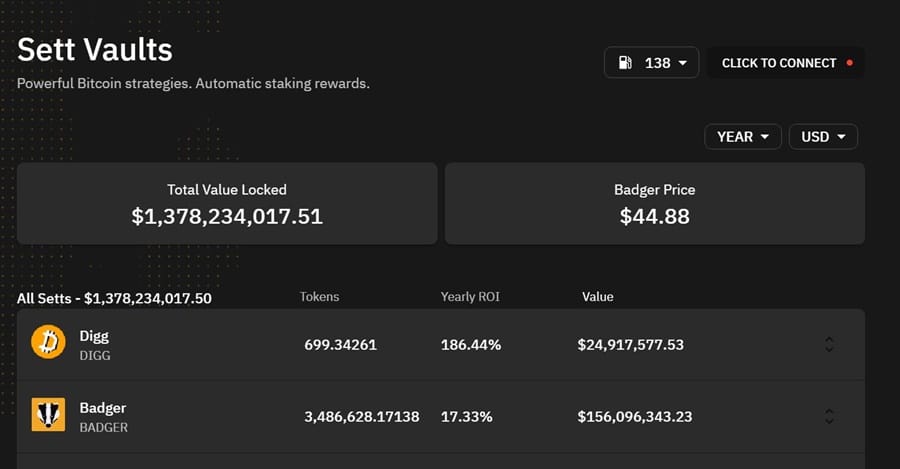

Badger DAO’s SETT Vaults

Badgers are animals that fiercely protect themselves and their loved ones from larger animals. That’s why Badger DAO chose the name to advocate for that same kind of fierce unity and the desire to create. The real badger builds homes out of leaves and grass and these homes are called Setts. They are built to last, and can provide a home to generations of badgers over decades of use.

Badger DAO wants to provide a home for its user’s crypto holdings too, and as a result the first product created was SETT, and automated DeFi aggregator. Because Badger DAO was created with a focus on Bitcoin products the SETT vaults are modeled after Yearn.finance vaults, but they exclusively use tokenized Bitcoin. SETT is also planned to be the only way for users to earn BADGER tokens, although that could change with a governance vote.

Sett automated Bitcoin yield strategies. Image via Badger.finance

Sett automated Bitcoin yield strategies. Image via Badger.financeAs with any other DeFi vault setup, users can deposit assets and earn yield in return. These assets are put into smart contracts which then execute a variety of strategies that put the assets to work across the universe of DeFi protocols. This allows BTC holders to optimize the yield they receive for their tokens without engaging in the mental acrobatics and effort required to execute the typical yield farming strategy manually.

For an unspecified limited amount of time users can deposit into SETT vaults to earn both yield and BADGER tokens. Those who stake for an extended period of time enjoy the benefit of a multiplier being applied to their rewards.

At this time there is a 0.5% withdrawal fee for taking funds out of the vaults, but there is no lockup period. There is also an additional 4.5% fee levied on any profits made. These fees are meant to cover transaction fees and gas costs.

Launching Badger DAO SETTs

At launch there were five SETTs created. Four of these were for compounding strategies: Curve – SBTC, Curve – RENBTC, Curve TBTC, and Badger – WBTC. In addition to those four there was a fifth SETT strictly for staking BADGER to earn more BADGER.

Since that time an additional 6 SETTs have been added, including one to stake DIGG to earn more DIGG.

An increasing number of ways to earn staking rewards. Image via app.Badger.finance

An increasing number of ways to earn staking rewards. Image via app.Badger.finance The SETT vaults are only several months old and are understandably still in the very early stages of development. But it seems pretty sure that new strategies and innovations will be coming rapidly as the community continues to grow.

There’s no saying just what will be created next, but some possibilities are single asset vaults with multiple strategies, native BTC deposits, other compounding strategies, and strategies that will help to protect against Bitcoin price volatility.

Badger DAO DIGG

The second product launched by Badger DAO is a community project that’s called DIGG. It adds to the list of Bitcoin synthetics, but unlike other platforms it is non-custodial.

Digg - An elastic supply cryptocurrency pegged to Bitcoin. Image via Badger.finance

Digg - An elastic supply cryptocurrency pegged to Bitcoin. Image via Badger.finance Basically you could think of DIGG as a stablecoin, since it is an elastic supply cryptocurrency pegged to the price of Bitcoin. Every single day the supply of DIGG is adjusted across all of the wallets holding the token. Those adjustments occur based on the value of DIGG versus the U.S. dollar and Bitcoin.

In practice this means that when DIGGs price rises relative to Bitcoin the amount of DIGG tokens in each wallet will increase. And conversely if the value of DIGG declines versus Bitcoin the amount of DIGG in each wallet will decrease. Also in play is a price oracle that’s summoned each day to determine whether the supply of DIGG should be increased to depress the price, or decreased to boost the price of DIGG.

The goal of the DIGG project is to remove centralized control over synthetic Bitcoin assets and deploy elastic parameters as an alternative means for maintaining the peg. And the protocol does far more than simply maintaining a peg. It can also add new incentives to influence price and send it higher or lower, and it is capable of rebasing each block.

The DIGG token also has a SETT vault where users are able to stake and earn more DIGGs.

Of the tokens that were not distributed during liquidity mining, 50% are controlled by the Badger DAO. With their first product, $BADGER token holders will govern things like the token supply, future smart contract changes, marketing decisions, and protocol parameters for present and future projects built by the DAO.

bBadger Tokens

When staking BADGER users receive bBADGER tokens which are a composable yield farming token. In addition, staking rewards are also delivered in bBADGER, making the rewards for staking auto-compounding. This should encourage even greater lockup for the token since no gas is required to stake, but is required to unstake. Indeed, BADGER is seeing a lockup rate in excess of 90% since the decision to make bBadger auto-compounding was passed by the DAO.

bBadger is a composable DeFi asset. Image via Badger DAO blog.

bBadger is a composable DeFi asset. Image via Badger DAO blog. Currently the Badger DAO team is working on adding utility to bBADGER tokens by integrating them as a collateral type for other DeFi protocols. This will allow users to mint stablecoins on UMA and earn additional yield. It’s also seen the token added to the CREAM platform, where it will allow users to borrow assets using bBADGER as collateral. This effectively allows speculators to long/short bBADGER with leverage.

There has also been a proposal to create liquidity pools for CLAWS on the Sushi platform, and create additional Sett Vaults for SLP tokens that will be created to use as collateral for stablecoins.

Basically all of the proposals being made in connection with bBADGER at this time are ways to add yield on top of yield. The intention is using the composability of bBADGER to create passive income money machines with a wide variety of income sources.

CLAWS

While CLAWS has been described by some as a stablecoin, it is essentially a “yield dollar” rather than a stablecoin. Essentially, a yield dollar is a collateralized asset with an expiration date. Once the yield dollar expires, it can be redeemed on the UMA protocol for $1 worth of its collateral. Until expiration, the market determines the price of the asset — but generally it should approach $1 as expiration nears.

You'll enjoy sinking your CLAWS into this new yield dollar. Image via Badger DAO blog.

You'll enjoy sinking your CLAWS into this new yield dollar. Image via Badger DAO blog. Yield dollars like CLAWS are collateralized assets. That is, they are minted when a user puts up some collateral at a set loan-to-value ratio. In the case of CLAWS, there are two collateral types of collateral that can be used to mint tokens — bBadger and wBTC/ETH SLP tokens. This will be the primary method for obtaining CLAWS tokens, although they can also be purchased on the open market. Speculators will need to take care if purchasing CLAWS on the open market however, bearing in mind that the token will approach $1 as it gets closer to expiration.

One of the wonders of DeFi composability is the ability to earn multiple forms of yield with the same base assets — maximizing your potential returns. This is the case with CLAWS. Once a user mints CLAWS tokens, they will be able to deposit their CLAWS into a Sushiswap Liquidity Pool and receive CLAWS-SLP tokens in return. These CLAWS-SLP tokens can then be staked in a dedicated Badger Sett vault to earn additional rewards (in the form of additional UMA, xSushi, bDIGG, and bBadger).

In total, CLAWS Sett vaults have nearly 10 sources of income — making it a diversified basket of passive incomes unto itself. Ultimately CLAWS Sett vaults are going to change the yield farming game by providing a stable asset with multiple yield streams.

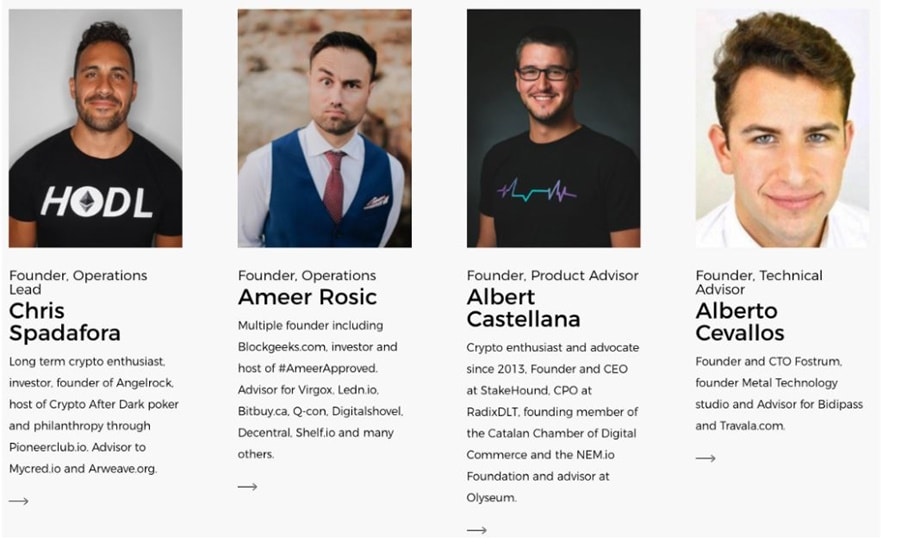

Badger DAO Team

Because the project is under the control and governance of the community there isn’t a huge spotlight put on the founding members. That said, there are four founding members who brought the Badger DAO project to life in an effort to include Bitcoin in the DeFi revolution. Those four are:

The four founders of Badger DAO. Image via Badger DAO blog.

The four founders of Badger DAO. Image via Badger DAO blog. - Chris Spadafora is the operations lead. He’s a serial entrepreneur who has founded a number of companies over the years. His latest project prior to Badger Dao was Alwayshodl.com. He is also a partner at Angelrock, a company that provides strategic consulting for long-term crypto holdings.

- Ameer Rosic is also part of the operations team at Badger DAO. Another serial entrepreneur he is the founder of Blockgeeks.com. He is also an integral part of Dollarcake, a browser extension that can be used to monetize social media networks.

- Albert Castellana is the co-founder and CEO at Stakehound.com and serves as the product advisor for Badger DAO.

- Alberto Cevallos is the technical advisor for the project. He also advises Travala and is the founder of Metl, a company engaged in creating the infrastructure for the internet of money.

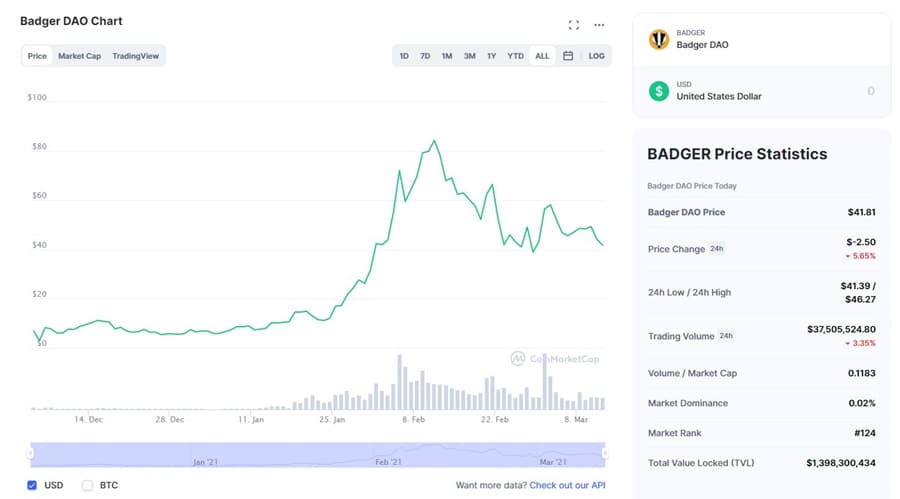

BADGER Market Performance

As mentioned previously, the Badger DAO team was very clear in stating that the BADGER token has no value and is simply meant as a governance token for the network. Still, people will speculate, and after the token was released it soon had a price of $6-7. Over the next 5-6 weeks the price remained range bound, trading between $7 and $10 for the most part.

A breakout occurred at the end of January 2021, with the price of BADGER surging from roughly $11 in the final week of January to an all-time high of $89.50 on February 9, 2021.

Badger DAO price history. Image via Coinmarketcap.com

Badger DAO price history. Image via Coinmarketcap.comSince that time price has pulled back, finding support several times in the $39-42 range. As of March 12, 2021 the BADGER token is trading at $41.80, so we will have to see if support holds yet again for the token, or not.

The token has been listed on a number of major exchanges already, and the top trading volumes are occurring at Binance and at Huobi Global. There’s also good volume and liquidity at Uniswap, which is an improvement over the first few weeks of trading for BADGER.

Conclusion

As with any blockchain project the proof of whether it becomes viable or just another has-been will come down to adoption. In the case of Badger DAO much of this will depend on the community and the ability of the team to foster the collaboration that’s so important to the platform. It needs developers and content creators to publish apps and other content such as videos, memes, and art, but it also needs community to consume these products.

In looking at the growth of the token and the TVL for the project it seems to be succeeding, but it is very new. A few months of history is certainly not long enough to let us know what the long-term will bring. In the case of Badger and its fully decentralized DAO governance model you can’t even rely on the project leaders to make a success of the project, since there are no leaders.

Badger DAO is off to an excellent start, and if it can continue with the momentum its generated it could find itself as one of the top DeFi projects. Certainly there are enough users who can benefit from the platform that’s brought DeFi more fully to the Bitcoin ecosystem.