Decentralized finance (DeFi) projects have been increasingly common recently as the space has become wildly popular, but each one suffers the same problem of a lack of interoperability.

This creates some frustration from users, since they have to interact with a number of different applications if they want to take advantage of all that DeFi has to offer. A simple interface allowing a user to interact with all their preferred DeFi applications in one place would be an excellent solution, and that’s exactly why Reef Finance was created.

The Reef Finance project is attempting to create a platform that combines all of the various DeFi applications in one place, easing user access to the DeFi ecosystem. With Reef Finance it becomes possible to buy, trade, stake, loan and borrow a variety of assets in one platform.

What is Reef Finance?

Reef Finance is a liquidity aggregator and multi-chain smart yield engine that allows the integration of any DeFi protocol. It has been created with Polkadot, and shares its security model across the ecosystem while enabling cross-chain integrations. Reef will allow retail investors a way to access DeFi without significant technical barriers, while also aiding in the decision making process.

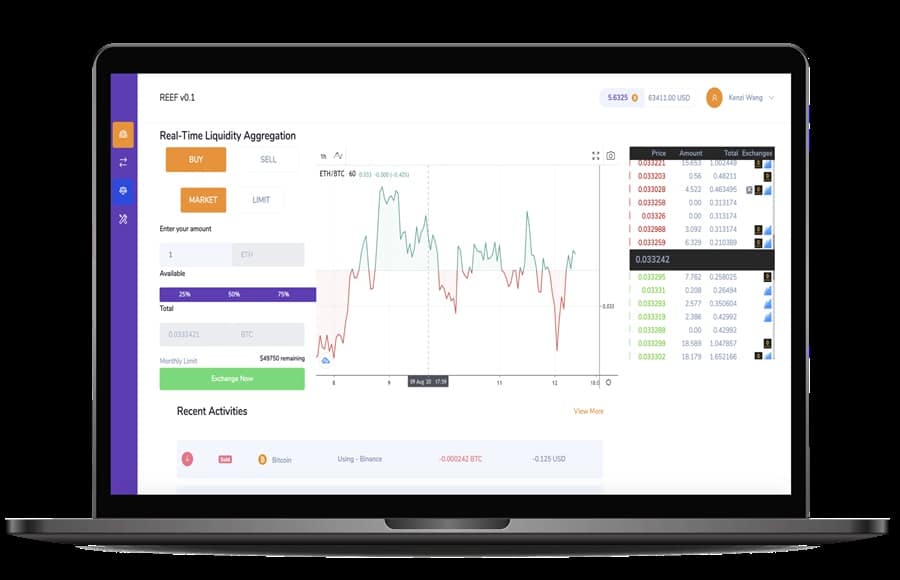

Reef is the newer, simpler way to do DeFi. Image via Reef.finance

Reef is the newer, simpler way to do DeFi. Image via Reef.finance Denko Mancheski, CEO and co-founder of Reef Finance, envisioned a solution to the psychological barriers that have held back adoption of DeFi products. According to Mancheski the average person is just overwhelmed when looking at the DeFi space due to the large number of overlapping products. This makes adoption by newcomers unlikely. Mancheski has stated that at Reef their

job as a global development community is to abstract away complexities.” He further adds, “from a technical point of view, we’re moving towards being able to onboard a simple non-tech savvy user.

That would be a huge leap forward for the DeFi space.

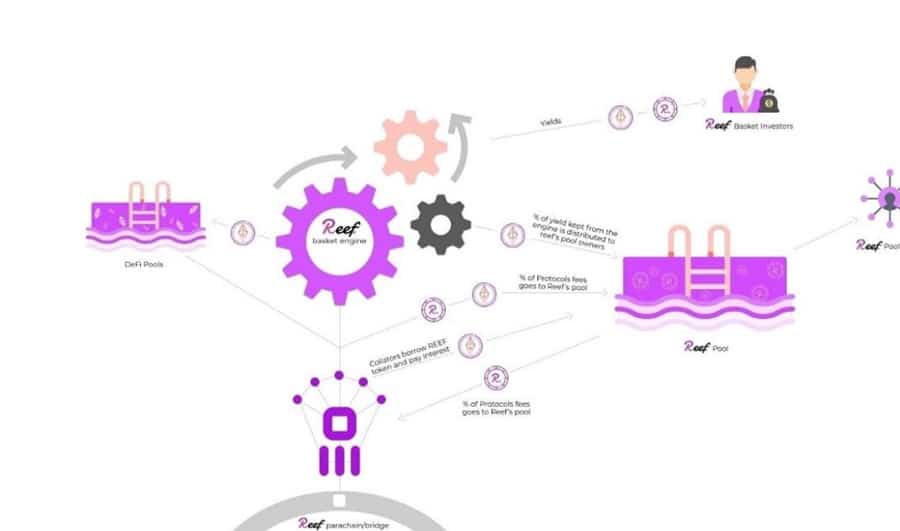

The underlying infrastructure of Reef is a chain of smart contracts that compose and integrate the ecosystem This is the base component of the system and is known as the “basket engine.” It communicates with the analytics engine and liquidity aggregator to allow a user the ability to enter and exit positions on multiple DeFi platforms from one easy to use interface.

It also does away with the need to manage the outputs (e.g. LP tokens) of all the various platforms manually. In addition to its basic functionality the engine is also being extended to allow for multi-hop strategies, and to extend insurance cover for the basket engine. Ultimately the infrastructure will support Ethereum and a number of other blockchain networks to give users the greatest access to DeFi.

Reef simplifies the DeFi ecosystem for all users. Image via Reef blog.

Reef simplifies the DeFi ecosystem for all users. Image via Reef blog. The platform also includes an AI driven system that makes crypto asset management much easier for the beginner. It corresponds to various risk levels, is customizable, and can be set to help achieve the financial objectives of individual users.

The system also includes a utility token – REEF – that can be used for the governance of the system and to pay for fees within the ecosystem.

Reef Finance was created as a non-custodial platform as well, meaning users do not need to worry about giving up access to their private keys. And thanks to the underlying use of Polkadot the entire platform is hardened against attacks. Taken together there is a diminishingly small chance of any loss of funds due to theft from the platform.

Why was Reef Finance Created?

Reef came about organically as a result of the founders observations of the same problems related to complexity that have repeated over and over in various industries. They then applied those observations to the DeFi ecosystem.

The Current DeFi Landscape

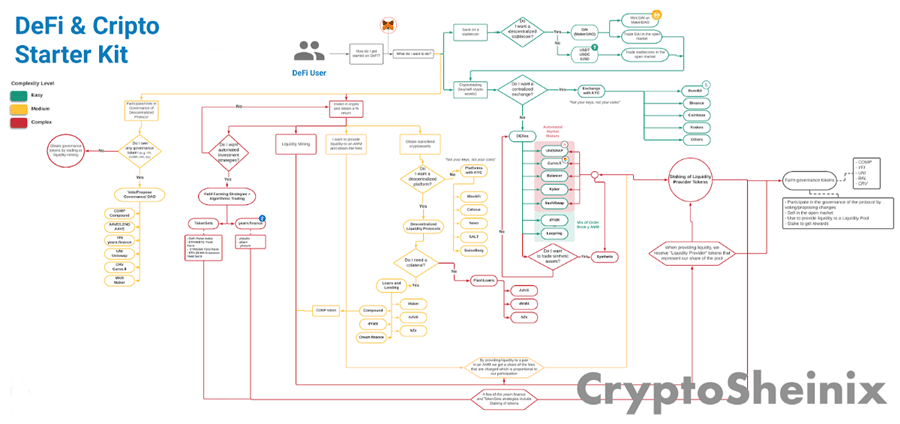

Any time a new industry moves too fast it can easily become fragmented, and the same has been true for DeFi. For users that means whenever you want to do something that involves more than a single aspect you need to find a way to piece it together yourself. Some people like this type of challenge and can thrive, but most people will balk at the complexities involved in bringing together a number of disparate systems and platforms.

DeFi becomes complex very quickly. Image via Medium.com

DeFi becomes complex very quickly. Image via Medium.com Imagine trying to create a system of bank accounts in a number of countries and different currencies, and then using those accounts to shift money around. It’s going to be complex and it’s going to encompass not only a number of banks, but also all the infrastructure behind those banks, which isn’t necessarily connected (such as SWIFT and IBAN).

Now include the purchase of bonds and equities from those accounts and things become even more complex. That’s why bringing new retail investors into the stock market has been an arduous process until quite recently. Previously the only way for an individual to participate in global equity markets was to use the broker middlemen who were charging exorbitant fees.

With the revolution in finance however we now have apps like TransferWise for banking, and Robinhood for trading which connect everything together seamlessly, freeing the user from the troublesome experience of figuring it all out themselves.

The DeFi ecosystem is increasingly large and complicated to maneuver. Image via Medium.com

The DeFi ecosystem is increasingly large and complicated to maneuver. Image via Medium.com A similar thing is happening now with DeFi. Currently there is a high bar for entry into the ecosystem. New investors are confused by the need to work with so many different platforms and manage wallets across all of them. The fear of making a mistake is real, and many stay away simply because of that.

In addition to the issue of using multiple platforms to accomplish many strategies, there’s also the inherent complexity in the technology behind the systems. All of this combines to freeze many investors, keeping them from participating. It’s Reef’s plan to change this.

Validation for Creating Reef Finance

Despite the fact that there were no others envisioning a way to leverage blockchain technology and DeFi to enable interoperability between all the platforms, the team at Reef did. They began working on a solution without any validation, understanding inherently that a solution to the complexity of DeFi was needed.

Fortunately the Reef team members have a long history of working together, which has created strong relationships and synergies. Many team members are already experienced with building trading algorithms and analytic tools for crypto firms. Others have experience in creating the software that runs blockchains.

Denko Mancheski - the brains behind Reef Finance. Image via Reef blog

Denko Mancheski - the brains behind Reef Finance. Image via Reef blog The project was named Reef because the founders saw it as similar to the reef ecosystem in the sea. In looking at a coral reef you can see how all the individual components of an ecosystem work together to create a whole. Reef Finance wants to bring together all the individual projects in DeFi to make it simple for the user to see how the whole works together.

Reef Aids Mainstream Adoption

One of the problems with many applications is that developers become immersed in the technology, and they miss out on how an average user views and interacts with the application.

Later the developer community continues building on existing tech, and soon you find an ecosystem of technological complexity, new concepts and terms that are only understood by the development teams, and a lack of approachability. At some point, developers need to step back and view their systems from the perspective of the users.

Instead developers have the assumption that users will adapt to their creations and learn new ways to interact with technology, however that rarely happens. This is why so many projects struggle with adoption. It doesn’t matter how the new tech is presented from a value standpoint when much of it is too complex for the average user to ingest.

Reef Wants to corner the mainstream

Reef Wants to corner the mainstream This creates resistance, and as time passes complexity increases until adoption becomes nearly impossible until someone can abstract the complexity to make the tech approachable again. This is where Reef comes into the DeFi ecosystem. And once the complexity is removed it is possible for innovation in the space to accelerate alongside adoption and the increased stability of the entire ecosystem.

Currently it is primarily the tech-savvy who are participating in the DeFi revolution, but Reef will make it possible for everyone to reap the benefits provided by DeFi, which is the intention and reason for DeFi in the first place. Reef is the force abstracting the DeFi landscape so everyone can participate as intended.

Why Polkadot?

Most DeFi projects run on the Ethereum network, so why is Reef built on Polkadot? Reef made the choice to deploy on Polkadot as a way to benefit the user base in terms of speed and transaction costs. It avoids the problem of skyrocketing fees and excessive transaction times that have increasingly become the norm on the Ethereum network. While Ethereum 2.0 is meant to fix this problem it will be a long time until Ethereum 2.0 is fully deployed.

Reef uses Polkadot technology to avoid the problem of skyrocketing fees and excessive transaction times. Image via Reef blog.

Reef uses Polkadot technology to avoid the problem of skyrocketing fees and excessive transaction times. Image via Reef blog. Polkadot doesn’t have the issues common with Ethereum and it never will. The use of parachains means network congestion can’t occur. It also helps to power the interoperability needed by Reef. By deploying on Polkadot Reef can bring in services and products from various networks.

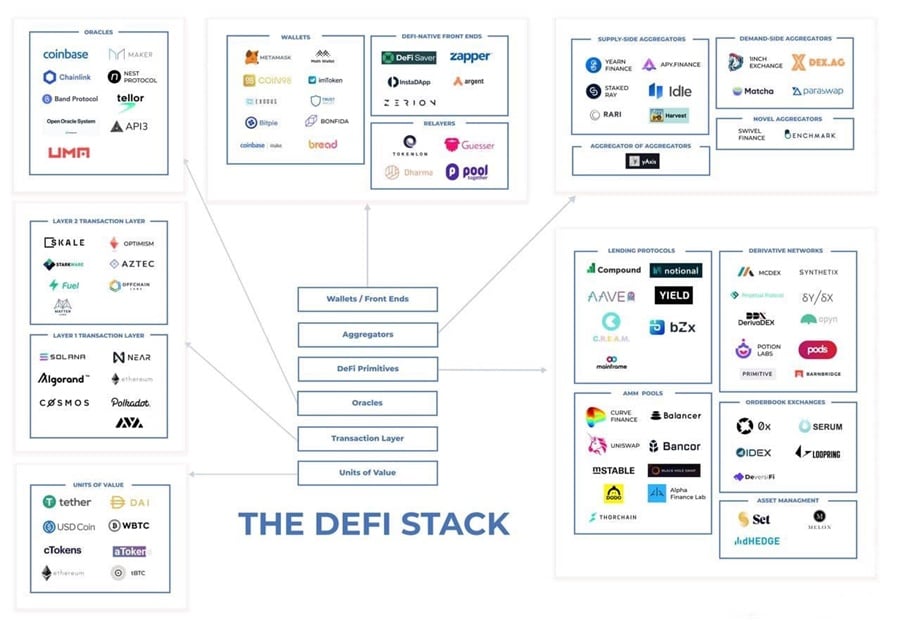

The Reef platform is made of three major components that complement each other. These three are the Global Liquidity Aggregator, Smart Yield Farming Aggregator, and Smart Asset Management.

Global Liquidity Aggregator

The Reef platform has connected to some of the largest crypto trading platforms available to offer unparalleled liquidity. The unique factor is that all the aggregated liquidity goes through DEXs and CEXs. This allows users to hedge against the downsides of the two different sources, which include high slippage and high trading fees.

Reef gets liquidity from everywhere - both CEXs and DEXs. Image via Reef.finance

Reef gets liquidity from everywhere - both CEXs and DEXs. Image via Reef.finance Centralized exchange liquidity is accessed through broker services, while decentralized liquidity comes from online order books and AMMs. As an additional benefit, the liquidity aggregation protects Reef users from issues such as front-running and market manipulation.

Reef Trading Terminal

Reef uses the Polkadot atomic bridge in the aggregation of liquidity in its ecosystem. This includes the largest crypto exchanges in the world, such as Binance and Huobi. With the inclusion of decentralized and centralized exchanges users are able to access the greatest liquidity possible, keeping slippage and spreads low. This will make trading on Reef affordable as well as easy and diverse.

Smart Yield Farming Aggregator

Another feature of Reef is the way in which it simplifies yield farming, making this profitable, but complicated asset management activity accessible to the average user. The basket engine used by Reef allows anyone to earn yield rewards when creating a stake in various asset baskets.

It also automates other DeFi services such as mining, borrowing, and lending. The basket engine combines with the “Yield Engine” and the “Intelligence Engine” to make this happen. Users have little to worry about since the Reef AI will allow for asset management based on the needs and goals of individual users.

Reef brings together liquidity from CEXs and DEXs alike. Image via Reef blog.

Reef brings together liquidity from CEXs and DEXs alike. Image via Reef blog. The Reef Yield Engine allows users to stake in any of the available asset baskets, and the entire process can be automated with the use of the AI, which is configured based on financial goals. Once the user configures the system and allocates assets to each basket the AI will dynamically adjust and rebalance the portfolio, moving assets to more appropriate basket as needed.

Smart Asset Management

The third major component of Reef is the Smart Asset management that’s provided by the Reef Intelligence Engine. It allows users of Reef to seamlessly rebalance their holding between the various baskets. Plus the AI engine will make recommendations based on all its available information.

Reef Intelligence Engine

The Reef Intelligence Engine works to enable the AI to appropriately manage assets based on the user’s needs and goals. With the Intelligence Engine anyone is able to automate staking and trading. Creating a profitable asset allocation is simplified so it is available to all. And the Intelligence Engine uses machine learning, which powers its growth and evolution over time.

Machine learning improves the Reef platform over time. Image via Shutterstock

Machine learning improves the Reef platform over time. Image via Shutterstock Because the AI is driven by data it requires off-chain data to function. That’s being provided by an oracle that serves the off-chain data to proxy smart contracts. The AI also monitors every online source of information that could be pertinent to the Reef Finance services. And Reef integrates with some Defi insurance protocols to provide coverage for its users.

The Reef Engine uses the data coming from this function to manage assets and determine investing opportunities. This way, theory can create profitable allocations through multiple asset baskets while keeping note of their risk levels.

REEF Token

The REEF token is the native utility token for the Reef Finance platform. It has several functions on the platform, which include powering the governance mechanism and the reward structure of the protocol. Of course it can also be used as a medium of exchange and it is available for trade on a number of exchanges.

Use cases for the REEF token. Image via Reddit.com

Use cases for the REEF token. Image via Reddit.com Here are the four primary uses of the REEF token:

- Governance: vote on different proposals such as releasing new features and re-adjusting certain parameters in the system.

- Protocol fees: pay fees for operations such as entering/exiting a basket, reallocation, rebalancing and other activities. This also helps in moving liquidity between pools.

- Staking: stake into various pools to earn interests with preferred APR.

- Yield Distribution: choose the payout ratio of the profit generated by the activities in your basket.

There is also a way to generate REEF tokens by helping to maintain the network. The group called “Network Collators” hold a full copy of the parachain and create the new blocks that help to form the Polkadot Ledger. In return for helping to maintain the reliability and accuracy of the network they are rewarded with REEF tokens.

The REEF tokens allocated to the network collators come from the gas payments made as protocol fees. There are a number of transactions that require the payment of network collator fees, which include transaction processing, deployment of smart contracts, and submitting governance proposals, among others.

REEF ICO

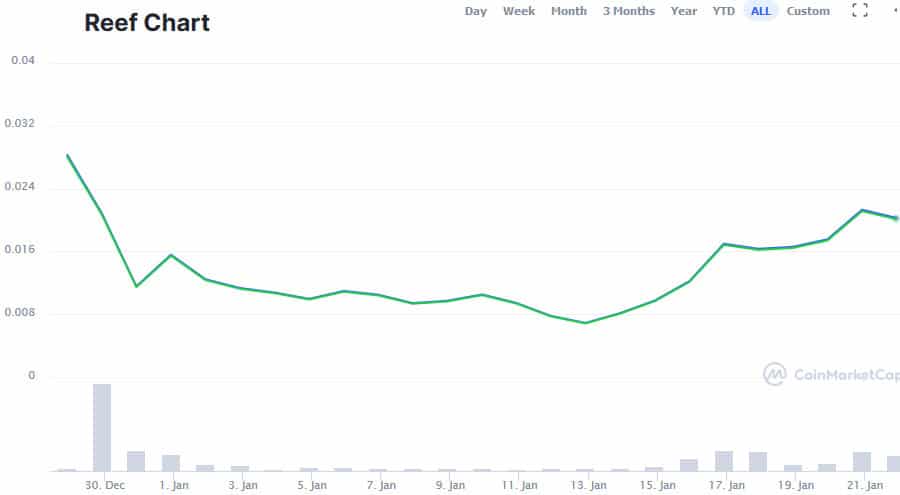

Reef held a series of public of private sales in September 2020. These saw roughly 4.2 billion REEF sold for an average cost of about $0.00095. When the REEF token began trading in late December 2020 it opened at $0.02792, giving those early private investors a massive return.

Price quickly dipped from that opening high, but began recovering again within weeks and as of late January 2021 the price is remaining above $0.02 for a return of more than 1,600% for the early investors. As a DeFi token further gains are expected for as long as DeFi remains popular.

REEF tokens really haven't been trading for long. Image via Coinmarketcap.com

REEF tokens really haven't been trading for long. Image via Coinmarketcap.com Just recently, some questions have arisen about the total supply of REEF. The REEF token is supposed to have a maximum supply of 20 billion divided between Ethereum and the Binance Smart Chain. However, the total combined amount of tokens on both chains works out to just 50% of this maximum supply.

Moreover, many REEF finance investors noted a recent minting of half a billion REEF. The team has not clarified where theses tokens came from or what they will be used for. Some REEF investors who have asked questions have been banned from Reddit and Telegram for “spreading FUD”

Staking Yield in the REEF Pool

Those who stake REEF tokens in the Reef pool are rewarded with more REEF tokens. The APY that’s being generated by the Reef pool comes from the three income streams in the Reef ecosystem. These income streams are:

- Basket engine.

- Protocol fees.

- Interest paid by power users borrowing REEF tokens to increase voting power.

In the future there are plans to introduce the Reef Treasury, which will receive these income streams too. Then the DAO can vote on the best way to use these funds, whether that be buybacks, grants, or something else entirely.

In addition to earning yield from the Reef pool, users can also generate yield through the use of the smart yield farming engine that gives exposure to a variety of DeFi activities and tokens from all the ecosystems included on the Reef Finance platform.

Reef Governance

Voting rights in the Reef platform are granted to those who stake REEF tokens. This allows the owners to also have a say in the decision making processes of the network. There are many things that could be voted on, but here are some of the more common possibilities:

- Changing asset basket structure, including fees and new proposals;

- Modifying reserve limits, as well as adjusting yield rewards and interest rates;

- Amending liquidity pool attributes like voting power time function and dynamic interest;

- Revising the structure of the DAO.

The voting power of any individual or entity is proportional to the amount of REEF they have staked. Because of this it is possible for users to borrow REEF tokens in order to increase their voting power.

Yield Distribution

While governance is important, one of the primary features that most users will be interested in is the ability to stake REEF tokens in liquidity pools to earn yield. Users can receive their rewards in ETH/USDC or they can receive rewards in REEF tokens for higher rates. This is to incentive platform users to hold more REEF, which allows for compound staking and greater interest payments.

An early look at the Reef app. Image via Reef blog

An early look at the Reef app. Image via Reef blog There is an ETH/USDC pair kept in smart contracts. They are used to:

- Pay interest fees for those who stake REEF tokens;

- Buyback and automated market making functions;

- Accumulate revenue and support the platform’s cashflow.

All of these processes are automated through the use of smart contracts, and users don’t need to be aware of what’s occurring in the background. This allows the platform to remain as user-friendly as possible, so anyone can begin to earn yield from the digital assets they hold.

Reef Finance & Binance Access

Reef Finance has many valuable partnerships, and one of the most recent and most talked about is the integration with Binance Access that will allow Reef users to purchase cryptocurrencies using fiat currency and trading in a non-custodial manner. The Reef team has also announced that the platform will soon be able to offer Binance Smart Chain support.

As one of the largest global cryptocurrency exchanges, Binance is expected to be an important partner for Reef Finance. Reef has chosen to work with Binance Access and Smart Chain for many distinct advantages, including the ease of use for fiat access, encompassing seamless user experience and low transaction fees, and access to liquidity that Binance offers.

The collaboration with Binance brings a host of benefits to Reef Finance. Image via Reddit

The collaboration with Binance brings a host of benefits to Reef Finance. Image via Reddit Early in 2020, Binance launched the Binance Smart Chain , an Ethereum Virtual machine-compatible blockchain enabling the creation of smart contracts for tokens on the Binance blockchain. BSC seeks to create an ecosystem where validators, token holders, developers, and users benefit from a blockchain platform that offers high performance and opportunities for further innovations. Of course this meshes well with the goals of Reef Finance.

As you might guess, this partnership is expected to bring many innovations for Reef users. When users want to trade the Binance brokerage integration can be used, and an Access gateway will be created to allow for the purchase of cryptocurrencies with a credit card. Since Binance Access supports many different currency options the Reef platform will be able to span the globe, allowing users to transact in their own currency. Reef Finance CEO, Denko Mancheski said:

We share the vision of Binance in ushering in mainstream adoption by making the fiat to crypto onboarding experience seamless

The Reef Roadmap

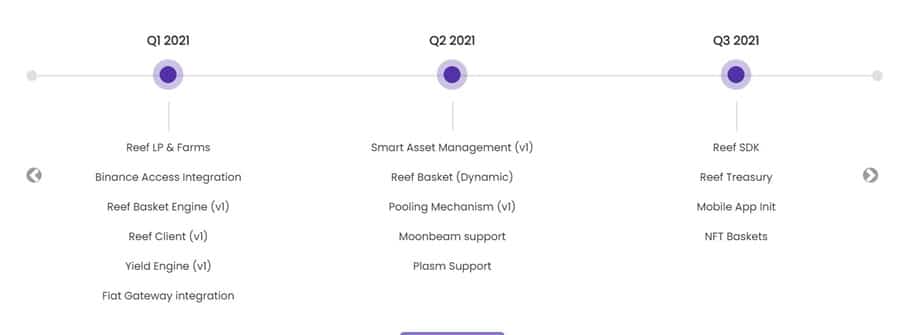

The first quarter of 2021 is crucial to the development of Reef Finance. Image via Reef.finance

The first quarter of 2021 is crucial to the development of Reef Finance. Image via Reef.finance Or you can find a live version of the roadmap on Notion.so here.

Conclusion

Ever since DeFi burst on the scene developers have struggled to find ways to make their services responsive and understandable for users. Unfortunately their tech backgrounds often made that unworkable.

Thankfully the Reef Finance platform has been developed, allowing newcomers to enter the DeFi ecosystem without needing to fully understand what’s happening in the background. This is helping to promote increased adoption of DeFi applications and services in general.

Reef is a ground-breaking platform since it finally opens DeFi to anyone who wants it. Experience and knowledge of blockchain will no longer be a block to those just starting out in the realms of DeFi. Through the reliable automation provided by Reef users now have a simpler method for earning yield and managing digital assets.

Institutional investors are also seeing the immense benefits Reef can offer to the DeFi ecosystem and have been throwing their support behind Reef in increasing numbers. Of course their investment will grow if Reef becomes a successful platform.

That said, the future of Reef Finance is unclear given how it has handled recent controversies about its maximum and circulating supplies. Both the team and CEO have been incredibly vague about why those 500 million REEF were minted and where they came from. Answers will likely surface as time goes on, but, it is best to be cautious with this project, especially since it has yet to get off the ground.