Bitcoin SV Review: Complete Beginners Guide to BSV

Bitcoin SV is one of the more controversial coins in the cryptocurrency space. Despite this, the intense interest in BSV has seen extensive trading volume across the space.

When looking through exchange listings for “Bitcoin” you'll come across quite a few variants that include Bitcoin as part of their name. Bitcoin SV, also known as Bitcoin Satoshi Vision, is one of the most recent. A Bitcoin fork that has shot into the top 10 of all coins by market cap.

So, is Bitcoin SV worth considering?

In this Bitcoin SV review I will attempt to answer that. I will take an in-depth look at the project as well as the long term adoption and price potential of BSV.

What is Bitcoin SV?

Bitcoin SV was created on November 15, 2018 as a fork of Bitcoin Cash due to differences in the viewpoint of the development community regarding how Bitcoin Cash should evolve. With the successful activation of Genesis by the Bitcoin SV team on February 4, 2020 the altcoin is coming closer to the original vision of Satoshi Nakamoto as laid out in the original 2008 Bitcoin white paper.

Because of this Bitcoin SV is said to be the original Bitcoin, with the original Bitcoin protocol. The developers claim this will keep Bitcoin SV more secure and more stable, while also allowing it to scale massively.

As Bitcoin SV positions itself as the original, real Bitcoin there are many who dispute the claim. After all, it isn't the first time a project has claimed to be the original Bitcoin, although in this case there does seem to be some merit to the claim. With the restoration of the original Bitcoin protocol it is hard to dispute the claim of Bitcoin SV returning to the core of what Bitcoin was meant to be.

Another consideration one has to wonder about is whether Bitcoin SV will ever be able to compete with the original Bitcoin in terms of branding, market traction, and pricing. So far in 2020 it seems to be doing a good job, having climbed from just below $100 at the start of the year to $373 as of February 11, 2020.

And even though Bitcoin SV is now the fifth largest cryptocurrency, the $6.65 billion market cap pales in comparison with Bitcoin and its $185 billion market cap.

How Bitcoin SV Emerged

In August 2017 there was a fork in the Bitcoin blockchain which created Bitcoin Cash. The reason for the fork was a difference in vision among the developers, some of whom believed Bitcoin had moved away from its original purpose of creating an efficient, peer-to-peer digital cash. So they forked Bitcoin and created a new version that they felt was more in-line with the original vision of Satoshi Nakamoto.

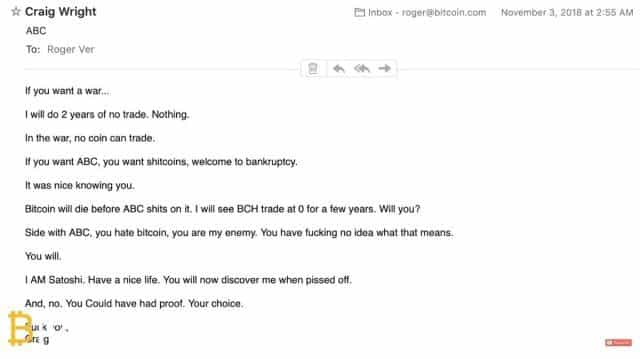

The community behind Bitcoin SV forked from Bitcoin Cash in November 2018 for many of the same reasons, however this fork was somewhat different in that it was a more aggressive split. In the initial days following the fork from Bitcoin Cash the new Bitcoin SV community behaved in a way that appeared as if they were trying to compel others to follow their vision by force.

The fork came about after nChain and CoinGeek, the two organizations behind Bitcoin SV, made a claim that Bitcoin Cash had made so many changes to its protocol that it had also become far from what Bitcoin was originally meant to be.

The followers of these groups chose to fork Bitcoin Cash and return to the original vision of Bitcoin. However when the fork occurred the Bitcoin SV community didn't simply roll back the changes that had been implemented in Bitcoin Cash and declare Bitcoin SV to be back to the original Bitcoin protocol, instead they actively, overtly, and aggressively attempted to wipe out Bitcoin Cash by taking over its hash power.

Eventually this hash war was ended by the implementation of replay protection by both Bitcoin Cash and Bitcoin SV. This made the split between the two blockchains permanent, and each network was able to show sufficient community support to remain viable without destroying one another.

It's interesting to note that the Bitcoin SV community has remained controversial ever since, with their de facto leader Craig Wright causing a huge rift within the blockchain community as a whole after claiming to be Satoshi Nakamoto.

That claim has never been proven, but if it is someday there's little doubt that Bitcoin SV should be able to take over as the leading cryptocurrency. On the other hand, if the claim is never proven Bitcoin SV could become despised for its aggressive and controlling behavior.

Main Technological Innovations

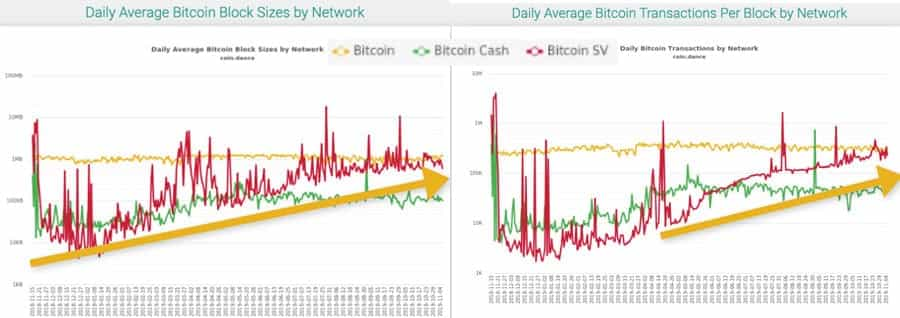

As you might suppose given that Bitcoin SV was a fork from Bitcoin Cash, the two have some definite similarities. One of those is a pursuit for larger block sizes to enable the processing of as many transactions as possible. Bitcoin Cash has kept its block size to 8 MB, which is much larger than the 1 MB size for Bitcoin.

In the case of Bitcoin SV, it has already mined a 103 MB block, which is the largest block ever mined on a public blockchain. In the future Bitcoin SV could theoretically mine blocks that are multiple gigabytes in size. If Bitcoin SV can pull this off, and initial indication are that they will, this is something to certainly look forward to.

By increasing the block size in this way the Bitcoin SV developers are pursuing the scaling that was intended for the original Bitcoin. But increased block size is only one of the goals of the project. The developers also want to have a blockchain that allows businesses to build applications on top of it, and to provide a clear choice for miners.

Perhaps most tellingly, the community behind the project believes Bitcoin SV can provide an improved global payment system, with an exceptional user experience. Obviously that's a huge undertaking, and while the team is heading in the right direction now, there will be plenty of hurdles along the way.

Below are three of the main improvements expected from Bitcoin SV:

- Scale - Bitcoin SV has mined a 128 MB block, but the successful implementation of the Genesis protocol has removed block size limits for Bitcoin SV.

- Transaction costs – One major goal of the project is to minimize the transaction costs, which the developers feel is one of the keys to a successful cryptocurrency.

- Network development – Developing the network to match Satoshi's vision required lots of work, and the release of the Genesis protocol is a major step in creating the cryptocurrency described by Satoshi in the original Bitcoin white paper.

Bitcoin SV vs. Bitcoin Cash vs. Bitcoin

You already read above how Bitcoin SV shares characteristics with both Bitcoin Cash and Bitcoin. Of course they all started with the Bitcoin protocol, so it shouldn’t come as a surprise that there are similarities.

Primarily all the differences that exist between the three coins started with the adoption of Segwit. It was Segwit that led to the fork which created Bitcoin Cash. And that fork led to the larger block size of Bitcoin Cash.

In the case of Bitcoin SV it was later forked from Bitcoin Cash when the community claimed Bitcoin Cash had moved so far from the original Bitcoin protocol that it is little more than an altcoin developer experiment. The community chose to split from Bitcoin Cash in an effort to preserve the original vision of Satoshi Nakamoto, leading to the moniker “Satoshi Vision” for the newly forked coin.

Because of this Bitcoin SV is said to have a clearer vision, giving the coin more stability, better scalability, and increased adoption by the businesses in the crypto ecosystem. In a similar manner, the company nChain that runs Bitcoin SV has a mission to “ignite global adoption and enterprise-level usage of Bitcoin” which they intend to achieve through Bitcoin SV.

nChain believes that massive scaling and a stable protocol are what’s needed to make Bitcoin SV the coin that business choose over Bitcoin Cash, and even over Bitcoin itself.

BSV Crypto Nomics

It’s interesting to note that Bitcoin SV has always been the least profitable coin to mine between itself, Bitcoin Cash, and Bitcoin. That said, profits do fluctuate very regularly. And Bitcoin SV recently surpassed Bitcoin Cash in terms of market capitalization, although the flippening was short-lived and Bitcoin Cash has since recovered its number four position in terms of largest market caps.

The long-term value of Bitcoin SV will ultimately be determined by the ability of the developers to turn it into an actual currency that’s used regularly in commerce. To make that happen an objective use-value outside a medium of exchange will need to be discovered or created for Bitcoin SV. One industry that’s been developing that use-value is the gaming industry. There are others, but gaming seems to be at the forefront for now.

Here’s why it is logically necessary for Bitcoin SV to develop a use-value. Like any good or service, Bitcoin SV is not apart from the laws of economics. It is just as subject to those economic laws as any asset or store of value.

Consider why U.S. dollars have value. Of course now it is backed by the U.S. government, but at one time dollars were backed by gold. Because they were once gold receipts you can look into the past to see where the use-value of the U.S. dollar originated.

Other paper currencies may have similar past use-value, but in the present many are considered to be backed by the dollar as the world’s reserve currency. It all traces back to the connection with gold, and as time goes by that connection is eroding, which is why the purchasing power of money continues to erode.

In today’s day and age cryptocurrencies in general, and Bitcoin SV specifically has a value that’s been attributed to it. This value has nothing to do with being backed by anything in the past.

It’s never been backed by gold, or a reserve currency like the U.S. dollar, or by anything else which has intrinsic value. Instead the use-value of Bitcoin SV comes from its present inherent value, not from anything in the past.

So, what exactly is that present inherent use-value? What can someone use BSV for today, other than exchanging it for another currency?

BSV Use Cases

According to Simit Naik, the Director of Business Services for nChain, the one current use-value for Bitcoin SV is provably fair gaming. This use as a verifier in fair gaming is completely separate from its exchange value. According to Naik:

That’s just one use-value. Firms like nChain are in the business of discovering new ones all the time. The more that are found and applied, the higher BSV’s use-value becomes. That in turn becomes its value floor. The remainder is speculative. The higher the floor, the more stable the total value.

That brings us to the interesting, but speculative question of which cryptocurrency currently in circulation has the highest value floor?

Each coin has both an inherent value and a speculative value blended into its current price, which makes it impossible to know exactly what the floor of any given coin is. However it does seem as if Bitcoin SV has a higher floor than Bitcoin for example.

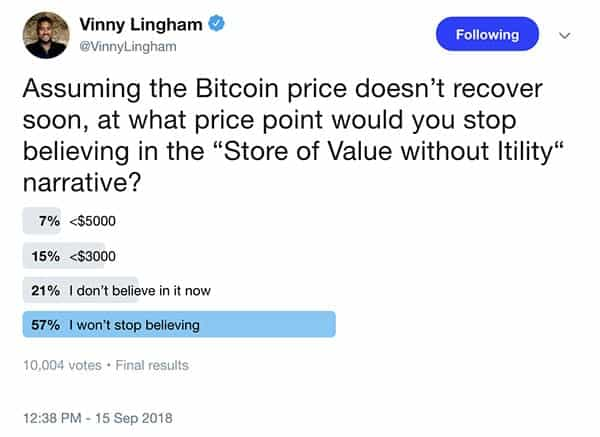

That’s because BSV has already shown a higher use-value than BTC. In fact, Bitcoin might have an extremely low floor, since it is relegated to block sizes of only 1 MB. It could be that Bitcoin is relegated to no more than a store of value, with nearly zero use-value otherwise.

Ethereum clearly has a higher use-value, and thus a higher floor, since it can be used to directly store ownership records for other assets, among other things. While we know that this gives Ethereum a use-value floor today, we can’t really say where that floor is.

For something to be considered as money it isn’t enough for it to simply have a use-value though. Consider computer software. It certainly has a use-value, but isn’t considered to be a form of money. That’s because it’s not fungible. There’s no way to easily divide it into homogeneous units, nor is there any fixed supply.

Cryptocurrencies are a type of software, however it is also fungible with a fixed supply and it is divisible into homogeneous units. This is why we can logically consider Bitcoin SV as a form of money. And it is approaching a use-value where it can not only logically be thought of as money, but can also practically be thought of as money.

BSV Exchanges & Wallets

When it comes to the markets for Bitcoin SV, it is fairly well supported across a range of exchanges. These include the likes of Huobi, OkEx, Binance JEX and others. There also appears to be quite extensive volume for the cryptocurrency across these exchanges.

Taking a look into the individual order books, they appear deep with extensive liquidity. This could make it easy to execute larger block orders without incurring to much price slippage on the orders. BSV is crossed with other cryptocurrencies as well as fiat pairs like the Korean Won.

When it comes to storing BSV, there is limited support from most of the major hardware wallets. However, there are a number of desktop and mobile wallets that could be used for storing your coins. We covered this extensively on our post of the best Bitcoin SV wallets.

People Behind BitcoinSV

Unlike some other cryptocurrency projects where there is an individual or individuals who are the founders and leaders of the project, Bitcoin SV is sponsored and developed by corporate entities.

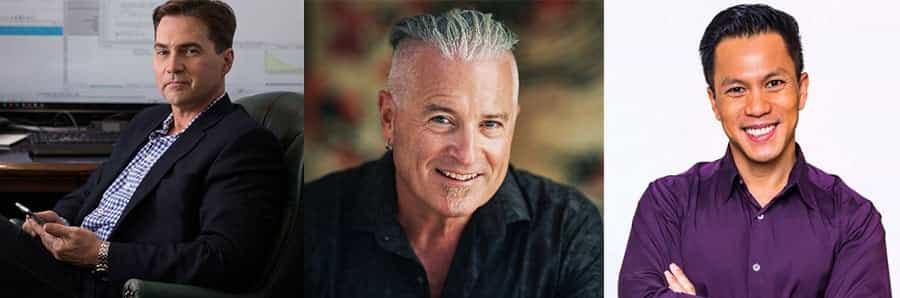

The sponsorship for the project comes from CoinGeek, while the development work on the project is carried out by nChain, a company that’s been involved in blockchain development efforts since 2017, when it was founded by Craig Wright. nChain is well-known for filing numerous blockchain related patents.

The team that’s developing Bitcoin SV was assembled with the full intention to follow industry best practices in an effort to deliver a full node implementation of the Bitcoin blockchain. It is also committed to maintaining the network, and to deliver stability and unprecedented quality.

While nChain was founded by Craig Wright, who has claimed to be the one and only Satoshi Nakamoto, and is currently run by Jimmy Nguyen, the development efforts are overseen by Daniel Connolly as the Lead Developer at nChain.

He joined the company after working for two decades in enterprise systems development, holding several senior IT positions with United Nations agencies. Daniel was an anonymous contributor to Bitcoin in the past, as well as being the primary contributor to the BitcoinJ-Cash project.

The Technical Director at nChain is Steve Shadders, and he not only helps to provide oversight for the Bitcoin SV project, but is also responsible for liaising with sponsors and other industry participants. Steve has been contributing to Bitcoin development efforts since 2011, and was also one of the first contributors to BitcoinJ, in addition to creating one of the first open-source mining pool engines.

Bitcoin SV Team

The Bitcoin SV core research team has more than ten PhDs across a variety of disciplines including mathematics, cryptography, physics, computer science, and network theory. They also have industrial experience in software development, data science, business strategy, and consulting.

This core team includes five full time C++ developers who have a collective 95 years of experience. Additional C++ developers are also working on the project on a contracted basis.

Quality assurance is equally important, with one full time QA manager and three full time QA engineers ensuring the development and maintenance of test environments as well as the documentation, performance, and approval of all changes to the protocol.

BSV Price Performance

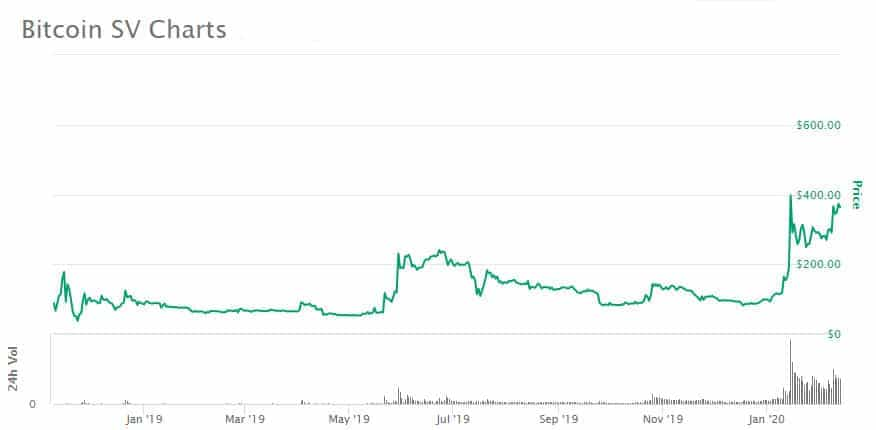

Bitcoin SV began trading at $88.30 and on the first day of trading historical data shows the coin closing at $68.75. Within a week the price of Bitcoin SV was pushed above $200, but as the hash wars came to an end so too did the price of BSV drop to the $50 level. That also reversed rapidly and by December 2018 the coin was trading around the $85-100 range for the most part.

Price declined in the first quarter of 2019, keeping mostly to a range of $60-80. That lower level was broken in April 2019, but by the end of May the coin was rallying again, and topped $200 heading into June.

July, August, and September 2019 saw a steady decline in BSV from over $200 to the $80-85 level. As the coin headed into 2020 it was trading just below $100.

The beginning of 2020 has been excellent for the coin, with BSV rising to $363.40 as of the close on February 11, 2020. That’s a gain of more than 250% in just six weeks.

Development Progress

Based on communications from Lead Developer Daniel Connolly and Technical Director Steve Shadders the recent Genesis hard fork that took place on February 4, 2020 came with the following changes to the Bitcoin SV protocol:

Solution to Bitcoin’s Scalability Problem

One of the nagging problems for Bitcoin has been its inability to scale, and the community hasn’t seen fit to fix the issue, insisting on a block size of just 1 MB and limiting Bitcoin to just 4-7 transactions per second. Needless to say this has seriously undermined any attempts to support enterprise usage of Bitcoin.

In the case of Bitcoin SV a record setting 128 MB block has already been mined, but with the implementation of the Genesis fork there are no limits on the possible size of blocks. This solves the scalability issue and means transaction capacity for Bitcoin SV is now infinite.

This will allow the mining community to manage block size and transaction capacity on the network, which is exactly what Satoshi envisioned in the original Bitcoin white paper.

The removal of a cap on the block size will allow for enterprise-level applications to be built on the Bitcoin SV blockchain. Miners will also benefit since they can earn more transaction fees to make up for the slow erosion in mining rewards due to the halving process that occurs every four years and reduces mining block rewards by half.

Restoring the Originality of Bitcoin Protocol

Bitcoin has now existed for over a decade and each year the developers make changes to the Bitcoin protocol. Because of this the Bitcoin we know today has strayed far from the original Bitcoin protocol. The Genesis hard fork on Bitcoin SV has restored the original Bitcoin protocol as outlined in the original white paper. In essense this has resulted in four key technical changes:

- Restoring the OP_RETURN Functionality: This change allows script developers to terminate scripts early, and with ease.

- Increasing The Script Numeric Type To Big Numbers: This change allows for complex mathmatical calculations to be performed more efficiently. The change was needed due to the limitations of 32-bit numbers. This change returns the original design and enables it to perform complex calculations and scripts with advanced functionality.

- Rescind P2HS For New Transactions: Pay to Hash Script (P2HS) enables hiding output scripts at the time of creation. This change was introduced by developers, but it is against the original Bitcoin protocol, which supports an honest record of events. P2HS has led to poor privacy practices, and rescinding P2HS will allow Bitcoin SV to return to better privacy practices.

- Restoring nLockTime and nSequence: Restoring the original usage of nLockTime and nSequence will allow for high-speed micropayments as intended by Satoshi.

P2P Relay of Transactions with Complex Scripts

Since the Genesis fork all participants are now able to use complex transaction types freely. Prior to Genesis a participant would need to find a miner to assist in confirming block transactions whenever complex transaction types were used.

Like any software we can expect the public blockchain that is Bitcoin SV to evolve as time goes by. While technical changes are inevitable, one thing that won’t change are the base protocol rules that govern Bitcoin SV.

Roadmap & What to Expect

Bitcoin SV begins by simply restoring what was the original Bitcoin protocol. The precepts laid out in the original Bitcoin whitepaper are being embraced by those working on the Bitcoin SV project.

By re-enabling the Satoshi op_codes Bitcoin SV is now prepared to add advanced technical functions, including smart contracts and tokenization. This original Bitcoin protocol is what has been needed to see Bitcoin grow and thrive, and it needs to be allowed to exist without constant tinkering and changes.

Now that this original protocol has been restored it needs to remain stable. Aside from critical security patches there shouldn’t be any needed changes required. By remaining stable Bitcoin SV will generate confidence from enterprises looking to build applications on top of a public blockchain. Just like the protocols that govern the internet has remained relatively stable over the years, so too will Bitcoin SV remain stable.

Next will be the growth of massive scalability to meet future market needs rather than simply viewing current transaction volumes. It’s important that Bitcoin SV is prepared for potential demand as a function of supply.

This will allow Bitcoin SV to function as the foundation of many different industries that require this type of massive scaling. Scaling will also help keep the mining community healthy, since increased transaction volume also means increased mining fees.

Of course security also remains critically important to the Bitcoin SV roadmap. The developers will continue to ensure the blockchain is properly optimized, and that quality assurance and testing steps remain in place.

Finally, Bitcoin SV will strive to continually improve the payment experience. The project will work on both measurement and improvement of the safety of 0-conf transactions, fast transaction propagation, and miner-configurable fee policies.

Conclusion

Sure Bitcoin SV hasn’t been without its controversies and detractors, but at the end of the day it still has a strong community, and appears to truly be interested only in delivering the vision of Bitcoin’s creator. The Genesis hard fork makes the blockchain the closest to the protocol set out in the original Bitcoin white paper.

It isn’t certain yet if this is what markets need, but Bitcoin SV has certainly seen some massive gains in price leading up to the Genesis hard fork, and unlike the pumps we’ve seen from other coins over the years, these gains are sticking. That simply highlights the strength of the Bitcoin SV community, and their dedication to making Bitcoin SV the biggest and most useful blockchain on the planet.

The true test for Bitcoin SV begins now that it has restored its protocol to match Satoshi’s Vision. Will the blockchain thrive? Will it finally succeed in turning a cryptocurrency into money that’s actually widely used where so many have failed?

It certainly won’t happen overnight, but we should find out over the coming months how successful Bitcoin SV can be.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.