Did you know that Vitalik Buterin created Ethereum after he realized Bitcoin could not effectively support smart contracts? Privacy coins like Monero and Zcash were created for the same reason: their founders saw that Bitcoin could not support the degree of privacy they wanted. It should come as no surprise then that both Monero and Zcash are actually privacy-focused forks of Bitcoin.

While smart contract or bulletproof privacy advancements on Bitcoin have been slow, and some may argue not even feasible, there are some projects that are trying to get us as close to that point as they can. Stacks (previously Blockstacks) is one of these projects. However, it is not just another layer-2 scaling solution like the Lightning Network. Stacks brings smart contracts and privacy to Bitcoin by anchoring its blockchain to Bitcoin’s.

Stacks 2.0 is the rebranded and upgraded iteration of Blockstack, addressing the utility and scalability issues that affect the Bitcoin network. It is a layer-2 blockchain that indirectly assists in using smart contracts and dApps on Bitcoin’s network.

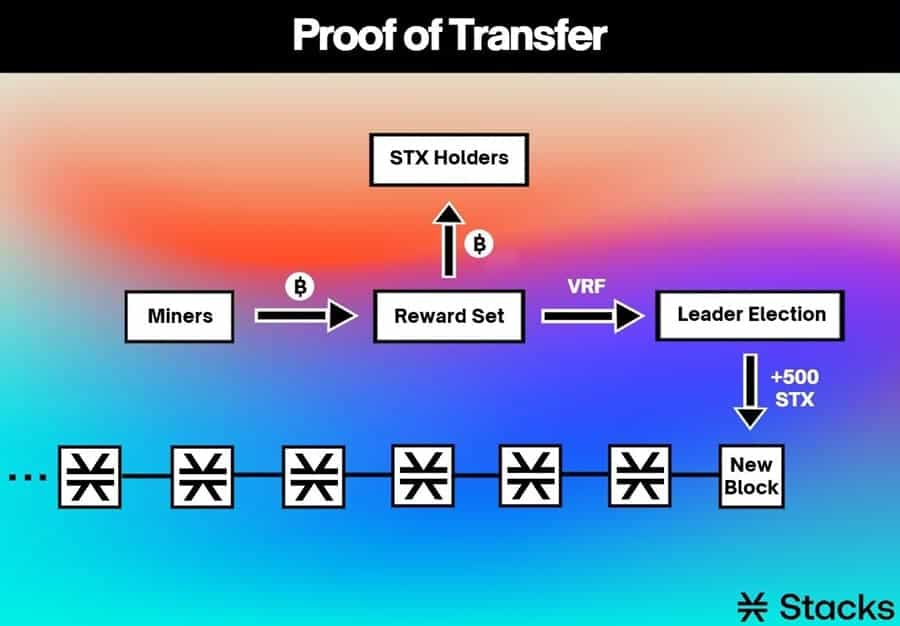

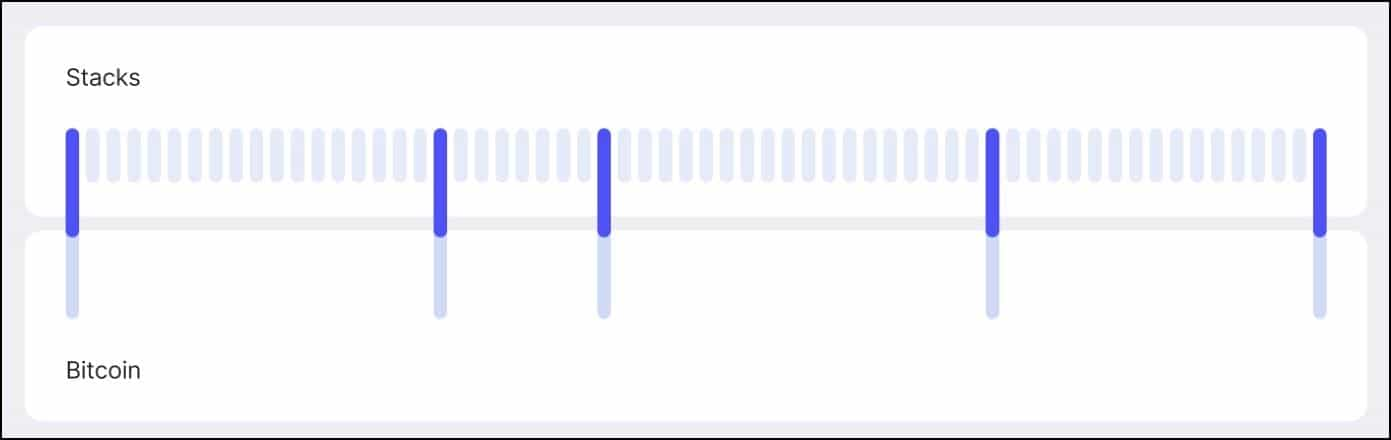

In order to achieve this the team has created a new and unique consensus mechanism they’ve dubbed Proof of Transfer (PoX) which connects the Bitcoin and Stacks blockchains. In this design the Stacks blockchain contains the smart contracts, whereas the Bitcoin layer acts as the finality and security layer. Leader elections occur on the Bitcoin blockchain, while new blocks are written to the connected Stacks blockchain.

In this network construction, the Stacks blockchain transactions are capable of scaling independently of the Bitcoin blockchain. Bitcoin’s chain is only needed for security and finality. This means that thousands of transactions on the Stacks blockchain result in just one single hash on Bitcoin’s blockchain.

Stack's transactions are settled on Bitcoin automatically each time a block is created on Bitcoin. In addition, Stacks introduces a new concept of microblocks that provide confirmation in seconds. The microblock idea is the main direction for scalability research, where a theoretically faster consensus algorithm like PoX can use microblocks that settle on Bitcoin each time a new block is mined.

Thus Bitcoin serves as Stacks settlement protocol. The Bitcoin blockchain and blocks serve as the ultimate truth, and hashes of the Stacks block history are archived on Bitcoin. The Stacks team chose Bitcoin as the settlement, security and finality layer due to its proven history of excelling in all three areas.

Smart contracts and dApps are programmed using a new language called Clarity, which benefits from being a predictable language that uses no compiler.

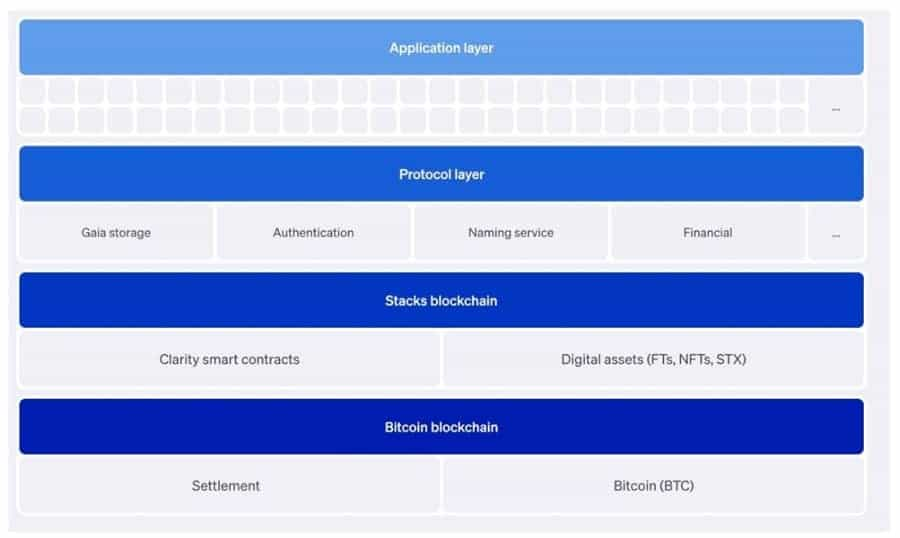

The project has four major layers – the application layer, the protocol layer, the Stacks blockchain, and the Bitcoin system.

Stacks 2.0 Design Elements

It’s mentioned above that the Stacks blockchain can support the use of smart contracts and decentralized applications, and depends on Bitcoin for security and finality. It uses a new consensus algorithm called Proof of Transfer (PoX), and we will explore PoX and its capabilities in further detail below.

Proof of Transfer (PoX)

Every consensus algorithm used in blockchain constructs requires some type of resource to secure the blockchain, whether it be computing resources or financial resources.

For the most part, these algorithms are divided into two major types. The first is proof-of-work, where nodes dedicate computing resources in a process called mining. The second is proof-of-stake, where the nodes dedicate financial resources in a process called staking.

The high-level idea that led to the creation of proof-of-work and proof-of-stake is to make it feasibly impossible for a malicious entity or group of entities to be able to attack the network.

There are variants of these two primary algorithms, and one of the variants of proof-of-work is the proof-of-burn consensus mechanism where miners compete for network rewards by “burning” or destroying the proof-of-work cryptocurrency in lieu of using computing resources.

Stacks has taken the proof-of-burn concept to create a new consensus mechanism they’ve named Proof-of-Transfer.

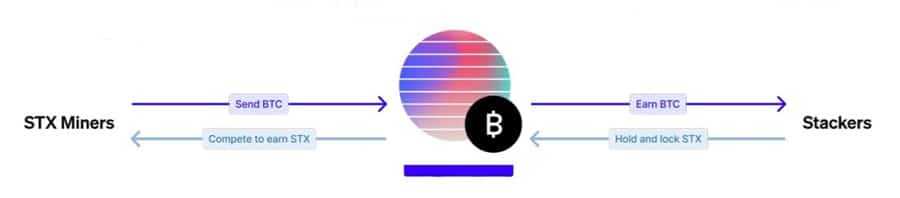

The PoX algorithm is in essence a generalization of Proof-of-Burn. In PoX the Proof-of-Work cryptocurrency of an already established blockchain is not burned, but instead, it is used to secure the new blockchain. Rather than burning the existing cryptocurrency, it is transferred by miners to other participants in the network.

The miners receive some of the new cryptocurrency and the other network participants receive the established cryptocurrency in the transfer. This allows network participants who are adding value to the new cryptocurrency network to earn a reward in a base cryptocurrency by actively participating in the consensus algorithm.

This new consensus mechanism encourages the use of an already extremely secure blockchain such as Bitcoin to secure new chains without introducing new Proof-of-Work chains and cryptocurrencies.

This also introduces the novel property of allowing network participants to receive payouts in an existing, stable cryptocurrency while participating in the new blockchain network. This helps to solve the bootstrapping problem typically faced by new blockchains by giving early participants a solid incentive to join.

This is exactly the consensus mechanism being used in Stacks.

Transaction Life Cycle

Transactions and other smart contract interactions originate on the Stacks network and are finalized by the Proof of Work consensus of the Bitcoin network. Similar to other traditional blockchain networks, all transactions and smart contract calls must originate from a Stacks 2.0 user account.

Here are the transitions every on-chain interaction goes through before achieving finality:

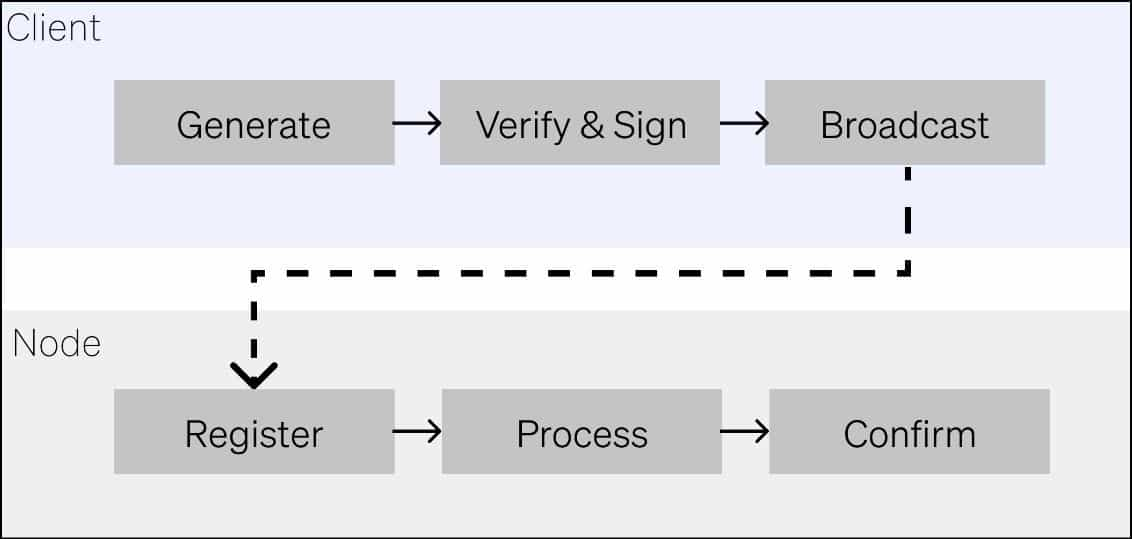

- Generate: The client assembles the transactions according to the rules of the network.

- Verification and Signing: The client validates the transactions and registers the signatures.

- Broadcast and Registration: The client sends the transaction to a Stacks node. The node adds the transaction to the mempool of transactions waiting for inclusion into the network.

- Consensus: The miners of the Stacks network include the transaction in the current block. The transactions may comprise complex smart contract calls that may emit multiple events at various steps.

- Confirmation: Miners successfully mine blocks with a set of transactions. The transactions inside are successfully propagated to the network.

- Finality: The transactions achieve finality when their Bitcoin block attestation achieves finality.

PoX Consensus

As we’ve already established the PoX consensus algorithm works by using an existing Proof-of-Work cryptocurrency (like Bitcoin) to secure a new blockchain (in this case Stacks). PoX is the very first consensus algorithm to use two blockchains rather than just one.

In the PoX implementation on Stacks, miners participate in leader elections each round. This election occurs on Bitcoin’s blockchain. A leader is chosen by the protocol through the use of a verifiable random function. That leader then writes the new block on Stacks’ blockchain while also minting the rewards.

In essence, the algorithm has miners bid on becoming the leader using Bitcoin, and the Bitcoin is then transferred to other network participants who are securing the network. It is thought to be an improved version of Proof-of-Burn that works without needing to burn the existing cryptocurrency in order to generate new tokens.

In PoX the Bitcoin is transferred to STX holders as rewards for securing the network. Rewards are distributed based on the total number of STX tokens held. In return the PoX miners receive newly minted STX tokens.

PoX Parameters:

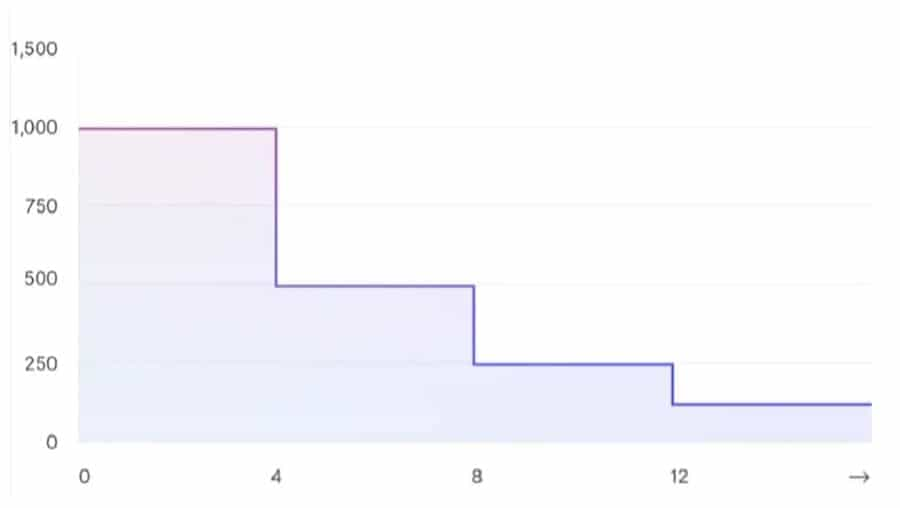

- Block reward: 1000 STX/block for first 4 yrs; 500 STX/block for following 4 yrs; 250 for the 4 yrs after that; and then 125 STX/block in perpetuity after that.

- Block time: Stacks blockchain produces blocks at the same rate as Bitcoin. Bitcoin blocks are produced roughly once every 10 minutes, so that will be the rate for Stacks 2.0 mainnet. However, microblocks can give faster initial confirmation.

- Block reward maturity window: 100 blocks, meaning if a miner wins a block, they will earn the coinbase reward for that block after 100 blocks have elapsed.

- Stacking parameters: 2 reward addresses per block; reward cycle 2000 blocks (~2 weeks) for a total of 4000 reward slots.

- Stacking threshold: the minimum number of STX needed is dynamic based on participation.

- This threshold is 0.025% of the participating amount of STX when participation is between 25% and 100% and when participation is below 25%, the threshold level is always 0.00625% of the liquid supply of STX.

The Nakamoto Hard Fork

The Nakamoto hard fork upgrade on the Stacks network represents a significant development in the ecosystem aimed at enhancing the network's performance, scalability, and security. It represents a pivotal moment for Stacks, as it introduces critical improvements and new features to the network:

- Including transaction speed improvements.

- Enhancing Bitcoin’s guarantees to Stacks transactions.

- Mitigating MEV (Miner Extractable Value).

- Leveraging the new guarantees to enable more utility of the Stacks Network.

Tenure-Based Block Production

One major scalability bottleneck in the Stacks network was the slow throughput of the Bitcoin network. Before Nakamoto, the Stacks blocks propagated in parallel to Bitcoin blocks, maintaining a 1:1 anchor. The 10-minute block time of Bitcoin meant that Stacks blocks and comprising transactions had to wait for at least 10 minutes for finality, leading to slow transaction speeds. The Nakamoto upgrade upgrades this relationship to adopt tenure-based block propagation.

The initial anchor to the Bitcoin block has been replaced with tenure-based block propagation. For every Bitcoin block, a single Bitcoin network miner is cryptographically selected to produce Stacks blocks, generating a new block every five seconds.

More Responsibility Over Stackers

Previously, all Stackers could do was stake STX tokens and earn rewards in BTC. The Nakamoto upgrade makes stackers integral to Stacks consensus by enforcing more responsibilities over the stackers. In Nakamoto, Stackers will also validate and approve each block produced during a miner’s tenure and keep them in check. The Stacks protocol will leverage stackers to reference the first block produced in each tenure to the next Bitcoin block.

The reference commits the state of the Stacks network with the Bitcoin network, linking the stacker's activity with the miner activity in the Bitcoin network and creating more secure Stacks blocks. The new relationship between the miners and the stackers is a symbiosis of utility and security. The Bitcoin network gains additional utility in the Stacks layer, while the Stacks layer is able to harvest Bitcoin’s complete finality commitment. After Nakamoto, the Bitcoin network consensus will include Stacks block data, which means the entire Bitcoin network syncs the Stacks block data and not just the miners who connect to the Stacks network.

Using Stackers to Police Miners:

Only one miner in every tenure is responsible for writing Stacks blocks to the Bitcoin network, requiring a mechanism to watch over its behavior and ensure it operates honestly. Stackers, who had the sole responsibility of staking STX in the network, assumed this job. They ensure the miner references the expected Stacks block and prevent the network from forking, propagating the canonical chain forward.

Nakamoto Update MEV Protection

The Nakamoto upgrade in the Stacks network tackles a big problem known as Miner Extractable Value (MEV). Before this upgrade, some miners could unfairly influence which transactions get added to a block or their order. This was especially a problem in the Stacks network, where Bitcoin miners could manipulate the system to win more rewards at a lower cost, harming the fairness and trust in the network.

To fix this, Nakamoto introduced several key changes to make mining on Stacks more fair. First, miners now need to have been actively trying to mine in the last 10 blocks to qualify for rewards, encouraging consistent participation. Second, the system now looks at the average of bids (how much miners are willing to pay) from the last ten blocks to decide who wins, preventing miners from using unusually high or low bids to game the system. Lastly, it uses a fixed measure of bids to keep the mining process stable and fair, regardless of short-term fluctuations.

These updates aim to make sure miners are rewarded for genuinely contributing to the network's security and fairness, reducing the chance for manipulation and ensuring rewards are distributed more evenly.

sBTC – Bitcoin Powered DeFi

Following the Nakamoto upgrade, the Stacks blockchain has complete knowledge of the Bitcoin network. Any Stacks node can read Bitcoin transactions and state changes, which means the Bitcoin state can trigger events on the Stacks network. For instance, a Bitcoin state change can trigger a smart contract operation on the Stacks network.

One such smart contract application on Stacks is sBTC, a trustless synthetic representation of Bitcoin on the Stacks network that maintains a 1:1 peg with BTC. sBTC unlocks more smart contract-enabled functionality to Bitcoin and enables developers to build applications with Bitcoin as the settlement currency.

How Does sBTC Work?

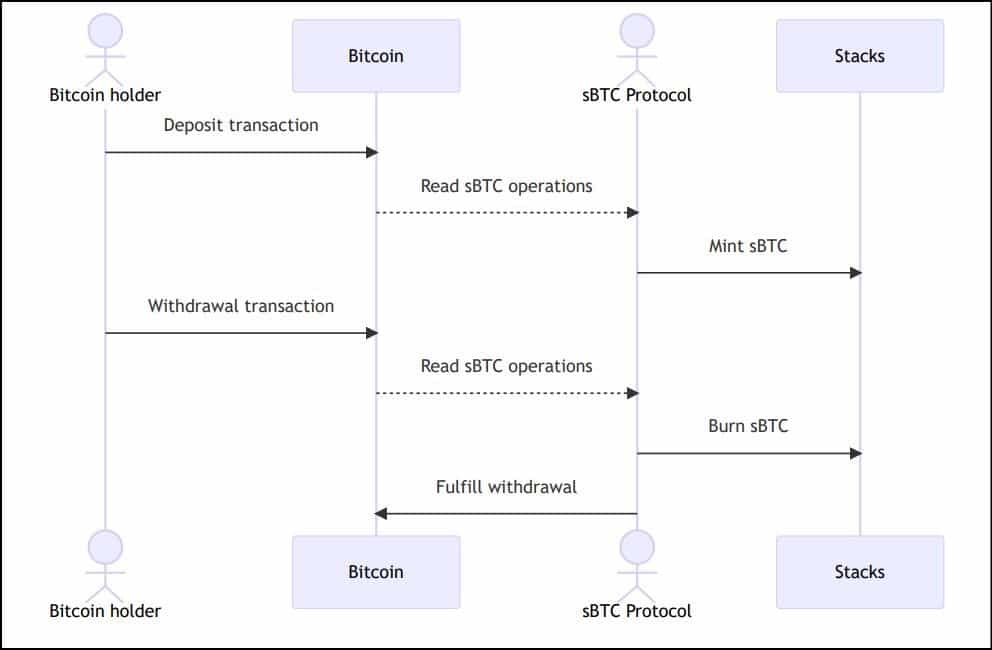

Bitcoin owners have two main ways to engage with sBTC: making deposits and withdrawals, both actions facilitated by specific Bitcoin transactions.

To add BTC to sBTC, an owner initiates a deposit transaction on the Bitcoin network. This signals to the sBTC protocol the amount of BTC being deposited and the Stacks address where the owner prefers to receive sBTC. Following this transaction, the sBTC platform credits the specified Stacks address with the equivalent amount of sBTC.

For withdrawing BTC, an owner executes a withdrawal transaction on the Bitcoin network. This transaction specifies the amount of sBTC to be withdrawn, the Stacks address from where it should be deducted, and the Bitcoin address that should receive the equivalent BTC. The sBTC system then removes the specified sBTC from the mentioned Stacks address and processes the withdrawal by transferring an equivalent amount of BTC to the provided Bitcoin address.

Is Stacks Bitcoin Connection Equivalent to Ethereum Layer 2 Mechanism?

Ethereum layer-2 networks operate by submitting their block data in a rollup smart contract on the Ethereum network. Stacks documentation claims the Bitcoin network's 100% finality power back Stacks blocks after the Nakamoto upgrade. Therefore, can we say that the Nakamoto-enabled Stacks network receives the same cryptographic guarantees and settlement as layer-2 networks operating over Ethereum?

The crux to this answer lies in understanding the connection between Stacks and Bitcoin. After Nakamoto, stackers commit stacks transactions via settlement blocks. These blocks are anchor points at which Stacks submits a cryptographic hash of the previous stacks block to the Bitcoin network to include in the block during consensus, and this is where the difference lies.

The difference between layer-2 networks like Polygon, Aritrum and Optimism on Ethereum and Stacks is in data availability. Ethereum is a Turing complete blockchain network where smart contracts operate with a broader range of functionality than Bitcoin is capable of. Ethereum layer-2 blocks share data availability of their blocks with Ethereum, allowing its validators to very each layer-2 transaction and reconstruct its state. The Stacks network neither makes complete block data available to Bitcoin, nor is the Bitcoin network built to process off-chain transactions. Therefore, while Ethereum consensus can validate layer-2 transactions, Bitcoin consensus cannot and thus requires another mechanism to ensure the honesty of network participants. The relationship between miners and stackers ensures this honesty.

The Stacks Blockchain

As already noted, the Stacks network has four major layers - application, protocol, Stacks blockchain, and the Bitcoin system.

The Stacks blockchain is the cement holding the entire ecosystem together. By itself, the Stacks blockchain is a distributed layer where users can deploy smart contracts and create virtual assets.

The interesting aspect is that this is not a layer-2 chain, but instead, it is connected to the Bitcoin-powered chain in a 1:1 block ratio. This means that whatever happens in the Stacks ecosystem should be verifiable on the Bitcoin blockchain.

How Do Stacks and Bitcoin Connect?

Connecting two independent distributed ledgers is accomplished with PoX where miners are able to mine STX tokens by transferring BTC. Apart from the new consensus mechanism this decentralized platform also supports smart contracts, dApps, and the creation of virtual assets that are indelible and easily transferred.

These virtual assets can represent any number of use cases, from governance to funding or other business models. Stacks supports both fungible token creation and non-fungible token creation.

To power the smart contracts Stacks uses the Clarity programming language, which provides enhanced security and is a predictable language that uses no compiler. Developers might be familiar with Clarity as it is used in other leading decentralized platforms such as Algorand.

The Stacks network connects with the Bitcoin network through a unique mechanism that balances the need for fast transaction confirmations with the robust security and finality of Bitcoin's blockchain. Here's how they interlink:

- Initial Speed and Block Production: Originally, Stacks produced blocks at the same rate as Bitcoin, roughly every 10 minutes, which is relatively slow and unpredictable. However, with the Nakamoto release in 2023, Stacks began generating faster blocks, approximately every 5 seconds, between two Bitcoin blocks. This significantly improves the speed of transactions on the Stacks layer while maintaining the integrity and finality of settlements on the Bitcoin main chain, which still occurs at the Bitcoin block rate.

- Smart Contract and Block Production Comparison: Unlike other modern Layer 1 (L1) smart contract platforms like Ethereum or Solana that use Proof-of-Stake (PoS) mechanisms for fast, forkless block production, Bitcoin relies on a Proof-of-Work (PoW) system. PoW, while slower and allowing for forks, optimizes for decentralization and security. Stacks seeks to merge these worlds by offering the rapid transaction confirmations expected on PoS networks, with the unparalleled security of Bitcoin's PoW system.

- PoX Consensus Mechanism: The connection between Stacks and Bitcoin is facilitated by the Proof of Transfer (PoX) consensus mechanism. PoX enables Stacks to access both the Stacks and Bitcoin ledgers. An open bidding process on the Bitcoin ledger determines a group of Stacks miners who can mine Stacks blocks until the next Bitcoin block is found. This process allows for the production of fast Stacks blocks every 5 seconds, independent of the timing of Bitcoin blocks.

- Block Types on Stacks: With Nakamoto, Stacks introduces two types of blocks:

- Fast Blocks: Produced every 5 seconds, containing new transactions and smart contract calls, creating a linear sequence without allowing forks.

- Settlement Blocks: Occur at every Bitcoin block, settling the sequence of fast blocks on the Bitcoin chain without containing new transactions. Miners are incentivized to include the longest sequence of fast blocks for settlement.

- Fork Management: In this system, forks are not permitted within the fast blocks that occur between settlement blocks, ensuring a smooth and predictable transaction flow. Forks are only possible at the settlement block level, adhering to Bitcoin's forking rules.

This innovative architecture provides Stacks users with fast transaction confirmations and the benefits of Bitcoin's security and finality. It represents a significant advancement in blockchain interoperability, offering a hybrid model that leverages the strengths of both PoW and PoX consensus mechanisms.

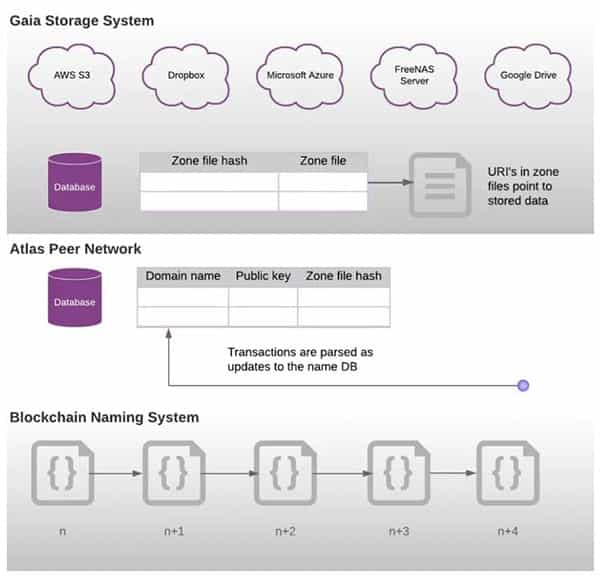

Protocol Layer

The protocol layer of Stacks is where the storage, authentication, financial and naming services reside. The storage system used in Stacks has been named Gaia and it stores app data off-chain without the need for a third-party storage provider.

Gaia uses off-chain cloud systems such as Azure to provide applications with blazingly fast data access. The data remains secured by the private key of the creator.

In addition to that Stacks uses a decentralized authentication feature. This authentication is how access is granted for apps, with the username and other details stored in Gaia.

The financial aspect of the protocol layer can support decentralized finance platforms, similar to Uniswap and 1inch. These platforms can give users the ability to participate in DeFi exchanges and lending, or even more advanced DeFi such as yield farming. This layer is strengthened even further by the use of Clarity in the creation of smart contracts.

As an example, the smart-contract programming language is actually capable of interfacing directly with the Bitcoin blockchain. It has also been reinforced to prevent potential security breaches while also anticipating possible vulnerabilities.

Stacks was also created with a unique naming service feature called the Blockstack naming Service (BNS). Even though the platform is decentralized the naming service allows the platform users to give human-readable names to assets, with those assets being secured with a combination of public and private keys.

PoX Participants

The PoX consensus mechanism consists of two types of participants:

- STX miners

- STX holders

STX Miners

The group of STX miners are able to view state on both the Stacks and Bitcoin blockchains. They are responsible for the leader elections each round and they spend Bitcoin by sending transactions on the Bitcoin network. Leaders are selected each round via a Verifiable Random Function, and the newly elected leader is responsible for writing the new block to the Stacks blockchain.

STX miners are then rewarded for their activity with the newly minted STX that come from transaction fees and from the smart contract execution fees.

PoX Mining

Let’s take a look at PoX mining and the method by which an STX holder is able to earn BTC.

As already mentioned, PoX mining is simply an improved type of Proof-of-Burn, where tokens are transferred to other network participants as rewards rather than being burned and destroyed.

In the Stacks ecosystem a PoX miner transfers Bitcoin to eligible owners of Stacks (STX) tokens, and in return, they receive the newly minted Stacks (STX) tokens. Thus all the network participants benefit.

The miners who choose to participate in this PoX mechanism run a mining client on their computer or server. The mining client is responsible for implementing the necessary PoX mechanism, and this ensures that the process is handled properly through four key phases:

- Registration – Miners register themselves for the incoming election by sending consensus data to the network.

- Commitment –To participate in the election, the registered miners transfer Bitcoin to the eligible Stacks (STX) tokens holders proportional to the amount of their staked token.

- Election – A verifiable random function randomly chooses one miner as a leader to write a new block on the Stacks blockchain.

- Assembly – The leader writes the new block and, in return, receives newly-minted Stacks (STX) tokens as a reward.

Mining Reward

PoX miners are rewarded with newly minted STX tokens when transferring BTC. The rewards schedule was set by the developers as follows:

- First 4 years, 1000 STX per block are released for mining.

- Next 4 years, 500 STX per block are released.

- Next 4 years, 250 STX per block are released.

- For the rest of the period, 125 STX per block will be released.

Miners rewards are made up of the block rewards above and the transaction fees, however these take 100 blocks on the Bitcoin blockchain to mature. This means miners will typically not see their rewards until roughly 24 hours after they are generated.

STX Holders

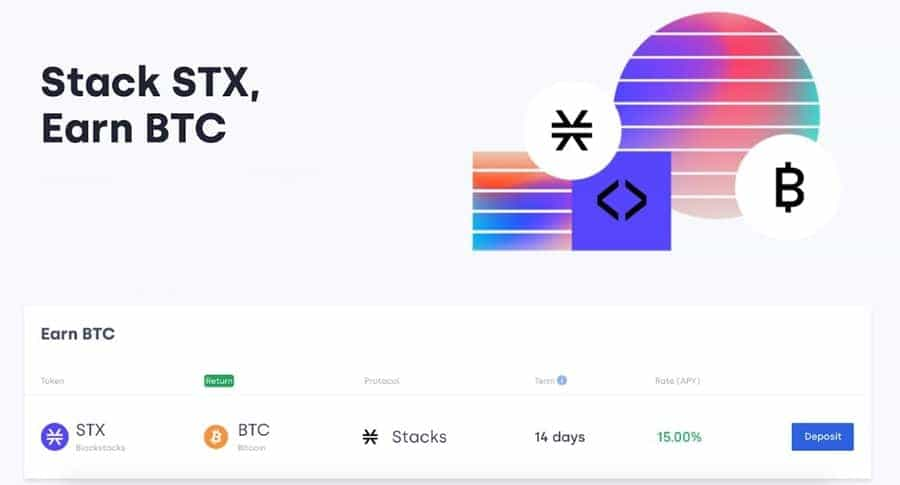

Normal users who hold STX tokens are the users who can participate in the consensus of the network by locking their STX tokens in a staking contract, running or supporting a full node, or sending useful information over the network as STX transactions. As a reward for these actions, STX holders earn BTC in a two-week-long reward cycle.

By locking their STX (called ‘Stacking’) and sending occasional transactions the STX holder is an active participant in securing the network. This entitles them to a portion of the Bitcoin rewards that are created when the miners make BTC transfers as part of the mining process.

This Stacking mechanism is a new secure method for earning Bitcoin without needing to invest in costly mining rigs, become involved in centralized lending schemes, or leverage potentially risky third-party DeFi products.

Stacking

Stacking is the unique new method used by Stacks to allow users to earn BTC. This is the first time that users are able to lock one asset and earn their rewards from the protocol in a reserve currency. Stacks calls this process “Stacking” and it is a key component of the Proof-of-Transfer consensus mechanism.

Stackers in Stacks help to support network consensus by either locking their own STX tokens, or by delegating them to others. As a reward, they receive BTC at the end of each stacking cycle.

This is preferable by many to the current DeFi methods where users are forced to stake all sorts of tokens, typically earning their rewards in that same token, which then needs to be converted to BTC or some stablecoin for safekeeping and holding value as many altcoins can lose over 90% of their value over time.

Rather than accepting the risks that the process entails, Stackers are able to directly earn the most valuable of all cryptocurrencies by participating in the network. That also keeps users away from potentially buggy or shady projects.

Staking vs. Stacking

While Stacking sounds similar to Staking there are some key differences to understand:

Staking

(e.g. Tezos, Cosmos, Cardano)

- User funds might be slashed based on network activity

- Requires high uptime and guarantees from nodes

- Funds received from staking are generally sold to offset maintenance and uptime costs, creating potential for market sell pressure

Stacking

Only possible with Stacks (STX)

- Your funds never leave your wallet, and there's no risk of losing them

- No special hardware required. Users can participate on their own through the STX wallet or through providers

- Earnings are paid in BTC, but the reward-generating asset is STX, meaning there is no added sell pressure for STX

Stacking and Earning

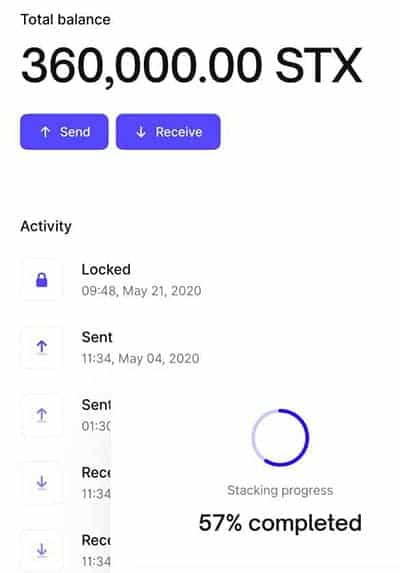

All these technical details are fascinating, but by now I'm sure you just want to know how you can Stack and make some passive BTC. It's actually pretty straightforward.

To run a full node requires 70,000 STX tokens, which isn't realistic for most small traders and stackers. However it is also possible to delegate or use an STX pool if you have less than 70,000 STX, so even us small fry can stack and earn BTC.

If you're interested in doing just that the first thing to do is download the Stacks desktop wallet Hiro.

Once you've downloaded and installed the wallet you'll need some STX and you can get that from Binance using the BTC/STX pairing. Other exchanges offering STX include OKX and KuCoin. Get some STX and transfer it to your wallet.

Once the STX is in your wallet you can get started with stacking by clicking the get started button. This will then ask you if you want to Stack by Yourself or Delegate. If you don't have the required 70,000 STX to Stack by Yourself the wallet will show an insufficient balance message. Most of us will be choosing the Delegate option.

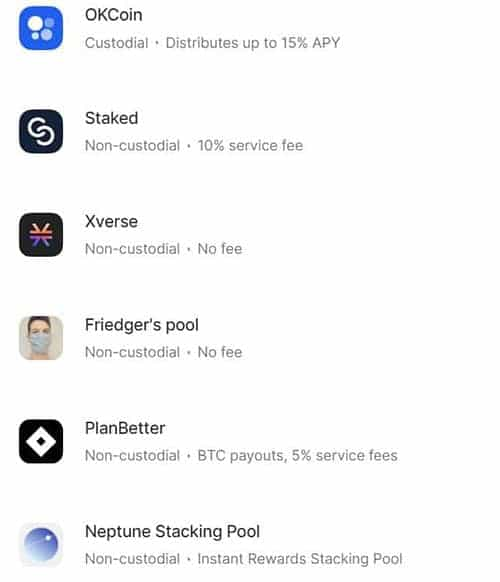

When you click Continue on the Delegate option it will take you to a page where you can choose between the various services that offer delegation of STX. Each delegator has different minimum token criteria, fees and payouts, so you may want to research each option before making a choice.

Once you've delegated you'll also need to provide an address where your BTC is deposited. Then simply sit back and wait for the BTC to stack up. Earning cycles are roughly 14 days long, and if you don't unlock your STX at the end of a cycle they are automatically stacked in the next cycle.

Clarity Smart Contracts

Clarity is the programming language used to create smart contracts and dApps on Stacks. The Clarity code is what’s known as predictable code because developers are able to determine what the program is going to do, how much data it will consume, and what the cost will be for the application.

That’s preferable to Ethereum’s Solidity language, which does not allow developers to know or predict what the program will do, its data needs, or its costs without actually executing the code under given conditions.

Clarity is also different from most other programming languages because it doesn’t get compiled. Instead, the source code for any smart contract is published and directly executed on the blockchain nodes. The Clarity smart contracts also have visibility into the Bitcoin state, which is important because it allows contract logic to be triggered based entirely on Bitcoin transactions.

Stacks Team

Stacks began as a project to build a better internet all the way back in 2013 in the Princeton Computer Sciences Department. A year later, co-founders Ryan Shea and Muneeb Ali went through Y Combinator and recruited a group of other computer scientists from Princeton for the initial R&D efforts. In 2017 Muneeb’s PhD thesis laid out the framework for a user-owned internet that would be built on blockchains.

Stacks is being developed by a globally distributed team that includes leading researchers from MIT, Princeton, and Stanford. The project is owned by Hiro Systems PBC (formerly Blockstack PBC) and is overseen by the Stacks Open Internet Foundation.

The STX Token

STX was created primarily to be used as fuel for executing Clarity smart contracts. However, they have additional functionality in the Stacks ecosystem. STX can be used to publish new smart contracts to the blockchain, pay for transaction fees, and register digital assets, among other uses.

The STX token is unique in that it was initially distributed to the public through the first-ever SEC-approved token offering in U.S. history. The project also released a legal memo in December 2020 that outlined how STX would be able to move from its current status to become tradeable on U.S. exchanges.

The Genesis block saw 1.3 billion STX minted, and there is a planned maximum supply of 1.818 billion tokens. The tokens minted with the genesis block were shared among the founders, treasury, equity investors, employees, two token sales, and app mining.

While the STX token has seen noteworthy performance since 2023, the long-term value of the token is dependent on the growth of the Stacks ecosystem and network, as well as the demand for Clarity smart contracts. This is logical since developers need STX tokens to add smart contracts to the blockchain and users need STX tokens as fuel (gas fees) when executing the contracts.

Stacks Ecosystem

The Stacks Ecosystem offers all the products you would typically expect from a smart contracts platform but with finality on Bitcoin. Stacks harbours Bitcoin NFTs, numerous Dapps, a synthetic token and a domain naming system, let's go over these products:

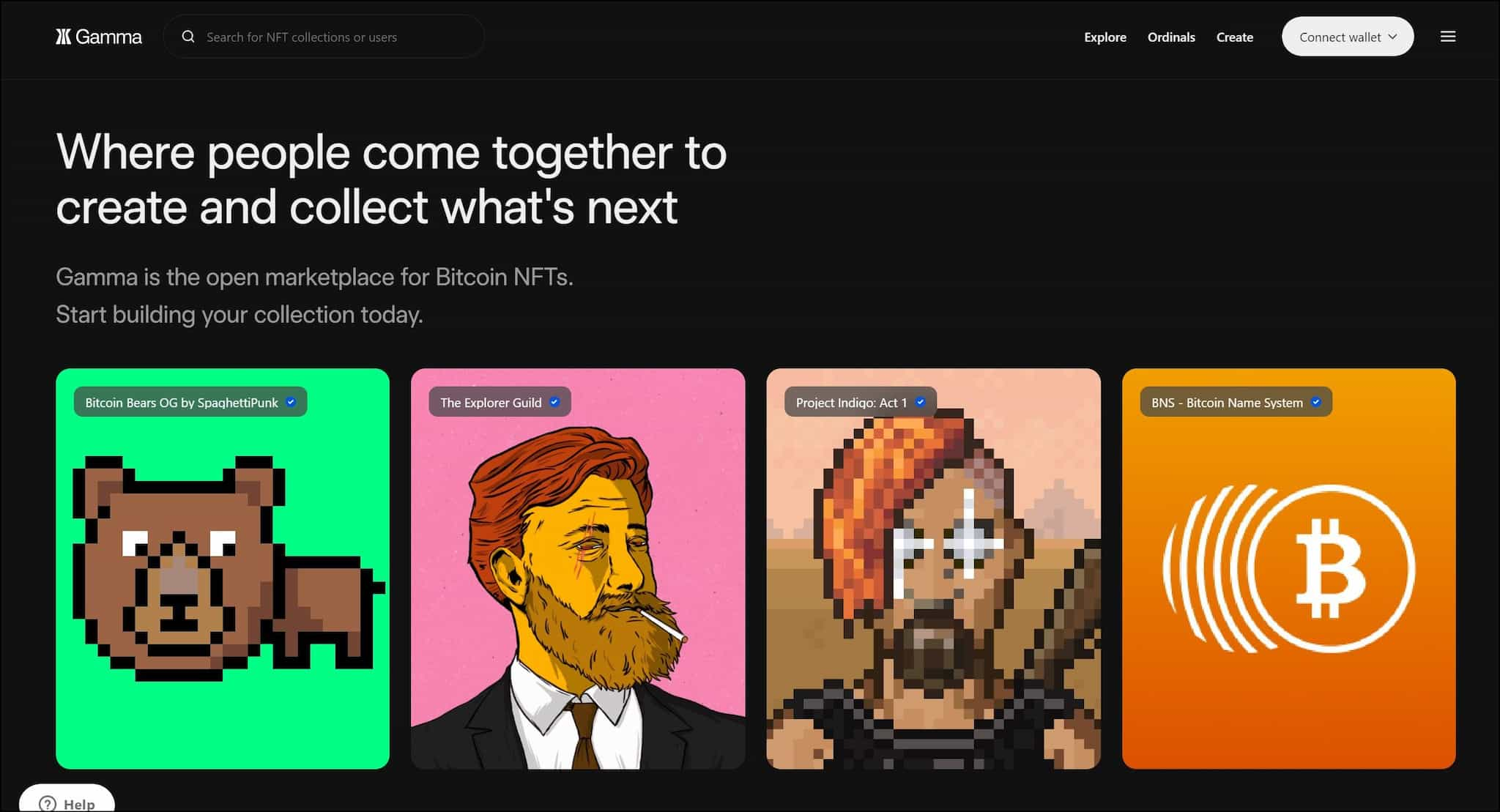

Bitcoin NFTs

Stacks allows for the creation of unique digital assets, or non-fungible tokens (NFTs), that are secured by the underlying Bitcoin blockchain. This integration provides a dual advantage: the unparalleled security of Bitcoin and the enhanced functionality and flexibility of Stacks for NFTs. Bitcoin NFTs on Stacks represent a range of digital assets, from artwork and collectibles to digital rights and more, offering creators and collectors a secure and versatile platform. By marrying Bitcoin's reliability with Stacks' innovative technology, Bitcoin NFTs stand out as a secure and advanced choice for digital asset enthusiasts looking to explore beyond traditional NFT platforms.

Bitcoin Naming System (BNS)

BNS is a naming system on Stacks. Similar to Ethereum Name Service, BNS offers a domain name to replace hard-to-remember alphanumeric addresses on the network. BNS names on Stacks are globally unique, human-readable, and enable complete control to owners.

Stacks Dapps

The Stacks dApp ecosystem leverages the security of Bitcoin to offer a wide range of applications, from DeFi and NFT platforms to social networks and identity solutions. It stands out for enabling smart contracts and Dapps on Bitcoin, fostering innovation without compromising on security. The ecosystem is characterized by its diversity, with apps addressing privacy in data collection, decentralized finance, gaming, and community engagement. This versatility showcases Stacks' capability to support complex applications, making blockchain technology more accessible and applicable across various sectors. Here's a concise overview of some top dApps on the Stacks network, reflecting a variety of utilities and innovations secured by Bitcoin:

- BlockSurvey: Enables private and secure collection and sharing of form data.

- Boom: A platform for creating, sending, and receiving yield-generating NFTs in STX and Bitcoin.

- Console: Facilitates decentralized community focus and action.

- Dots: Manages all your BNS names in one account for upgrade and management.

- Arcane: A DeFi and NFT portfolio tracker.

- Arkadiko: An open source stablecoin protocol

- Force Prime: Free to play Web3 games.

- StackingDAO: Liquidity for stacked tokens on Stacks.

Stacks Review: Conclusion

Stacks is a unique and innovative project that promises to enhance the utility of the Bitcoin network and unlock the massive potential of Bitcoin by making it more useful in the DeFi ecosystem through the inclusion of smart contracts and dApps. When combined with the already formidable store of value narrative for Bitcoin, this is expected to increase the useability and long-term value of Bitcoin even further.

The platform is also unique in creating a way for users to earn Bitcoin without mining or participating in shady schemes. By locking STX tokens, users can directly earn BTC. This is the first time that it’s possible to earn BTC passively by locking tokens from another blockchain.

What will be interesting to see is how rapidly the blockchain community adopts Stacks, and whether adding smart contracts to Bitcoin actually causes people to move away from other networks that were designed for dApps, such as Ethereum.

So far, given the rising token price, the enthusiasm for Stacks seems clear.

Frequently Asked Questions

Stacks chooses Bitcoin as its security layer due to Bitcoin's unmatched security and widespread recognition. By leveraging the Bitcoin blockchain, Stacks ensures that its transactions and smart contracts benefit from the robust security mechanisms and network effects of Bitcoin, making it more secure and decentralized.

Proof of Transfer (PoX) in the Stacks protocol is a consensus mechanism that allows Stacks to run on top of Bitcoin. It enables participants to earn rewards in Bitcoin by locking up their Stacks (STX) tokens. This innovative approach uses the security of Bitcoin to secure the Stacks blockchain, creating a unique synergy between the two networks.

The Nakamoto Upgrade introduced significant improvements to the Stacks network, such as faster block times and enhanced smart contract capabilities. It aimed at improving scalability, security, and the overall user experience on the Stacks blockchain, making it more efficient and robust for developers and users alike.

After the Nakamoto upgrade, Stacks submits cryptographic hashes of Stacks blocks to the Bitcoin blockchain, mirroring the concept of Ethereum's layer-2 rollups but with key differences in data availability and processing capabilities. Ethereum's layer-2 networks fully share block data with Ethereum, allowing validators to verify transactions. Stacks, however, does not make its block data fully available to Bitcoin; Bitcoin is not designed to directly process these transactions. The integrity of the Stacks network relies on the relationship between miners and stackers, ensuring network honesty through a different mechanism than Ethereum's consensus validation.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.