Deribit Review: Complete Exchange Overview

Users of the cryptocurrency exchange Deribit can purchase, sell, and trade futures and options contracts for Bitcoin and Ethereum. Advanced traders favour it because it offers European-style options, has a wide range of cutting-edge trading tools, and boasts deep liquidity across all of its markets.

Deribit is one of the only places that you can buy cryptocurrency options on the market at the moment.

Deribit has also expanded their product offering to include Bitcoin & Ethereum futures. This is great as it gives traders an alternative to the status quo of Bitcoin futures exchanges.

However, is Deribit safe and reliable?

In this complete Deribit Review, we will give you everything that you need to know about the exchange. We will also a give you some top tips when it comes to trading Futures and Options.

Deribit Overview

Deribit was launched in 2016 and is based in Amsterdam, the Netherlands. They operate under the Deribit B.V. company which is located at Stationsstraat 2 B 3851 NH, Ermelo. The exchange was launched as a Bitcoin futures and options platform although it is better known for its options.

Deribit was founded by Bitcoin enthusiasts and ex traders. For example, the CEO (John Jansen) was a trader on the Amsterdam options exchange. He teamed up with the current CTO (Sebastian Smyczýnski) in order to develop an exchange that had the minimum latency and maximum functionality.

Other members of the team include John's younger brother, Marius, who is the CMO as well as Andrew Yanovsky who is the Lead developer. You can read more about the team members and their background in the about us section of Deribit.

Deribit is currently unregulated as an options broker but that is mainly because European financial regulators have still not developed a framework for these exchanges to fall into.

Is Deribit Safe?

One of the most important questions that traders want to know about a cryptocurrency exchange is whether it is safe. We know all too well the consequences of using an untrustworthy or insecure exchange.

There are a few things that we look for when analyzing the safety of an exchange and these either relate to exchange side safety or user side safety.

Exchange Security

To date, Deribit has not suffered any sort of security breaches since inception. This does not mean that they are immune but it does show that they seem to have the right protocols in place.

In terms of coin handling, Deribit claims to make use of a 95% cold storage policy. This means that these coins are kept offline in a secure wallet that is "air gapped". In this case, the wallets are kept in numerous different bank vaults.

In order to make sure that there are no vulnerabilities in the new code and updates that Deribit pushes, they have a pretty extensive bounty program. This is great as it encourages white hat hackers to find these bugs and receive their bounty before the black hat guys do.

They also have real time auditing of their accounts as well as a unique liquidation engine that makes sure that underfunded accounts get closed. This all forms part of the Deribit insurance fund which we cover below.

Lastly, they also have what they call their "risk engine" which is vital to the functioning of any derivative exchange. This analyses all incoming orders before they hit the exchanges book's and are met with the matching engine.

User Security

Given that most often the user is the weakest link when it comes to account security, Deribit has a number of features to enhance your individual security.

For a start, all communication with the Deribit server is conducted through an SSL connection. You can confirm this by taking a look at the padlock in your browser address bar. This is also an extra check that you want to confirm before logging in to make sure that you are not on a phishing site.

Even if you have a compromised password, Deribit offers you the chance to enable two factor authentications. This is not enabled by default so you may want to enable it when you login.

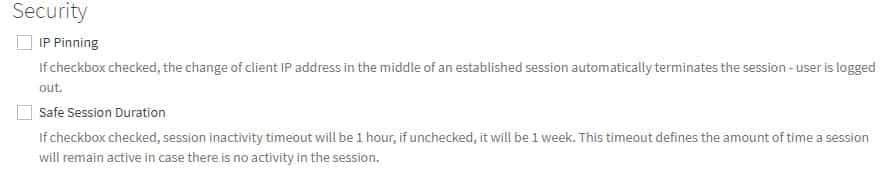

There are some other security features that you can enable on your account settings including IP pinning. This means that if someone were to login to your account from another IP when you are logged in, it will terminate the sessions.

You can also manually set your session timeouts. The standard timeout for inactivity in the account is one week but you can change this to an hour.

Opsec 101 ✔️: If you do not control the keys you do not control the coins

Of course, irrespective of the security procedures at an exchange, it is never wise to leave a large amount of coins on them.

Deribit Fees

Given that Deribit is a trading platform, exchange fees are important. This is especially true if you are trading a large degree of volume with leveraged instruments that could be liquidated or delivered.

Here is the fee structure at Deribit:

Exchange Fees

Like most other exchanges, Deribit operates a "maker-taker" model. This means that those traders who provide liquidity to the Deribit books will get a lower fee (or even a rebate) than those traders who take it.

Confused ❓: As a rule of thumb, you get a taker fee when you execute a "market" order and you could get a maker fee with a "Post Only" limit order. We cover these below.

For the Bitcoin / Ethereum futures, they charge a 0.02% / 0.025% rebate for the makers and they charge a 0.05% / 0.075% taker fee. Taking a look at the perpetual futures contract, the rebate for makers is 0.025% and the fee for the taker is 0.05% for both Bitcoin and Ethereum.

Bitcoin

| Fee Type | Futures | Perpetual Future | Options* |

| Maker | 0.02% (Rebate) | 0.025% (Rebate) | 0.04% |

| Taker | 0.05% | 0.075% | 0.04% |

| Delivery | 0.025% | 0.025% | 0.02% |

| Liquidation | 0.35% | 0.375% | 0.19% |

Ethereum

| Fee Type | Futures | Perpetual Future | Options* |

| Maker | 0.025% (Rebate) | 0.025% (Rebate) | 0.04% |

| Taker | 0.075% | 0.075% | 0.04% |

| Delivery | 0.025% | 0.025% | 0.02% |

| Liquidation | 0.90% | 0.90% | 0.19% |

When it comes to the options, Deribit places a limit on the fees. They can never be higher than 20% of the cost of the option. This only really applies to those deep out of the money options that are really cheap.

The liquidation fees apply to the fees that Deribit will charge for liquidation orders. These are executed by Deribit for accounts where margin has been exhausted. In this case, the bulk of the fees go towards the Deribit insurance fund.

Insurance Fund ❓: This is the fund that protects traders from "socialised losses". We explain it in full below

Here are the exact liquidation fees that are headed to the insurance fund for Bitcoin / Ethereum:

- Futures: 0.30% / 0.90%

- Perpetuals: 0.30% / 0.90%

- Options: 0.15% / 0.19%

Funding & Withdrawal Fees

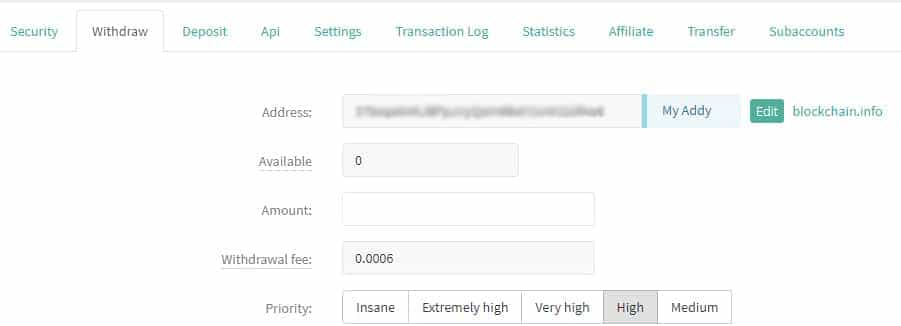

Deribit does not charge a fee for deposits of coins onto the exchange. They will however charge a fee for withdrawals. This fee is based on the mining fee that is currently applicable on the network.

This may vary slightly from the fees that you can see on the open market. This is because on the processing of the withdrawal, Deribit will charge you the fee that they think best applies to the network. If could be slightly higher or slightly lower based on transaction batching.

Deribit Signup

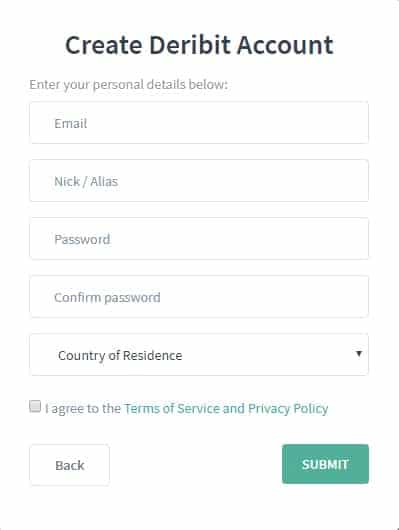

Assuming that you wanted to sign up and give Deribit a try then you need to create an account. You can head on over to their sign-up section and register your details.

Privacy Hawks 🕶️: Deribit is an anonymous cryptocurrency exchanges, so you are not required to give your name. An alias will do!

Once you have given them the details, they will send you an email with a confirmation link. When you follow that link your account will be fully functional and you can start using it. Now is perhaps the best time to also set up your two-factor authentication if you want to secure your account.

Deribit Testnet

Something that Deribit has that is not available on a number of exchanges is a live test-net for all users. You can think of it as a separate demo account. This can be accessed on test.deribit.com. You will need to create another account but you can use the same credentials if you like.

Once you have signed up and created an account here, you are given 10 BTC as demo funds. You can now trade these as you would a live account and test out your strategies. This is great for those traders who are beginners and are just getting used to options / futures. Or it could also be used by those traders who want to get a feel for the Deribit UI.

Slippage 🥿: The only thing the Testnet cannot replicate is the "slippage" of live orders

This domain is also useful for those of you who would like to develop bots on the Deribit API. This will give them the chance to refine their cryptocurrency algorithms before they can turn them on the live accounts.

Funding & Withdrawal

If you are content on with your trading and you would like to start trading on a live account then you will need to fund your account. Deribit is a crypto only exchange and unfortunately you cannot fund your account with any Fiat money.

Therefore, if you only have Fiat funds and you would like to trade with Deribit then you would need to make use of what is called a fiat gateway exchange. These are exchanges such as Bitstamp, Coinbase, Kraken (or your local equivalent).

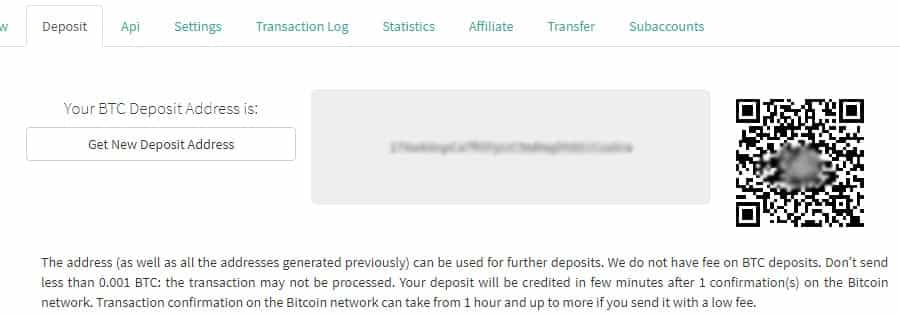

Once you have your Bitcoin you will need to send it to your Deribit account. You can do this by hitting the "Deposit" button in the top right of the online panel. You will then need to generate a deposit address which you can send the funds to.

Once you have this address and you send the funds, Deribit will wait for one confirmation and top up your account. This means that you can get trading much more quickly as most exchanges require at least three confirmations.

Pro Tip ✔️: Use a Bitcoin Block Explorer to track your transaction

When it comes to withdrawals, it is just as simple. You will need to create a new wallet profile with a name and attach your external wallet address. Once this has been done you can process the withdrawal.

Deribit says that they will try and do this immediately but this will of course depend on whether the funds are available in their hot wallet. If they need to replenish their funds from cold storage you may need to wait a little bit.

Deribit Platform

It is time to go into the belly of the beast and examine the underlying platform and exchanges. From a first glance, we are quite impressed. The platform looks highly functional yet appears to also be relatively intuitive.

Compared to other futures exchanges, it is also more attractive from a User Interface (UI) perspective. The menus are laid out to the left sidebar with all the options for markets, FAQs and other important documentation. Deribit has also translated the website and platform into a number of different languages.

You also have a lot of functionality when it comes to managing your accounts. For example, you can set up different sub accounts, cross margin between accounts as well as get a comprehensive breakdown of your trading statistics.

For Night Owls 🦉: You can switch the interface to the dark theme in the top right of your platform.

There is also extensive documentation and content to help you get started trading. These include overviews of their trading instruments as well as more general information about the exchange itself. They also have helpful videos which can explain the process to you.

Futures Exchange

If you have traded futures on other exchanges such as BitMEX then the futures exchange is a familiar territory for you (see our BitMEX Review). The markets will change according to the expiry date of the futures contract. You can then decide on whether to go long or short either as a "buy" or "sell".

Like other exchanges, Deribit also offers what is called a "perpetual futures". These are essentially just contracts that do not have an expiry date. You can think of them as a rolling futures contract and they are equivalent CFD's (Contracts for Differences) and spread betting derivatives.

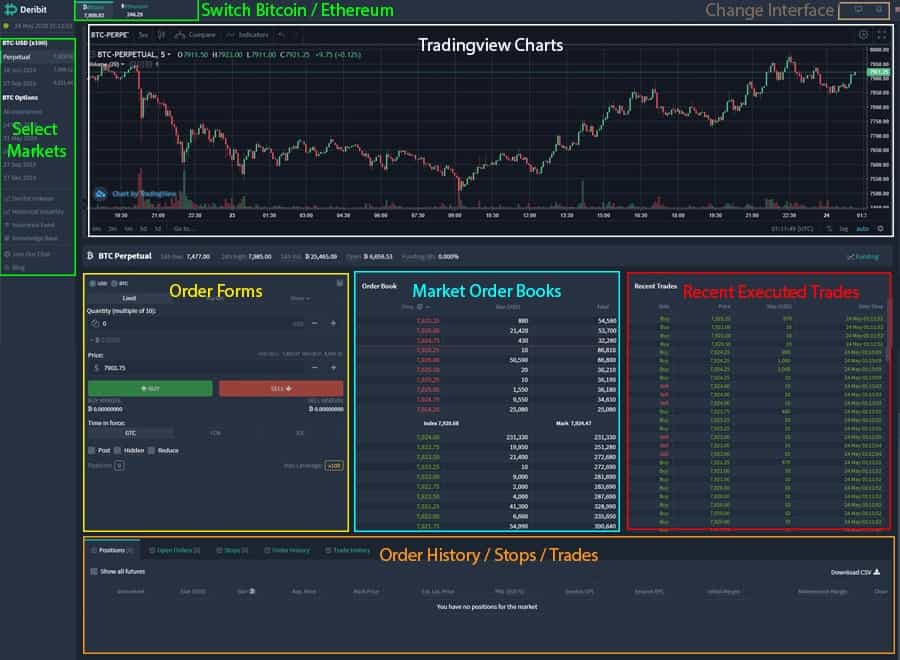

Below we have the screenshot from the Deribit Perpetual Futures exchange. You can see the order books, recent trades as well as the order form all in one place. You also have access to your current orders and live trades just below that.

Note ✍️: The platform will look exactly the same for the futures contracts that have a set expiry time as well as on the Ethereum market

Like most professional exchanges, Deribit has also integrated Tradingview charting technology into their platform. This is a dream if you are a crypto technical analyst and you are looking for the best tool, indicators charting software.

Of course, what use is Technical Analysis if you do not have advanced order functionality. Deribit has a range of options for you when it comes to placing and maintaining orders. We cover this below.

Options Exchange

When you move on over to the options exchange, you will be presented with all of the option markets. This is probably a bit more complicated to the uninitiated trader when they first take a glance at it. They present you with the different expiries, option type and strike on the platform. They also give you other important data like the volatility, Delta, open interest etc.

A full overview of option theory is beyond the scope of this review but you can read our complete guide to cryptocurrency options should you want more information. Below we have a screenshot from the Deribit options market. This just gives you a full "lay of the land".

In the platform above are the order books for the 31 May 2019 and the 7 June 2019 option markets. As you can see, there is a plethora of information that you can glean from the Deribit option platform.

You can see your option portfolio dynamics across the top of the screen. Below that you choose to refine the markets according to particular filters. This could be through price, Open Interest or even the option "Greeks".

Greeks 🔱: These are option parameters such as "Delta", "Theta", "Gamma" etc. You can read much more about option greeks here

If you wanted to trade a particular option then there are two methods that you can use to narrow in on the exact option in question. You could either refine the search criteria in the top right or you could select the option in the particular order form.

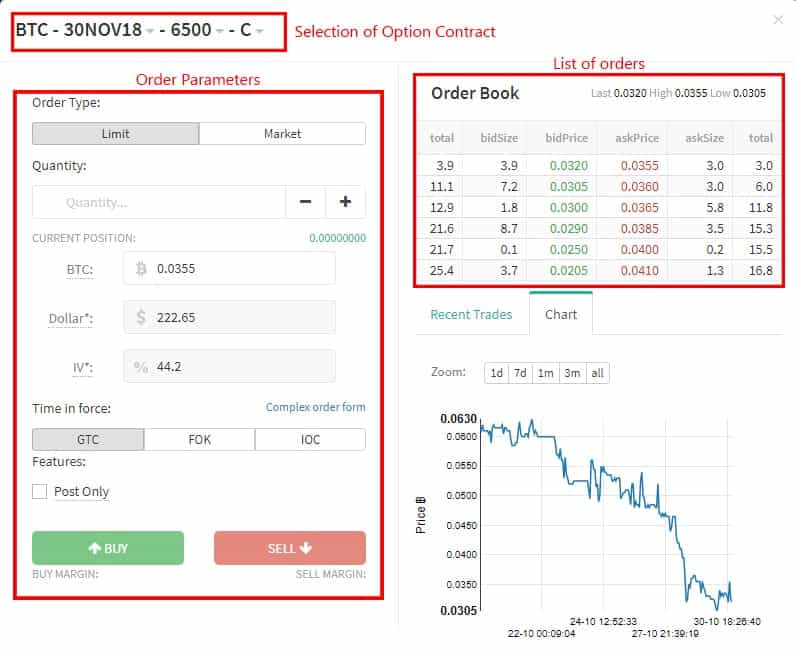

When you click on a particular option in the market overview, you get presented with the option order form. In this case we have selected the most liquid market, the $6,500 call option expiring at the end of November 2018. Below is the specific order form where you will see the order books.

In this form you can refine your order or you can even change the option type in the top left. You will of course notice that the further out-of-the-money / in-the-money you take your options, the more illiquid the market becomes.

There are also a number of other order form parameters that you may want to consider. We give you a full overview of Deribit's order functionality for both futures and options just below.

The only thing that we did notice about the Deribit options is the general lack of liquidity for those options that are out of the money or deep in the money. This could limit the range of option strategies that you could employ.

Order Forms

As mentioned, Deribit has a pretty extensive array of order options on both the Futures and Options instruments. These could help to augment your trading strategy.

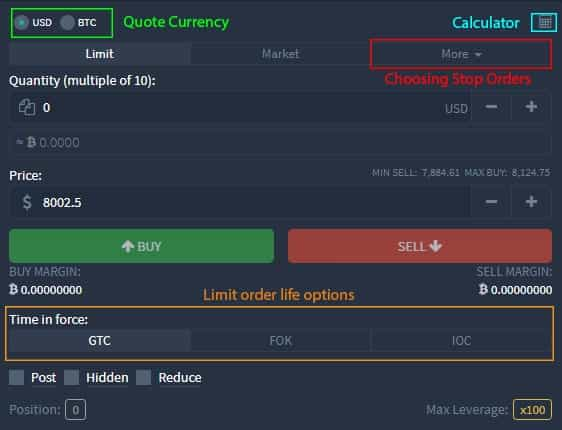

First of all, let us take a look at the Futures order forms. Below is the order form for the Bitcoin perpetual market that we have in the screenshot above.

The first thing that you will notice is that you can refine the order form to either be denominated in USD or in BTC. This is unique to Deribit and allows beginner traders to assess margin levels in USD.

Pro Tip 💯: You can use the order calculator in the top right to quickly determine profit / loss

There are four different types of orders that you can place with the futures instruments. These are the following:

- Limit: This is an order that is placed at a predetermined price. It will only be cancelled either once it has been executed or when it has been removed manually

- Market: These orders are placed such that they are executed immediately. This would be at the bid for a sell and the offer for a buy

- Stop-Market: This is a market order that will have a stop loss placed with it. It will execute at the market price and then you will have a stop loss to protect losses

- Stop-Limit: Almost the same as the stop-market except it will be a limit order with a stop.

With the limit orders, you can also determine how long you would like the order to be alive for. This is what is termed the "order life". There are three of these parameters at Deribit:

- Good-Till-Cleared (GTC): This limit order will remain open permanently. The only time that it will be closed is when it is either manually cancelled or whether the order is executed

- Fill-Or-Kill (FOK): This will either execute an order immediately and in its entirety or not at all. In other words, there cannot be partial orders.

- Immediate-Or-Kill (IOC): This is similar to the FOK order except it allows for partial execution. In other words, it will execute part of the order that it can and will cancel those portions that cannot be executed.

Which order life you should use really depends on your trading strategy. GTC is great if you want complete control over your orders although it is less than ideal for rapid execution.

Stop Trigger 🔫: When setting stops you have three "trigger price" options for reference stop price. These are the Last Price, Mark Price and Index Price. You can read more about these here.

Finally, you have three more order parameters that you may want to consider. These are the "Post", the "Hidden" and the "Reduce".

Post orders are those that will always enter the order book as a "maker" order. Hidden orders are those that don't appear on the order book and Reduce will only ever decrease the size of your position.

When it comes to option orders, you have most of the same parameters (except for the stop orders). What is unique about the option order form is that in addition to BTC and dollar value, you also have the Implied Volatility (IV) of the option.

These are for the more professional option traders out there but what it allows you to do is define the IV for your option. IV is used as a major input in the price of an option so by defining it you are adjusting the price you are willing to pay.

Margin and Leverage

As you may now know, you do not trade physical products at Deribit but rather derivatives. These are of course levered instruments as you will need to post a margin for the position. This is comprised of the initial position margin as well as the maintenance margin.

Futures

In the case of futures, the Initial Margin is 1% of the position for Bitcoin and it is 2% of the position for Ethereum. This implies a leverage of 100x for BTC contracts and 50x for ETH.

This is not constant and will increase in a linear fashion. This it at 0.5% per 100 BTC increase in Bitcoin contract and 1% increase per 10,000 ETH in an Ethereum contract. Below is the formula that they use to apply the initial margin:

BTC IM = {1% + (Position Size in BTC) * 0.005%} * {Position Size in BTC} ETH IM = {2% + (Position Size in ETH) * 0.0001%} * {Position Size in ETH}

In terms of the maintenance margin, this starts at 0.55% for BTC and 1.0% for ETH. It will increase at a 0.5% rate per 100BTC increase for Bitcoin a Bitcoin position. For Ethereum, it will increase at 1.0% per 10,000ETH increase in position size.

Below is the formula that is used to determine the Maintenance Margin (MM):

BTC MM = {0.55% + (Position Size in BTC) * 0.005%} * {Position Size in BTC} ETH MM = {1.0% + (Position Size in BTC) * 0.0001%} * {Position Size in BTC}

The prices for settlement for the futures contract is based on what they call the "Mark Price". This price is calculated based on their own internal Deribit BTC Index which is itself derived from the prices on a number of different exchanges. You can read more about how it is calculated in the docs.

Options

When looking at the options, you are not required to post a margin for Long options. This is because of the nature of these payoffs, you will never have to post anymore collateral. You have a limited downside risk which is the expense of the option.

Note ✍️: If you are new to options we would suggest you avoid shorting them and stick to more familiar futures. They can be risky if you don't know how to trade them

However, you are required to post margin for short option positions. Given the unique risks of these instruments, the calculations are much more involved. They will also differ based on whether it is a call / put.

Here are the Initial Margin and Maintanence Margin requirements for a Short call:

IM = Maximum (0.15 - Out of the Money Amount/Underlying MarkPrice, 0.1) + Mark Price of the option MM = 0.075 + mark price of the option

And here they are for a short put option:

IM = Maximum (Maximum (0.15 - Out of the Money Amount/Underlying MarkPrice, 0.1 )+ markprice_option, Maintenance Margin) MM = Maximum (0.075, 0.075 * markprice_option) + mark_price_option

These are of course just a short overview of the margin conditions. If you more in-depth analysis of the contract specifics and margin requirements etc. you can read all about this in their Docs.

Portfolio Margin

For the more advanced traders among us, you can ask Deribit to apply what is called a "Portfolio Margin". With this, Deribit will apply a margin that is based on the historical volatility in your portfolio. It also combines the positions that you have in both futures and options.

So, for example, if you have positions that are partially offsetting risk for the portfolio in aggregate then Deribit could apply a lower margin. These could theoretically allow you more leverage on a particular trade.

In order to qualify, you need to maintain a minimum of 0.5BTC in your account at all times. You also need to have some prior experience trading option instruments in order to apply. There is a whole section on how the Portfolio margin works in the Options margins section.

Insurance Fund

While we are on the topic of margins and highly leveraged trades, it is worth mentioning the Deribit insurance fund. For those traders who have used BitMEX before, it is the same concept as the one their exchange.

The insurance fund is basically a pool of BTC that stands in reserve in case of position bankruptcies of the traders. It is funded through the fees that are charged by Deribit for liquidation orders (given above). These are then added every hour to the insurance fund.

As you can see from the above image, the Deribit insurance fund currently stands at 142BTC. As long as there is a non-zero amount of BTC in the fund, traders can withdraw unrealized profits on futures contracts.

However, if the insurance fund somehow gets depleted then the rest of the traders are on the hook and the bankrupt traders will be "socialised" among the winning traders. You can basically think of the insurance fund as a collective risk mitigation fund.

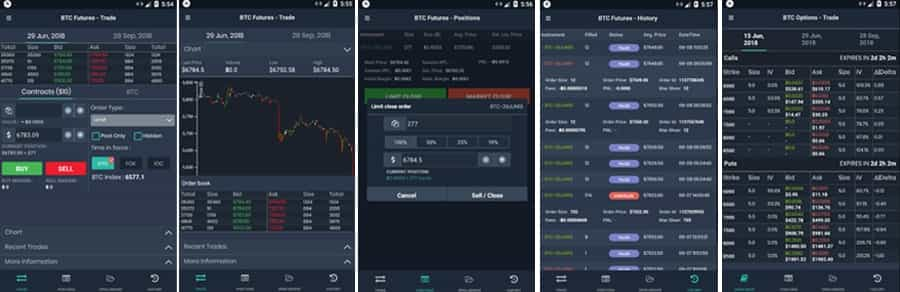

Deribit Mobile App

While mobile apps can never match the functionality of web and PC client-based platforms, they can be helpful for those traders who cannot be at their desks the whole day. They could also be helpful merely to monitor live positions.

Deribit has their own Native app that is available for both iOS and Android devices. This is an advantage that they have over BitMEX which has no apps at all. Similarly, the Deribit app could perform faster than other exchange based mobile apps as it is connected through the API.

Taking a look through the application, there appears to be a great deal of functionality. For example, you can access both the options and futures exchange and it gives you about the same overviews and order options that you will find on the web app.

In terms of feedback, there have been no reviews from users on the Apple Store. However, there were some users who submitted reviews on the Google play store. They were generally quite positive although there was some constructive criticism.

For example, some traders took issue with the fact that the app was data and energy heavy. There were also one or two bugs that needed ironing out. Some users expressed concerns that they needed an API key to use the app and were not too comfortable with this login option.

We would have to agree with some of these users.

While the API connection does indeed make the App fast, it is less secure than making use of standard local mobile authentications. Perhaps this is something Deribit could consider adapting with later versions of the App due towards the end of 2018.

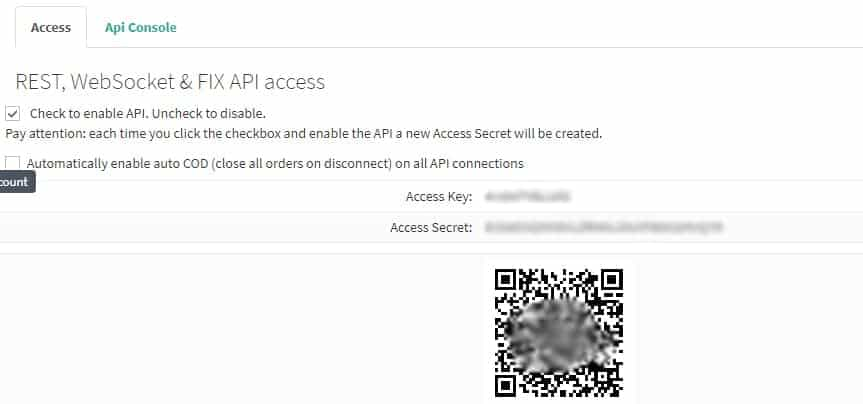

Deribit API

For those traders who like to develop their own bots and trading algorithms then they will want to make use of the Deribit API. This is actually quite an extensive API system that has a range of functionality for developers.

Deribit has both a REST API and a Websocket API. The former has a public and a private part. If you merely wanted to develop applications that made use of market data etc., then you could get by using the public API. However, if you want to access the private API, your requests must be signed with your API key.

In order to get your API key, you will head on over to your account and hit the API tab. You will then have to request your API key. Make sure that once you have your API key you also save your access key in a safe place. This is because it is your only way of recovering your API key in the case of loss.

Just as a general security measure as well, you have to be extra careful with your API keys. If any scammer or hacker gets hold of it that can send wayward trades to your accounts. The API console tag will give you all information as it pertains to your interaction with the API. In terms of rate limits on the API, they have a simple limit of 300 requests per second.

Something else that Deribit does that is not an option at other exchanges is that they offer developers co-location at their data center. This basically means that one can set up their trading servers right near Deribit's servers in order to reduce latency. Their data-center is at OVH data-center in Strasbourg.

It is also worth mentioning here before we move onto the mobile app that this application operates through the API. Therefore, if you were considering using the Deribit mobile app then you will need to request an API key in any event.

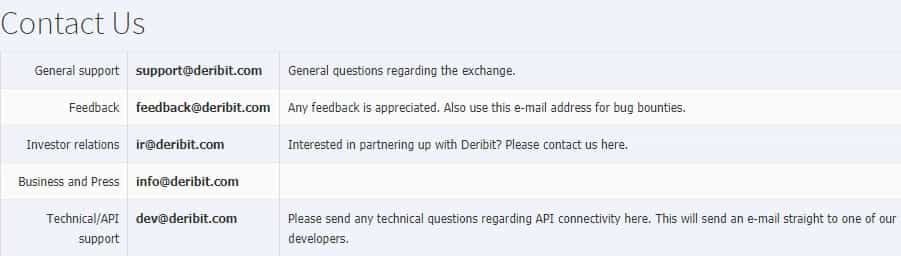

Deribit Customer Support

For those traders who were active during the 2017-2018 bull run, they will know first hand how difficult it was when it came to customer support at a number of cryptocurrency exchanges. Days on end and unanswered tickets.

So, how does Deribit stack up?

They seem to have all of the standard customer support options. For one, they have a range of specific emails that you can reach them on from their contact page. However, they do not have an online contact section similar to those provided by a number of other exchanges.

Given that they do not require you to verify your exchange, you do not have to wait on them to examine any documents like they do at numerous other fiat exchanges. These were often the slowest processes at these exchanges.

If you would like a more direct contact with them then you can always join their Telegram support channel. They also have a Twitter account which they seem to be relatively active on so you could also use these.

Top Tip ✔️: If your question is routine in nature then you can head on over to their FAQ section. It is quite extensive and will most likely have the answer to your question over there.

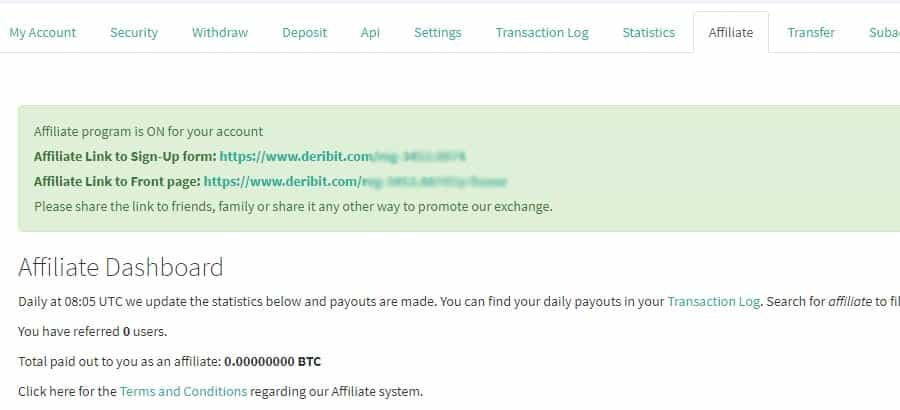

Deribit Affiliate Program

If you happen to have a relatively strong following online then you could take advantage of the Deribit affiliate program. Much like other exchange referral programs, this will give you a share of the trading commission for the users that you refer.

Essentially, if you get your referrals to sign up and start using Deribit then they will get a 10% discount on their trading fees for up to 6 months. For your referral, you will get 20% of these trading fees for the first 6 months. Thereafter, you will get 10% in perpetuity.

This is better than the affiliate offer that is currently available on BitMEX where you will start at 10% fixed. However, it is slightly less attractive than that of Binance where you will get 20% unrestricted.

If you wanted to refer some people to Deribit then it makes sense to get yourself an affiliate link. You can obtain this in the affiliate section of your account. The below screenshot is your affiliate dashboard.

You are given two links that you can send your referrals to and these are either the homepage or the signup form.

Note ✍️:You are advised to read the affiliate terms and conditions to make sure that your marketing / referral practice is honest.

What We Didn't Like

Of course, no review would be complete without taking a look at some of the biggest drawbacks that we could identify on the Deribit exchange.

Firstly, while the extensive range of option instruments on Deribit is great to implement option strategies, the lack of liquidity in some markets could impede that. This is not really a fault of Deribit but is more a result of lack of volume for traders on the other side.

Currently, Deribit only has Bitcoin and Ethereum markets with no other altcoins. If you wanted to trade in these markets then you would need to consider an alternative like Kraken or IQ Option.

Deribit is also not open to traders from particular regions such the United States, Canada or the Netherlands. They block IP addresses from these geos. This is on account of the regulations that these specific countries have for financial securities.

Some traders have used VPNs to create an anonymous account. However, this is breaking the Deribit TOS and may come with risks. If there is ever a time Deribit may need some verification in the future, they may not take kindly to their TOS being broken.

Finally, while the lack of Fiat currency funding is not an issue for most crypto traders, it could be a slight impediment to traditional traders who could easily use a CFD or spread betting platform that accepts USD, EUR, GBP etc.

Conclusion

We were pleasantly surprised with our review of Deribit. The exchange is one of the most functional that we have seen which would satisfy most pro traders. It is also relatively intuitive with plenty of resources for some of the newer traders.

We also really liked the concept of a "demo account" on their test-net. This could be beneficial to all of those traders who are considering a switch from another exchange. It gives them more perspective on the entire exchange before they put forward live funds.

Yes, there are some issues that we thought warranted improvement. However, these should not overshadow the rest of the benefits of the exchange. Bitcoin options are still in a nascent stage of adoption and as more traders move over, volumes and awareness will increase.

In summary, a great exchange if you want to trade Bitcoin options and a strong alternative to BitMEX for futures trading.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.