Monaco Coin (MCO) Review: Everything You Need to Know

Update: Monaco has re-branded to crypto.com. Read our full crypto.com review.

Monaco Card is a cryptocurrency funded visa debit card that allows you to spend your cryptocurrencies on everyday purchases.

Users first purchase Monaco coins in order to get a Monaco Card delivered to them. They then download the app in order to open a bank account where they can deposit their cryptocurrencies. Once there, users manually convert their coins to fiat money before you they can make purchases by swiping the card at any store.

Under their Blue 'Free' card, there is a $200 limit on free ATM withdrawals, and a $2,000 limit on interbank exchanges.

Monaco cards provide a gateway for merchants to begin accepting crypto-currencies as payments while reducing the costs of crypto to fiat conversions for customers.

Monaco Card Uses

Monaco Card will allow cryptocurrency holders to easily spend their crypto on everyday purchases without having to convert them to fiat. The card will also be used for those regular travellers. This is because they can spend with their Monaco card without having to convert to the local currency.

There will also be the functionality for the holder of the card to buy and sell cryptocurrency in an automated manner. For example, they can buy and sell crypto based on market movements and cash out onto the card in real time.

They also hope to be able to provide credit lines to those crypto holders who have at least $10,000 in Monaco coins on the app.

These use cases have resulted in a number of benefits for the Monaco card user.

Pros

- Monaco Card is free for Monaco coin (MCO) holders.

- Users can purchase everyday items at a store using cryptocurrency funds.

- International travelers can make purchases using their Monaco card anywhere in the world by converting their cryptocurrencies to the local fiat currency.

- Monaco exchanges your cryptocurrencies to fiat money at a very low cost and doesn’t charge the user for the exchange. The charge instead goes towards 1.5-2% of the 4% processing fee that merchants typically pay every time a user makes a purchase on their Visa cards.

- Users with the more exclusive Black card can receive 2% cash back options when they spend using Monaco card. These returns come back to their account in the form of Monaco Coins.

- No minimum balance or monthly fees for your Monaco Bank account.

- Investing in Monaco coin allows you to gain access to a limited edition card that carries additional features like free ATM withdrawals and transfers between Monaco bank accounts.

- Connected to 8 of the top ten international foreign exchange banks for currency conversion.

Cons

- Monaco has several regulatory hurdles to pass through before the product will become available to users. Due to these regulatory hurdles, there is a waitlist in Asia and Europe and it is not yet available in the US.

- The project works in collaboration with Visa, which means it relies on traditional centralized financial institutions that Blockchain companies are supposed to be disrupting.

Other Concerns

There are quite a few other concerns that people have raised about projects such as Monaco Coin.

For example, a purchase made using Monaco card may not be considered a pure cryptocurrency transaction because the seller is still selling in fiat, and you as the buyer are technically also paying in fiat money. This creates less incentive for stores to accept cryptocurrencies.

Furthermore, Visa currently does not allow Monaco to automatically convert users cryptocurrencies to fiat money, so that process has to be done manually, which creates friction for the user experience.

Some would also argue that Monaco’s initiative does not push forward the Blockchain communities collective mission to make cryptocurrency use (by the seller and buyer) more mainstream. On the other hand, others might say it’s a positive first step because it at least encourages consumers to hold more cryptocurrencies for reasons other than speculative investing.

This would give the cryptocurrency community a chance to prove to the SEC how tokens can actually become a utility.

In the long run, it seems like merchants may opt to accept cryptocurrencies directly in order to avoid the processing fees that cut into their revenue every time a customer pays them with a Monaco card.

History & Team

Monaco was founded in June 2016 in Switzerland. Their first prototype was developed in October of that year. In February of 2017, they were accepted into a Hong Kong Government backed Cyberport incubation program, where they developed their platform until they were ready to launch their token sale in 2017. The sale closed in June with $26.7 million in funding.

Their app became available to pre-registered users in August 2017, followed by the official partnership with Visa in October. Most recently they’ve been listed on various exchanges, including Bithumb in South Korea.

The team consists of seasoned veterans in the fin-tech space, most of whom have experience in Asia, where Monaco Cards have first been made available:

Kris is a Serial Entrepreneur in the Southeast Asia Internet industry. He has developed 2 companies from $0 to $100m in revenue and achieved 2 exits. His former roles include CEO at Ensogo, Founder at BEECRAZY (sold for US$21m to iBuy Group in 2013).

Rafael has 15 years’ experience in finance, a deep understanding of risk, compliance and the Mobile Payments ecosystem in Asia.

He has led fundraising efforts as CFO at ASX-listed Ensogo, securing strategic investment from VIPSHOP (NYSE:VIPS) and raising over $50m from blue chip institutions like Fidelity, Goldman Sachs and BlackRock.

Gary Or is the CTO and is a Hacker, Product Designer, Entrepreneur, 9 years of full stack engineering experience (RoR, Elixir, Golang). He has a keen interest in Machine Learning and AI.

Monaco’s future plans include shipping its Visa cards to European and US customers, launching its automated crypto investing feature, and releasing its app globally.

There are no specific timelines on these plans, but it’s safe to say the team is working to get them accomplished by end of 2018/2019.

ICO & Token Performance

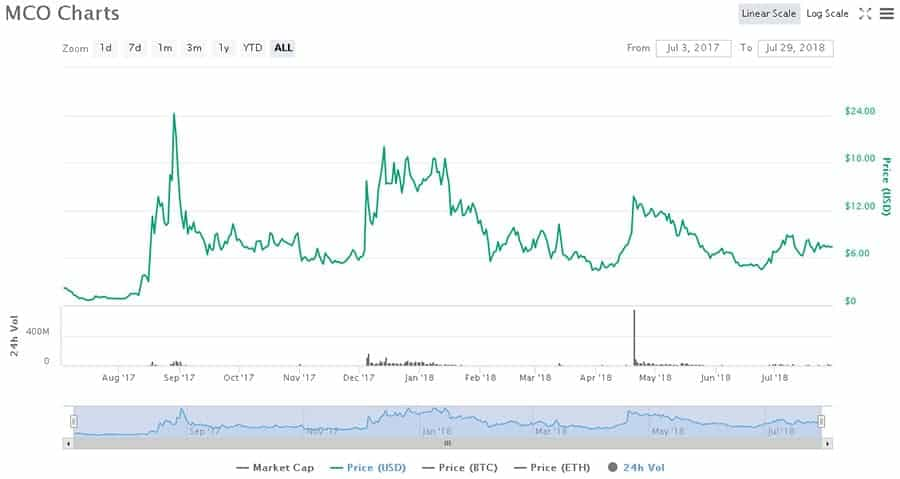

MCO tokens were valued at $7.40 as at 30th of July 2018. This is exactly 1 year since the listing of the token last year.

MCO launched its ERC20 token in June 2017 and raised $26 million during their Initial Coin Offering (ICO). MCO’s initial listing price in July 2017 was $2.25.

It peaked on August 28th at $24.22, around the time their app first came to market, and at least 4 months before the wider cryptocurrency markets hit its price peak.

During the months of December and January (while Bitcoin was at $19,000), MCO’s price dropped down to $14.

This diversion from the crypto markets general price rise may have to do with Monaco’s position as a less conventional more ‘centralized’ Blockchain solution. Monaco relies on Visa, a centralized institution who many crypto purists believe Blockchain technology is supposed to disrupt. Similar complains are made about Ripple (XRP).

There was also media speculation that the company had not yet secured their Visa partnership, despite announcements’ being made and advertising of the Visa logo on their cards pre ICO. The information was later clarified when the Visa partnership was officially confirmed in October, however, the confusion likely had a negative impact on their token price during the latest half of 2017.

MCO’s price continued dropping to $5 on April 4th, before climbing up to its current price of $11.60

Competition

Monaco card has stiff competition from a variety of debit cards that offer similar value propositions, though not all are partnered with big institutions like Visa.

Some noteworthy competitors include:

- Shift Card (by Coinbase) - Shift Card deducts balances directly from LTC, BCH, ETH and BTC wallets. It costs $10.00 to purchase and has a 0% BTC to USD conversion fee. Domestic ATM withdrawals cost $2.50 and international ATM withdrawals cost $3.50. You can connect Shift cards directly with Coinbase.

- TEN X – A prepaid card and digital wallet that you can use to spend cryptocurrencies on everyday purchases at stored

Are Monaco Coins Worth It?

Monaco seems to tackling a fundamental problem of how to get people spending cryptocurrencies, and their partnership with Visa allows them to scale at a much faster level than other competitors.

Although Monaco card may still be relying on Visa for their business model, they are helping with the mass adoption of cryptocurrencies. The more people that use crypto in their daily lives the better.

Currently, there aren’t many physical outlets that accept crypto, so it’s been hard for users who are holding unto coins and may want to spend them on regular everyday purchases.

I also like that MCO has purposefully chosen to make their coin supply more scarce than others, with only 15million out of a total 31 million MCO coins in circulating supply. This coupled with the potential to scale, as a partner of Visa should drive the price high once the regulatory hurdles are cleared.

Lastly, we can’t ignore the size of the market Monaco is going after.

According to their white paper:

IPK International reported that the world outbound travel market turnover for the full year 2016 topped the $2 trillion mark for the first time, which was an increase of around 7 to 8% compared to 2015

Monaco's mobile app can also be used for remittance (sending money back home). Worldwide, 230 million people send $500 billion in remittances each year, primarily using firms like Western Union, MoneyGram, and RIA.

For cross-border online shopping in foreign currency - The global B2C cross-border e-commerce market will balloon in size to $1 trillion in 2020 from $230 Billion in 2014, according to a report from global consulting firm Accenture and AliResearch, Alibaba Group’s research arm.

If you wanted to buy Monaco Coins, they are available on crypto currency exchanges like Binance, Bit-Z, Huobi, Bittrex, and Liqui.

Conclusion

Monaco is a very ambitious project that seeks to create a healthy middle ground between the world of Crypto and fiat payments. Regulatory compliance will be the company’s biggest challenge, however, they seem to have done everything right as far as whom they partner with:

- To manufacture their cards, Monaco is working with Gemalto, the same company that produces Visa cards

- Thomson Reuters World-Check is helping provide KYC/AML compliance

- Jumio is provided their ID verification services

- A level-one PCI DSS-compliant Visa/MasterCard processor is handling their Finally, transaction processing

Based on this list, Monaco will most likely be looked on more favorably by lawmakers as they navigate the complex and constantly evolving regulatory framework of cryptocurrencies and card payments.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.