Power Ledger (POWR): Decentralised P2P Energy Trading

Power Ledger (POWR) is a project that has seen quite a bit of interest lately. This has resulted in increased demand and trading for its POWR token.

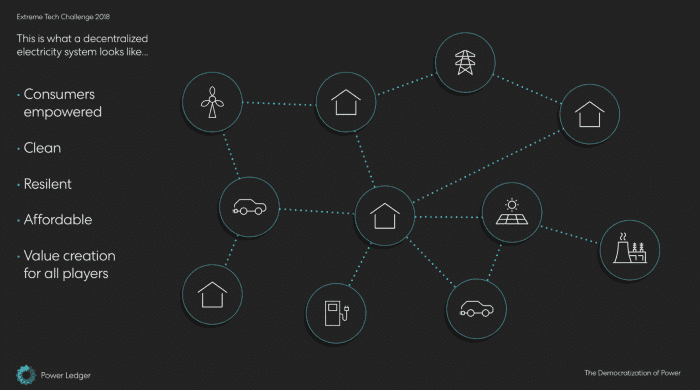

The project was one of the first to introduce blockchain based P2P power trading. They want to not only decentralise the process but also democratize it and give users a platform to sell their excess electricity. It also aims to optimise trading and eliminate waste that comes from centralised grids and providers.

Ambitious goals, but can it realistically achieve it?

In this Power Ledger Review I will attempt to answer that. I will also take a look at the long term use cases and adoption potential of the POWR token.

What is Power Ledger?

Power Ledger was the very first ICO conducted in Australia, and as a blockchain company it is somewhat unique in being non-financial in the field of financial blockchain projects.

Power Ledger has a goal of decentralizing the renewable energy markets and placing it into the hands of the users, and out of the control of centralized energy companies.

Power Ledger wants to make it possible for the end user to buy renewable energy, as well as selling their own unused renewable energy, by using the Ethereum blockchain to record energy consumption, usage, and creation.

When you consider the shift to renewable energies such as solar by industry, business, and residential users it seems common sense to have a system in place that allows these new renewable energy systems to sell their excess power back into the grid rather than simply letting it go to waste.

It’s an ambitious idea, but when you consider the vast usage of energy across the globe, could Power Ledger represent a new gold rush? Could this be a project that will become as valuable as the original coal, oil, gas, and nuclear power industries have become?

Let’s take a deeper look into Power Ledger and see the potential it has for the future.

Overview of Power Ledger

Power Ledger token holders are empowered to sell their surplus renewable energy through Power Ledger’s blockchain based platform. It’s possible to transmit this privately generated energy through the existing electricity distribution networks, or through micro-grids created on the Power Ledger platform.

The platform is empowering for consumers because it allows them to manage their own energy production, usage, and distribution. This is something novel in today’s world, allowing consumers to also become producers and distributors of energy products.

Power Ledger facilitates the sale and trading of energy, and consumers can receive payments for their excess renewable energy production in real-time through the decentralized, trustless, automated, and totally secure Power Ledger platform.

Buyers are able to choose only clean, green energy sources, and both buyers and sellers leverage blockchain technology. This means settlement costs are significantly lower than in the traditional energy markets, and translates to significantly higher returns for consumers who choose to invest in renewable energy.

There are a number of applications already running on Power Ledger, with more planned for the future. Current applications allow for micro-transactions, data acquisition, grid management, power metering, and more.

Key Applications on Power Ledger

The Power Ledger platform has been designed to handle most aspects of renewable energy transfer, including such things as carbon trading and market price management. Below are the current six applications that have been developed and released for PowerLedger.

xGrid

The xGrid application allows individuals to sell the energy they generate from their own solar panels to other households on the electricity grid.

In the 21st century consumers are increasingly aware of, and concerned with, their impact on the environment. Many are now aware of their carbon footprint and are seeking ways to reduce it, but not everyone has the money or the space to install solar panels.

Power Ledger believes everyone should have access to low cost renewable energy sources, and the peer-to-peer trading capabilities of the xGrid application makes that possible. As an added benefit is also ensures that the investment value of installed solar panels remains in the community where that investment is made.

With xGrid it’s possible for users to sell their excess electricity to their neighbors. This also allows electric companies to add new consumers and prosumers to their roles. If the prosumer also has batteries to store energy they can help the energy retailer manage price risk through the Power Ledger VPP 2.0 product we will discuss later.

µGrid

Where xGrid works for residential users, µGrid is meant for larger applications, such as shopping centers or apartment buildings. It allows these spaces to monetize their roof space, or allows the tenants to take control of their energy supply.

One barrier to installing solar in larger complexes such as apartment buildings has been convincing all the tenants to share the cost of installing solar panels. It’s just been too difficult to find a way to make sure everyone is being equally compensated in such a situation.

Now Power Ledger has made it possible to install solar in commercial spaces and monetize the often large rooftop spaces. Tenants and residents can use their share of the energy produced, or they can sell it, often to those who are closest to them. This keeps all the investment and proceeds from the renewable energy right within the same community.

This even benefits the building developers and managers because they can offer tenants more attractive energy rates compared with the traditional energy companies. And the detailed usage statistics allows building managers to track usage at a granular level, allowing for better energy efficiency in common areas and across the entire community.

VPP 2.0

The VPP 2.0 application allows those renewable energy producers with batteries to sell the stored electricity during peak demand periods to achieve the best returns of their investment. It also helps to solve the demand shortages and price spikes that are so common within the electricity delivery industry.

In the current system energy companies can offer incentives ahead of time when they anticipate demand will spike, but there’s been no way to account for the energy contribution that customers might be likely to make.

With the Power Ledger VPP 2.0 application it’s now possible for energy companies to track the contributions being made by customers in near real-time. This provides energy companies with readily available capacity and energy when they need it, and provides returns to customers more quickly.

PPA Vision

PPA Vision is Power Ledger’s energy data management and settlement system for energy asset owners and operators, It provides greater visibility for energy that’s sold on the spot market or to offtakers.

With PPA Vision members in a Power Purchase Agreement can receive billing and settlement functionality for energy generated and sold to offtakers or on the wholesale energy market, as well as measurement tools.

The PPA Vision application was designed specifically for co-located renewable energy assets and PPA supply arrangements.

Data collected from onsite metering is then presented in an accessible dashboard with the following features:

- Matching of coincidental generation and consumption.

- Showing energy transactions between buyers and sellers.

- Simple and in-depth analysis of the usage and transaction data by both parties.

- Settlements for the energy supplied from the generator to the offtaker.

- Reports to individual consumers of their energy transactions.

- Remittance of any energy sold to the wholesale market.

In traditional metering and billing systems inaccuracies often exist, especially when multiple power providers are in the mix. This leads to delayed payments to power producers, and possibly even a loss of revenue.

C6

The C6 application is used in the verification, reporting and measuring of carbon credits and renewable energy credits. It is blockchain based, and integrates with outside data management systems and smart meters to provide crucial information regarding carbon and renewable energy credits.

C6 can generate reports for small electric vehicle infrastructure trying to track carbon credits, or it can let a massive petrochemical plant know how many carbon credits they need to purchase.

C6 also makes it a simple task for owners of wind and solar farms to track their carbon credits, as well as monitoring and obtaining carbon and renewable energy credits. The carbon credit reporting procedures are complex, but C6 automates much of the work, reducing the time and effort spent in producing paperwork and reconciling data.

C6 has also been seamlessly integrated with C6+ to create an end-to-end system for the carbon and renewable energy credit ecosystem.

C6+

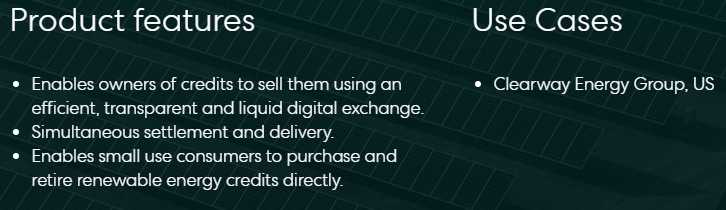

C6+ also resides on the blockchain and it creates a digital exchange and marketplace for renewable energy credits and carbon credits. It does this by tokenizing credits which allows for the transfer and sale of carbon credits and renewable energy credits in a decentralized marketplace.

In the U.S. alone a majority of stats require electric companies to supply a portion of their electricity from renewable sources. Many electricity companies simply purchase Renewable Energy Certificates (RECs) to meet these requirements. As countries around the world begin to implement programs to meet their Paris Accord targets the demand for RECs will increase dramatically.

So far most of these REC programs are paper-based and broker-driven, but Power Ledger hopes to change that by allowing RECs to be traded on an intuitive digital exchange.

Most have been excluded from the carbon credit and renewable energy markets due to a lack of transparency and extreme complexity. This has led to the concentration of power in the hands of a few large players and brokers. C6+ will give energy players a new paradigm that is composed of transparency, efficiency, and relative simplicity.

Buyers will be able to log into the platform and easily begin buying, and sellers will be able to log in and easily begin selling. The platform itself will handle all the details and complexity behind the scenes.

Even more importantly for those involved in the energy markets will be a drop in costs. Sellers of renewable energy and carbon credits will face lower transaction costs and faster sales, while buyers will get better pricing in a fair and open marketplace.

What are POWR Tokens?

Access and permissions on the Power Ledger platform are controlled by POWR tokens. They can be used for trading on the platform, but they also have real world uses.

Those hosting applications on the Power Ledger platform are required to purchase and hold a minimum number of POWR tokens to allow their users to interact in the marketplace.

All transactions are conducted in a deregulated and decentralized marketplace, without the need for third-party intermediaries. This is one of the top reasons for using blockchain technology and tokens in a marketplace system.

The market’s customers can also convert their POWR tokens to Sparkz tokens from within the platform. No intermediary is needed for this, which keeps the applications working without any outside interference.

POWR tokens are similar to a software license in that they grant access to the platform and its features. They are also valid anywhere in the world, which will encourage wider participation in the Power Ledger ecosystem.

Sparkz and Smart Bonds

All that is required to have access to the smart bond functionality is possession of POWR tokens. In addition to the initial tokens acquired to host an application, the application hosts also receive additional tokens from a growth pool as an incentive to spread the usage of their application, and to create new applications. All the POWR tokens can be held as surety for Sparkz.

The POWR tokens are kept in an Ethereum smart bond contract that was designed specifically for Sparkz. These Sparkz are the internal currency used for the Power Ledger platform and are the medium of exchange for buying and selling energy on Power Ledger.

Once they are done using Sparkz they can unlock their POWR by returning the Sparkz to the smart bond contract.

Power Ledger Team

The Power Ledger team has been referred to as remarkable. It was co-founded by Dr. Jemma Green, Dr. Govert Van Ek, John Bulich, and David Martin. These four co-founders have extensive experience in renewable and sustainable energy, blockchain technology, and risk management.

Dr. Green remains the Chairman of Power Ledger, guiding it in accordance with the vision initially set when the company was launched in 2016. She spent a decade with JPMorgan Chase, following which she completed her Ph.D in Electricity Market Disruption.

John Bulich is the technical director of the project and provides strategic direction for the project. He was a co-founder of Power Ledger and a pioneer in Australia’s blockchain scene.

The founders of Power Ledger created the company with a hope that they could facilitate increased green energy production and usage through blockchain technology.

It's also worth mentioning Bill Tai recently joined their advisory board. A venture capitalist since 1991, Bill Tai has served on the advisory boards of 7 publicly listed companies where he joined in the initial stages and helped guide the companies to where they are today.

Power Ledger Partnerships

Power Ledger is engaged in partnerships with international energy companies and government around the world, including a number in Australia and Japan. They have also begun trials in the U.S., in Thailand, Italy, India and Malaysia.

In Australia they are working with Australian National Energy Market retailer Powerclub, and have inked a deal with EPC Solar Canberra. They are also involved in a peer-to-peer solar energy trading project in the Kanto region of Japan, and have recently entered a trial to bring a blockchain based REC marketplace to the Midwestern U.S.

Other recent developments include an agreement with Thailand’s largest renewable energy developer BCPG to bring the Power Ledger technology to Thailand. They are also trialing a peer-to-peer solar energy trading marketplace in Malaysia.

POWR Performance

Power Ledger held their ICO in September/October 2017, raising $13.2 million and selling 350 million POWR tokens for $0.0838 each. The token began trading on November 1, 2017 at a price of $0.052671, which must have been disappointing for early investors.

They didn’t remain disappointed however since the ICO occurred just before the parabolic rise of the cryptocurrency markets in December 2017. POWR rose along with the broader market, hitting an all-time high of $2.01 on January 4, 2018.

It also followed the broader market lower in the cryptowinter of 2018, and nearly two years later on December 18, 2019 it hit its all-time low of $0.034268.

2020 has been kinder to the POWR token as it began the year with a gradual move higher from its start at $0.035, and then in February it exploded to a high of $0.128305 in mid-February. It has since pulled off those highs and as of late February 2020 trades at $0.086, which is roughly where it began at its ICO.

Trading & Storing POWR

When it comes to the markets for POWR, it has pretty broad exchange support. Your best bet for trading the token is perhaps Binance that has pretty strong Bitcoin order books. However, there are also pretty well established markets on BitHumb and Upbit.

In terms of volume and liquidity, it is well spread out across these exchanges. This bodes well for the price discovery of the token as it means that traders are able to quickly and effectively arbitrage out any sort of mispricings. It also means that they can trade with large block orders without too much slippage.

For storage, given that POWR is an ERC20 token you should not have too much difficulty. You can use any wallet that will support Ethereum such as MyEtherWallet, Metamask etc. Although, your best bet is probably to get your hands on a hardware device like a ledger or a Trezor.

Power Ledger vs Grid+ vs WePower

Grid+ is similar to Power Ledger, although there are some key difference. On the similarity side both are blockchain based, and both allow consumers to buy renewable energy directly. Both utilize a token based system.

On the differences, Power Ledger is P2P focused, while Grid+ offers wholesale sales and pockets the profits. Grid+ has its own hardware for figuring out energy pricing, while Power Ledger uses local metering. Grid+ is relatively new, and Power Ledger has been around since 2016.

WePower and Power Ledger are pretty similar in that they both allow for selling solar energy, they’re both blockchain based, and they both use tokens. Power Ledger uses a straight-forward P2P selling setup, while WePower uses an auction based system. Power Ledger and WePower have both developed global partnerships.

Conclusion

Power Ledger has an admirable vision in looking to improve the energy sector by making renewable energy cheaper and more easily accessible. The system they’ve developed could eventually see even those in large developments obtaining electricity from local providers working on micro-grids and PAAs.

Since its beginnings in 2016 Power Ledger has been continually developing new services, and improving their existing services, which is exactly what we like to see from blockchain projects.

As the platform gains in adoption it becomes more likely that it will disrupt the entire energy production and distribution system. That could drive down prices for consumers dramatically given the current state of electricity generation and distribution. The growing adoption also makes people begin to change the way they view the means for purchasing and consuming energy.

If Power Ledger has its way renewable energy sources will become far more feasible and widespread in usage, which is something that can only be good for the world.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.