When scrolling through social media sites like Youtube and Tiktok looking for crypto content you’ve probably stumbled across videos where people claim to be making thousands of dollars a day trading cryptocurrencies. This might sound very good and so your interest in trading has begun to grow. But what is trading?

You might think that trading only includes the most common type, which is day trading. However, it includes a lot more. Trading includes a large number of things and depending on who you ask, can include trading by the second all the way to investing for life. That’s why there are numerous different strategies on how frequently, and based on which metrics, you buy and sell assets. Although having a strategy when investing in any form is necessary I would argue that when dealing with cryptocurrencies it’s even more vital to have one. This is because cryptocurrencies are known for their extreme volatility and for many people this can cause tremendous amounts of stress unless you're completely aware of how you’re going to act in different market conditions and manage your risk.

Risk Management

Before getting into these various strategies it’s good to touch down on a vital piece of every strategy, risk management. Without having the proper risk/reward ratio there’s no point in trading. You might initially make good gains, but inevitably you'll end up blowing your account. This is especially important for those who trade shorter time frames since you’ll conduct a lot of trades and almost certainly not win all of them. However, with the right risk/reward ratio, it’ll be enough to win only a share of your trades.

Let’s say you make 100 trades in a certain period. For those trades, you always bet the same amount and always have the same risk-reward setup. In this example, we'll say that every time you win you’ll make $50 and every time you lose you’ll lose $25. Now, after making these 100 trades you end up with a profit of $1250. Yes, that means that we only won half of our trades but still ended up with a nice amount of profit. That's how powerful risk management is to your trading strategy.

You don't have to win every trade to be profitable.

You don't have to win every trade to be profitable.As seen from the example, risk management is a key to a successful strategy. This is also super easy to do since many platforms like TradingView offer a tool to do this, and luckily for you, Coin Bureau has a guide on how to use TradingView. However, when using this tool there’s one thing to keep in mind - Be Realistic. It’s not financially smart to simply put your profit levels to the moon just for the ratio to be good enough for you. Rather be realistic and if the ratio isn’t good enough then don’t enter the trade. There's always other opportunities out there.

Different Trading Strategies

Now before getting into these strategies there are a few things I want to point out. First, don’t limit your options to only one. If you want to be a short-term trader then that’s fine, but it doesn’t have to limit your option to invest in something you believe in for the long run. The same goes the other way 'round. If you prefer to invest long-term that's great, but it doesn’t hurt to try out some other strategies too. By using a combination of a few strategies you can lower your risk, and that’s always a good thing. Secondly, these aren’t all the strategies out there, and especially when it comes to these more specific strategies there are mountains of content to be found. And finally, these are not ordered from best to worst and you should therefore keep reading till you find something which seems suitable for your own personality.

Day Trading

Let’s begin with the most well-known form of trading. Day trading is simply buying and selling an asset during the same day. This is where many amateur traders start and also stop since they tend to lose money. This isn’t because the strategy is the worst, but rather because it’s not as easy as it might seem.

Day trading is almost always based on technical analysis (TA), which for a beginner might be quite difficult. Many people simply believe that drawing a few lines and then trading based on those will make them rich. And yes, while TA might be largely based on drawing lines you still need education to be able to draw and interpret those lines correctly. However, when you do learn the skills you might make a good amount on profits by doing this.

Day trading and technical analysis can be hard, but it's nothing you can't learn.

The hypothesis with day trading is that when trading on a shorter time frame you eliminate the risk of any black swans ruining your trade when you're away from the market. That’s also why you usually invest without actually having that much knowledge of the fundamentals of an asset but rather just by looking at the price chart and analysing that with TA. This is why if you prefer to invest in something that you truly believe in long-term day trading might not be for you.

Scalping

Scalping is a subcategory of day trading and also the extreme of day trading. In scalping, the goal is to make a large number of small trades, and then the small profits will stack up to a large profit. In scalping, you only keep an asset for a few minutes, or even just seconds. The reason people use this is that when only holding for such a short time you eliminate the risk of any black swans, and the price actions are purely technical.

If this is you, then cheer up, don't give up. Get yourself a solid strategy and learn the skills necessary.

When trying out scalping there are a few things to keep in mind. When you enter a trade keep your stop losses tight and don’t go chasing high profits for one trade. Also, because the profits from one trade are almost always less than 1% you need to have a cheap exchange. Many use Binance. Furthermore, I wouldn't recommend doing this unless you're extremely familiar with TA. Without the proper knowledge you’ll only end up gambling and this won’t teach you a thing. Plus it's almost a certainty you'll end up destroying your account, even if you're winning at first.

Breakout Tradin

An extremely popular strategy used by many people, both beginners and pros, is to take advantage of breakouts. This strategy is based on the most basic technical analysis and only includes finding support and resistance lines.

When you find the support and resistance lines, where the price tends to reverse, you’ll see a range between them. The price usually tends to trade inside this range before we see a larger price movement either by breaking the support or resistance line. When you’re trading the breakout you’ll look to enter when this happens. If the price breaks above the resistance line you’ll enter a long position and if it dips below the support line you’ll enter short. How you exit your trade is more up to you. The best way to adjust your upside is to look for the next resistance or support level. Try to find a realistic level, since looking for all-time highs after one breakout won’t likely happen.

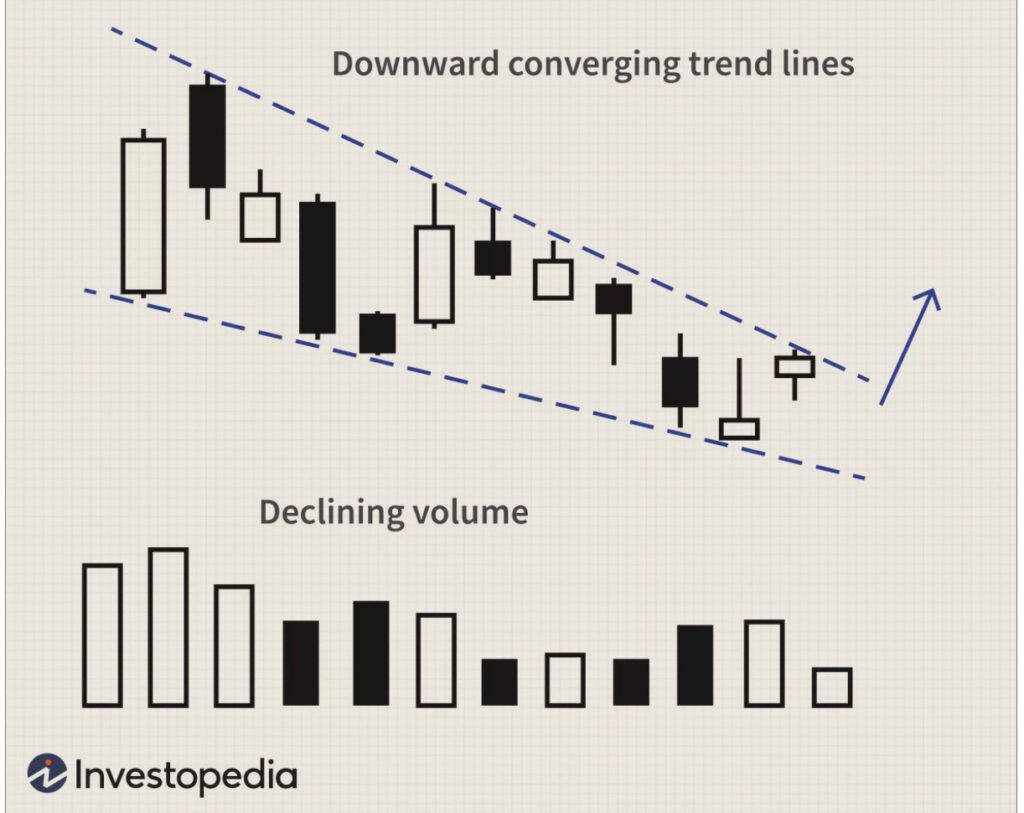

This same strategy can also be used for not only sideways movements. If you’re familiar with TA you might have heard of wedges. Wedges are basically ranges steadily ascending or descending while the highs and lows are slowly getting closer to each other. The principles in these compared to the previous example are the same and can actually result in even greater price movements when the high and lows get together leading to a breakout in either direction.

After a downward moving wedge the price tends to pump. Image via Investopedia.

One word of warning before you start trading with this is to be careful not to get fooled. This strategy is widely known and used which means that certain bigger players might trade against you. Therefore, look for a strong breakout. Don’t enter too early on a small breakout but rather wait for a strong green candle with a large volume. Yes, you might miss out on some gains if you wait, but I guarantee you that it’s worth it in order to lower the risk, which as mentioned earlier is the key.

Range Trading

After reading through the previous strategy this might be obvious for you. Simply put, instead of waiting for a breakout we’ll take advantage of the existing range and try to buy close to the support and sell near the resistance. Typically ranges are found in sideways movements but can also be found in both ascending and descending prices where the base trendline is drawn from previous lows and the resistance is drawn for the highs. This is often referred to as a channel. The risk with this strategy is that if you happen to enter near the resistance line just before a breakout to the downside you’ll lose money. Luckily there are a few entry strategies to prevent this.

A great strategy, but watch out for breakouts. Image via Investopedia.

The entry strategy I would recommend is engulfing. The way you use this is by looking at when the price moves close to the support line you want to enter. When the price hits the support line there will be a red candle indicating the dropping price. After that the next candle should be green and considerably larger, if that happens you enter. By using this we have confirmed a reversal in the price and it will be less likely that a breakout to the downside will happen. Engulfing can also be used in different strategies and it works the same for entering a short position, although naturally, the candles will be in the opposite directions.

Swing Trading and Position Trading

Next up we’ve got something for those whose nerves can’t handle the stress of day trading or scalping. Swing trading is based on holding an asset for a few days to even a few weeks, while position trading is holding even longer, from a few weeks to even months. In both of these, it’s possible to combine different forms of analysis like fundamental analysis and technical analysis.

Trend Trading

I won’t get into this too much since you can find a piece on-trend trading on from Coin Bureau. However, I wanted to mention it since it’s a powerful way to trade and it can also be suitable for those who prefer other forms of analysis besides TA. In trend trading, your goal is to jump on an already existing trend and then exit when the trend makes a reversal. This means that you won’t be looking to sell at the top or even close to the top, but rather wait for a clear signal that the trend has reversed. This makes it possible for you to capitalise on both short-term and long-term trends since you won’t have a predetermined exit price, nor time.

If you're interested and have time I suggest you take a look at this article.

Trend trading also offers the opportunity to trade in every different stage of the market cycle since the point is to find when certain categories will boom, not just a single coin. For example, if you see exchange tokens starting to move upwards you might enter a few of them until the interest in exchange tokens changes to perhaps gaming-related tokens. There are so many opportunities here so make sure to read the above-mentioned article on it.

Relative Strength Index (RSI)

This too is based somewhat on jumping on a trend but when using this specific indicator you might find a trend before it even begins. The relative strength index is a momentum indicator that shows you when an asset might be overbought and when it might be oversold.

The RSI gives you a reading of 0 to 100 and when it’s below 30 the asset is usually oversold and when over 70 it’s usually overbought. I won’t get into the technicalities on how it’s counted since the most important part for you is to know how you use it. RSI is usually used on a time frame of 14 days but can be adjusted for different time frames too. Because we’re talking about a few weeks RSI is perfectly suitable for swing trading but can also be used to find longer-term trends and opportunities when you adjust the time frame to say 50 days instead of 14.

Here's an example of how to RSI can indicate momentum shifts. Image via Investopedia.

Although the basic strategy on how to use the RSI would naturally be to buy near 30 and sell near 70 there are a few other ways to trade with RSI. One would be to wait for a price near or below 30 and instead of buying immediately wait for a reversal. Usually, after a small reversal, the price tends to dip again only to then jump back to near-term highs. The price we’re going to enter in on is when the price has dipped and then broken out from the previous high. If you didn’t catch what I meant you can read more about this strategy and also the RSI itself from Investopedia.

Moving Average Crossovers

Moving averages (MA) are very simple but also very powerful. They can give you a good indication of the overall trend of the markets and also, what makes this good for traders, it can show trend shifts.

To find these trend shifts the best way is to look at MA crossovers. There are two different types commonly used. One is to look at the price chart along with one moving average. Then if the price dips below the moving average it can be a sign of a downturn, and the same goes the other way around. However, the other way to use crossovers tends to work better.

Have you heard of a golden cross? Or perhaps of a death cross? Image via Academy Binance

When using these you combine two, or in some cases maybe three, moving averages with different time frames. Then if the shorter time frame MA crosses the longer time frame MA it’s a sign of a trend shift. If this strategy sounds familiar it might be because the terms golden cross and death cross comes from this strategy. A golden cross is a general term for when the shorter-term MA crosses the longer term. Lately, though, it has been widely associated with the 50 and 200-day MAs. Death cross on the other hand signals the same movement but reversed, as you could have guessed from the names. What people don’t often realise is that this strategy can work for any time frame MAs. I’ve seen people day trade by using 3-day and 6-day moving averages. That’s why you should take a look at this strategy since regardless of how you tend to trade it can give you good indications of the market.

Moving Average Convergence Divergence (MACD)

As with the previous indicator, this is also based on MAs and shows the momentum of a market However, there are many differences between this and MA crossovers.

First of all, this isn’t based on normal MAs but instead on exponential moving averages (EMA). Simply put, EMAs differ from normal MAs by placing more weight on the most recent price movements. When you use MACD on a chart you’ll see a line calculated by subtracting the 26-day EMA from the 12-day EMA. Then as a baseline, you’ll see the 9-day EMA. This indicator is also often depicted as a bar chart which can be easier to interpret.

Great indicator, but I suggest you combine it with something else, like RSI. Image via Investopedia.

The way you trade using this indicator is to buy when it goes above the baseline and sell when it dips below. However, MACD is known for giving a lot of false signals and is therefore often used with other indicators like the RSI. Since they both signal momentum changes it can be a good idea to combine those two and wait for them both to show the same signal. This should work relatively well since they are both calculated in different ways and it’s less likely that they both give the wrong signal. Also, as with the MA crossovers MACD can be used for all time frames. You can always use different periods than the 26 and 12 which can offer you ways to trade both longer and shorter-term momentum shifts

Dollar-Cost Average (DCA)

Now, this is something for all those not interested in short-term trading and who would rather be invested in a few things they truly believe in. The time frame here is for life since what’s the point of buying something you don’t believe in or selling something you do believe in.

Dollar-cost averaging is perfect for the crypto market since high price volatility might ruin your investment if you enter at the wrong time. What you do in DCA is that you consistently buy a certain asset. One good idea would be to buy with a certain amount on the first day of each month. This way you’ll be guaranteed to buy more of the asset at low prices and less when price is high. Eventually, you’ll also buy at peaks and quite ridiculous prices but it won’t matter since your average purchase price will be lower.

A great example of how DCA has been proven to be extremely profitable is found in this article by Coindesk. Essentially if you’d have bought $150 worth of Bitcoin at the beginning of every month from Jan 2018 until Mar 2021 you would have spent $23,550. This would have bought you 3.04 Bitcoins compared to the 1.69 Bitcoins you would have, had you bought with the same amount but everything in Jan 2018. For those interested in the dollar amount, at press time it would be $151,000 compared to $84,000. Quite the difference.

DCA is a proven strategy that'll make you money.

Yes, you could make even more by buying everything at the bottom, but that's highly unlikely to happen. However, there is a way to enhance the effect of DCA. This is by purchasing more when the price seems down while limiting your purchases when the price is too high. This could in practice mean that you use these different indicators talked about in this article to find trends and signals if an asset is potentially undervalued or overvalued. For example, when we had the major bull run where Bitcoin hit $64,000 in the spring of 2021 it would have been smart to gradually decrease your scheduled purchase amount since if you see a surge of that magnitude it’s almost certain that the price will come down eventually. However, don’t overthink. You can try to time your purchases to some extent but if you do it too much you’ll lose the power of DCA. Therefore, only make exceptions to your schedule in extreme cases.

Conclusion

Hopefully, from this article you found something intriguing and useful. Maybe you didn’t find the most specific strategy on how to trade but the important thing is to first know which of these different trading ways you’ll start using. If it’s day trading you prefer then you’ll find tons of content on the internet, but beware scams. Especially in day trading, many so-called pros are trying to sell you expensive courses which won’t help you at all. Funnily enough, most pros know to stick to simple and proven methods. Therefore, I suggest you stick to the free content and also try to absorb knowledge from many different sources while doing your own research on the methods you get introduced to. For those looking for longer time horizon trades, I suggest you do the same. Even for this, there’s a lot of content, although not as much as for day trading.

And lastly, before getting started make sure to have a specific strategy ready. Use what you’ve learned to draft a potentially profitable trading strategy and start executing that. Remember to track your process so you know if it works. If it doesn’t then change it and try again. You’ll possibly have to try many different approaches in order to find a working one. That’s why you’ll need to have the right risk/reward ratio with minimal losses. Good Luck!