SegWit has Activated, Why are Transaction Speeds the Same?

As many may know, SegWit was recently activated on the 23 August. This was the much talked about Bitcoin scaling update that would segregate the header information and hence increase the space for transaction data in the block.

This scaling update was touted as one of the most effective ways in which to increase transaction speed and reduce cost. Indeed, many users saw the inherent benefit of being able to use the Lightning Network for Bitcoin transactions.

However, for most of those users who were expecting to see a marked change in the speed and price of transactions, they are slightly disappointed. On forums such as Reddit, a number of users are lamenting the fact that they have not seen a marked change in either of these metrics.

Why Are the Changes Slow

Although many people are hoping for radical changes whenever technological updates occur it does take some time before all of the changes are fully implemented on the system. So new is the protocol upgrade that many of the block explorers are not providing enough clarity on SegWit Transactions.

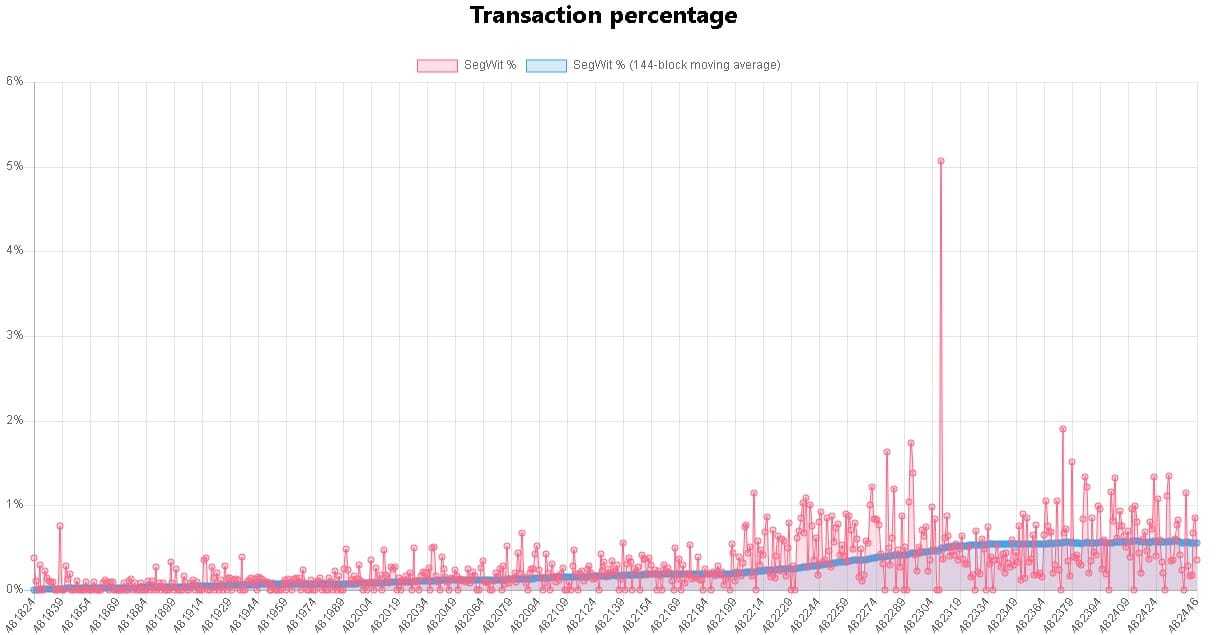

One block explorer tool that you can use to see the number of blocks that are now implementing segwit type transactions is Segwit.party. As you can see from the below image, there is only about 1% of the network in total.

There are a number of reasons, however, as to why these changes are taking so long to implement. One of those is the rate of adoption. One should not forget that the Bitcoin network is made up by a number of participants both on the user and company side. User wallets need to be able to handle the Segwit enabled transactions.

Although there are a number of these wallet providers that have pledged to implement the changes, they are waiting for a larger degree of support. This is mainly on security grounds and is one of the reasons that the wallet developed by Bitcoin core still does not support it.

One of the Bitcoin core developers, Greg Maxwell made the following comment on a Reddit post.

Using SegWit before the activation is buried is unsafe and could lead to funds loss if miners behave maliciously

This does not mean that some of the more popular external hardware wallets such as Trezor and Ledger don't already support the technology.

The Debate Still Rages

There remains the possibility that the slow uptake in Segwit transaction speed and scaling could reignite some of the older debates that have been a centrepiece. Although many people were of the opinion that the new SegWit protocol would change how block size is calculated there are a number of participants who think that size is the major requirement for scaling.

Technically with SegWit, various transactions now have "weights" in the block. Non SegWit transactions have a weight of 4 which means that a block comprised of non SegWit transactions is still capped at 1mb. However, SegWit transactions have a weight of 0.25 which means that a block that is full of SegWit transactions could reach a maximum of 4MB.

Hence, until all of the blocks are full of SegWit transactions it is unlikely that we will reach the 4MB block size. Many developers are of the view that the average block size is likely to be about 1.6MB. Others have the opinion that it is closer to 2MB if more Miner incentives are in place.

Yet, whether these forecasts are enough for those individuals who are in favour of more radical change is unclear. There are still those Bitcoin businesses who are aiming for an additional Fork of the network in November to increase the Block size limit.

There still remains much contention among Bitcoin Core, Miners and business. For all those users who were looking to the SegWit implementation to settle all of the old Scaling scores, you may still have some time to wait. The debate will rage on for the foreseeable future.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.