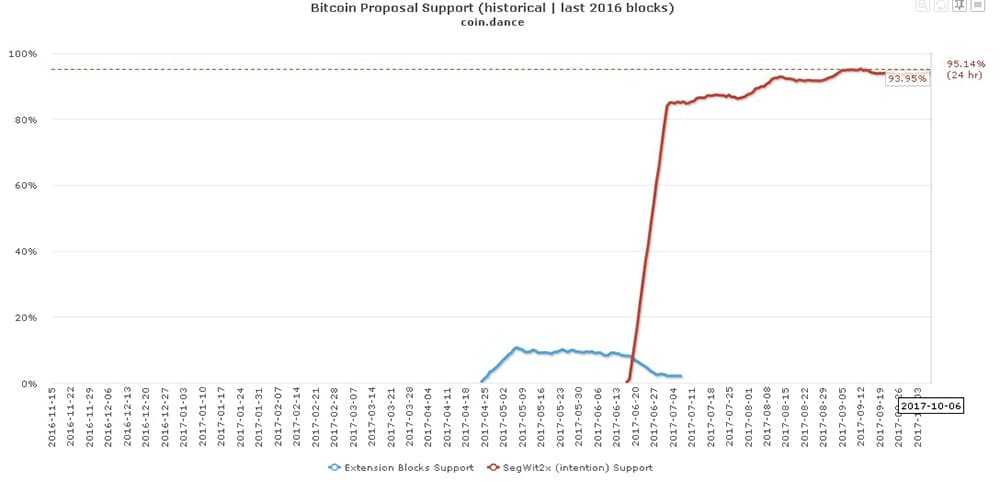

Miner Support for SegWit2X Slowly approaches 95%

With the SegWit2X fork around the corner, many people in the Bitcoin community are keeping a close eye on the current level of miner support as guidance. At 93.9%, this is precariously close to the 95% threshold that is required for a unanimous protocol upgrade. You can see it below in the graph from coin.dance.

This also includes previous miners who did were not immediately party to the New York Agreement (NYA) on scaling. This therefore made the decision near unanimous on the NYA to implement SegWit and increase the blocksize limit to 2MB.

Although this was previously supported by some small block supporters prior to the activation of Segwit, once the activation actually occurred these individuals decided to argue against it. One of these mining pools that does suggest so is Blockstream.

Potential Impact on Hard-Fork

This would mean that if Bitcoin was to hard-fork and there were two chains, Blockstream would attempt to mine the minority chain. However, given that they view the minority chain as the true Bitcoin, they will try and keep the "BTC" ticker.

They will also try and keep the chain functioning without implementing any protocol changes on the network. Yet, there are many that are questioning whether this is really feasible. If they only control about 5% of the total hash power then they would only find 5% of the total blocks.

This would mean that blocks would be cleared on the legacy chain at a really slow pace. This will mean that chain could go without clearing a block for an entire day. This could obviously severely hamper the network use.

Of course, there is also the concern of a possible 51% attack given the lack of miners working on the chain. This makes the shorter chain much less appealing to exchanges.

A Potential Protocol Change?

The last resort for the shorter chain would be to implement a protocol change. However, this may require changes to the proof of work which would severely hamper the security and make it much less appealing to regulated exchanges.

This would mean that these exchanges would not run the risk of having a less secure chain on their platforms. They will then most likely choose to only support the one chain and label it the BTC.

Does This Signify Much?

There is a raging debate as to whether miner support as measured by hash power is indeed an important indication that only one chain will have miners competing on it. Economic theory goes that the miners will compete where the most profit is to be made.

As such, if most of the users and Bitcoin Core are still wedded on the original Bitcoin and no one is transacting on the SegWit2X version, then they will be making any profits from mining that chain. Hence, many "NO2X" proponents are not too concerned with the support metrics we have above.

These people claim that the miners are just trying to create the perception that their support by hashing power is indicative of what will eventually occur. They say that the miners are trying to control the narrative around the fork to their own advantage.

How exactly it will play out is uncertain. Well known opponents of the hard fork include Charlie Lee of Litecoin and ex Coinbase including Bitcoin core developers and supposedly most users. They claim that the miners should not be able to determine whether there will be a fork and that we should allow the benefits of the SegWit activation to play out.

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.