“Do your own research”. These words (or the initialism DYOR) have been heard more than once especially if you watch the Coin Bureau YouTube channel. That’s because when investing in something it’s best the decision comes from you, made on the basis of information you've found while doing your research. Relying solely on a third-party opinion is risky. Some of the information might be outdated and there might have been new developments that impact the quality of the investment significantly.

So, the only thing to do is to continue the research. However, sometimes it might be tricky to know where to start. For me it was weird when starting out with cryptos. Being familiar with stock research I thought I can do the same things with cryptos. Needless to say, that didn’t work. Looking through the sites used for analyzing stocks was useless and when finding the crypto sites, I had no idea what to look for, or if the sites were any good. That’s why I’ve gathered here the top 10 crypto research tools that have helped me along the way. I'm sure you’ll get a lot out of them too.

10. Glassnode

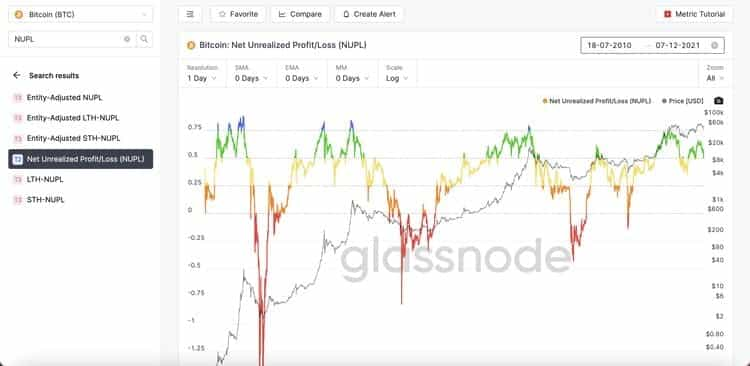

To start things off I wanted to go with Glassnode. Glassnode is an on-chain analytics tool and it’s one of my favorite places to visit when the markets turn red and I need to see the bigger picture to regain my confidence. Looking at active wallet addresses rising always helps me sleep at night. But that’s not all. Glassnode offers a variety of different metrics and they support many cryptos including big names Bitcoin, Ethereum, and Litecoin, as well as many DeFi tokens and ERC-20 tokens.

Last time I gave you a few metrics to look for and those were total active address and NUPL (Net unrealized profits/losses). However, Glassnode offers a lot more. The problem is that if you don’t know what to look for, or how to interpret the metrics and charts, it’s kind of useless. That’s why I want to redirect you to Glassnodes weekly on-chain analysis. You can read through these yourself or watch via YouTube, and I highly recommend you to do that. Watching those have helped me a lot in understanding the benefits of on-chain analysis as well as how I can do that analysis on my own. They also give you a sense of where we are in the market cycle which is often times helpful when managing your portfolio. Another place to really learn about on-chain analysis is from the Glassnode academy.

And do you know the best part of all of the learning opportunities at Glassnode? They’re both free. No need to pay for anything before you know how to use these metrics. Then when you have learnt everything and want to start doing your own research, I suggest you opt for the $29 a month plan. They do offer one higher plan too but that costs $799 a month so I don’t think it’s relevant to many of us.

9. CoinGecko

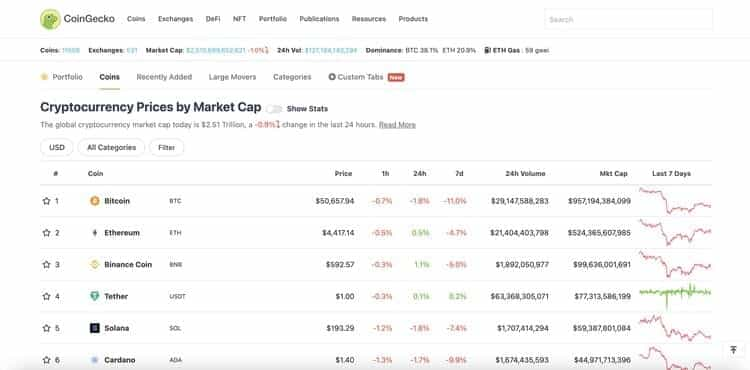

Doing any research is kind if pointless if you don’t have anywhere to check your prices. That’s where GoinGecko comes in, although they do offer lots of other useful stuff. CoinGecko is available both online and as a mobile application so you can use it anywhere. The most obvious thing to do here is simply create your own portfolio and track it from the app. That way you're always on top of crypto price movements.

On top of that CoinGecko is the perfect place to start when researching a new crypto. When you click on a crypto, you’ll find it’s market cap, price, volume, supply, exchange listings and a description. All of this is good to know when making up your mind whether the crypto is a s*itcoin or not. If you don’t know how to spot this type of a crypto then Coin Bureau has the perfect video on that. A few additional statistics you can find on CoinGecko are some social statistic, developer statistic and even brief analysis by IntoTheBlock.

Also, if you’re looking for something besides specific cryptocurrencies, you’ll find it here. On CoinGecko you’ll find derivatives, exchanges, DeFi, NFTs, Yield Farming, podcasts, and they have even published a couple of books. So, if there’s anything you’re looking for then steering your ship towards CoinGecko will be helpful. Most of the things they offer are free but they do have two paid plans available. First is the premium plan for roughly $4 a month which gives you an ad free CoinGecko. Then they have the premium+ for roughly $8 which opens up a lot more including access to their books, research reports, chat with their research analysts, and a lot more.

Last time I wrote about this topic I told you guys about CoinMarketCap and now I’ll say it the other way around. CoinMarketCap is just as good as CoinGecko and using either one will get you what you need. It’s often just about personal preference.

8. Messari

This is without a doubt the place you turn when searching for hidden gems and huge gains. That’s because the Messari screener is the best place to filter through your searches when on the hunt (or at least the best one I’ve found so far). You can filter by market cap, volume, liquid supply, on-chain indicators like active addresses, reddit subscribers and a lot more. On top of that Messari offers quite good research articles which do come in handy.

Now I know it can be exhausting to go through so many different cryptos you’ve never heard of, since to be real 90% of them are worthless. However, it would be nice if someone were to do that for you so that you know which ones to look at and which to ignore. That can be done at Messari in form of community created screeners. Here you can find loads of different categories ranging from certain types of projects to asset manager portfolios. Often, I like to look at what large funds have invested in and see if I can find any good projects I should be holding too. These screeners include funds from the likes of Coinbase and Alameda Research, so pretty reputable names to say the least. Also, if you’re looking at metaverse or gaming projects there are separate screeners for them too. These screeners can't be modified but you can always copy them by the click of a button and then edit them to be more suitable for your purposes.

When it comes to prices there are two options, $25 a month for the premium and then $625 a month for the enterprise plan. So, if you’re a retail user like I am then that $25 dollar a month plan should be enough.

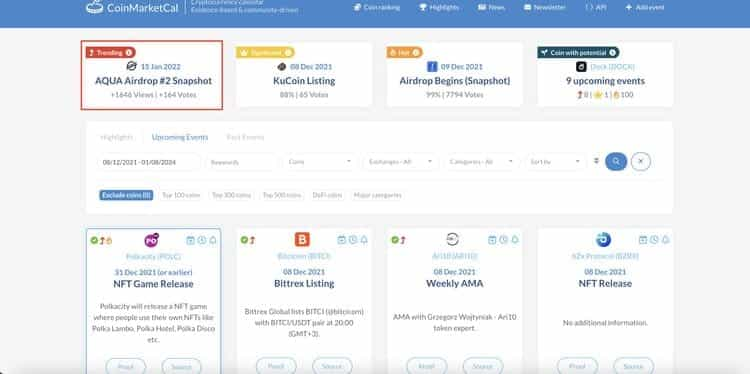

7. CoinMarketCal

Have you ever felt like you can’t keep up with all the events and upgrades going on in crypto? Well, I have. Luckily there’s CoinMarketCal. Here you can find a full calendar with everything surrounding crypto.

What I usually do is check the events listed as significant and then look at those concerning the top 100 coins. Often times I find stuff the news sites have totally missed, which is why this tool comes in handy. Did you for example know that if you’re an XLM holder you can be qualified for an AQUA airdrop in December? Or did you know that Stacks is getting a significant upgrade? Like the XLM example, it’s good to also check out what’s going on with those cryptos you hold. You don’t want to miss out on an airdrop just because you didn’t have a clue that there even was something to miss. We all know how lucrative airdrops can be.

Then lastly for those who like to trade. Looking here for potential big events can provide some good trading opportunities. That’s because CoinMarketCal supports a large variety of coins including small caps which tend to be extremely volatile. However, when trading based on news and events remember the saying, "buy the rumor, sell the news". On top of that there can also be some opportunities find in the 'Coins with Potential' by CoinMarketCal. Here are those coins that have many and/or major events coming.

All of the features on CoinMarketCal are free and what I like about the site is that it’s strongly community driven. Anyone can post events and they then get voted on whether they’re legit or not. This voting system also allows CoinMarketCal to sort the hot picks from others and it makes it easier for you to find interesting opportunities.

6. Coin Metrics

Here’s a tool that doesn’t run out of things to look at and use. Coin Metrics is best known for their accurate and up to date on-chain data with over 400 metrics and 100 supported cryptocurrencies. Now what I do have to say is that this tool feels kind of aimed at more experienced people. The site is stylish and simple but I get a sense that Coin Metrics aims more for institutional clients. That’s because they offer some paid plans which you can’t get access to online but have to contact them directly, and when you purchase these plans you gain an access key to an API through which you can get access to more tools and data. That’s why if you’re a retail user doing some on-chain analysis I would go with Glassnode since I find it easier to use, and cheaper besides.

That said, Coin Metrics is still a great site which is why I have listed it here although my personal preferences are for other sites. I’ve come across multiple news sites using Coin Metrics’ research as a reference and you too can get access to those. These are useful since they provide you with important data while teaching you how to do the analysis yourself next time. They usually sum up each quarter with different charts showing a variety of useful statistics. Here you’ll get a good sense of how everything has been going and where we might be heading. On top of that they also sum up each week in shorter reports which are worth checking out.

5. LunarCrush

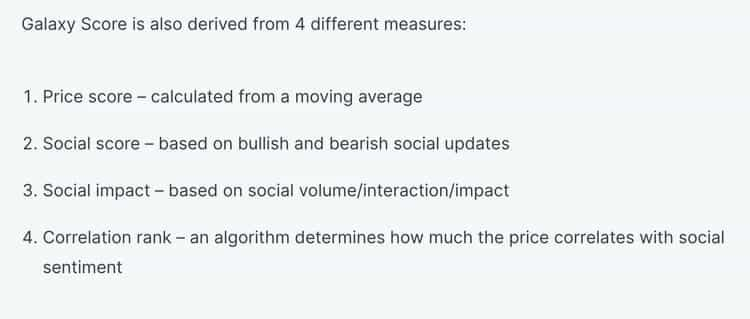

Hopefully you read the piece on sentiment analysis on Coin Bureau a few weeks ago, if you did you should be familiar with LunarCrush. But of course, not all of you read the piece so here’s a short introduction to LunarCrush. LunarCrush is a sentiment analysis tool that gives you all the essential information when it comes to public perception of a crypto. LunarCrush has two custom scores called AltRank and Galaxy score. I’ll leave a picture below so that you can see what they are based on. However, you don’t have to rely on this and LunarCrush does give you the ability to analyse cryptos yourself too.

LunarCrush gives you the ability to sort by different metrics like social volume, bullish/bearish sentiment, volume, market cap and a lot more. Then you can look at the statistics for yourself and make your own analysis. One thing I like to look at is the total social volume and how much of that is bullish versus bearish. Looking at this as well as seeing how they develop along with the price might help you determine where a crypto is going. One thing I found that could present trading opportunities was looking at the bullish sentiment alone. There were many places in the last 3 months when an uptick in bullish sentiment was followed by an uptick in the price. However, I did not find any definite correlation and you could just as well have lost money trading. But if someone else wants to dig deeper into this I think there might be some possibilities in this.

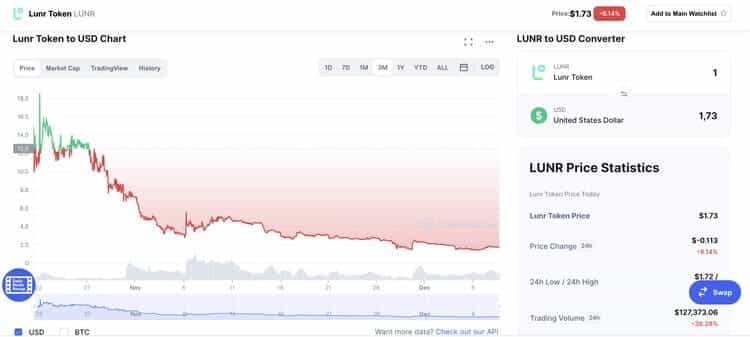

The problem with doing more thorough analysis with LunarCrush is that you need to pay for access to more data. Without paying you will get a maximum of 3 months charts and no charts for the Altrank or Galaxy Score, only the values. This makes it harder to analyze the long-term trends. When it comes to the cost you will need to purchase LunarCrush’s native token LUNR. There are three levels, tier 1 for free, tier 2 for 30 LUNR, and tier 3 for 100 LUNR. At the time of writing this LUNR is trading at roughly $1.45. The problem with this system is that the Lunr token has been in a constant downtrend in the last 3 months which means that if it continues you can get the levels a lot cheaper in the future. 3 months ago, level 3 would have cost you about €1500 and now it’s only €150.

Despite the potential cost LunrCrush is a great tool but there’s a one other thing I want to warn you about. While this is a place where you could find tradable assets and maybe even hidden gems there are a lot of scams. You should be aware that many meme projects use lots of bots and money to grow the awareness around their project. That naturally pushes these coins up in LunarCrush since that’s what this tool is for. However, these projects can be complete garbage and simply buying them based on the values shown on LunarCrush isn’t good. For example, right now there’s a crypto called Tacocat in the top 10 by social volume. I have no idea what it is or what it does but the name itself should ring some warning bells that tell you to do additional research.

4. Santiment

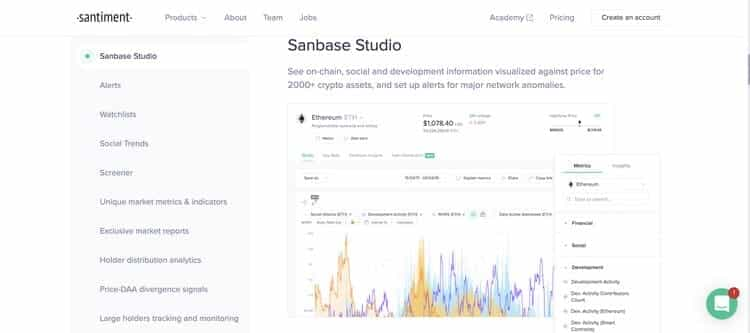

If you didn’t like the fact that you only see 3 months' worth of data on LunarCrush then maybe you should consider trying Santiment. Here you can do similar social analysis on over 1000 cryptos. You can also include data like market cap, volume and even some on-chain analysis. This is a great tool to study individual cryptos.

On top of that they offer great market insights that again, like Glassnode, offer both valuable information as well as context around the metrics found on the site. What I found is that they are quite active and tend to cover trending cryptos. One of their recent analyses is on Basic Attention Token (December 2021) that you might have noticed has had a good run lately. I’m not going to tell you here what they said about BAT, so if you’re a holder I suggest you take a look. I found it quite interesting. On top of this, Santiment has its own academy where you can learn lots about Santiment and the markets in general.

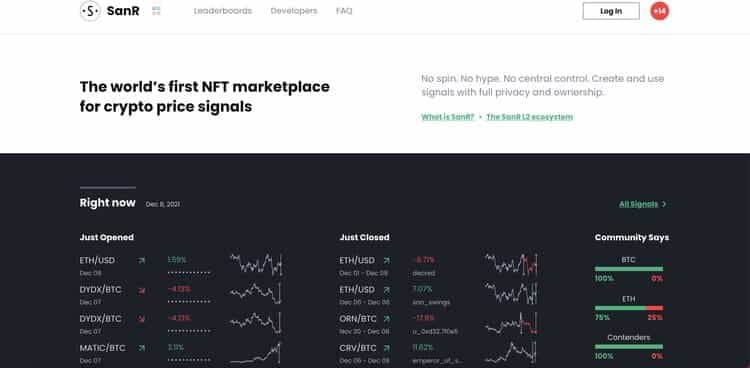

Then, on top of these two tools Santiment offers a screener tool. Here you can try and find those hot picks that’ll take your portfolio to the moon. However, to be able to use the social metrics you’ll need to have the pro plan. The Pro plan will set you back $49 a month and if you really want access to everything you can purchase SanAPI and that’ll with set you back $160 a month. SanAPI is, however, meant for developers and not retail users. If you want a discount on the prices, you can get that buy owning SAN tokens, a 20% discount to be exact. Staking these tokens will also unveil more possibilities which of one is SanR.

This is a decentralized market of trading signals. Here anyone that stakes 50 SAN can upload signals on where a cryptos price is headed. These positions will close in two weeks and the top performances in percentage terms will be awarded. Currently there aren’t many users so if you want to try to win some SAN you have a great probability. You can win up to $36 each two weeks with current prices. Other use cases for SanR are to look at the consistent top performers and maybe follow what they do. It’s interesting to see how this develops. Santiment also has plans to make the ecosystem even larger and greater by incorporating the SAN tokens. And don’t worry, the performance of SAN is a lot rosier than Lunr, though it is down considerably over the past month, mostly due to broader market forces.

3. Coinglass (Former Bybt)

Most of you might know this by its former name Bybt. I know wasn’t aware of the rebranding. Coinglass is a derivatives data tool and regardless of the name offers some valuable insights. In order to benefit from this data, you don’t need to be a derivatives expert. Most of the data here is useful for getting a sense of the market sentiment.

One thing I like to look at here is the long/short ratio. From here you get a good view of what the sentiment around a crypto is. Another thing here is that you can adjust the time frame to as narrow as 5 minutes and this might help you spot the local top. For example, as I’m writing this Bitcoin is +6% in the last 24 hours and now the short ratio is starting to rise which might signal that a top for this short bullish run might be here. (Looking back the next day I was right). Another thing I regularly check here is the Statistics surrounding Grayscale and also now the ETF. That’s because I’m interested in how institutions view cryptocurrencies and currently many of them rely on these products to gain exposure. Now whether you should be getting your Bitcoin exposure through these is another question and you can find the answer to that in this Coin Bureau article.

Lastly a nice thing to also check on once in a while is how Bitcoin is performing relative to the stock-to-flow model. If you don’t know what the S2F model is then CB has got you covered again. Shortly, it’s a valuation model that has so far proven to be one of the most accurate in projecting Bitcoin's price. All the things on Coinglass are free and although I only mentioned Bitcoin, they have statistics on a variety of altcoins.

2. Coin Dance

Are you a fan of Bitcoin? If yes then you’ll want to have a look at Coin Dance. Here you can find tons of useful statistics on volume, nodes, politics, and adoption. Even if you aren’t a fan of Bitcoin this site is worth checking out since as we all know Bitcoin largely influences the whole market.

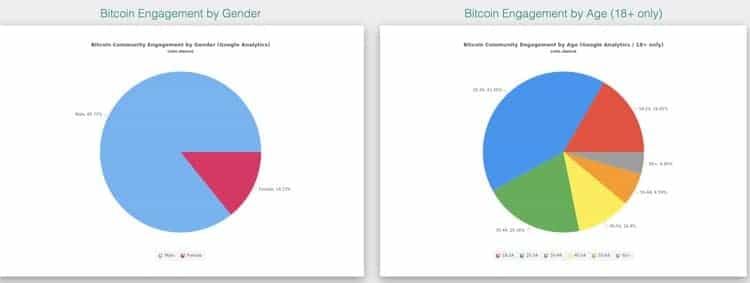

Interesting things I like to look at are those statistic that tell me about the wider adoption. Two in particular that I like to look at is Bitcoin by gender and Bitcoin by age. Currently Bitcoin is highly dominated by men so for those men reading this article try to get your better half to join us. And on the age thing, you should really try to get those elderly in on this too. It’s never too late to join a revolutionizing industry. And hey, they’re going to need those gains in order to fully enjoy retirement. Jokes aside, in order for cryptos to go mainstream we need to educate those who have no way of knowing what this whole crypto thing is. Regardless of age and gender everyone is needed and each of you can start by introducing cryptos to family and friends. And importantly, don’t just talk about the huge gains try to explain all the benefits since just entering because of 100x gains isn’t the right reason.

Then back to Coin Dance for one last thing. Look at the adoption by country. This is an interesting statistic and you’ll see that countries with a weak currency are likely to adopt Bitcoin, look at Venezuela. Also, it’s interesting to see each country’s view on crypto and CoinDance have even listed which parties support Bitcoin in certain countries.

1. CryptoQuant

Again, a site filled with extremely important metrics. CryptoQuant offers data on Bitcoin, Ethereum, Stablecoins, and then generally on Altcoins. This data consists of market data, on-chain data, and exchange flows.

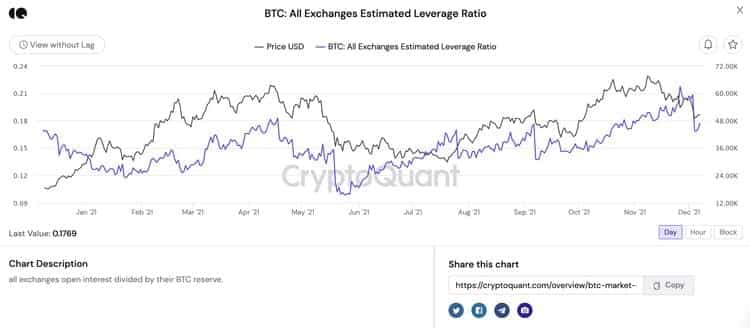

Getting right into certain picks here, one metric suited for the current situation is all exchanges estimated leverage. In the recent crash (December 2021) that took Bitcoin all the way down to $42k we saw the leverage drop significantly due to liquidations. Now, the price has started to rebound while the leverage has stayed relatively low. I would argue that this is extremely bullish since the leverage was rising constantly for a longer time and now we’ve shaken out a lot of over leveraged people, the rise in prices is on more sustainable ground I would say.

Another thing to look at is all exchanges reserves. You’ve probably heard Guy on Coin Bureau mention that we’ll see high volatility in the markets due to low liquidity on exchanges and this is true. However, now you don’t have to wait for Guy to say this since you can check this yourself on CryptoQuant. If you don’t now have the time to check I can quickly tell you that it’s extremely low, so, expect volatility.

Lastly, if you’re wondering on the cost, I’ll be happy to tell you that to access those statistics I mentioned plus lots more it’s completely free. You just have to create an account. If you need more, then they have an advanced plan for $39 a month (if billed monthly) that includes more accurate on-chain indicators. On top of that there’s the professional plan for $109 a month and a premium plan for $799 a month. I would argue that the best way to go is starting free and then if you feel that it’s necessary upgrade to the advanced plan. Those other two might be a bit too expensive, especially if you want to get some other tools on this list.

Bonus Tip: Telegram can also be a very powerful tool that you can use to keep your finger on the pulse of what is happening in Crypto. Feel free to check out our picks for the Top Ten Crypto Telegram Channels for some additional arrows in your quiver of research tools.

Conclusion

As I mentioned with LunarCrush you shouldn’t be relaying on just one of these tools and not even only those mentioned in these lists. There’re tons more useful tools and doing research also includes looking at the project site, including reading the complete whitepaper. These tools are just meant to enhance the analysis and using them in combination which each other makes them more powerful. Naturally, you have a higher chance of picking the right investment if five sites give you a buy impression rather than just one giving that. Also, these sites listed here are in no particular order since all of them are good with different use cases. But, enough said, take the things you learned here and head on out to do your own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.