Fantom Review: DAG Based DeFi Powerhouse

Blockchain technology is designed to transfer value between entities in a decentralized network. However, the high costs and slow confirmation times associated with blockchain transactions have led to the emergence of blockchain modularity as a solution. Fantom, a layer1 blockchain project, believes in the traditional monolithic approach, optimized to remove technical limitations. It leverages the Lachesis aBFT protocol and Directed Acyclic Graph data structures to achieve faster transactions than Ethereum, with over 2000 transactions per second. Fantom is a DAG-based distributed ledger and smart contracts platform that aims to alleviate scalability bottlenecks. The protocol consists of the Lachesis consensus protocol, which is leaderless and nonlinear, and Fantom Sonic, an upgrade that offers improved virtual machine, data management, and Lachesis protocol. Fantom offers a range of DeFi services, including trading, staking, lending, and borrowing, with near-zero fees and instant transactions. The Fantom team has built a robust technology stack, including the Lachesis aBFT consensus protocol and DAG data structures, and has recently released Fantom Sonic for greater scalability and efficiency. The team has undergone some changes, with Michael Kong as the current CEO and Andre Cronje as the DeFi architect. The FTM token is used for staking and as a reward for witness nodes. Fantom held its ICO in June 2018 and is listed on several exchanges. Storing FTM tokens requires different wallets based on the token version (ERC20, BEP2, or native Opera).

Overall, Fantom is a promising project that aims to address scalability challenges and provide a robust infrastructure for smart contracts and decentralized applications (dApps) in Web3.

Blockchain technology is designed to transfer value between entities in a decentralized network. However, the high costs and slow confirmation times associated with blockchain transactions have led to the emergence of blockchain modularity as a solution. Fantom, a layer1 blockchain project, believes in the traditional monolithic approach, optimized to remove technical limitations. It leverages the Lachesis aBFT protocol and Directed Acyclic Graph data structures to achieve faster transactions than Ethereum, with over 2000 transactions per second. Fantom is a DAG-based distributed ledger and smart contracts platform that aims to alleviate scalability bottlenecks. The protocol consists of the Lachesis consensus protocol, which is leaderless and nonlinear, and Fantom Sonic, an upgrade that offers improved virtual machine, data management, and Lachesis protocol. Fantom offers a range of DeFi services, including trading, staking, lending, and borrowing, with near-zero fees and instant transactions. The Fantom team has built a robust technology stack, including the Lachesis aBFT consensus protocol and DAG data structures, and has recently released Fantom Sonic for greater scalability and efficiency. The team has undergone some changes, with Michael Kong as the current CEO and Andre Cronje as the DeFi architect. The FTM token is used for staking and as a reward for witness nodes. Fantom held its ICO in June 2018 and is listed on several exchanges. Storing FTM tokens requires different wallets based on the token version (ERC20, BEP2, or native Opera).

Overall, Fantom is a promising project that aims to address scalability challenges and provide a robust infrastructure for smart contracts and decentralized applications (dApps) in Web3.

Editor's Note: Fantom has rebranded to Sonic. You can check out our full Sonic blockchain review here.

Blockchain technology is designed to move value from one entity to another over a network of established digital trust between users spread worldwide. The value blockchain technology can transfer may be in the form of storage space or general compute without centralized institutions like moderators and middlemen.

Over the years, Web3 users have realized that this digital commodity is expensive to operate; blockchain transactions are known to incur exorbitant gas costs and often have sluggish confirmation times.

A prominent workaround for this bottleneck has been blockchain modularity. Modularity is the practice of splitting the blockchain core operations across multiple networks, like layer-2 chains. Dividing the load makes the cohesive system significantly more scalable and efficient.

However, while Ethereum embraces its transition to modularity, some blockchain projects believe the traditional monolithic approach, when optimized to remove its technical limitations, can prove a more robust system.

Fantom (FTM), the focus of this piece is one such layer-1 blockchain project that believes in the superiority of monolithic designs. Fantom leverages the Lachesis aBFT protocol and DAG (Directed Acyclic Graph) data structures to build a consensus protocol that is much faster than Ethereum.

In recent developments, the team released an update dubbed Fantom Sonic. This update features an improved virtual machine, new data management techniques, and improvements to the Lachesis protocol that allow Fantom to achieve over 2,000 TPS. In this Fantom review, we will unpack all aspects of the Fantom protocol.

What is Fantom?

Fantom is a DAG-based distributed ledger and a smart contracts platform that aims to alleviate the scalability bottlenecks of traditional monolithic blockchain networks by making the coordination between the nodes more efficient.

The Fantom protocol consists of the Lachesis consensus protocol, an asynchronous consensus protocol that stands out by being leaderless and non-linear. The Fantom network aims for all users to benefit from quick transactions and near-zero transaction costs in applications built on Fantom Sonic, a new application layer upgrade to the Fantom chain.

Fantom History

The Fantom Foundation, founded in December 2018, launched alongside Fantom's mainnet, OPERA (now Sonic). The team includes developers, lawyers, project managers, and other specialists. Notable members are CEO Michael Kong and CTO Quan Nguyen. Fantom's consensus layer, Lachesis, can extend to other layers, forming the foundation for multiple blockchain layers. The first new layer, Opera, is an EVM-compatible smart contract platform released in December 2019. Opera uses Proof-of-Stake (PoS) with a Lachesis-based validator set.

In May 2019, Fantom announced a collaboration with Binance Chain to create a multi-asset and cross-chain ecosystem for improved interoperability. This plan includes adopting new token standards like Fantom versions of Ethereum’s ERC-20 and Binance Chain’s BEP-2, facilitating the integration of Ethereum applications into Opera by early 2021.

Fantom DeFi

As proof of Fantom's flexibility, the team was able to pivot quickly and make Fantom DeFi capable. Fantom promises to be the all-in-one DeFi suite for all users. Its EVM-compatible blockchain gives users the ability to mint, trade, lend, and borrow digital assets directly from their wallets. All of this comes with near-zero fees and instant transactions. This is DeFi for everyone.

Fantom's Opera mainnet was created using the DAG-based Lachesis consensus protocol, which supports EVM-compatible smart contracts. This allows Fantom users to execute smart contracts on the network, making DeFi ideal on Fantom.

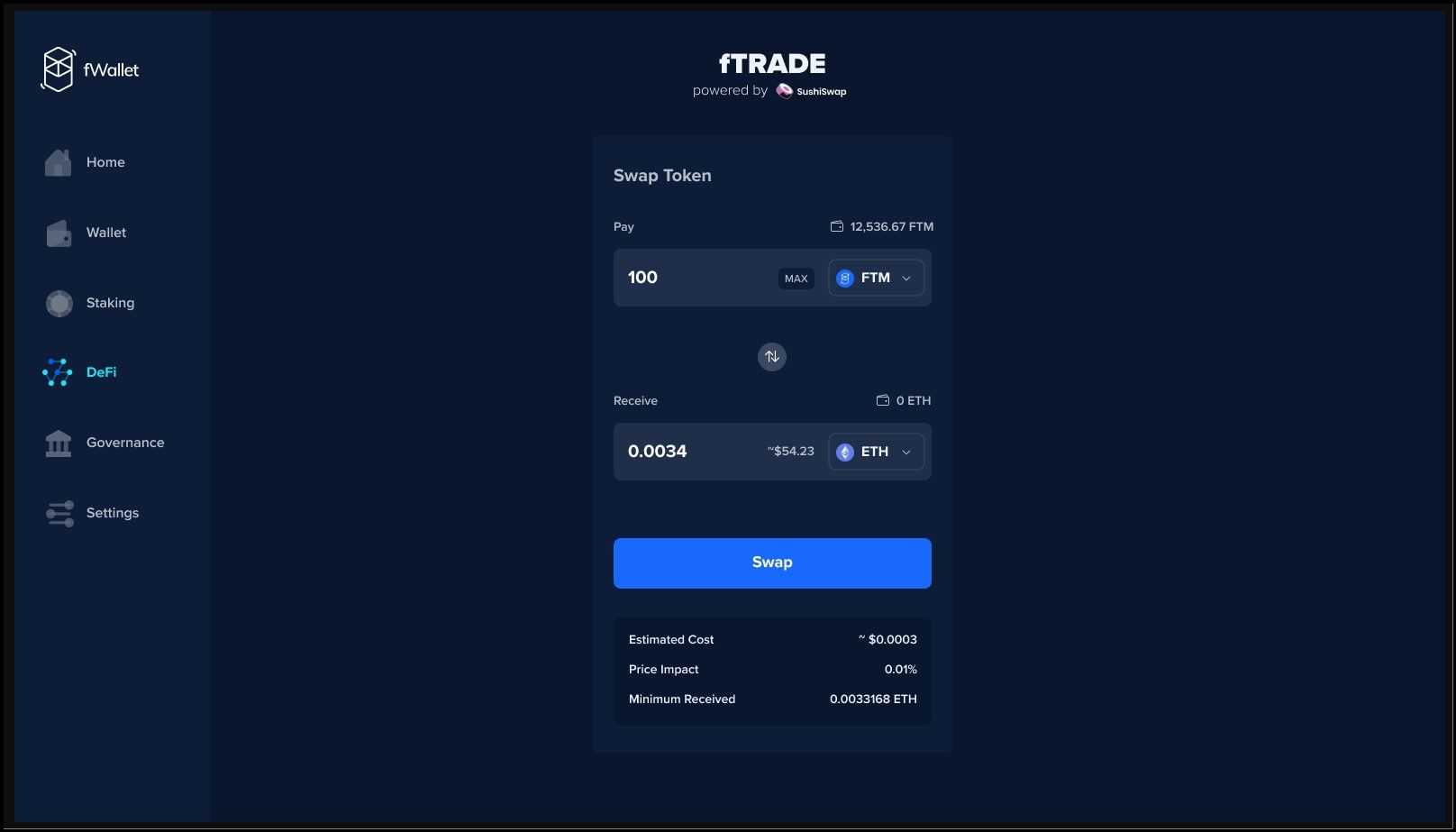

Fantom has worked hard to deliver a superior solution for DeFi and trading. What initially was a collection of separate products was later concatenated under Fantom Finance. Users can access various DeFi services like trading and staking with the Fantom fWallet, which supports the following operations:

- Liquid staking - Use staked FTM tokens as collateral for DeFi applications. All FTM delegations are liquid within the Fantom ecosystem.

- fMint - You can mint dozens of synthetic assets on Fantom, including cryptocurrencies, national currencies, and commodities.

- fLend - Lend and borrow digital assets to trade and earn interest without losing exposure to held FTM.

- fTrade - Trade Fantom-based digital assets without leaving the wallet. This makes for a fully non-custodial and decentralized AMM exchange.

In recent updates, Fantom diverged from maintaining separate Dapps for each of its services and instead opted to aggregate with DeFi. As a result, trading on Fantom, fTrade is now powered by SushiSwap.

Similarly, lending and borrowing on Fantom is powered by another DeFi application named C.R.E.A.M.

Thanks to the DAG technology used in Fantom, it is superior to many other DeFi platforms. Fantom benefits from its short confirmation time that provides finality in under 2 seconds, and from its low fees.

Fantom Technology

The Fantom technology stack comprises the following essential components:

- Lachesis aBFT consensus protocol.

- DAG (Directed Acyclic Graph) data structures.

- Fatom Sonic application layer, an upgrade to the former OPERA layer.

Lachesis Consensus

Lachesis is the consensus algorithm of the Fantom protocol. It is designed to offer high throughput, fast finally, and new-zero transaction fees. Lachesis is an asynchronous Byzantine Fault Tolerant (aBFT) consensus protocol, which is unlike a typical PoS protocol like Ethereum, which is synchronous.

Key Concepts and Components:

- Asynchronous: Lachesis does not require all the nodes to reach consensus simultaneously. This means that different nodes may validate several potential blocks at any time. Blocks achieve consensus gradually over time.

- Byzantine Fault Tolerance: The protocol can tolerate up to one-third of faulty or malicious nodes without compromising the integrity of the network. This ensures robustness and security against attacks.

- Directed Acyclic Graph (DAG):

- Due to the asynchrony, a node may receive parts of data about several blocks from different nodes at the same time. DAG is a web-like data structure that enables the nodes to appropriately timestamp and order the transactions in a coordinated common order.

- In Lachesis, transactions are recorded in a DAG structure where each node (vertex) represents a transaction, and edges represent dependencies between transactions.

Asynchronous Byzantine Fault Tolerance (aBFT)

Asynchronous Byzantine Fault Tolerance (aBFT) allows transactions to be processed without requiring all nodes to communicate and agree simultaneously. In an asynchronous system, nodes can operate independently and handle different parts of the network without waiting for a global synchronization point. This reduces the time needed for transaction confirmation and increases the system's overall efficiency and fault tolerance.

Difference from Synchronous Systems:

- Ethereum (Synchronous System): Ethereum, like other traditional blockchains, operates synchronously, meaning all nodes must reach a consensus simultaneously. This requires global synchronization, where blocks are added one at a time, and all nodes must validate each block before it is added to the chain. This process can lead to slower transaction times and higher energy consumption because all nodes must participate in the consensus process for each block.

- Asynchronous Systems: In contrast, asynchronous systems do not require nodes to reach consensus simultaneously. Transactions can be confirmed independently, and consensus can be achieved without waiting for a global state. This leads to faster transaction processing, higher throughput, and improved scalability.

Besides making networks particularly resilient to DDoS attacks, aBFT also lowers the transaction’s latency, resulting in a faster network.

Finally, aBFT networks allow for greater scalability and decentralization since there isn’t excessive communication to limit the number of participating nodes.

How does Lachesis work?

The Lachesis protocol is a consensus algorithm used by Fantom. It is designed to be asynchronous and Byzantine Fault Tolerant, meaning it can reach consensus even if some nodes act maliciously or fail.

Key Features:

- Asynchronous: Nodes do not need to reach consensus simultaneously, allowing for faster transaction processing.

- Byzantine Fault Tolerance: The protocol can handle up to one-third of nodes behaving maliciously or failing without compromising the network's security or performance.

- Leaderless: There is no single leader node that coordinates the consensus, reducing the risk of centralization and single points of failure.

- High Throughput: The protocol supports high transaction throughput due to its asynchronous nature, enabling the network to process a large number of transactions per second.

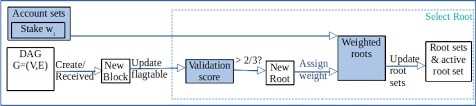

Lachesis Consensus Cycle:

- Event Blocks:

- Nodes create event blocks by executing batches of transactions and referencing the previous event block they encountered.

- Then, nodes broadcast the event block, which also includes a timestamp to help determine its position in the chronology.

- Gossip Protocol:

- Nodes use a gossip protocol to share the event blocks with other nodes, creating a DAG structure and spreading it rapidly across the network.

- DAG Updations:

- Each node maintains a local DAG. As they receive new event blocks, they validate the included transactions and update their DAG by adding the new events.

- Consensus Process:

- The reference acts as a validator's vote for any event block.

- When an event block collects a majority of references in a node's DAG, the node considers it final and concludes the consensus.

- The consensus process does not require global synchronization as blocks achieve finality gradually as DAGs progress.

An interesting result of Fantom's asynchronous and leaderless design is its MEV resistance. Fantom blockchain's asynchronous nature ensures nodes validate different blocks simultaneously, which makes manipulating the order of transactions very difficult for any node.

StakeDag

StakeDag is one innovation that leverages participants’ stake as validating power to achieve practical BFT in a leaderless asynchronous system. The StakeDag protocol extends the Lachesis protocol to use layer assignment on the DAG to achieve quick consensus with a more reliable ordering of final event blocks.

The benefits of StakeDag are two-fold:

- StakeDag protocol is fair because every node has an equal chance to create a new event block.

- It has fewer vulnerabilities than PoW, PoS, and dPoS.

Fantom Sonic

Fantom Sonic is the latest upgrade to the protocol that will replace the OPERA application layer. It is designed for greater scalability, improved data storage, and an optimized virtual state machine for the Fantom Protocol.

Key Features of Fantom Sonic

- Performance and Scalability:

- Transactions per Second (TPS): Sonic is designed to handle over 2,000 transactions per second.

- Finality: Transactions achieve finality in approximately one second, ensuring quick and irreversible processing.

- Fantom Virtual Machine (FVM):

- Enhanced Execution: The FVM significantly improves execution performance compared to the Ethereum Virtual Machine (EVM). It can process over 65 times more transactions per second.

- EVM Compatibility: The FVM converts EVM bytecode seamlessly, allowing existing smart contracts written in Solidity or other EVM-compatible languages to run without modification.

- Optimizations: The FVM employs super instructions to bundle common operations, reducing execution time and caching mechanisms for cryptographic hashing and jump destination analysis, further enhancing performance and security.

- Carmen Database Storage:

- Reduced Storage Requirements: Carmen uses flat storage structures instead of traditional tree-like structures, reducing node storage needs by up to 90%.

- Live Pruning: Validators can discard historical data no longer needed without going offline, maintaining continuous operation and reducing storage costs.

- Lachesis Consensus Mechanism:

- Improved Transaction Pool: The upgraded Lachesis protocol enhances transaction pool management, contributing to faster and more efficient processing.

- Testnet and Mainnet Launch

- Testnet Stages: Fantom Sonic has two testnets:

- Closed Testnet: Showcases the maximum theoretical limits of Sonic.

- Builders Testnet: Interactive, allowing developers and users to deploy dApps and experience the system.

- Mainnet Release: Sonic is expected to roll out as the mainnet in spring 2024, replacing the Fantom Opera mainnet without requiring a hard fork. Existing smart contracts and tools will remain compatible with the new system.

- Testnet Stages: Fantom Sonic has two testnets:

Advantages of Fantom Sonic

- High Throughput and Low Latency: Sonic significantly improves transaction speeds and network efficiency by allowing it to process thousands of transactions per second and achieve near-instant finality.

- Cost Efficiency: Reduced storage requirements and optimized execution processes lower the operational costs for validators and developers.

- Seamless Transition: The compatibility with existing EVM-based tools and contracts ensures a smooth transition from Fantom Opera to Sonic without disruptions.

The Fantom Team

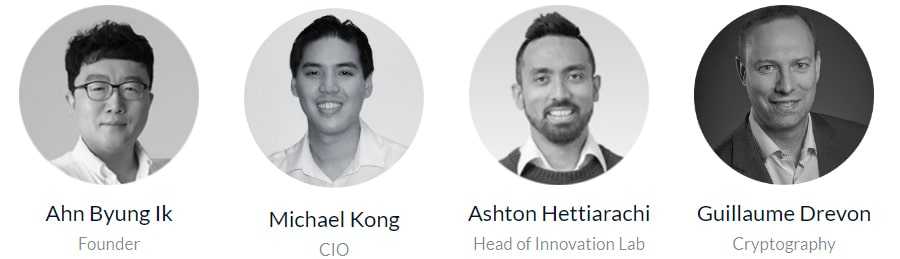

The team behind Fantom has undergone some changes since its earliest days. The technical team is comprised of 12 platform developers. There are additionally several management personnel, community outreach members, marketing members, and directors of various regions.

The founder of Fantom is Dr. Ahn Byung Ik. He holds a Ph.D. in computer science and is also the president of the Korea Food-Tech Association. Dr. Ahn is a contributing author at Fortune magazine and has frequently been published in South Korea’s major business media outlets.

Previously he founded the food-tech platform SikSin, which is similar to Yelp. That platform has over 22 million monthly page views, and the mobile app has been downloaded over 3.5 million times.

However, he is no longer associated with Fantom, and his LinkedIn profile does not mention any past connection with the project.

Michael Kong,who has several years of experience in the blockchain space as a smart contract developer, is taking over as CEO at Fantom. He has also continued as Chief Information Officer. Before joining Fantom, he was the Chief Technology Officer for the blockchain incubator Block8. He also built one of the first Solidity decompilers and one of the first detectors for vulnerabilities in smart contracts.

Also very notably at Fantom is the DeFi architect Andre Cronje, who is well known as the developer of Yearn Finance.

The rest of the team consists of highly successful, motivated, and experienced members from various disciplines, including finance, cryptography, business development, software engineering, architecture, and related disciplines.

Fantom Token FTM

The FTM token was originally an ERC-20 token used for staking and to reward Fantom witness nodes. BEP-2 and Xar Network versions were also created to enhance the network's interoperability. When the mainnet was released in December 2019, a bridge was created to allow the conversion of other tokens to the native Opera FTM token. Even so, Binance only recently (March 1, 2021) completed the wallet integration for the native FTM token. Binance also continues to support both the ERC-20 and Bep-2 FTM tokens.

Fantom held its ICO in June 2018, selling 40% of the total supply of 3,175,000,000 FTM tokens. The ICO price was $0.04306, and the team raised $39,650,000.

Unfortunately, it took several months for the tokens to be issued, and by that time (October 2018) the market was deep into bear territory, leading to an initial price around the $0.02 level, or half of the ICO price.

Fantom performed exceptionally well in the 2021 bull run, hitting an all-time high of $3.46 on October 28th before crashing back down with the rest of the crypto industry for the 2022-2023 crypto winter. As the markets recover in 2024, we see renewed interest in FTM with a series of bullish-looking higher lows, showing positive price action.

Buying & Storing FTM

As a popular cryptocurrency project, FTM is listed on quite a few reputable exchanges. We recommend:

Once you have bought your FTM tokens then the wise move would be to get them off the exchange and into a secure wallet. Because there are now three versions of FTM you need to know which version you’re buying when deciding what wallet to store the coin in.

The older and more prevalent ERC-20 token can be stored in any ERC-20-compliant wallet, such as MetaMask or MyEtherWallet / MyCrypto. The BEP-2 token needs to be stored in a Binance chain wallet, which you need to create before you can use the Binance Bridge to convert the ERC-20 tokens to BEP-2 tokens. The native Opera FTM token is supported by the following wallets:

- fWallet

- Ledger

- Trust Wallet

- Coinbase wallet

Conclusion

Fantom is not the only project that chose DAG technology as the path to scalability. IOTA and Nano were some of the first DAG-based projects, and both Constellation and Hedera Hashgraph use smart contracts similar to Fantom's architecture.

Fantom promises to add value through its addition of infrastructure supporting smart contracts and dApps, which could give it a leg up over projects like IOTA and Nano, which didn’t launch with smart contract functionality, although IOTA now has a separate layer that provides smart contract functionality. The solid performance of the IOTA token gives hope that investors will also see the value in Fantom.

Fantom is also a solid monolithic solution. While layer-2 networks circumvent the scalability trilemma by going modular, projects and Fantom and Solana are successful examples of high-performance monolithic designs. Delivering high transactions per second and low fees is certainly helping Fantom increase its acceptance in some industries and will push it closer toward enterprise adoption.

Of course, enterprise adoption is the goal of many blockchain projects, and Fantom, like all the others, remains open to the question of when such adoption might become a reality. That said, the Fantom team has the expertise, knowledge, and drive to succeed in the race for the ultimate blockchain solution in Web3.

Frequently Asked Questions

Fantom is unique due to its Lachesis consensus mechanism, which is an asynchronous Byzantine Fault Tolerant (aBFT) protocol. This allows the network to process transactions independently and achieve high scalability without requiring synchronization. The use of Directed Acyclic Graph (DAG) technology enables parallel processing of transactions, resulting in high throughput and near-instant finality. Additionally, Fantom's ecosystem supports a wide range of applications, from DeFi to enterprise solutions, and is fully compatible with Ethereum's EVM, ensuring seamless integration and interoperability with existing blockchain projects.

FTM, the native token of the Fantom network, serves multiple purposes. It is used for transaction fees, staking, and governance. By staking FTM, users can participate in the network's consensus mechanism, securing the network and earning rewards. FTM is also used for on-chain governance, allowing holders to vote on important network decisions and proposals. Additionally, FTM facilitates interactions within the Fantom ecosystem, enabling users to access decentralized applications (dApps) and DeFi services.

A Directed Acyclic Graph (DAG) is a data structure used in blockchain technology to record transactions in a non-linear manner. Unlike traditional blockchains that create blocks in a linear sequence, a DAG allows multiple transactions to be processed concurrently. Each node (or vertex) in a DAG represents a transaction, and edges indicate dependencies between transactions. This structure enables high scalability and efficiency, as it reduces the need for global synchronization and allows for faster transaction processing and confirmation times.

Fantom Sonic is the latest iteration of the Fantom blockchain, designed to provide unparalleled scalability, speed, and efficiency. Sonic introduces a new virtual machine (FVM) that outperforms the Ethereum Virtual Machine (EVM), significantly increasing transaction throughput. The Carmen database storage system reduces storage requirements by up to 90%, enhancing cost efficiency and performance. Sonic also includes an optimized Lachesis consensus mechanism, improving transaction pool management. With over 2,000 transactions per second and one-second finality, Sonic represents a major advancement in blockchain technology.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.