Solana Review: In-depth Analysis of the Scalable Blockchain

Solana is a cryptocurrency project that offers a unique approach to blockchain technology. Its focus is on introducing a decentralized clock to the blockchain, which significantly increases its efficiency. The project was founded by Anatoly Yakovenko, who realized the potential of timestamping transactions to improve scalability without sacrificing security or decentralization. Solana is a high-performance blockchain that supports smart contracts and decentralized applications. With its proof-of-stake consensus mechanism and timestamped transactions, Solana can process up to 65,000 transactions per second, making it much faster than Bitcoin or Ethereum. The Solana team includes former employees of Qualcomm, Google, Apple, Microsoft, and Dropbox, and the project is based on similar database technologies used by Google and Microsoft. Solana's architecture is also inspired by Filecoin, a decentralized data storage cryptocurrency project. The project has several unique features, including Proof of History (PoH), Sealevel technology, and Gulf Stream. PoH involves timestamping transactions, while Sealevel enables the processing of multiple parallel smart contract runtimes on a chain. Gulf Stream allows for the prediction of upcoming leaders to enhance transaction processing speed. Solana has also developed Firedancer, an independent validator client that aims to improve the blockchain's performance and scalability. With Firedancer, Solana could potentially achieve transaction speeds surpassing those of Visa. Solana has made efforts to address concerns about centralization by onboarding three additional validator clients and increasing the number of block-producing validators on the network. The project has also measured its carbon footprint in real-time, demonstrating its commitment to sustainability. Solana has partnered with tech giants like Google, Amazon, and Visa, and its native cryptocurrency, SOL, is used for trading, payments, and staking. SOL token holders can help secure the network and earn rewards. The price of SOL has seen significant growth and consolidation, making Solana one of the top-performing assets. Solana offers several wallet options and has collaborated with Chainlink, Tether, and Shopify, among others. The project has embraced AI integration and announced the upcoming release of the v1.14 upgrade, which includes features like estimated fees and improvements to the staking program. Despite concerns about the emission schedule of SOL tokens and competition from other blockchain projects, Solana has demonstrated resilience, decentralization, and a commitment to the NFT and DeFi narratives.

Overall, Solana is a promising project with strong backing, a focused team, and impressive technological advancements.

Solana is a cryptocurrency project that offers a unique approach to blockchain technology. Its focus is on introducing a decentralized clock to the blockchain, which significantly increases its efficiency. The project was founded by Anatoly Yakovenko, who realized the potential of timestamping transactions to improve scalability without sacrificing security or decentralization. Solana is a high-performance blockchain that supports smart contracts and decentralized applications. With its proof-of-stake consensus mechanism and timestamped transactions, Solana can process up to 65,000 transactions per second, making it much faster than Bitcoin or Ethereum. The Solana team includes former employees of Qualcomm, Google, Apple, Microsoft, and Dropbox, and the project is based on similar database technologies used by Google and Microsoft. Solana's architecture is also inspired by Filecoin, a decentralized data storage cryptocurrency project. The project has several unique features, including Proof of History (PoH), Sealevel technology, and Gulf Stream. PoH involves timestamping transactions, while Sealevel enables the processing of multiple parallel smart contract runtimes on a chain. Gulf Stream allows for the prediction of upcoming leaders to enhance transaction processing speed. Solana has also developed Firedancer, an independent validator client that aims to improve the blockchain's performance and scalability. With Firedancer, Solana could potentially achieve transaction speeds surpassing those of Visa. Solana has made efforts to address concerns about centralization by onboarding three additional validator clients and increasing the number of block-producing validators on the network. The project has also measured its carbon footprint in real-time, demonstrating its commitment to sustainability. Solana has partnered with tech giants like Google, Amazon, and Visa, and its native cryptocurrency, SOL, is used for trading, payments, and staking. SOL token holders can help secure the network and earn rewards. The price of SOL has seen significant growth and consolidation, making Solana one of the top-performing assets. Solana offers several wallet options and has collaborated with Chainlink, Tether, and Shopify, among others. The project has embraced AI integration and announced the upcoming release of the v1.14 upgrade, which includes features like estimated fees and improvements to the staking program. Despite concerns about the emission schedule of SOL tokens and competition from other blockchain projects, Solana has demonstrated resilience, decentralization, and a commitment to the NFT and DeFi narratives.

Overall, Solana is a promising project with strong backing, a focused team, and impressive technological advancements.

There are over 25,000 cryptocurrencies at the time of writing. Almost all of them claim to bring something unique to the table – something which no other cryptocurrency project has done before. Many of you will know that most cryptocurrency projects have either failed to deliver on their promises or never really had anything all that special about them to begin with.

Solana does not fall into this category. It is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is so devilishly simple that it makes you wonder why you did not think of it: time. As it turns out, introducing a decentralized clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined.

A Brief History of Solana

The story of Solana begins with a sunny California beach of the same name. Solana Beach is located just 30 minutes north of San Diego, where (cryptocurrency project) Solana’s founder and CEO Anatoly Yakovenko has spent most of his life working in telecommunications. This is a bit of an understatement given that Yakovenko was instrumental in developing the technology found in all our smartphones during his 12 years at Qualcomm.

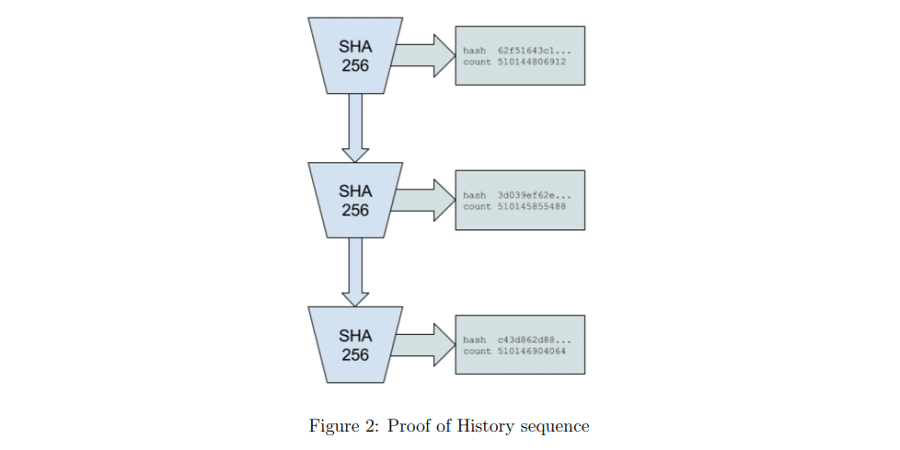

Yakovenko was initially not that interested in Bitcoin and Ethereum only slightly piqued his interest. He did, however, briefly mine Bitcoin while he was developing a deep-learning computer network. During a self-described “caffeine-induced fever dream at 4 a.m.” in 2017, he realized that Bitcoin’s hash function, SHA256, could be used to create a decentralized clock on a cryptocurrency blockchain.

Yakovenko theorized that timestamping transactions would exponentially increase the scalability of a cryptocurrency blockchain without sacrificing its security or decentralization. He knew it was possible to build since Google and Intel had both implemented similar technologies in their own databases, albeit in a centralized manner. Solana’s revolutionary whitepaper was quietly published in November 2017.

What is Solana?

Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralized applications. It uses a proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximize efficiency.

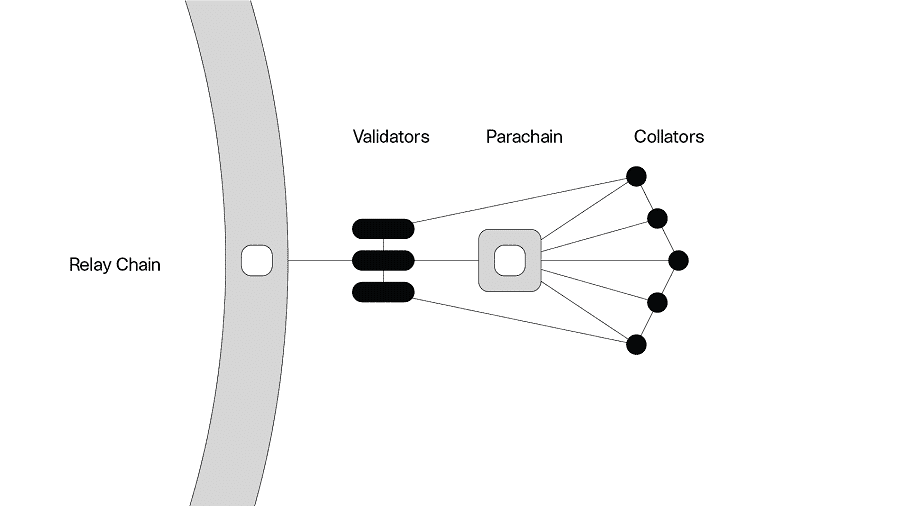

This allows Solana to process up to 65000 transactions per second (TPS). Compared to Bitcoin’s 7 TPS and Ethereum’s 30 TPS. Solana is super fast and only getting faster with innovations such as Firedancer (more on that later). In contrast to other similar projects such as Polkadot and Ethereum, Solana is a single blockchain (layer 1) and does not delegate operations to other attached chains (layer 2).

The team at Solana has designed their blockchain with a long-term vision in mind. This comes from founder Anatoly Yakovenko’s own experience watching telecommunications technologies almost double in capability every year during his time at Qualcomm.

Solana is developed by a company of the same name which is based in San Diego, California. The Solana team consists of former Qualcomm, Google, Apple, Microsoft, and Dropbox employees. In addition to being based on similar database technologies used by Google and Microsoft, Solana’s architecture is also inspired by Filecoin, a decentralized data storage cryptocurrency project.

If you want to dive deeper into the Solana ecosystem and what projects are being built, check out our Top Solana DAps article.

How Does Solana Work?

Disclaimer: Solana is incredibly complex. Let us start with a term you may have heard if you have looked at the project before: Proof of History (PoH). PoH is not a consensus mechanism. Rather, it is a component in Solana’s Proof of Stake consensus.

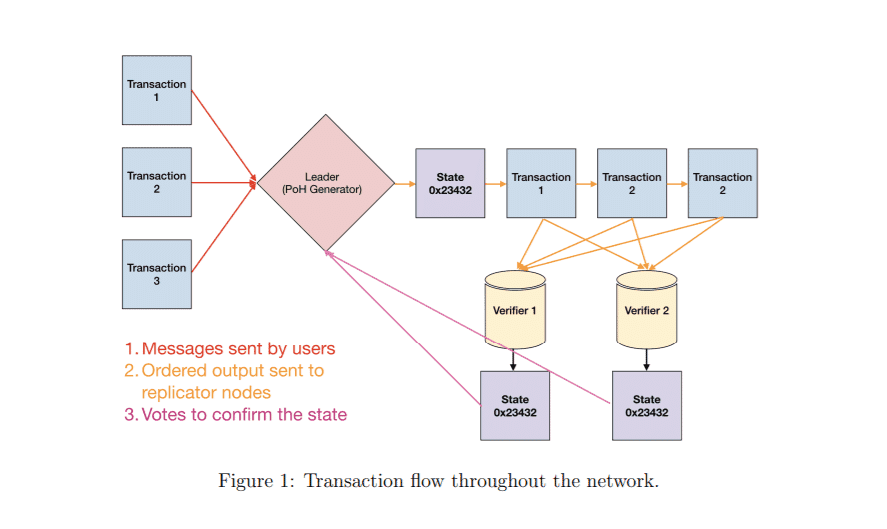

Proof-of-history (PoH) involves timestamping transactions when they are added to a Solana block. A new block on Solana is generated every 400ms (compared to Ethereum’s roughly 30 seconds and Bitcoin’s 10 minutes). Without getting into too much detail, the decentralized clock which is used as a reference for the timestamps is the SHA256 hash function. SHA256 may sound familiar because it is used in Bitcoin’s Proof of Work consensus mechanism.

However, instead of working to “solve” the hash functions to produce a new block, Solana instead uses SHA256’s repetitive outputs as reference – timestamps. This produces a sort of “clock tick” where each clock tick is 400ms (instead of one second like a regular clock).

Next, let us clear up a few misconceptions about Solana. Many sources label Solana’s consensus as Delegated Proof of Stake DPoS. This is not accurate, and the Solana team has noted this many times. It is an easy mistake to make because there are various roles on the Solana blockchain (leaders, validators, archivers, etc.).

Whereas DPoS cryptocurrencies will essentially delegate these roles among network participants, Solana does not. Simply put, all nodes on Solana play a part in fulfilling all network roles.

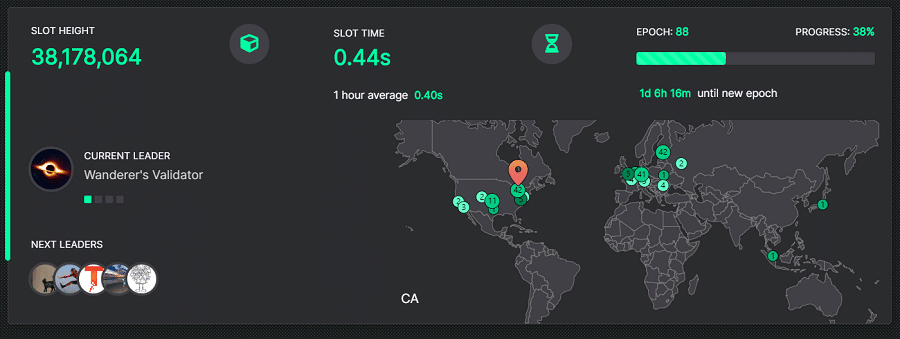

For example, Leaders on Solana are tasked with producing new blocks. Leaders rotate every 4 blocks (1.6 seconds). While a node occupies a Leader position, they basically cram as many transactions as they can into the four blocks they are producing and show these blocks containing the transactions to the relevant groups of nodes, called Solana Clusters. These nodes validate the transactions using digital timestamps as reference and then rapidly pass on the records to other relevant nodes on the network.

In contrast to other PoS cryptocurrencies, there is no minimum stake required to be a node on the Solana blockchain. For example, Ethereum node operators must stake 32 ETH, which is a considerable amount of money. Naturally, the amount of block rewards you get is proportional to the amount of SOL tokens you have staked on the network. While Leader selection is pseudorandom, the amount of SOL you stake also influences your likelihood of becoming a Leader which actually produces blocks. Misbehaving nodes see their stakes slashed and the slashed funds are added to block generation rewards.

There are in fact 8 core features which make up Solana. One of them has already been covered (Proof of History). Of the remaining 7, only 2 are worth noting for the purpose of this article. These are Sealevel and Gulf Stream.

Solana's Sealevel technology was the World's first technology to enable the processing of multiple parallel smart contract runtime on a chain, which means that the chain is more effective at processing simultaneous transactions. Gulf Stream makes it possible to know a small number of upcoming Leaders so that they can already begin accumulating transactions before they begin producing blocks.

If you are scratching your head, let us go through a simple example that should help you understand how Solana works.

Envision a small company with 180 employees. Even though there are different departments at this company (e.g. accounting, shipping and receiving, customer service), every employee knows how to do the job of every other department. Furthermore, each employee gets pseudo randomly picked to be the boss (Leader) for 1.6 hours at a time, during which they must sign incoming paperwork from the various departments.

Although which employee is picked to be the boss is partially random, every employee has a little window on their computer screen that shows them the next 10 people who will be temporarily filling the boss role. This allows them to give their paperwork to that employee before they become the boss so that they can do the work faster (Gulf Stream).

Whenever the boss signs some paperwork, it is timestamped and sent back to the appropriate department(s) (Solana node clusters) to be double checked, and if approved is added to the company database. Each department can do its own paperwork at the same time since it does not overlap (Sealevel).

Every employee has some role in storing this paperwork, in checking this paperwork, and in making sure that the boss is really doing his job and not slacking off. This is basically how Solana works.

The key takeaway about Solana is that it allocates different tasks to different nodes on the network as needed to optimize speed, and all transactions are timestamped to ensure they are correct. This means that a cluster of nodes (Solana Cluster) could be responsible for hosting a DeFi platform such as Uniswap, and another Solana Cluster could be responsible for processing microtransactions made in Decentraland's virtual world. This makes Solana scalable, fast and secure without compromise.

Solana Firedancer

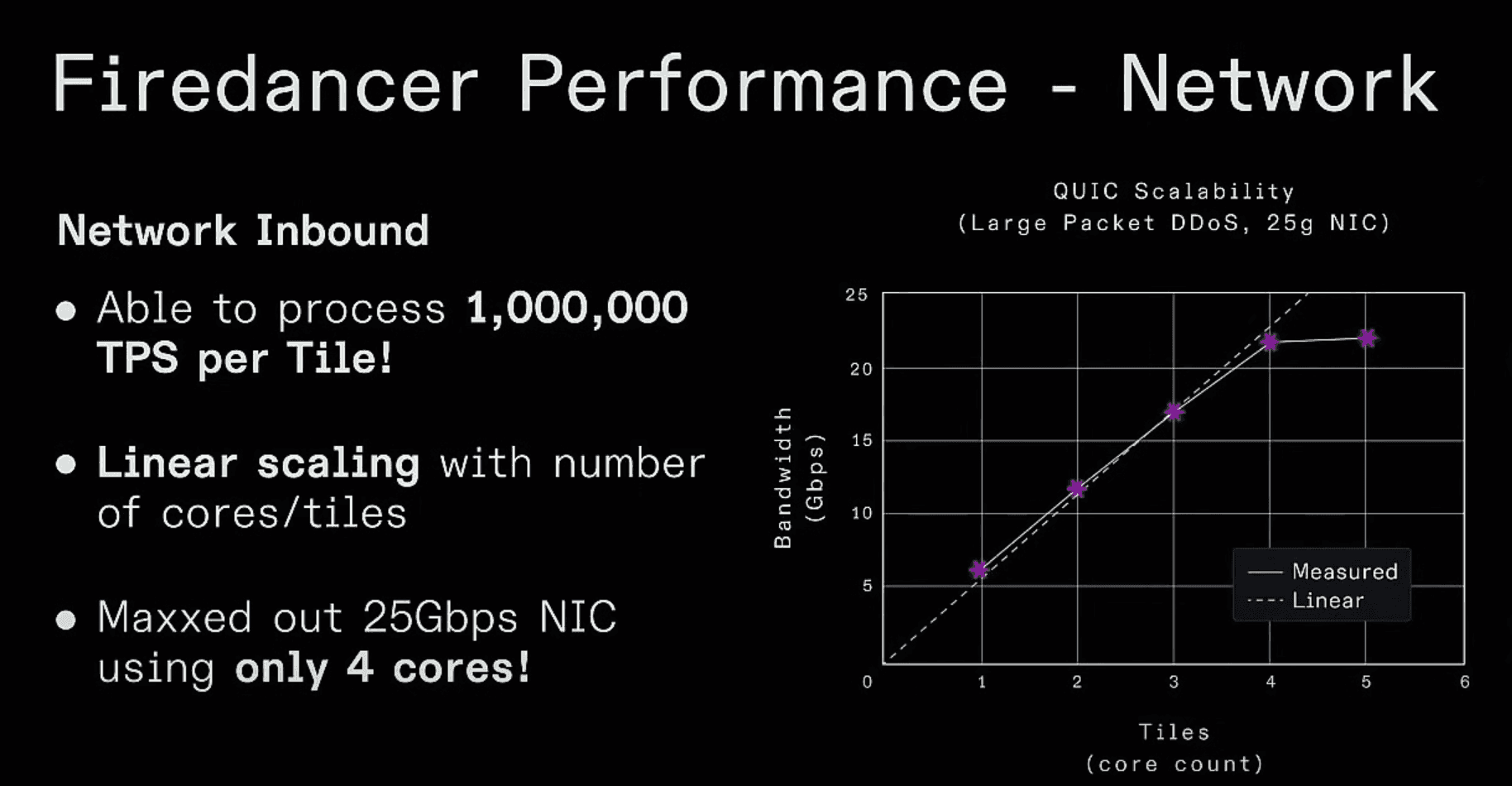

The current Solana node client faces limitations in concurrent transaction processing, restricting the number of transactions it can handle simultaneously and potentially causing slowdowns. Additionally, the client lacks support for sharding, a technique essential for horizontal scalability, hindering its ability to efficiently expand as the network grows. These limitations pose challenges to Solana's performance and scalability in handling increasing transaction volumes over time.

Enter Firedancer, an upcoming independent validator client for Solana that aims to enhance the blockchain's performance and scalability. In a November 2022 demo, it processed 1.2 million transactions per second, showcasing significant improvements. Firedancer is expected to introduce redundancy, efficiency, and potentially reduce operating costs for Solana node operators.

Among other things, Firedancer introduces:

- Sharding support: This enables horizontal scalability for the Solana blockchain as it grows, dividing the network into smaller pieces for improved efficiency.

- Enhanced consensus protocol: Firedancer uses a modified version of the Solana consensus protocol, a proof-of-stake (PoS) system, making the consensus process more efficient and reliable.

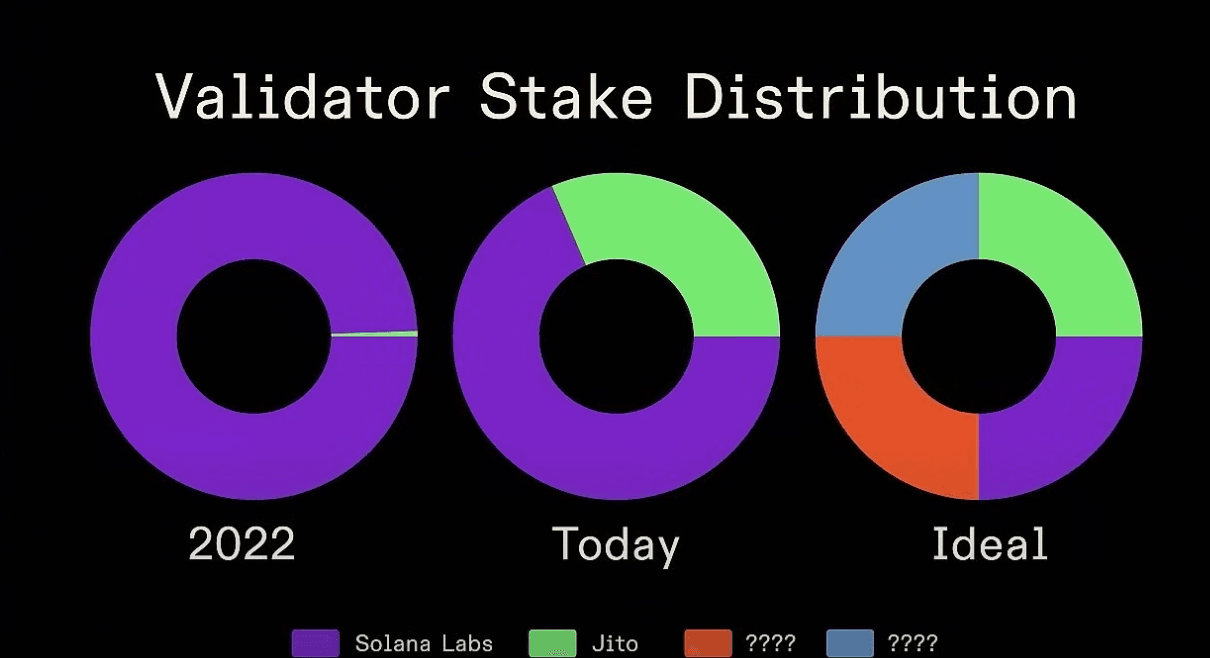

Firedancer is also contributing to Solana's network resilience. Back in 2022, there were centralization concerns regarding Solana's validator client. There was only one validator client, pushed by Solana Labs, who was responsible for pushing updates and understanding the protocol.

Ideally, the Solana project should not have a single point of failure anywhere, whether it be the protocol level, or the team that builds it, being Solana Labs. Solana is looking to have four separate validators, written by four separate teams in four separate programming languages to build multiple redundancies. Jito was brought on board, and then Firedancer, who contributes the following:

- Ground-up rewrite of Solana validator code

- Compatible with existing protocol and validators

- Written in C for high performance

- Early tests are showing 10x-100x improvement

- achieved 1M+ TPS

At Solana Breakpoint 2023, it was announced that Firedancer went live on testnet with it being forecast to be ready on mainnet in the second half of 2024. This upgrade signals a major improvement for the Solana ecosystem. Solana was initially created looking to fulfil the niche of speed and micropayments. Solana has a bold ambition to be a leader in low-cost, high-accuracy, and lightning-speed transactions that complete without failure. Solana was already far ahead of much of the competition in the space, and Firedancer looks to take Solana to the next level. If Firedancer lives up to even a fraction of its testnet results, Solana will be in a league of its own when it comes to speed and scalability.

While it is still early days for Firedancer, the performance tests show that Solana could have what it takes to consistently surpass the likes of Visa or any other blockchain when it comes to transactions per second (TPS). Perhaps one of the most impressive aspects of Solana's scalability is the potential for Firedancer to increase Solana's performance exponentially on the mainnet. There is no need for a new scaling solution every few years and sidechains, with the result being a unified Solana network, unlike the fragmented network seen with Ethereum, which has multiple layer 2s and sidechains.

In fact, Firedancer is such a technological feat that tech expert Paul Barron went as far as saying:

“If you think about what technology advancements we've made in compute power over the past two-three decades, I would put this one up there at one of the top ten for sure. What they've been able to do is pretty amazing.” (Source)

A Move Towards Decentralization

In Solana's early days, the project underwent a lot of criticism for its centralization, not only at the protocol level with a single validator node but with the Solana Labs team having all the power and the VC funding behind it.

In the blockchain trilemma, which argues that a project can either be decentralized, secure, or scalable, with it being possible to only achieve two at the sacrifice of the third, Solana sacrificed decentralization.

Solana has not only understood this concern but acted with impressive haste, onboarding three additional validator clients, Sig, JITO and Firedancer. This makes Solana the only other major blockchain along with Ethereum that has more than one live validator client.

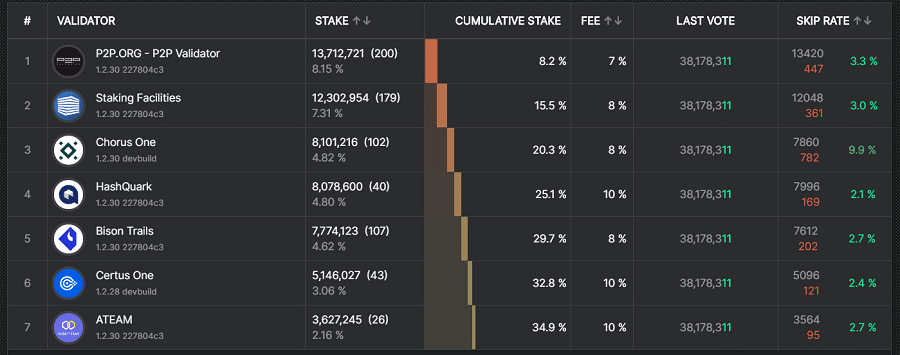

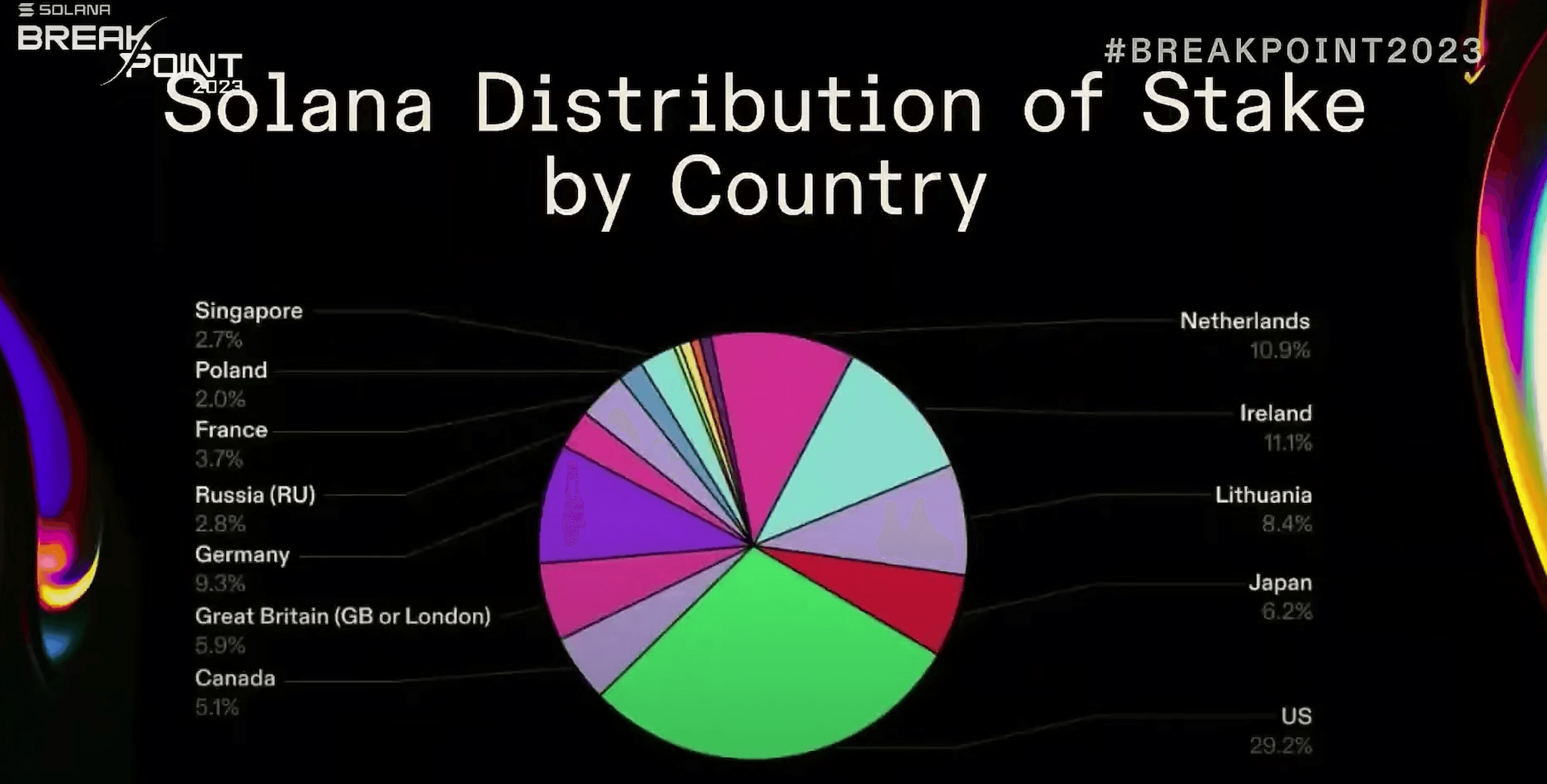

At the time of writing, there are over 2,000 block-producing validators live on Solana, a number that is steadily rising, along with the Nakamoto Coefficient. In fact, Solana has one of the highest Nakamoto Coefficients of all the proof of stake blockchains, leading to it being resilient against the risk of node operators controlling more than 33.33% of all stake on the network.

Even the Solana distribution of stake looks healthy by country:

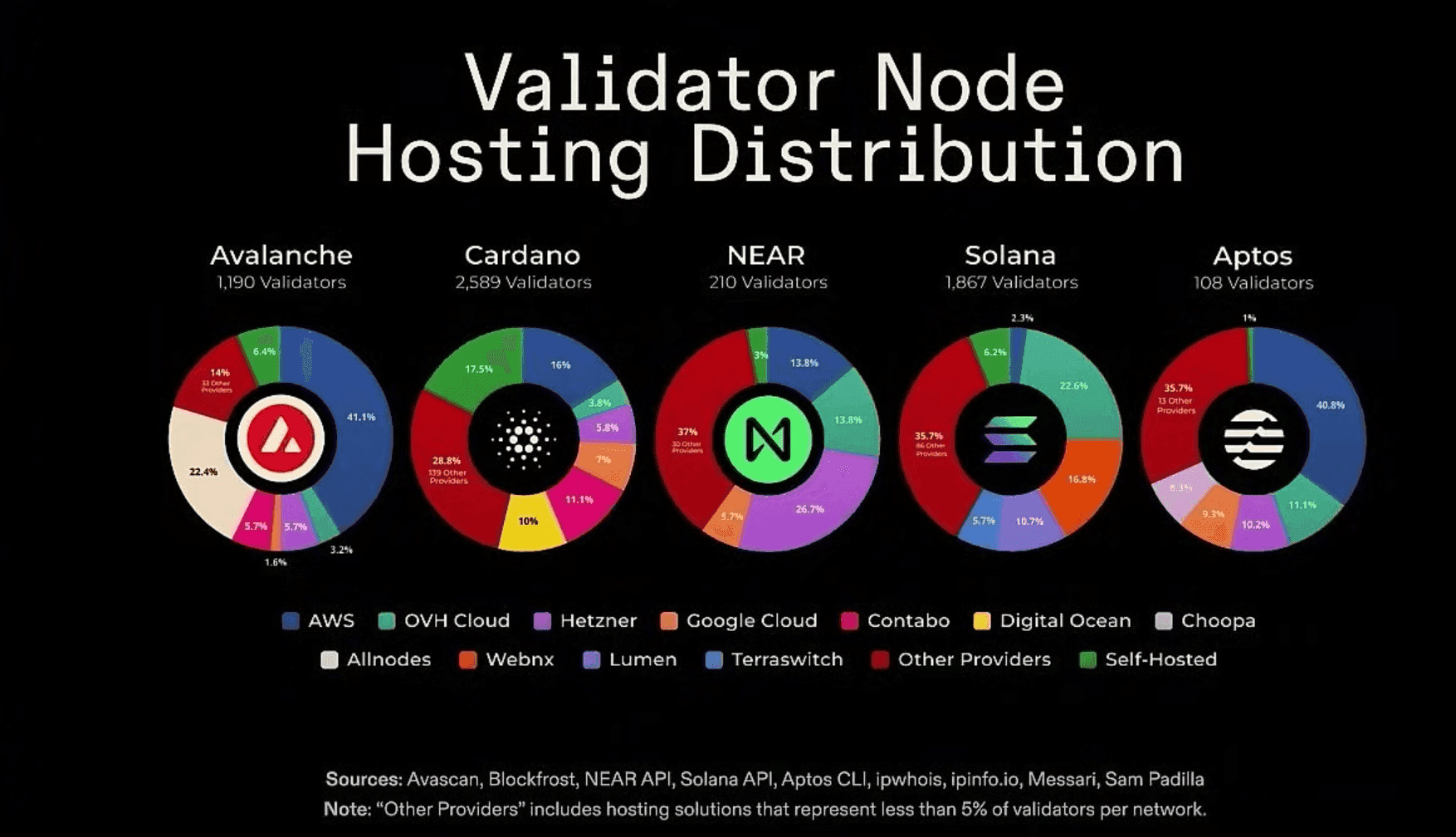

Validator node hosting distribution is also seeing improvements. This is important as it means that Solana is not over-reliant on a single data center such as AWS hosting.

Looking at the image above, we see Solana does not have close to 33% reliance on any single data center, reducing any single point of failure issues. When we first reviewed Solana in its early days, centralization was a concern. These improvements are great to see and Solana shows solid signs of being a sustainable ecosystem.

Solana and the Environment

Regardless of your stance on the ESG movement and sustainability, I think we can all agree that energy shouldn't be wasted for the sake of waste. Solana is growing increasingly attractive to users and investors who are concerned about their impact on the climate.

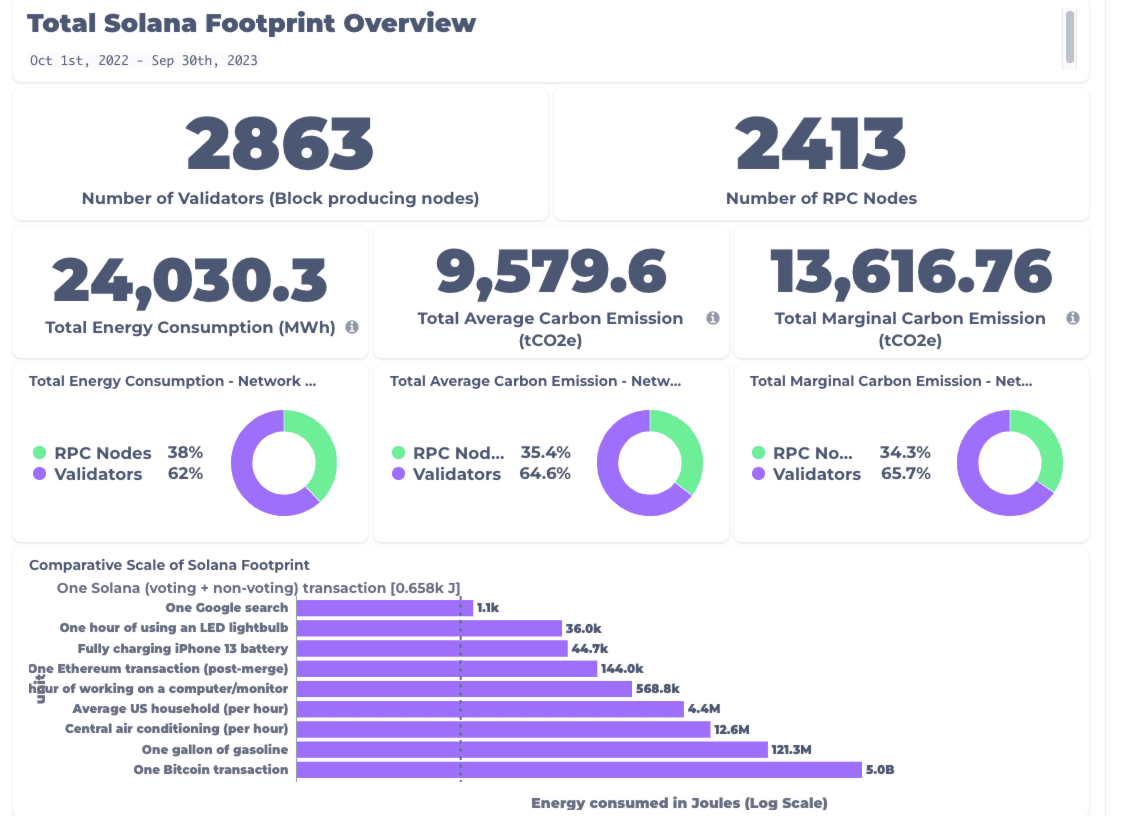

Solana was the first blockchain project to have its carbon footprint measured in real-time. Talk about transparency and having nothing to hide.

The image above shows that a single Solana transaction uses less energy than a single Google search.

It isn't just Solana's low energy use that is worth pointing out but their focus on sustainability in general.

To date, there are over 20 regenerative finance (ReFi) teams building on the network and multiple initiatives that are aiming to make the world a little greener. You can learn more about that by checking out the Solana.com/environment page.

This is not only good news for the planet, but investors as well. From 2020 to 2022, there was a three-fold increase in annual capital raised for ESG funds. This shows that the ESG narrative shows little signs of slowing down and for any firms wanting digital asset exposure, Solana could become front and center.

Solana Partners With Big Tech

Solana has formed relationships with a few small unknown startup companies called Google, Visa, and Amazon… It's probably nothing.

Partnerships with tech giants are often seen as an important milestone for a blockchain project as they not only cement the project's legitimacy, but show real-world adoption, use cases, and advancements.

Solana nodes can now be run on Amazon's AWS easily via the Node Runner App for Solana. Solana nodes can be spun up with very little friction, and the AWS Activate Program is now available with Solana Ventures, incentivizing startups to build on Solana.

Google's BigQuery also integrated with Solana for Data Analytics. This simplifies access to Solana-based data and provides more comprehensive insights into Solana's blockchain analytics. Google is also running a block-producing Solana validator on Google Cloud.

Credit card giant Visa tapped Solana, introducing settlement of the USDC stablecoin over the Solana network. This enables partners to use the Solana blockchain to send or receive settlements in USDC. This partnership isn't just for show either, Visa stated that in live pilots, that they had already moved millions of USDC between its partners over both the Solana and Ethereum networks, settling fiat-denominated payments authorized over VisaNet.

SOL Cryptocurrency

SOL is a cryptocurrency native to the Solana blockchain. It is burned to pay for fees on the Solana network. SOL can also be staked to run a blockchain node.

SOL tokens are used for trading, P2P (peer-to-peer) payments and incentives for staking SOL. If you are looking to stake Solana, check out our Solana Staking Guide and Best Pools article.

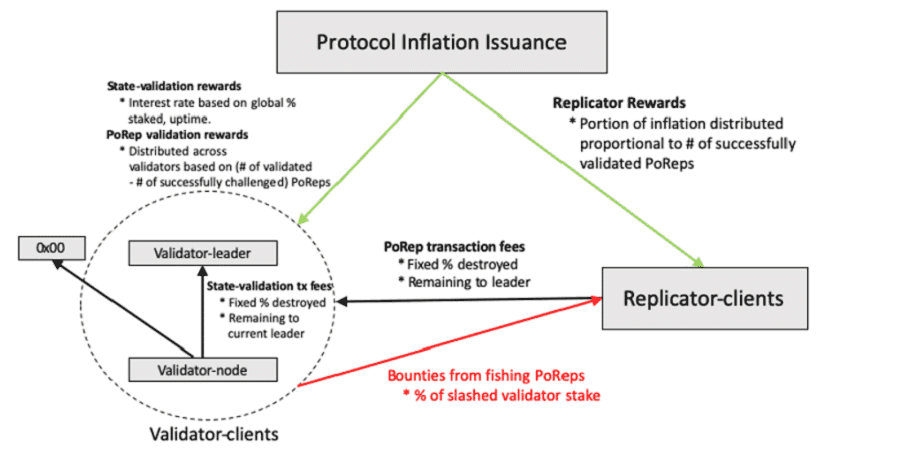

SOL token holders can help secure the Solana network and earn rewards at the current inflation rate. The yield amount depends on the number of Solana (SOL) staked, validator fees and their uptime. Solana's initial inflation rate is 8% annually. It decreases by 15% per year until it reaches a long-term fixed annual inflation rate of 1.5%.

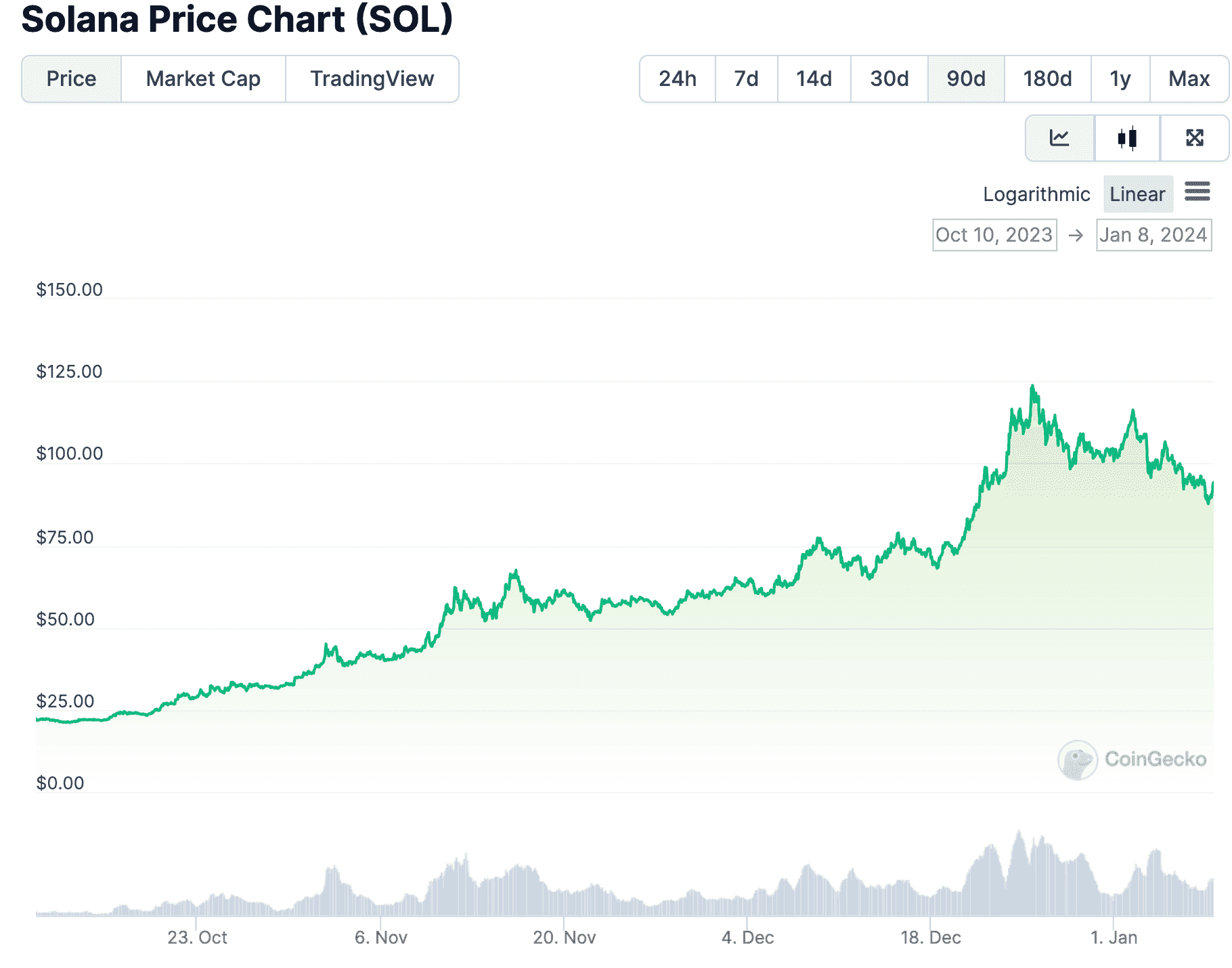

SOL Price Analysis

Solana began trading in March 2020. It is listed on CoinMarketCap as a top ten cryptocurrency with a market cap of $18.5 billion, with a total supply of 561,946,257 SOL

The price of SOL failed to gain momentum until the first ascent in early 2021. It then began an almost vertical rise in July 2021, from under $27 to an all-time high of almost $268 in November 2021.

The entire crypto market gradually declined near the end of 2021, and the price of SOL reluctantly moved with the rest of the market, which is normal price action for cryptocurrencies.

Throughout 2022, the price of Solana has been consolidating, but we have seen a series of lower highs in the back half of 2023 with an impressive rally leading up to the BreakPoint conference in October 2023. As we are entering what many are hoping is the next bull market in 2024, Solana has been one of the best-performing assets, recently passing XRP in market cap and shooting to a high of $123.

Nobody can predict when the crypto market will recover, but when it does, many Solana fans are hopeful that SOL will not only reclaim but surpass its all-time highs.

Best Exchanges to Buy Solana

If you are looking to get your hands on some sunny SOL cryptocurrency, our recommendation would be Binance, OKX, Bybit, Kraken or Coinbase sticking with the reputable exchanges with plenty of liquidity. Be sure to check out our Guide to Buying Solana in the US if you are state side and looking to pick up some SOL.

SOL Cryptocurrency Wallets

Thanks to Solana's popularity, there are some solid wallet options. Phantom wallet is Solana's answer to MetaMask, and hardware wallets that support Solana are the likes of ELLIPAL, NGRAVE, and Ledger.

As far as mobile wallets go, good options are Exodus and Trust Wallet.

Interestingly enough, there is a Solana web wallet available named SolFlare, which is non-custodial and developed by the Solana community. If you want more alpha on where to store Solana, check out our Top Solana Wallets article.

Solana Partnerships

Aside from the big tech companies like Google, Amazon, and Visa mentioned earlier, Solana has secured some serious partnerships.

One such partnership is with Chainlink, a decentralized blockchain oracle network built on Ethereum. “The network is intended to be used to facilitate the transfer of tamper-proof data from off-chain sources to on-chain smart contracts” (Source: Wikipedia) The oracle is cheaper to use and will be able to update price data every Solana block (400ms). In addition, Solana secured another major partnership with Tether to bring USDT to Solana’s ecosystem.

In 2020, Solana partnered with Circle to Bring the stablecoin USDC to the Solana Blockchain.

"USDC is the lifeblood of the DeFi ecosystem and we couldn't be more excited to welcome USDC to the Solana community. We’ve seen a flurry of inbound interest from teams looking to build DeFi products on Solana recently, and a trusted stablecoin like USDC is a critical building block for many of them,” Anatoly Yakovenko, Co-Founder, Solana. (Source: Circle)

Solana formed a partnership with the sportswear Company, Asics. The shoes can be purchased with Solana's payment platform, Solana Pay using USDC.

In August 2023, Finnish fintech company Membrane Finance launched the first euro stablecoin on Solana. EUROe is a crypto-assets-compliant euro stablecoin that can be created and redeemed in a 1:1 ratio, without fees, by anyone with a EUROe account. EUROe is backed by 100% bankruptcy-protected cash and 2% CET1 equity capital in European financial institutions or banks.

Another notable partnership is Solana's link-up with Shopify. As a result, users will be able to pay for items on Shopify using USDC. In addition, because we're in the crypto sphere now, transactions will be settled almost instantly. The partnership will also allow Shopify merchants to create new NFT loyalty programs.

Solana Web3 Smartphone

Solana launched Saga, in May 2023, an Android smartphone with advanced blockchain features. It's available to customers in the United Kingdom, EU, Canada, United States, New Zealand, Switzerland, and Australia.

Access exclusive dApp features only on Saga. Discover the newest dApps right from your phone" (Source: Solana Mobile)

Solana Embraces AI

On May 2023, Solana announced the integration of ChatGPT (developed by Solana Labs). The integrated and open-source plugin can be downloaded from GitHub.

‘"AI will make Solana more usable and understandable." Anatoly Yakovenko: Solana Founder

The ChatGPT plugin integrated into Solana is open source and can be downloaded from GitHub.

The plugin initially enables the following activities: -

- Purchasing NFTs

- Transferring tokens

- Finding NFT collections

- Reviewing transactions

- Interpreting public account data

(Source: Coin Telegraph)

“Every developer building consumer-oriented apps should be thinking about how their app is going to be interacted with through an AI model because this is a new paradigm for telling computers what to do," Solana co-founder Anatoly Yakovenko. (Source: Coin Telegraph)

Solana Upgrades

On May 30th 2023, the Solana Foundation announced that the proposed version 1.14 upgrade to the "Solana Labs validator client" would become available for the mainnet-beta soon and it has "been adopted by 97.4% of stake."

Solana Cites the Below Features of the V1.14Upgrade: -

- Get Estimated Fees Remote Procedure Call (RPC): Developers can retrieve recent transaction fees and apply the information for estimating future transactions.

- Improvements to the Staking Program:

o Permissionless deactivation of delinquent stake.

o Minimum stake delegation.

o Optimized caching.

o Compact Vote State Update Instruction

o Turbine Improvements (the block propagational protocol)

(Source: Solana)

You can read the in-depth details about the upgrade on Solana's news site. Solana's Twitter account is excellent for up-to-date Solana updates.

The Solana team wants to reduce block generation time down to just 80ms from 400ms, thus making it possible to execute cryptocurrency trades on a 1ms timeframe in decentralized exchanges built on Solana’s blockchain. For context, Binance’s smallest trading timeframe is 1 minute.

There are no specific milestones for the project going forward. Although there has been some discussion around introducing community governance over the network to all SOL token holders, a detailed governance plan and release date have not yet been outlined by the Solana team.

Our Take on Solana

There is something Solana’s creator noted in an interview that everyone should think about: what happens when decentralized exchanges become more efficient than centralized ones? The answer of course is that centralized cryptocurrency exchanges will switch to using the decentralized blockchain which is providing this higher efficiency. Solana is dead set on becoming that blockchain and has a fighting chance of clinching that title.

Solana has 11.5 million active accounts, almost 22 million minted NFTs, and fast block times of 400ms. It is energy efficient with zero net carbon impact (June 2023).

One concern about Solana is the emission schedule of SOL. Supply is going to increase by about 43% between 2022 and 2027. Unless demand and interest also increase, we all know how basic supply and demand economics works.

It is also questionable whether Solana will outperform other competitors such as Ethereum, Avalanche and NEAR. Although it prides itself in not using layer 2 blockchains, the fact of the matter is that the average user of a decentralized application is not going to care what the underlying infrastructure looks like as long as it works well. This sort of narrowminded ethos could be Solana’s undoing if it is not careful

Solana has produced a Q1 report that highlights news, major achievements and technological advances for the first quarter of 2023. It's an interesting read if you want to explore Solana news straight from the source.

It's an in-depth report, which you can read online. However, we will cover the key insights below: -.

- Solana has often been "accused" of not being fully decentralized, but this report states it is "more decentralized than most blockchains, including Ethereum."

- Addressing the outage, Solana says they are working towards better network stability practices, debugging and testing.

- Updated data shows 2,160 staked validators in 230 individual data centres in thirty three countries, running 3,621 nodes.

- Solana is putting the FTX bankruptcy behind them and focusing on the future.#2,053 active developer are working on projects with a Solana integration.

- Grizzlython (the Solana hackathon) had over 10,000 developers that submitted more than 800 projects.

- Many projects and protocols are helping to improve the Solana network features and benefits.

- The Solana NFT community is maturing and Solana is 100% committed to the NFT-DeFi Narrative. The report states, "The growth of NFTs on Solana resulted in fast innovation sparked by an ecosystem’s need to experiment with new use cases and forge new paths."

Despite facing significant challenges, the Solana ecosystem has consistently demonstrated remarkable resilience and continued growth. The network has positioned itself as one of the top contenders for handling millions of users on decentralized trading protocols.

If you want further analysis into how Solana stacks up against Ethereum, feel free to check out Guy's ETH vs SOL video below:

All in all, Solana is a promising project with many heavyweights backing and placing their faith in the network. First, the team is rock solid and forward-thinking. Second, even though Solana is still in beta, it is proving to be more than a slick interface with hundreds of billions of transactions confirmed so far. Third, the company has a humble beginning – it was not propped up by hundreds of millions of dollars of venture capital investors who want to turn a quick profit. Taken together, these facts point to one thing: results.

Frequently Asked Questions

Solana has faster transaction speeds (up to 65,000 TPS) and lower fees than Ethereum (30TPS), but that doesn't mean that it's “better.”

Solana is a faster alternative than Ethereum for smart contracts and has an NFT marketplace. If you're considering buying SOL tokens, there's a significant difference in the price point of Solana (SOL) compared to Ethereum (ETH).

Solana is ranked in the top ten cryptocurrencies and Ethereum is listed at number two. Ethereum has the most developers than any network and Solana has been “accused” of not being decentralised enough.

Ultimately, whether one is better than the other is personal choice.

Solana has sometimes been called the Ethereum killer because of the networks super fast transaction speeds (65,000 per second compared to Ethereum's 30 TPS). Like Ethereum, Solana is is a layer-1 public blockchain, but Solana's fees are very low compared to Ethereum's “gas” fees, which can run into hundreds of dollars.

In November 2021, the price of Solana (SOL) topped at over $248, so it is certainly possible in the future than the price of SOL tokens could be higher than $100.

Solana isn't without its drawbacks. While it boasts impressive speed, some worry about its level of decentralization due to the smaller validator set. Network outages have also caused disruptions in the past. While more eco-friendly than Bitcoin, Solana's energy consumption remains a concern for some. Compared to Ethereum, Solana's developer ecosystem and established dApps are still catching up. Finally, the tokenomics with high initial inflation raise questions about SOL's long-term value.

Choosing between Solana and Cardano depends on your priorities. Solana shines in speed and scalability, making it ideal for high-volume transactions. Cardano prioritizes methodical development for future scalability and security while maintaining stability and boasts a more decentralized structure. Cardano has proven to be more robust than Solana with zero downtime while Solana has proven to be faster than Cardano.

Both Solana and Cardano are rapidly growing in these areas, but the choice depends on whether you prioritize bleeding-edge tech (Solana) or a more established, secure and dependable approach (Cardano).

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.