Two prevalent stories exist around enhancing scalability in blockchain technology. There's layer-2 scalability to begin with. Proponents of layer-2 protocols believe that a modular setup allows each layer to concentrate on specific functions, leading to superior performance compared to a singular, all-encompassing design of monolithic networks like Ethereum.

Conversely, various alternative layer-1 blockchains challenge this view. Some have developed unique scalability solutions that deliver sub-second scalability without breaking the network into multiple layers. Several notable blockchain projects were competing in this space by 2023. They had cultivated dynamic ecosystems, like the Solana protocol, that attained near-instant transaction times with its Proof of History consensus mechanism. A June 2023 Decrypt article highlighted another emerging layer-1 protocol that set out to challenge Solana’s legacy. The Sui Network, led by several pioneers of Meta’s project Novi, has garnered significant attention for its network performance in the crypto community.

This Sui review will unpack its unique innovations like parallel processing, Sui objects, and the Move programming language. Let's delve into the buzz surrounding it!

This article focuses on the Sui Network itself, if you want to know about some of the top projects and DApps building on Sui, feel free to check out our Top Sui DApps article.

Sui Network History

The foundation of the Sui network is rooted in several years of research and development under Meta, where its founders developed a series of products that took new names and purpose to culminate under the Sui network.

Here’s a series of notable events that led to the foundation of the Sui network:

- Meta (then Facebook) launch blockchain initiatives (May 2018): The vice president of Facebook’s Messenger app, David Marcus, announced the company’s new blockchain initiative under his leadership.

- Announcement of Project Libra (June 2019): Facebook unveiled Project Libra in association with Andreessen Horowitz, Visa, and Uber. The vision behind Libra was to support the global financial system with blockchain technology. The project featured the Libra stablecoin tied to a basket of globally transacted fiat currencies, balanced by the Libra Association, like the dollar, pound, euro, Swiss franc, and yen.

- Move programming language: The Libra Association promoted an open-source blockchain development platform powered by their Move programming language, designed for smart contract development in the Libra ecosystem.

- The exit of crucial members from Libra Association (October 2019): Following intense regularity scrutiny, critical partners like PayPal, Mastercard, and Visa pulled out of project Libra. Regulators cited KYC/AML-related issues with Libra, its potential to disrupt financial markets and the status of the US dollar reserve currency.

- Rebranding and strategy shift (April 2020): Regulatory hurdles forced Libra to rebrand and scale back. Instead of a global stablecoin, the team continued to work on the Move language to develop a digital payments network.

- Transition to Diem (December 2020): The rebranding to Diem represented a fresh start for the project. Move continued as a core component of the project and the underlying blockchain network.

- Regulatory challenges continue (2021): Despite the rebranding, Diem struggled with the regulators, who were concerned about a cryptocurrency run on the network and still demanded stricter KYC-related compliance from the network users. Failing to take off, Diem decides to sell its assets, including the Move language.

- Foundation of Mysten Labs (2022): After Meta disbanded the Diem project, some key members, such as Evan Cheng, Sam Blackshear, Adeniyi Abiodun, and George Danezis, left the project, found Mysten Labs and began working on the Sui blockchain.

Sui Recent History

Here are some recent milestones, significant partnerships, and notable developments in the Sui network:

- August 2022: Sui's incentivized testnet launched.

- April 20, 2023: Sui's ICO takes place.

- May 3, 2023: Sui's mainnet goes live.

- May 3, 2023: Sui lists its token on several exchanges, including OKX, Kucoin, Bybit, and Binance

- August 2023: Sui achieves 1 million active addresses within two months of its mainnet launch.

- September 2023: Sui hits significant growth milestones, with nine million accounts becoming active on the network.

- November 2023: Sui's unique scalability, consistent gas fees, and exceptional performance are showcased in the first 90 days of its mainnet launch.

- December 2023: Sui surpasses $100 million in bridged USDC, confirming its position among the top DeFi protocols worldwide.

Additionally, Sui has made significant partnerships and developments, including an ecosystem investment with leading Web3 security firms OtterSec and Zellic and introducing a feature to simplify the onboarding process for Web3 through the innovative zkLogin (Zero Knowledge login) functionality. The network's decentralized ecosystem and independent builders have fueled its growth, with several projects over $10 million in TVL and 11 projects exceeding $2 million.

Move Programming Language

The Move programming language, particularly in the context of the Sui blockchain, represents a significant development in blockchain and smart contract technology. Designed initially by Facebook for the Diem (formerly Libra) project, Move has since found a prominent place in the Sui blockchain.

Move is a statically typed, resource-oriented language. Its most defining feature is its ability to define custom resource types, which can be used to represent assets on the blockchain. These resources are subject to strict ownership rules enforced by the language: they cannot be duplicated, reused, or accidentally destroyed. This aspect of Move offers a robust framework for representing digital assets, making it ideal for applications in finance and economics.

In the Sui ecosystem, Move plays a crucial role. Sui is a decentralized blockchain that supports various applications, including NFTs, DeFi, and other decentralized applications (Dapps). Sui aims to offer high throughput, low latency, and scalable infrastructure vital for supporting complex and high-volume transactions.

Move in Sui helps create an environment where developers can build secure, efficient, and sophisticated Dapps. The language's emphasis on safety and resource integrity makes it particularly suitable for financial applications, where precision and reliability are crucial. Moreover, Move's modular design allows developers to create reusable modules, which can be published and integrated into other projects, fostering a collaborative and efficient development ecosystem.

In summary, with its unique focus on resource safety and efficiency, the Move programming language plays a pivotal role in the Sui blockchain's vision of creating a scalable, secure, and developer-friendly platform for the next generation of decentralized applications.

Sui is designed to address some of the critical challenges existing blockchain technologies face, such as scalability, speed, and flexibility. Its development closely ties with the Move programming language, which plays a central role in its ecosystem. Here's a detailed look at the Sui blockchain:

Sui Blockchain Consensus

Sui is a Byzantine Fault Tolerant blockchain network that uses Delegated Proof of Stake (DPoS) consensus process to validate blocks on the network. In a DPoS consensus mechanism, there are direct and indirect consensus participants. In-direct participants are the SUI token holders who wish to participate in consensus without needing to operate a full node and validate block transactions during the consensus process. Direct participants are validator nodes that stake SUI tokens, maintain a full node, and participate in the voting process where the weight of their vote is proportionate to their stake.

In-direct participants can delegate their stake to full node validators who participate on their behalf and share their rewards with the delegates proportionately. A DPoS consensus system has the following benefits:

- Increased Scalability: DPoS systems often provide higher transaction throughput than PoS systems. In DPoS, only a small number of delegates are responsible for validating transactions and creating blocks, which can lead to faster processing times and higher scalability.

- Increased Network Stake: The minimum staking requirements in DPoS systems are significantly lower than in PoS systems, motivating more token holders to participate in network consensus and improving the security of the blockchain.

- Reduced Token Liquidity: Reduced minimum staking requirements attract more token holders to participate in consensus that contracts the token supply, which can be healthy for the token's value.

- Faster Consensus: DPoS can achieve consensus faster than traditional PoS because it relies on a limited number of delegates to validate transactions and create blocks, reducing network latency. It can be particularly beneficial for networks that require quick transaction confirmations.

However, it's important to note that DPoS systems can also have downsides, such as the risk of voter apathy or the possibility of a small number of delegates gaining disproportionate control over the network. As with any consensus mechanism, the specific implementation and network parameters play a crucial role in determining the effectiveness and security of the system.

Sui Network Validator Spread

The Sui Blockchain Explorer gives us an insight into the validator network that runs the blockchain. As of January 2024, here are some technical facts about the Sui Network:

- Sui network runs on 392 nodes, of which 106 are full node validators participating in DPoS consensus.

- The validators are spread across 13 countries. Europe and America house most of the validators.

- 8.24 B SUI, comprising 82.4% of SUI total supply, is staked in the network.

- The voting power spread between the validators is 0.32% - 2.7%.

Narwhal and Bullshark

Narwhal and Bullshark are vital components of the Sui blockchain's consensus mechanism, contributing to its scalability and efficiency and enabling key differentiating characteristics of Sui.

Key Aspects of Narwhal: The Mempool Module

Narwhal acts as the Sui network's mempool module, ensuring the availability of data (transactions) submitted to consensus.

- Narwhal enables parallel ordering of transactions into batches, an essential efficiency optimization technique used in Sui.

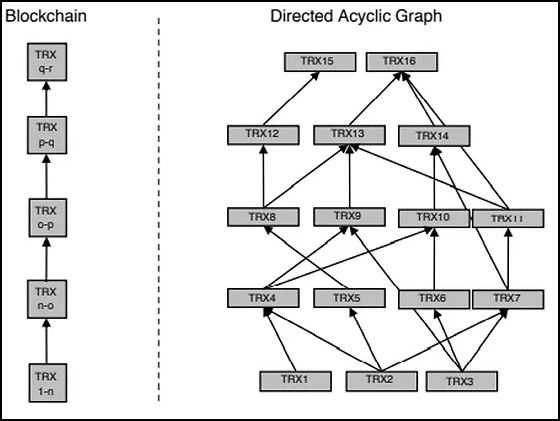

- The Narwhal mempool is structured as a Directed Acyclic Graph (DAG) for efficient data traversal. In a DAG-based blockchain, blocks are not constructed linearly (like in Ethereum). Instead, each node validates transactions as it receives enough information about it.

- Narwhal operates in rounds. For each round, validators collect unordered transactions into batches called collections. These collections are validated based on certificates of availability and a quorum of validator approvals.

Key aspects of Bullshark: The Consensus Engine:

Following Narwhal, the validated certificates are ordered through the consensus process called Bullshark.

- Bullshark is the DAG-based execution algorithm for transactions propagated by Narwhal.

- Bullshark builds a DAG of blocks that were proposed concurrently in the network and creates order between them.

- Bullshark orders the transactions before executing them.

Benefits of Sui Consensus Algorithm:

Combining Narwhal and Bullshark in Sui's consensus mechanism enables high-throughput system parallelization with multiple transaction processes co-occurring. This design significantly enhances the scalability and efficiency of the Sui blockchain.

- DAG-Based Consensus: This approach, where validation happens at the transaction level rather than the block level, allows validators to trace all the blockchain data related to a transaction, preventing double-spending issues.

- Practical Scalability: Sui achieves a high level of throughput (over 125,000 transactions per second with a 2s latency for 50 validators) without sacrificing cryptography, permanent storage, or network security.

In summary, Narwhal and Bullshark form a robust and efficient consensus mechanism for the Sui blockchain.

Move Optimized for Sui

As implemented on Sui, Move exhibits several key distinctions compared to its usage on other blockchains. Leveraging Move's inherent security and adaptability, Sui augments it with additional features outlined in subsequent sections. These enhancements significantly boost transaction throughput, minimize finality delays, and simplify the Move programming experience. Let’s understand these features by drawing a parallel from a more familiar network design, Ethereum:

Key differences with Move on Sui include:

- Sui uses its own object-centric global storage.

- Addresses represent Object IDs.

- Sui objects have globally unique IDs.

- Sui has module initializers.

- Sui entry points take object references as input.

Move as a Smart Contract Language (Similar to Solidity in Ethereum)

- Ethereum: Uses Solidity as its primary language for writing smart contracts.

- Sui: Uses Move, an open-source language for writing packages (akin to smart contracts) that manipulate on-chain objects.

Object-Centric Global Storage in Sui vs. Account-Centric in Ethereum

- Ethereum: Has an account-centric model where smart contracts and accounts have storage that can be accessed and modified by transactions. This is similar to Sui's description of Diem's global storage model.

- Sui: Uses an object-centric global storage model. Unlike Ethereum, where transactions can access and modify any account's storage, Sui transactions specify their inputs upfront using unique identifiers, allowing for parallel processing of non-overlapping transactions.

Address Representation

- Ethereum: Uses a 20-byte address to represent accounts and smart contract addresses.

- Sui: Repurposes the concept of an address as a 32-byte identifier for both objects and accounts. This is different from Ethereum's account-centric model.

Globally Unique IDs on Sui

- Ethereum: In Ethereum's model, smart contracts have storage that is accessed via their address.

- Sui: Each object on Sui has a globally unique id.

Module Initializers and Entry Points

- Ethereum: Smart contracts in Ethereum are initialized at deployment and can expose functions that can be called externally.

- Sui: Move on Sui allows for module initializers (init functions) that execute only once upon module publication. Additionally, Sui entry points can take object references as input, allowing for more flexible interaction with on-chain objects.

In summary, while both Ethereum and Sui provide platforms for deploying smart contracts, their approaches to storage, transaction processing, and smart contract interaction differ significantly. Ethereum's account-centric model and Solidity language contrast with Sui's object-centric model and Move language, each tailored to their respective blockchain architecture and performance goals.

SUI Tokenomics

SUI Tokenomics reflects a comprehensive economic model designed to incentivize participation in the Sui ecosystem. It encompasses various roles, from users and validators to token holders, each contributing to the network's security, governance, and development. The token distribution and vesting schedule are structured to ensure long-term sustainability and active community involvement. Integrating bridging capabilities and a storage fund further enhances the network's functionality and appeal. Here’s a summary of key aspects of SUI tokenomics:

1. Types of SUI Network Participants

- Sui Users: Individuals who engage in transactions, create, modify, and transfer objects, and interact with smart contracts on the Sui blockchain.

- Sui Token Holders: Owners of the native SUI token. They can stake their tokens to secure the network and earn rewards. They also participate in Sui’s governance operations.

- Validators: Responsible for compiling and validating transactions submitted by users and securing the network.

2. SUI Token Use Cases

- Medium of Exchange and Store of Value: SUI tokens are used for transactions within the Sui ecosystem.

- Staking: Token holders can stake SUI to participate in the network's security and consensus mechanism.

- Governance: SUI token holders have the right to vote or propose on-chain protocol upgrades and governance decisions.

3. SUI Token Liquidity, Supply, Distribution, and Vesting Schedule

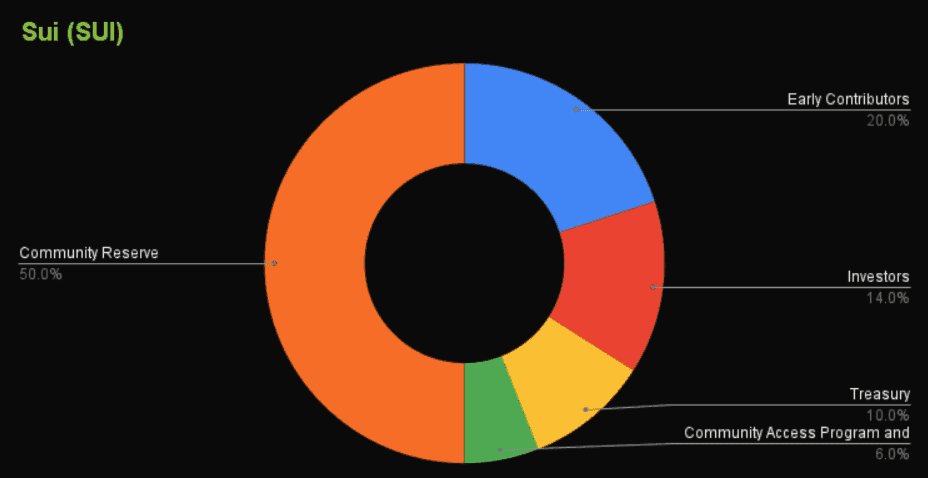

- Max Supply: The maximum supply of SUI is capped at 10 billion tokens.

- Distribution:

- 50% to the community reserve (includes delegation program, grant program, research and development, and validator subsidies).

- 20% to early contributors.

- 14% to investors.

- 10% to the Mysten Labs Treasury.

- 6% for the Community Access Program and App Testers.

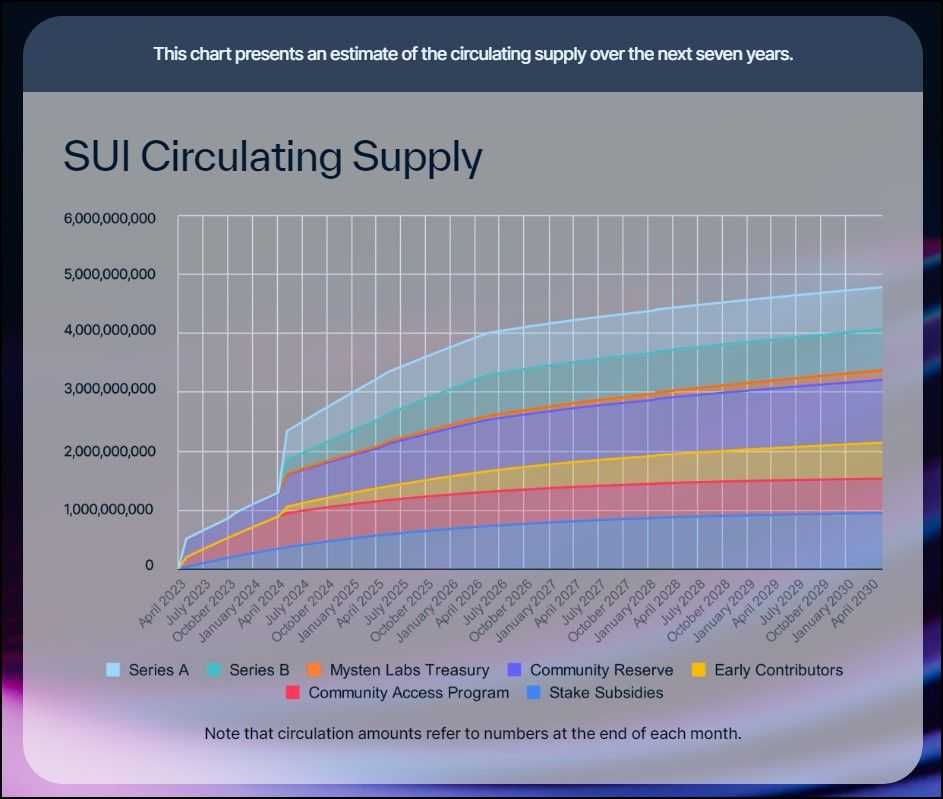

- Vesting Schedule: A significant portion of the total supply will be liquid at Mainnet launch, with the remaining amount vesting over the coming years for future staking rewards.

4. SUI Wormhole Bridging Details

- Bridging: Sui supports the transfer of tokens and NFTs to and from other blockchains through services like Wormhole Connect. This facilitates interoperability and asset movement across different blockchain ecosystems.

5. SUI Storage Fund

- Purpose: To offset the costs associated with large amounts of on-chain data storage.

- Funding: Funded by past transactions, it compensates future validators for the storage needed when entering the ecosystem.

- Features:

- Funded by transaction fees paid by users creating on-chain data.

- Pays out from returns on its capital, not distributing the principal accrued over time.

- Offers a deletion option for data, allowing users to receive a storage fee rebate for data no longer stored on-chain

Sui Price

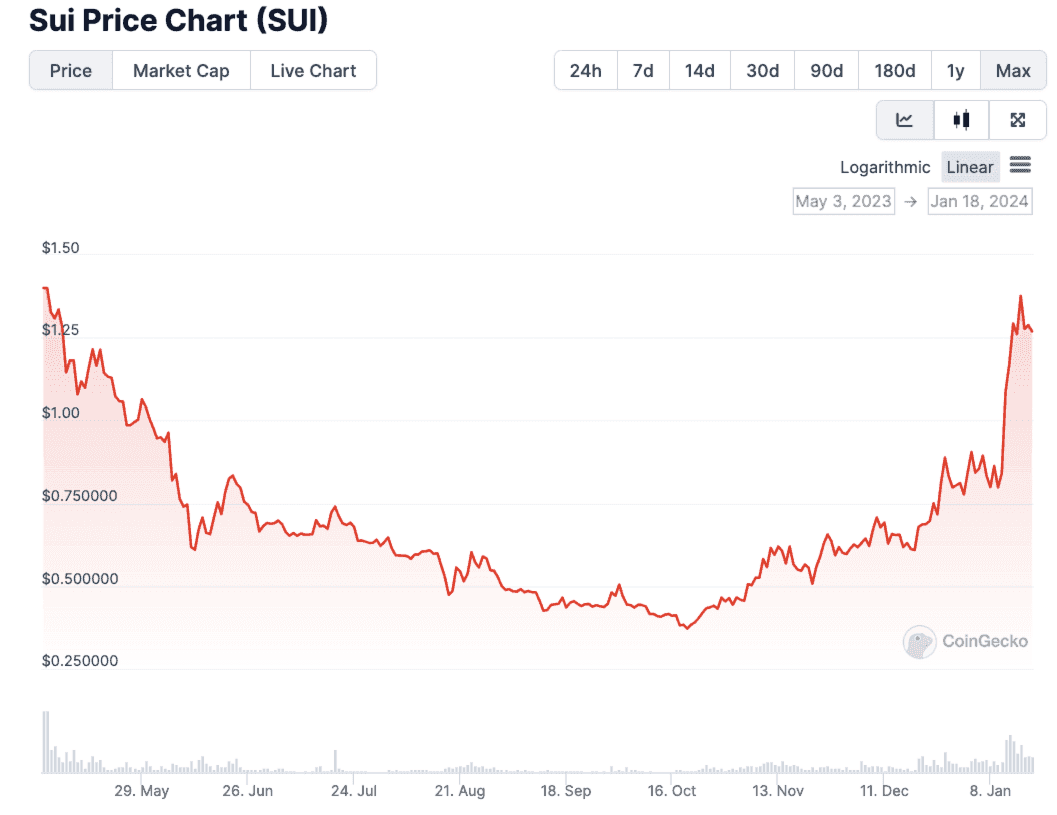

Sui launched its coin to the public in May 2023 with a price of around $1.40. This was during a period when the cryptocurrency industry was struggling through its worst bear market in history. The lack of interest and capital in the space resulted in a poor launch for the token price, and the price went straight down to an all-time low of $0.36.

This type of price action was not unique to Sui, but affected the vast majority of cryptocurrencies as investor interest and sentiment across the sector was low.

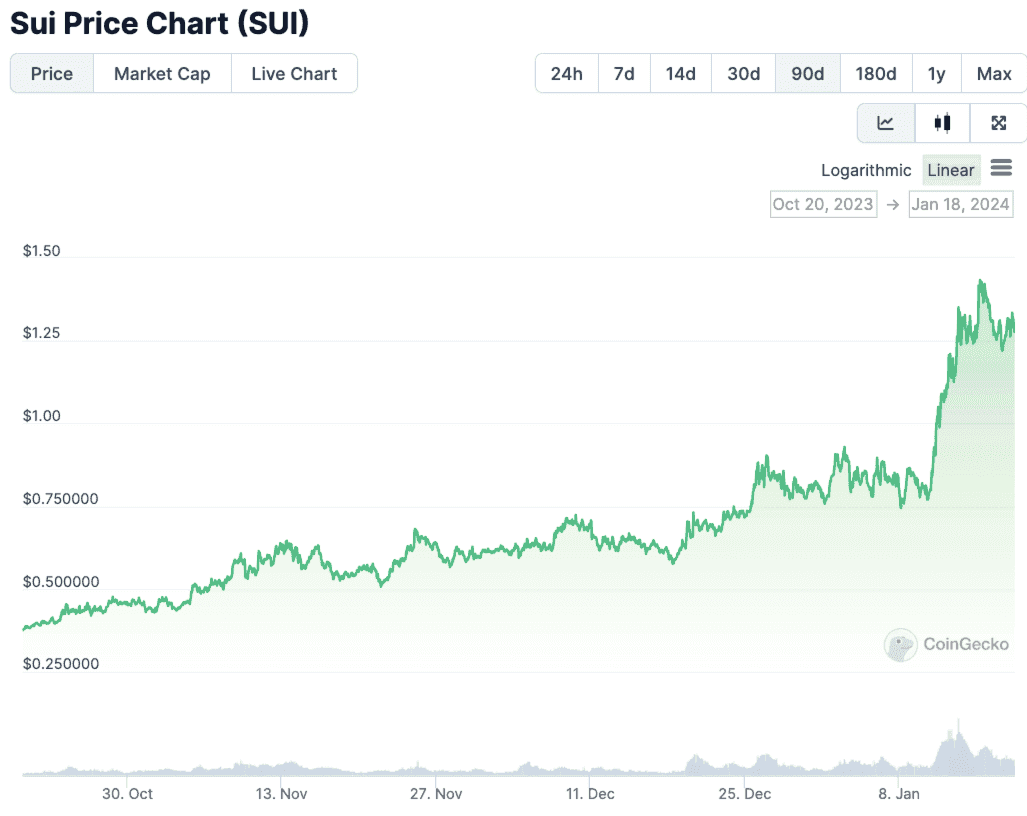

As we progress into 2024, interest is returning to the crypto industry and taking a look at more recent Sui price performance, we can see that investor interest is returning to the asset.

Sui Ecosystem

The Sui ecosystem is a vibrant and diverse network comprising various projects and applications across multiple domains. Here's a breakdown of the key projects within the Sui ecosystem:

Automated Market Makers:

- Turbos Finance – A non-custodial DEX backed by Jump Crypto.

- BlueMove – An all-inclusive Dapp offering NFT launchpad, marketplace and a DEX.

- Cetus - A concentrated liquidity protocol DEX on Sui.

API:

- NodeReal – Offers API services for Dapp development.

- Nodeinfra – Helps building Move-based Dapps and provides RPC endpoints on Sui.

- Chainbase – A Web3 data infrastructure for indexing and utilizing on-chain data.

Bridges:

Decentralized Finance

- Pyth Network - A first-party financial oracle network designed to provide low-latency real-world data to multiple blockchains in a secure and transparent manner.

- ABEx – An on-chain derivatives and swap protocol.

- Typus – A real yield infrastructure that integrates lending and derivatives on Sui.

Gaming:

- Blockus – A platform to build blockchain-compliant games.

- Sui 8192 – A simple puzzle game built on Sui.

- Worlds Beyond – A creator platform with built-in AL tools to build virtual games.

Non-Fungible Tokens:

- Cosmocadia – A community-based farming game.

- Mentaport – Create location-aware digital assets.

Wallets:

- Desig – A multisig solution for Dapps.

- Surf Wallet – A wallet provider on Sui.

- OKX Wallet – A wallet service built by OKX.

Social

- Releap Protocol – A decentralized social graph.

- Easy – A social wallet built on Sui.

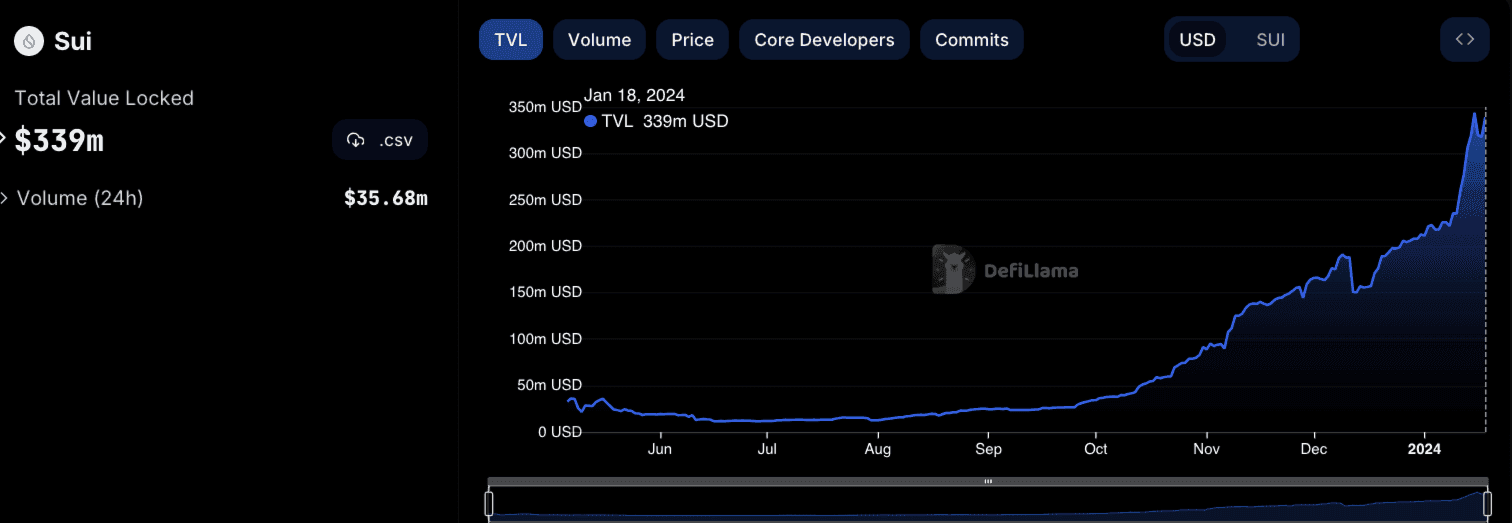

Sui currently has a TVL of 339m with an impressive upward trajectory since its launch, showing the excitement surrounding the potential of this blockchain.

How to Buy Sui

As Sui was a highly anticipated project with early excitement thanks to Sui's founders and the project's potential, many major exchanges were quick to support the Sui coin. We recommend OKX, Kucoin, Bybit, and Binance as solid places to buy Sui.

For those looking to pick up Sui on a DEX, Cetus is the leading DEX on the Sui network.

Top Sui Wallets

If you are going to get involved with the Sui ecosystem you are going to need a Sui Wallet. Some of the top Sui wallets are Suiet Wallet, which is a browser extension wallet similar to MetaMask on Ethereum or Phantom on Solana, and the Ethos wallet, which is a mobile wallet that supports the Sui network.

Parting Thoughts

In concluding our Sui review, it is evident that Sui represents a fresh take on the fundamental principle of blockchain technology and innovation. Although it is a smart contract platform like Ethereum, Sui is built significantly differently from legacy networks. These infrastructural innovations are meticulously designed to enable Sui to tackle near-instant transaction times.

Sui also represents a fresh take on the Move language. While networks like Aptos are also built on Move, Sui has customized how the blockchain stores and interacts with on-chain identities, programs, and data. The ability to incorporate such foundational changes while offering composability with other Move modules is a testament to its flexibility.

Blockchain technology is evolving with an ever-growing number of users, and networks like Sui are an example of innovation pushing the limits of this technology. However, it is worth pondering over Sui’s growing competition in the layer-2 ecosystem of Ethereum, which has been getting more secure, faster, and cheaper every day.

Whether layer-1 networks like Sui, Aptos, and Solana can take over the Ethereum layer-2 ecosystem and emerge as the go-to platform for everyday on-chain operations remains unseen.

Frequently Asked Questions

Sui is a decentralized blockchain platform that utilizes an object-centric storage model, contrasting with Ethereum's account-centric approach. While Ethereum groups transactions into blocks in a linear chain, Sui treats each asset or resource as an independent object with its own unique identifier. This allows for parallel processing of transactions, enhancing scalability and efficiency. Sui is particularly known for its high throughput and low-cost transactions.

In Sui's object-centric model, fungible tokens are represented as distinct objects or batches of tokens, each with unique identifiers. This differs from Ethereum's method of tracking token balances within smart contracts. Sui allows for direct manipulation of these objects for transactions, enabling parallel processing and reducing bottlenecks. Large quantities of tokens can be batched for efficiency, and these batches can be split or merged as needed.

The SUI token serves multiple purposes within the Sui ecosystem. It acts as the primary medium of exchange and a store of value. Token holders can stake SUI to participate in network security and consensus, earning rewards. Additionally, SUI tokens grant holders governance rights, allowing them to vote on or propose protocol upgrades and other on-chain decisions.

The Sui ecosystem hosts a diverse range of applications, including DeFi platforms, gaming, and NFT marketplaces. Notable projects include Cetus Protocol (a decentralized exchange), NAVI Protocol (a decentralized money market), and gaming applications like SUI 8192. The ecosystem benefits from Sui's efficient transaction processing and object-centric model, attracting a wide array of developers and users.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.