The United Kingdom's status as a would-be crypto utopia underwent a profound transformation, marked by a regulatory U-turn.

In June 2023, the UK enacted laws to legitimize the crypto landscape. This legislation, first introduced in July 2022, aimed to bring crypto and stablecoins under the purview of regulation, treating them as regulated activities while overseeing crypto promotions. Despite these efforts to establish a regulatory framework, the trajectory seemed to take a downturn.

A significant blow came in October 2023 when a new bill empowered law enforcement agencies to freeze crypto assets linked to criminal activities without requiring a conviction. Furthermore, the Financial Conduct Authority (FCA) expanded its reach by adding over 220 crypto-asset companies, including prominent names like Binance and HTX, to its "warning list." These companies were deemed unfit for marketing their services in the UK as they lacked the FCA's approval.

What was once considered a haven for crypto enthusiasts is now subject to a more regulated environment. Only exchanges registered with the FCA can cater to UK residents, leading to the exodus of several established players from the UK market. This shift has left users scrambling to explore alternative avenues for accessing cryptocurrencies, including sought-after assets like Solana.

Despite the challenges posed by the regulatory landscape, there remains a route for those eager to embark on the crypto journey in the UK. In this guide, we will show you how to buy Solana in the UK and highlight some of the best FCA-approved exchanges.

Disclaimer: Each exchange featured in this article is registered with the Financial Conduct Authority (FCA) of the UK. Non-FCA-registered exchanges cannot accept UK users. A full list of these registered companies can be found on the FCA's website.

Best Exchanges to Buy Solana in the UK

Thanks to the UK government's clampdown on crypto companies in the country, British residents lack the vast sea of options available across the pond. Here are our top picks of UK government-approved exchanges.

eToro

eToro is a traditional financial investment company that branched out into crypto in 2014, six years before Solana would come into existence. Bitcoin, the bellwether of the crypto industry, ended 2014 at just $320.19 (I'm having major FOMO right now).

Today, eToro boasts over 30 million users. In addition to Solana, users can also purchase other cryptocurrencies including Bitcoin, Ethereum, Ripple and Cardano. Overall, the investment company support 80 cryptoassets.

While users can invest in stocks and ETFs without worrying about commissions or management fees, investments in crypto assets incur a flat 1% fee on both buying and selling. There's also a monthly inactivity fee if your account remains dormant for 12 months. However, you can steer clear of deposit fees thanks to a wide variety of payment options.

Turning to security, eToro utilizes SSL encryption to safeguard customers' personal information, and you can also activate two-factor authentication for an added layer of security. There's also educational content on offer — from lessons on investment terms to reading the markets — that range in complexity from novice to pro. In addition, eToro provides $100,000 in a virtual portfolio as a practice account so you can learn the ropes before committing capital.

The eToro Money crypto wallet lets you store or transfer coins. However, the wallet currently only supports eight coins, and Solana isn't included. Check out our article on the Top Solana Wallets if you are looking for places to store your SOL.

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Uphold

Uphold is connected to 28 underlying trading venues, including centralized and decentralized exchanges, Layer 2 networks and Rollups.

Uphold is a solid choice for anyone who is looking to get their hands on a large variety of tradable coins and tokens. Here's a snapshot of some of its top features.

- Easy to Use: Signing up for Uphold is easy, and you'll only need to enter basic personal information like email, country of residence and nationality. You'll need to verify your identity, however.

- One-Step Payments: Most of the exchanges require you to deposit fiat into your on-exchange account, which is then used to buy crypto. With Uphold, you can purchase a coin directly from your linked account.

- Solid Security: Uphold utilizes encryption and layered defences to limit attacks. In addition, all of its employees and third-party vendors must undergo due diligence and background checks. There's also a bug bounty program in place.

- Debit Card: Uphold's Mastercard-branded crypto rewards debit card lets you spend the crypto in your account. The card boasts a 0% foreign exchange transaction fee and you receive cashback in XRP for each purchase. In the UK, there is a £2.50 fee for national ATM withdrawals and £3.50 for foreign ones.

- Staking: Uphold lets you stake over 30 digital assets. In addition to Solana, you can stake ETH, ADA, FET and INJ, among many others. The APY for SOL currently stands at 5.5%.

Turning to fees, Uphold charges a trading fee of 1.9% and 2.5% on all altcoins, which is every crypto not called Bitcoin. Then there are deposit and withdrawal fees. The exchange charges a deposit fee of 3.99% and a withdrawal fee of 1.75% if your chosen method is a debit card. With credit cards, you can expect deposit and withdrawal fees of 3.99%.

Our full Uphold review explores the exchange's features as well as the pros and cons.

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Bitstamp

Bitstamp was recently rated the world's No. 1 centralized crypto exchange by CCData, an FCA-authorized benchmark administrator.

Though Bitstamp does not offer advanced investing strategies like margin trading, it offers a solid entry point into the world of crypto. You can trade 86 coins and tokens, stake ALGO and ETH, and lend unused coins (SOL isn't supported). Both of these yield-generating products aren't available to customers based in the UK, the US, Singapore, Japan or Canada.

In terms of order types, Bitstamp provides a comprehensive set, including instant, limit, market, stop, and trailing-stop loss orders. In addition, Bitstamp distinguishes itself by offering human support — a rarity in the current landscape of automated assistance. Users can reach the support team via email and phone, although live chat support is not currently offered.

Security is a paramount consideration, especially in the crypto space. Bitstamp experienced a security breach in 2016, resulting in the loss of 19,000 BTC, valued at $5 million at the time and a whopping $700 million-plus in today's market. Notably, all affected users were fully reimbursed. Since the incident, Bitstamp has implemented enhancements to its security protocols, including storing the majority of digital assets offline in cold storage. According to CER, an independent crypto security and auditing firm, Bitstamp is ranked among the top 10 most secure exchanges with a rating of AAA, the highest CER awards to the exchanges it rates.

Examining the fee structure, Bitstamp maintains a competitive pricing model. The exchange does not impose fees for trades valued at less than $1,000. For trades falling under the $1 million-volume threshold, Bitstamp's trading fees are as follows:

| 30-Day USD Volume | Maker Fee | Taker Fee |

|---|---|---|

| < $1,000 | 0.00% | 0.00% |

| > $1,000 | 0.30% | 0.40% |

| > $10,000 | 0.20% | 0.30% |

| > $100,000 | 0.10% | 0.20% |

| > $500,000 | 0.08% | 0.18% |

There are also other fees you should be aware of, such as a 4% surcharge on any credit card or debit card purchases in addition to any fees charged by the card issuer. While crypto deposits are free, you'll have to pay a withdrawal fee, which is 0.01 SOL for Solana. You can find the full Bitstamp fee schedule on its website.

Our in-depth Bitstamp review explores its features, security procedures, fees and customer support.

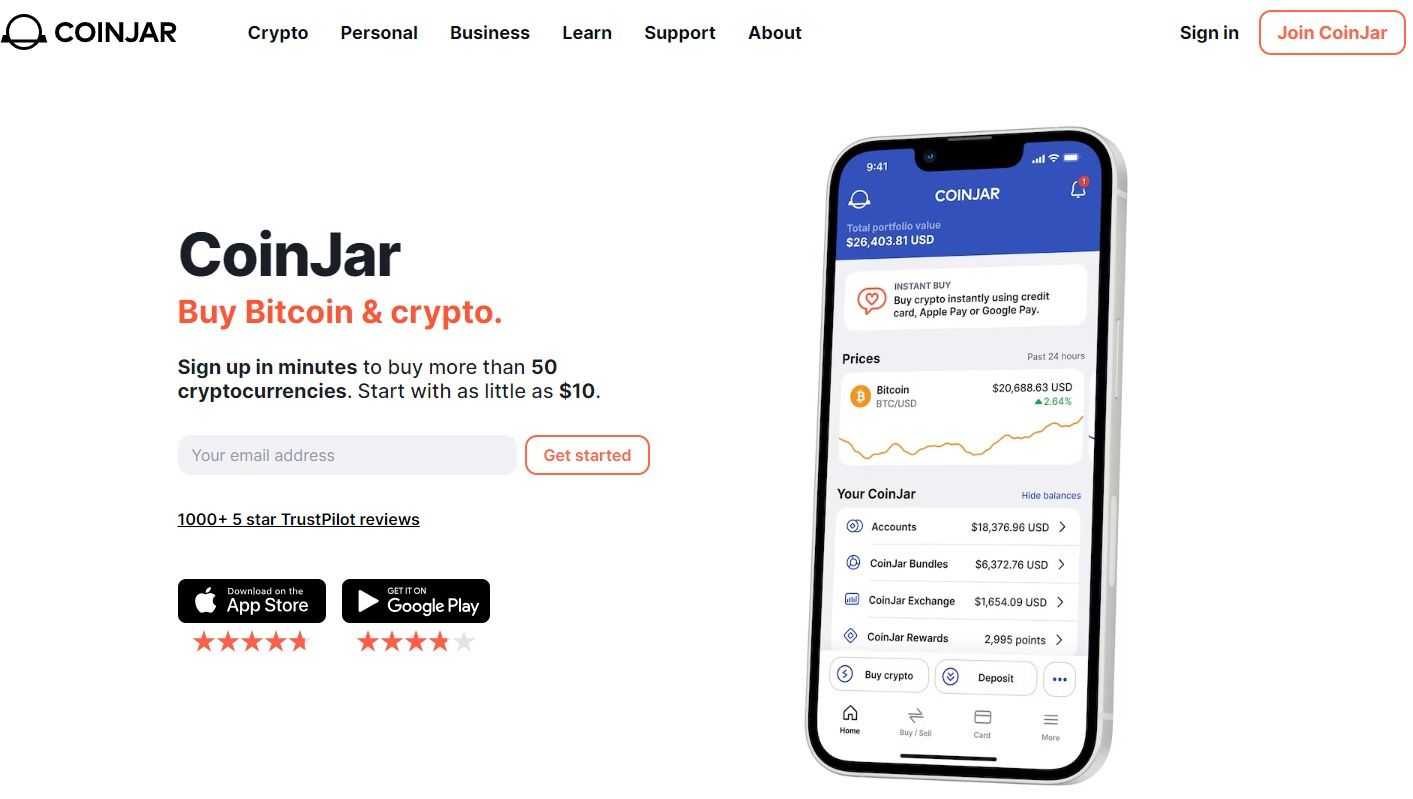

CoinJar

Operating since 2013, CoinJar is Australia’s longest-running cryptocurrency exchange. It boasts over 600,000 customers and is available to UK residents.

Here's a snapshot of CoinJar's top features:

- You can trade over 50 coins, including Solana.

- You can set up automated weekly, fortnightly or monthly debit and credit card crypto purchases.

- Invest in themed baskets of crypto with CoinJar Bundles.

- CoinJar Card, which is free to set up, lets you spend your crypto like cash.

Fees-wise, CoinJar charges a fixed 1% fee on the conversion of fiat to crypto, crypto to fiat and crypto to crypto. Its maker/taker is 0.10% on average 30-day trading volume of $10 to $100,000 on AUD, USD, EUR and GBP trading pairs. You can find out more in the CoinJar fee schedule.

How to Buy Solana in the UK

Now that you know of some of the best FCA-registered exchanges, it's time to show you how you can purchase Solana in the UK.

Step 1: Open an Account

In light of recent regulatory actions by the British government against crypto companies, residents in the UK now face a more limited selection of platforms. However, there are still reputable options available, as we've highlighted above. As noted, all of these exchanges comply with the FCA's guidelines.

The first order of business is to lock down on an exchange of your choice and open an account with them. Most exchanges today offer two straightforward options for account creation: through your email address or your mobile phone number. Opt for the method most convenient for you and input the required details.

A Note on KYC: Know Your Customer (KYC) standards are aimed at ensuring compliance with regulatory measures that tackle money laundering and other illicit financial activities. Nearly all centralized exchanges, like the ones we've highlighted in this article, will request that you verify your identity by uploading images of your driver's license, passport, or another form of government-issued ID.

Step 2: Fund Your Account

Once your account is set up, the next step is funding it. Exchanges commonly allow direct connections to your bank account or linking with a debit or credit card. Some platforms even accept alternative payment services such as PayPal or NETELLER.

While many exchanges permit the use of credit or debit cards for crypto purchases due to their speed and convenience, it's crucial to monitor associated fees. In our experience, funding your crypto account via bank transfer is often the most cost-effective, and in some cases, free. However, be prepared for a longer processing time, typically taking 3-5 business days for funds to reflect.

Additionally, it's advisable to consult with your bank before using a credit card for crypto purchases, as some financial institutions may categorize these transactions as cash advances, incurring high interest rates with no interest-free grace period.

Step 3: Buy Solana

With funds successfully added to your account, the final step involves acquiring Solana. Crypto exchanges generally mirror the features of traditional stock brokerages, offering market and limit orders, with some also providing stop-loss orders.

- Market Order: Executed immediately at the prevailing market price, market orders provide swift transactions. However, prices may vary slightly due to market volatility.

- Limit Order: This order type enables you to specify a price at which you are willing to buy or sell. For instance, if Solana is currently priced at £47, but you wish to purchase it at £40, setting a limit order initiates the trade automatically when the price reaches your desired point.

- Stop-Loss Order: Designed to mitigate potential losses, this order type triggers a market order to close a trade when the price falls to or below a predetermined stop price.

- Trailing-Stop Loss Order: This type of trading order "trails" the market price at a predetermined distance or percentage. While a standard stop-loss order has a fixed price level, a trailing stop-loss order is designed to automatically adjust its stop price based on the market's price movements.

What Are The Fees to Buy Solana?

The fees associated with buying Solana can vary depending on the exchange you choose. Here are some common types of fees you can expect to encounter.

- Exchange Fees: Most platforms charge a fee for buying, selling, and trading cryptocurrencies including Solana. Different exchanges go about their own way of implementing this — it can either be a percentage of the transaction amount or a fixed amount. This is why it's important that you fee schedule of the specific exchange you're using.

- Payment Method: The method you choose to fund your account can influence the fees as well. Using a credit card or certain payment services like PayPal may result in higher fees compared to bank transfers or cryptocurrency deposits.

- Withdrawal Fees: If you plan to transfer Solana to a personal wallet, you will have to pay withdrawal fees. Additionally, network fees, which vary depending on network congestion, may apply.

In addition, other items can influence fees as well.

- Transaction Size: Some exchanges may have tiered fee structures based on the size of your transaction. Larger transactions might incur higher fees, either as a percentage or a fixed amount.

- Market Conditions: In times of high market volatility, you might experience increased fees or wider spreads between buying and selling prices. You must be aware of market conditions before making any transactions.

Check out our article on crypto network fees to learn more about how those work.

Best Places to Store Solana

Upon acquiring Solana, it becomes part of your on-exchange wallet. While convenient, this practice exposes you to various risks:

- Lack of Control: An exchange wallet operates as a custodial wallet, meaning you lack control over your private keys and, consequently, your funds. If the exchange faces financial issues or imposes restrictions on your access, the ability to transfer your Solana could be compromised. A notable example is the collapse of the FTX crypto exchange, where millions of users lost access to their funds.

- Security Vulnerabilities: Exchange wallets serve as prime targets for hackers due to their centralized nature. In the past, significant crypto exchange breaches have occurred, such as the $600 million hack of the now-defunct FTX on the day of its bankruptcy declaration and the $570 million loss suffered by Binance in October 2022. A compromised exchange's security may result in the theft of your Solana holdings.

- Exchange Insolvency: In the unfortunate event of an exchange becoming insolvent or facing financial challenges, your funds are at risk. Recovering your assets under such circumstances can become an arduous task, adding a layer of complexity and uncertainty to the safety of your Solana holdings.

Given these risks, the optimal choice for securing Solana is through the utilization of an off-exchange self-custodial wallet. You can choose from hardware wallets, desktop wallets, and mobile wallets, depending on your preferences and needs.

Notably, hardware wallets such as Ledger Nano X and Ledger Nano S Plus and Trezor (One, Model T and Safe 3) are among the preferred choices due to their robust security features. These hardware wallets offer an elevated level of security, making them a solid option for keeping your Solana holdings safe.

You can learn more about wallets by reading about the types of crypto wallets available or how hardware wallets work before deciding on whether you need one.

We also go into far greater detail on the security strengths and weaknesses of crypto storage devices in our crypto safety guide.

Crypto Tax in the UK

Whether you're transacting in pounds or Solana, the taxman cometh for you!

In the UK, you may be liable to pay capital gains tax on crypto under the following circumstances:

- Selling your Solana tokens

- Exchanging your tokens for a different type of crypto asset

- Using your tokens to make purchases of goods or services

- Giving away your tokens to another person, except when it's a gift to your spouse or civil partner

It's important to be aware that your tax liability is based on the profit made, not the entire transaction amount. For instance, if you acquired £1,500 worth of Solana and realized a profit of £800, the tax will be calculated on the gained amount (£700), not the initial investment.

To streamline the tax filing process, maintaining detailed records for each transaction is recommended. This should include:

- Type of tokens

- Date of token disposal

- Quantity of tokens disposed of

- Quantity of tokens remaining

- Value of the tokens in pound sterling

- Bank statements and wallet addresses

- A record of pooled costs before and after token disposal

Capital gains tax rates in the UK vary between 10% and 20% for individuals, depending on their income levels.

Speaking of taxes, our article on crypto tax tools will help make tax time a breeze.

How to Buy Solana in the UK: Closing Thoughts

The UK's journey to becoming a crypto hub has turned into a crypto dud thanks to a regulatory shift that introduces more control and oversight into the decentralized digital asset space. As a result, the UK market witnessed an exodus of several established players, leaving users seeking alternative avenues to access cryptocurrencies like Solana.

Focusing on FCA-approved exchanges, such as eToro, Uphold, Bitstamp and CoinJar, users can still engage in crypto transactions while adhering to regulatory guidelines. These exchanges boast solid features, security measures and transparent fee structures. The process of purchasing Solana in the UK involves opening an account on an approved exchange and funding the account using various payment methods with careful consideration of associated fees.

Enjoyed this content? If you want to hear more from us and get up-to-the-minute updates and behind-the-scenes content, feel free to check out our Socials Channels and Resource Hub.

Frequently Asked Questions

No, crypto isn't regulated in the UK. However, some crypto exchanges like Uphold and eToro are registered with the FCA.

It's best to use a crypto exchange registered with the FCA as registered exchanges offer more reliable products. We recommend eToro or Uphold.

No, the FCA and the Financial Ombudsman Service will not compensate you if you lose your money.

No cryptocurrency, Solana included, can be considered safe. All investments carry a degree of risk and your capital is not protected in the cryptocurrency industry.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.