TradeSanta Review: Merry Trading or Mischievous Bots?

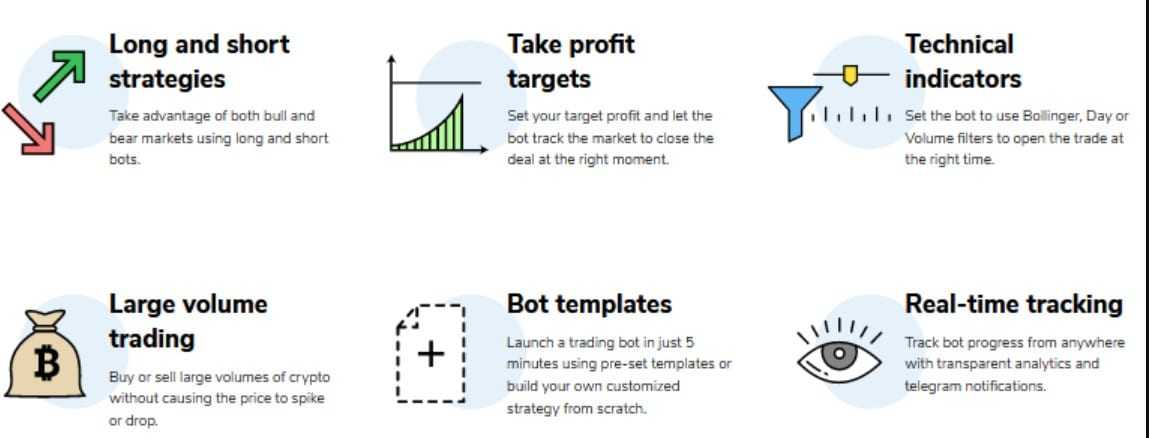

TradeSanta is a software that allows users to automate their cryptocurrency trading strategies in a simple, straightforward manner. It offers long and short trading bots that work in both spot and futures markets, with risk management tools to minimize risks in unfavourable market conditions.

Passive income is a dream that many people chase, and it is easy to understand why. We spend much of our lives trading time for money, leaving many people looking for a way out, searching for the “holy grail,” of passive income schemes so we can make money while we sleep, eat, game, watch films, read books etc., which may be what has brought you to this TradeSanta review today.

To know more on the topic, check out our crypto passive income guide for beginners.

The search for passive income strategies is popular among day traders who trade forex, stocks, crypto, commodities, indices, corn, oil, cotton, basically, anything with a price chart, people will trade it, and try and automate their trading. Day trading is a labour and focus-intensive way to make money, and it comes with a lot of stress and long hours in front of a computer studying price history, price patterns, practicing trading strategies, tweaking strategies and ultimately, trading.

To make the lives of traders easier, many of them have turned to automated strategies and trading bots. TradeSanta is one such company.

This TradeSanta review will tell you everything you need to know about this company.

What are Trading Bots?

Spoiler alert, they are nothing like the creepy image above. In reality, it is much less robot-like, and more of just a program that runs on your computer. No Terminator/iRobot droids here.

Trading bots are tools used by both beginner and advanced traders to assist in their trading. Trading bots can range from being fully automatic, basically as a “set and forget,” just let it run type program, or they can be used alongside manual trading strategies to automate some of the tedious tasks manual traders need to perform.

Trading bots have many benefits as they allow traders to be able to trade around the clock while they work another job or at times when they are not at their computers, and they can increase the efficiency of full-time traders as they can execute their bot on one chart while they are focusing on other charts, searching for additional trades using the bot more like an assistant. And of course, another benefit is that bots do not have emotions so they can reduce risks associated with a trader's biases and emotions such as fear and greed which do not belong in trading strategies.

I have used trading bots myself for years, designing my own and testing literally hundreds of different ones. In my experience, the most beneficial way that I have seen traders effectively utilize bots is when experienced traders use a bot to assist them in their own, already formed trading strategies as more as an assistant and not so much trying to run a bot by itself on full auto.

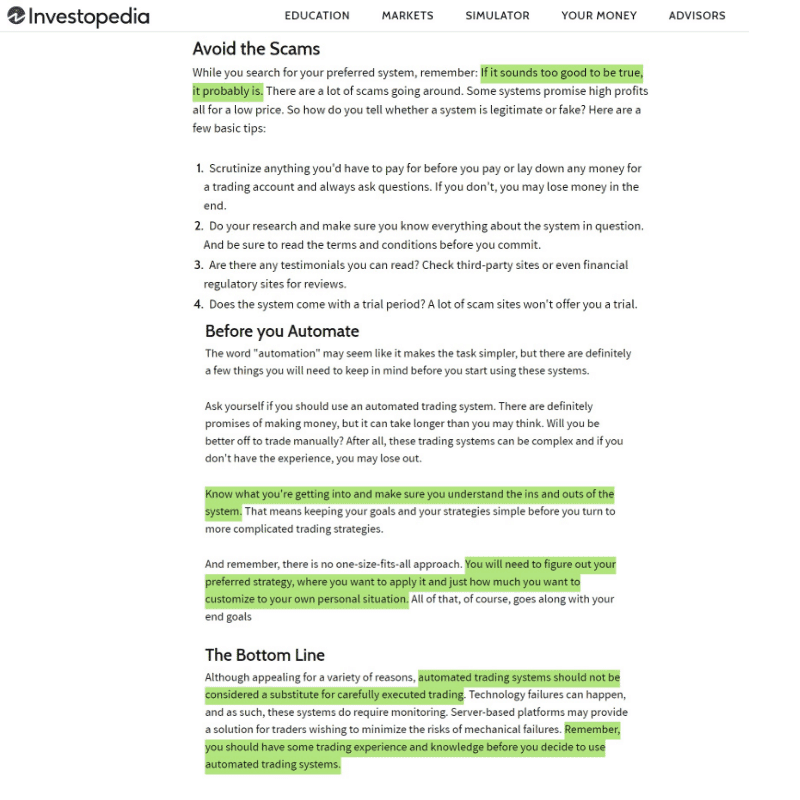

While trading bots that run on full auto-pilot sound great and are every trader’s dream, I don’t want to fuel hopium and be completely transparent when I say that fully automatic trading bots do not have a great track record and far more people have lost their accounts than have made money using them.

This is mostly due to people who do not know how to trade or recognize chart patterns or trends thinking that they can throw a trading bot on any chart at any time and let it go which is not the case. Please be sure to do your own due diligence and learn more about expert advisors/trading bots to decide if they are worth the risk and always test bots on demo accounts before risking live capital.

Check out our top picks for the best crypto trading bots.

What is TradeSanta?

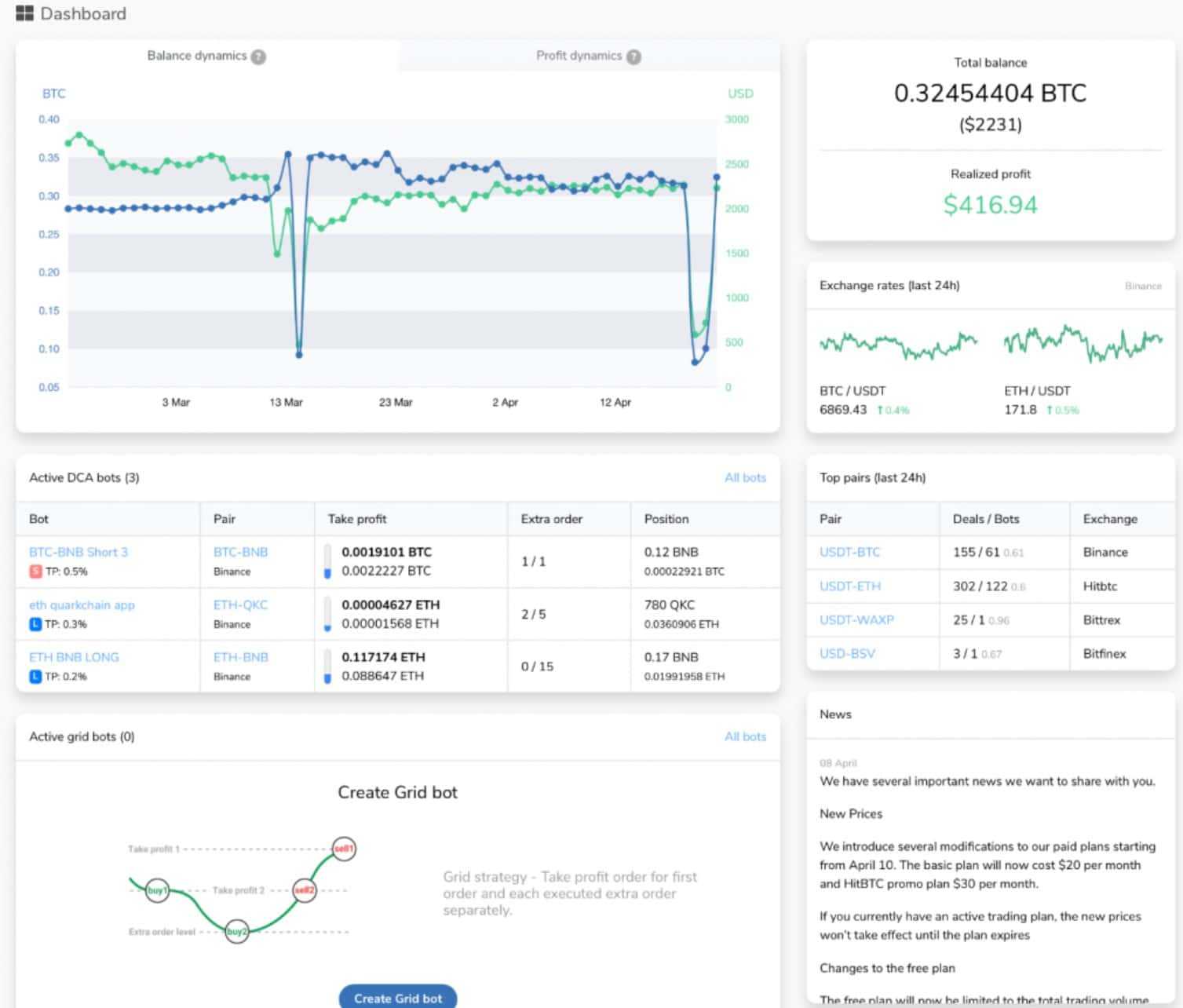

TradeSanta is an automated crypto trading platform that looks to simplify crypto trading by allowing traders to use customizable automated trading bots so they can benefit from the use of trading bots without having to have the skills or knowledge needed to program their own. The TradeSanta platform allows users to create, monitor and adjust the bots in a way that suits their trading style.

For anyone who has ever tried to use trading bots in the past, you will know that trying to find a good trading bot on the internet is like trying to find a needle in a stack of needles. It is a complete minefield with literally thousands of them being spammed all over the internet on scammy looking websites and trading forums, with many bots being about as useful at trading as a rock.

Fortunately, TradeSanta is a well-established and well-respected company within the crypto community and has been around since 2018 with hundreds of positive reviews and happy users so you can be confident that their system is dependable and will function as expected. Of course, keeping in mind that the trading success of the bot is completely dependent on the settings and strategy that the trader chooses, and how they choose to deploy the bot.

TradeSanta is great for beginners to the world of automated trading systems as it is very user friendly, but also has loads of customizable features making it also suitable for intermediate or advanced traders who are looking to add some automation to their trading.

TradeSanta Review: Pricing

TradeSanta offers subscription packages at three different price points. The differences between the packages are based on the number of bots a trader wants to deploy and other features such as enabling trailing profit settings and receiving trading signals. The number of bots needed depends on how many trading pairs a user wants to trade as each bot will be assigned to one pair.

The price plans are as follows:

- Basic Plan-$14 per month, up to 49 bots.

- Advanced- $20 per month, up to 99 bots, trailing take profit, TradingView signals

- Maximum- $30 per month, unlimited bots, everything included in the lower plans plus access to Binance Futures.

Types of TradeSanta Bots

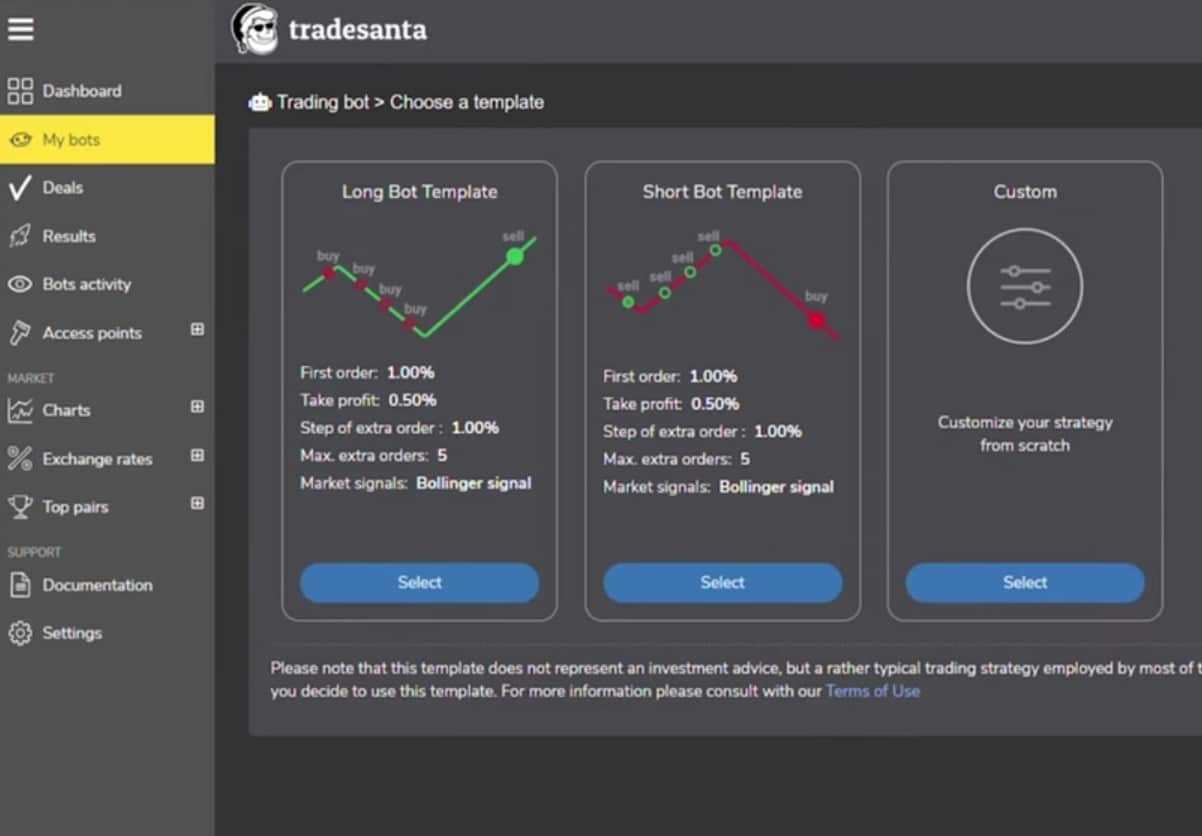

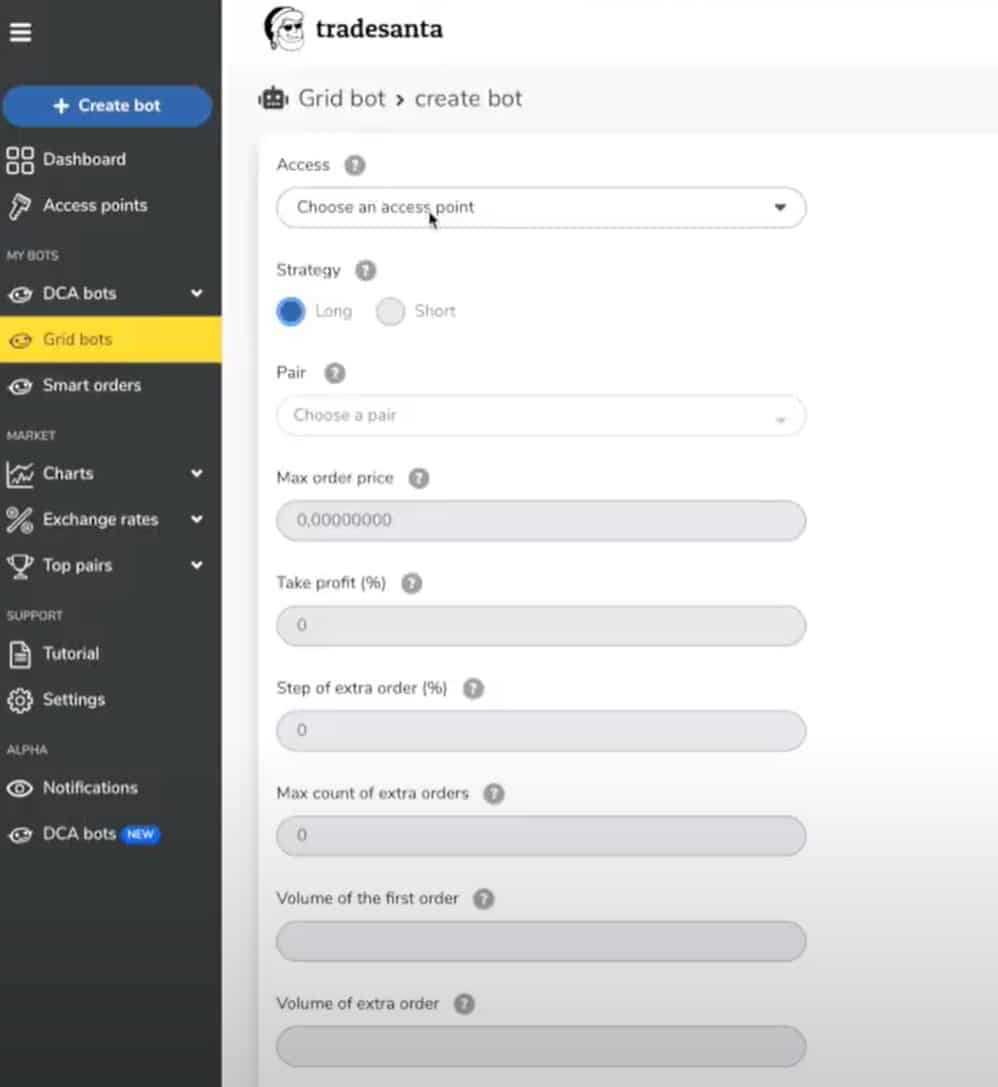

Traders start by choosing a bot with a long strategy if they are bullish, or a short strategy if they are bearish. Once a trader has their directional bias, they can then choose which technical indicators to use like the RSI and MACD and use trade filters and volume filters to determine buy and sell entry points. Traders can then choose if they want their bot to follow a dollar cost averaging or grid trading strategy which I will cover more in a bit. Traders can choose from a selection of preset templates that they can tweak as well.

DCA (dollar cost average)- DCA bots are great for volatile markets where price swings up and down multiple times throughout the day or week, remaining within a fairly stable range. This trading style is ideal for traders who want to ensure their position is fully exited once a profit target is reached. The weakness is that dollar cost average strategies can fall apart and result in heavy losses when price is in a strong trend against the trader’s open position.

If there are no retracements in price, the basket of trades is unable to close out in profit and due to the extra open positions will result in larger losses. During ideal trading conditions, the DCA strategy has the potential to substantially increase a trader’s win rate. The chaps over at the FX Axe YouTube trading channel have a fantastic video discussing everything you need to know about the dollar cost averaging (aka Martingale) strategy, along with the risks associated with it.

Example of how a DCA bot Trades Image via TradeSanta

Example of how a DCA bot Trades Image via TradeSanta

To avoid confusion, note that a dollar-cost averaging trading strategy is different to a dollar cost averaging investment strategy. Though they have the same name, are similar in principle, and are both very popular strategies that are mentioned a lot in trading/investing, they are two very different approaches to trading/investing and carry very different levels of risk.

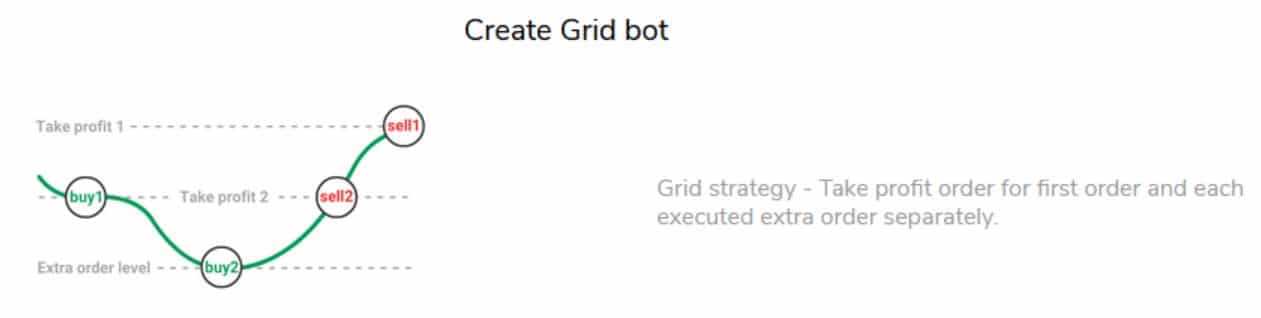

Grid- Grid bots treat every order separately, so if one order buys x quantity of a coin, the bot will trigger sell orders for the same quantity. Grid trading strategies work best in stable markets when price is consolidating. You can learn more about Grid trading strategies and the pros and cons in this great grid trading article from tradingbot.info

Technical Indicators Available

TradeSanta supports technical indicators that can be used when setting the bot’s trading strategy. These include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger signals. Traders can also choose trading and volume filters to further customize their strategy and buy and sell triggers. There are literally thousands of different trading indicators out there, it would be nice to see TradeSanta support a few more highly popular ones such as moving averages and Stochastics.

Speaking of, we also have a crypto technical analysis guide for you.

Trading Bot Trade Example

Let’s say you believe your crypto asset of choice is going to increase in value, so you choose a long strategy. You buy 10 coins each costing $20 dollars for an investment of $200 dollars. You expect that the price will rise and want to sell once you have made a profit of 1%, the bot will automatically close the position once you have made that 1% profit, or whichever profit target you set.

But what happens if the price goes against you? In that case, the DCA bot will place extra orders as price falls further against your profit target to dollar cost average (lowering) your average entry price. You can choose how many extra orders the bot will take if price goes against you and the percentage of your account to risk on each trade.

So, in this example say you allow the bot to open up two extra orders if price falls with each trade being opened with 5% risk. If the price drops to $19 per coin, the bot will by 10 more coins, then another 10 if price drops to $18 per coin. As a result, if the market goes down by 10% you will now have 30 coins with $19 dollars as your entry price, lower than the original $20 dollars per coin.

This is advantageous as now you only need the price to increase to $19.19, which is below your entry price in order to reach your 1% profit goal.

How to Get Started on TradeSanta

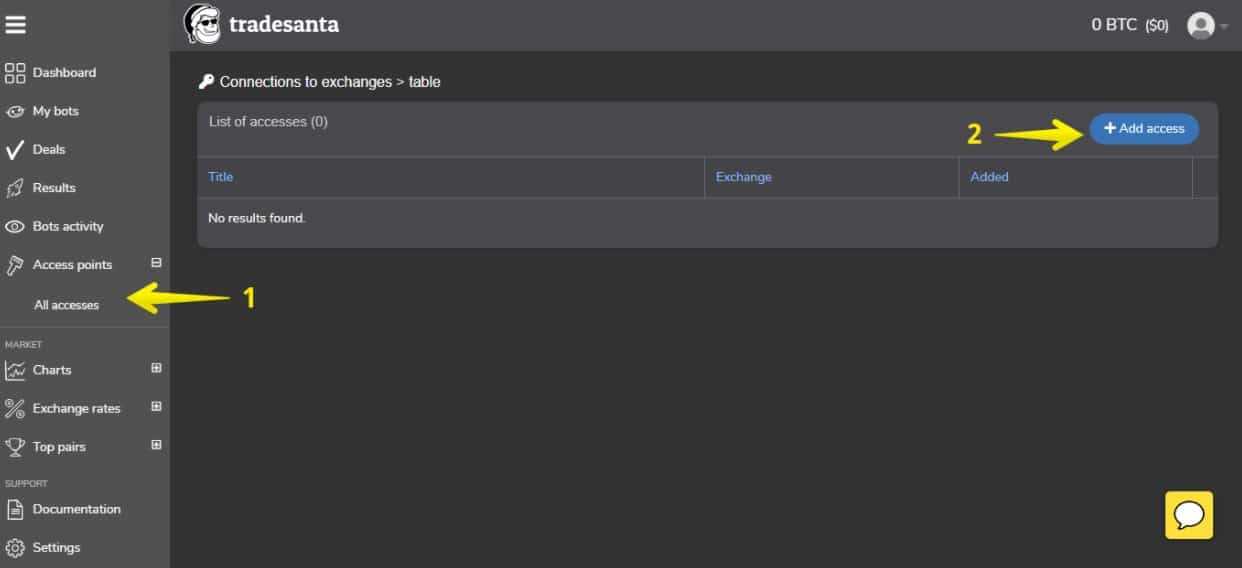

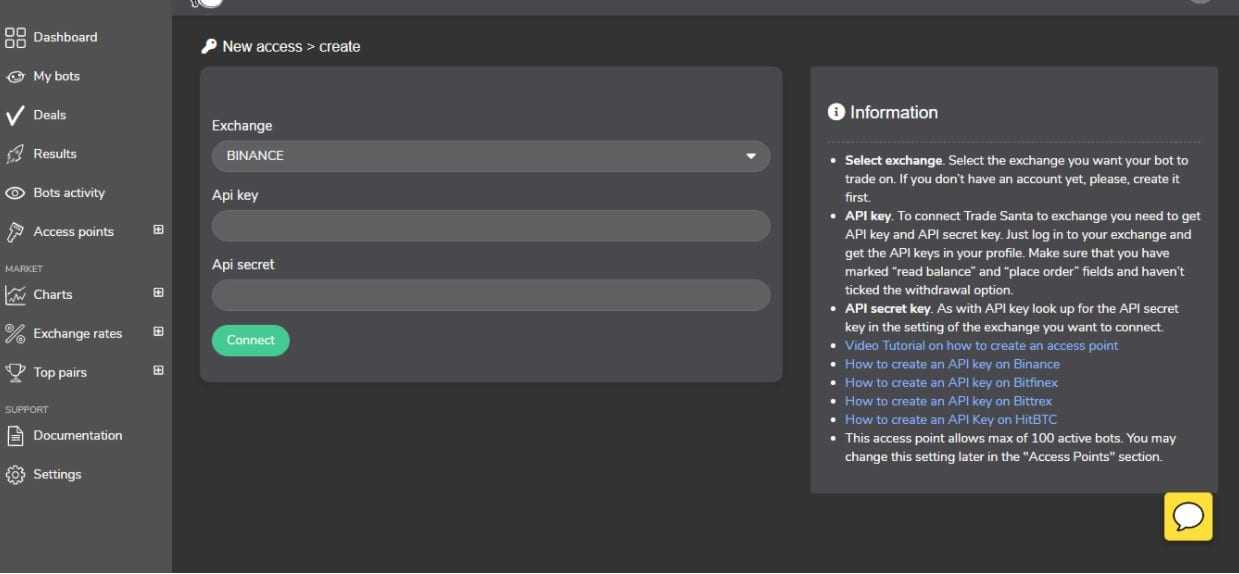

Users will first need an account with a crypto exchange. They can create and connect to a new crypto exchange through the TradeSanta platform or connect an existing exchange account which is more common. The supported exchanges are Binance, HitBTC, HTX, UPbit, OKX, Coinbase and Binance.US.

Users will need to insert the API keys from their crypto exchange account into their TradeSanta account to synchronize the two together. Don’t worry, this is easier than it sounds as there is a setting directly in Binance under the Account settings called “API Management,” and from there you will be able to generate an API key.

I am assuming the process is similar for other exchanges, but through Binance it is a breeze. Once a user has generated the API key in their exchange of choice, an API secret key will also be automatically generated and both the API key and API secret key can simply be copy and pasted into the user’s account on the TradeSanta platform.

Mobile App

The mobile app offers the same tools and features as the desktop dashboard. Each bot has a dedicated, “bot card” where users can check their performance and make any tweaks on the go. This is really convenient as I can’t tell you how many times I was out when the markets took a serious dive and I had to rush home (often too late) to tweak my bots or shut them down on the computer. As you know, markets move fast and can flip on a dime so being able to tweak bots on the go is a real positive.

Customer Support

Users of the platform seem genuinely satisfied with the great level of customer support. This is always a good sign as many of the trading bots available online have no support service whatsoever. TradeSanta provides in-platform support via live chat and are quick to respond. Customers can also reach out to them on Telegram or email at [email protected]

User Interface

The dashboard and mobile app both have a great interface that is clean, easy to navigate and use. All the metrics and features are easy to locate and finding your way around to the different areas is a breeze, definitely one of the most user-friendly platforms I have seen.

Education

As I have mentioned, the TradeSanta platform makes creating trading bots easy regardless of technical skill meaning that it is suitable for any level of trader from advanced to beginner. However, as I have also mentioned, trading bots and trading, in general, carries a high level of risk. If you are a beginner, while TradeSanta is beginner-friendly, the world of day trading and automated trading bots isn’t.

Fortunately, TradeSanta has done a fantastic job at creating educational content and have some great educational resources in their blog and FAQ section to help you get more fluent and up to speed in the world of trading. If you’ve never traded before, YouTube is also a great place to go and learn the basics such as Guy’s three-part series on learning technical analysis. A little bit of homework and you’ll be well on your way to securing your best chances of using TradeSanta safely and profitably.

Security

While cryptocurrency trading can be risky, the TradeSanta platform itself is very secure, using two-factor authentication and password protection. The API key used to link a user's brokerage account also only grants trading permissions, not withdrawal permissions so you don’t need to worry about the TradeSanta team or your bot going all AWOL and running off with your funds.

One concern that I am seeing a lot of as I dive deep into this review is a lot of customers claiming that TradeSanta is a scam, claiming that TradeSanta has taken money out of customers wallets and exchange accounts. After looking into these claims I can confidently say that these allegations have nothing to do with the TradeSanta team and is yet another one of hundreds of sad stories where customers are being tricked on Telegram by scammers impersonating support staff of crypto companies.

The “trade only” API integration makes it impossible for TradeSanta to withdraw any funds and each of the “scam” reports I am reading have the common theme that customers were talking to someone on Telegram who pretended to be from TradeSanta and the customer provided personal information that gave the scammers access to their exchange account or wallets. I see this same story regardless of the company so please always be certain of who you are talking to and know that no support team will ever ask for passwords or private keys.

The TradeSanta support team seem to be very active and engages with reviews, complaints and suggestions across various review sites so kudos to them.

TradeSanta Review: Closing Thoughts

TradeSanta has done a great overall job at completing what they set out to do and that is making automated cryptocurrency trading as easy as it can be. The very user-friendly plug-and-play settings makes programming and deploying the bots easy. Before companies like TradeSanta, users would basically need a degree in computer science to create these bots then figure out how to install them on their trading platforms but being able to do everything directly on the TradeSanta platform thanks to the API integration is such a time saver and game-changer.

The two biggest criticisms that I have are the lack of available indicators on the platform and settings for the bot, making the bots not ideal for more complex trading strategies, and the fact that they only offer a 3-day free trial is pretty lame. Many similar companies will offer a 7 to 14-day trial as it can take a while to get used to the platform and users should be able to test the bot and run it for a few days to see if it’s right for them.

For the price, you can’t really go wrong. Being able to deploy an army of 99 bots to trade around the clock while you kick back and enjoy a pina colada for $20 dollars a month is a steal. As I have alluded to, TradeSanta is best suited for traders who do have experience in crypto trading and just need a tool to handle the programming side of automating their strategies.

From the customer reviews I have read, TradeSanta has generally positive reviews across various sites and customers seem satisfied with the TradeSanta product, price, and customer support. I haven’t seen any glaring red flags other than a few traders who left angry reviews as they thought auto trading bots were supposed to work like money printing machines and used the bots irresponsibly and with too much risk and inevitably lost money.

TradeSanta has been around since 2018 which is a good amount of time for companies who offer trading bot software. I have seen it happen over and over where a trading company releases a trading bot, a bunch of users lose money with it, then the company disappears or goes bust in 6 months so the fact that TradeSanta has been around a while and has a lot of great reviews means that they are offering a product that works and that people are happily using it.

The TradeSanta team also have a good reputation within the crypto community and over 4000 active members in their official Telegram group. Overall I think TradeSanta is a good option for experienced crypto traders who understand crypto market conditions and know when to, and when not to deploy a trading bot and have a fairly straightforward trading strategy that can be easily automated by the TradeSanta bots.

If you want to know Guy's take on crypto trading bots, feel free to check out his video on the topic below:

Frequently Asked Questions

Once you sign up for a plan or the free trial, getting started is as simple as following these steps:

1. Connect TradeSanta to a crypto exchange. I recommend Binance or Huobi as they support APIs. Users can generate an API key in TradeSanta and paste it into the exchange's account settings. TradeSanta provides detailed instructions with images to walk you through the process.

2. Choose a pair of currencies you want to trade on the exchange.

3. Choose your strategy using the Trading View graph and price parameters.

4. Set your stop loss, take profit, and other details for the strategy.

5. Turn the bot on and let it go.

Traders select their own parameters and indicators to enter into a plug-and-play algorithm creator interface on TradeSanta, which is why this tool is best used by experienced traders with a proven successful trading strategy in which they can automate. Indicators are things like movements in price or volume that can be selected to trigger a buy or sell order from the bot. The bot will constantly monitor the trading pair it is assigned to and will enter or exit a trade when those parameters are met.

Traders can certainly be profitable using TradeSanta, but it is by no means guaranteed. Statistically speaking, far more traders lose money trying to use automated trading strategies than those who make a profit. Traders who use automated strategies with the most success are those who have already found a profitable trading strategy that is rules-based, not emotionally or biased based, and understand how to identify the market conditions in which the bot should be deployed that will give it the highest likelihood of success.

Yes, TradeSanta is a legit service that provides traders with a no-coding skills necessary platform where they can automate their trading strategies and deploy them onto a crypto exchange. TradeSanta delivers exactly what it promises, and that is a simple place to automate trading strategies. It works very well.

The platform has plenty of positive reviews, and I have used it myself and can confirm that it works as intended. A number of the negative reviews appear to be from amateur traders who incorrectly assumed that they could use automated trading bots to win trades and earn money passively, but ended up losing trades as they did not take the time to understand the fundamentals of trading. Similar negative reviews are common across many auto trading services and often do not reflect the service itself. Remember that trading bots are not magic money-making machines, one needs to learn how to trade to understand what parameters to set on a bot and recognize the proper market conditions for that specific strategy.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.