Crypto Technical Analysis: Complete Beginners Guide to TA

What's the real deal with Technical Analysis? Can you really use it to make trading returns on a consistent basis?

Indeed, this is an ago old question which long predates cryptocurrency trading. Some traders will swear by it while others view it as nothing more than financial tarot card reading.

As with most things related to trading, the answer to this question usually comes down to the individual trader and the assets being traded. It is not just whether it is used but how it is used.

In this post, we will take a deeper look into technical analysis theory and whether it can effectively be used in your cryptocurrency portfolio.

But first, let's start with some basics...

What is Technical Analysis?

Technical analysis is quite broadly defined as the practice using past price information on a particular asset in order to make forecasts as to the future direction of said asset.

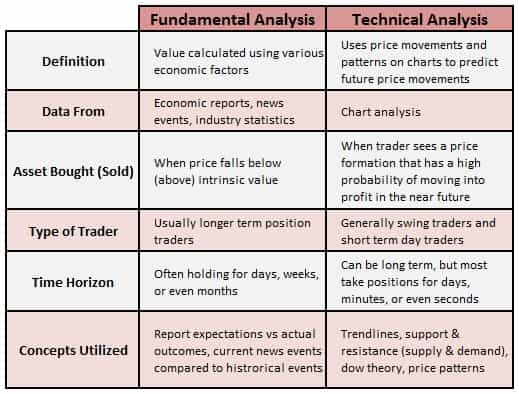

Unlike fundamental analysis that analyses the underlying asset itself, technical analysis is merely concerned with the price levels, trends and volume. It is a theoretical expansion of the notion of behavioral economics.

They believe that price trends tend to repeat themselves due to the collective behavior of these investors. Technicians base their analysis on crowd psychology and the patterned behavior of the investors.

Given that technical analysis is purely concerned with price data, it can be used to map the price of any asset over any period of time. Hence, they have been used in broad range of asset classes with analysis stretching from years to mere hours.

While this is the textbook definition of what technical analysis is, many technicians know that it should not be looked at as an exact science. They view it as a strategy that can inform their trading and increase their chances of long-term success.

Now that you have a reasonable idea of what technical analysis is, let's take a look at the other side of the argument.

Arguments Against Technical Analysis

One of the most quoted arguments against the significance of technical analysis is that of the Efficient Market Hypothesis (EMH). This basically asserts that asset prices fully reflect all available information and that price movements follow what is called a "Random Walk".

In other words, the asset price will reflect all available information in the market and is correctly priced. If there are movements in one way or the other, these will be related to pure chance and cannot be modeled or predicted.

Of course, the EMH is itself quite a dogmatic theory that is often also used to dismiss other forms of investing such as fundamental analysis. In its strictest form, the EMH asserts that the most optimal investing strategy is to "buy and hold" the market as any other form of active management cannot yield excess returns in the long run.

While most people will avoid this rigid approach when countering technical analysis, these are some of the other arguments that are made:

- Subjective Pattern Interpretation: When the technician is trying to identify charts and patterns in the price of an asset, it is possible for them to "see" a pattern when it is really subjective. In other words, it is possible that one technical analyst will identify a head and shoulders pattern when others are not likely to see it. So the effectiveness of a trading strategy based on subjective interpretation is hard to assess.

- Data Mining Bias: This is when a technical analyst will select one indicator over the other given that this indicator confirms their view of where the market is going. Even if that indicator is contradicted by a whole host of other technical indicators.

- Stronger Competition: Even if there are cases when past price information informs future prices, technicians have some pretty stiff competition from the likes of quantitative hedge funds and high frequency trading firms. These firms use complicated AI algorithmic trading strategies that are able to read order flow and movements much more quickly than the average technical analyst can.

Indeed, some of the most notable investors such as Warren Buffet do not view technical analysis too favorably. He famously once said:

I realized that technical analysis didn't work when I turned the chart upside down and didn't get a different answer

So, do these arguments have any basis in fact?

Countering the Critics

These arguments against technical analysis tend to miss the mark in a number of ways. This is because they assume that those who practice technical analysis view it as some sort of a divine text that cannot be questioned.

The vast majority of technicians use it as a basis to inform their opinion and manage risks. They do not operate in a silo without consideration of other factors that could drive the price of the asset.

Let's take a closer look at some of the above arguments and how they can easily be refuted:

Efficient Market Hypothesis:

This is exactly what the name suggests it is, a hypothesis. It is based on a mathematical theory that markets are always rational and that there are never any mispricings. There have been countless studies and empirical research that can refute this hypothesis.

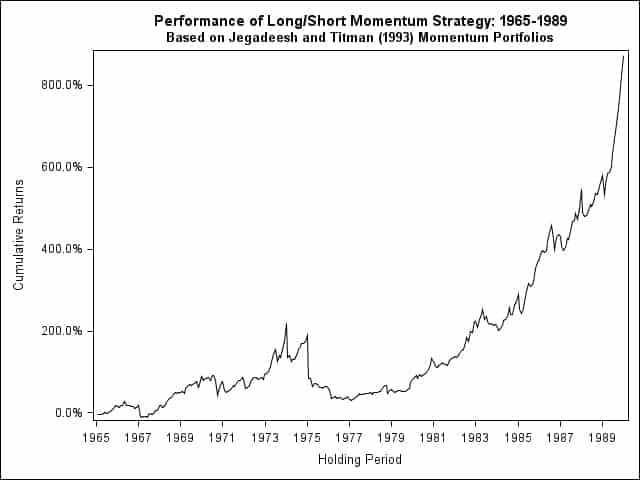

For example, studies such as those done by Jegadeesh & Titman have shown the statistical significance of momentum-based trading strategies. There have been a number of other studies that have shown the same statistical significance in other markets.

Momentum studies are used regularly in technical analysis and they clearly show that past returns are related to the future returns.

Pattern Interpretation

Yes, it is possible that a technician is noticing a pattern that is entirely subjective, however this argument makes a generalization. It assumes that all technical analysts lack discipline and will "reason" their way into recognizing and confirming a pattern.

Disciplined technical analysts will have clear mental guidelines and rules of thumbs that they will use when identifying the exact patterns and formations. Getting the setup right is essential and a weak pattern is likely to be a less instructive sign for the technical analyst.

Data Mining Bias

This also depends on the professionalism of the technical analyst. Very few technicians will use only one or two indicators. They will try and combine a number of them in order to confirm the signals certain indicators are giving.

If they have contradictory readings from one or the other then they are likely to do more research instead of choosing the only indicator that confirms their view.

Moreover, the skilled technical analyst will also borrow studies from other disciplines in order to confirm their view. Traders should never operate in a vacuum and be hostile to other analysis and methods

Stronger Competition

This argument is actually irrelevant to the broader question.

So what if a large sophisticated hedge fund is able to get better returns than you? That is not the underlying question. All that matters is whether technical analysis is able to provide you with the right tools and indicators to get better returns than you would if you did not use it.

Whether the High Frequency trader can get better levels and faster execution should be irrelevant to your decision of whether you should use it. Their systems costs millions of dollars to develop and operate, your home PC is incomparable. It's really comparing apples and pears.

Moreover, it misses the broader point about these firms. Many of the trading algorithms that are run by these firms operate based on inputs similar to those that are used in technical analysis. This should further add weight to the argument that technical analysis can work when applied correctly.

Technical vs. Fundamental

No trader should do their analysis in isolation. They should try and incorporate other points of view and analysis into their decision making in order to build a fuller picture.

Having said that, there are at least two advantages that Technical Analysis has over the likes of the more research heavy fundamental analysis.

Less Opinionated

External research reports that are based on fundamental inputs are often way more subjective. You have to draw a conclusion of the long-term prospects of a company, commodity or cryptocurrency based on a range of different factors (Economic growth, sector growth, CEO vision).

which are completely verifiable. When you are trying to interpret a chart, it is only your analysis that counts. You are unlikely to be swayed by the view of the person who is drawing up the research report.

Better for Risk Management:

When an investor is entering a position based on their fundamental research, they are doing so based on their fair value assessment of the price of the asset. This means that they will usually hold the asset over a long period of time in the hope that the price will eventually reflect that.

The problem with this is that they leave very little room for their analysis being wrong. They have invested the time and the effort into their research and are way less likely to give up on the trade even if it is going against them.

Technical analysts, on the other hand, mostly trade with stop losses. They will often incorporate their stop loss, limit and take profit positions based on technical levels. Hence, if a trend does not confirm their analysis, they will have the adequate backstops in place.

Technical traders can be considered more methodical in this sense. They have no qualms in giving up a trade and quickly cutting losses if it appears that they could have been wrong.

Crypto Technical Analysis

So it is clear that technical analysis can work when used in a risk controlled way by disciplined traders. But can it be used effectively in the nascent cryptocurrency markets?

Well, it really depends on what coins you are trading.

Technical analysis is likely to work more effectively in the markets that are liquid and where there is a greater degree of volume across a range of exchanges. Trying to read the charts of some mid and micro-cap coins is much less effective.

This is because there is a great deal of market manipulation that takes place in the smaller market cap coins. There are pump-and-dump groups and crypto whales that will try and create movement and interest in a coin in order to cash out on less experienced investors.

What you may interpret as a price that has broken a trendline could merely be the actions of some nefarious traders goading less experienced ones. Pump-and-dumps also bring volume with them which is usually also another important indicator used in technical trading.

Moreover, with thin markets prices are likely to gap much more easily. This means that levels could easily shoot past your stop orders or be hard to exit when you would like. Artificial markets and artificial demand could quickly deplete your portfolio.

What does this mean?

Stick with coins that you know have a lot of volume and are not as susceptible to market manipulation. For example, the coins that are in the top 10 of market capitalization are likely to be the most secure from a market efficiency standpoint.

What Makes a Good Technical Trader?

It is important to note that technical analysis is a tool and like most tools, it can be used correctly and incorrectly.

If you are using technical trading and are not doing so in a systematic and methodical way then you are gambling. If you are firing off trades based on one or two levels that you think might confirm your view then you are being unsystematic.

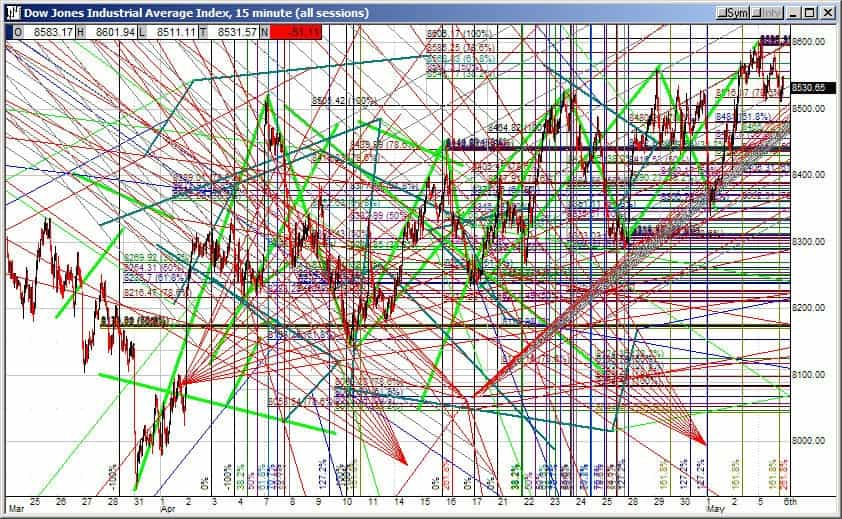

Indeed, there are also many technical traders who try to bombard the charts with hundreds of indicators and try to develop a strategy that is comically bad. You should not be doing technical analysis just because you can.

It is also important to point out that emotions should be completely disregarded in trading generally and in technical analysis specifically. You should be placing and exiting your trades based solely on what the charts and analysis is telling you.

You should never run a bad trade and remove your stop losses to chase losses. You should take your profits at the designated levels and not allow the "winning streak" mentality to cloud your analysis.

This is not a roulette wheel in Vegas. This is a highly systematic but sometimes idiosyncratic market that needs a disciplined and methodical trader to best exploit its inefficiencies.

Complementary Analysis

As mentioned above, the best traders are those that are able to incorporate other analysis and use it in a complementary way. There does not have to be a choice between using technical and fundamental analysis.

Remember, technical analysis is not a science and is based on placing trades that are more likely to go in the direction that you predict. If you are trading based on likelihood then it can only add to the case if the fundamental also confirm that view in the medium to longer term.

For example, you can create a list of coins that you think make sense from a fundamental / value perspective over a short to medium term horizon. You can then use technical analysis to better place time the trades in a risk-controlled manner.

The same can be said for those coins that you think are likely to suffer head winds in the short to medium term. These could be prime candidates to place a short position on assuming that the levels and indicators point to a potential break lower.

Doing Effective Research

Despite what you think of your technical analysis ability, it is helpful to get opinions and research of others. This could also help you avoid any sort of subjective bias when it comes reading patterns.

There are a number of resources that you can use in order to get pretty decent analysis. The best places are probably on charting focused forums such as Tradingview or the like. The technicians who provide analysis there have verifiable track records.

If you are able to get into some of the more professional Telegram and Discord channels then that could also be a good place for you to augment your analysis.

You should probably avoid reading too much into the charting that is done on social media sites such as Twitter, Facebook et al. There is often too much noise in this space as people compete for a larger following.

Conclusion

Technical analysis is a helpful tool that can be used by traders to make calculated and risk-controlled trades on a consistent basis. Of course, it is not without its limitations and it important for the user to know these limitations.

It is not a science and it should not be followed like a bible. Traders should try and augment their technical analysis with a number of other indicators and fundamental research to make sure that they have the best chances of trading profitably.

You should also make sure that your trading is done in a systematic manner. Be disciplined around where you are placing your stops and how you are exiting your positions. The markets are not a casino.

In the end, technical analysis is like any tool. The usefulness of the tool depends almost exclusively on how the tool is being used.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.