Trend Trading the Crypto Markets for Fun and Profits

Trading is perhaps one of the most promoted ways to make money in financial markets, especially the crypto market. On social media, you see “experts” promoting their courses and guaranteeing at least 20% profits every day. Trading is also viewed as something cool, largely due to the videos of these same experts claiming ownership of “Lambos” and the like.

The real truth is that trading involves tremendous risks and no one can honestly guarantee you any gains. Therefore before you even think about starting you should be aware of what trading involves and how you can try to minimise your risk.

If you were to ask someone how you should trade, the obvious answer they would give is to buy at the bottom and sell at the top. This sounds fairly simple and, yes if you could succeed in always finding the bottoms and tops then naturally you would make a ton of money.

However, trying to find these tops and bottoms is not as easy as it sounds, which makes trading extremely risky, especially day trading. This is why many do swing trading. In swing trading, the time you keep an asset can vary from a week to even a few months. Swing trading often stems from analysing trends in a certain asset, which results in deliberately entering a rising market rather than trying to find a bottom.

Crypto Categories

In almost everything around you there are trends. Maybe the best example would be fashion. In fashion, we divide everything into different categories, like pants, shirts, hoodies, and skirts. For these larger categories, we have subcategories and we also have different brands which compete to be the best in these categories.

This same structure can be found in crypto markets. There are a few different ways of looking at what the main categories are, but one particularly good video about this is by our very own Guy. In that video you’ll learn about stores of value, smart contracts, oracles, payment, privacy, exchanges, and meme cryptocurrencies. On top of these, we have smaller categories that can somewhat fit into one of these bigger ones. We have sub-categories like NFT-focused cryptocurrencies and gaming cryptocurrencies.

It’s good to know we have these different categories since they tend to pump and dump at different times which means there’s always a chance to trend trade on something that is currently pumping. For example, NFT related coins and tokens tend to rally together and the same is true for the class of DeFi tokens.

Of course it can be tough to pick the winner from the entire NFT space, so you might be more interested in analysing and trading only a specific cryptocurrency. Even if that is the case, you should be aware of these different categories and how they tend to move together since even if you find a crypto that seems perfect, it might not pump if interest in that particular category is low. The key is to understand that trends come in different strengths and lengths, and that they can be for a specific cryptocurrency or for the broader markets.

Profits

To keep your interest level high, let’s move on to the fun part, profits. Many would think that since you’re not looking to enter at the bottom, nor sell at the top, that you won’t make as much profit as you would from day trading or any other trading for that matter. Well, that’s not actually the case.

First of all, before even talking about profits we should look at risk. In trend trading, you are jumping on an asset that is already moving upwards and if nothing special happens then it ought to continue to move upwards. When trying to find a bottom you are jumping on a downwards movement and hoping that something will happen which would turn the price around. Just from these simple examples, you should see that in a basic sense trend trading is less risky than trying to find the bottom.

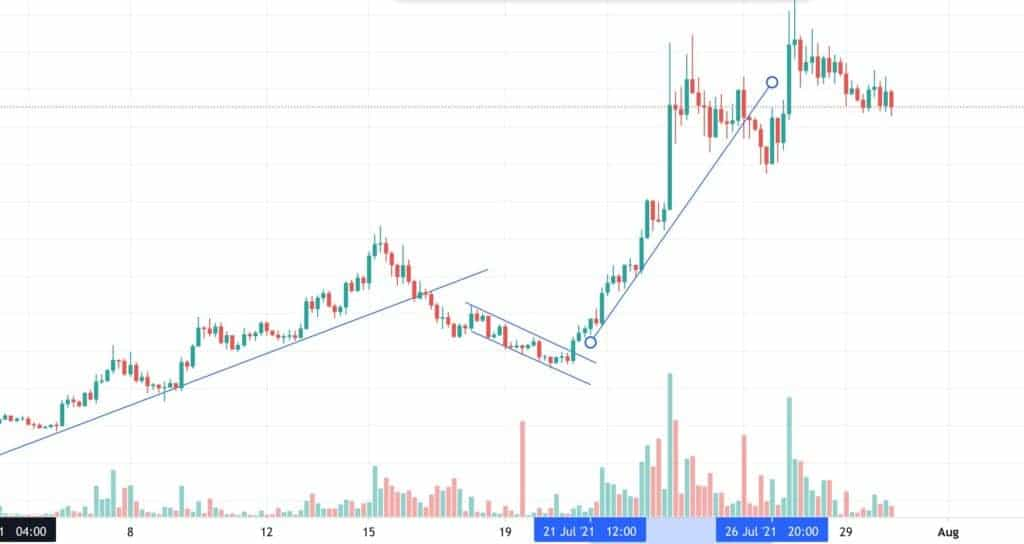

To see the power of trend trading first hand we can use Axie Infinity as an example since it has moved massively in recent months. To better understand the prices and days I’m about to refer to I suggest you open TradingView in another tab and search for Axie Infinity’s price chart (use 4 hour candles).

As Axie Infinity starts moving up at the end of June you as a swing trader start looking at it. You can clearly see how the volumes continuously rise while Axie forms higher lows. Let’s now assume that on July 9th you have confirmed there is an upwards movement and you enter the market at roughly $15.

Then on July 16th, you decide to sell at roughly $20 since the price went below an upwards moving trend line of previous lows. In just one week you secured a gain of 33 %! Not bad from someone who didn’t even buy at the bottom, nor sell at the top.

We could also have kept Axie Infinity in hopes that the uptrend is still intact and just experiencing some shorter-term downwards pressure. If you did that you would currently be sitting on an unrealised gain of 180%. Yes, that is impressive. However, we could have secured even bigger gains thanks to the fact that we sold.

Because in this example we sold our holdings at $20, but then we decided to enter again on July 21st at roughly $19 when the price broke out of a downward moving wedge. Then we would have sold at roughly $38 on July 26th when price broke below the uptrend. This would have made us about 100%. With quick maths investing $1000 in the beginning and using the profits from the first trade we would have turned that initial investment into $2600. Not bad.

As clearly seen from this example, buying at the bottom and selling at the top is unnecessary. Naturally, the closer to the bottom you can buy the more you will profit, assuming you sell at a good price. However, you need to give time for a trend to form, otherwise, you’re just gambling on something that may or may not happen. We want to be traders, not gamblers.

Now, to make a trade similar to the Axie Infinity one we need to look at some ways to analyse a trend.

Methods for Analysing Assets

In the example above all the trading we hypothetically made was based on the most basic technical analysis there is. In a real situation, it would be wise to combine some other forms of analysis like trader sentiment and fundamental analysis.

Even if you only want to use technical analysis I suggest you conduct a slightly more thorough analysis using some other indicators, like Bollinger bands and Fibonacci retracements. Also, the Axie Infinity chart formed a textbook bullish flag which if you were an experienced trader you could have spotted. In this article though we will assume that you like to do as much analysis as possible and therefore we will start with fundamental analysis.

Fundamental Analysis

If you are someone who doesn’t feel confident investing money in projects simply by looking at a chart and some patterns, then fundamental analysis might be the tool for you. In more traditional assets like stocks, it’s much easier to do fundamental analysis since companies are centralized and release quarterly earnings. Because cryptos don’t have these we need to look at the broader picture and for example, analyse a currency's user base or use cases

Let's start by using Chiliz, which is the founder of the fan engagement platform Socios.com, as an example. First, you need to complete a quick overview of the cryptocurrency in question. Look at what they do, their market cap, the trading volume of their coin. Visit their website, and maybe even read their whitepaper.

Explaining all the analysis steps here would take too much time, so I suggest you watch this Coin Bureau video if you don’t know how to do this fundamental analysis. Yes, analysing this much for your trading might feel overwhelming but this analysis can help discover the best coins and decrease the risk of any unexpected downturns. Additionally, the trend you’re entering might be stronger if there truly are people who believe in the project entering and not just traders.

After doing the basic analysis if you feel confident that the project is good, now you need to look at when the price might start pumping, or if it already is. To do some trend analysis you could start by analysing how many users the platform has gained and see whether it is gaining popularity. This is often referred to as on-chain analysis and it’s extremely good to analyse as many factors as possible. One of the most popular tools for this is Glassnode.

Another piece of fundamental analysis would be to look for news about any major partnerships. If you find both an increasing use of the platform and a good amount of positive news coming out then that’s great!

However, a small upwards move doesn’t matter because as already mentioned multiple times, we are not looking for the bottom but rather to get onboard in an already established trend. In this example, let’s say the price has moved up for a couple of days and the volumes continue to rise steadily while positive news just keeps flowing. Should you enter? Yes, now you could enter if you feel confident that you have spotted an upwards trend. However, if you want further proof of an uptrend you could try some sentiment analysis.

Sentiment Analysis

With sentiment analysis there are two, or maybe three especially important things to analyse. First, it would be good to analyse practically the whole world's view towards risky assets and different financial markets in general. This is called risk appetite. You’ll have to do this since it can be hard to find any winners if you happen to buy in the middle of a crash similar to the Covid one last spring.

The next thing to analyse is the sentiment around crypto markets. Here you can take the results with a grain of salt since many people view Bitcoin and the whole crypto markets as one asset. The fact is that even when Bitcoin and other large currencies are moving downwards you can still find winners, especially from small and medium cap coins. The last analysis to do is about the specific cryptocurrency you plan to trade.

Now for those who have no idea how to do sentiment analysis here are a few tips. Sentiment analysis is done to find out what the mood around a certain thing or topic is. One useful tool to analyse the overall sentiment is the fear and greed index. You canlook at the fear and greed index for stocks to see how people view the most common type of investing, and then you can look at the Bitcoin fear and greed index as well.

After looking at those two you could use one of the most popular crypto sentiment analysis tools called CryptoMood. This tool creates an overview of the mood around a certain cryptocurrency by analysing news, social media, and whale movements. Keep in mind though that to use CryptoMood for any coins other than Bitcoin you will need to pay about $5 a month. For more tips about sentiment analysis you can again turn to Coin Bureau’s Youtube channel and watch this video.

Now you have analysed both the fundamentals and the sentiment around a cryptocurrency. Next, you should move on to some technical analysis, just to be sure that you’ve picked a real winner.

Technical Analysis

For a beginner, we now enter perhaps the hardest type of analysis of them all. When conducting fundamental analysis, or sentiment analysis, you can go a long way with basic intelligence. You only need to analyse the facts you are given by the numerous tools available.

In technical analysis (TA) you have to be a bit more experienced to find patterns before they have formed. Technical analysis is often as much an art form as it is a science. Therefore you shouldn’t expect tremendous profits when you first start with technical analysis, since even most experts struggle to be profitable.

However, we now have a good basis to start doing technical analysis because we’ve already conducted both fundamental analysis along with sentiment analysis and from there decided that this certain crypto will likely go up. We just need to make sure that there aren’t any bearish TA patterns forming, and we can also use TA to try and find the optimal entry price for us.

Let’s keep things simple and begin our look at technical analysis with a few basic things. When you look at traders on Youtube, or other platforms, you probably see that they use charts with many red and green candles that show the price action.

Sometimes these candles show the minute by minute or even tick by tick movements of price.. This is something we don’t want. When doing trend trading we want to keep one candle representing one day, also called daily candles. Candles of four hours can also work well and I like to use that, especially when analysing shorter time frames.

A good thing to keep in mind when using different time variables, which you will notice and maybe get frustrated with, is that many of your found TA patterns will get tossed in the trash once you change the time frame. It is quite possible that a daily chart will show an uptrend, the four hour chart will show a downtrend, and the minute chart will show an uptrend. Because of this it is good to stick with one timeframe, either with the daily or four-hour candles.

Next, you could start with one simple line. Draw a line using all the previous lows similar to the one I used in the Axie Infinity chart. Is that line moving up? If yes, great! Now look at the current price and see if it’s moving closer to that line or further away.

If the price is moving towards your line it might be time to enter soon. The optimal time to enter would be when the price hits your line, but since we rather wait for a safe upwards movement you can test your line once and see if the price starts moving up from there. If it does then it might be time to enter.

However, we haven’t yet looked if any longer-term bearish patterns are forming like a death cross, head and shoulders, Wyckoff distribution, bearish flag, or something other formation traditionally considered as bearish.. I’m not going to explain all of these, therefore if you didn’t understand these terms then I suggest starting by watching this Coin Bureau video. It will give you a great understanding of these technical analysis terms and much more.

If you spot some of these bearish patterns it might be good to consider whether entering is worth it or not. You could enter for a shorter period of time and see if you can profit from that, and in the best case scenario, the bearish pattern you saw beginning won’t fully form at all. Nevertheless, you should be aware of the increased risk if a bearish pattern is looming just around the corner.

All together, you have now used three different ways to analyse a trend. If after these analyses your trend still seems intact and you feel confident about this particular crypto then you should enter. Although I do suggest you learn to use more advanced TA than what I just demonstrated, since one line might not show the whole picture.

Low Risk - High Reward

As I mentioned numerous times it can be risky to engage in trading. Therefore you ought not expect tremendous gains in the beginning, and you should even be prepared to lose some money. I would also not encourage you to quit your job for trading, but rather view it as a hobby that can potentially make you some money.

Understandably, you might have high expectations and the part where you lose money in order to learn doesn’t entice you. That is why you should work on minimising your risk while maximising your gains.

Risk Management

First of all, trend trading itself can be thought of as lower risk than day trading. So you’re already reducing your risk profile. We have also looked at three different ways of analysing a potentially trending crypto which also lowers the risk substantially. It’s highly unlikely that you lose a lot of money on something where all three analyses look positive, although there is that possibility.

That is why you might want to use stop losses. Essentially you put an order to sell your holdings if they drop below a certain price level. This price level could be best to determine from TA. One example of a good stop loss level is when the price drops below your support line.

Another way to minimise your risk is to buy a long-term winner. Yes, in this article we should be focused on trend trading for a shorter amount of time, but hear me out. If you believe in a crypto like Ethereum, then why not just enter and HODL. If you believe that Ethereum will be bigger in 10 years than it is now then enter that upwards trend and HODL.

Okay, that’s not trading anymore, it’s investing, but the point is that even when trading for shorter periods it can be wise to buy great cryptocurrencies which you might consider keeping. This can be especially good in the beginning, since if you enter a crypto and it goes down you might not be tempted to sell and take the loss, but rather wait for it to bounce back up. This is more likely to happen in a crypto with strong fundamentals and already a great use case and adoption rather than in some meme coin.

Also, try to diversify your trading into trends with different lengths and strengths. One trend might be a long one based on institutional adoption, which doesn’t happen in one week but rather over months, and another might be based on some potential partnership and maybe good TA patterns forming, which might cause an upwards trend of perhaps a few weeks.

Increasing Rewards

Practice, practice, and then more practice. As for anything in this world you need to practice to get good. One way to start is to use trading simulators where you trade with fake money. This might sound dull to some, so another option would be to start trading with a fraction of the amount you initially planned to trade with.

The important thing isn’t the dollar amount you make but rather the percentage amount you make. When you use only small amounts you can make a larger number of trades and see which ones worked. From there you try to distinguish which factors made them work and once you find the winning pattern you can start increasing the dollar amount.

Those who feel extremely confident could try leveraged tokens which move x amounts more than the actual coin. For example, if you buy a bull Bitcoin token with 3x leverage, then if Bitcoin goes up 1% your token will go up 3%. Keep in mind though that this works both ways and you will lose a lot more if the price goes down.

Thus if you use this you need to understand your risk level rises substantially. Still, I believe this is a much better way to trade than with actual leverage since although the token can go down a lot in one day it’s still your own money you lose rather than borrowed money.

One more thing I almost forgot to mention is; don’t get greedy. Not only should you use stop losses but you should also be ready to sell at any time. If you do your technical analysis and spot a potential upcoming top, or see that we already might have been to the top, analyse the patterns again and come up with a selling price. If you believe that a top will form at say $10 then you might put your sell order at $9.50, to avoid getting dragged into the potential pullback at $10.

This will often happen since many who are doing TA will spot that same top at $10 which is why you want to guarantee your gains and leave a bit earlier. Yes, you might not sell at the top and the price can continue to rise, but assuming you entered at a good price then those last few percentages won’t matter much anyway.

Conclusion

Hopefully, this article gave you a good view of trend trading since this is something many could do and earn some good profits. It works well to allocate a certain amount of your portfolio for trend trading since the diversification will help minimize your risks. Keep in mind though that the best strategy, according to numerous studies, is to HODL, which makes it important for you to separate your long-term holdings from your trading capital.

When starting out, remember not to rush into anything. You shouldn't be in a hurry to enter something just because it has moved up a couple of days. Simply take your time and use all the different ways of analysis. Only with good analysis can you truly minimise your risk. You can also take help from others to analyse a certain cryptocurrency. Nowadays there are many talented people on Youtube and you can use their content to see how their analysis compares to yours, but be aware of scammers since there are a lot of those too.

Furthermore, don't get greedy. Even a compounded 5% per month would be excellent. That would turn your $1000 into almost $1800 in a year. Also, don’t be afraid to take losses. Sometimes you win, sometimes you lose, that’s just how it is. And remember, as the saying goes, practice makes perfect.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.