DPEX Review 2024: Unveiling the DPEX Decentralized Exchange

DPEX is a decentralized spot and perpetual exchange that offers traders minimal swap fees and zero price impact. It is built on the Polygon network and utilizes Layer 2 technology to enable faster transactions at lower fees while maintaining high levels of security and accuracy

There is no denying that 2022/2023 was a rough time for cryptocurrency trading and centralized exchanges. After the collapse of FTX and the regulatory crackdowns reverberating throughout the crypto industry, the need for decentralized exchanges is stronger than ever, which has led to increased trading activity on decentralized exchanges like Uniswap and DPEX.

Decentralized exchanges have emerged as viable solutions to the concerns that exist in the centralized exchange industry and have gained popularity in recent years as they offer users a secure and efficient way to trade cryptocurrencies without relying on a central authority.

In this DPEX review, we will review DPEX, a decentralized exchange platform that offers users a seamless and secure trading experience for futures and spot trading on Bitcoin, Ethereum, and other digital currencies with up to 50X leverage. We will take a closer look at DPEX’s features, trading fees, security measures, and more to help you decide if it is the right exchange for your needs.

What is DPEX?

DPEX is a decentralized exchange platform on the Polygon network. Traders on DPEX enjoy low fees, zero-price impact trades and can access up to 50x leverage for both short and long trading positions.

The DEX makes use of multi-asset liquidity pools where liquidity providers can earn fees from swaps, market making, leveraged trading, spreads, funding fees, liquidations, and asset rebalancing. The price feed is highly efficient thanks to Chainlink oracles that offer dynamic pricing and TWAP pricing from leading decentralized exchanges.

DPEX places a strong emphasis on ensuring accurate price feeds to protect traders from malicious liquidation of their positions. Leveraging Chainlink oracles, DPEX ensures that the submitted prices are within a 2.5% range of the price, which is the only price feed used for liquidation calculations.

When it comes to obtaining price data, DPEX aggregates data from five centralized exchanges, including Binance, OKX, Kucoin, Bitfinex, and Gate.io. The median price of these exchanges is then used to submit the price on-chain until ChainLink is updated by the ChainLink foundation. This approach helps to ensure that DPEX’s price keeper is providing accurate and reliable price feeds to its users.

Decentralization is a Central Ethos of DPEX

For the true cypherpunk, you will be happy to know that DPEX stands for Decentralized Perpetual Exchange. Decentralization is a core priority behind the platform.

A red flag for me is any time a project has a large portion of equity allocated to the team or early investors. The DPEX foundation is founderless and memberless, governed by a DAO, with no equity being received by the team or investors. Satoshi himself would be proud.

The DPEX token is issued by DPEX Ltd, a special-purpose vehicle that oversees the issuance of the DPEX token. The team states that there has been a lot of legal work and planning to ensure the platform was created and remains as decentralized as possible.

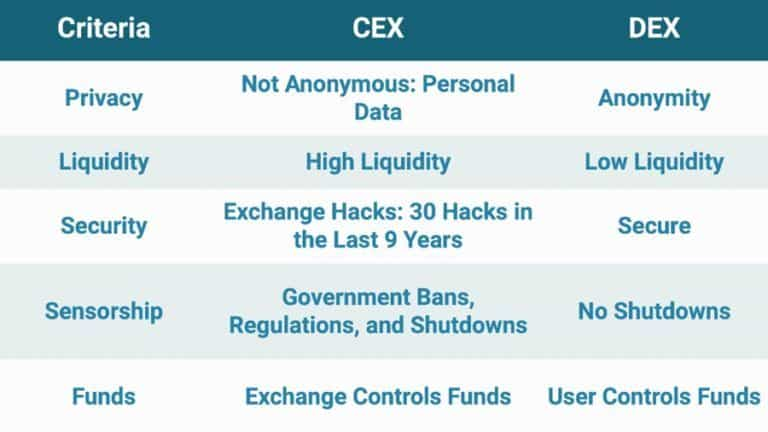

CEXs vs. DEXs:

Centralized exchanges have long been the dominant player in the world of crypto trading. These exchanges are run by a single entity, which controls the exchange’s funds and user data. This centralized structure provides several benefits, such as faster transaction times, deeper liquidity, and a greater selection of trading pairs.

However, there are also significant drawbacks to centralized exchanges, such as vulnerability to hacks and security breaches. There have been several high-profile thefts of user funds, impacting the likes of Binance, Coinbase, KuCoin, dating back all the way to the infamous Mt. Gox hack. Many of the top exchanges have fallen victim to security breaches in recent years.

Additionally, centralized exchanges are subject to government regulation, which can limit their operations in certain jurisdictions and see users blocked from accessing their funds.

Decentralized exchanges, on the other hand, operate in a peer-to-peer (P2P) manner, with no central authority controlling the exchange’s funds or user data. This structure provides a high level of security, as there is no central point of failure that can be targeted by hackers or collapses that can happen as a result of company mismanagement.

Additionally, DEXs are not subject to government regulation or draconian boundary over-stepping restrictions that can result in users being blocked access to their crypto.

One of the most significant advantages of DEXs is their compatibility with DeFi and empowering users to retain control and custody over their assets without needing to trust a third party. DeFi refers to a set of financial applications that operate on blockchain technology and are designed to be decentralized.

However, DEXs also have some drawbacks. First, they tend to have slower transaction times and lower trading volumes than centralized exchanges. Additionally, the user experience can be more complicated, as users must interact directly with smart contracts as self-custodial wallets to execute trades.

The Shift to DEXs:

Despite the drawbacks of decentralized exchanges, there has been a significant shift towards DEXs in recent years, especially after crypto companies like FTX, Celsius, BlockFi, and others collapsed in 2022, highlighting the risks of centralized entities as customers lost access to millions worth of their crypto assets.

This shift has further been driven by other factors, including increasing concerns about security and privacy, the rise of decentralized finance (DeFi), and the emergence of new technologies that make DEXs more user-friendly.

Another factor driving the shift to DEXs is the emergence of new technologies, such as automated market makers (AMMs). AMMs are algorithms that use smart contracts to facilitate trades on DEXs. They have made it much easier for users to trade on DEXs, as they eliminate the need for order books and the complexities of price discovery.

Key Features of DPEX

DPEX offers a range of features that make it a solid choice among traders. Some of its key features include:

Decentralized Trading

DPEX operates on a decentralized platform, which means that it does not rely on a centralized entity to manage trades. This eliminates the need for intermediaries and offers users a higher level of security and privacy.

DPEX supports spot and futures trading and traders can enjoy up to 50X leverage on their trades.

Swaps

For swaps, click on the “Swap” tab on https://app.dpex.io/#/trade

This will open the interface to swap tokens with zero price impact.

Stop Loss and Take Profit Orders

Traders can access some advanced trading features such as stop-loss and take-profit orders by clicking on the “Close” button and selecting the “Trigger” tab.

After creating a trigger order, traders will find the open trade in the position’s row and under the “Orders” tab. Here, users can edit the order and change the trigger price if needed.

Low Fees

One of the main attractions of DPEX is the low transaction fees, making it an ideal and affordable platform for traders from all walks of life.

The trading fee to open a position is just 0.1% of the position size, and then another 0.1% fee to close the position.

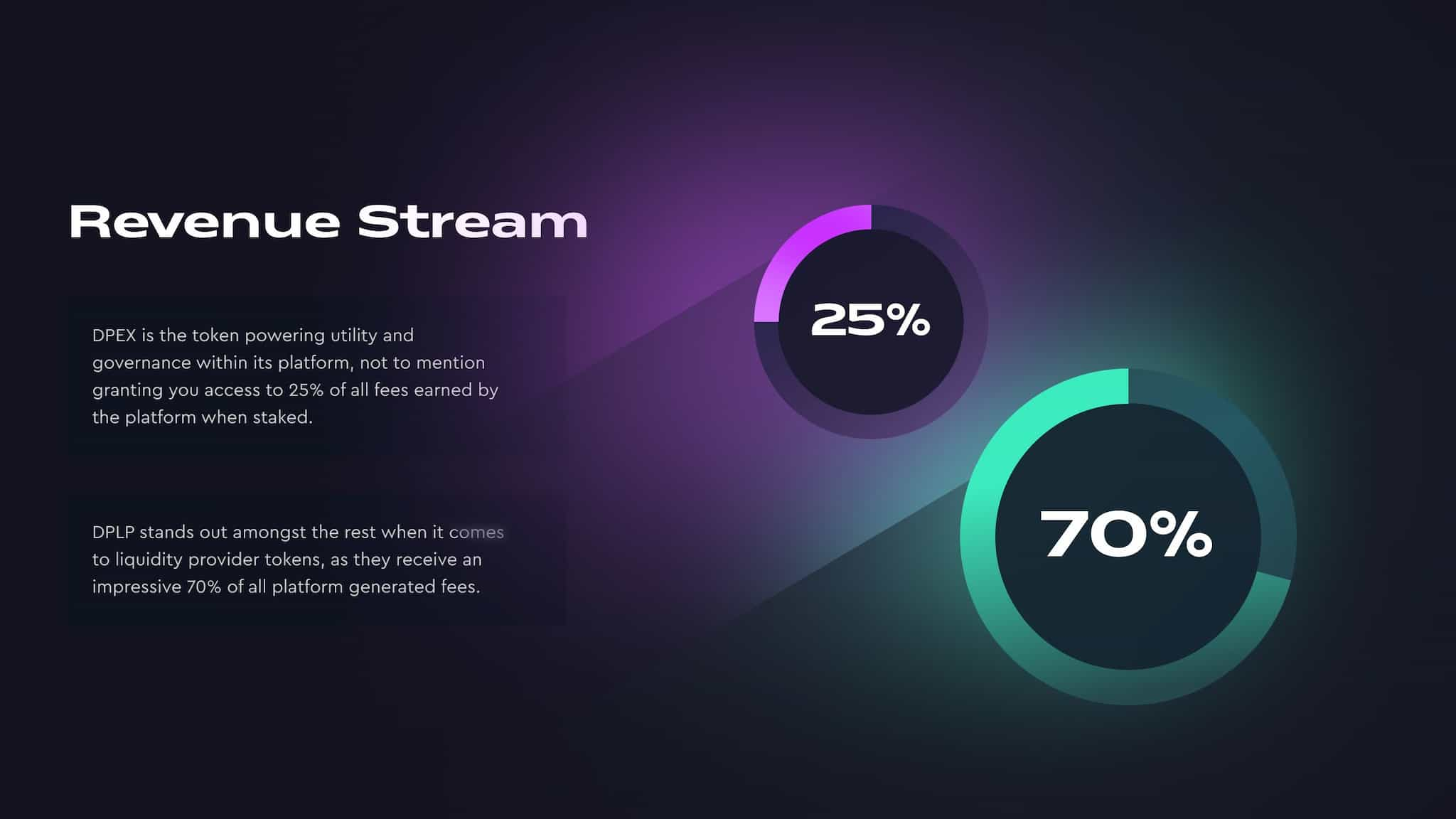

It is good to note that 25% of all fees earned go towards DPEX stakers, and liquidity providers who hold the LP token DPLP enjoy 70% of all the fees generated by the platform.

The high percentage of fee distribution going back to the users and DPEX community is good to see as it helps lead to a sustainable platform and provides ample incentives for users to provide liquidity and interact with the platform.

DPEX allocates just 5% of trading fees to the foundation to finance maintenance and operational costs.

Multiple Trading Pairs

As far as asset support, DPEX supports trading for the following assets:

- Bitcoin

- Ethereum

- MATIC

- USDC

- DAI

- USDT

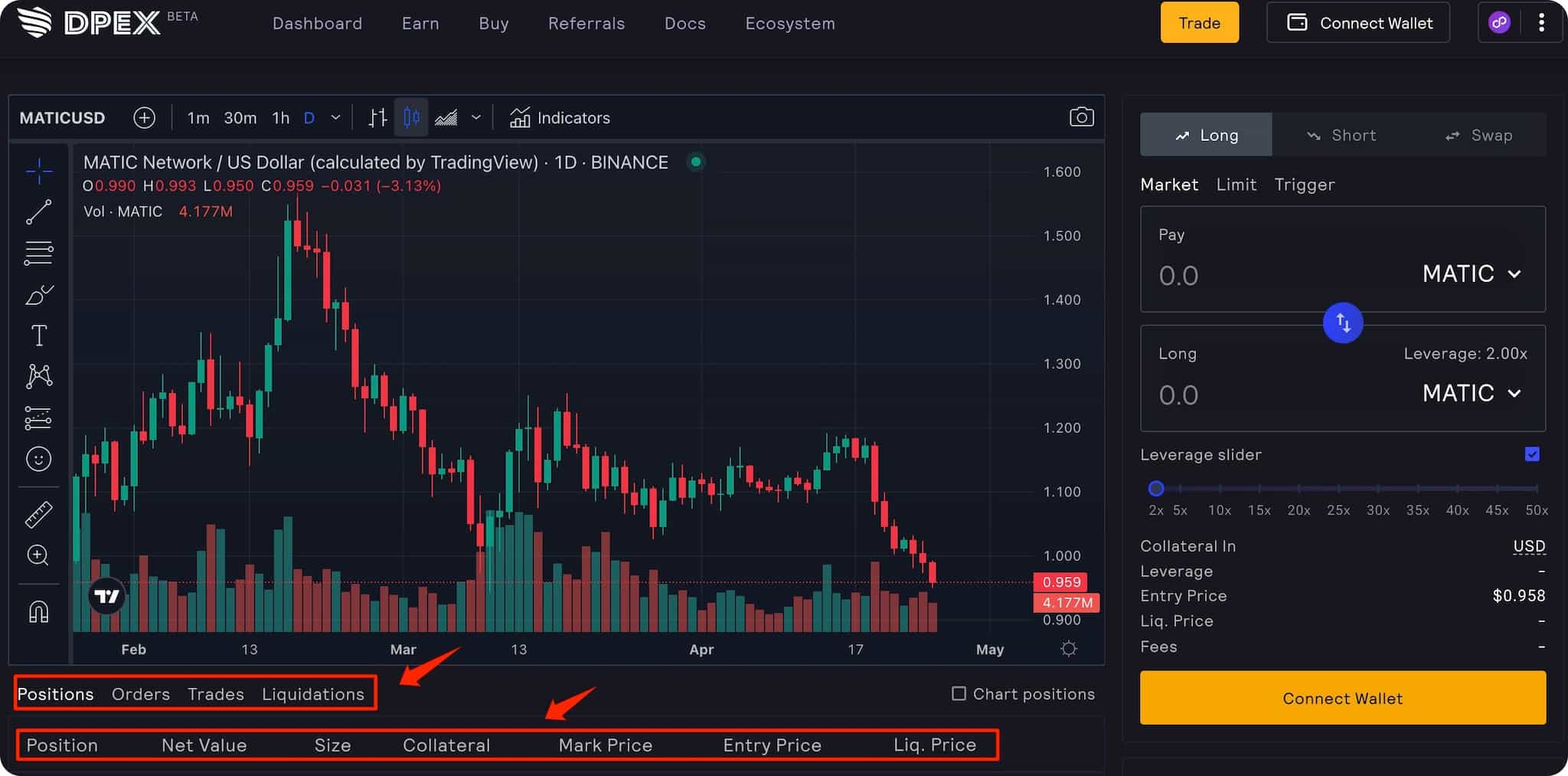

User-friendly Interface

DPEX has a simple and user-friendly interface that allows traders to navigate the platform easily and make trades quickly.

One of my favourite features of DPEX is the Tradingview integration for charting capabilities. Tradingview has become the industry gold standard for traders, thanks to its plethora of tools and features, the Tradingview integration makes DPEX suitable for even the most hardcore of technical analysts.

How to Use DPEX

Using DPEX is easy, and traders can start trading in a matter of minutes. Here is a step-by-step guide to using DPEX:

- Visit the DPEX website at https://dpex.io/

- Hit the “connect” button in the top left to connect your wallet.

- Choose the trading pair, decide if you want to go long, short, or simply swap, and enter the price at which you wish to buy or sell the cryptocurrency.

- Choose the amount of leverage you want

- Execute the trade.

You can find a more detailed breakdown of trading using the DPEX Trading Guide.

DPEX Security Measures

DPEX takes security seriously and has implemented several measures to ensure that traders’ funds are safe.

Here are some of the security measures that DPEX has put in place:

Regular Audits

DPEX conducts regular audits to ensure that its security measures are up-to-date and maintained. DPEX’s smart contracts are reviewed through audits conducted by CertiK for token security and Zokyo for platform security.

Self-Custody: A Cornerstone Of Security

Self-custody refers to the act of managing your own private keys rather than relying on a third-party custodian. This approach gives users complete control and responsibility over their cryptocurrency and reduces the risk of losing access to assets if the custodian is hacked or goes out of business.

To achieve self-custody, you’ll need to store your private keys in a secure location. This could be a hardware wallet, a paper wallet, or a software wallet with strong security features. It’s important to choose a wallet that’s compatible with your chosen cryptocurrency and to follow best practices for securing your private keys, such as storing them in a safe place and avoiding public Wi-Fi networks when accessing your wallet.

Self-custodial wallets such as Metamask, Coinbase Wallet, or other wallets via WalletConnect can be used to access the trading site. For the security-minded, cold storage hardware wallets like Ledger can be used via a Metamask connection to the DPEX decentralized exchange.

The ability to retain custody over your own funds is one of the reasons DEXs like DPEX are gaining in popularity, and for many, are a preferred way to trade versus using centralized platforms like Binance or Coinbase, where users give up ownership and rights over their assets.

DPEX Rewards

DPEX Rewards benefit long-term users of the protocol; these rewards come in Escrowed DPEX and Multiplier Points.

DPEX holders who choose to stake on the platform and DPLP holders (i.e., liquidity providers) receive rewards. These rewards can be in the form of tokens – Escrowed DPEX (esDPEX) and MATIC – and Multiplier Points. Here is a summary:

- Staked DPEX earns MATIC, esDPEX, and Multiplier Points.

- Staked esDPEX earns MATIC, esDPEX, and Multiplier Points.

- Multiplier Points: earns MATIC when staked DPLP held in the wallet earns MATIC and esDPEX.

Compounding or Claiming

There are two options for rewards on the Earn portion of the DEX. Users can either compound or claim their rewards. Compounding will stake a user’s pending Multiplier Points and Escrowed DPEX rewards, increasing the amount of rewards received.

Claiming will simply transfer any pending Escrowed DPEX and MATIC rewards to a user’s wallet. Compounded or Staked Escrowed DPEX tokens can be unstaked at any time.

Escrowed DPEX

Escrowed DPEX (esDPEX) can be used in two ways:

- Staked for rewards similar to regular DPEX tokens

- Vested to become actual DPEX tokens over one year

Vesting

You can convert your esDPEX tokens to DPEX tokens through vesting, which is accessible on the Earn page. When you initiate vesting, the average amount of DPEX or DPLP tokens used to earn your esDPEX rewards will be reserved.

Keep in mind that unstaked esDPEX tokens won’t earn rewards, but staked tokens will continue to earn rewards. After you initiate vesting, your esDPEX tokens will convert to DPEX every second and fully vest over a year. Once converted, you can claim your DPEX tokens at any time.

If you sell your DPEX or DPLP tokens and want to vest your esDPEX rewards later on, you’ll need to buy back the tokens. You can use DPEX, esDPEX, or Multiplier Points interchangeably for the required reserve amount.

You can deposit into the vesting vault while existing vesting is ongoing, but tokens reserved for vesting can’t be unstaked or sold. To unreserve your tokens, use the “Withdraw” button on the Earn page. Keep in mind that withdrawing will unreserve all tokens and pause vesting, as partial withdrawals aren’t supported. Finally, all esDPEX tokens that you vest into DPEX will remain as DPEX tokens.

Multiplier Points

Earn rewards for holding DPEX with Multiplier Points. Stake DPEX and receive Multiplier Points every second with a 100% fixed APR. Earn fee rewards by staking Multiplier Points through the “Compound” button on the Earn page. When you unstake DPEX or Escrowed DPEX tokens, a proportional amount of Multiplier Points will be burned. To transfer staked tokens without burning Multiplier Points, use the Transfer button on https://app.dpex.io/#/earn. The “Boost Percentage” on the Earn page shows the boost amount from your Multiplier Points, calculated by dividing your Multiplier Points by your total staked DPEX.

Here is a look at the equation and example of the boost percentage as per the DPEX Rewards page:

Boost Percentage = 100 * (Staked Multiplier Points) / (Staked DPEX + Staked esDPEX) An example: 100 * (6.1717) / (14.55 + 5.00) = 31.56%Boost Percentage = 100 * (Staked Multiplier Points) / (Staked DPEX + Staked esDPEX) An example: 100 * (6.1717) / (14.55 + 5.00) = 31.56%

Distribution Rates

The distribution of Escrowed DPEX tokens will be made to staked DPEX and DPLP tokens based on the schedule agreed upon in the most recent snapshot vote. The rewards will be distributed every second to the staked tokens. It’s worth noting that the reward rates will be reviewed on a monthly basis, and adjustments may be made. If any changes are to be made, they will be announced at least seven days before implementation.

DPEX Tokenomics

The DPEX token is the platform’s utility and governance token, holders of the DPEX token enjoy various platform benefits.

DPEX holders can stake their tokens for the following rewards:

- Escrowed DPEX – esDPEX

- Multiplier Points

- MATIC Rewards

25% of fees generated from swaps and leverage trading are converted to MATIC and distributed to staked DPEX tokens.

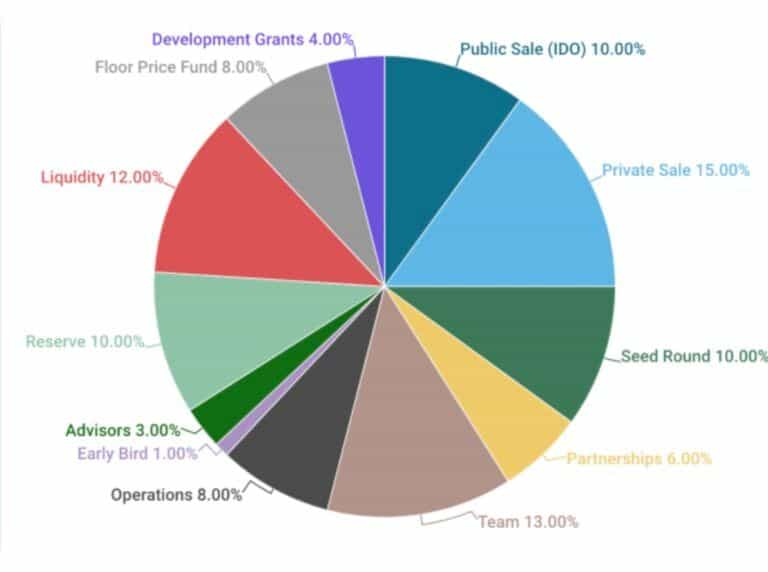

Taken directly from the DPEX Docs, the token supply is allocated as follows:

The maximum supply of DPEX is 1,250,000,000. Minting beyond this maximum supply is controlled by a 28-day timelock, an eventuality that will only be considered if the protocol demands an increase in the supply. This option will only be used if more products are launched, and liquidity mining is required; a governance vote will be conducted before any changes.

Circulating supply changes are dictated by the number of tokens distributed through other DEXs, vested, burnt, and spent on marketing.

- 50,000,000 DPEX for Launchpad IDO ($0.0024 / DPEX – $120,000)

- 75,000,000 DPEX for Strategic Round ($0.0016 / DPEX – $120,000)

- 187,500,000 DPEX for Private Sale ($0.0012 / DPEX – $225,000)

- 125,000,000 DPEX for Seed round ($0.0008 / DPEX – $100,000)

- 162,500,000 DPEX for Core-team

- 37,500,000 DPEX for Advisors

- 75,000,000 DPEX for Partnerships

- 100,000,000 DPEX for Operations

- 125,000,000 DPEX for Reserve

- 150,000,000 DPEX for Liquidity

- 100,000,000 DPEX for Floor Price Fund

- 12,500,000 DPEX for Early Bird / Airdrops

- 50,000,000 DPEX for Development Grants

Max Supply: 1,250,000,000 DPEX

Total Raise: $565,000

Vesting

- Launchpad IDO: 50% at TGE, 5% weekly

- Strategic Round: 25% at TGE, 5% weekly

- Private Sale / Seed: 12.5% at TGE, 2.5% weekly

- Partners/Advisors: 0% at TGE, 5% monthly after 6 months lockup

- Team: 0% at TGE, 2.5% weekly, after 1-year lockup

DPEX Referrals

DPEX users can enjoy fee discounts and earn rebates through the DPEX referral program

The DPEX platform utilizes an on-chain referral system that’s unique, has fantastic benefits, and is easy for anyone with a web3-wallet like Metamask or Coinbase wallet to take advantage of. Here are the steps to get your unique DPEX referral code:

- Go to https://app.dpex.io/#/referrals

- Click on the Affiliates tab

- Create a referral code using any combination of letters, numbers and underscores

Note that referral codes are case-sensitive.

Once you’ve created your code, click on the copy icon next to the code to get your referral link, it should look something like this: https://app.dpex.io/#/?ref=<your code>.

Once your code is minted on the Polygon blockchain, both you and anyone who uses your code will enjoy lifetime discounts on trading fees. If someone clicks on the link you provided, their account will save your referral code. When that person performs a trade, they will get a discount, and you will earn rebates based on their trading fees. You will keep earning those rebates regardless of the device they use because the referral code is saved in the contract when they make their first trade.

The referral program has a tier system to prevent gaming through self-referrals, this helps to ensure that referrers receive the rebates for the users they brought onto the platform.

- Tier 1: 5% discount for traders, 5% rebates to referrer

- Tier 2: 10% discount for traders, 10% rebates to referrer

- Tier 3: 10% discount for traders, 15% rebates to referrers paid in MATIC, 5% rebates to referrers paid in esDPEX

Anyone can create a Tier 1 code. To upgrade your code to Tier 2 or Tier 3, the following parameters will need to be met:

- Tier 2: At least 15 active users using your referral codes per week and a combined weekly volume above $1 million

- Tier 3: At least 30 active users using your referral codes per week and a combined weekly volume above $5 million

Pros and Cons of Using DPEX

Like any other cryptocurrency exchange, DPEX has its advantages and disadvantages. Here are some pros and cons of using DPEX:

Pros

- Decentralized trading, which offers users a higher level of security and privacy.

- Low transaction fees, making it an affordable option for traders.

- User-friendly interface that makes it easy for traders to navigate the platform.

- Tradingview integration makes DPEX suitable for all skill levels of trader.

- Anonymity through the lack of user verification procedures.

- Audited smart contracts by Zokyo and CertiK for additional security.

- Fast transaction processing times

- Community-Driven: DPEX’s commitment to involving its community in decision-making processes, such as adding new assets through voting, fosters a sense of ownership and engagement among users.

Cons

- Limited trading options compared to centralized exchanges.

- Lack of customer support, which can be a problem for novice traders. DPEX does have an active community on Telegram and Discord provides some level of support that can still benefit beginner traders.

- The platform is still relatively new and has not been extensively tested.

- Faces competition from other DEXs and decentralized trading platforms.

In summary, DPEX is a promising DEX that offers traders a more secure and efficient way to trade digital assets, with a focus on perpetual trading options, fast transaction processing times, and low fees. Even though the platform is still new, it has undergone rigorous testing to ensure its reliability and security. But typically, new platforms undergo a process of improvement over time until they reach maturity.

DPEX Review Conclusion

DPEX is a new and promising decentralized exchange platform that offers users a secure and efficient trading experience. Its low fees, options for leverage, perpetuals, and spot trading, along with robust charting and order type capabilities, make DPEX a fantastic trading platform alternative for anyone interested in DeFi.

While in the early stages, it may have some limitations compared to centralized exchanges when it comes to things like asset support and other product offerings, DPEX’s focus on security and privacy makes it a viable option for those who value these factors. I am also going to go ahead and assume that the platform is also going to get better over time, enhancing product and feature offerings.

In conclusion, the shift from centralized exchanges to decentralized exchanges is a significant trend in the world of cryptocurrency. While there are advantages and disadvantages to both types of exchanges, the rise of DeFi and new technologies like AMMs has led to a growing preference for DEXs. As the crypto landscape continues to evolve, it will be interesting to see how this trend develops and what new innovations emerge to support it.

Disclaimer: This article is sponsored, and as such, the views and opinions expressed within it do not reflect those of the Coin Bureau. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article. Readers are encouraged to conduct their own research and due diligence before making any investment decisions.

Frequently Asked Questions

DPEX is a decentralized exchange and therefore does not require regulation by any government or financial authority.

DPEX supports Bitcoin, Polygon, Ethereum, and others, as well as a selection of stablecoins.

Yes, DPEX has undertaken rigorous audits from crypto auditing firms to ensure their smart contracts are robust and there are no easily exploited vulnerabilities. As for user funds, users retain in full custody over their assets at all times, at no point does DPEX hold onto tokens on behalf of users.

Yes, DPEX has a user-friendly interface that makes it easy for beginners to navigate the platform and make trades. As long as users follow responsible self-custody and follow the best practices laid out in our Crypto Safety 101 article, DPEX is suitable for all skill levels of traders.

Currently, DPEX does not have a mobile app, but the platform is accessible through mobile web browsers.

DPEX interacts with reliable price oracles like Chainlink to provide users with accurate and up-to-date market data.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.