dYdX Review 2026: Complete Guide to the Perpetuals DEX

This dYdX review was fully updated in January 2026 to reflect how the platform actually works today on the dYdX Chain, and how the perp DEX landscape has evolved since our previous coverage. We rewrote the guide around the real trader experience. We also expanded the risk and safety coverage to better frame leverage, liquidation mechanics, and the tradeoffs of self-custody, plus refreshed the security/audits section and added clearer notes on geo restrictions and regulatory access at the interface level. Finally, we updated the onboarding walkthrough and added our testing methodology.

dYdX is a non custodial perpetual futures exchange that aims to deliver a familiar order book trading experience without depositing funds into a centralized platform. It is built for traders who already understand leverage, liquidation risk, and how to manage positions with discipline.

Since 2024, dYdX has continued maturing on the dYdX Chain, while competition in perp DEXs has intensified, with venues like Hyperliquid raising the bar on speed and listings.

How We Tested and Reviewed dYdX

This section explains how this dYdX review was put together and where the edges are. The goal was to reflect how dYdX actually feels for a real perp trader, not a perfect-demo scenario.

What We Tested

- Core trading flow on dYdX Chain: Wallet connect, USDC funding, placing and managing positions, closing out, and withdrawing.

- Order book execution basics: Depth visibility, limit vs market behavior, conditional orders (stops / take-profit), and how predictable fills feel on liquid markets.

- Costs that matter in practice: Maker/taker fees, funding rate impact on holds, plus the “hidden” friction: deposit/withdraw routes and network costs.

- Risk controls + guardrails: Cross vs isolated margin behavior, liquidation buffers, and how clearly the UI communicates risk (margin, maintenance, liquidation levels).

- Usability checks: Charting, order entry speed, mobile app basics (monitoring/adjusting/closing), and general reliability during normal usage.

What We Didn’t Test

- Pro/edge-case performance testing: No HFT-style latency benchmarking, colocated setups, or stress tests designed to break matching/feeds.

- “Best venue” claims by metrics: We didn’t attempt to crown a universal #1 by volume/OI/liquidity across windows (those rankings change fast).

- Adversarial scenarios: We didn’t simulate oracle attacks, validator collusion, or extreme market dislocations beyond discussing how the system is designed to handle them.

- Jurisdiction workarounds: We don’t test or recommend attempts to bypass geo restrictions; access depends on the front-end and local rules.

What Is dYdX and How Does It Work?

dYdX is designed for trading crypto derivatives, specifically perpetual futures, in a way that feels closer to a professional exchange while keeping you in control of your funds.

dYdX is a non custodial perpetual futures exchange where you trade from your own wallet using an order book style interface on the dYdX Chain.

- Perps basics: Perpetual futures are futures contracts with no expiry date. Instead of settling on a fixed day, they use a funding rate to keep prices aligned with the broader market. A simple way to picture funding is a small periodic adjustment paid between longs and shorts that helps pull the contract price back toward the real world price.

Check out our guide on perpetual futures for better understanding. - Leverage: Leverage lets you control a larger position using less collateral. It can amplify gains, but it also increases liquidation risk because a smaller adverse move can wipe out your margin.

Check out our guide on leverage for more knowledge. - Cross vs isolated margin: With cross margin, positions share one collateral pool, which can be capital efficient but can also spread risk across your account. With isolated margin, each position has its own dedicated collateral, like keeping separate envelopes of money for separate trades.

- Why an order book matters: An order book matches buyers and sellers directly, so you can place precise limit orders and see market depth. That differs from AMM based perps, where pricing is driven by a formula and pooled liquidity rather than a queue of bids and asks.

The Big Shift: From Ethereum L2 to dYdX Chain

dYdX v4 moved trading onto the dedicated dYdX Chain, an application specific chain built with the Cosmos SDK. This approach aims to optimize performance for trading and shifts security and governance toward a validator set rather than relying on a single platform operator.

dYdX is best understood as a self custody, order book based perp exchange, with its newer chain design meant to support faster trading and a more decentralized operating model.

dYdX Chain Deep Dive

The move to a dedicated chain is one of the biggest reasons dYdX feels different from many other DeFi trading apps. Instead of competing with unrelated on chain activity for capacity, the network is built around the needs of high frequency derivatives trading, with its own validator secured infrastructure and trading specific rules.

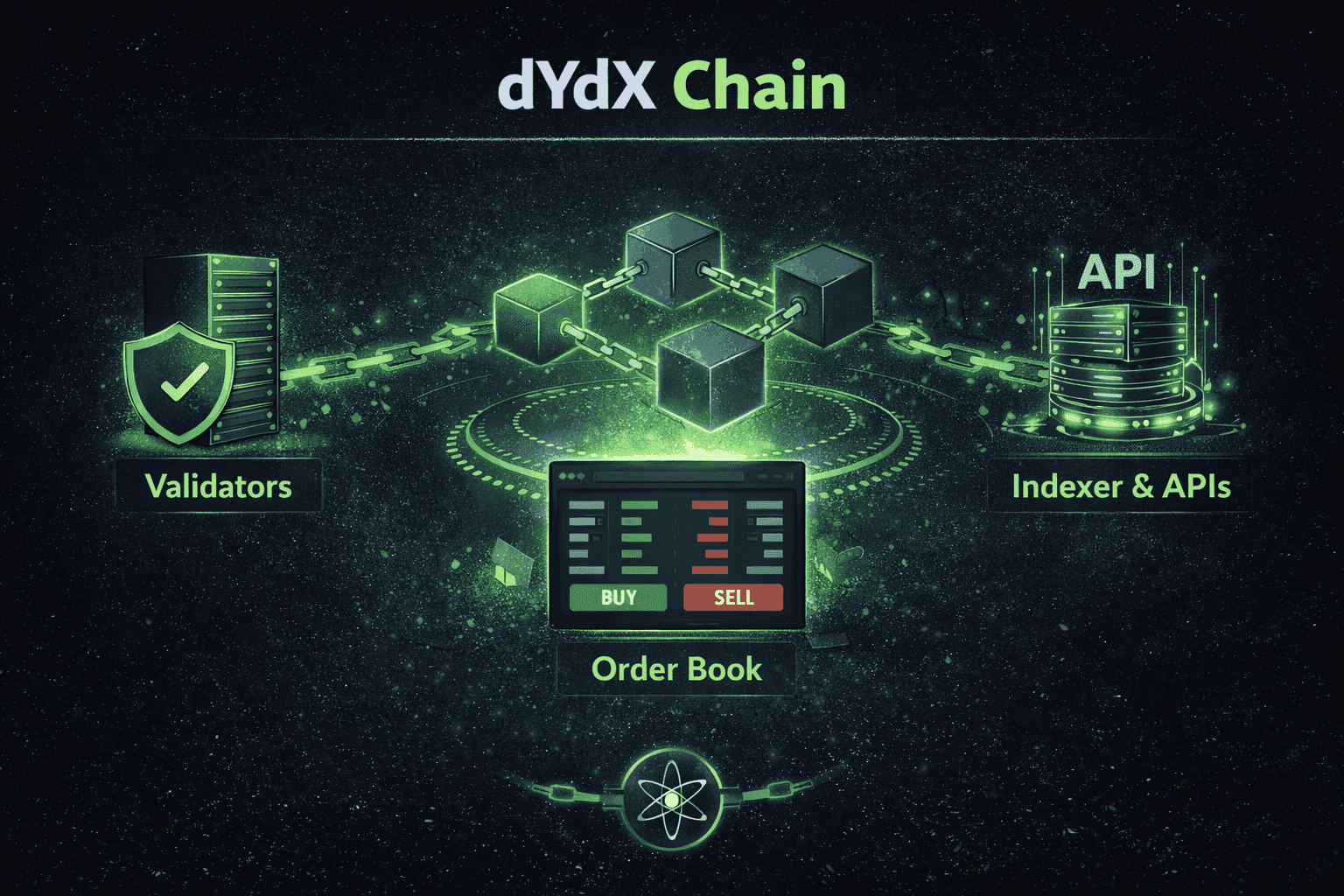

Architecture Overview

dYdX runs as an application specific chain built with the Cosmos SDK and uses Tendermint style proof of stake consensus. Trading uses a decentralized limit order book, while most users interact through an indexer that serves fast data over web friendly APIs and websockets, even though the underlying state is finalized on chain.

Validator Set and Decentralization Reality Check

- What validators do: Validators produce blocks, enforce trading rules, and coordinate price inputs used across the system through oracle prices.

- What decentralized means here: Core logic is open source and runs across validators, but many traders still rely on hosted interfaces and data services for a smooth experience, which can concentrate day to day access even when settlement is decentralized.

- How staking works and how rewards are earned: DYDX holders delegate to validators, and rewards come from protocol fee activity distributed through the network’s staking rewards mechanics.

IBC and Cosmos Ecosystem Integrations

IBC enables cross chain transfers across the Cosmos ecosystem. In practice, dYdX supports deposit flows that route USDC through Noble using CCTP and IBC, which can make moving collateral across supported chains feel more direct than traditional bridging.

Oracles, Risk Controls, and Market Integrity

Funding is designed to keep perp prices close to the protocol’s oracle price, which is also a key reference for collateral checks and liquidations. Many venues separate index price and mark price, but on dYdX the oracle price plays the central role in risk management. Additional backstops include an insurance fund and protocol level deleveraging events surfaced through the indexer.

Roundup of What Changed in 2025

- January 2025: dYdX Chain v5.0 introduced isolated markets and isolated margin, alongside performance and risk upgrades.

- H1 2025: The dYdX Foundation highlighted an iOS app, instant deposits, and API latency improvements in its H1 2025 ecosystem report.

The big 2026 takeaway is that dYdX Chain is a purpose built trading network where validators secure and enforce the rules, while user experience still depends heavily on the surrounding data and interface layer.

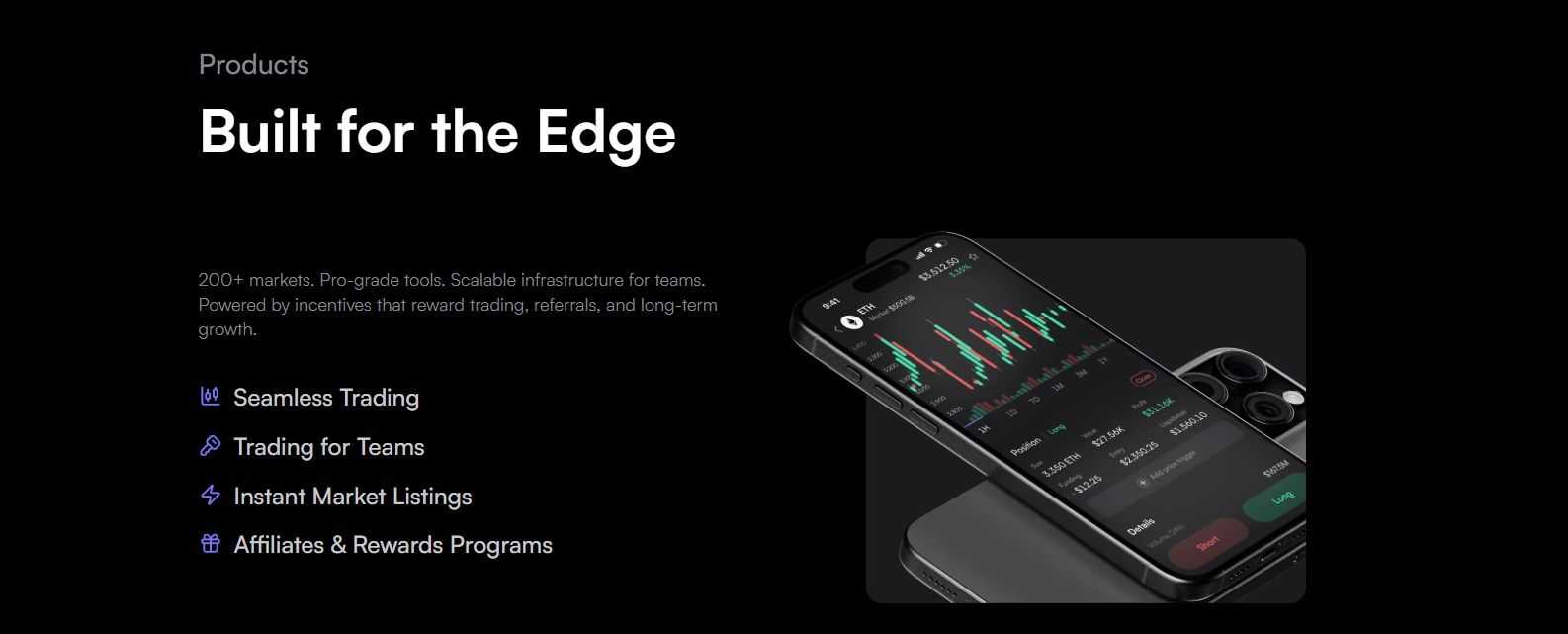

dYdX Features and Trading Experience

dYdX is built to feel familiar to experienced derivatives traders, with an order book interface, pro style order controls, and a workflow that rewards active risk management.

Markets and Contracts Available

dYdX focuses on perpetual futures and supports 200 plus perpetual markets on its main front ends. Majors like BTC and ETH are available alongside a long tail of altcoin markets that can expand quickly through features like Instant Market Listings.

Order Types and Pro Trading Tooling

- Core orders include market, limit, and conditional orders like stop limit and take profit limit.

- The interface emphasizes charts, depth, and fast execution, with pro access options like the dYdX API.

Cross vs Isolated Margin

- With isolated margin, each position has its own collateral, so one bad trade is less likely to spill into the rest of your account.

- With cross margin, positions share collateral, which can reduce liquidations in some cases but can also spread losses.

Most traders should start isolated.

Funding Rates Explained

So, let's keep it simple. If funding is 0.10% every 8 hours, a $1,000 position pays about $1 per interval, or about $3 over 24 hours, assuming the rate stays constant. Funding can flip direction, so it is a cost that can also become income.

Mobile App and Device Experience

The iOS app is best for monitoring positions, adjusting risk, and closing trades quickly. Android support exists via the Google Play app, though feature parity can vary over time as releases roll out. App behaves more or less similar across modern devices.

The experience is strongest for active perp traders who want pro controls without giving up self custody.

Fees, Funding, and the Real Cost of Using dYdX

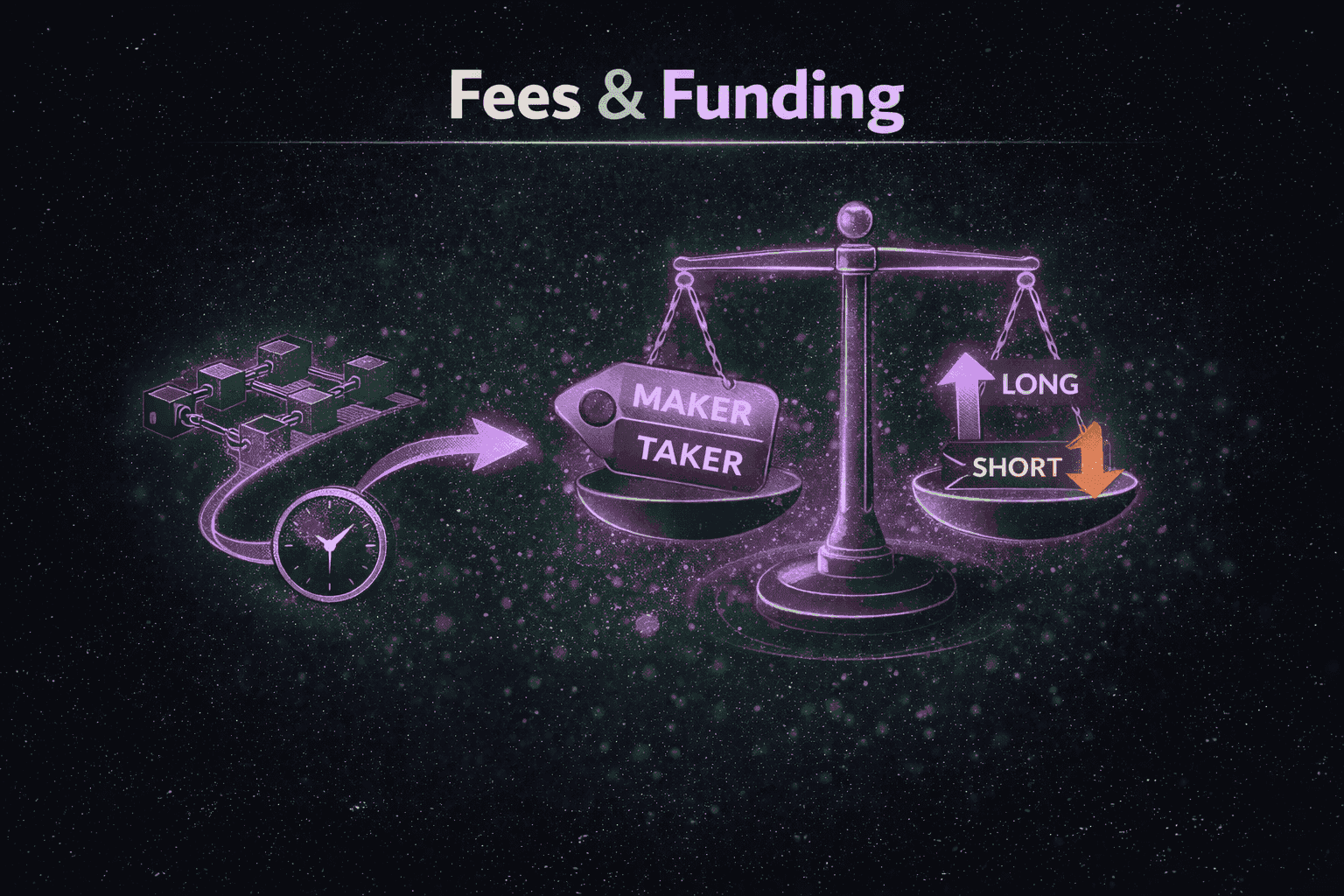

On a perp exchange, the bill you pay is not just the trading fee. Funding payments, deposit routes, and the time cost of moving collateral can matter just as much.

Trading Fees (Maker Taker) and Tiers

dYdX uses a tiered maker and taker fee schedule based on your trailing 30 day volume. At the lowest tier, taker is 0.05% and maker is 0.01%, with lower rates at higher volumes. If you stake dYdX, you may also qualify for staking fee discounts on net positive trading fees.

Funding Fees (The Fee People Forget)

As we mentioned before, funding is a periodic payment between longs and shorts that helps keep perps aligned with the oracle price. If you hold positions for hours or days, funding can easily outweigh the entry and exit fee. Funding rates change frequently, so do keep a track to stay updated.

Deposits Withdrawals and Network Costs

There are three separate costs:

- Platform trading fees,

- Network and route fees for deposits and withdrawals,

- Opportunity cost from waiting on transfers and confirmations.

Once your USDC is on the dYdX Chain, trading itself feels “gas-free,” but deposits and withdrawals can still cost cents to a few dollars depending on the route. dYdX’s deposit & withdrawal docs list typical ranges: Skip Go Fast (Instant Deposit) is 10 bps (0.10%) + gas (~$2.5 on Ethereum or ~$0.01–$0.10 on major L2s), with that 10 bps waived above $100 (Ethereum) or $20 (L2s); Skip Go (regular) is ~$0.02 to deposit and ~$0.10–$7 to withdraw, plus chain gas; Coinbase via Noble adds Coinbase’s withdrawal fee + ~$0.10–$0.20 IBC, while direct IBC transfers are typically ~$0.10–$0.50.

Real Cost Examples

- $1,000 trader, 1 round trip: Tier 1 taker entry and exit is about $1.00 total. If funding were 0.03% per 8 hours, one day costs about $0.90 on a $1,000 position.

- $1,000 trader, 20 round trips after one deposit: Trading fees are about $20 total, while a typical deposit route fee can be small enough to fade into the background once amortized.

- $10,000 trader, multiple positions: One taker round trip is about $10 per position, but funding can add up quickly across positions.

dYdX vs CEX Cost Reality

A CEX can be cheaper for a single trade because there is no bridging friction, and fee schedules can start around 0.020% maker and 0.050% taker on some futures products. Bybit lists non VIP perps at 0.02% maker and 0.055% taker. dYdX tends to make more sense when self custody matters and you plan to trade repeatedly after funding your account.

The simplest way to think about dYdX costs is that trading fees are usually predictable, but funding and collateral movement are the variables that can quietly become the biggest line items, especially if you hold leveraged positions for longer than a few hours.

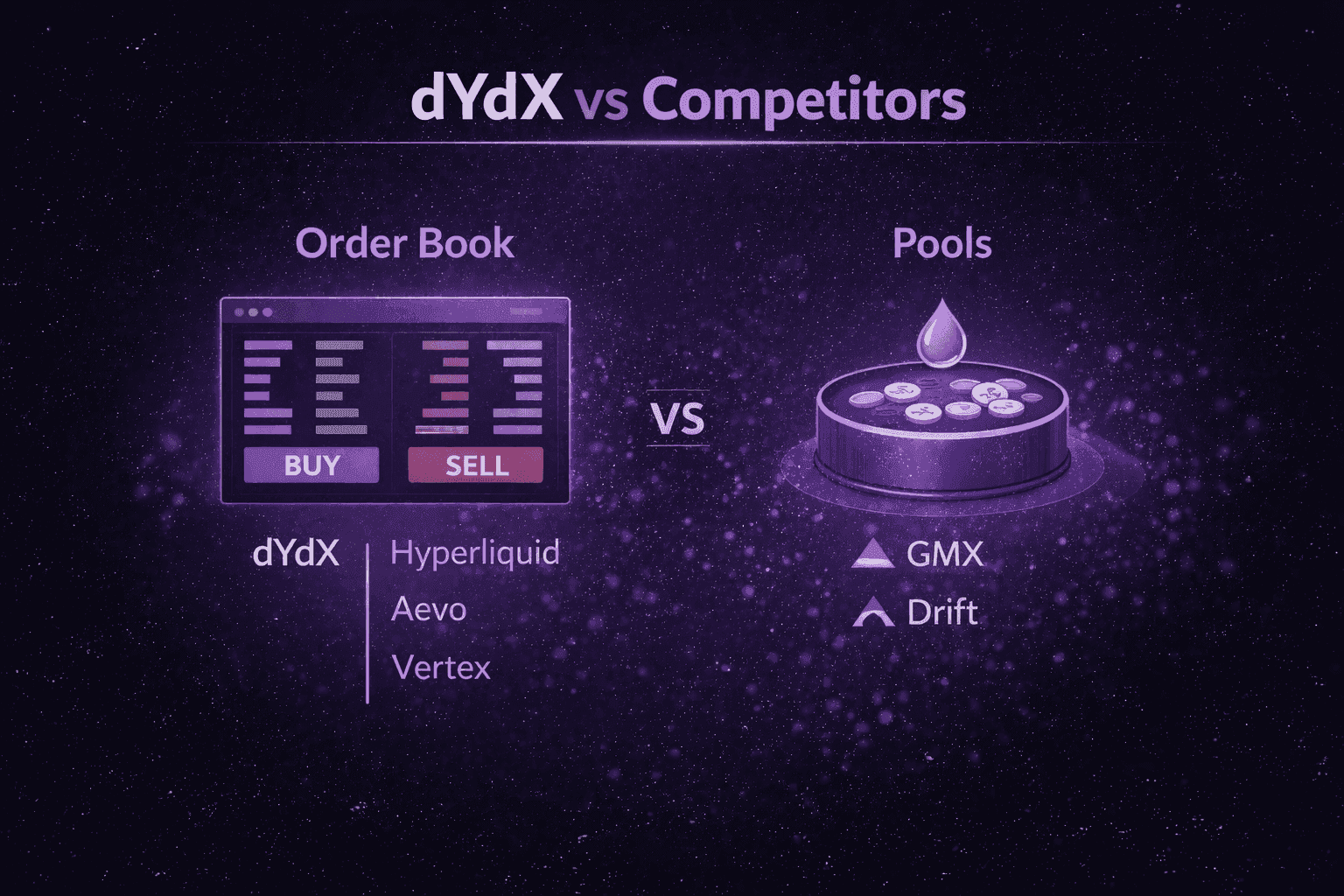

dYdX vs Competitors

In 2026, most perpetuals platforms fall into two execution styles: order books (matching buyers and sellers directly) and pool based liquidity (pricing from a liquidity pool). That choice tends to shape everything from slippage to how risk is managed when markets get volatile.

Comparison Table

| Venue | Leverage | Base fees | Liquidity style | Chain | Gas model | Pairs | UI | Mobile | KYC | API | Insurance, risk backstops |

|---|---|---|---|---|---|---|---|---|---|---|---|

| dYdX | Up to 25x | Maker 0.01%, taker 0.05% | Order book | dYdX Chain | No gas for trading, network fees only on transfers | Varies | Pro style | iOS | No | Yes | Loss mechanisms |

| Hyperliquid | Up to 40x | Maker 0.015%, taker 0.045% | Order book | Hyperliquid L1 | No gas for trading, network fees only on transfers | 100+ perps | Pro style | Web mobile | Wallet based | Yes | Liquidations |

| GMX V2 | Up to 100x | Open and close 0.04% to 0.06% | vAMM style pools | Public Chains like Arbitrum and Avalanche | Network gas on trades | Varies | Simple | Web mobile | Wallet based | Limited | ADL and risk controls |

| Aevo | Up to 20x | Maker 0.05%, taker 0.08% | Order book matching | Aevo L2 | Low cost L2 execution | Varies | CEX like | Web mobile | Wallet based | Docs and APIs | Contract specs include liquidation rules such as a 1% liquidation fee |

| Vertex | Varies | Maker 0.0%, taker 0.02% | Hybrid order book and pool | Varies by deployment | Network gas on chain actions | Varies | Pro style | Web mobile | Wallet based | Yes | Varies by deployment |

| Drift | Up to 20x and up to 101x on SOL, BTC, and ETH perps | Taker 0.0350%, maker rebate minus 0.0025% | Hybrid DLOB and AMM | Solana | Solana fees | 40+ markets | Pro style | Web mobile | Wallet based | Yes | Insurance Fund |

| Binance | Market dependent | Maker 0.02%, taker 0.05% | Centralized order book | Centralized | No on chain gas | Very broad | Very mature | Full apps | Account and ID checks via Identity Verification | Yes | Exchange managed backstops |

| Bybit | Market dependent | Maker 0.02%, taker 0.055% | Centralized order book | Centralized | No on chain gas | Very broad | Very mature | Full apps | KYC is mandatory | Yes | Exchange managed backstops |

When to Choose dYdX

- You want an order book experience with precise limit orders and visible depth.

- You prefer self custody with no KYC.

- You plan to trade repeatedly after funding once, rather than doing a single one off trade.

- You value protocol level transparency around loss mechanisms.

When to Choose Hyperliquid / GMX / Aevo / Vertex / Drift Instead

- Hyperliquid: You want very broad perp listings like 100+ assets and are comfortable with its fee schedule.

- GMX V2: You prefer pool based execution and want fees expressed as an open and close fee like 0.04% to 0.06%, rather than maker and taker.

- Aevo: You want a unified venue for perps and options with clear published contract specs like 20x max leverage.

- Vertex: You want very low headline trading fees like 0.02% taker with maker at 0.0%.

- Drift: You are Solana native and want flexibility, including paths that can reach 101x on select markets.

“Is dYdX Still #1?”

This is a typical question or approach taken on by users. The truth is, “number one” only makes sense if you define the metric first, such as volume, open interest, active traders, liquidity, or uptime, and then measure it over a specific time window. If you are not anchoring the claim to a snapshot metric, it is more accurate to describe dYdX as one of the leading perpetuals venues rather than using absolute rankings.

The cleanest way to pick is to decide whether you want an order book or pool based venue first, then compare fees and liquidity on the exact markets you actually trade.

For more information, check out our exclusive reviews of the following:

How to Start Trading on dYdX

Getting started on dYdX is mostly about connecting a wallet, depositing USDC, and keeping your first position sizes small until you are comfortable with how perps behave.

Quick Start in 5 Step

- Set up a wallet: Connect a supported wallet such as MetaMask or Keplr.

- Fund with USDC: dYdX uses USDC as collateral as per its FAQs.

- Deposit: Use the in app deposits flow, which supports options like Skip Go routes and direct IBC transfers depending on where your USDC is.

- Place your first trade: Choose a market, set leverage, then place an order from the orders panel.

- Close and withdraw: Close the position, then use the withdrawal flow.

First Trade Settings

- Keep leverage around 2x to 3x.

- Start with BTC or ETH perps.

- Risk cap: keep each trade to 1% to 2% of account equity.

Common Errors During Setup

- Stark key confusion: dYdX Chain does not use Stark keys; it uses a wallet based secret phrase.

- Wrong network or route: Recheck the deposit option in deposits and withdrawals.

- Deposit not showing or wallet disconnects: Refresh the session, reconnect WalletConnect, and confirm the connected address.

Once you can deposit and place a small trade smoothly, scaling up becomes a lot safer and more consistent.

Risk Management and Safety

Perpetuals reward discipline more than cleverness. The fastest way to lose money is to combine high leverage with loose risk controls.

The Leverage Reality Check

At 25x leverage, a move of roughly 4% against you can be enough to liquidate, because your margin buffer is thin. Think of it like driving fast with almost no braking distance: small mistakes become account ending mistakes.

10 Costly Mistakes to Avoid

- Max leverage. Use 2x to 5x first.

- Ignoring funding. Check it before holding overnight.

- No stop loss. Use a stop market order.

- Using cross margin too early. Start isolated.

- Trading low liquidity pairs. Start BTC or ETH.

- Using most of your balance as margin. Keep a buffer.

- Chasing pumps with market orders. Prefer limit entries.

- Panic closing normal volatility. Follow a plan.

- Forgetting transfer costs and delays. Deposit once, trade many times.

- No liquidation buffer. Stay well away from the trigger.

Position Sizing Rules

1 to 2 percent risk per trade

| Account equity | 1% max loss per trade | 2% max loss per trade | Quick sizing rule |

|---|---|---|---|

| $500 | $5 | $10 | Position size = risk amount ÷ stop distance % |

| $1,000 | $10 | $20 | Example: $10 risk with a 2% stop = $10 ÷ 0.02 = $500 position |

| $5,000 | $50 | $100 | Wider stop means smaller position |

| $10,000 | $100 | $200 | Keep risk fixed even if you increase equity |

Leverage matrix by experience level

| Experience level | Suggested leverage | Typical approach | Main risk to watch |

|---|---|---|---|

| Beginner | 2x to 3x | BTC or ETH only, isolated margin | Over sizing and liquidation from small moves |

| Intermediate | 3x to 5x | Defined plan, consistent stops | Funding cost and stop execution slippage |

| Advanced | 5x to 10x | Shorter holds, tighter entries | Volatility spikes and liquidity gaps |

| Professional | 10x to 25x | Very short holds, strict rules | Tiny adverse move can wipe margin fast |

Stop loss guidance, including when stop limit fails

| Situation | Better stop type | Why | Simple tip |

|---|---|---|---|

| Fast volatility, news moves, thin liquidity | Stop market | Prioritizes getting out even if price slips | Reduce size to limit slippage impact |

| Calm market, tight ranges | Stop limit | Targets a specific price | Set the limit with some room, not right at the trigger |

| Overnight holds | Stop market | Price can gap past a limit | Lower leverage and keep extra margin buffer |

What Happens During Liquidation

When collateral falls below the maintenance margin requirement, the liquidation engine starts closing positions, and a liquidation penalty can apply, with a default maximum of 1.5%. In extreme moves, protocol backstops can include deleveraging.

The goal is simple: Survive long enough to learn, then scale only when your process is consistent. You must also check out our risk mitigation guide to learn more.

Security, Audits and Trust

With any perpetuals platform, the real question is not whether it works on a normal day. It is whether the system holds up when markets move fast and something goes wrong.

Custody Model

On dYdX, you keep control of your wallet keys, which is the core idea behind self custody. What you do not control is protocol risk, including chain level issues, bugs in open source code, oracle failures, and governance decisions that can change parameters over time.

Audits and Public Security Track Record

The dYdX Chain codebase has been audited by Informal Systems, with the audit materials referenced in the public audits repository.

Security is also supported by a bug bounty program that lists rewards up to $5 million for eligible critical findings.

Governance can update key risk and trading parameters, including liquidations and oracle settings, through on chain governance functionalities.

Insurance Fund / Backstop Mechanics

As mentioned earlier, dYdX uses an insurance fund as a backstop when liquidations cannot close positions cleanly. In practice, this can include covering certain shortfalls by adjusting liquidation pricing within protocol limits, as described in contract loss mechanisms, with liquidation penalties flowing into the fund under the default software settings.

Operational Risks

Operational risks still exist, including validator or network downtime, unexpected behavior in oracle prices, and deposit route dependencies. Deposits and withdrawals can involve external routing systems such as Skip Go and other transfer paths described in the deposits and withdrawals flow, which adds third party and cross chain risk on top of trading risk.

dYdX reduces exchange custody risk, but it replaces it with protocol, chain, and infrastructure risks that traders should understand before using leverage.

KYC, Geo Restrictions and Regulatory Notes

Perpetuals trading sits in a higher risk regulatory bucket than spot trading, so even non custodial platforms often restrict access at the interface level.

Is dYdX KYC Free?

dYdX does not use traditional identity verification for everyday access, but the official front ends apply geo restrictions and detailed eligibility rules in the dYdX Software Terms of Use.

United States Access: What Actually Works

The official interfaces list the United States as restricted, and the terms state the software is not available for certain users and prohibit attempts to circumvent restrictions, including via a VPN. Rewards and promotions are also framed around eligibility and restricted persons in dYdX materials such as trading league rewards. Rules vary by jurisdiction, so check local requirements before using leveraged products.

Regulatory Developments to Watch

Key pressure points include sanctions compliance expectations like OFAC virtual currency guidance and derivatives enforcement signals such as the CFTC DeFi derivatives orders. Stablecoin rails also matter because tools like CCTP and USDC infrastructure can become chokepoints during enforcement events.

In practice, access and compliance are as important to understand as fees and leverage.

dYdX Token, Staking and Governance

DYDX matters less as a “hype token” and more as the coordination tool for how the chain is secured, how incentives work, and how key parameters can change over time.

What DYDX Is For in 2026

On the dYdX Chain, DYDX is used for staking and governance. Staking also ties into trading benefits through a community approved staking based fee discount program.

Tokenomics and Emissions: What Changed Since 2024

DYDX has a fixed maximum supply discussed in the original Introducing DYDX release materials, with tokens continuing to unlock over time based on the vesting schedule. On chain incentives have shifted toward being more usage linked, including trading rewards that are constrained by protocol fee generation.

Staking Rewards and Validator Economics

Staking rewards are generated from protocol activity. In simple terms, stakers earn from trading and gas fees, net of parameters like community tax and validator commission as shown in staking rewards shared earlier.

Risks include slashing, unbonding delays, and chain level or oracle failures.

Governance: How Proposals Work

Proposals pass based on quorum and thresholds as per the chain’s governance module, and voting is done with bonded DYDX using the how to vote guide.

Overall, DYDX is best viewed as the stake and voting token that connects traders, validators, and the rules of the exchange.

Deposits, Withdrawals, and Supported Wallets

Moving collateral in and out of a perp platform is where most beginner mistakes happen. A clean setup and a predictable deposit route can save you time, fees, and stress when markets move fast.

Supported Wallets and Best Setup

dYdX supports popular wallets like MetaMask, WalletConnect, and Coinbase Wallet. For better security, you can pair MetaMask with a hardware wallet and keep a separate cold wallet for long term storage.

Check out our exclusive reviews of:

Deposits and Withdrawals: Step by Step

- Hold USDC on a supported chain.

- Use Instant Deposit for the fastest funding, noting the fee rules and waivers.

- Trade, then withdraw using the withdrawal flow, mentioned earlier as well.

Troubleshooting Hub

- Deposits or withdrawals pending: check the selected route in Deposits and Withdrawals.

- Margin errors: confirm collateral and position settings in Margin.

- Wallet connection issues: reconnect using the supported wallet list in Supported wallets.

- Fast support: dYdX Discord and the Help Center.

A smooth deposit and withdrawal routine matters as much as your trading strategy, especially when you use leverage.

Customer Support and Documentation

dYdX is not a traditional help desk style platform, so support is community first, with official docs doing most of the heavy lifting.

Support Channels Ranked (Fastest to Slowest)

Documentation Quality

Traders will spend most time in the trading concepts docs and the Help Center. Builders get separate coverage through the API and developer docs, plus open source references in the v4 chain repository.

As a baseline safety habit, treat all support DMs as suspicious and follow common sense checks from our crypto safety guide.

Final Verdict: Should You Use dYdX in 2026?

If You’re a Frequent Perp Trader

If you already live in the world of perpetual futures, dYdX can feel like a purpose built workstation. The order book experience, pro style execution, and self custody workflow tend to make the initial setup friction feel “worth it” once you are placing trades regularly and managing positions actively.

If You’re a Beginner

If you are still learning how leverage behaves, dYdX is not the easiest place to start. A better path is to build habits first using paper trading or small spot positions, then return to perps once you can explain liquidation risk in plain English and size trades consistently.

If You Want “All in One”

dYdX is a focused tool. It does not try to be a full crypto app with spot markets, earn products, or fiat on ramps. Most people will want to pair it with a fiat friendly on ramp and a secure crypto wallet setup, then treat dYdX as the place they go only when they specifically want perps.

If you like clean execution and self custody, dYdX can be a strong fit, as long as you approach it like a power tool: useful in skilled hands, expensive when used casually.

Interested in derivatives? Don't forget to check out our top picks of the best derivatives exchanges.

Frequently Asked Questions

It depends on how you access it. dYdX is a decentralized protocol, but availability can vary by region, and some features (such as trading rewards) have historically been restricted for U.S. users. Rules and front-end access can change, so treat this as a compliance-sensitive area and check the current restrictions for your jurisdiction before trading.

The minimum trade size is often around $10, but most users need more than that in practice. A more realistic starting range is $100–$500+, because you’ll want:

- extra buffer for margin and volatility

- room to place multiple small “learning trades”

- funds to cover any network costs involved in depositing/withdrawing (depending on your route)

No. dYdX is crypto-only. Most users buy USDC on a centralized exchange, transfer it to a self-custody wallet, then deposit to dYdX.

dYdX is a decentralized exchange protocol built for perpetuals trading. The experience feels like a pro trading venue (orderbook UI, advanced orders), but funds are typically handled in a non-custodial way (you’re not opening a traditional custodial exchange account).

dYdX is designed to be decentralized at the protocol level, but “decentralized” is not a single on/off switch. It’s better to think in layers:

- Custody: you control keys (non-custodial access)

- Execution: trading runs via protocol + network

- Governance: changes are proposed and voted on

- Infrastructure: frontends, indexers, and data services can add practical points of dependence

The key question is: if one website disappears, can the protocol still be accessed? That’s the decentralization test most users actually care about.

dYdX focuses on perpetual futures (perps), typically on major crypto markets and a curated set of altcoins. If you want spot trading, you’ll likely need a different platform or a companion exchange.

As of the shift to its newer architecture, dYdX has been primarily perps-focused. If spot trading is critical to you, consider alternatives or plan to use a separate spot venue alongside dYdX.

dYdX has historically offered up to 25x leverage on many markets. Remember: more leverage doesn’t just magnify profits, it shrinks your margin for error.

Trading is often designed to feel “gas-free” once funds are deposited within the dYdX environment, but moving funds in/out can still involve network fees depending on the chain/bridge path used. Think of it like: you may pay for the door, not every step inside the room.

dYdX commonly supports popular self-custody wallets and connectors (for example MetaMask-style browser wallets, WalletConnect flows, and hardware wallets via integrations). Use a wallet you trust and consider a separate “trading wallet” rather than your long-term cold storage wallet.

dYdX has built a strong reputation over time, but “safe” in DeFi always means tradeoffs:

- Smart contract / protocol risk

- Oracle risk

- Liquidation mechanics during volatility

- Chain/infrastructure risk

Your biggest controllable risks are usually leverage, position sizing, and operational security (wallet hygiene, avoiding phishing, securing seed phrases).

dYdX has historically maintained a strong security record, with audits and a long operating history. Still, users should verify the current security posture via official disclosures and remember: no protocol is risk-free forever.

dYdX supports common order types on many markets, typically including stop-style orders. In fast moves, stop orders can still slip. The goal is risk reduction, not perfection.

They’re optimized differently. In general:

- dYdX: strong pro trading feel, established brand, perps focus, orderbook-style execution.

- Hyperliquid: known for extremely fast UX and aggressive fee/leverage positioning.

The better choice depends on whether you prioritize track record and ecosystem maturity or ultra-fast execution/fee structure.

GMX is often favored for a simpler experience and a different liquidity model, while dYdX targets a more traditional trading feel with an orderbook-style interface. If you want the “closest thing to a pro exchange UX” in DeFi perps, dYdX is frequently the pick. If you want simpler mechanics and a different design philosophy, GMX can be a better fit.

It’s apples vs a very fast, very sharp orange.

- CEX futures (Binance/Bybit): more markets, fiat rails, higher leverage, traditional support, but custodial + KYC.

- dYdX: self-custody / DeFi-style access and fewer TradFi-style rails, but typically more onboarding friction.

If you want no-KYC/self-custody, dYdX is compelling. If you want max leverage + huge market selection + fiat, CEXs are usually more convenient.

Usually not. The platform is designed for traders who already understand:

- Leverage

- Liquidation

- Funding

- Wallet security

Beginners are better off learning perps on simpler venues or paper trading first, then moving to dYdX when they’re comfortable.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.