Bybit Review 2024: Complete Exchange Overview

Users located in the US and UK are not supported. For UK-based readers, we recommend checking out eToro. We have an eToro guide and sign-up link that offers a free 100k demo account. For US-based users, our eToro US sign-up link offers a free $10 crypto airdrop bonus!

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Bybit is a cryptocurrency exchange that provides a professional platform with an ultra-fast matching engine, quality customer service, and multilingual community support for traders of all levels. Bybit operates a safe, secure, transparent, and efficient futures trading platform with over 20 million users worldwide and offers more than 230 perpetual and futures contracts.

Bybit is a popular cryptocurrency and derivatives trading exchange that launched its services at the end of 2018.

The exchange gives traders the ability to trade cryptocurrency perpetual contracts with up to 100x leverage. In its short time in operation, the exchange has managed to build up sizable liquidity and become one of the most respected and widely used crypto exchanged in the world.

However, can Bybit really be trusted?

In this Bybit review, we will give you everything you need to know about the exchange. We will also provide top tips when it comes to trading crypto futures.

Bybit Key Features:

- Great Selection of Tradeable Assets- Bybit offers a wide range of trading instruments including derivatives, spot, and instant buy crypto features.

- Professional Grade Trading & Matching Engine- Bybit is known for its ultra-fast matching engine and instant trade execution.

- Multilingual Support- Bybit offers good customer support, available in multiple languages.

- Leverage trading available

- NFT Marketplace

- Fiat Withdrawals

- Crypto Loans

- Bybit Copy Trading

- Bybit crypto debit card

Note: Users located in the US and UK are not supported.

This Bybit review primarily focuses on the trading aspect, security, Bybit trading fees, and the Bybit App. If you want a deeper dive into other areas of the platform, be sure to check out our dedicated articles covering How to Sign Up on Bybit, Bybit Earn, and the Features and Products available on Bybit, where we cover the launchpad, NFT marketplace, Bybit Card and More!

Bybit Overview

| HEADQUARTERS: | Dubai |

| YEAR ESTABLISHED: | 2018 |

| REGULATION: | Granted an in principal license as a Virtual Asset Service Provider in Dubai. Regulated by the authorities in Cyprus |

| SPOT CRYPTOCURRENCIES LISTED: | 100+ |

| NATIVE TOKEN: | The Bybit exchange does not have a native token. However, it has launched the BIT token for BitDAO. |

| MAKER/TAKER FEES: | Spot Trading – From 0.1% maker/0.1% taker Perpetual and Futures Contract- 0.02% maker/ 0.055% taker fees Options- 0.03% Maker/ 0.03% Taker Users with VIP status unlock fee discounts |

| SECURITY: | 2FA, Cold Storage of Assets, Multi-Sig wallets, Insurance Fund |

| BEGINNER-FRIENDLY: | Yes |

| KYC/AML VERIFICATION: | Required |

| FIAT CURRENCY SUPPORT: | 20+ Fiat currencies supported via P2P exchange Deposit 16 fiat Currencies, and withdraw 11, including USD, EUR, GBP, and more. |

| DEPOSIT/WITHDRAW METHODS: | Bank transfer, credit/debit card, crypto transfer, third-party fiat on and off-ramps |

Bybit is a cryptocurrency futures exchange that is currently headquartered in Dubai after moving from Singapore in 2022. The exchange operates under Bybit Fintech Limited, which is a company that is registered in the British Virgin Islands.

In their about us page, the exchange claims that they have a team which is comprised of experts in blockchain technology and finance. For example, their technology team has people who hail from Morgan Stanley, Tencent etc. You can check them out on LinkedIn.

The primary product offered on the exchange is perpetual futures products with 100x leverage, but the platform has also grown increasingly popular for spot traders, offering up to 10x leverage. Bybit has quickly grown to become one of the top exchanges in the industry, surpassing the likes of BitMEX and Deribit to become the #2 ranked derivates platform in the world, second only to Binance according to CoinGecko.

Note: While the leverage feature on Bybit is popular, the use of high leverage is incredibly risky and is recommended for expert traders only. Be sure to understand the risks of leverage before utilizing it

While there are many similarities between the exchanges, Bybit has some unique features that make it attractive and have led to its astronomical rise to the top. We will touch on these features when we cover their trading technology.

The Bybit exchange is open to most traders around the world and the website has been translated into English, Simplified and Traditional Chinese, Korean, Japanese and recently Russian. However, there are some jurisdictions that they do not operate in and these include the likes of the USA, Syria, and the Canadian province of Quebec.

If you are interested in Guy's take, feel free to check out the guide he put together below:

Is Bybit Safe?

The security of an exchange is one of the most important factors that any exchange user should consider.

As such, when conducting this review, we looked into the safety of the Bybit exchange with regard to its coin management, user security tools and, of course, risk management.

Bybit Review: Exchange Security

To counter the threat posed by hackers, Bybit operates a secure cold storage solution. This means that it stores the bulk of their crypto reserves, and all client funds, in offline wallets, stored in a secure “air-gapped” location.

There is only a small portion of Bybit's own coins that are kept in their “hot wallets” in order to service the needs of traders when it comes to withdrawals. Moreover, if they ever need to move funds from cold storage, they need to use a multi-signature address scheme.

Multi-signature means that the exchange will need more than one key in order to sign a transaction from one wallet to another. This prevents the risk posed by having a single individual manage all the funds on the exchange.

The Bybit site utilizes SSL-encrypted communication to prevent the risk of online snoops and phishing attacks, along with HTTPS secure communication as indicated by the lock icon in the image below.

As with most crypto exchanges and websites, looking for this lock icon can help ensure you are on a legitimate site and not a scam or phishing site set up to look like the original. If there is no lock icon or the site is not prefixed by "https" it could be an indication of a phishing site and is best avoided.

In addition to 2FA, Bybit also supports:

- Fund password

- Anti-Phishing code

- New address withdrawal lock

- Bybit Authenticity Check

Bybit has done a great job enhancing their security framework in recent months, which is great to see from a confidence perspective. Our team did not uncover any red flags upon review, and independent security audit company Certified has ranked Bybit a top 10 secure exchange with an AAA security rating.

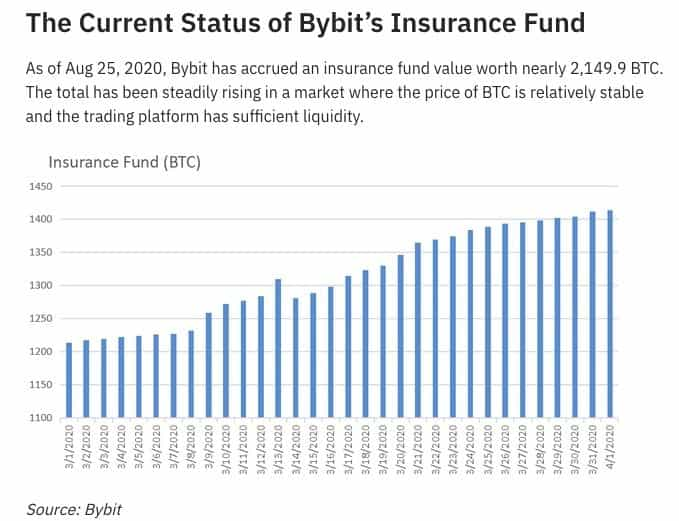

Bybit Review: Insurance Fund

In order to manage the risk posed by shortfalls in futures contract settlement, Bybit operates what they call an "insurance fund".

Essentially, this fund will be used in the case that a trader gets liquidated at a level below their "bankruptcy price". The latter is the price at which the trader’s initial margin has been completely depleted.

Without the fund, there would be a shortfall whereby the counterparty to the trade would not be made whole. It is essentially an insurance policy to protect traders in the case that Bybit cannot liquidate the position at bankruptcy price or better.

These funds are replenished with the initial margin that liquidated traders have at the outset of their trade. The difference between the price at which the trader is liquidated and the bankruptcy price is how much will be sent to, or taken from, the insurance fund.

Bybit Review: Leverage

Given that Bybit is a leveraged exchange, it means that they allow crypto margin trades. Traders will only have to put up a small percentage of the initial position as collateral for their trades.

This means that if you have the leverage of 100x, you will be required to put up a margin of 1% of the initial notional amount of the trade. So, if the notional on a 10BTC contract is $36,000, you will have to put up $360 in initial margin.

Major Pro 💯: With Bybit, leverage is freely adjustable, meaning that it can be changed even after opening a position, which is something that cannot be done on other exchanges.

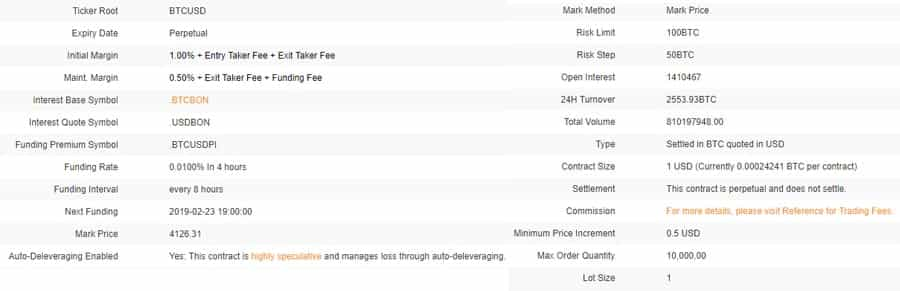

What is surprising about the perpetual contracts on Bybit is their size. Each contract is only worth 1 USD, which is much smaller than the contracts on other exchanges. Below is all the other specifics of their BTCUSD contract.

They have pretty much the same terms on their ETH/USD contracts. You can find more information about the different contracts on the Bybit Market Overview Page.

While Bybit does offer up to 100x leverage on their contracts, this is not constant. If you are a large trader and are entering sizable positions then they will bring down the leverage that you can achieve on your contract.

This protects the exchange from the risk posed by large positions. Below is the table of the BTCUSD risk limits. You can find the ETHUSD, EOSUSD and XRPUSD risk limits on their Risk Limit Levels page.

| Position Value | MM* | Initial Margin | Max Leverage |

| 150 BTC | 0.5% | 1.00% | 100 |

| 450 BTC | 0.5% | 2.00% | 50 |

| 750 BTC | 2.5% | 3.00% | 33 |

| 1,050 BTC | 3.5% | 4.00% | 25 |

| 1,350 BTC | 4.5% | 5.00% | 20 |

| 1,500 BTC | 5.0% | 5.50% | 18 |

MM* stands for Maintenance Margin

As you can see, the maintenance margin is constant at 0.5% for all contract sizes. However, for larger positions, they will increase the minimum initial margin requirement such that there is a much greater shortfall between the liquidation level and the bankruptcy level.

Liquidation

Liquidation is what happens when you have nearly depleted your initial margin and the mark price hits the “liquidation price”. In this instance, the trader will be liquidated with the rest of their margin, if any, being sent to the Bybit insurance fund.

ADL ⚙️: Bybit operates an Auto Deleveraging system. Essentially, this happens when a position can't be liquidated at a price that is better than the bankruptcy price and the insurance fund cannot cover it. The ADL system will automatically deleverage a position of an opposing trader that is selected according to their defined criteria. You can read more about the ADL in Bybit's Auto Deleveraging article.

While there are many traders who may be upset by a liquidation, it is an important risk management tool in a futures exchange and is a part of margin trading. However, Bybit has a number of tools that will help traders avoid the risk of liquidation. These include the following:

- Dual Price Mechanism: In order to prevent the risk of market manipulation on the exchange, Bybit uses a dual price mechanism as the contract reference price. This is composed of the "Mark Price" which triggers liquidation and the “Last Traded Price” which is used to calculate the price at which the position is closed. The former is a global Bitcoin price whereas the latter is the current Bybit market price. Using external pricing inputs reduces singular exchange manipulation.

- Auto Margin Replenishment: If you want to make sure that your position will always have adequate levels of margin then you can set it to auto-replenish. This means that whenever your margin is close to being depleted, it will draw on your funds to keep your position open

- Stop Loss: This forms part of the order options that we talk about below. Having effective stop losses on your positions will ensure that it never gets down to the liquidation level.

Mark / Spot Price 📈: For those interested, the Mark price is derived from the Spot price. The spot price is a Bitcoin price index that represents the global price. It is comprised of prices on Bitstamp, Coinbase Pro and Kraken. The Mark price is the spot price index plus a decaying funding basis rate

Bybit Fees

Trading fees are an important criterion for us because of obvious reasons. It's especially true when it comes to a futures exchange where you are paying fees on positions that are much larger than your margin.

Bybit operates what is called a "maker-taker" fee model. That means they charge traders a fee if they take liquidity off their books and they will give them a rebate if they provide liquidity to the exchange.

Confused ❓: If you place an order and it gets executed immediately you are taking liquidity off the books. This is most of the time through a market order. However, if you place a limit order that is away from the current price you are making liquidity and this will get you the maker rebate.

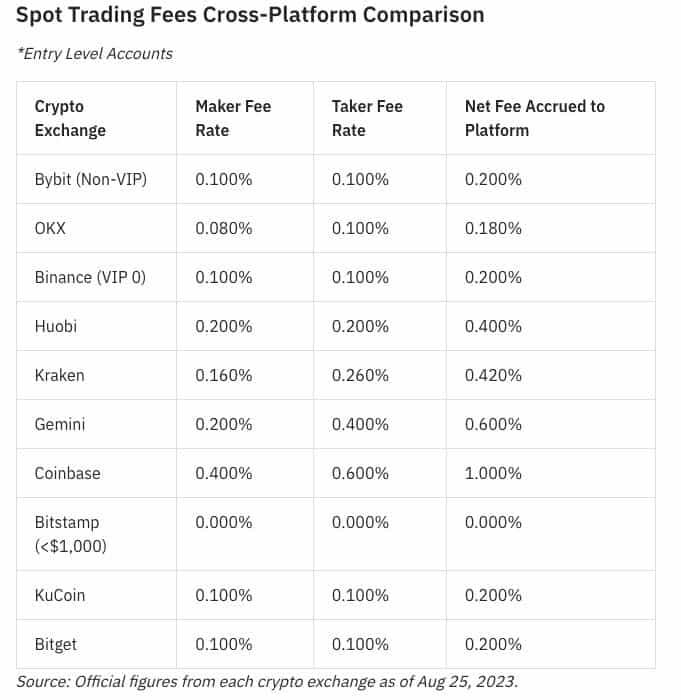

Below is a chart comparing Bybit's fees to competitors like Binance, OKX, Kraken, HTX (previously Huobi), and others for entry-level spot trading fees:

Perpetual and Futures Contracts traders can expect the following fees:

| Non-VIP | Maker Fee | Taker Fee |

| Inverse Perpetual | 0.020% | 0.055% |

| Inverse Futures | 0.020% | 0.055% |

Bybit trading fees are competitive within the industry, coming in slightly lower than exchanges like Deribit, but on par with the likes of Binance and OKX.

The other fees that you will see when you open the trade is the funding rate. This is analogous to an "overnight" rate and it is a financing charge. Given that margin trading is based on "borrowing" positions, you will either pay a financing charge or be receiving it. However, contrary to the transaction fees, these fees are directly exchanged between traders and not Bybit.

The funding rate is determined by market conditions and interest rates. This means that it is not fixed and will vary on a daily basis. You will be able to see the funding rate that will apply under the position details when you open your trade.

Withdraw and Deposit Fees

In terms of deposit/withdrawal fees, Bybit does not charge fees on crypto deposits or withdrawals. However, when you are withdrawing your coins you may incur a miner or “network” fee due to blockchain mining. This is industry standard. You can find more information on this in our Guide to Network Fees.

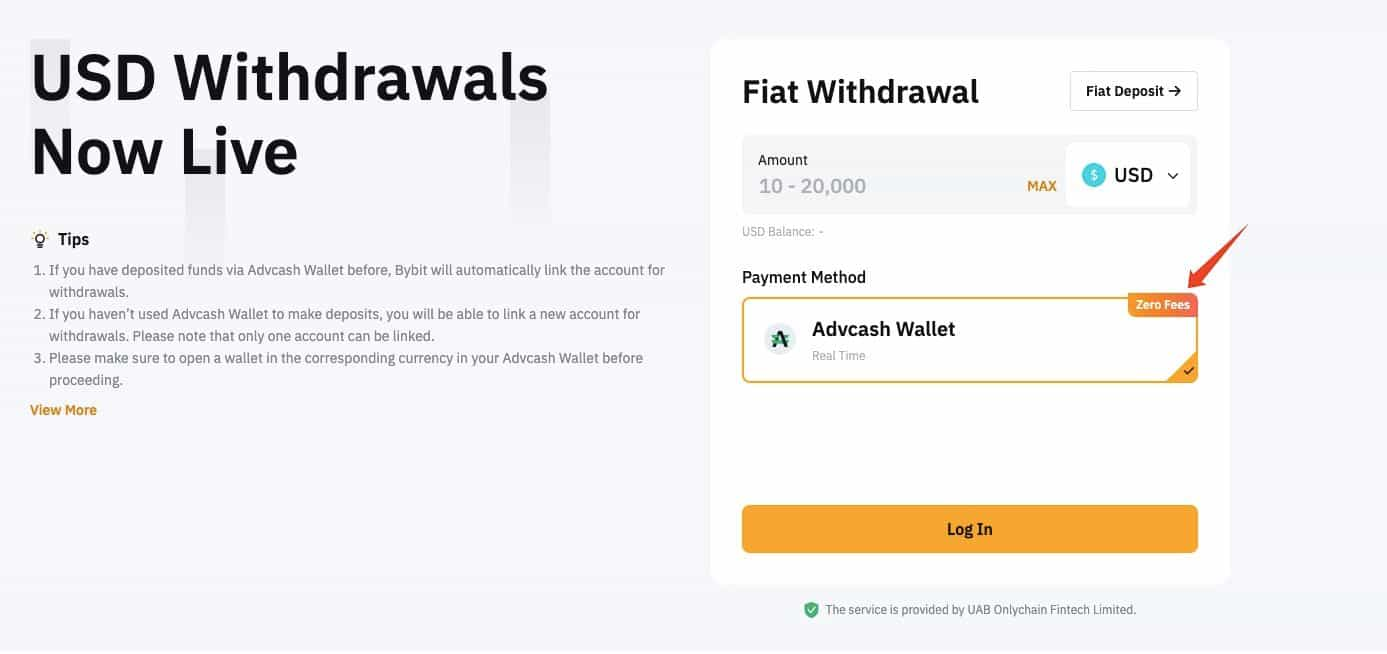

Bybit also offers fee-free fiat deposits and withdrawals, which is quite impressive and certainly gives them an edge. Talk about making every Satoshi count! I wasn't able to find if this is a temporary promotion or if it is here to stay. Just be sure to look for this little “Zero Fees” banner when depositing or withdrawing crypto to see if the method you selected supports free transactions:

Along with fee free deposits and withdrawals, if you want to find out why there is so much hype surrounding Bybit lately and why they are one of the fastest growing exchanges in the industry, you enjoy up to $50,000 deposit rewards and 30 days of no fees by using our Bybit Sign-Up Link

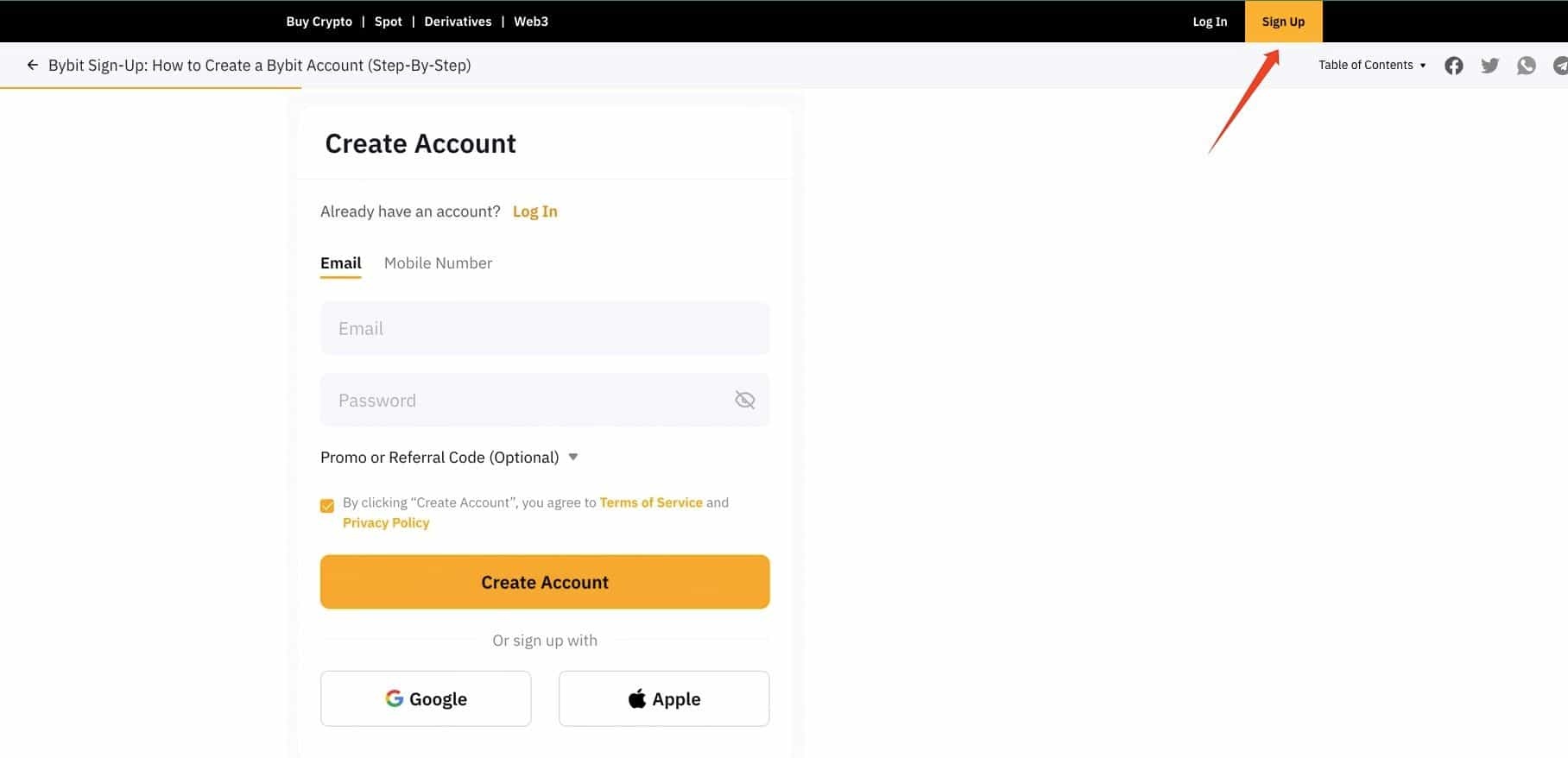

Bybit Registration

If you decide you would like to give Bybit a go then your next step is to create an account. In order to do this, you can hit the “Sign Up” button at the top of their page or simply use our Bybit Sign-up Link.

Bybit requires an email address, phone number, or Google/Apple account, and a password.

We won't go into great detail here as we have a Step-by-Step Guide on How to Sign Up for Bybit where we cover the details.

Bybit Review: Deposits/Withdrawals

Bybit originally started as a crypto-only exchange, with no options to fund an account with fiat currency. They have recently upped their game and now supports fiat deposits for:

- USD/GBP/EUR

- ARS/BRL/COP

- CRC/KZT/MXN

- PEN/PLN/RUB

- TRY/UAH/UYU/VND

And fiat withdrawals for:

- USD/EUR/GBP

- BRL/KZT/MXN

- PLN/RUB/TRY

- UAH/VND

Methods available are SEPA bank transfer, Easy Bank, Advcash, PIX, Zen.com and Faster Payment Service to name a few.

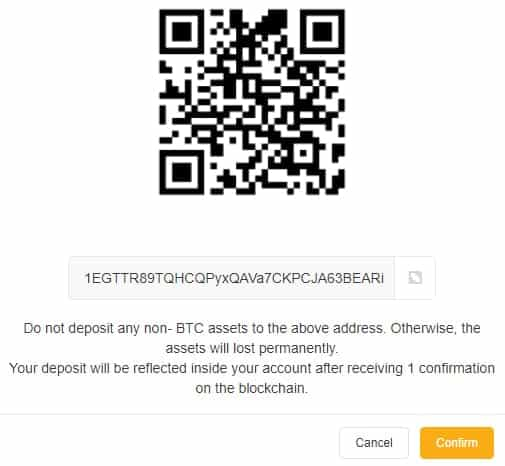

To deposit crypto, you will need to generate a wallet address and initiate a transaction into the wallet. You can do this by heading over to your "Assets" section in the header. This will present your wallet balances where you will select "deposit" and it will bring up the BTC / ETH address.

Withdrawals are just as easy…

Simply hit the withdrawal button on the applicable asset. It will ask for your wallet address as well as to confirm the transaction through 2FA. You will also be given information on the miner fee that will be applied to the transaction.

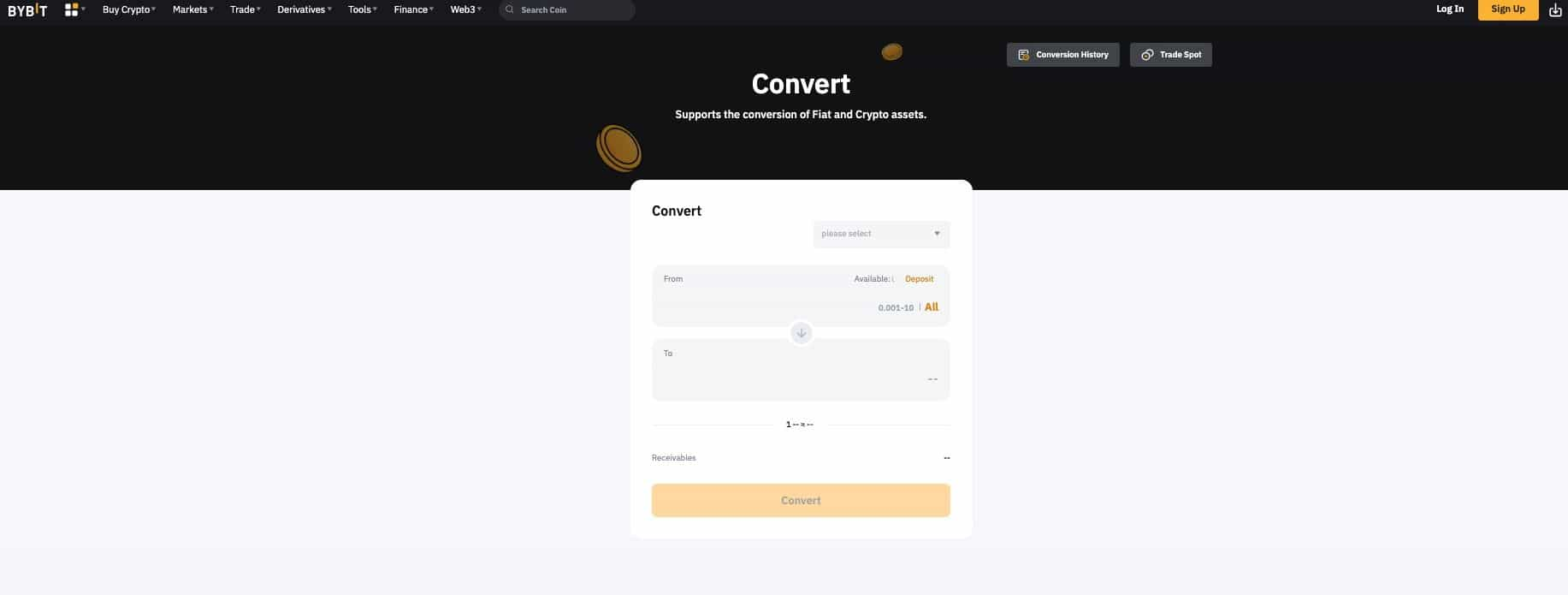

Bybit Convert

Bybit Convert is the easiest way to trade assets on the Bybit exchange. The simple-to-use interface supports trading between digital assets or fiat without fees or slippage.

Convert is a great option for traders who are just looking to swap assets and do not need a charting interface or need to perform technical analysis.

Bybit Trading Platform

One of the most important things for a trader is to have an effective trading platform with advanced technology.

So, how does Bybit stack up?

Very well here, in line with the top exchanges in the industry. The trading platform is well laid out and intuitive. At the top, you can toggle between your wallets and account management. You can also switch between the BTC and ETH futures markets.

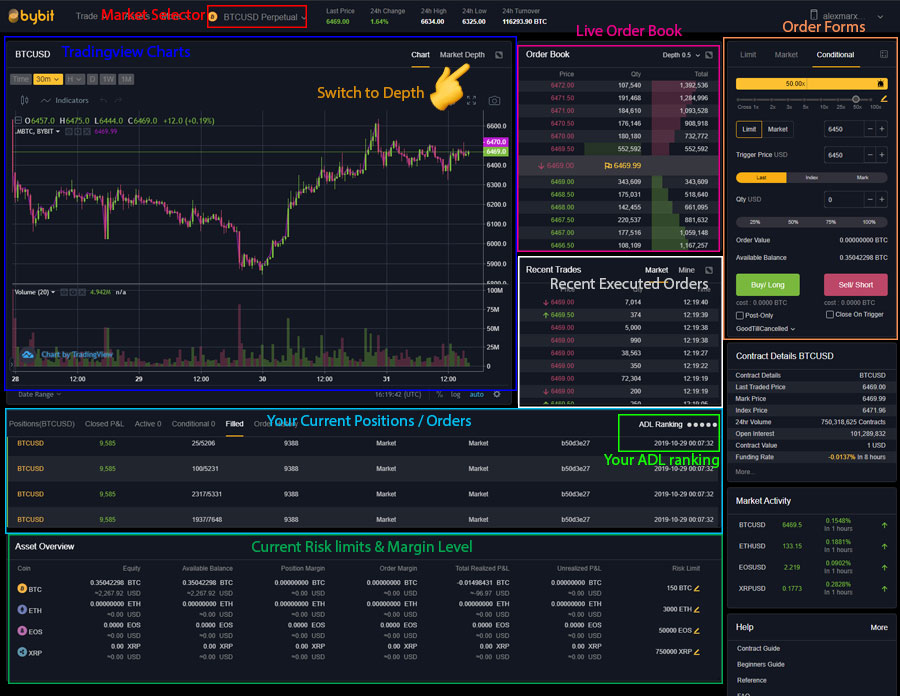

Looking at the standard interface, you have the chart and market depth on the left (you can toggle between them). Then in the middle, you have the order book and the last trades. On the right, you have the order forms as well as the contract details.

Scrolling down from the main interface you have other important trading information. This includes things such as the current market activity and your assets.

Something that we really liked about their interface is that it is customizable and modular. You can detach some of the modules, resize them, and move them around such that they are in your chosen position.

For those seasoned traders among you, you will have noticed that Bybit uses TradingView charting technology. This third-party charting package is well-known in the industry for having the most functionality and features. TradingView has multiple indicators and has a clean, user-friendly interface suitable for crypto trading beginners.

Similar to many stocks and forex platforms, TradingView has become adopted by many crypto platforms, so it is relatively easy for you to adapt if you do open an account somewhere else.

Top Tip 💯: You can switch out the TradingView price charts for the market liquidity charts. These are helpful for the trader to determine market sentiment (bullish/bearish)

You will also notice that in your current position/order bar, you have the "ADL ranking" indicator. This will show you where you currently are positioned for potential deleveraging in the case that the ADL is triggered. As mentioned above, this is done to manage risk.

Something that Bybit appears to be quite proud of is their order-matching engine. They claim that this trading engine is able to execute a total of 100,000 transactions per second per contract. So for every new asset they will add, their matching engine will have a dedicated 100,000 transactions per second for that asset only.

Why does this matter?

Well, faster order execution means that the risk of slippage and trading errors is greatly reduced. Moreover, with an asset that moves as quickly as Bitcoin, it is really important to be able to match both sides of the order book almost instantaneously.

We have had members from the Coin Bureau team test out the trading execution and have heard from other high-level traders and can attest to the claims that Bybit has a professional grade matching and trade execution engine that are second to none in the industry. Check out our Bybit Trading Guide for a look at the trading functionality offered.

Order Functionality

Bybit has a pretty advanced order functionality on the platform. This is great as it allows you to not only customise your entry levels but also allows you to manage your risk on the exit levels.

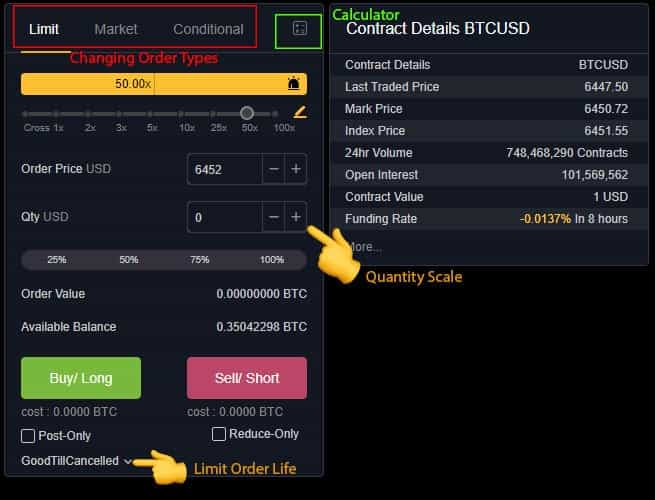

When you are placing your order, you will see the following order form. At the top of the form, you can switch between the order types. Below that you adjust the leverage, price and quantity. There is also information on the contract specifics.

There are three order types that you can place on the Bybit platform. These are outlined below:

- Market Order: This is an order that is placed at the prevailing market price. It will place the order at the "bid" if it is a sell or at the "ask" if it is a buy.

- Limit Order: This is an order that is placed at a chosen level that may be away from the market. The order is open for the order life which we cover below.

- Conditional Order: This is an order that will become either a market or limit order once certain price levels are reached. When placing the trade, you will define the trigger price along with the direction, quantity, and leverage.

Stop Losses 🛑: When trading with leverage, stop losses are essential. There are 3 different ways in which you can set up a stop-loss at Bybit. These are covered on Bybit's article on Stop-Loss types.

As mentioned, with the Limit order and the Conditional limit order, the order will have a certain order life. This is for how long the order will remain open until it is “killed”. There are three order life options at Bybit:

- Good-Till-Cancelled (GTC): This is an order that will remain open until you decide to close it.

- Immediate-or-Cancel (IOC):: This order is designed to be filled immediately and at the best price. If there are any portions that are unfilled then this portion will be cancelled. This means that this order type allows for partial order execution.

- Fill or Kill (FOK): This order is designed to be filled at the best price in its entirety or not at all. This is quite similar to the IOC order except that it does not allow the execution of any partial orders.

On top of all these orders, you also have some optionality around how these orders are executed. For example, with your Limit and Conditional orders, you can set them as "Post Only". This will ensure that the order will be done as a "market maker" and you will receive the maker fee.

In addition, you have the option of making your limit order a "Reduce Only" order, meaning that the order will only execute if it is going to reduce your position. If the order were to increase the position, it would be amended down or cancelled.

You also have a similar order parameter on the Conditional order. This is called "Close on Trigger" and it can be used in conjunction with your conditional stop losses. It will ensure your stops reduce your position and don't increase it.

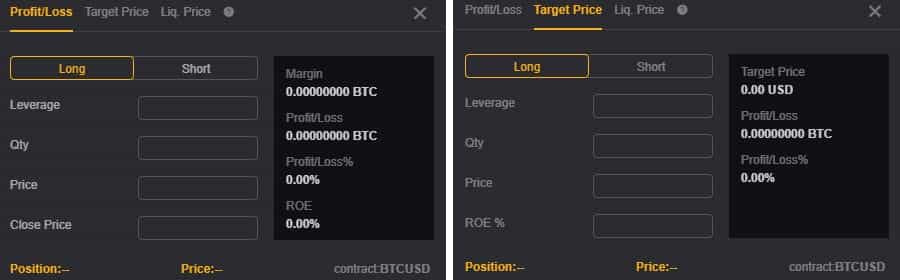

One more handy tool that you may want to check out is their position calculator. You may have seen similar tools at other exchanges like BitMEX et al.

This lets you calculate your Profit / Loss and ROE on target levels. It can also be used to determine your liquidation levels.

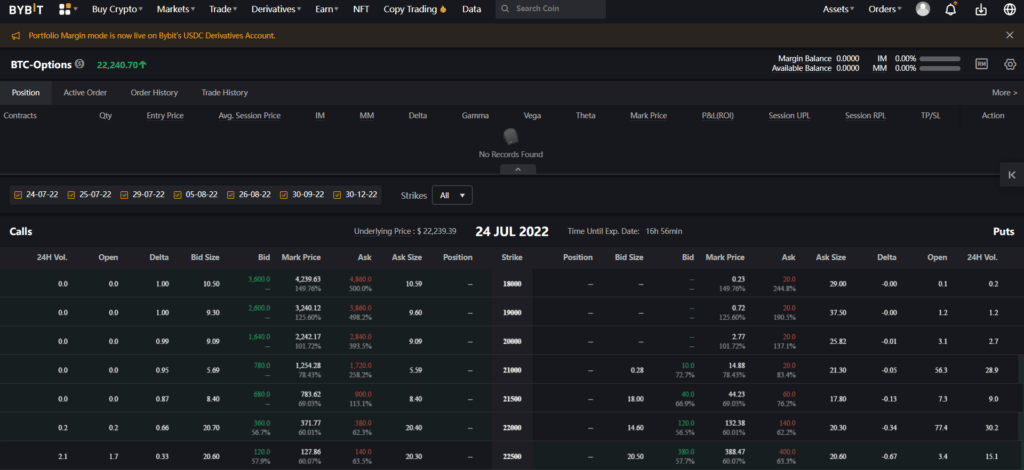

Bybit Options

The last time we covered Bybit, we mentioned the lack of options contracts on the platform. Well, it seems like Bybit listened, because the exchange now allows users to trade USDC options for BTC on the platform.

Options are a type of derivatives contract that allows the buyer the option to buy or sell an underlying asset at a specified price and date. Buyers must pay a premium to acquire the call or put option in order to have this right. Call options provide the buyer with the right to buy the underlying asset from the seller of the option, whereas ‘put options’ provide the buyer with the right to sell the underlying asset to the seller of the option. Option sellers receive a premium from the option buyer for the contract.

Bybit offers European-style cash-settled options. European-style options can be exercised only at expiration and there is no actual physical delivery of the underlying asset required. Bybit’s European options will automatically be exercised when an option expires. The options are settled in USDC.

Inverse vs. USDT Contract

Before you can trade on Bybit, it's necessary to understand an essential distinction between the two types of perpetual contracts they have on offer. The contracts differ according to what margin is used.

For the USDT contract, the underlying margin used is Tether. You can think of this as analogous to a contract that has USD as a base currency (given that Tether is a stablecoin). So, the dollar value of your collateral will remain the same.

However, when it comes to the inverse contract, the underlying cryptocurrency itself is used as margin. So, if you are trading BTC/ETH/EOS/XRP as the base currency then your margin will be in this as well. So for example, for ETHUSD contracts you will have ETH as the margin.

The inverse contract is slightly riskier than the USDT contract. This is because not only do you have exposure to the actual market but you will also have exposure through your underlying collateral. So, keeping with our example, if you are long Ethereum and the price falls not only will your position deteriorate but you will also see the USD value of your collateral falling.

If you are going to be trading anything other than Bitcoin then it will have to be an inverse perpetual. You will also have to make sure that you have the coin in question before you can actually trade it.

It is also important to note that although the margin required is in the coin in question, it is still quoted in USD. Each inverse perpetual contract is 1 USD in value. It's a pretty neat feature as it allows you to trade contracts for as little as 1 USD. This is in contrast to the USDT contract that is written on 1 BTC.

Isolated & Cross Margin

Something else you may notice when you are trading BTCUSDT on the Bybit platform is that you have two options around how the margin is apportioned in the account. These are isolated and cross margin.

When you select Isolated margin, the margin that you have on the trade is applicable to only that position. It does not take into account the equity levels and positions PnL that you have on other orders for the same trading pair. So, even if you are in profit on some other trade, it has no bearing on whether you are likely to get liquidated (and vice versa).

However, when you have selected to cross margin it means that all available balances will be combined in order to prevent a liquidation. So, if you have other positions that are open for the corresponding trading pair then these will be included in a calculation of margin levels before liquidation occurs.

Note ✍️: When you select to cross margin, you cannot manually select the margin level. The initial margin is set in accordance with the maximum leverage limit for said pair. So, if you are trading BTCUSDT, this would be 100x or 0.1% initial margin.

Which is better?

Honestly, we would suggest using Isolated Margin. Not only does it allow you to adjust the margin but it also means you have full control of your risk on a particular position. If you are trading the inverse perpetual swaps then the isolated margin is set by default.

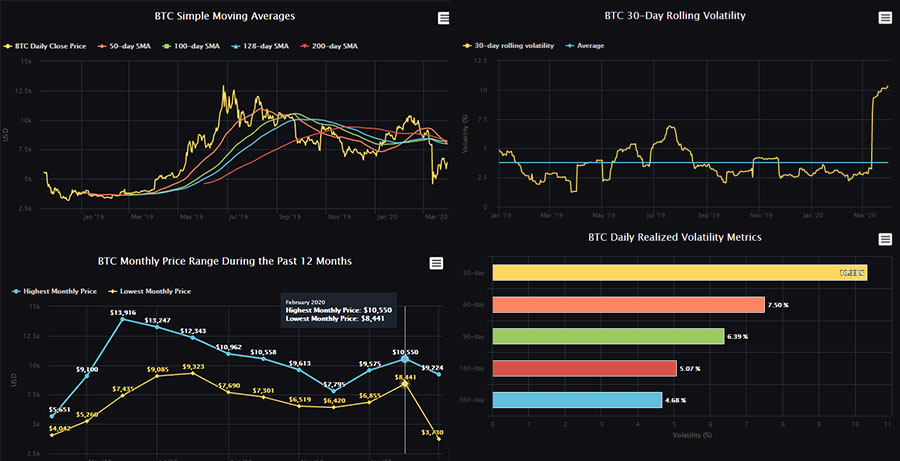

Market Analytics Data

Something else we found pretty neat was their market data section and particularly their advanced data section. This contained some really handy graphs and charts that could help inform your trading.

You can also pull up some of these charts and download the data. This could either be as an image, vector file or as a csv. Here you can see an example of us doing that with the rolling volatility chart.

Here is a list of the data that you are able to download as well as what it means:

- BTC Daily Realised Volatility Looking at what the realised volatility was like over a certain period of time

- Monthly Price Range Takes a look at monthly highs and lows in the price. It allows you to observe the range the asset traded in.

- Price Moving Averages: This has the price of Bitcoin along with the number of moving average indicators of different time frames.

- Rolling Volatility The realised volatility over the past 30 days compared to the average for the period. Gives you a sense of how much the price swung in a given period.

There is also a host of other data that you can examine in these tabs. That includes information on the specific index price, funding data and the insurance fund. You should also note the weights that are used to calculate the spot price.

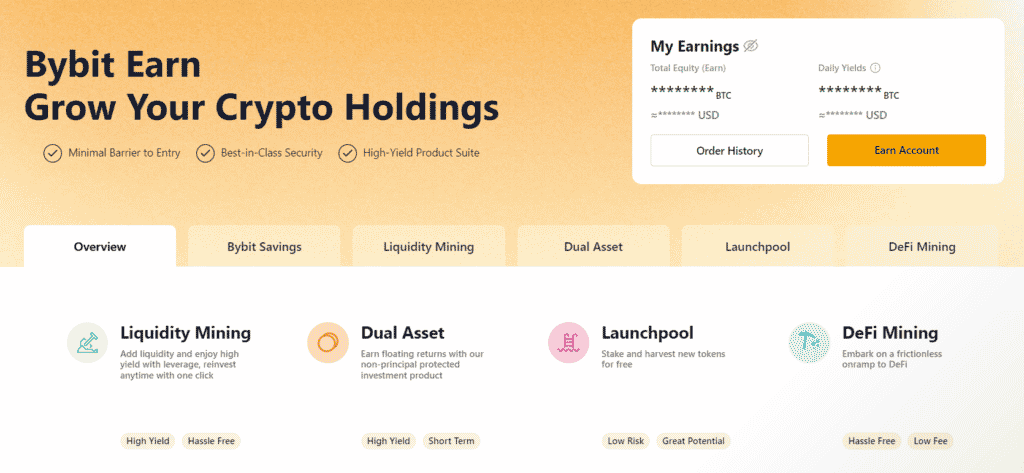

Bybit’s Earn Program

Bybit allows its users to earn passive income on their idle assets through a variety of products available on its “Earn” program. The products available on its ‘Earn’ program are-

- Bybit Savings

- Bybit Liquidity Mining

- Bybit Dual Asset

- Bybit Launchpool

- Bybit Defi Mining

There are Earn products available for both new and experienced crypto users, as well as a good selection of high-risk and low-risk products. We cover each of the products in greater detail in our dedicated Bybit Earn Analysis if you would like to learn more.

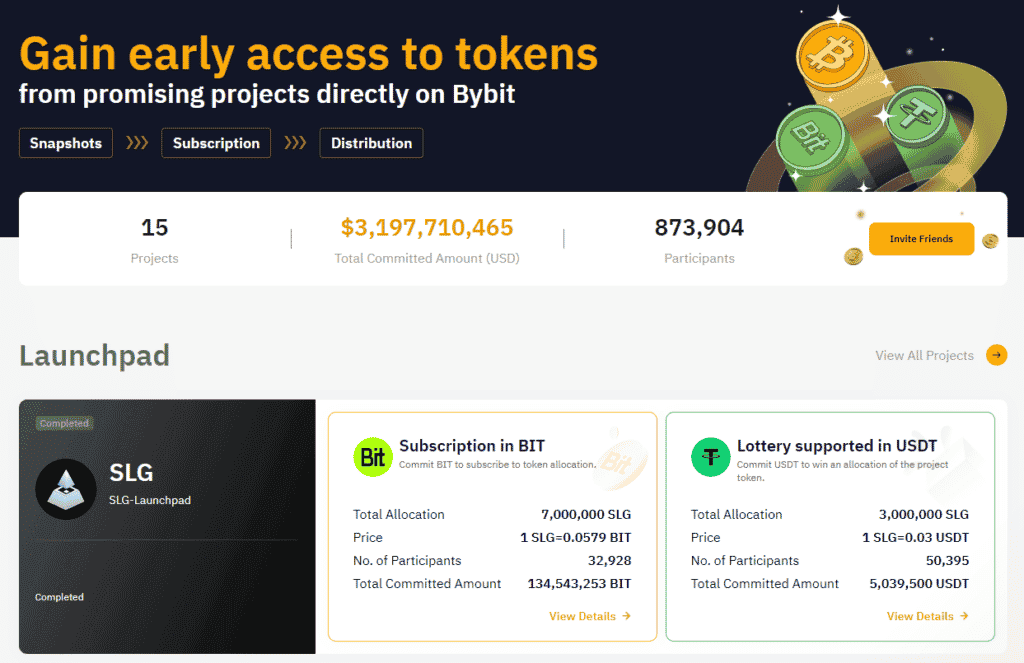

Bybit Launchpad

The Bybit launchpad is a token launch platform that enables users to gain early access to pre-listing coins by enabling them to purchase these tokens at an attractive introductory price.

To participate in Bybit’s launchpad, users need to maintain a daily average wallet balance of 50 BIT or 100 USDT in their spot wallet for five consecutive days before the subscription period.

Once these eligibility conditions are satisfied, users can purchase launchpad tokens by staking their BIT tokens in the BIT pool or stake USDT

Bybit NFTs

Like most top centralized crypto exchanges, Bybit has ventured into the NFT space by launching its own NFT marketplace. Bybit’s NFT marketplace often partners with GameFi NFT projects and individual artists to launch an exclusive sale, users can purchase these assets via the marketplace.

Bybit Copy Trading

Bybit enhances its platform with the introduction of copy trading. This feature allows less experienced traders to replicate the strategies of seasoned traders, providing a valuable learning tool and a potential source of additional income for experienced traders sharing their strategies. Bybit's copy trading is designed for ease of use, making it accessible to traders at all levels

Bybit Mobile App

For those traders on the go, you will no doubt want to keep track of your open positions. This is why Bybit has developed their mobile application. It's available in iOS and Android and appears to be quite functional.

In fact, it has most of the same functionality as the desktop version. You have advanced charting and order management all easily accessible through the navigation pane. You can also set a whole host of price levels to be sent as push notifications.

You also have those advanced order forms that you see on the main exchange. This is not something that we have seen at other exchanges and brokers. Most of the time the order functionality is stripped down - so top marks here.

The app is listed in both the App Store store as well as Google Play. There are over 10 million downloads with overall positive reviews across both app stores.

So, should you consider the Bybit App?

Well, it is no doubt quite functional but we always prefer to use web and PC-based trading. This is because you can never really replicate the effectiveness of PC trading on a mobile device. You can't easily study charts and monitor numerous markets at the same time. You should ideally only be using it at times when you are away from your desk and need to monitor your positions.

Bybit Customer Support

The customer support offered on Bybit is quite good and there aren't too many glaringly negative reviews online regarding quality and response times for support. We did try to reach out to their customer support lines to get an idea of typical response times and found responses came in at acceptable time intervals and the support received was helpful.

In terms of support options, you have a Zendesk 24/7 live chat function that is available on their platform. Support is available in the languages Bybit has translated on their website into.

You can also reach out to them via email at [email protected] for customer support or [email protected] if your query is more technical in nature.

We tested out the live chat function and we were able to get a support agent almost immediately. Email support took a bit longer but was similarly helpful.

Social Channels 📱: If you are struggling to get a response through these channels then you can always reach out on their social media. They have a Telegram Channel for more direct questions. You can always Tweet them a ticket number if you prefer.

Of course, if your question is more routine in nature and not specific to your account then you can always make use of their extensive help section. This includes their FAQ resources as well as other helpful guides that could help your trading.

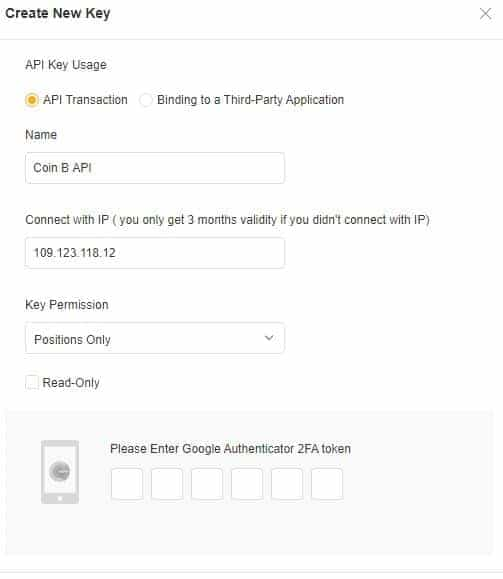

API

Those developers among you will be happy to know that Bybit has a pretty robust API. This will allow you to code algorithms and bots in order to manage the trading programmatically.

You can get all of the technical documents about how to interact with the API from their GitHub. If you would like to make use of the API then you will have to generate an API key. This can be done in the "API management" section of the exchange.

Here, you can generate a new key that will be used to access the API. You will also have to decide what permissions you want to give the API (read, write or withdraw). Read allows you to monitor prices, write allows you to place trades and withdraw will allow your bot to process a withdrawal (not advisable).

You may also want to bind the API to your IP address. This will prevent anyone from placing trades in your account should your API key be compromised. Either way, you will want to be very careful when dealing with your API key.

For example, we would advise against the use of third-party trading bots. Many of these have questionable returns and when they have access to your API keys they can manipulate markets to their own advantage.

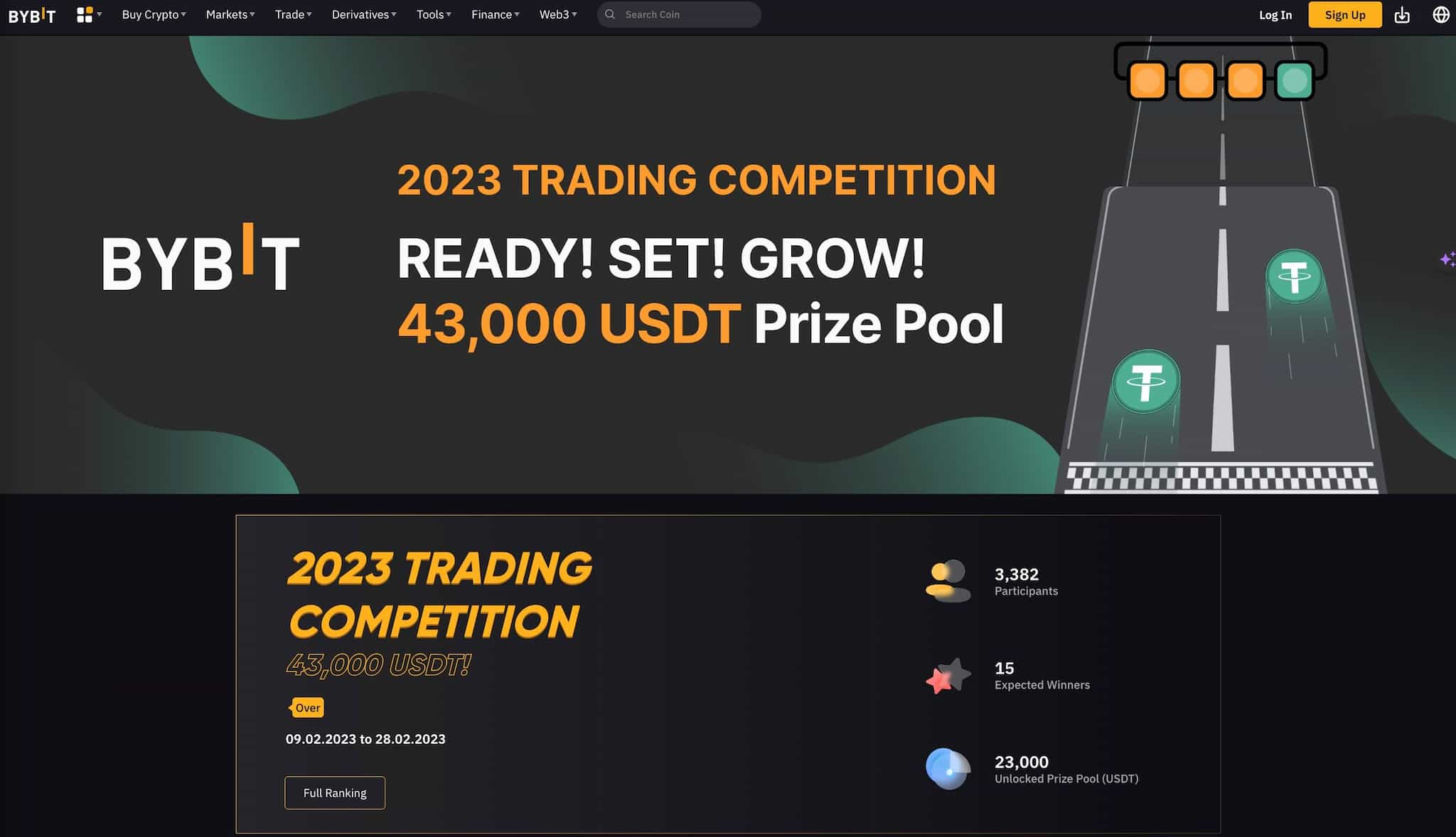

Trading Competitions

Perhaps one of the things Bybit does better than most of the competition are their trading competitions, which attract some of the most skilled traders in the industry.

Local Competitions 🌎: To target those traders who speak a specific language or are in a specific region, Bybit has local competitions. They have recently run the Korea & Japan competition

Bybit hosts both large competitions with huge prize pools for those with the gusto to get involved, as well as smaller, more frequent trading contests for anyone looking to test their skills.

Bybit Top Benefits Reviewed

Bybit is an excellent platform for non-US customers looking for a derivatives exchange or those wanting to trade the spot market. It offers one of the best trading experiences in the industry. Some of the top benefits Bybit offers are:

Wide Range of Assets and Services - Since 2018, Bybit has grown into one of the top exchanges that provides users with access to a wide range of assets as well as services. Bybit has over 300 assets in the spot market and 200+ contracts in the derivatives market. It also offers users services such as trading bots, lending, institutional services, referral and affiliate programs, the Bybit debit card, P2P market, copy trading, and more. Bybit has done a great job competing with the likes of Binance as a “one-stop-shop” crypto exchange that offers everything a crypto user needs under one roof.

Bybit Copy Trading- Because Bybit has become a highly respected exchange, thanks to its professional-grade trading and matching engine and fantastic selection of products, the platform has attracted some of the most talented crypto traders in the industry. This has led to their copy trading platform becoming one of the best in the industry as traders can copy the trades of some of the best traders in crypto.

High Leverage and Risk Management - The exchange allows users to trade with up to 100x leverage on select assets, but it also has a variety of tools that ensure risk is properly contained. Some of the tools include Bybit’s insurance fund, auto deleveraging, cross and isolated margin accounts, a range of order options, etc.

Good Customer Support - Bybit has 24/7 customer service available for users to get any issues addressed.

What can be Improved?

The last time we covered Bybit, we were disappointed by the lack of fiat services, trading pair availability, mentioned that the support could have been better, as well as we found that accessing the demo accounts was unnecessarily complicated.

It is great to see they have significantly upped their game and all of those gripes have been addressed.

Truthfully, it is difficult to find much fault with the platform at all. The only thing to highlight, which is very minor, is that the NFT marketplace and Launchpad aren't quite up to the quality and standards of the projects and NFTs that can be found on Binance, but that is to be expected as Binance is considered the “king” of crypto exchanges for a reason.

However, Bybit is only getting better all the time and has been continuously taking market share from Binance and is growing at a faster rate, a true testament to what a great exchange Bybit has become

Bybit Exchange Review: Conclusion

We found Bybit to be a user-friendly exchange with strong technology, reasonable fees and a relatively intuitive user interface. We are also glad to see Bybit has developed an insurance fund to manage market risk.

Bybit is well-positioned to offer an alternative to the status quo in the crypto derivatives trading market and has enjoyed astronomical growth in the industry.

The exchange is one of the fastest growing platforms around, with new products and features being added all the time, which has only been fuelling its growth.

So, should you use Bybit?

You would be in good company if you chose to do so. Many of the best traders in crypto and even some institutional traders trust Bybit and they have a robust security framework in place. We encourage you to do your own research but on the face of it, Bybit appears to be a fantastic exchange that ticks most of our boxes. You can learn more about Bybit and how it stacks up against other exchanges in our Bybit vs KuCoin review.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Frequently Asked Questions

The co-founder and CEO of Bybit is Ben Zhou. He is a public figure who is respected in the crypto industry and prior to Bybit, he ran a retail forex brokerage for nearly a decade.

Bybit is a cryptocurrency and derivatives trading exchange established in 2018. It offers a professional-grade, high-performance matching engine, making it a popular trading platform with over 2 million users. The exchange is known and respected in the crypto community for advanced trading options, good customer support, and its dedication to crypto education.

Bybit is about as legitimate as an unregulated "off-shore" crypto exchange can be. Thanks to the robust security measures in place, and the fact that this exchange has been operating since 2018, Bybit is one of the most highly trusted exchanges outside the top 5.

Unfortunately not. Residents from the United States and Sanctioned countries are not permitted to use Bybit.

Inverse Perpetual Contracts allow traders to use BTC and other coins as the base currency. An Inverse Perpetual Contract is different from a USDT Perpetual Contract in the calculation of margin, Profit and Loss (P&L) and risk exposure. You can learn more in Bybit's Introduction to Inverse Perpetual Contracts article.

Bybit is headquartered in Dubai, United Arab Emirates

Bybit is an unregulated crypto platform and does not adhere to many of the USA government's rules and regulations.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.