Best 5 Crypto Derivatives Exchanges 2024

In the dynamic world of cryptocurrency, derivatives have emerged as pivotal instruments for traders seeking to hedge risk, speculate on price movements, or gain exposure to the crypto market without holding the underlying assets. The inception of the first-ever crypto derivative in 2011, known by the ticker ICBIT, marked a significant milestone in the evolution of digital finance. This innovation laid the groundwork for a burgeoning market that, according to Crypto.com, was valued at over $2 trillion in 2023.

This article will explore cryptocurrency derivatives and identify the top exchanges that have contributed most to this monumental growth. We will also discuss the complexities and challenges traders face and offer insights on efficiently navigating this lucrative yet intricate landscape. This introduction sets the stage for a deeper investigation into crypto derivatives, underlining their significance in the broader financial ecosystem.

What are Crypto Derivatives?

Numerous cryptocurrencies exist, serving a myriad of use cases. Bitcoin is a store of value asset, while cryptocurrencies like Ethereum and Solana fuel smart contract blockchains. Regardless of utility, every asset, in the cryptosphere or otherwise, has a monetary value that fluctuates over time. Derivatives are financial instruments that isolate an asset's price potential from its other intrinsic characteristics like utility and ownership. They track the price of an underlying asset, allowing traders to construct arrangements that can capitalize on market events.

How do Crypto Derivatives Work?

Crypto derivatives are financial contracts between two or more parties that derive their value from the price of another crypto asset, such as bitcoin or ether. They are a means of gaining exposure to cryptocurrency price fluctuations without owning them in on-chain wallets.

Let’s understand the functioning of crypto derivatives through the main types of contracts: futures, options, and swaps. Here’s how each of these derivatives works:

Futures Contracts

A futures contract is an agreement to buy or sell a specific quantity of a crypto asset at a predetermined price at a specified future date. These can be:

- Standardized Contracts: Traded on exchanges, allowing traders to speculate on the future price of the cryptocurrency or hedge against potential price movements.

- Perpetual Contracts: A type of futures contract without an expiry date, allowing traders to hold positions indefinitely, with periodic funding rates to ensure the market price is anchored to the spot price.

Options Contracts

Options give the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific amount of a cryptocurrency at a predetermined price (strike price) before or at a specific date. Options can be used for hedging or speculative purposes, providing an asymmetric payoff profile:

- Call Options: Traders buy call options if they anticipate the price of the cryptocurrency will rise above the strike price before the expiry date.

- Put Options: Traders buy put options if they expect the price of the cryptocurrency to fall below the strike price before the expiry date.

Guy has put together this great video that covers Bitcoin Options in detail:

Swaps

Swaps are private agreements between parties to exchange cash flows or the financial instruments of one cryptocurrency for another, based on a specified notional amount. In the crypto context, this often takes the form of:

- Interest Rate Swaps: Parties might exchange fixed for floating rate payments in cryptocurrency.

- Currency Swaps: Exchanging one cryptocurrency for another, with agreements to reverse the swap at a later date at a predetermined price.

Working Mechanism

- Price Speculation: Traders can speculate on the price movement of cryptocurrencies, taking long positions if they believe the price will increase or short positions if they believe it will decrease.

- Leverage: Many crypto derivatives allow the use of leverage, enabling traders to open larger positions with a smaller capital outlay. While this can amplify profits, it also significantly increases risk.

- Hedging: Investors holding cryptocurrencies can use derivatives to hedge against adverse price movements, securing a certain sale price for their holdings even if market prices fall.

- Market Efficiency: Derivatives contribute to price discovery and liquidity in the crypto market, helping to stabilize prices and allow for more efficient market functioning.

Execution Platforms

- Exchanges: Many crypto derivatives are traded on regulated or decentralized exchanges, providing a platform for standardized contracts with liquidity and price transparency.

- Over-the-Counter (OTC): Customized contracts between parties can be executed outside of exchanges, offering flexibility but with potentially higher counterparty risk.

Crypto derivatives are complex financial instruments that require a good understanding of the market and risk management practices. They play a crucial role in the cryptocurrency ecosystem by providing tools for speculation, hedging, and leveraging positions.

Why Trade Crypto Derivatives?

Trading crypto derivatives opens access to unique strategies and instruments that may help a crypto investor optimize their investment portfolio to accommodate the distinct nature of the digital assets market. Some of these optimizations are reminiscent of using derivatives in traditional markets, while some offer unique advantages over the volatile nature of this market. Here are some key reasons why investors include derivatives in their investment portfolios:

- Leverage: Most crypto derivative platforms offer a leverage facility where an investor pledges collateral to open significantly higher positions in the market. Leverage is a tool to gain multiplied profits with loss limited to the collateral. Leverage multiplies sensitivity to volatility, which amplifies profits or a potential loss in case of poorly positioned trades.

- Hedging Volatility: The cryptocurrency market is known for its extreme volatility. Traders can use derivatives like futures and options to hedge against price fluctuations in their crypto holdings, securing a predetermined price for a future date and thus managing their exposure to market movements.

- Ownership: Derivatives are helpful when an investor is solely interested in an asset’s price potential and wants to avoid the hassle of physical ownership, like key management and storage.

- Access to Restricted Markets: Some investors may face regulatory or logistical barriers when attempting to purchase specific cryptocurrencies directly. Crypto derivatives offer a way to gain exposure to these assets without direct ownership, bypassing certain restrictions and complexities.

- Cost Efficiency: Trading derivatives can be more cost-efficient than directly trading underlying cryptocurrency. Derivatives traders can avoid the costs associated with on-chain transactions, security, and wallet management of actual cryptocurrencies.

- Income Generation: Through strategies such as writing covered calls or selling futures contracts, traders can generate income from their existing cryptocurrency holdings, adding another layer of utility to their investment strategy.

- Risk Management: Derivatives offer sophisticated risk management tools that enable traders to effectively implement complex strategies to protect their investments from adverse market moves.

Trading crypto derivatives requires a good understanding of the derivatives market and the underlying cryptocurrency assets. While offering significant opportunities, it also comes with high risk, exemplified by the leverage involved and the inherent volatility of the crypto market. As such, traders must approach crypto derivatives with a well-thought-out strategy and a clear understanding of the risks.

What to Look for in a Crypto Derivatives Exchange

Selecting the suitable derivatives exchange that suits your needs and preferences is a pivotal decision for traders. This choice can significantly impact their trading efficiency, risk management, and overall experience in the crypto market. With various platforms offering diverse services, understanding the essential factors distinguishing an exemplary exchange from an average one is critical. Here are some factors to consider when looking for a crypto derivatives exchange:

Open Interest (Liquidity)

Open interest, indicating the total number of outstanding derivative contracts, is a primary measure of an exchange's liquidity. High open interest suggests a vibrant market with ample traders, facilitating easier entry and exit at competitive prices. Liquidity is crucial for minimizing slippage, especially for large orders, and ensures that the market can absorb trades without significant price impacts.

Regulatory Compliance

Compliance with regulatory standards may be paramount if you are looking for a centralized platform for derivatives trading, which typically offers higher regulatory assurance, undergoing strict oversight to protect users against fraud and insolvency. Decentralized exchanges circumvent regulation and offer privacy. Traders should weigh the trade-offs between regulation and privacy to determine their ideal option.

Fees

Understanding an exchange's fee structure is essential. This structure includes exchange fees, which can vary widely among platforms, gas fees for decentralized platforms, and deposit and withdrawal fees. High costs can erode profits, especially for high-frequency traders, making choosing an exchange with a competitive fee structure that does not compromise other critical services imperative.

User Experience

The platform's interface and ease of usability play a significant role in trading success. A user-friendly interface, comprehensive charting tools, and efficient trade execution capabilities can enhance decision-making and trading speed. Additionally, reliable customer support is crucial for resolving issues promptly, contributing to a positive trading experience.

Non-essential Factors

While not deal-breakers, certain non-essential factors can also influence the choice of an exchange:

- Security: Although paramount, most leading exchanges now offer robust security measures. Therefore, while important, security might not be the primary differentiator.

- Product Offerings: The variety of derivatives (futures, options, perpetuals, swaps) can cater to different trading strategies but should align with the trader's expertise and interests.

- Leverage Limit: High leverage can amplify profits but also risks. Traders should consider their risk tolerance and trading strategy over the maximum leverage offered.

- Deposit and Withdrawal Options: The flexibility of depositing and withdrawing in both fiat and cryptocurrencies is convenient but secondary to factors like liquidity and fees.

Choosing the right crypto derivatives exchange is a nuanced decision that hinges on balancing important and non-essential factors. Ultimately, the goal is to select a platform that aligns with one's trading strategy, offers a secure and efficient trading environment, and fosters a positive user experience.

Best Crypto Derivative Exchanges

This section will explore some platforms for trading crypto derivatives options available. The exchanges mentioned here have been selected based on the factors mentioned previously. Not every exchange mentioned here excels in every aspect, so we will cover the strengths and weaknesses of every alternative discussed here.

Binance

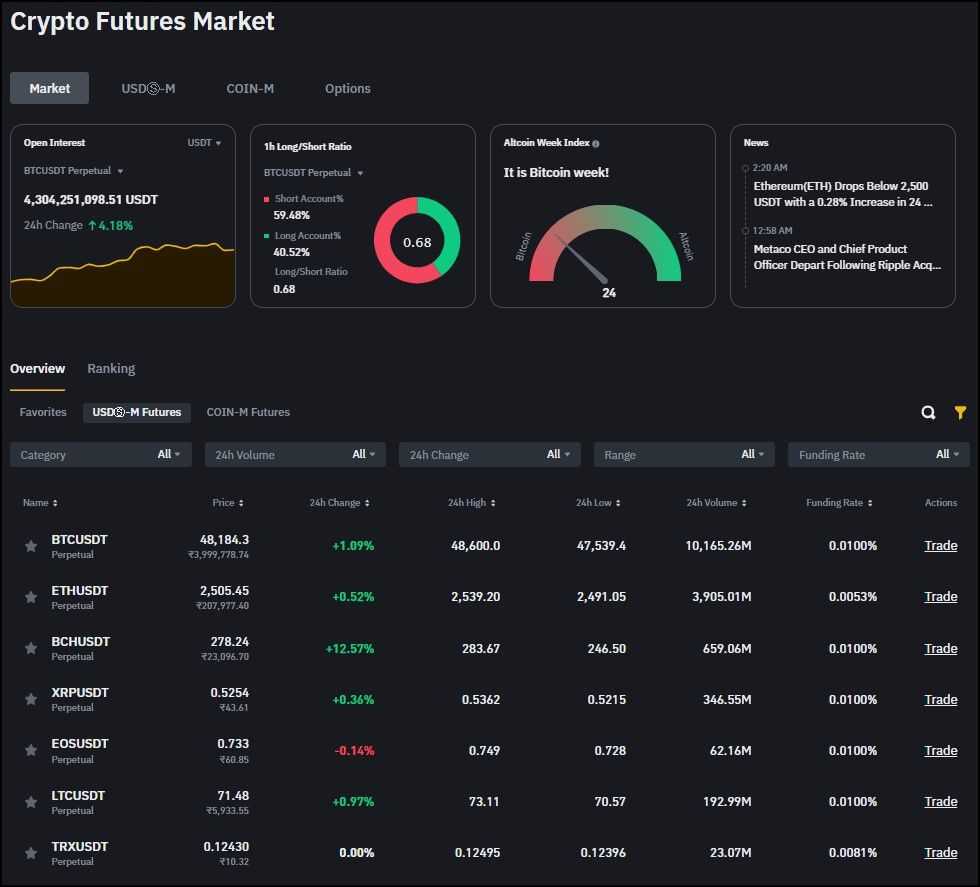

Binance, as one of the world's leading cryptocurrency exchanges, offers a comprehensive platform for derivatives trading, making it an attractive option for many traders. Evaluating it against the essential factors mentioned:

- Open Interest (Liquidity): Binance excels in liquidity, boasting high open interest across various derivatives products. Ample liquidity ensures traders can execute large orders with minimal slippage, making it an ideal platform for retail or institutional traders.

- Regulatory Compliance: Binance operates in a complex regulatory environment. It has made efforts to comply with regulatory standards in various jurisdictions, including obtaining necessary licenses and adhering to KYC/AML regulations. However, potential users should be aware of ongoing developments and ensure that Binance meets their local compliance requirements. Binance is not authorized to offer derivatives in the US.

- Fees: Binance is known for its competitive fee structure, offering relatively low trading fees that can decrease further based on trading volume and BNB token holdings. The platform also maintains transparent policies regarding deposit and withdrawal fees, which are generally favorable compared to the industry standard.

- User Experience: The platform offers a user-friendly interface, advanced charting tools, and a responsive trading system suitable for novice and experienced traders. Customer support is accessible, assisting various channels, although response times can vary.

Regarding non-essential factors, Binance provides robust security measures for various products, including futures, options, perpetual swaps, flexible leverage options, and diverse deposit and withdrawal methods, catering to a broad spectrum of trading strategies and preferences.

In conclusion, Binance stands out for its liquidity, competitive fees, and comprehensive user experience, making it a strong contender for derivatives trading. However, traders should continuously monitor regulatory compliance and consider their specific needs and risk tolerance when trading on the platform. You will find more details about Binance and its offerings in the Binance Review on Coin Bureau.

ByBit

ByBit, a prominent player in the crypto derivatives market, offers a specialized trading platform focusing on futures and perpetual contracts. Let’s examine the characteristics of ByBit.

- Open Interest (Liquidity): ByBit often ranks among the top exchanges in terms of open interest for crypto derivatives, particularly for BTC and ETH perpetual contracts. While specific numbers can vary, its open interest is generally in the billions of dollars, indicating a deep market that can support large trades without significant price impact. Compared to smaller exchanges, ByBit's liquidity is superior, facilitating better price discovery and tighter spreads.

- Regulatory Compliance: ByBit has made efforts to navigate the complex regulatory landscape by engaging with regulatory bodies and adhering to international compliance standards. However, its decentralized nature and the regulatory challenges faced in some jurisdictions (e.g., the UK and the USA) may require traders to use additional caution and conduct their due diligence.

- Fees: ByBit's fee structure is transparent, with maker fees typically around -0.025% (providing a rebate to makers) and taker fees around 0.075%. These rates are competitive when compared to other major exchanges, which can have taker fees as high as 0.075% or more. However, the exact benefit depends on whether a trader's strategy involves making or taking liquidity.

- User Experience: ByBit offers a sophisticated trading interface that caters to both beginners and experienced traders. Its platform provides a range of tools and charts, high-speed trade execution, and a mobile app for trading on the go. Customer support is robust, featuring 24/7 availability through live chat and other channels.

Non-essential Factors

- Security: ByBit employs industry-standard security measures, including cold storage for client funds, two-factor authentication, and SSL encryption, which are on par with the security protocols of leading exchanges.

- Product Offerings: Specializing in derivatives, ByBit offers a wide array of products, including futures, perpetual contracts, and options, with a focus on the major cryptocurrencies. This selection matches or exceeds the variety found on many competing platforms.

- Leverage Limit: ByBit provides leverage up to 100x on certain contracts, aligning with the offerings of other major derivatives exchanges. Such high leverage allows for significant position sizing but also introduces increased risk.

- Deposit and Withdrawal Options: ByBit supports multiple cryptocurrencies for deposits and withdrawals, providing flexibility for traders. While it doesn't support fiat deposits directly, it offers fiat gateway services, which is a common practice among crypto-only platforms.

ByBit stands out for its competitive fees, high liquidity, and user-friendly trading environment. Its approach to regulatory compliance and the breadth of its product offerings make it a compelling choice for crypto derivatives traders. However, as with any exchange, traders must consider their specific needs, trading strategies, and the regulatory environment they operate in. Read the ByBit review on Coin Bureau and learn more about the exchange.

👉 Readers of the Coin Bureau can get up to $50,000 in sign-up bonuses, 0 fees for 30 days and a $30 airdrop by using our Coin Bureau Sign-Up Link

OKX

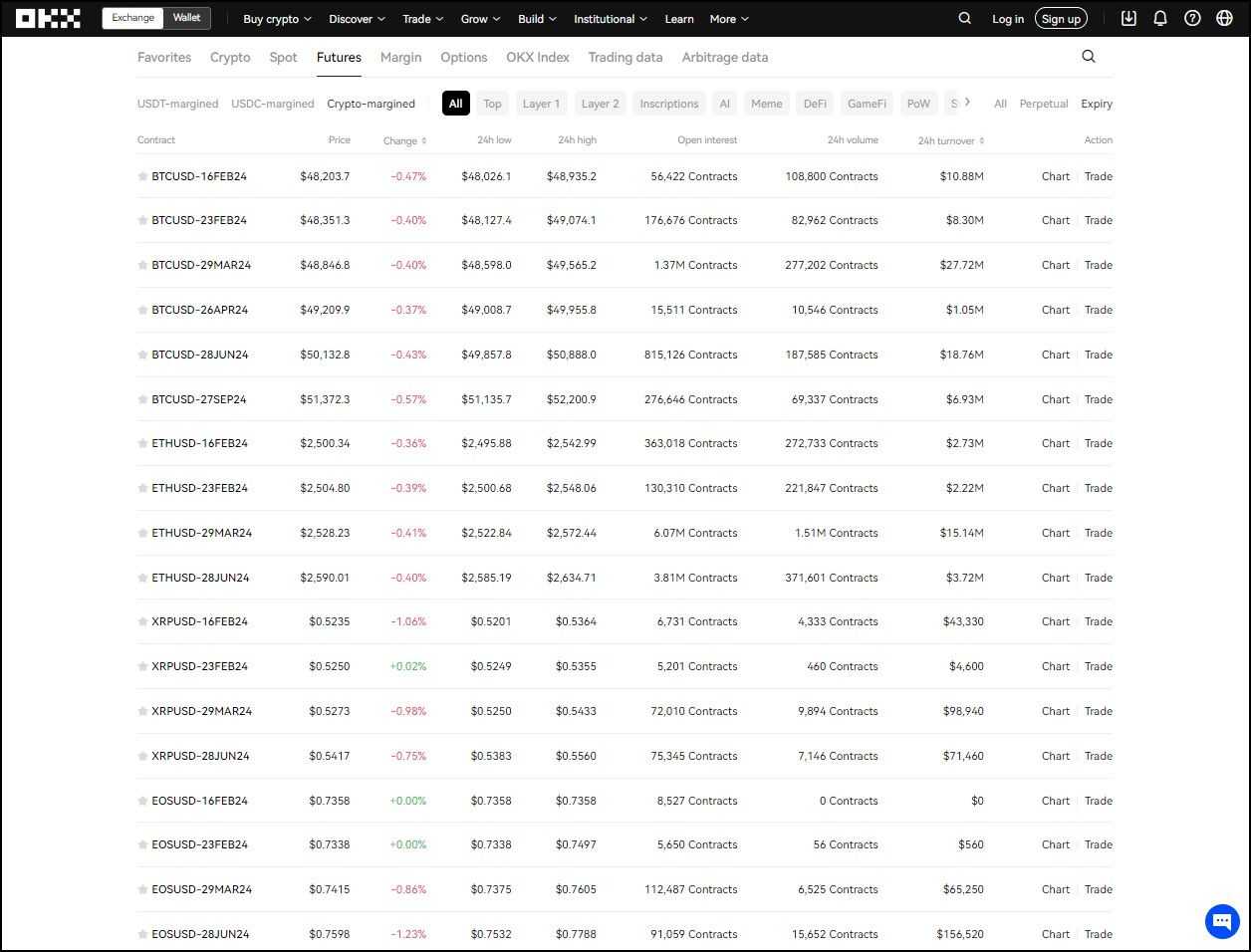

OKX is a comprehensive cryptocurrency exchange offering a wide range of financial services, including a robust platform for crypto derivatives trading. Here’s an analysis based on the important and non-essential factors mentioned earlier:

- Open Interest (Liquidity): OKX consistently ranks high in terms of open interest for crypto derivatives, showcasing its position as one of the leading platforms for liquidity. With billions of dollars in open interest across various contracts, OKX facilitates efficient trade execution, even for large orders, minimizing slippage and ensuring competitive pricing.

- Regulatory Compliance: OKX operates with a keen focus on regulatory compliance, adapting to the global regulatory landscape by implementing strict KYC and AML procedures. This commitment enhances its credibility and trustworthiness among users, although the regulatory stance in specific jurisdictions may affect its accessibility and the range of services offered to users in those regions.

- Fees: The fee structure on OKX is designed to be competitive, with maker fees typically around -0.02% to 0.02% and taker fees between 0.05% to 0.075%. These rates are attractive, especially for high-volume traders, and are in line with or better than those offered by many other exchanges. Additionally, OKX provides tiered fee levels, where traders with higher 30-day trading volumes or larger OKB (OKX's native token) holdings benefit from lower fees.

- User Experience: OKX offers a sophisticated yet user-friendly trading platform, suitable for both novice traders and seasoned professionals. It features an intuitive interface, comprehensive charting tools, and advanced order types. The exchange also provides strong customer support through various channels, ensuring timely assistance for users.

Non-essential Factors

- Security: OKX emphasizes security with a multi-tier and multi-cluster system architecture, cold and hot wallet technologies, and two-factor authentication (2FA) for enhanced account protection. Its security measures are robust and on par with industry standards.

- Product Offerings: The exchange boasts a diverse range of derivatives products, including futures, perpetual swaps, and options, across a wide selection of cryptocurrencies. This variety allows traders to employ various strategies and hedge their positions effectively.

- Leverage Limit: OKX offers leverage up to 100x on certain derivatives products, similar to other leading exchanges. While this allows for significant profit potential, it also carries a high level of risk, especially for inexperienced traders.

- Deposit and Withdrawal Options: OKX supports a broad array of deposit and withdrawal options, including numerous cryptocurrencies and fiat currencies through bank transfer and other payment methods. This flexibility makes it accessible to a global user base.

OKX stands out as a premier choice for crypto derivatives trading due to its excellent liquidity, commitment to regulatory compliance, competitive fees, and user-friendly platform. Its comprehensive security measures and wide range of products enhance its appeal to a diverse trading audience. Like any exchange, traders should assess how OKX aligns with their trading needs and strategies, especially considering the dynamic nature of crypto regulations and market conditions. OKX’s position in the market and its service offerings make it a strong contender for traders looking for a reliable and efficient derivative trading platform—the OKX review on Coin Bureau dives deeper into the exchange nuances.

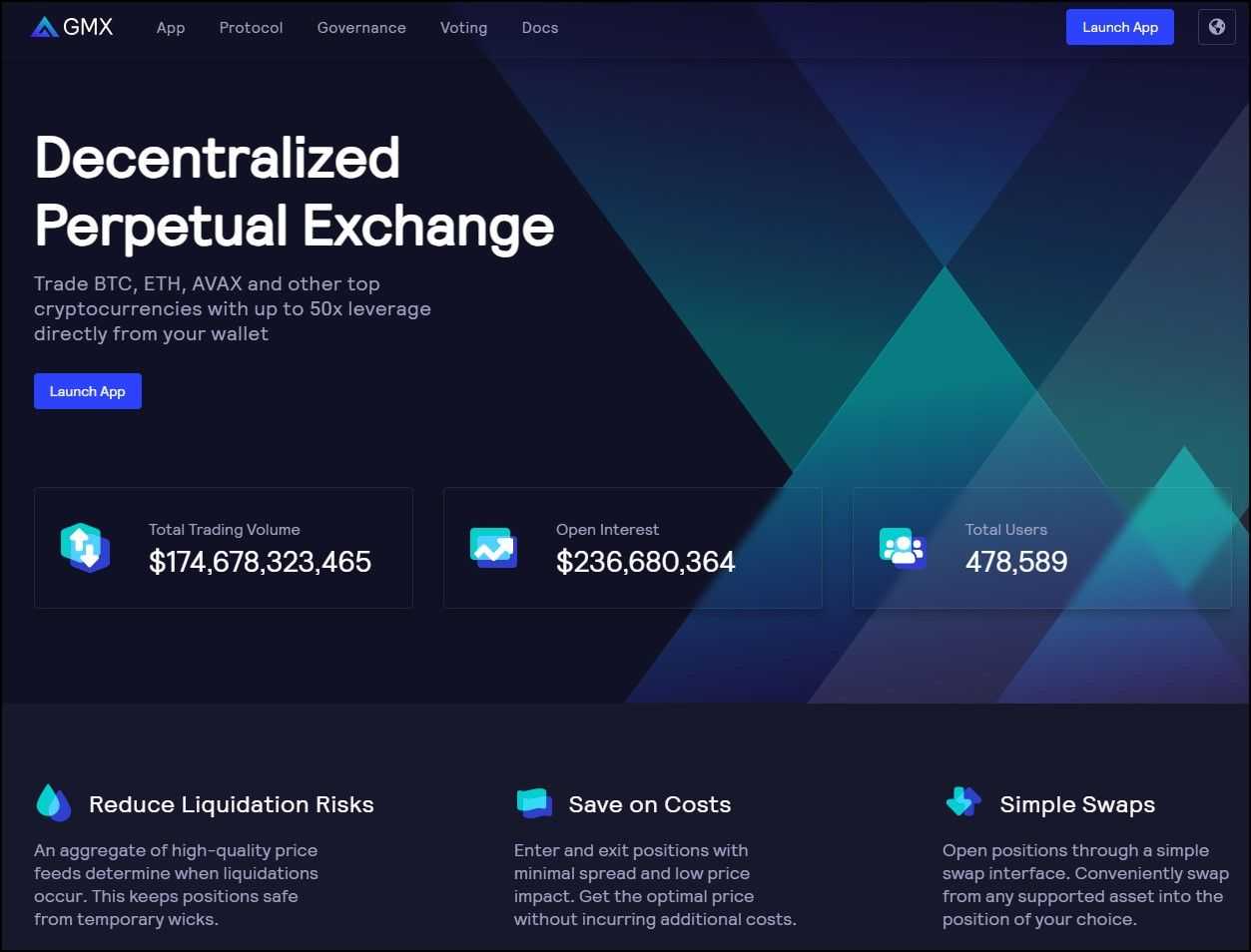

GMX

GMX, although newer to the scene compared to giants like ByBit and OKX, has carved out a niche in the decentralized finance (DeFi) space, focusing on providing a user-friendly platform for trading crypto derivatives with a unique approach. Here's an analysis based on the specified important and non-essential factors:

- Open Interest (Liquidity): As a decentralized exchange (DEX) specializing in derivatives, GMX offers liquidity that, while growing, may not match the depth of more significant centralized exchanges. However, GMX utilizes a unique liquidity pool system for efficient trade execution with minimal slippage, making it competitive within the DeFi ecosystem. The platform's innovative approach to liquidity, including features like zero price impact trades for certain sizes, is a significant draw.

- Regulatory Compliance: Operating in the DeFi space, GMX leverages blockchain technology to offer a permissionless and decentralized trading environment. On-chain existence equates to GMX inherently facing fewer regulatory hurdles regarding user access but also implies a different kind of regulatory risk, as the DeFi space is less clear-cut and rapidly evolving. Traders interested in GMX should be aware of the regulatory environment of their jurisdictions and the inherent risks of DeFi platforms.

- Fees: GMX distinguishes itself with a transparent and competitive fee structure. Trading fees are relatively low, and the platform employs a unique mechanism where traders can earn a share of the platform's trading fees by staking the native GMX token. The token can offset some trading costs and incentivize participation in the platform's ecosystem.

- User Experience: The platform prioritizes a smooth user experience with an intuitive interface catering to beginners and experienced traders. Being a DEX, it offers the advantage of wallet-to-wallet trading without the need for traditional account setups. Customer support is primarily community-driven, with resources like forums and social media channels assisting.

Non-essential Factors

- Security: GMX strongly emphasizes safety as a DEX, with smart contracts audited by reputable firms. However, trading on DEXs inherently carries different security considerations compared to centralized exchanges, mainly related to smart contract vulnerabilities.

- Product Offerings: GMX focuses on a concise range of derivatives products, mainly perpetual swaps for a selection of major cryptocurrencies. While the product range may be narrower than on some centralized exchanges, it covers the most traded assets.

- Leverage Limit: The platform offers leverage up to 30x for trading, which is lower than some centralized counterparts but is designed to balance opportunity with risk in the volatile crypto market.

- Deposit and Withdrawal Options: Being a DEX, GMX supports cryptocurrency transactions directly from users' wallets. There are no fiat deposit or withdrawal options directly on the platform, but users can access cryptocurrencies through other means before trading on GMX.

GMX offers a compelling option for traders seeking a decentralized approach to crypto derivatives trading, combining innovative liquidity solutions with a user-friendly interface and competitive fees. While it may not match the sheer liquidity and product variety of larger centralized exchanges, its unique features and community-driven ecosystem make it a noteworthy platform, especially for those prioritizing decentralization and direct control over their trading environment.

Traders considering GMX should weigh the benefits of its DeFi model against the different risk profiles compared to traditional centralized platforms. If you wish to know more about this exchange, the GMX review on Coin Bureau has got you covered.

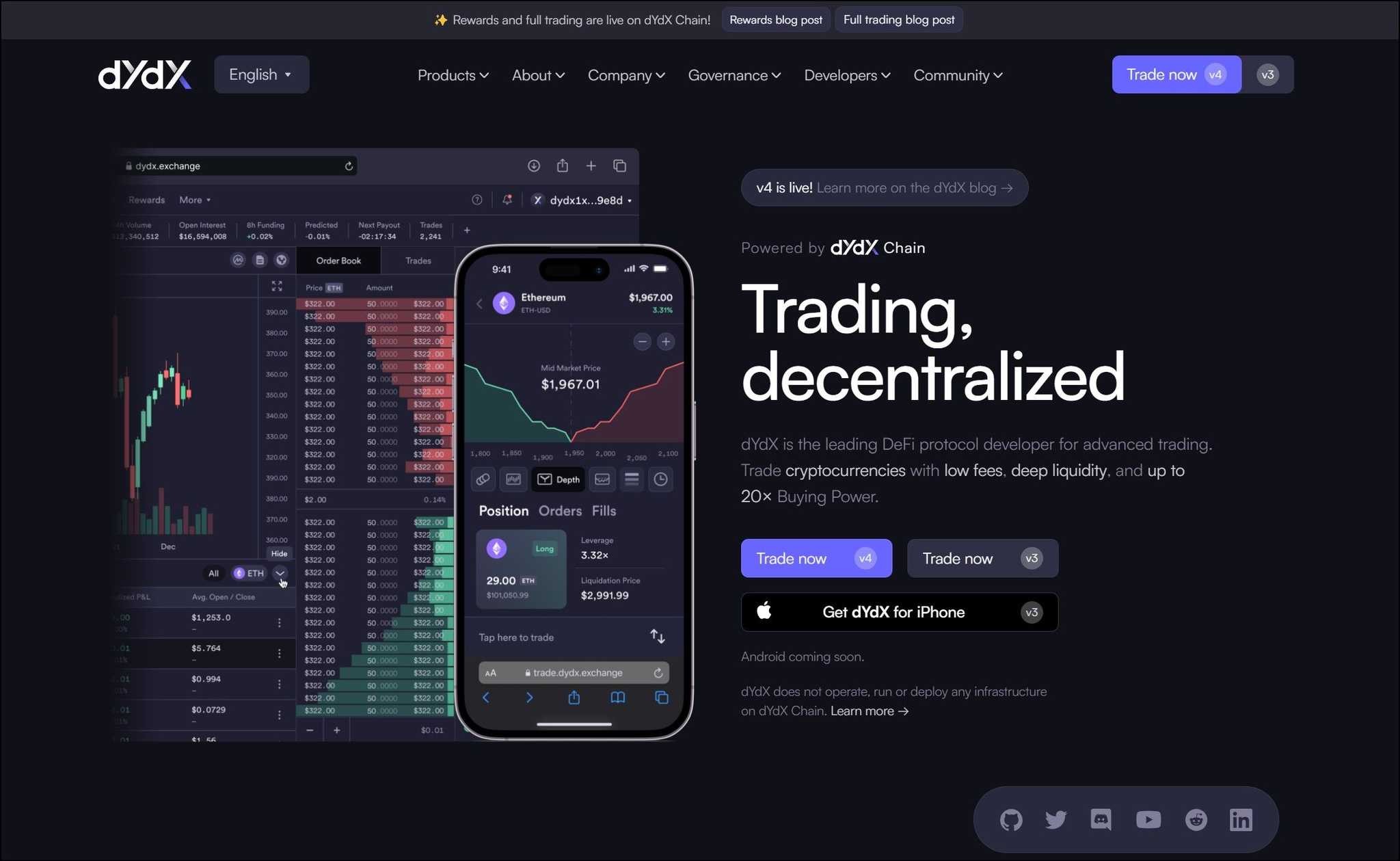

dYdX

dYdX operates as a standout platform within the decentralized finance (DeFi) landscape, offering advanced crypto derivatives trading focusing on perpetual contracts. Here’s an in-depth analysis based on the important and non-essential factors previously outlined:

- Open Interest (Liquidity): dYdX showcases strong liquidity for a decentralized exchange, particularly in its perpetual contracts market. This liquidity is supported by its innovative funding mechanisms and the participation of liquidity providers, ensuring competitive spreads and efficient order execution for traders. While it may not rival the largest centralized exchanges, dYdX's liquidity is commendable within the DeFi space, facilitating sizable trades with reduced slippage.

- Regulatory Compliance: As a decentralized platform, dYdX offers a permissionless trading environment, bypassing many regulatory constraints that centralized platforms face. This approach provides traders worldwide with access to derivatives trading without traditional KYC processes. However, the evolving regulatory landscape for DeFi means traders should remain informed about potential implications in their jurisdictions.

- Fees: dYdX's fee structure is competitive, particularly for its target DeFi audience. It employs a maker-taker fee model, where makers can earn rebates for liquidity, and takers pay a fee for market orders. This structure incentivizes liquidity provision and aligns with dYdX's goal of maintaining deep market liquidity. Trading fees are transparently outlined, making it easier for traders to understand their potential costs.

- User Experience: The platform excels in offering a sophisticated yet intuitive trading interface. dYdX caters to the needs of both novice and experienced traders by providing detailed charting tools, a variety of order types, and a seamless trading experience. While customer support is decentralized, dYdX offers comprehensive guides and a community-driven support system to assist users.

Non-essential Factors

- Security: dYdX prioritizes security, with its smart contracts undergoing rigorous audits. The decentralized nature means users maintain control over their funds until executed within trades, mitigating specific central points of failure.

- Product Offerings: dYdX primarily focuses on perpetual contracts for various cryptocurrencies. While this focus may limit variety compared to exchanges with a broader range of derivatives, it allows dYdX to specialize and innovate within its niche.

- Leverage Limit: The platform offers up to 25x leverage on perpetual contracts. This leverage level is designed to strike a balance between offering traders the potential for high returns and managing the risk inherent in leveraged trading.

- Deposit and Withdrawal Options: As a DEX, dYdX supports direct cryptocurrency transactions from users' wallets for trading activities. The platform does not handle fiat currencies directly, encouraging users to convert fiat to crypto through other services before trading.

dYdX stands out as a premier decentralized platform for trading crypto derivatives, particularly for those interested in perpetual contracts. Its liquidity, competitive fees, and user-friendly interface make it a compelling choice for traders looking to leverage the benefits of DeFi. While it offers fewer product varieties and lower leverage than some centralized counterparts, dYdX's focus on perpetuals and its innovative approach to liquidity and security position it as a key player in the decentralized trading space.

Traders attracted to the autonomy and innovation offered by DeFi platforms will find dYdX's offerings particularly appealing, provided they are comfortable navigating the unique risks and opportunities of decentralized derivatives trading. Coin Bureau also covers dYdX in depth in a dedicated review.

Other Centralized Alternatives for US Nationals

US citizens have multiple avenues to access crypto derivatives within a regulatory-compliant framework.

Centralized Alternatives

Centralized platforms like Kraken and Gemini offer a secure and regulated environment for trading a variety of crypto derivatives. Kraken, known for its advanced trading features and low fees, caters to both novice and experienced traders. It offers margin trading and other complex trading services within the regulatory confines of the U.S., except for a few states. Gemini, on the other hand, emphasizes security and regulatory compliance, appealing to institutional traders with its robust platform that adheres to stringent U.S. regulations, including those of New York State.

CME Crypto Futures

Additionally, for those looking to trade Bitcoin and Ethereum futures within a regulated marketplace, the Chicago Mercantile Exchange (CME) provides a viable option. The CME lists Bitcoin and Ethereum futures contracts that are cash-settled and based on reference rates that aggregate the trade flow of major spot exchanges. Here are the key details about the cryptocurrency futures available on the CME:

1. Ether Futures

- Ticker Symbol: ETH

- Contract Unit: The contract size for Ether futures is 50 ether per contract.

- Settlement: Cash-settled based on the CME CF Ether-Dollar Reference Rate, which serves as a daily reference rate of the U.S. dollar price of Ether.

- Trading Hours: Similar to Bitcoin futures, Ether futures trade from Sunday to Friday, 5 p.m. to 4 p.m. Central Time (CT).

2. Micro Bitcoin Futures

- Ticker Symbol: MBT

- Contract Unit: Each Micro Bitcoin futures contract is worth 1/10 of one bitcoin.

- Settlement: These are also cash-settled based on the CME CF Bitcoin Reference Rate.

- Benefits: Offers the same features of Bitcoin futures but with smaller capital requirements, making it accessible for a broader range of traders.

3. Micro Ether Futures

- Ticker Symbol: MET

- Contract Unit: Each Micro Ether futures contract is worth 1/10 of one Ether.

- Settlement: Cash-settled based on the CME CF Ether-Dollar Reference Rate.

- Benefits: Similar to Micro Bitcoin futures, these contracts provide traders with an opportunity to trade Ether in a more capital-efficient manner.

For the most current and detailed information about these and potentially other cryptocurrency futures contracts listed on the CME, including specifications, trading hours, and settlement procedures, it's best to visit the CME Group's official website.

Risks of Trading Crypto Derivatives

Trading crypto derivatives carries unique risks, due to the inherent characteristics of both the derivatives market and the cryptocurrency market:

- Volatility Risk: The cryptocurrency market is highly volatile, with prices fluctuating widely in short periods. Such fluctuations can lead to significant gains or losses in derivatives trading.

- Leverage Risk: Crypto derivatives often involve leverage, which can amplify profits but also magnify losses, potentially leading to the loss of more than the initial investment.

- Regulatory Risk: The crypto market faces uncertain regulatory environments across different jurisdictions. Changes in regulations can impact the accessibility and value of crypto derivatives.

- Counterparty Risk: In over-the-counter (OTC) derivatives, the counterparty may default on its obligations, leading to financial loss.

- Liquidity Risk: Some crypto derivatives may suffer from low liquidity, making it difficult to enter or exit positions without affecting the market price.

- Operational Risk: Technical issues, such as exchange downtime or transaction delays on the blockchain, can impact trade execution and settlements.

- Market Manipulation Risk: The crypto market is susceptible to manipulation, which can lead to distorted prices and unfair trading conditions.

- Complexity Risk: Crypto derivatives are complex instruments that require a thorough understanding to manage effectively. Misunderstanding these products can result in unintended losses.

Understanding these risks is crucial for anyone considering trading in the crypto derivatives market. Proper risk management strategies and ongoing education are essential to effectively navigate this dynamic and evolving space.

How to Trade Crypto Derivatives Efficiently

To trade crypto derivatives efficiently, consider the following strategies and practices:

- Understand the Product: Gain a thorough understanding of the specific derivative (futures, options, swaps) you intend to trade, including how it functions and its settlement mechanisms.

- Start with a Plan: Develop a clear trading strategy, including entry and exit points, and stick to it to avoid emotional decisions.

- Use Leverage Cautiously: While leverage can amplify gains, it also increases the risk of losses. Consider the volatility of the crypto market when using leverage.

- Manage Risk: To limit potential losses, employ risk management techniques, such as setting stop-loss orders.

- Stay Informed: Keep up-to-date with market trends, news, and technical analyses that can impact the price movements of the underlying cryptocurrency.

- Practice with a Demo Account: Many platforms offer demo accounts, allowing you to practice trading with virtual money and understand the platform's features without financial risk.

- Diversify: Spread your investments across different assets and derivative products to mitigate risk.

- Monitor the Regulatory Environment: Be aware of regulatory changes in your jurisdiction that could affect crypto derivatives trading.

- Choose a Reputable Platform: Trade on reputable exchanges that offer robust security measures, transparent fee structures, and reliable customer support.

- Continuous Learning: The crypto market is rapidly evolving. Engage in constant learning to stay abreast of new products and strategies.

Efficient trading in crypto derivatives requires discipline, a solid understanding of the market, and adherence to risk management principles.

Closing Thoughts

As we approach the end of our exploration today, let’s recap what we covered in this piece. We began by understanding the basics of crypto derivatives and why they have tremendous potential to grow as a major global asset market. Following the introduction, we learned that derivatives are not just speculative instruments but also essential tools for portfolio optimization that can mitigate risks if applied correctly.

Moving forward, we covered five crypto derivative trading providers, three centralized and two decentralized exchanges that offer unique benefits and trade-offs. The rise of robust layer-2 networks like Arbitrum and Polygon has proven phenomenal in growing the popularity of decentralized alternatives. Layer-2s are finally maturing, offering sufficient security guarantees to derivative DEXs that serve retail investors.

Following the comparative analysis, we also explored the risks of crypto derivatives and some techniques to mitigate them. I will close this piece by iterating that more than competing in a volatile market, trading derivatives is a bet against one’s trading prowess. Thankfully, trading is a skill that one can hone with experience, learning, and practicing.

Frequently Asked Questions

Crypto derivatives are financial contracts whose value is derived from the underlying cryptocurrency assets. These instruments allow traders to speculate on future price movements without owning the actual cryptocurrencies. Common types include futures, options, and swaps. Traders can leverage these products to hedge against price volatility, engage in arbitrage, or speculate on price movements, providing a flexible and sophisticated approach to crypto trading.

Trading crypto derivatives carries significant risks, including market risk from volatile crypto prices, leverage risk where losses can exceed deposits, liquidity risk affecting the ability to enter or exit positions, counterparty risk in OTC markets, and regulatory risk from changing laws. These risks necessitate careful risk management and a thorough understanding of the derivative products being traded.

Trading crypto derivatives offers numerous benefits, such as leverage, which allows traders to gain greater exposure with less capital; hedging opportunities to protect against adverse price movements; access to a wide range of markets; and the ability to speculate on price movements without holding the underlying asset. These advantages make derivatives a versatile tool for strategic trading in the volatile crypto market.

The best centralized crypto derivatives exchanges include Binance, ByBit, and OKX, known for their extensive product offerings and liquidity. For US nationals, Kraken and Gemini are viable options, providing regulated platforms that ensure compliance with US laws. These exchanges offer various derivatives products like futures and options, catering to a wide range of trading strategies and preferences.

dYdX and GMX stand out as the best decentralized crypto derivatives exchanges. dYdX offers a non-custodial trading experience with a focus on perpetual contracts for various cryptocurrencies. GMX, on the other hand, allows for leveraged trades and provides a unique liquidity model that facilitates low-slippage trading on major crypto assets. Both platforms offer the benefits of decentralized finance (DeFi) with high liquidity and innovative trading features.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.