Is Coinbase Spamming the Bitcoin Memepool? The Case for SegWit

According to some new data that has being presented, Coinbase, the largest cryptocurrency exchange in the world, has been responsible for a large amount of the network spam that has being plaguing the Bitcoin memepool recently.

A twitter user called Civ Ekonom was able to identify the issue when they ran an analysis on the effect on the Memepool when Coinbase disabled Bitcoin withdrawals. He suggested that a simple solution would be the implementation of SegWit.

More particularly, the moment that Coinbase had announced that they would be shutting down their withdrawal functionality, the size of the Bitcoin Memepool seemed to drop steadily. The Bitcoin memepool is an indication of the amount of transaction data that is awaiting being processed.

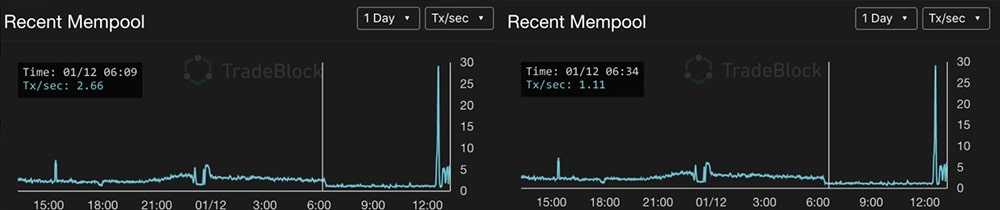

The exact effect of the size that the memepool has on the transaction volume can best be expressed by these two graphs. The one on the left is the transactions per second at a time just prior to the Coinbase outage and the one on the right is the put-through just prior.

As is clear, the transaction times are almost double what they should be when Coinbase is in operation and sending the individual transactions out.

SegWit Adoption Key

This all stems from the fact that Coinbase has still not implemented SegWit transactions. The Segregated Witness (SegWit) upgrade on the Bitcoin network allowed people to send transactions with the header information stripped out. This substantially reduced the amount of data being added to the block.

Hence, those who sent transactions as SegWit ones were able to make a great deal of savings as compared to non SegWit. However, Coinbase and a number of other Bitcoin businesses have still not supported the payment option to this day.

This also appears to not have been a priority for the CEO of Coinbase, Brian Armstrong. In a separate blog post, his Vice President confirmed that they would be implementing it but not as a priority upgrade.

Apart from the fact that this has the affect of clogging up the Bitcoin network, this makes the transactions unnecessarily expensive for the Coinbase users. This has not gone unnoticed with a number of them signing a petition to get Coinbase to implement SegWit support. To date, the petition has reached the 10,000 signature requirement.

Is Coinbase Listening?

Although these frustrations are particularly acute at this time of great network stress, there is light at the end of the tunnel. In response to the tweet calling out Coinbase, Brian Armstrong responded.

Although the tone does appear to be similar to that of the Vice President’s blog post, it does show that they are at least being responsive to their customer's complaints.

Indeed, if Coinbase was to more appropriately "batch" their transactions this could have a much more alleviating effect on the bloated memepool and rising number of uncomfirmed transactions.

One can only hope that Coinbase is able to roll out some of these fixes sooner rather than later. Until off-chain solutions like the lightning network are up and running, the transaction backlog is likely to remain.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.